Divine Info About Relationship Between P&l And Balance Sheet

However, if they wish to see their entire financial picture, the balance.

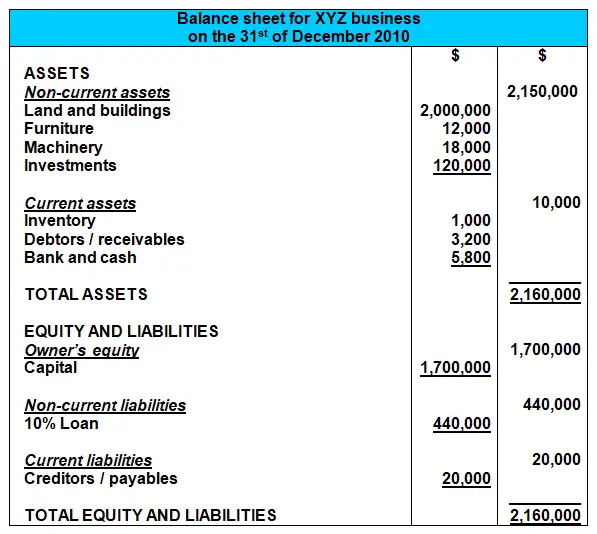

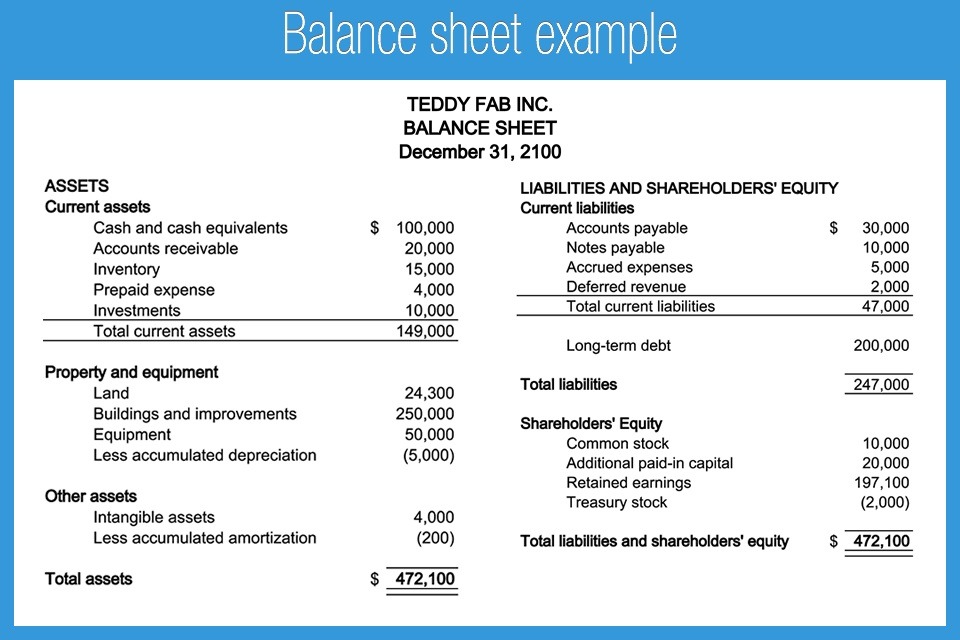

Relationship between p&l and balance sheet. Assets = liabilities + equity the balance sheet is a document that is usually created by companies at the end of a financial year. A profit and loss account is an account that shows the. A balance sheet shows what a company owns in the form of assets, what it owes in the form of liabilities, and the amount of money invested by shareholders listed.

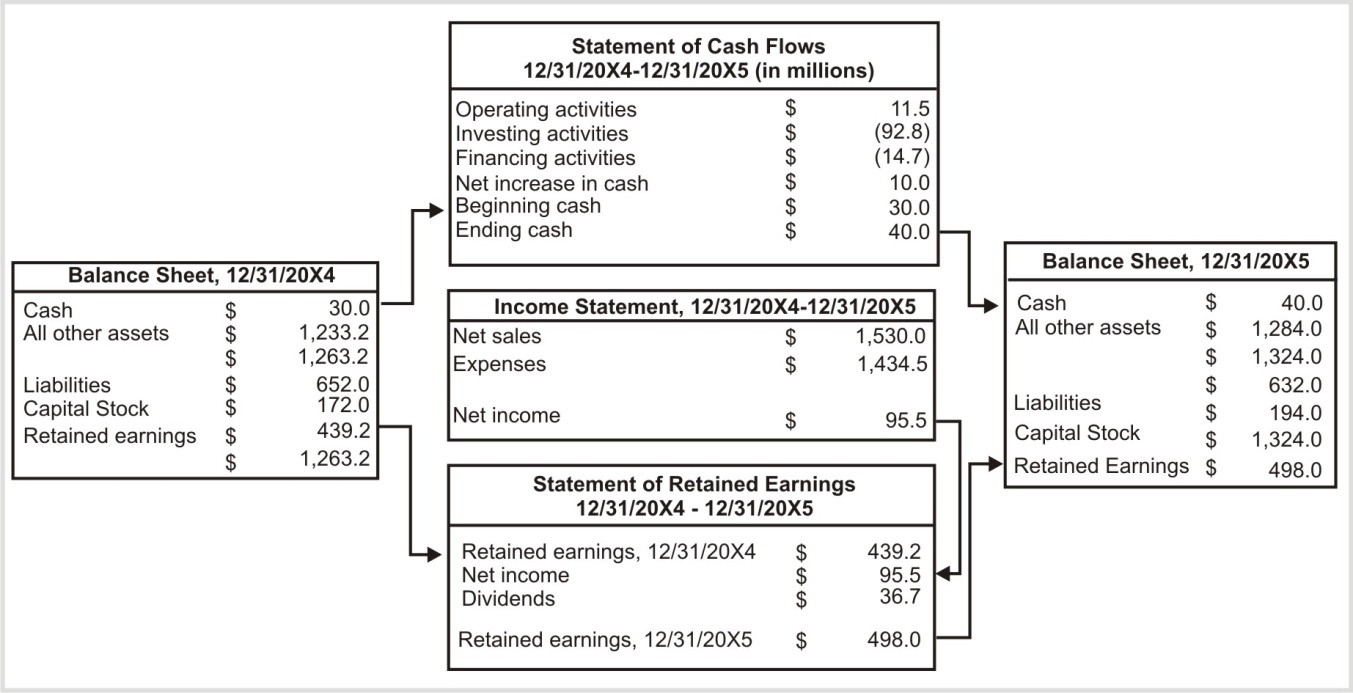

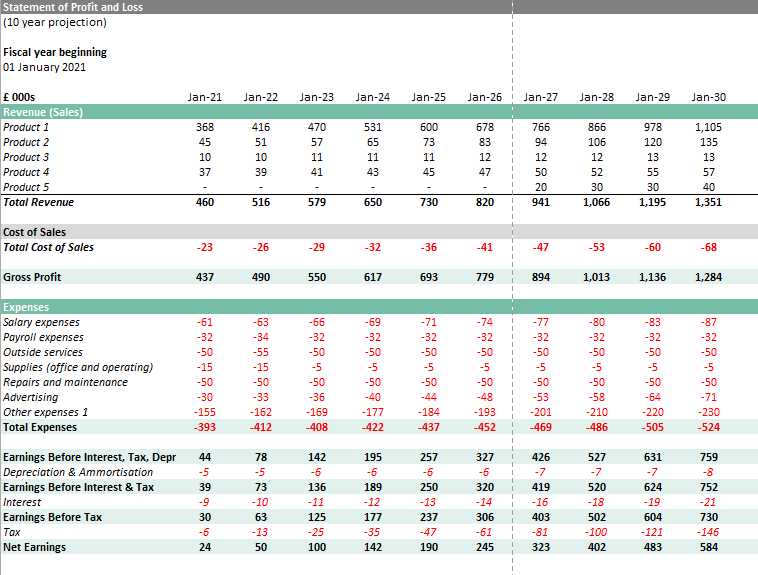

The financial ratio analysis 00:16:48 9. The connection between balance sheet, p&l statement and cash flow statement 00:04:34 8. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

What are the three financial statements? Trial balance, profit and loss (p&l), and balance sheet reports are essential financial statements that provide valuable insights into a company's financial performance and. The profit and loss statement and the balance sheet are two of the three financial statements that companies issue regularly.

The different types of financial statements are not isolated from one another but are closely related to one another. P&l the p&l is the report to which most business owners default; Balance sheets and profit and loss statements are two of the three financial documents that most accountants use when preparing a financial report for their.

Two sides of a balance sheet 1. I like to think of the. Financial statements provide an ongoing.

Although the balance sheet and the p&l statement contain some of the same financial information—including revenues, expenses and profits—there are important differences between them. Sales revenue > cash and debtors cost of. The three financial statements are:

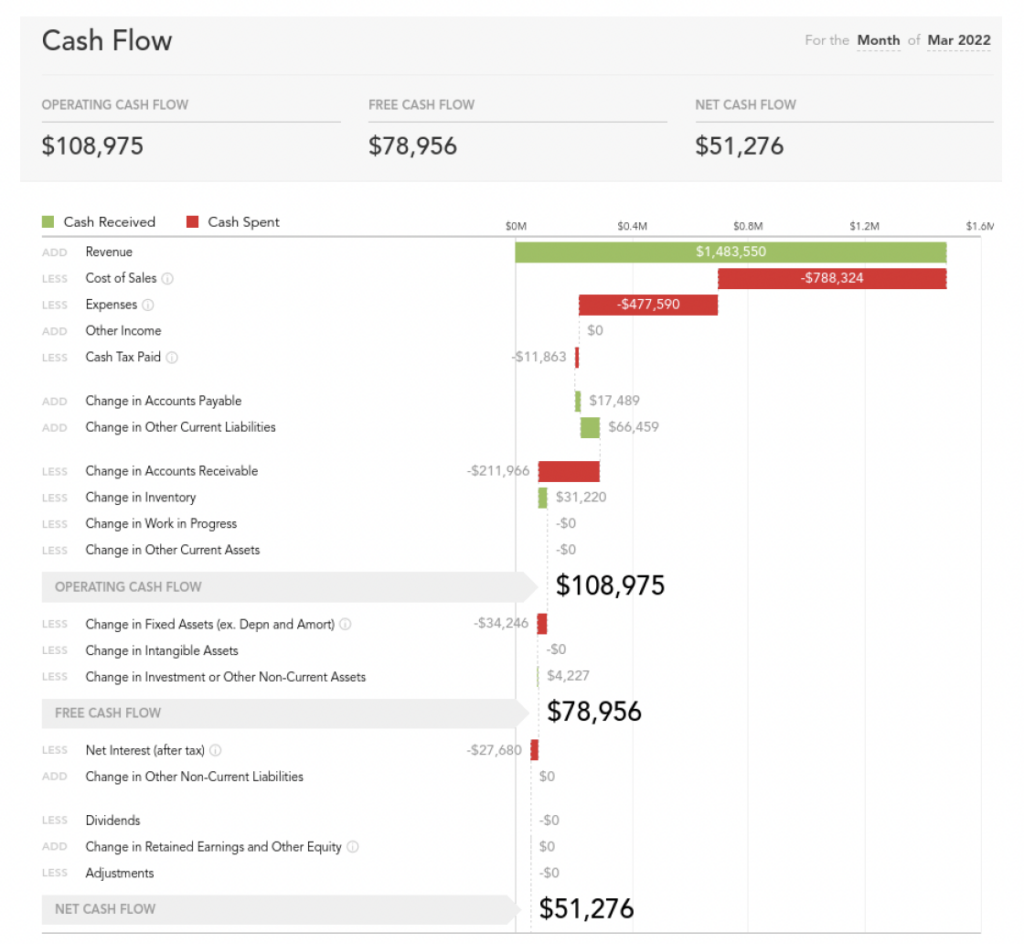

There are several key differences between the p&l and balance sheet, particularly the information presented and what it means. Purpose of financial statements. The following list shows the connections between the profit & loss statement and the balance sheet accounts.

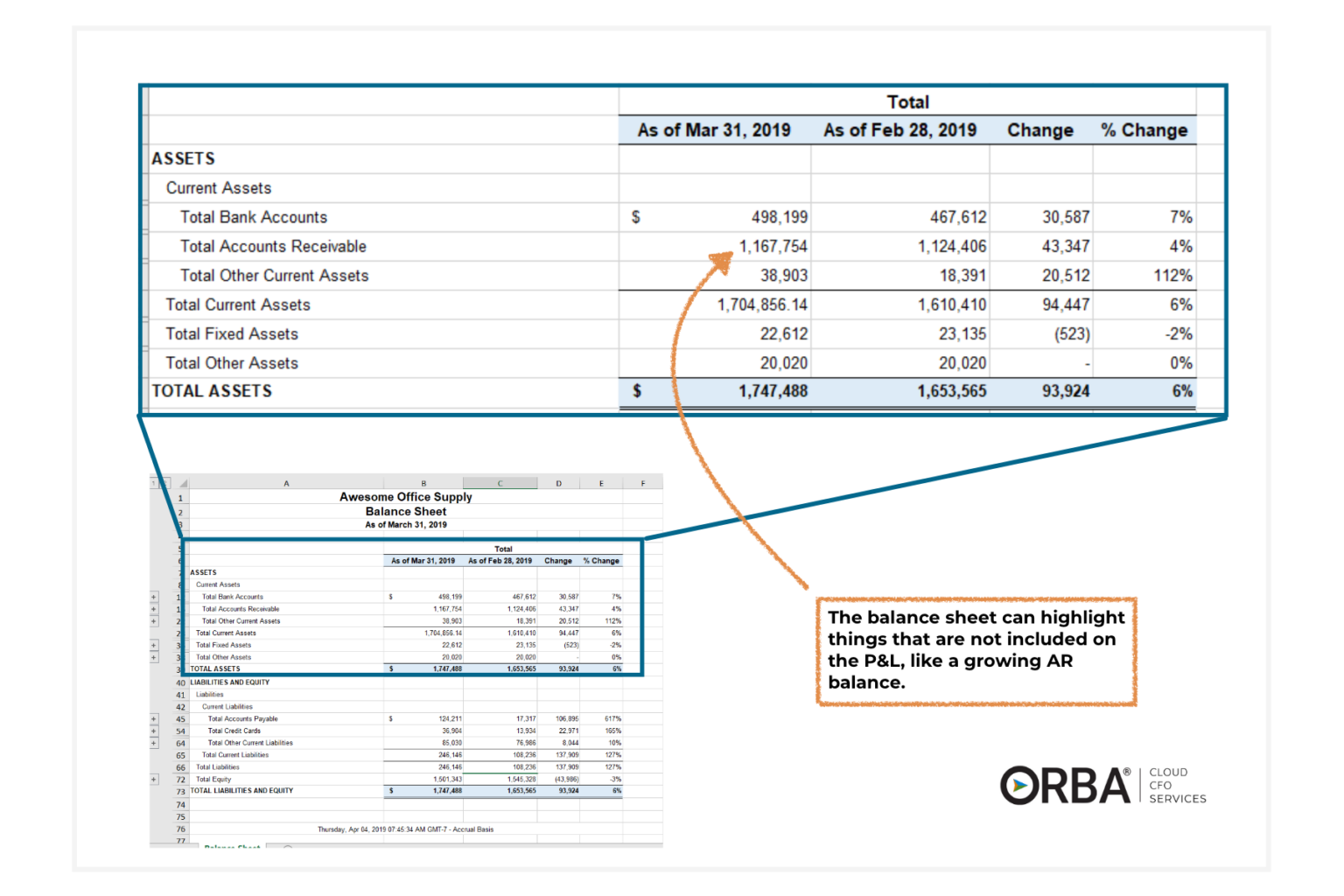

The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. The relationship between balance sheets and profit and loss accounts the profit and loss account summarises a business’s trading transactions, such as. Changes in current assets and current liabilities on the balance sheet are related to revenues and expenses on the income statement but need to be adjusted on the cash.

This snapshot of the company’s financial position is important for assessing: The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a. I'd say that the income statement shows all revenue and expenses, on an accrual basis, between two points in time (usually represented by balance sheets).