Best Tips About Petty Cash In Trial Balance

This is because line items in the balance sheet are sorted in their order of.

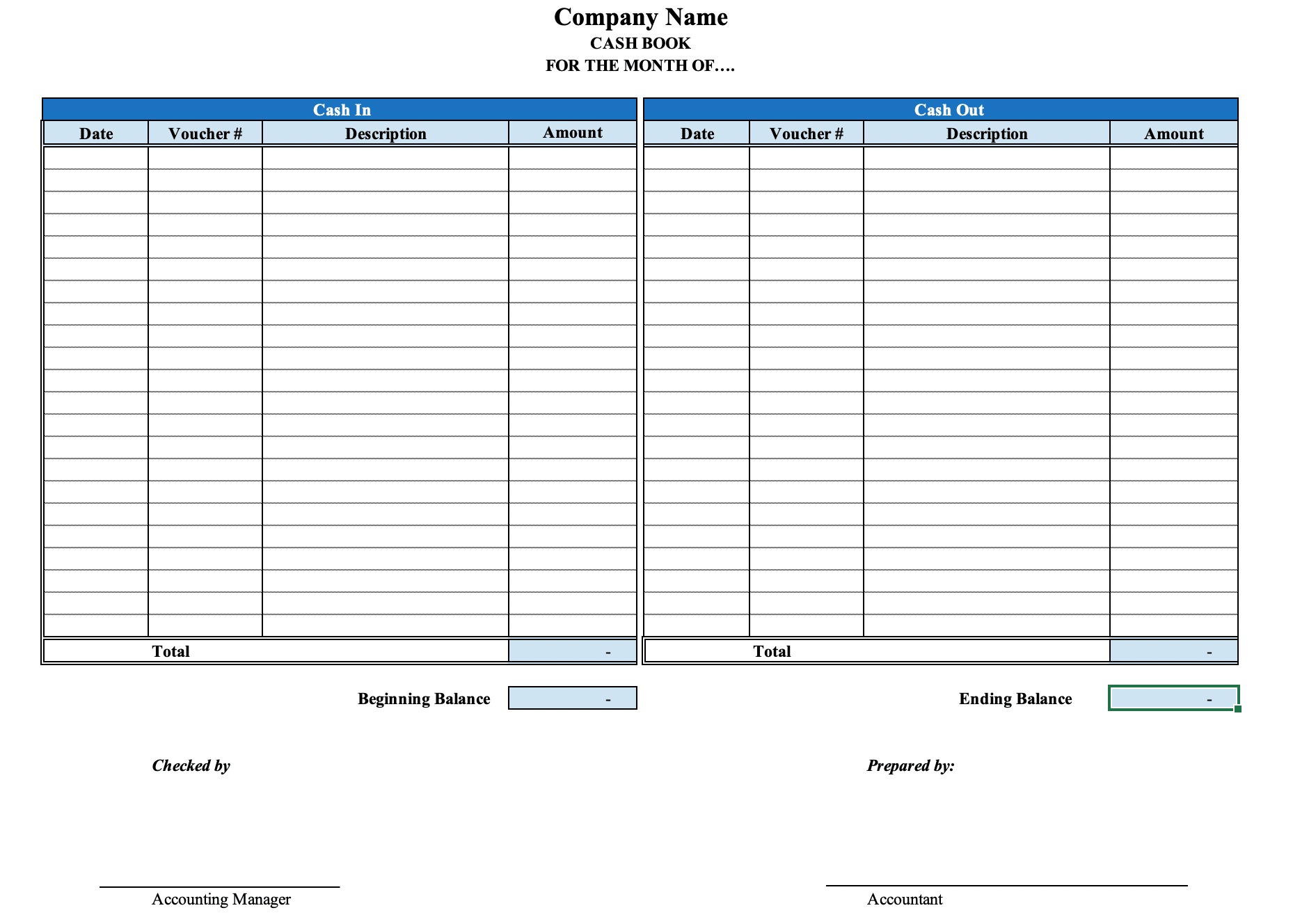

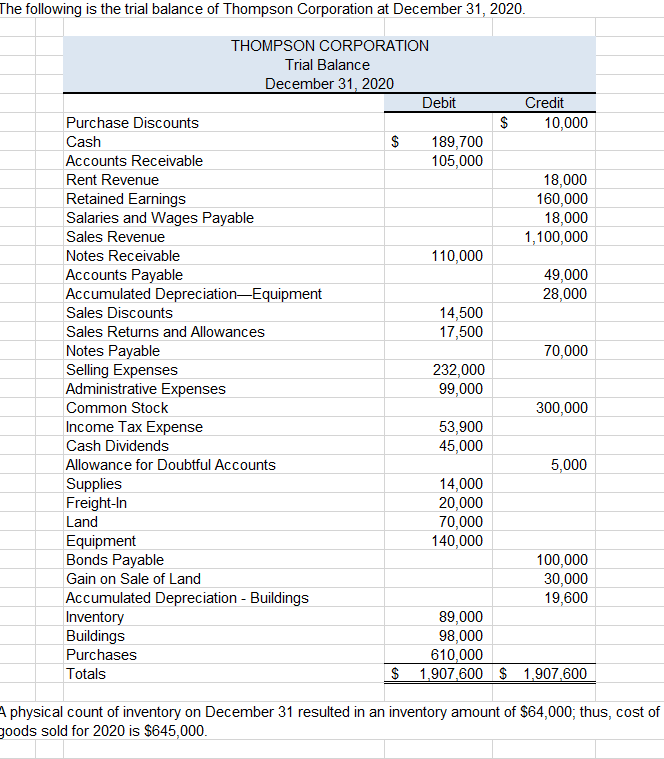

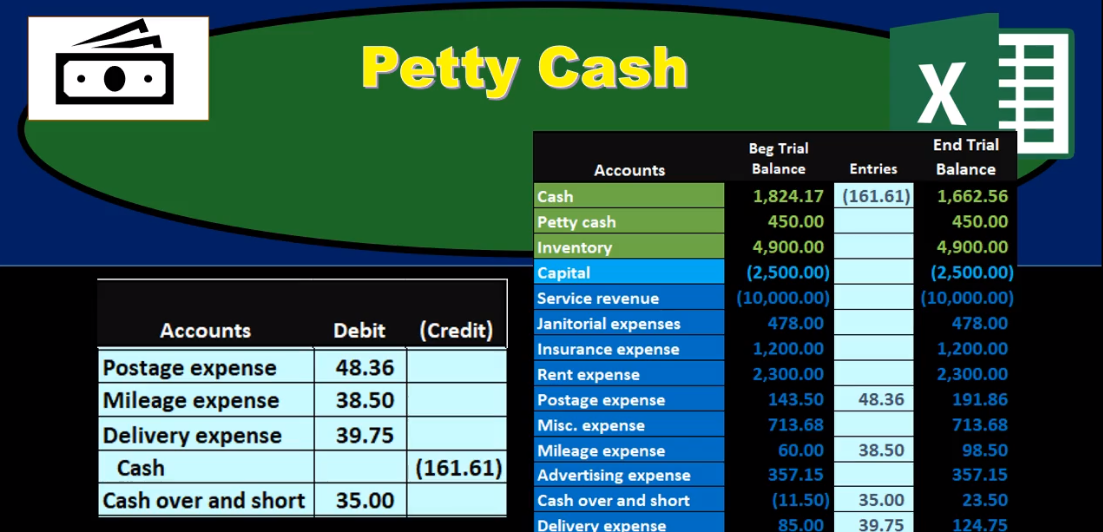

Petty cash in trial balance. The accounting equation, cash journals, general ledger and trial balances debtors,. It is used to identify debits and credits entries from the. They review and reconcile the petty cash book with the trial balance (tb).

This trial balance is an important step in the. Auditors systematically assess the petty cash fund to verify its use and management. A petty cash fund is a type of imprest account, which means that it contains a fixed amount of cash that is replaced as it is spent in order to maintain a set balance.

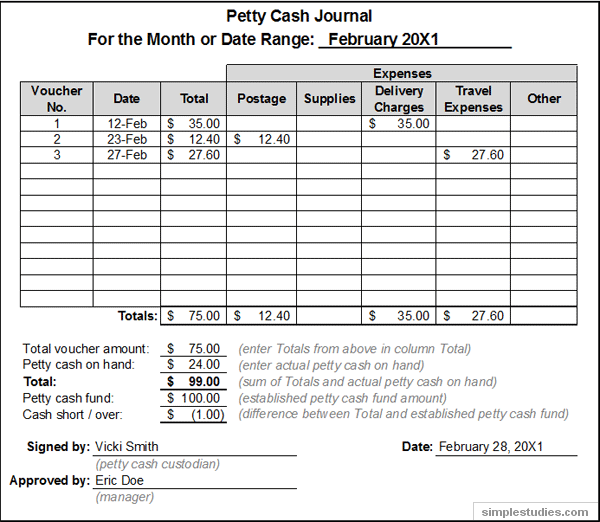

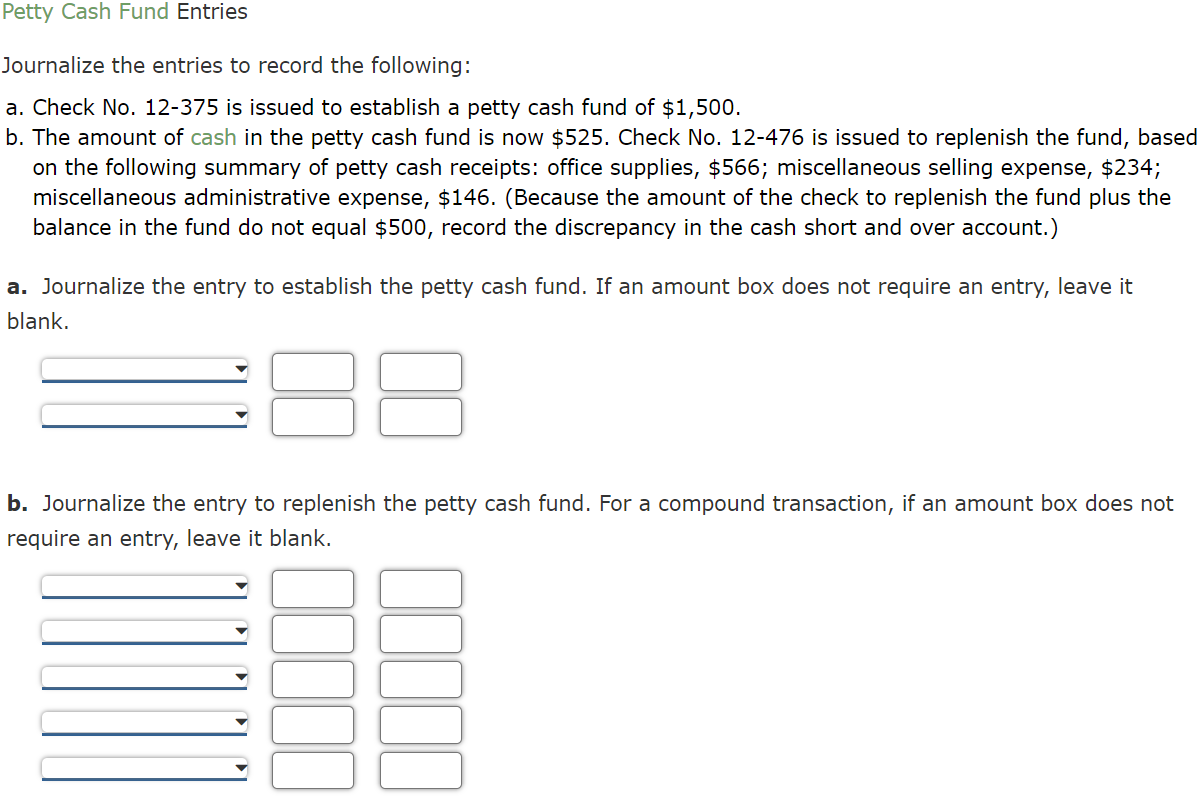

8.4 define the purpose and use of a petty cash fund, and prepare petty cash journal entries 8.5 discuss management responsibilities for maintaining internal controls within an organization 8.6 define the purpose of a bank reconciliation, and prepare a bank. There is no credit or. Entries are needed to (1) establish the fund, (2) increase or decrease the balance of the fund (replenish the.

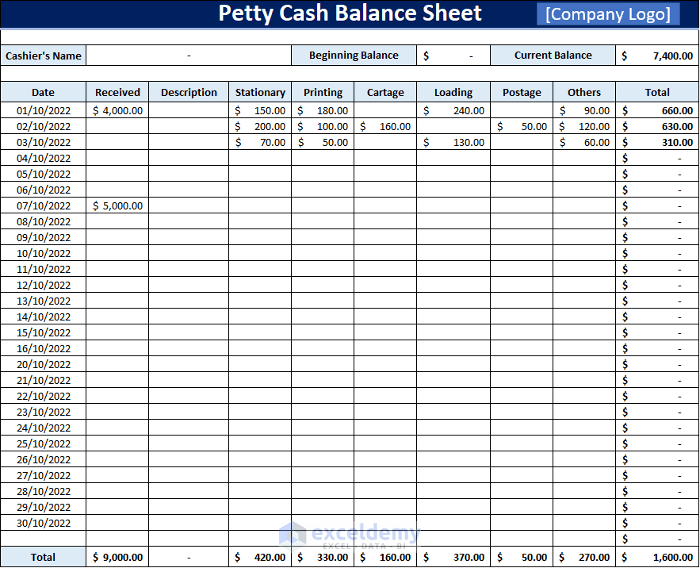

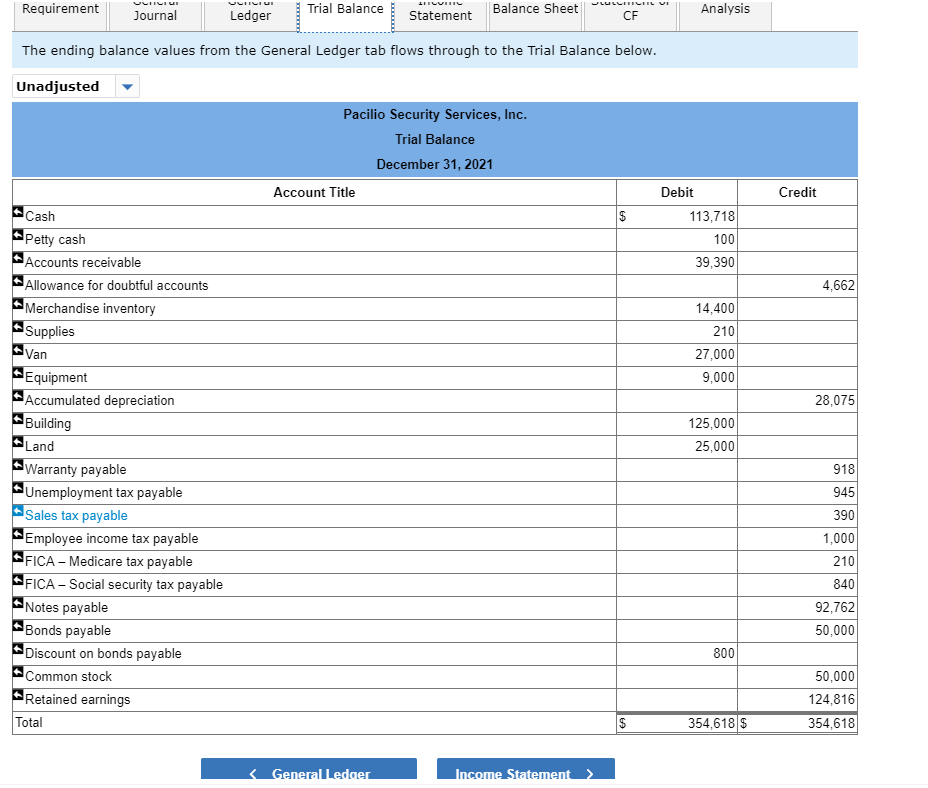

Go to general ledger work center and report view. At the end of the period the petty cash float is ‘topped up’ by withdrawing an amount from the bank totalling the petty cash payment made during the. Remember to record petty cash expenses in your accounts as.

Acca fa financial accounting forums. Why did this affect the trial balance, we forgot to record it in the tb. In question 3 the petty cash book balance $500 had been omitted from the trial balance.

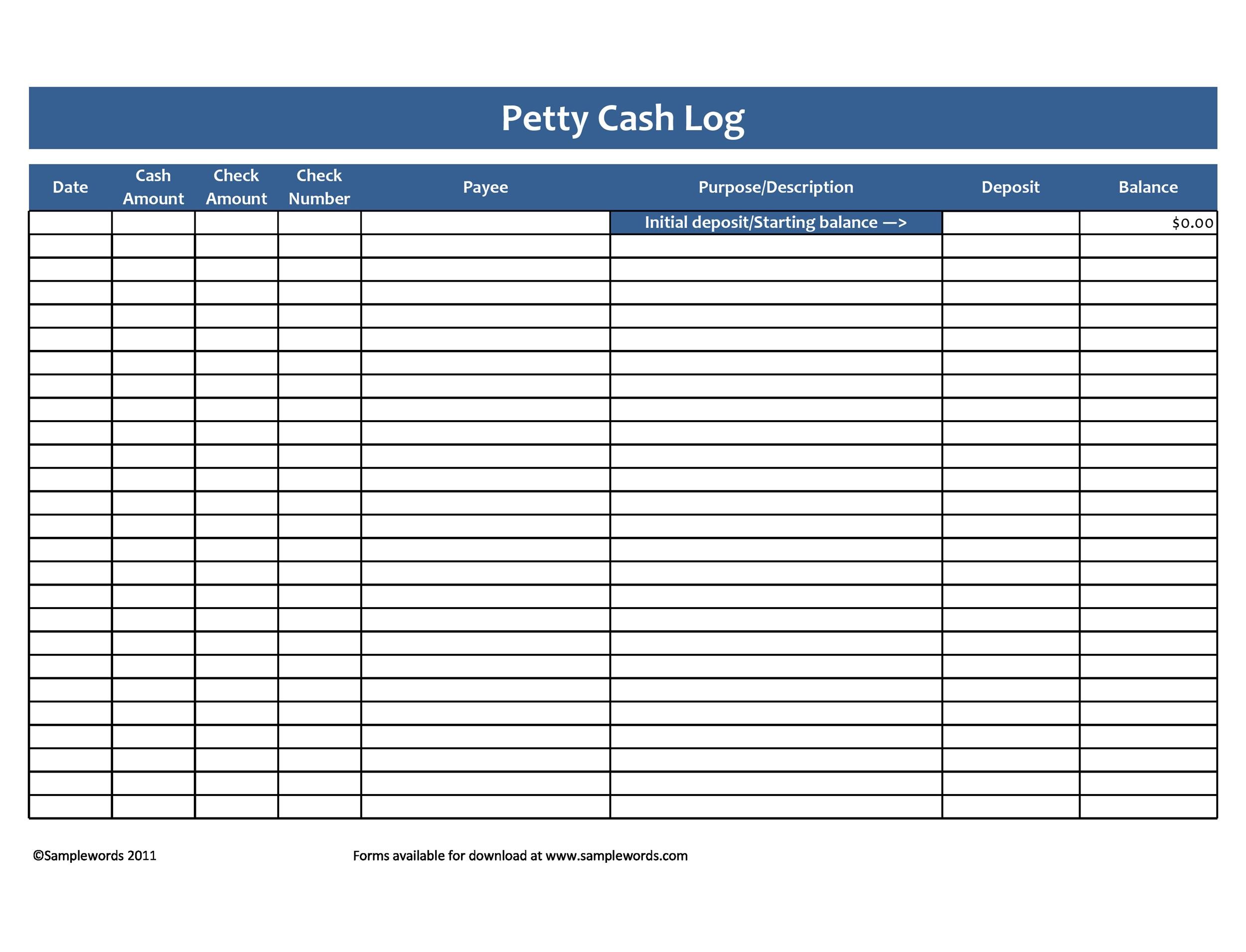

Petty cash accounts are managed through a series of journal entries. A the petty cash balance of $1,200 has been omitted from the tb b a receipt of $1,200 for commission receivable has been omitted from the records c $600 paid for plant. Petty cash & trial balance.

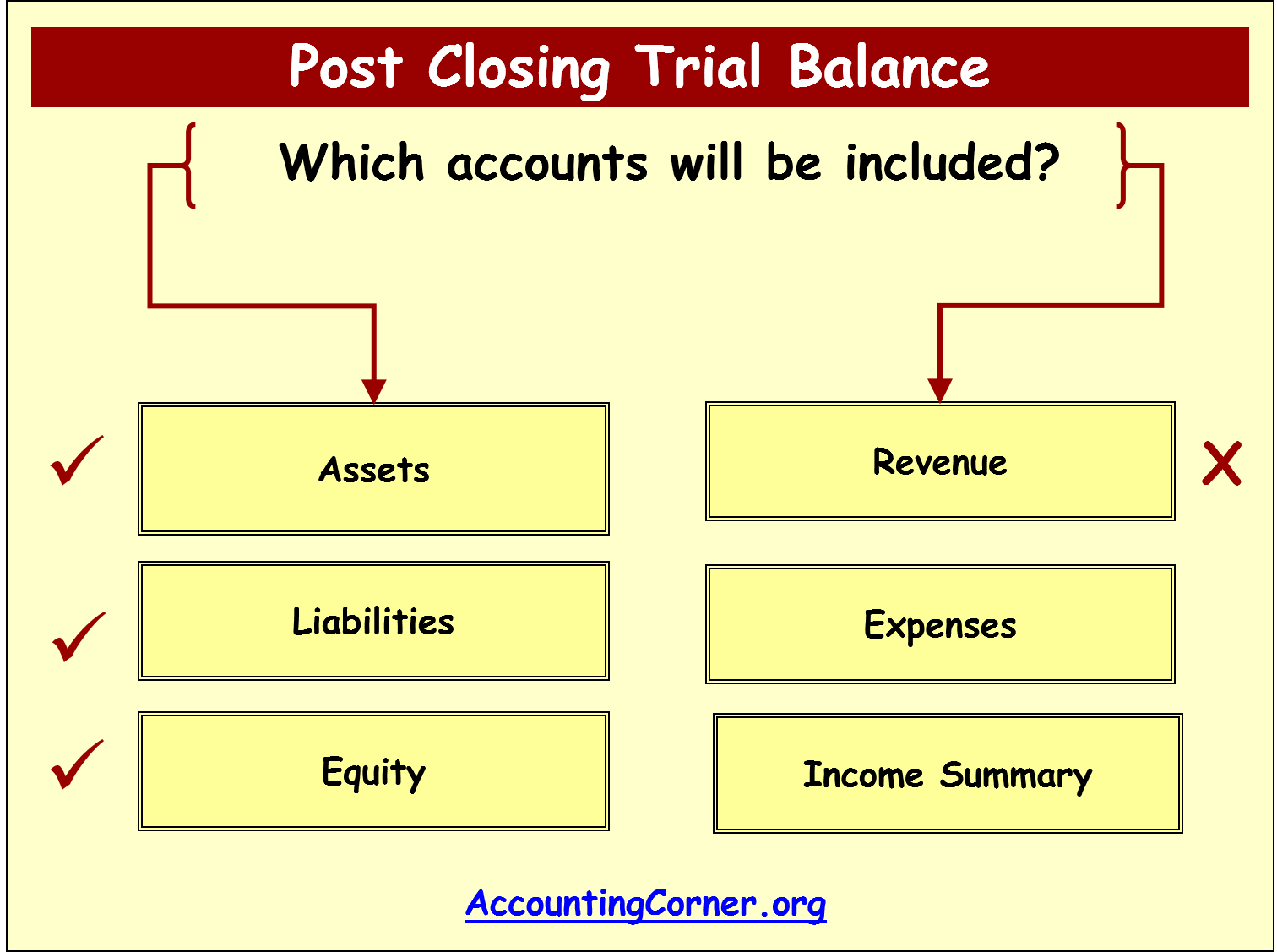

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Module 1 • financial accounting below is an overview of the work covered in this module. The first step of recording and interesting your financial results is the trial balance.

The petty cash custodian lets the cash balance in the petty cash box decline to $20 before applying for replenishment. The cashier issues a replenishment. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances.

You typically evaluate your petty cash fund at the end of each month for more accurate balances. Reporting petty cash on the financial statements. Input company, set of book and g/l account of the petty.

Petty cash appears within the current assets section of the balance sheet. Petty cash is a small amount of cash on hand used for paying expenses too.