Perfect Tips About Negative Balance Sheet Editable

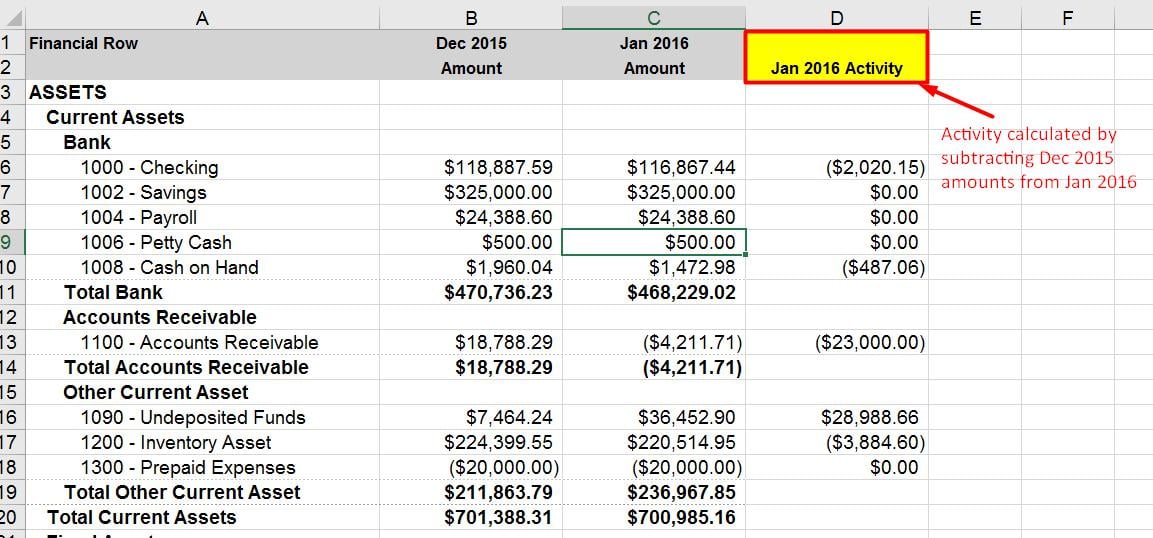

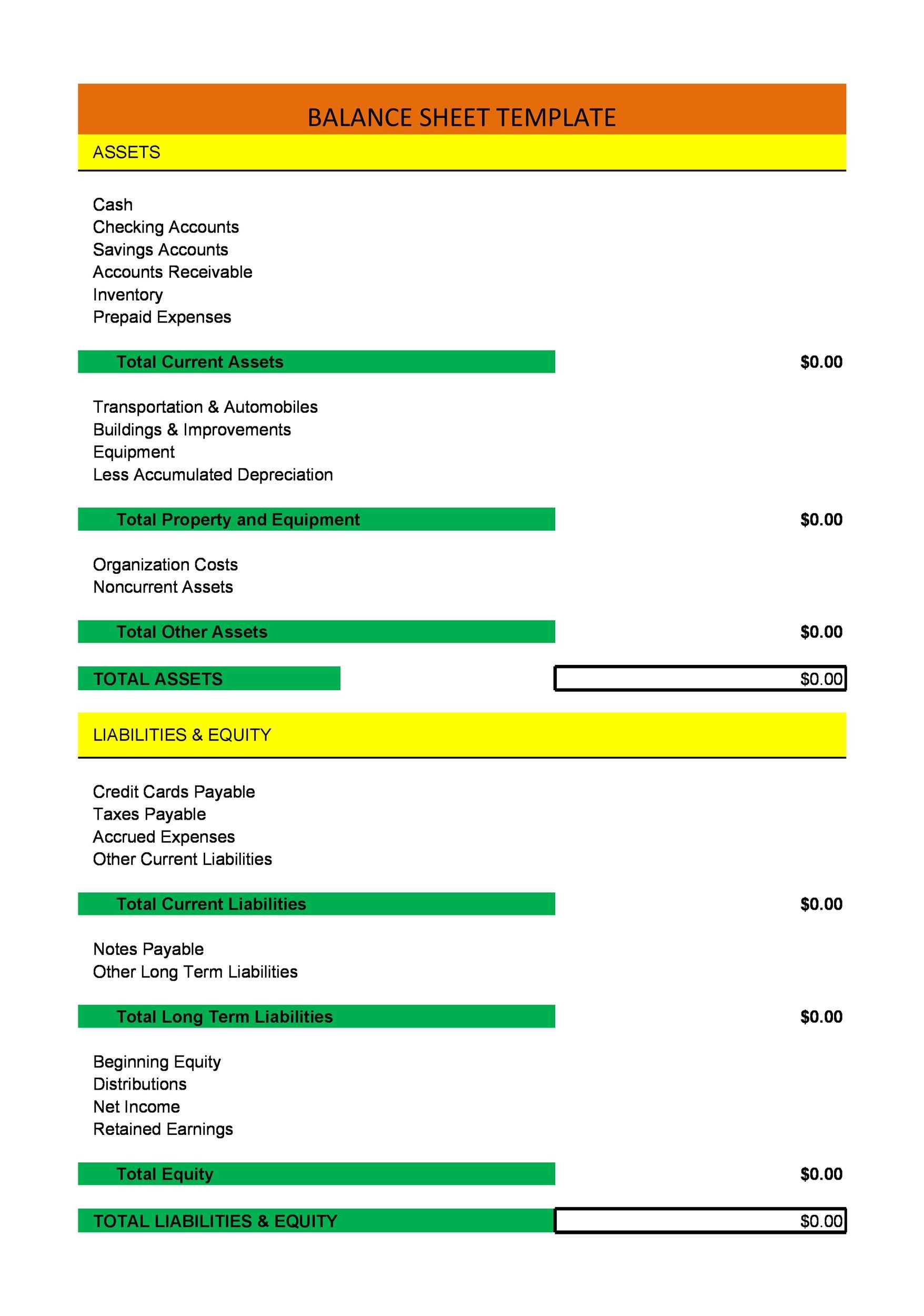

Accounts receivable, accumulated depreciation, current liabilities/retirement contribution payable, and shareholder distributions for (sep, draws, and tates).

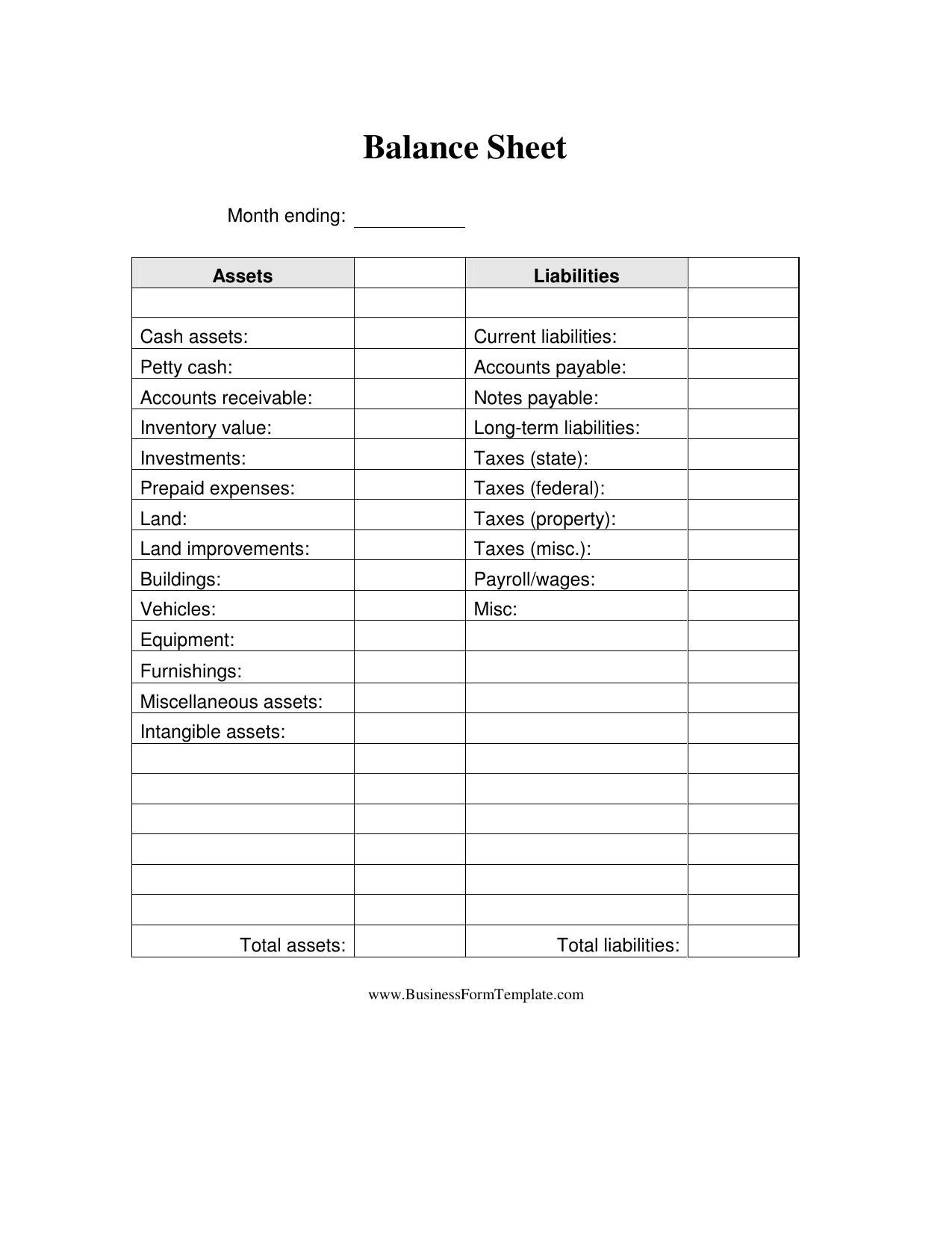

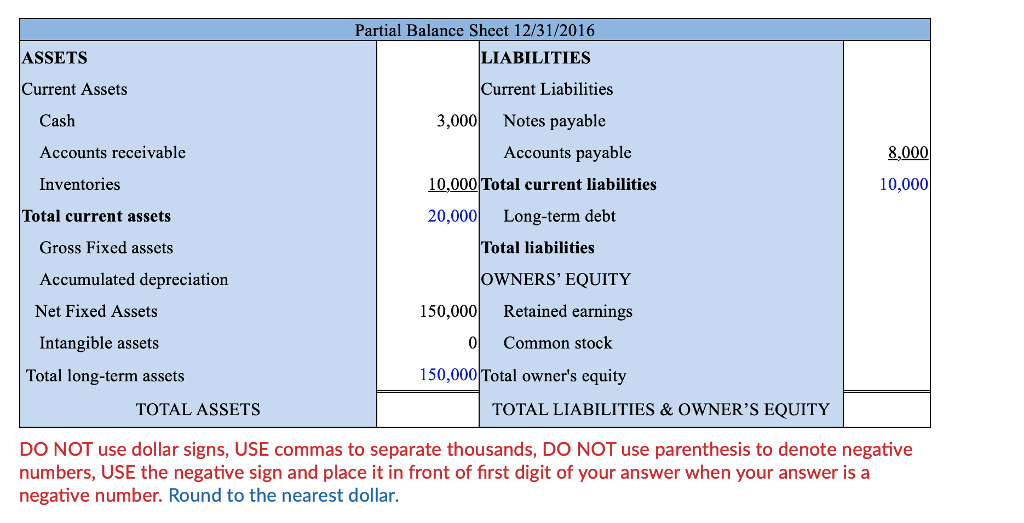

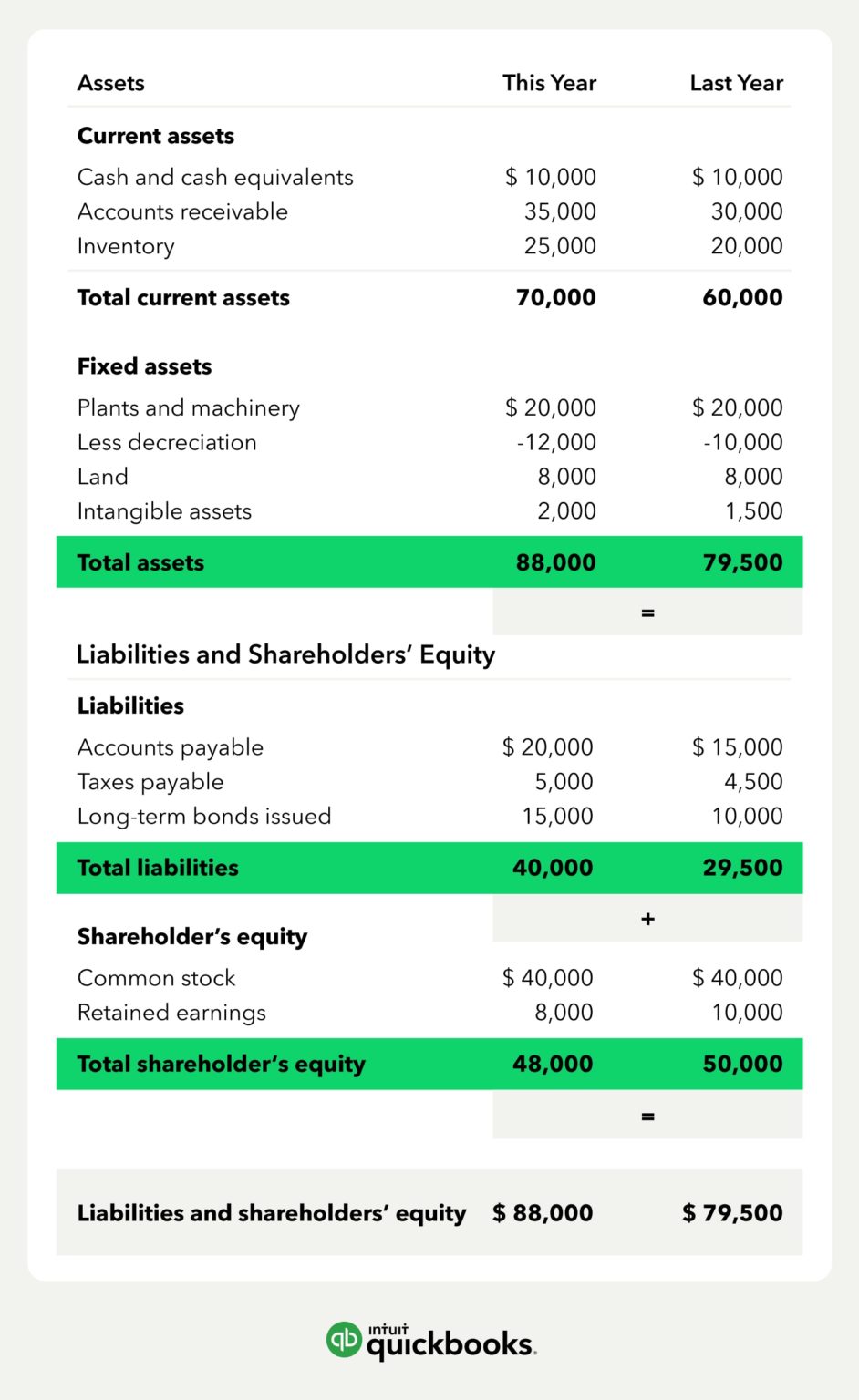

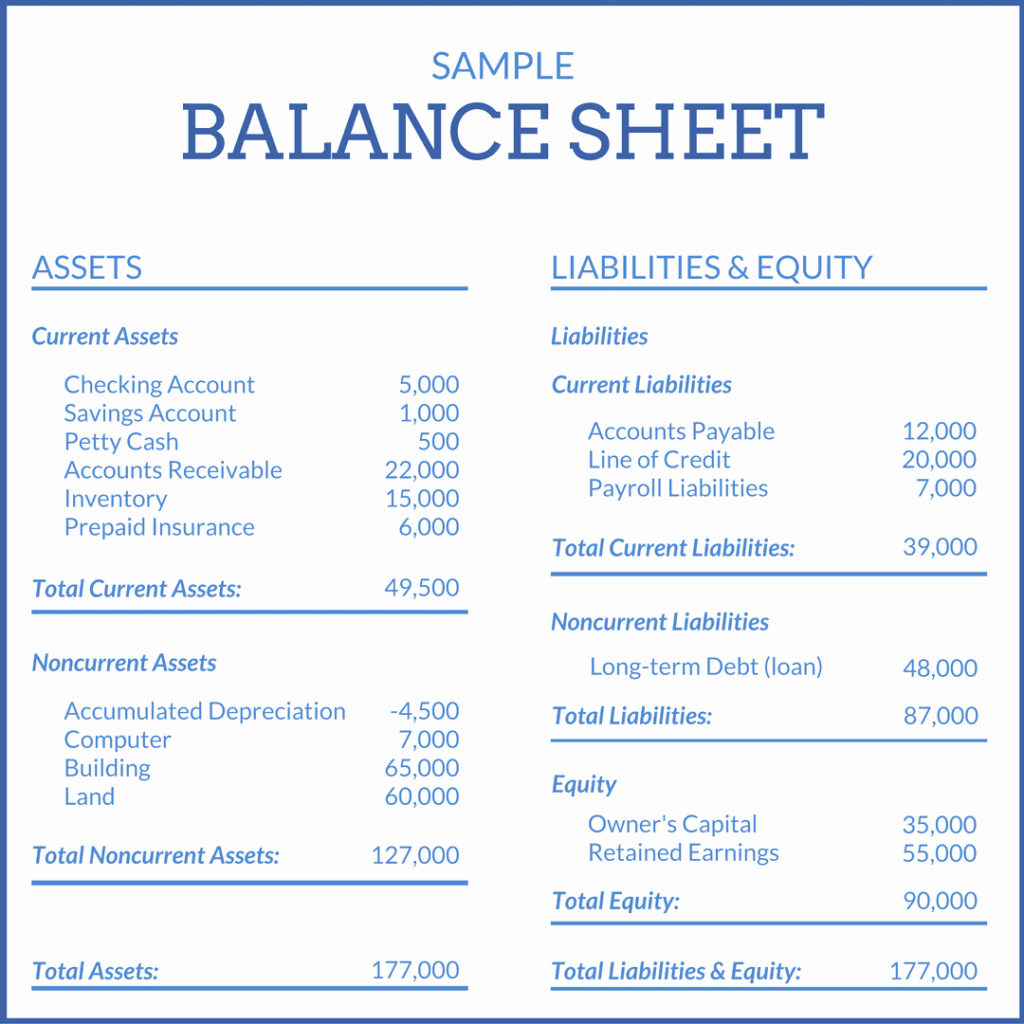

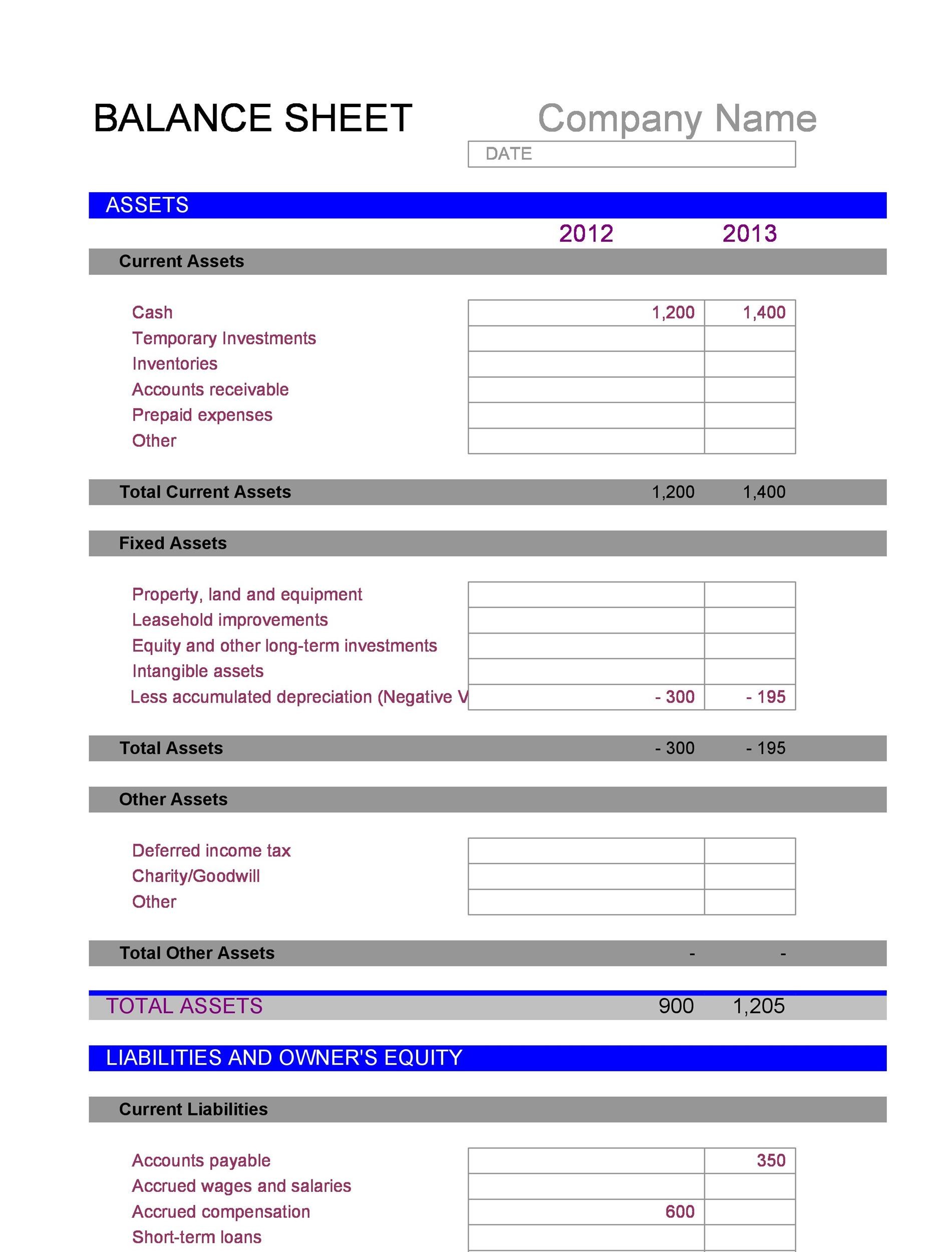

Negative balance sheet editable balance sheet. When a company prepares its balance sheet, a negative balance in the cash account should be reported as a current liability which it might describe as checks written in excess of cash balance. Assets = liabilities + equity. Doing so shifts the cash withdrawal back into the cash account at the beginning of the next reporting period.

The statement must always balance, hence the name. Find and open the balance sheet. These three balance sheet segments.

If a client has a negative balance sheet (not massively to the tune of 3k) is it a neccesity to include a going concern disclosure, or as an accountant is it acceptable simply to get confirmation from the director that the business will be supported for the next 12 months, and submit the financial statements to the relevant authorities excluding. When a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to automatically reverse; In the accounting menu, select reports.

A negative cash balance in the general ledger does not mean that the company’s bank account is overdrawn. When an inventory item shows a negative asset value, it means you have sold what you do not have in stock. 1.1 current assets current assets include what is in your bank account, your investment accounts, and petty cash.

The way they are shown on the statement is based on the fundamental accounting equation: The negative values per the attached balance sheet report is on: Select any other options you want the report to show.

Plus, find tips for using a balance sheet template. You can use the search field in the top right corner. Assets nonprofit assets are what your organization receives or is owed.

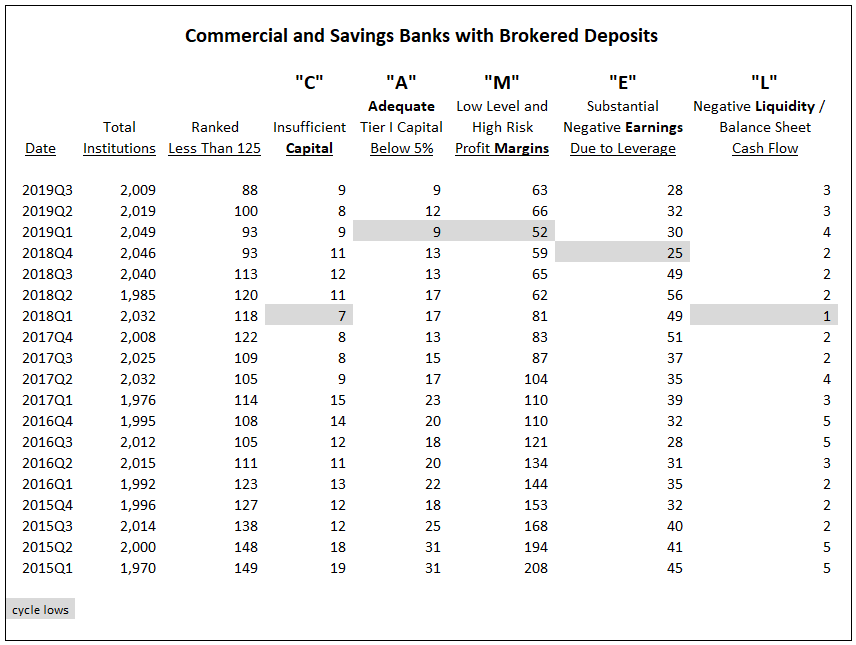

It can also be referred to as a statement of net worth or a statement of financial position. From a balance sheet perspective, negative equity reduces the value of assets, exposes the risk associated with liabilities, and results in a negative equity figure. So what are the warning signs you should watch out for?

This way, the balance will be zeroed out. The balance sheet includes things owned (assets) and things owed (liabilities). Ngw in the balance sheet in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation.

A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. I've got the instructions on how you can resolve this.

The balance sheet is made up of three parts: Select the date or click the arrow next to the date to select a common reporting date like end of last month or end of last quarter. If only one liability account has a negative sign, it is likely that the liability account has a debit balance instead of the normal credit balance.