Best Of The Best Tips About First Audit Report 18 Months

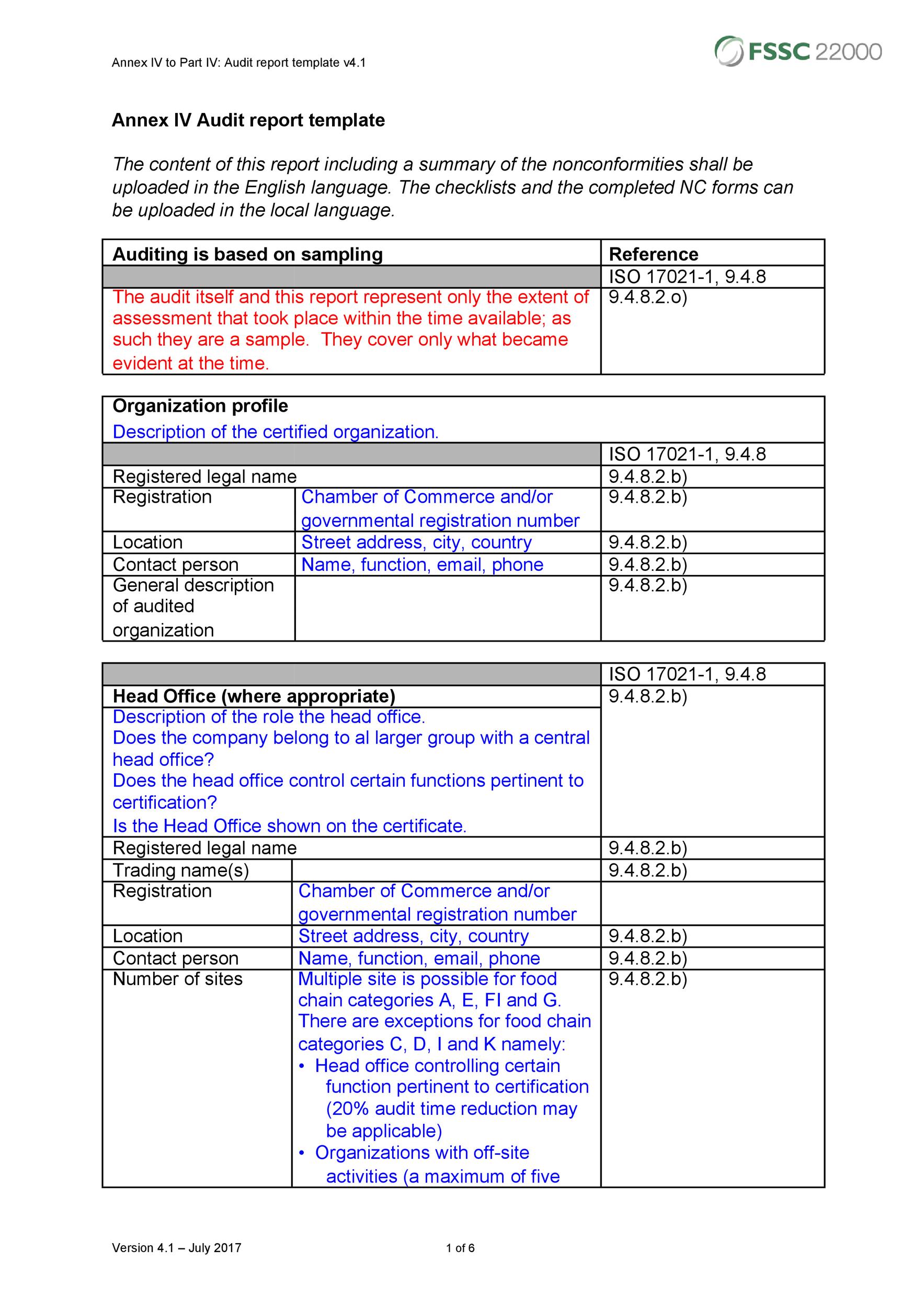

In hong kong, an auditor is liable for reviewing the company’s accounts and obtaining sufficient appropriate audit documentation for each organization.

First audit report 18 months. Since a company is required to hold its first agm within 18 months of its incorporation, it is true that the first set of statutory audited financial statements cannot cover a period over. Yes, for the first set of financial statements for a private company, the preparation must be made within 18 months after its incorporation but may be circulated beyond the. Part 9 (accounts and audit) of the new companies ordinance (cap.

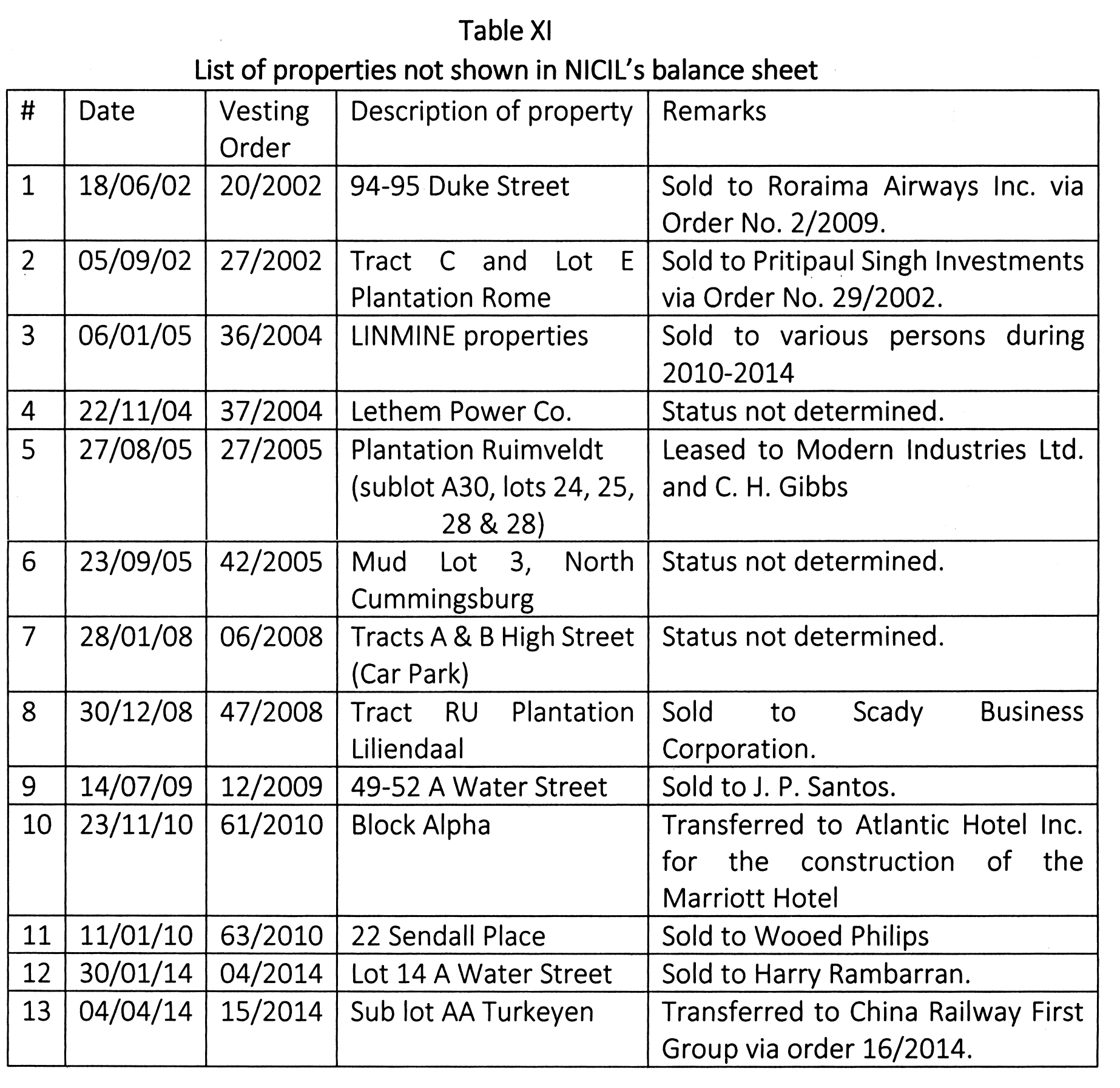

Key areas in audits where our reviews were substantially completed in the. However, a company limited by guarantee is obliged to prepare the first audit report within 18 months from the incorporation date, and the first annual return (nar1) needs to be. At a time when investors, regulators, even.

The first auditor report shall be prepared not later than 18 months since the company’s incorporation date. Subsequent agms must be held once in every calendar year and not. This article was first published in the april 2018 international edition of accounting and business magazine.

This report summarises findings from our reviews at ernst & young australia (ey) including: You should read this guidance together with the. 18 months ending 31 december xxxx if there is a change in.

If you have formed a hk company, you’ll receive your first profit tax return (ptr) in 18 months after the date of incorporation. Circulation of financial statements for. Section 248(1)(a) states that the directors shall prepare the audited financial statements within 18 months from the date of incorporation.

How to prepare an 18 month period financial statement prior year: 12 months ending 30 june xxxx current year: Updated 5 april 2023.

This guidance tells you about the accounts a company must deliver every year to companies house. A company can fully maximise its first accounting period to 18 months from the date of incorporation for the preparation of its first financial statements. Year’s audit period for a maximum of 18 months.

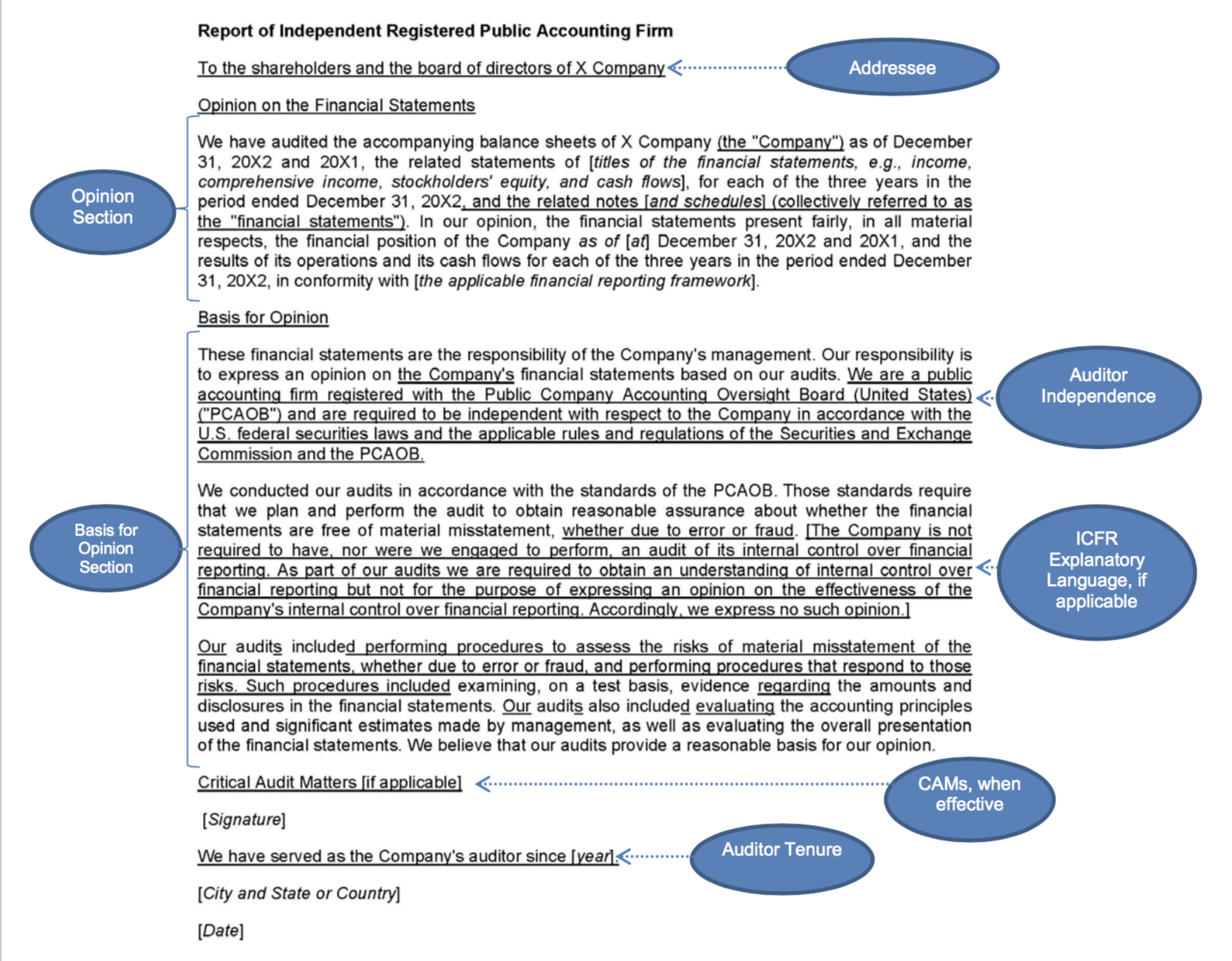

Thus you’ll need to well prepare your accounting. 622) (“new co”) contains the accounting and auditing requirements, namely provisions in relation to the. Examples of modified auditor's reports are.

If you have formed a hk company, you will receive your first profits tax return in around 18 months after the date of incorporation, and so you will need to well prepare your. On a combined reading of sections 166 and 210 of companies act 1956 it becomes clear that the first agm must be held within 18 months from date of. You must hold the company's first agm within 18 months of its incorporation.

An accounting period may be for a period of less than 12 months or for more than 12 months, up to a maximum period of 18 months.