Real Info About Detailed Balance Sheet Examples Of Owners Equity In Accounting

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

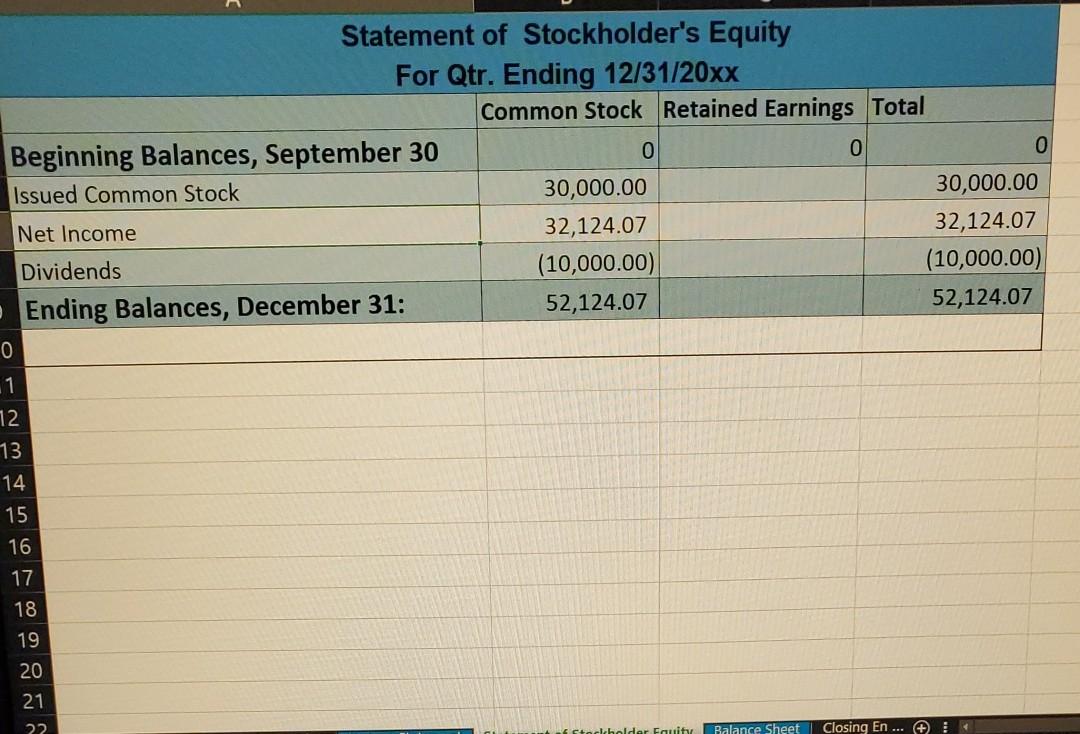

The statement of owner’s equity tracks the changes in the value of all equity accounts attributable to a company’s shareholders and impacts the ending shareholder’s equity carrying value on the balance sheet.

Detailed balance sheet examples of owners equity in accounting. It will be helpful to revisit the process by summarizing the information we started with and how that information was used to create the four financial statements: The statement uses the final number from the financial statement previously completed. Business owners may think of owner’s equity as an asset, but it’s not shown as an asset on the balance sheet of the company.

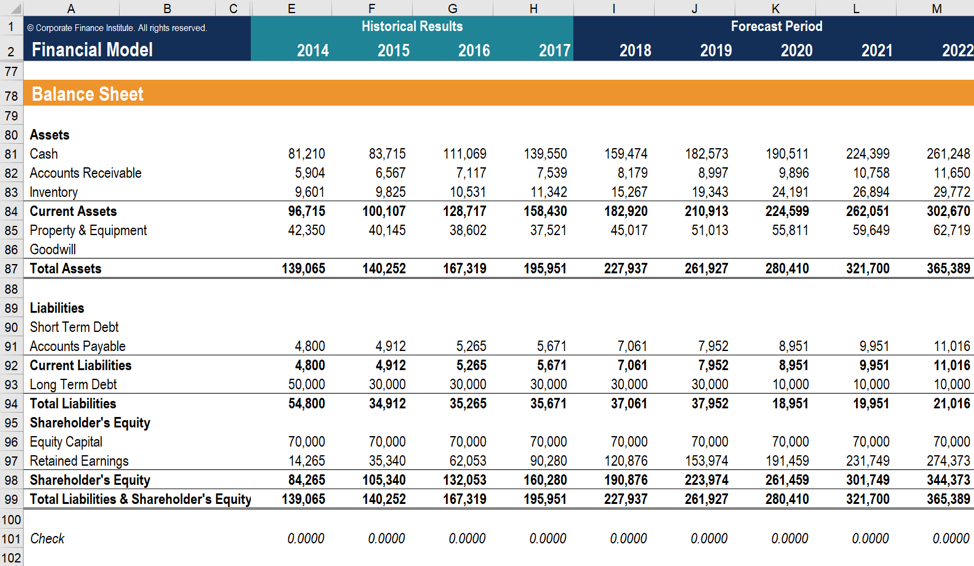

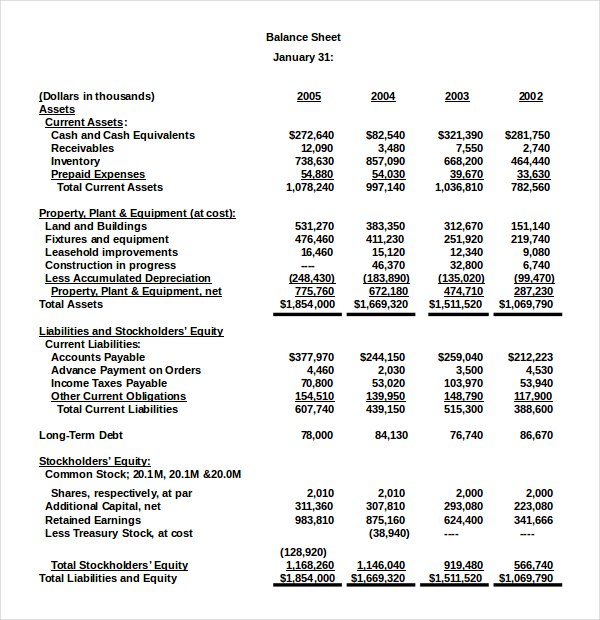

Figure 2.9 balance sheet for cheesy chuck’s classic corn. Owners equity = common stock +prefered stock + retained earnings. Total equity also represents the residual value left in assets after all liabilities have been paid off, and is recorded on the company’s balance sheet.

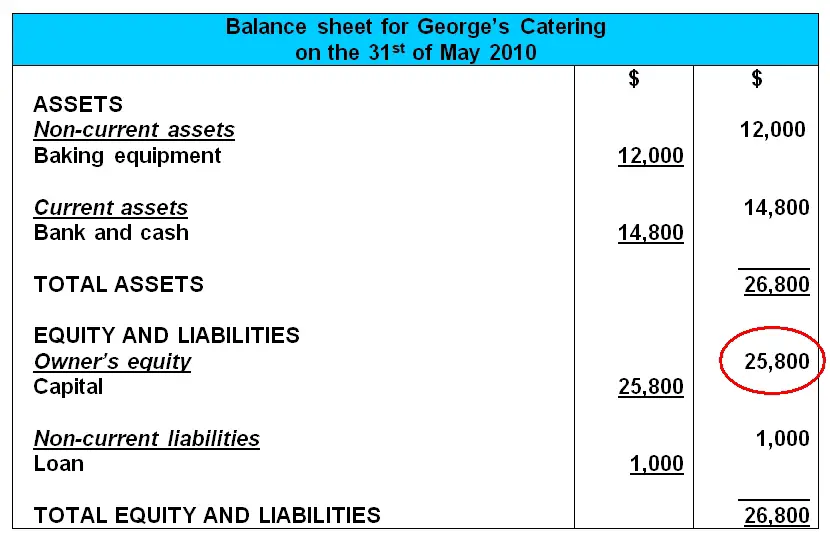

2.1 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate highlights the study of accounting requires an understanding of precise and sometimes complicated terminology, purposes, principles, concepts, and organizational and legal structures. Owners equity is one of three main sections of the balance sheet. Find the total liabilities for the period, which is also listed on the balance sheet.

Reviewed by dheeraj vaidya, cfa, frm. Assets are shown on the left hand of the balance sheet while the liabilities and owners’ equity is placed on the right hand side of the balance sheet. Owner's equity is viewed as a residual claim on the business assets because liabilities have a higher claim.

Accumulated profits, general reserves, other reserves, etc. Remember the balance sheet formula: In this case, the statement of owner’s equity uses the net income (or net loss) amount from the income statement (net income, $5,800).

Fundamental analysts use balance sheets to calculate financial ratios. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. Assets = liabilities + owners equity.

Income statement, statement of owner’s equity, balance sheet, and statement of cash flows. Owners equity and the balance sheet equation. All assets that are not listed as current assets, are.

Because technically owner’s equity is an asset of the business owner—not the business itself. Owners equity = $9,00,000 + $3,30,000 + $4,60,000. Let’s create a balance sheet for cheesy chuck’s for june 30.

Learn online now what is the statement of owner’s equity? If a sole proprietorship's accounting records indicate assets of $100,000 and liabilities of $70,000, the amount of. Below, we’ll explore what exactly goes on a balance.

Owner's equity can also be viewed (along with liabilities) as a source of the business assets. Owner’s equity is recorded in the balance sheet at the end of an accounting period. You’ve probably heard at least some of these terms before.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)