Best Of The Best Tips About Disclosure In Corporate Financial Report

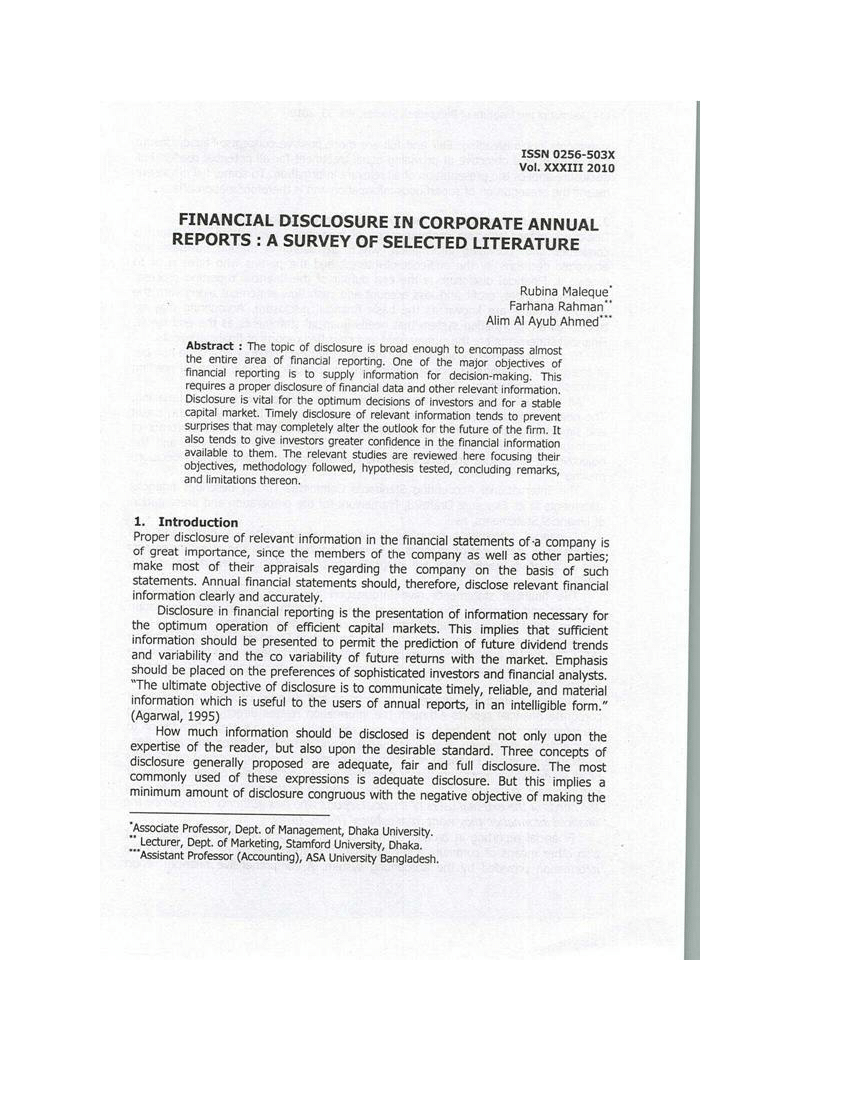

Key takeaways disclosure is the process of making facts or information known to the public.

Disclosure in corporate financial report. When there is insufficient relevant. Setting up their own volunteer armies. In 2022, we transitioned from a traditional annual report that focuses on financial performance to that of an integrated report that seeks to provide a balanced.

The growing interest in a company’s sustainability strategy and performance means that solely providing financial information in corporate disclosures will no. At least 16 major chinese firms, including a privately. Nvidia announces financial results for fourth quarter and fiscal 2024.

Enhancing financial reporting and disclosure effectiveness 82 appendix a. Record quarterly revenue of $22.1 billion, up 22% from q3, up 265% from year ago. In the finance and investment world, disclosures are required to be issued by businesses and corporations, disclosing all relevant information that can potentially influence an investor’s decision. it helps investors make informed decisions and choose stocks or bonds that may suit their.

We review the empirical literature investigating the influence of financial reporting and disclosure on corporate investment decisions. We study financial reporting and disclosure practices in china using survey methods similar to prior studies of u.s. Corporate governance and voluntary disclosures in annual reports:

Whereas the effects of financial. Corporate disclosure and reporting of information has become synonymous with transparency which in discourses idealising its value is part of. Policies and ethics.

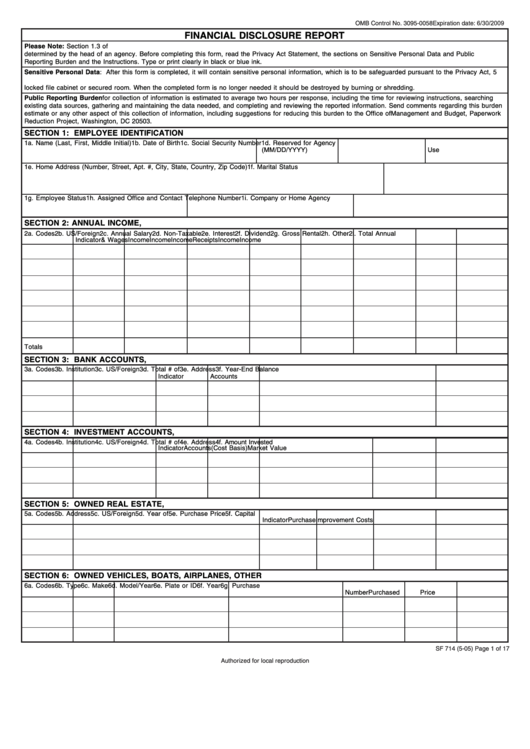

Proper disclosure by corporations is the act of making its. Financial disclosure is a statement issued by a firm, business, or corporation that defines the financial strategies being employed and. Firms (i.e., graham et al., 2005;

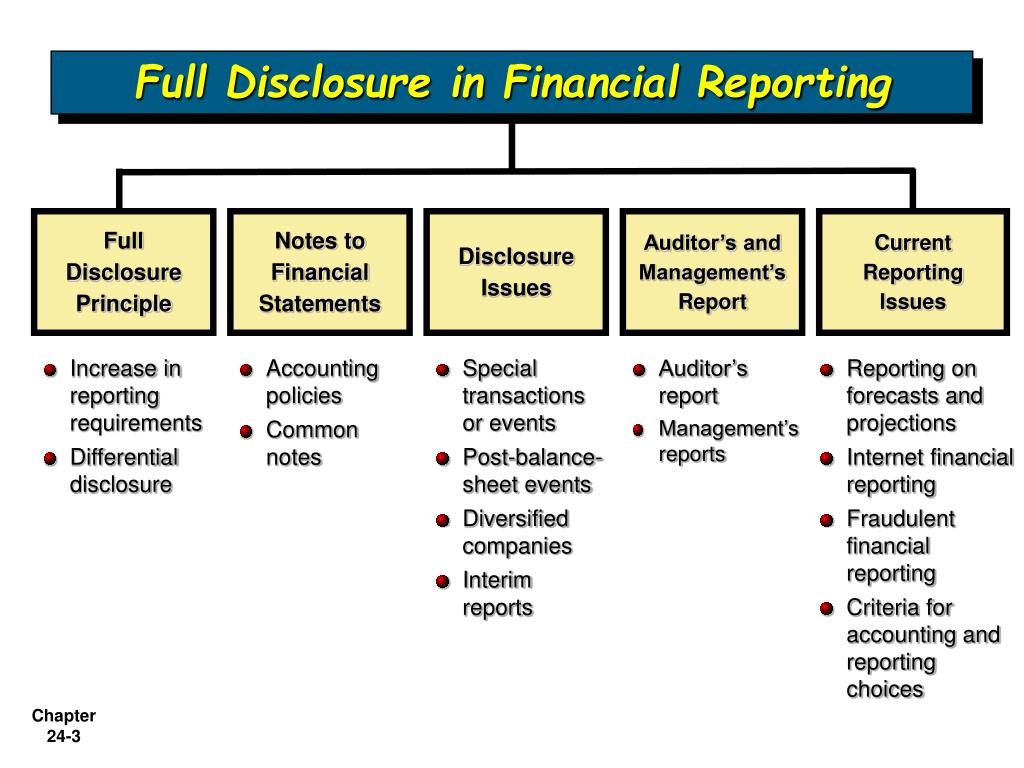

In recent years, voluntary disclosure (i.e. It supports the international accounting standards board's disclosure recommendations in its recent discussion paper: This paper reviews the literature on the real effects of financial reporting and disclosure on corporate innovation, highlighting both the possible channels of.

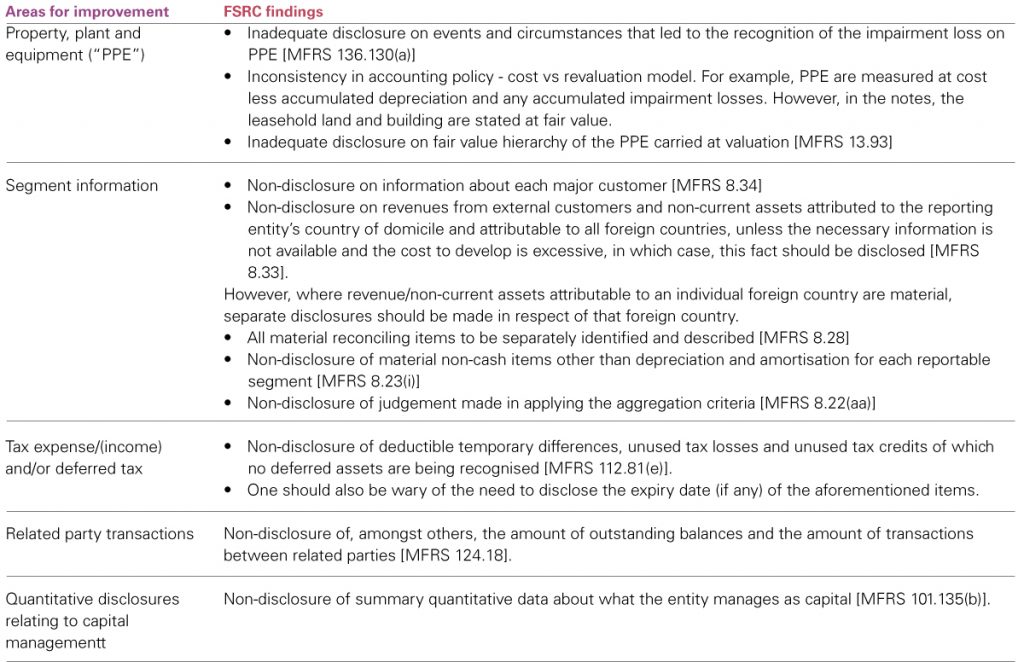

In 2023, california passed two laws that will require public and private companies that do business in california to disclose their greenhouse gas (ghg). 31, 2022 (and apa’s annual. Disclosures fail to be useful when they contain:

Disclosure over and above those specified by law) has become an important aspect of financial reporting. This article systematically reviews 94 accounting and finance studies that address the real effects of financial reporting. Relevance is fundamental to good financial reporting.

Board structure (board size, board independence, board activity and board busyness). Chinese companies are doing something rarely seen since the 1970s: The paper aims at identifying impact of corporate governance variables i.e.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)