Divine Tips About Accounts Payable Audit Companies

The goal of an accounts payable audit is to identify any discrepancies and help organizations remain on track as far as their expenses and financial obligations.

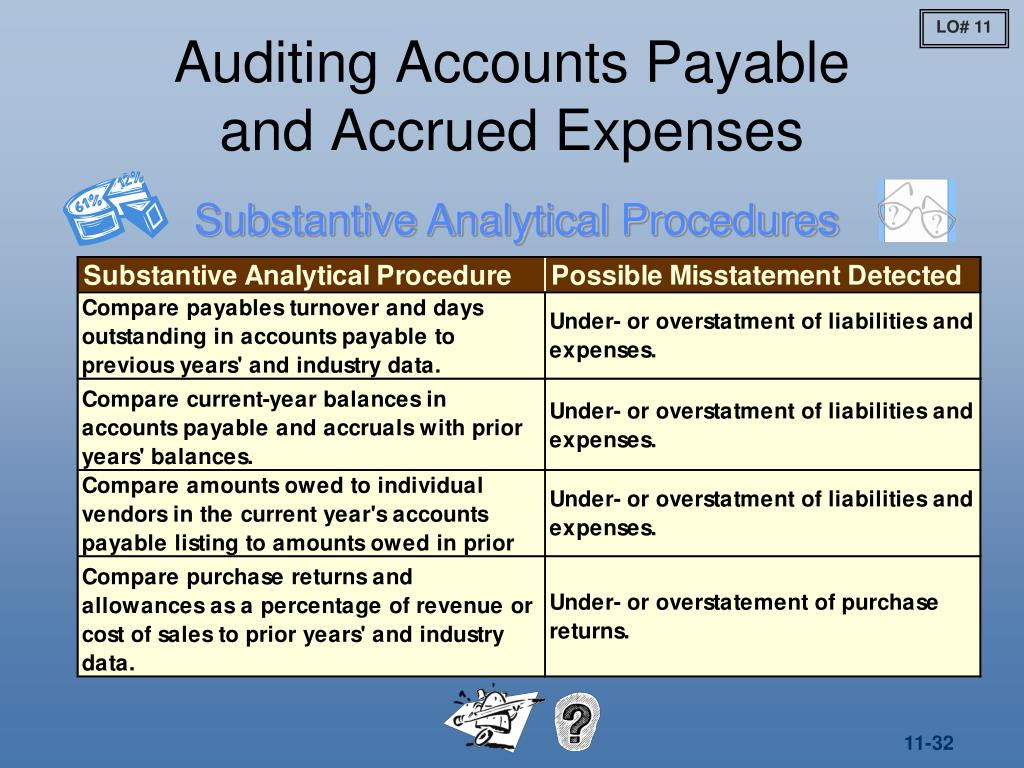

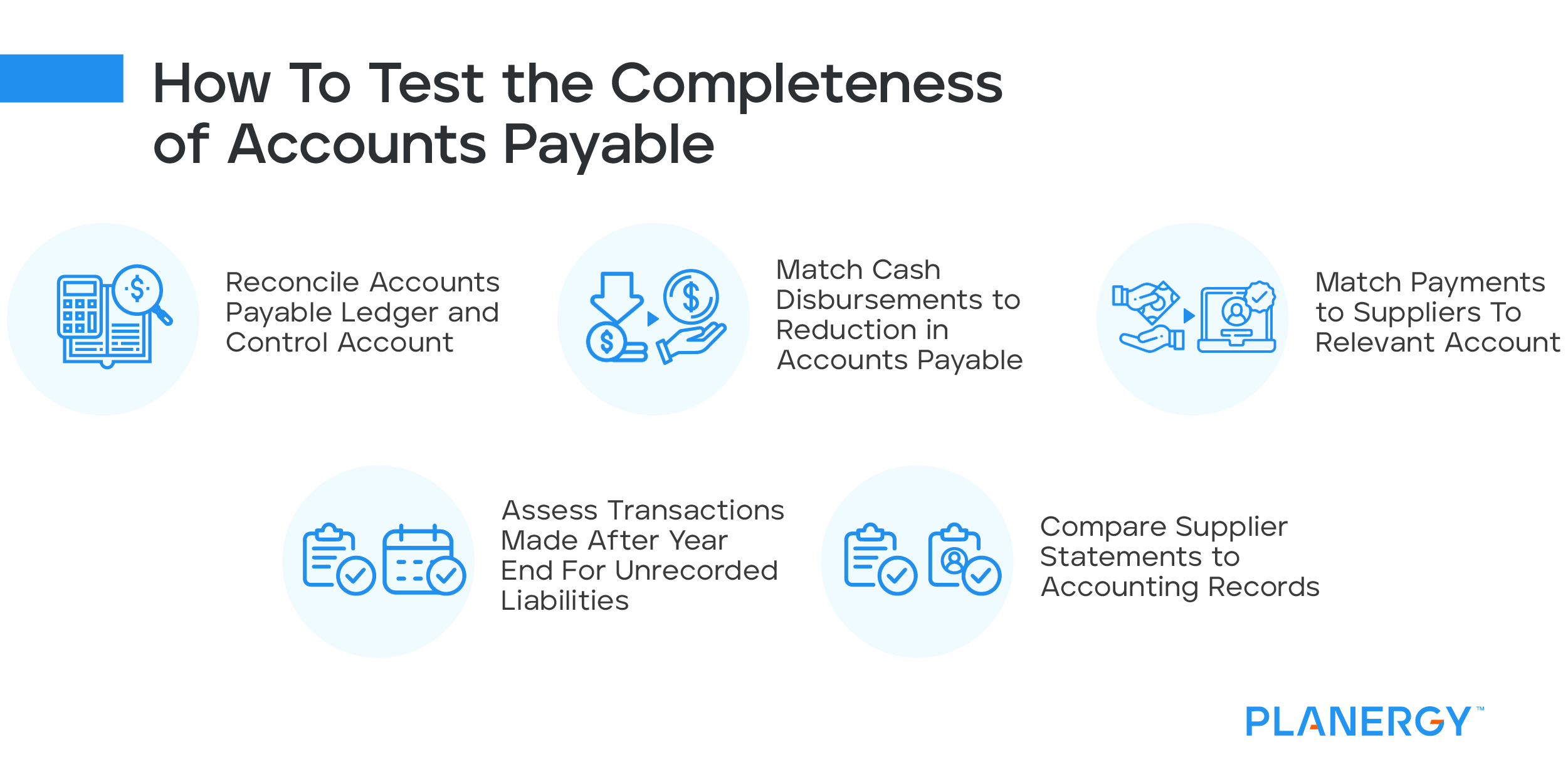

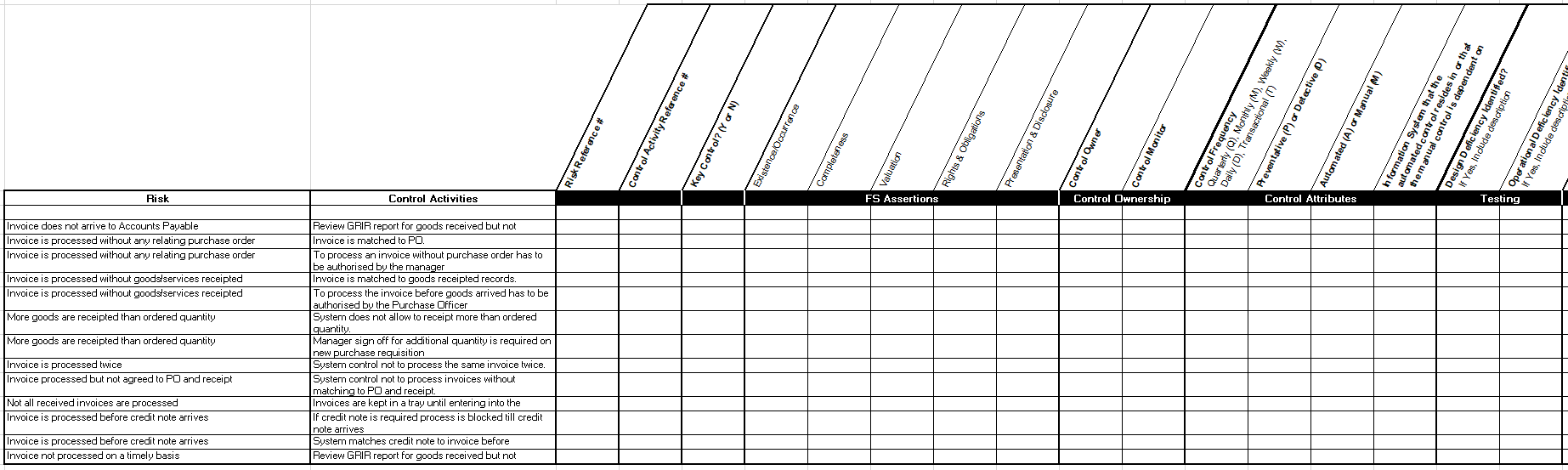

Accounts payable audit companies. The basics of ap auditing broadly speaking, in the american business world audits generally refer to either ones companies don’t plan for that are performed by the internal revenue service or planned. Auditing accounts payable involves verifying the accuracy of transaction records, adherence to internal policies and external regulations, and detecting opportunities for enhancement. This is due to accounts payable can be a subjective area that leads to misstatement which is due to fraud or error.

Why are accounts payable audits important? This 5% decline has a notable impact on profits across businesses of diverse sizes. This phase is crucial as it sets the stage for the entire audit.

An accounts payable audit is an independent and systematic examination of an organization’s accounts payable records. Take the first step towards better accounts payable. This guides business management and others through accounts payable audits, offering the benefits, how to.

Rate this article based on 40 reviews. Updated on wednesday 21st june 2023. All of our senior level auditors are seasoned financial professionals with expertise in all areas of accounts payable & procure to pay recovery auditing, including accounts payable transaction analysis, contract compliance audit services, statement reconciliation, pricing, rebates, allowances, escheatment avoidance, sales and use tax, media.

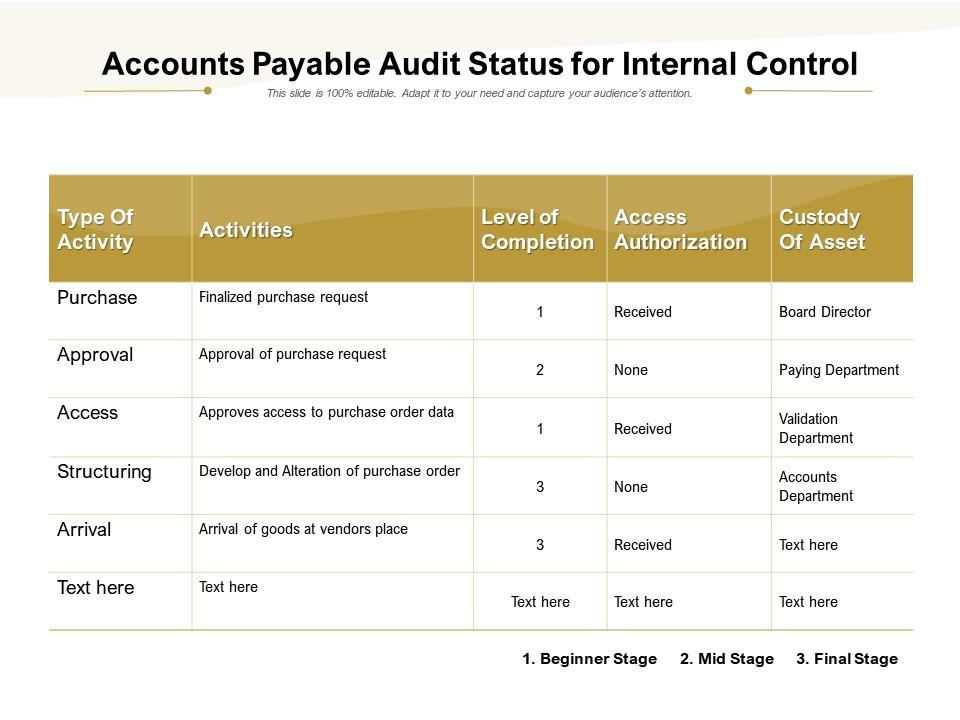

The planning phase helps auditors identify the risk that something might be off or fraudulent in the balance. At paidanalytix, we work with medium and large companies who benefit from artificial intelligence (ai) for accounts payable audits and ap controls which are more effective than audits completed by another person. Automate to illuminate with stampli.

This trail serves to verify every event in the workflow. Ap audits often identify cases where a vendor has been overpaid due to errors in invoicing, incorrect pricing or quantity, or other issues.

Meet with one of our ap experts. Through thorough analysis, these audits can help companies improve their overall accounting processes, protect their financial interests, and foster strong relationships with vendors. Learn more empower your team with ap audit and recovery software

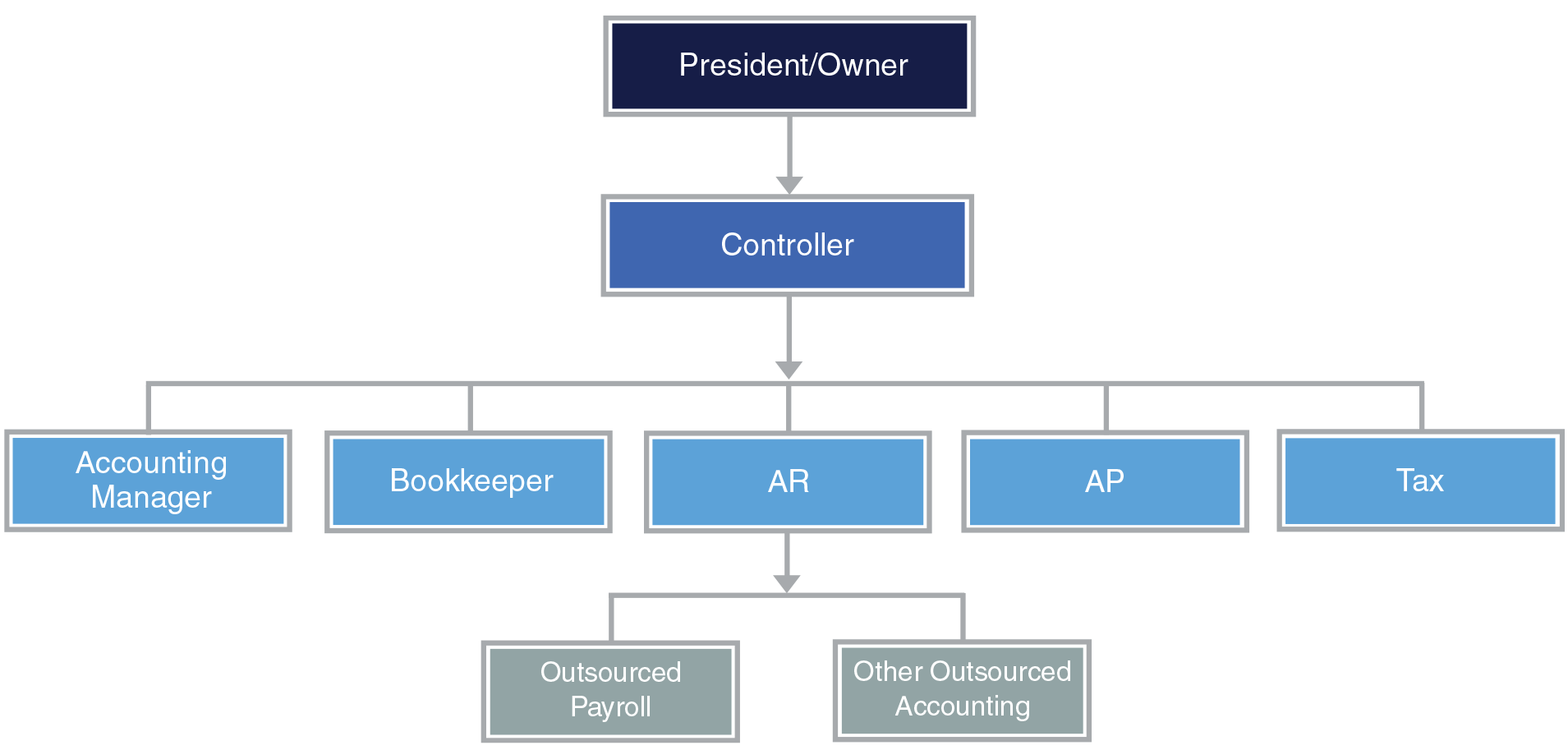

Let our health system ap auditors help you to maximize the recovery of lost dollars and identify control deficiencies to. Understanding the accounts payable process, the associated documents, and the approval metrics is the foundation of a successful audit. Partnering with the right accounts payable recovery audit firm that understands the hospital and healthcare environment is essential.

Firststrike® software helps us quickly consolidate and analyze a wide range of data from disparate purchasing and disbursement systems. Cost of an online accounting degree. Broniec associates is the recognized leader in the accounts payable audit and recovery industry, delivering exceptional results to clients globally.

The areas of an accounts payable recovery audit include duplicate payments, supplier credits, payment terms, accruals, rebates, allowances, pricing, contract terms, transportation, escheatment, fraud detection, real estate leases, among others. It checks whether your transactions are properly recorded and whether those recordings present an accurate view of your business. Some common errors that an ap audit may uncover include: