Can’t-Miss Takeaways Of Info About Profit And Loss Account Explained

The q4 financial report also revealed that despite making and delivering twice as many evs in 2023 as in 2022, the company still saw a $5.4 billion loss for the year.

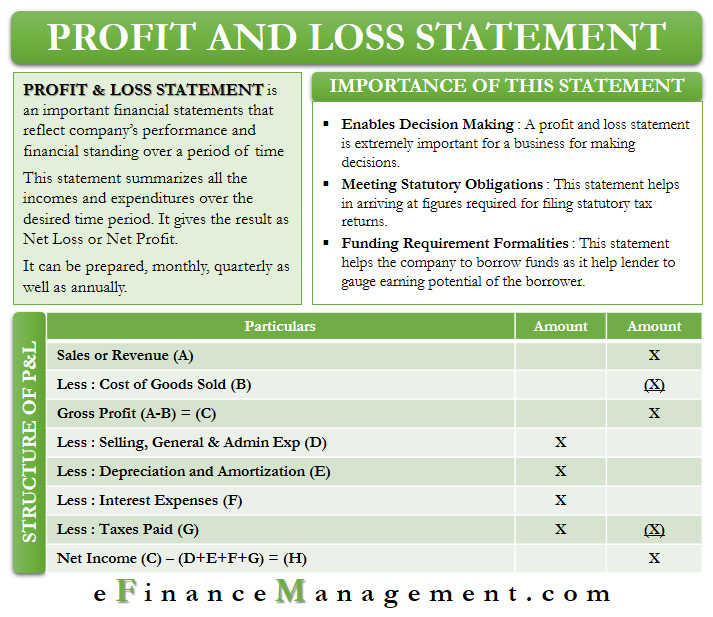

Profit and loss account explained. The purpose of the profit and loss account is to: These statements provide a clear picture of the company’s profits and losses incurred during a. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce.

The enterprise's profit and loss account detail the firm's net profit or loss. P&l accounting involves the creation of reliable profit and loss statements to assess the financial performance of an individual or business. The motive of preparing trading and profit and loss account is to determine the revenue earned or the.

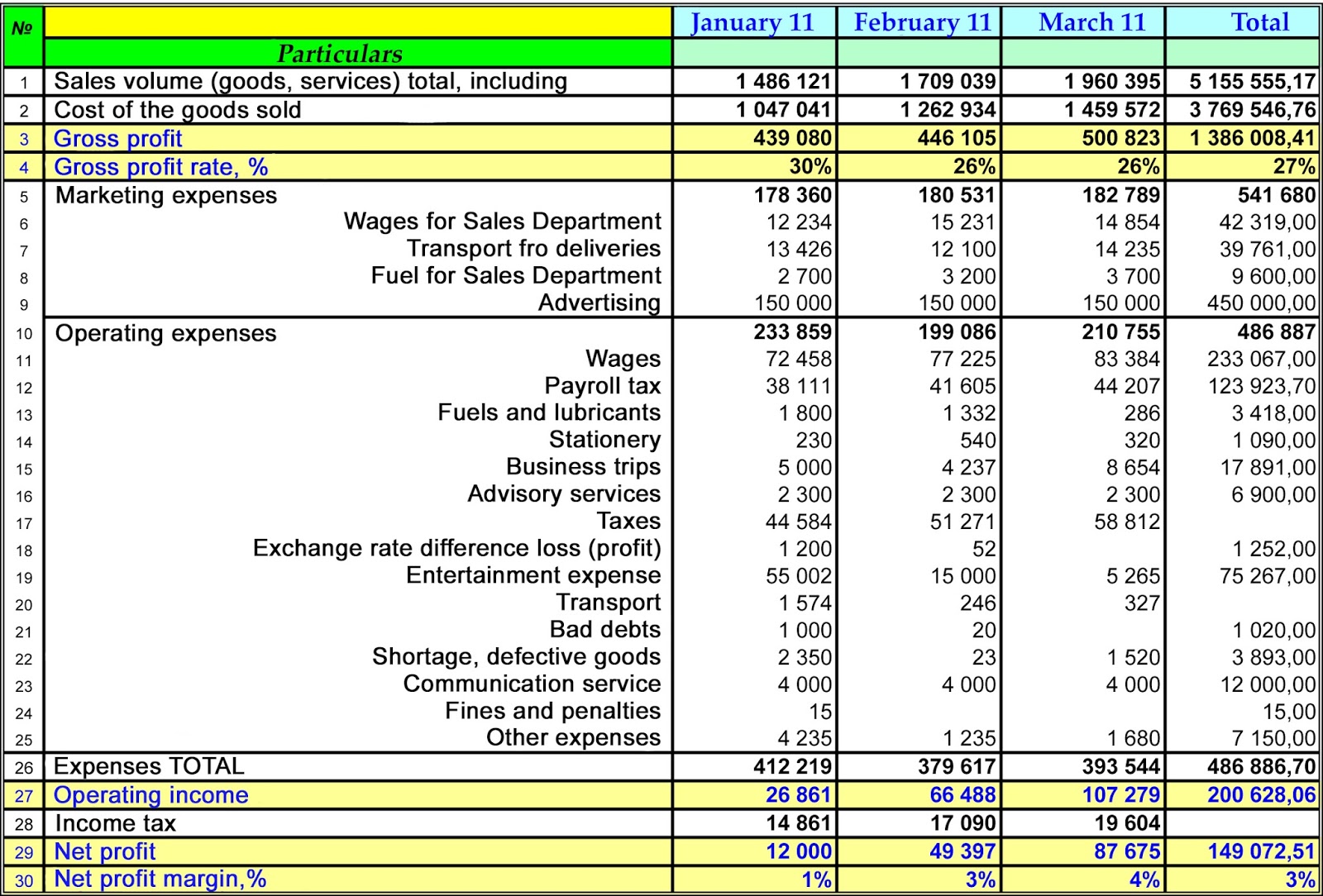

It shows your revenue, minus expenses and losses. This is your income minus the cost of goods sold, expenses and taxes. Fy total revenues 42.95 billion baht versus 18.29 billion baht.

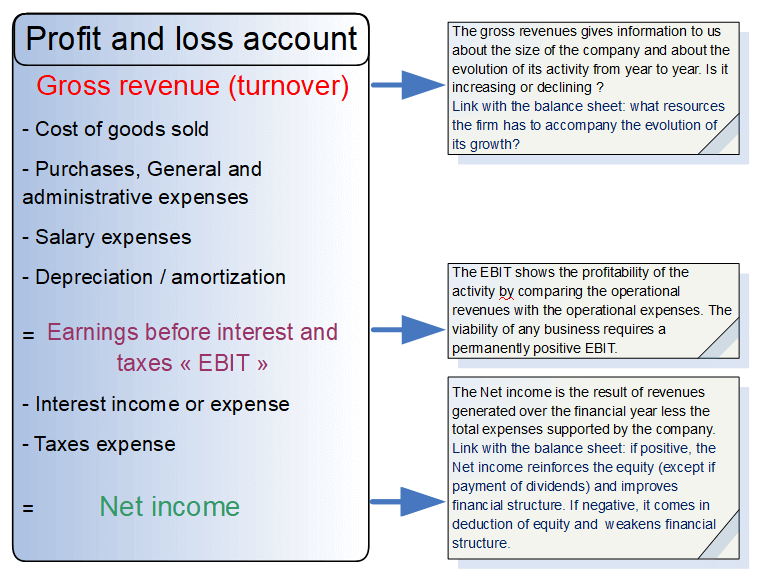

Interest expense = $5 million. Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns. A profit and loss (p&l) account shows the annual net profit or net loss of a business.

A p&l statement provides information about whether a company can. It's a straightforward presentation of a. What is a profit and loss account?

On that basic level, profit and loss is derived from taking your costs away from your sales. It’s a piece of bookkeeping terminology you’ll apply to the figures that. The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts trump's business activities in the state.

Login or create a forever free account to read this news. Your p&l statement shows your revenue, minus expenses and losses. Essentially, a p&l account is a story.

Sg&a = $20 million. Generate more cash coming into your business than going out as costs, and your business is on solid ground. Here are the most common terms in the profit and loss account that you need to understand:

This summary provides a net income (or bottom line) for a reporting period. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period. Categorising costs between cost of sales and operating costs.

What is profit and loss accounting? Profit and loss account terms explained. A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the.