Underrated Ideas Of Info About Miscellaneous Income On Statement

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

When you earn more, you will end up paying more in taxes.

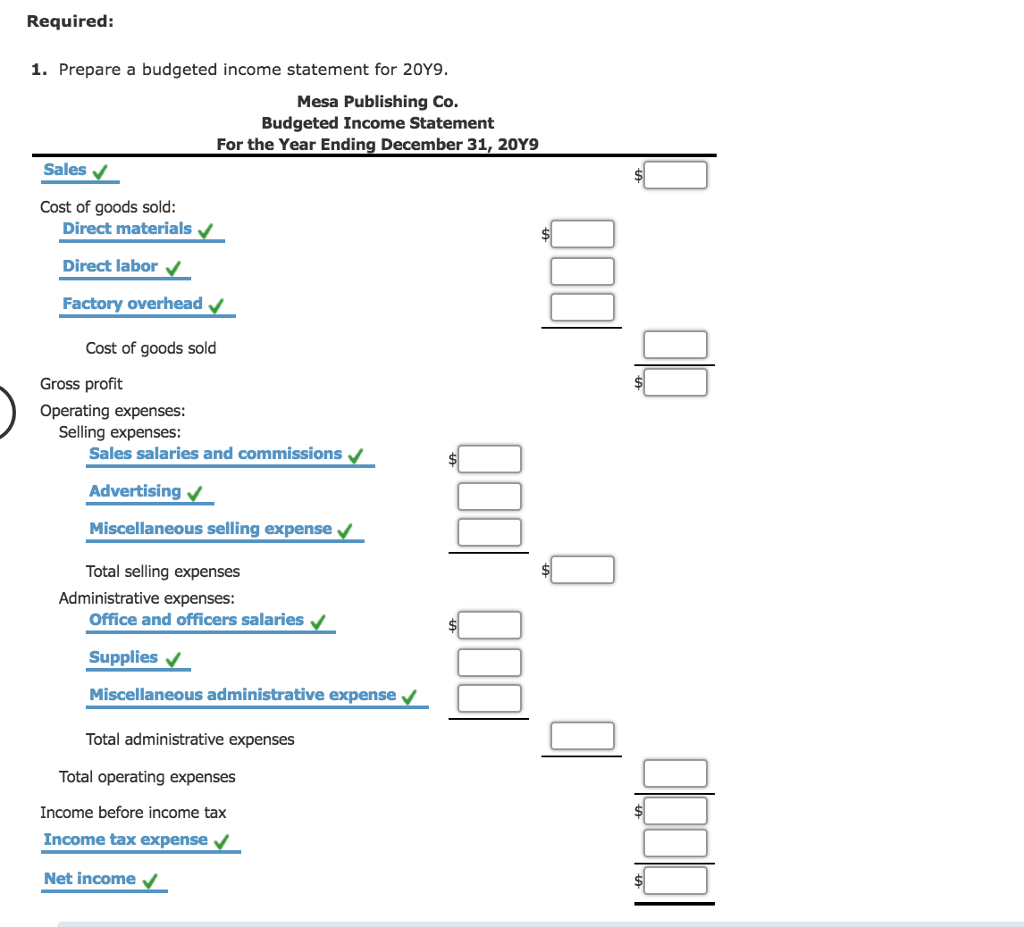

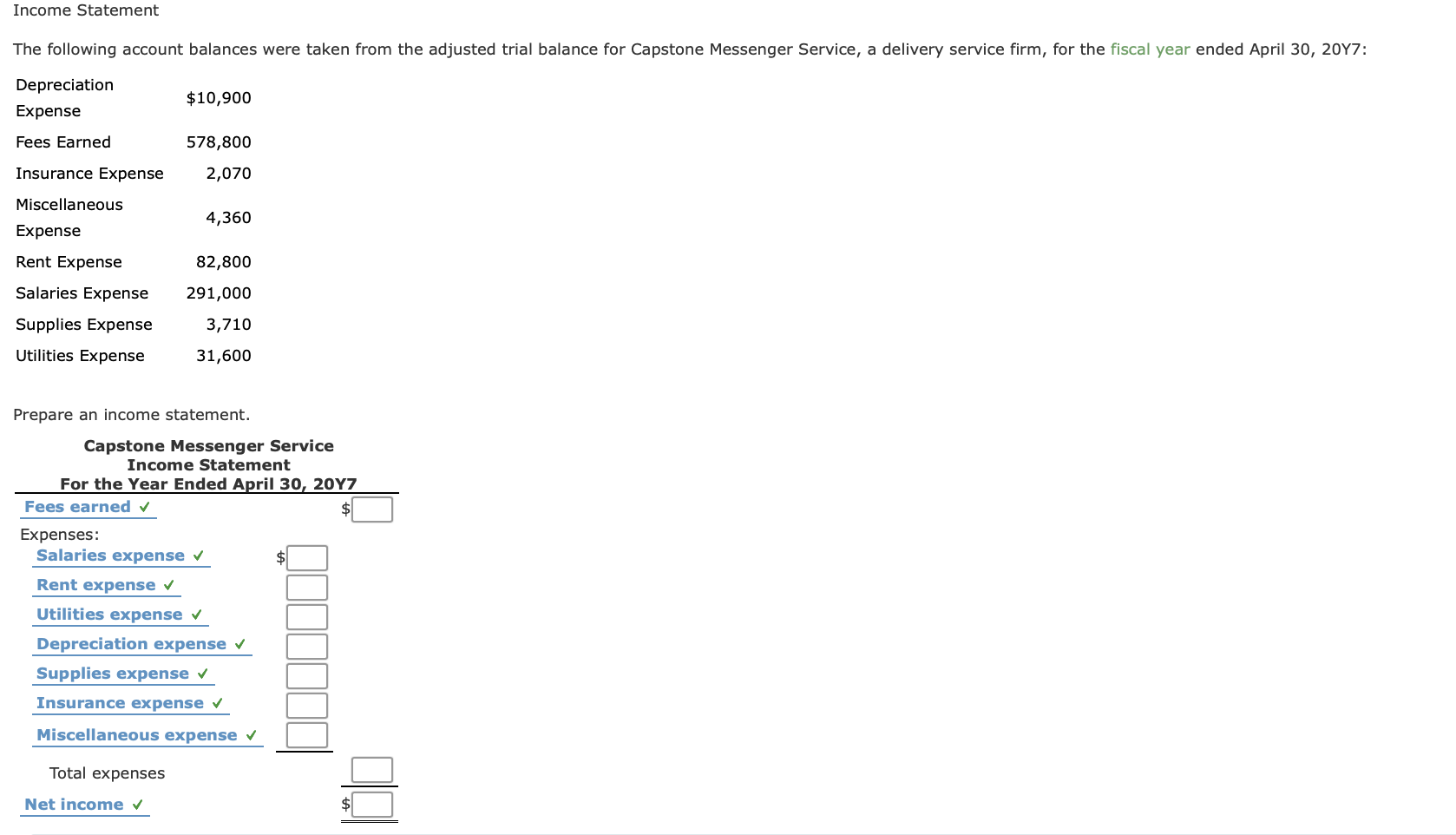

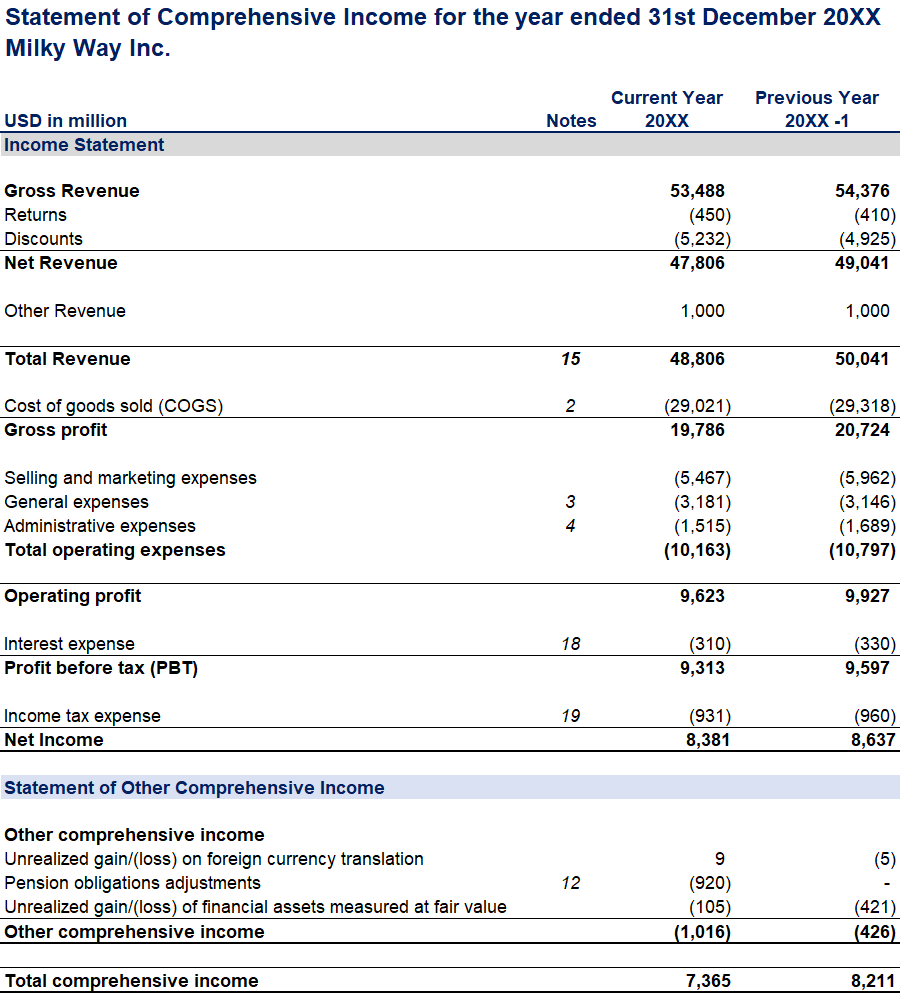

Miscellaneous income on income statement. It has lots of employees to prepare the incense sticks. In such a stressful economic environment, the last thing anyone. For example, during the year the company makes revenue of usd500,000, cost of sales usd300,000 and other income usd5,000, then the extract p&l of the company is as follows:

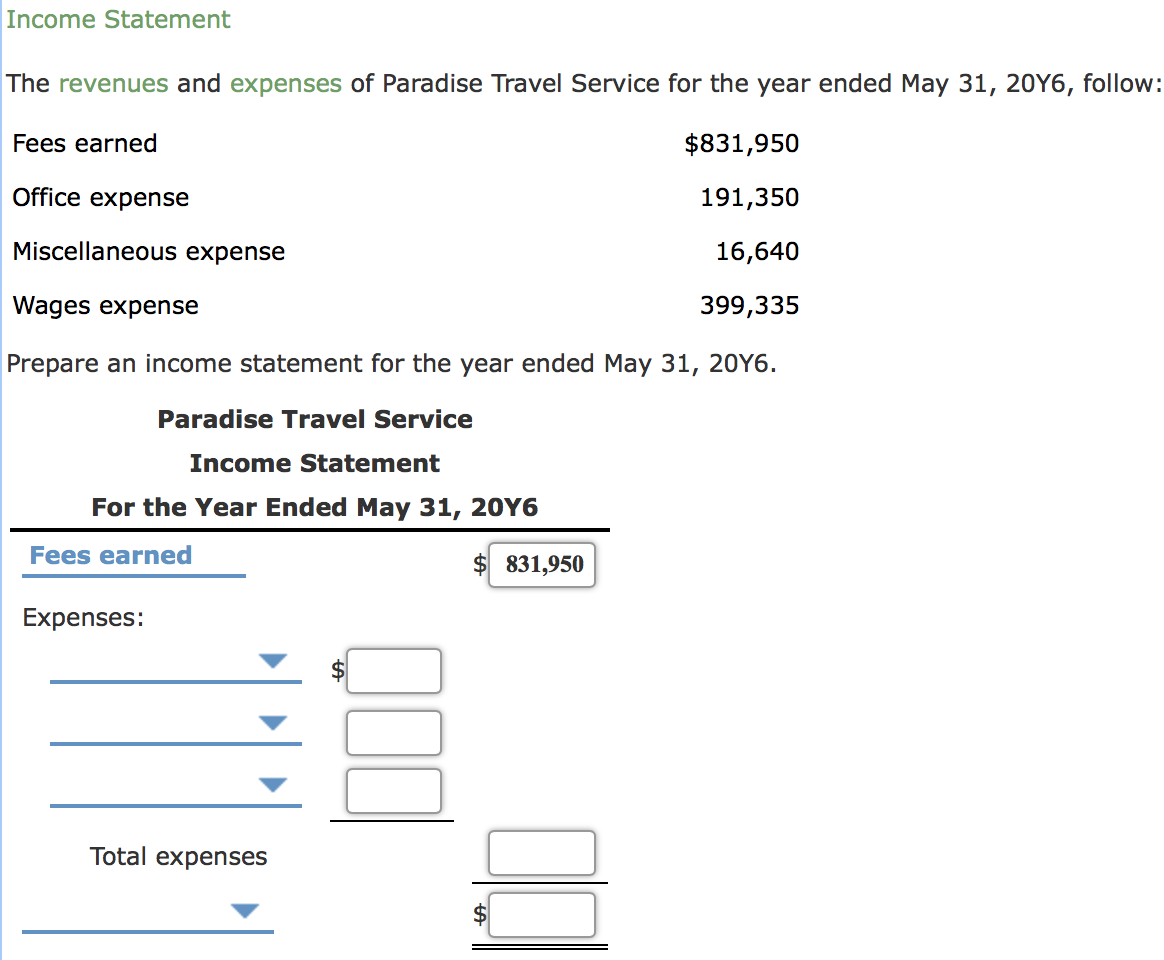

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. So, instead of food, you could list: If you are filing a joint return with a.

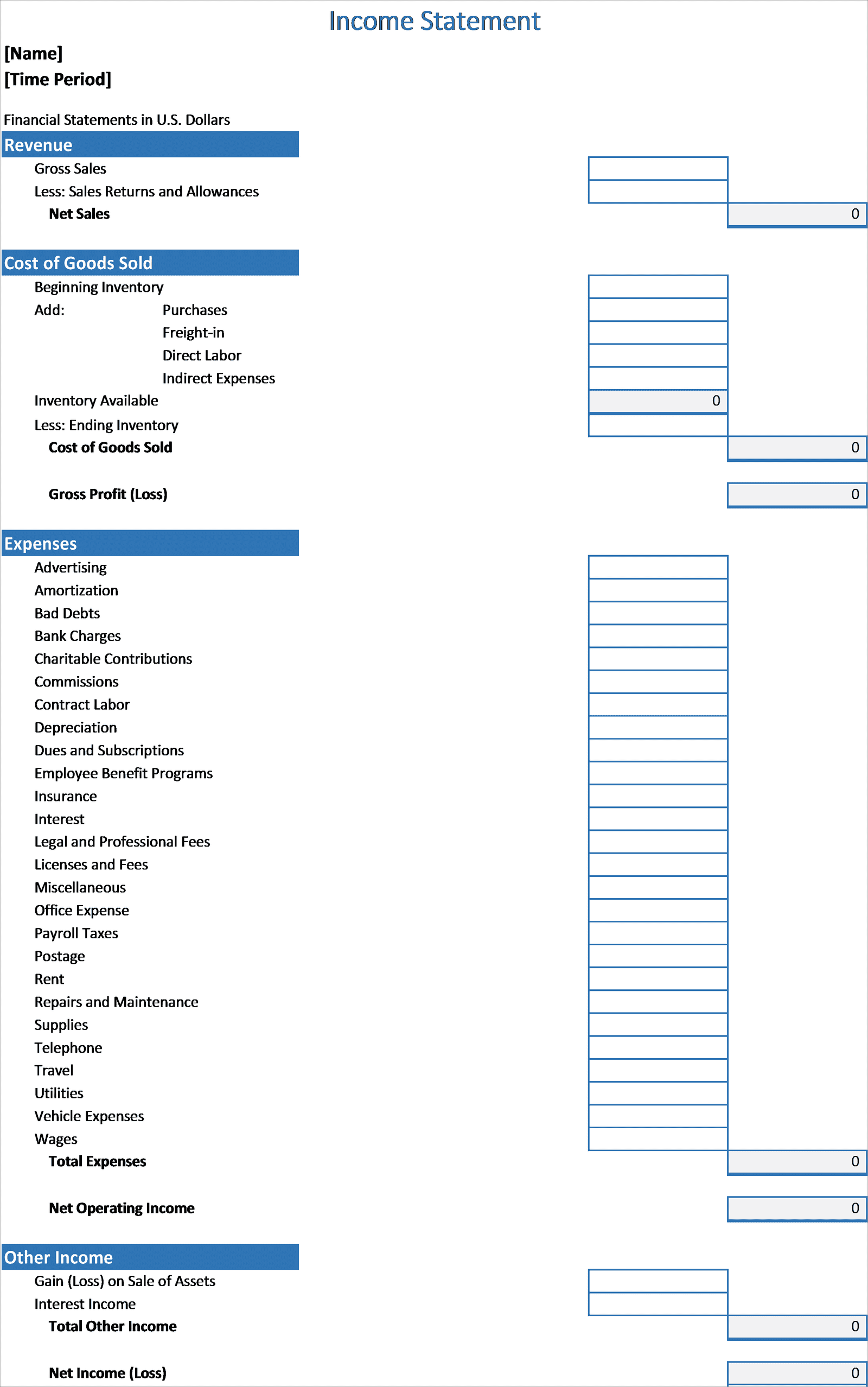

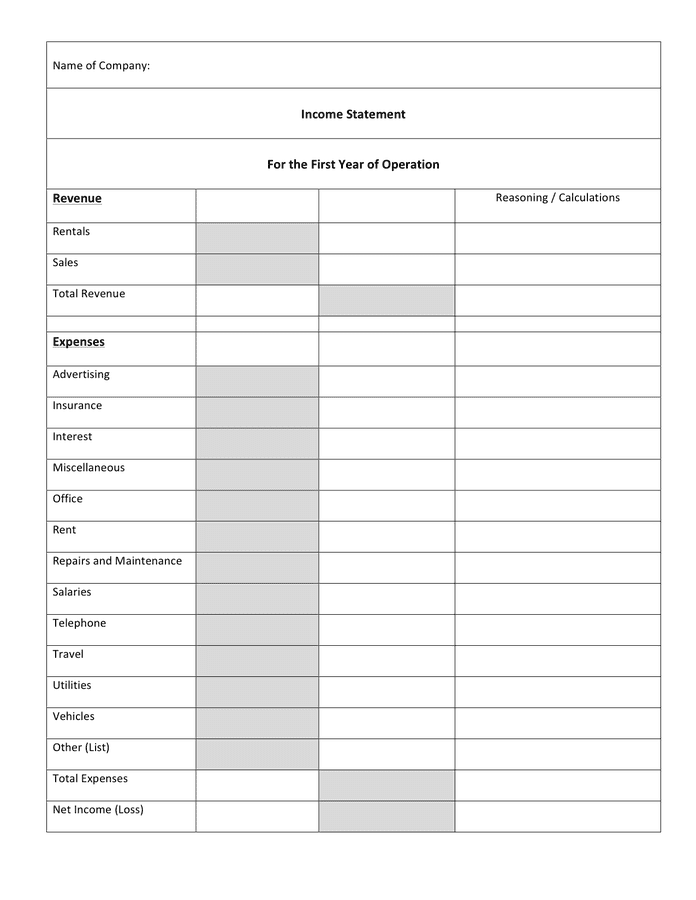

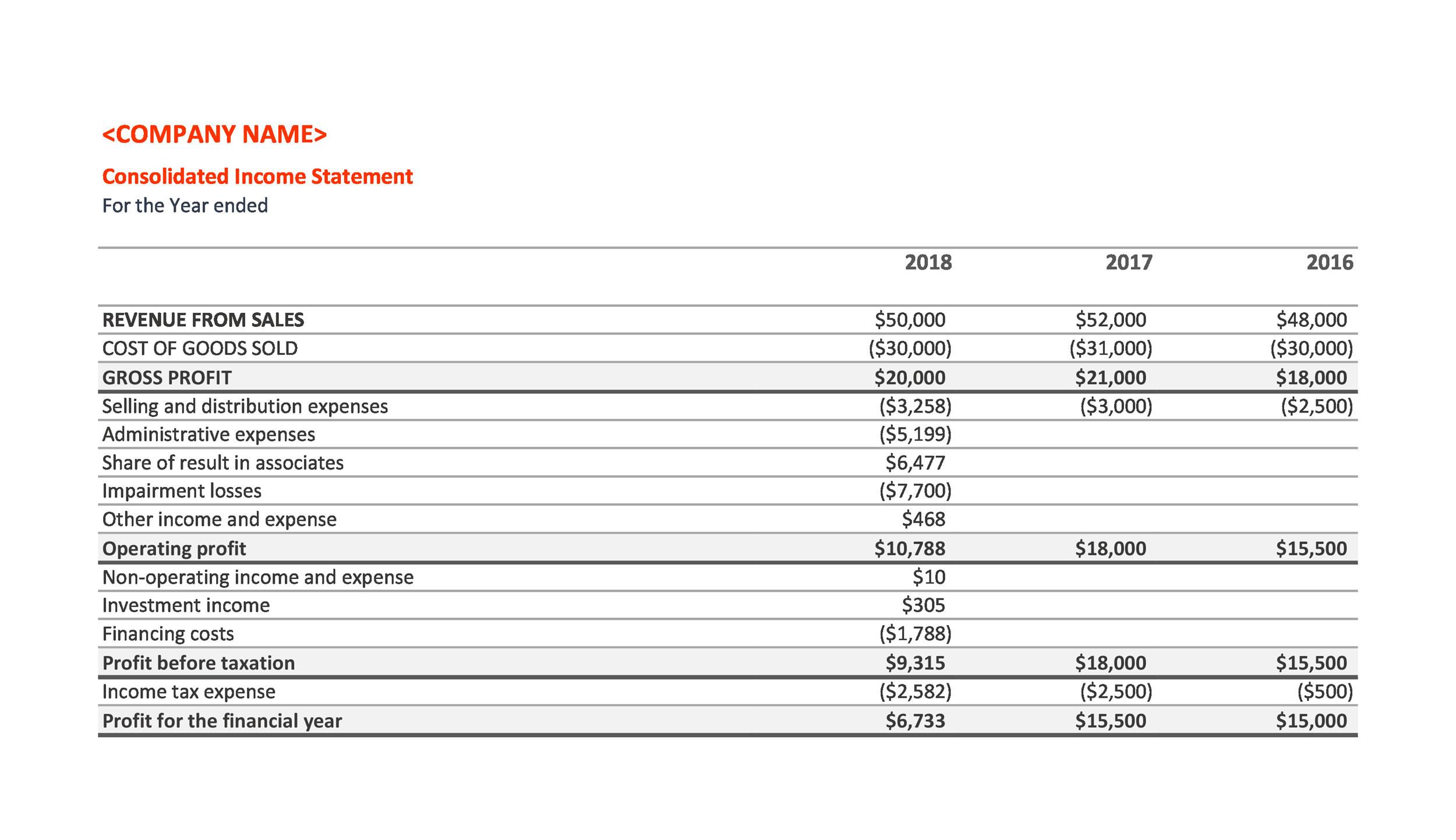

Previously, these types of payments were called miscellaneous income. The income statement focuses on four key items: The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

Add up all your revenue from sales during the reporting period and deduct your returns and concessions. Revenue, expenses, gains, and losses. After a long period of high inflation following the covid‑19 pandemic, many canadians are feeling financial strain.

Since other income is not revenue, where do we find it on the profit & loss statement (aka income statement)? If you are an unmarried senior at least 65 years old and your gross income is more than $14,700. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous.

This year, the process of filing an income tax and benefit return may feel particularly daunting. With a provisional income of $34,001 and above for single files or $44,001 and. To keep track of your costs, you may choose to break some of these categories down further.

What is income tax? Sales revenue = ($400,000) gross profit = $200,000. In a restaurant income statement, cogs relates to your food and drink costs.

Income range where 85% of your social security is taxable. Regular, extensive, and ongoing expenses, such as payroll, office rent, and inventory supplies — all have their own account to track, and each expense records its associated costs every month. In the income statement, other income is presented after the other gross profit.

The net income or loss is known as the. Miscellaneous expense is a term used to define and refer to costs that typically do not fit within specific tax categories or account ledgers. What is an income statement?

The answer is that each company presents this information differently. What is miscellaneous income (information)? The subject line (above) was cut short.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)