Top Notch Info About Cash Paid To Suppliers For Inventory Is An Investing Activity

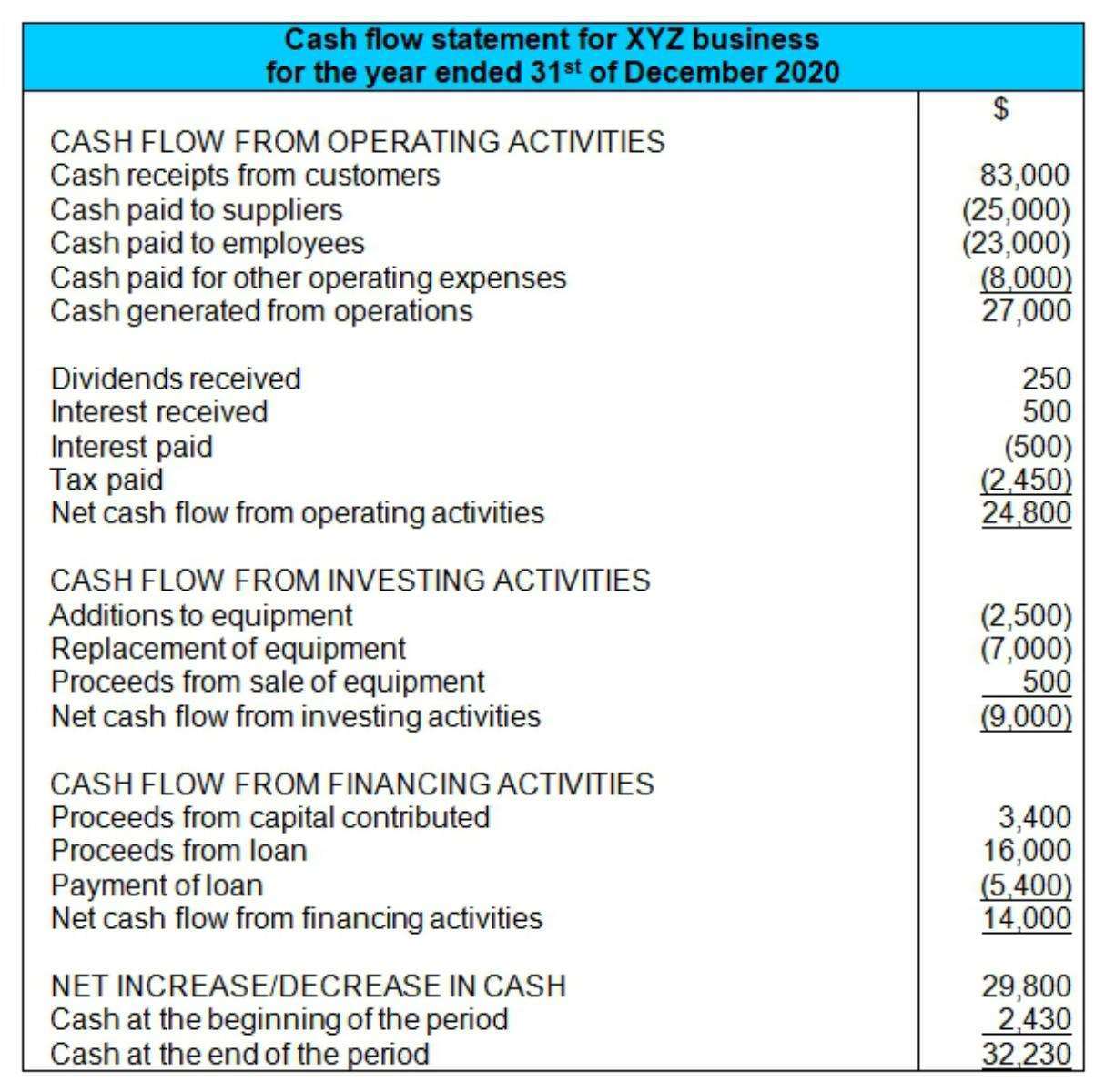

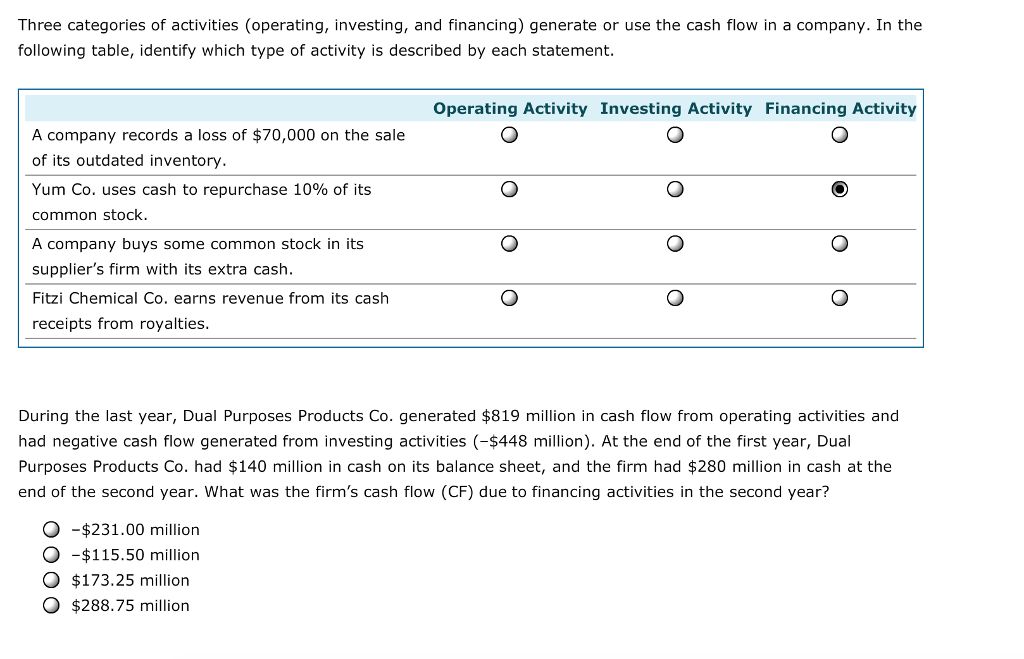

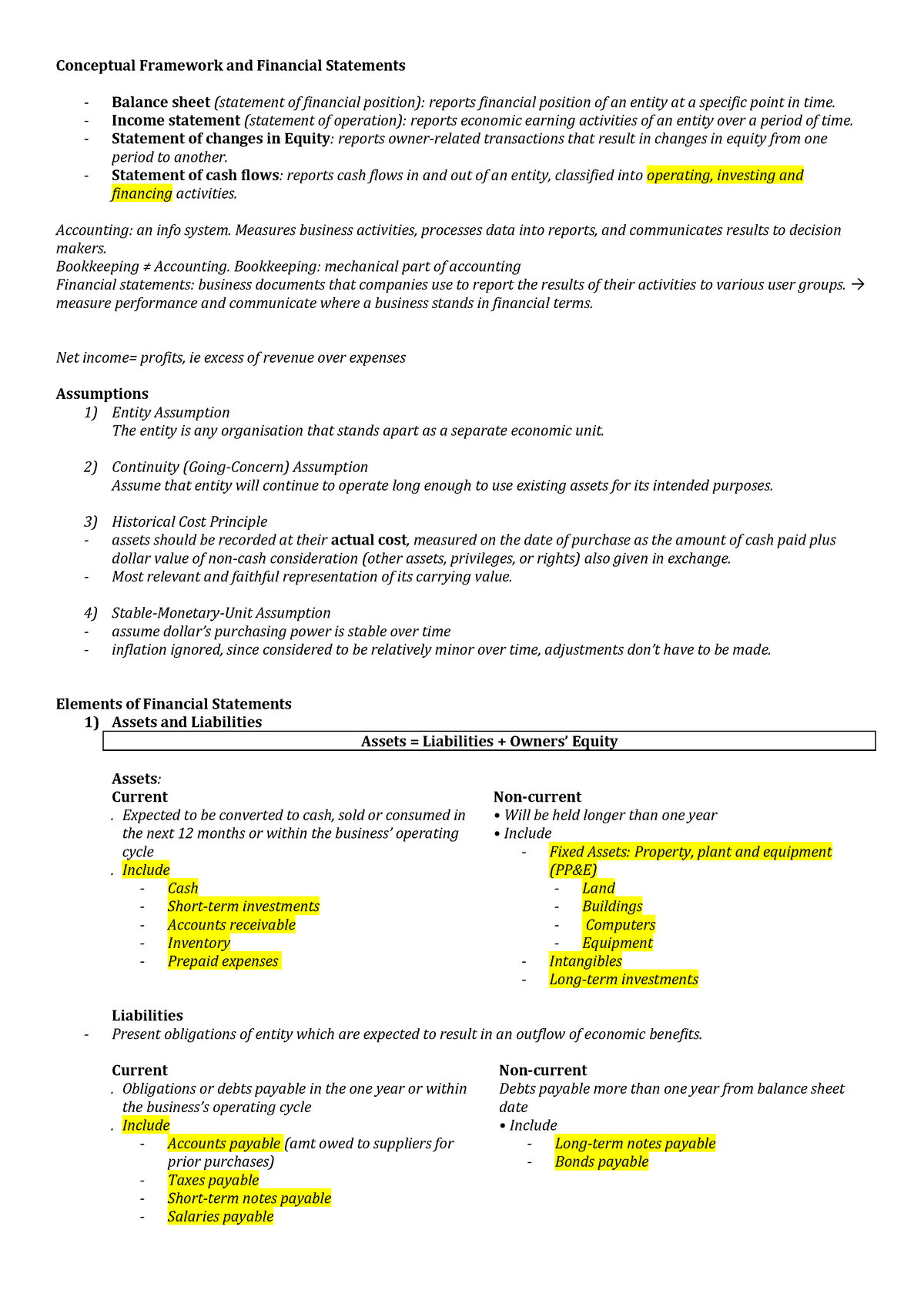

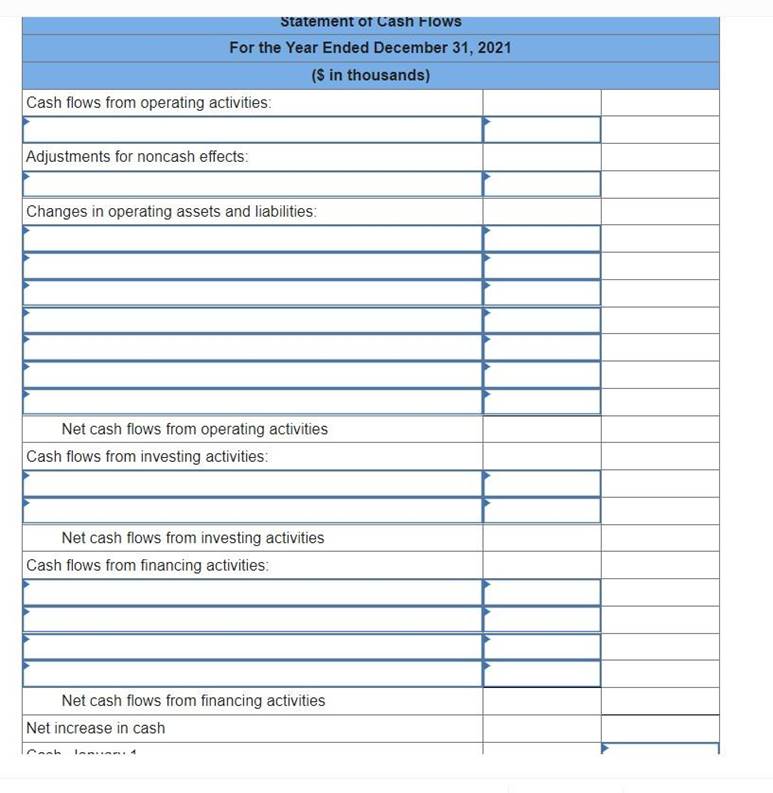

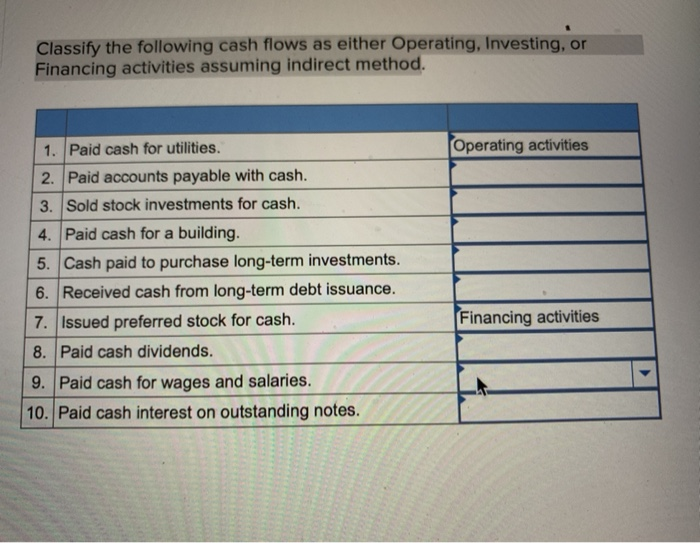

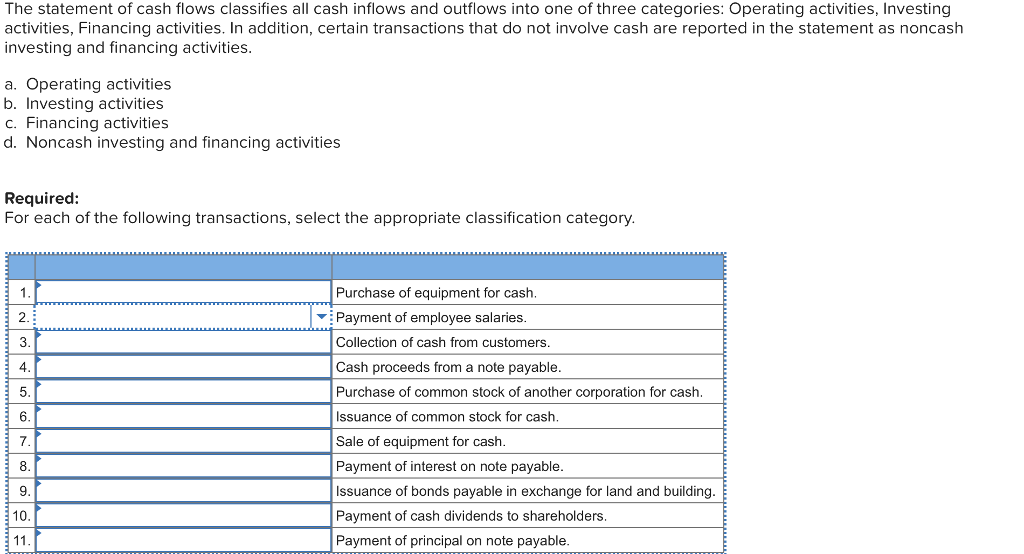

Operating activities involve the cash effects of transactions that enter into the determination of net income, such as cash receipts from sales of goods and services and cash.

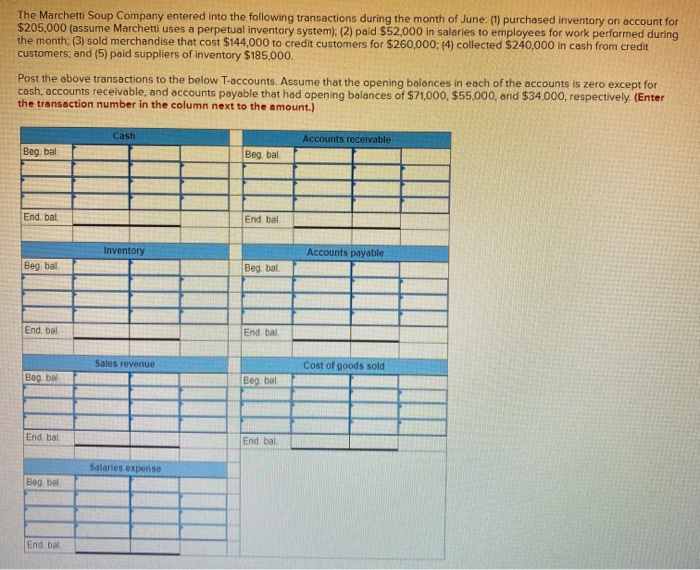

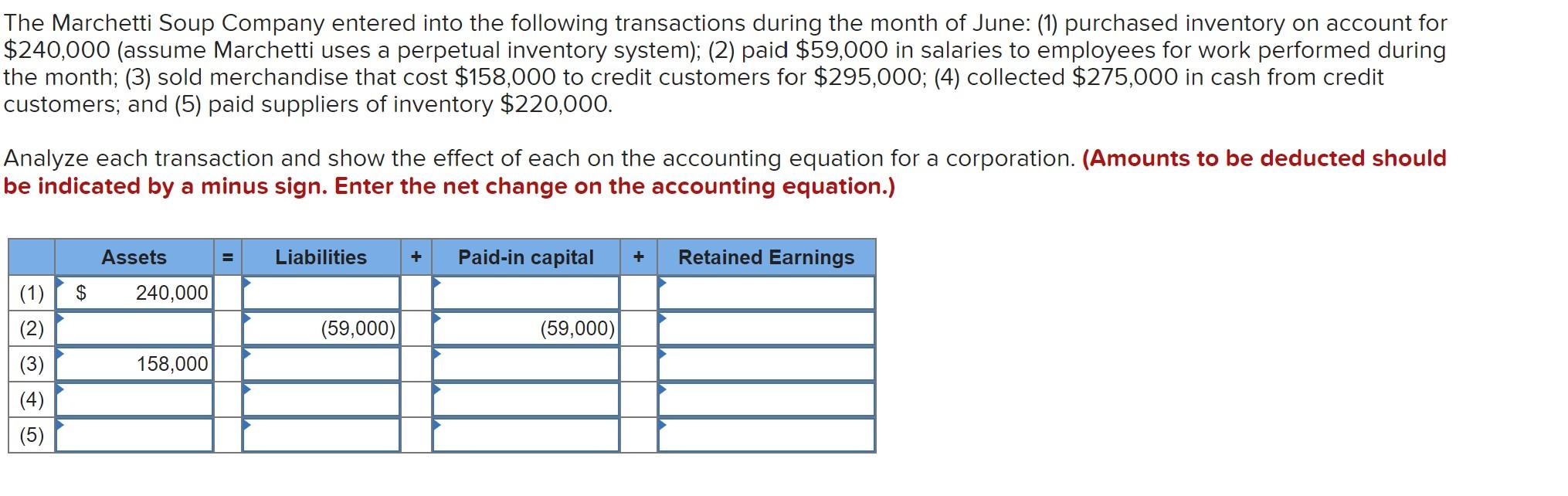

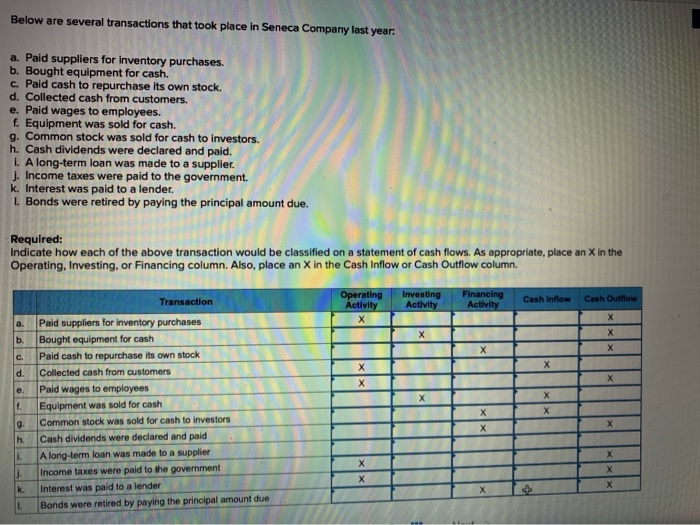

Cash paid to suppliers for inventory is an investing activity. Cash flow from investing activities. Cash paid for rent is reported as an operating activity. The cash paid to suppliers for purchases relating to inventory is calculated by adjusting cost of goods sold (cogs) from the income statement for movements in.

Cash contributed to the business by an owner is an investing activity. Is the payment to a supplier for inventory classified as an operating activity, an investing. When a company pays a supplier for inventory it has purchased, the cash outflow is recorded in the investing activities section of the statement of cash flows.

Cash paid for inventory is different from the cost of goods sold that is recorded on the accrual basis financial statements. Cash paid to suppliers for inventory. Paid bills to insurers and utility providers.

Payment of cash to suppliers for inventory b. Operating cash flow = net income + depreciation and amortisation + accounts receivables + inventory + accounts payables. If an arrangement is made whereby a cash disbursement is made by a third party (e.g., a financial institution) on behalf of the reporting entity to satisfy the reporting entity’s.

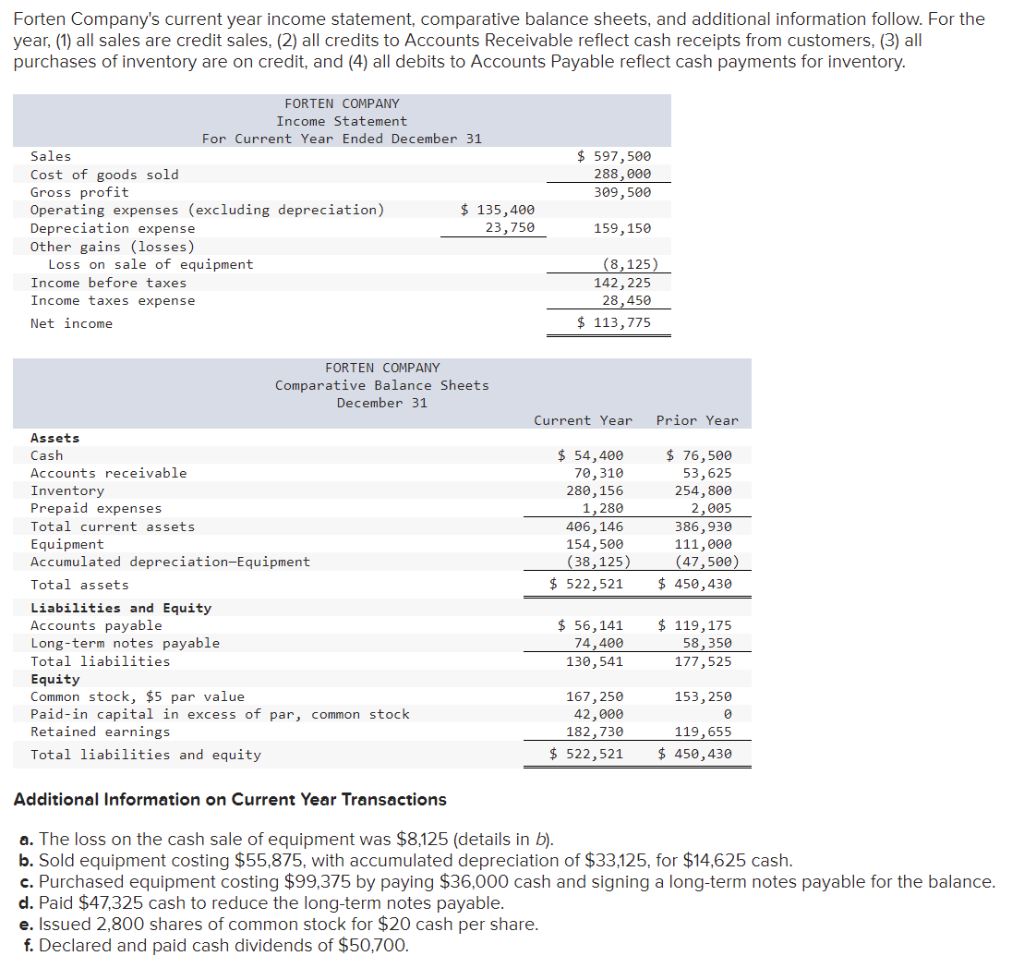

Common cash flow calculations include the tax paid (which is an operating activity cash outflow), the payment to buy property, plant and equipment (ppe) (which is an. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments. During the year, a company sold $500 of inventory, paid $400 to suppliers for inventory previously purchased on account, purchased $100 of inventory for cash, acquired $75.

Which is an example of a cash flow from an investing activity? Study with quizlet and memorize flashcards containing terms like collected cash from customers,. Investing activities include purchases of physical assets, investments in securities, or the sale of.

Payment of cash to repurchase outstanding capital stock c. Is the payment to a supplier for inventory classified as an. Direct method of operating activities cash flows is one of the two main techniques that may be used to calculate the net cash flow from operating activities in a.

For example, operating cash flows.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)