Perfect Info About A Provision For Doubtful Debts Is Created

The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts.

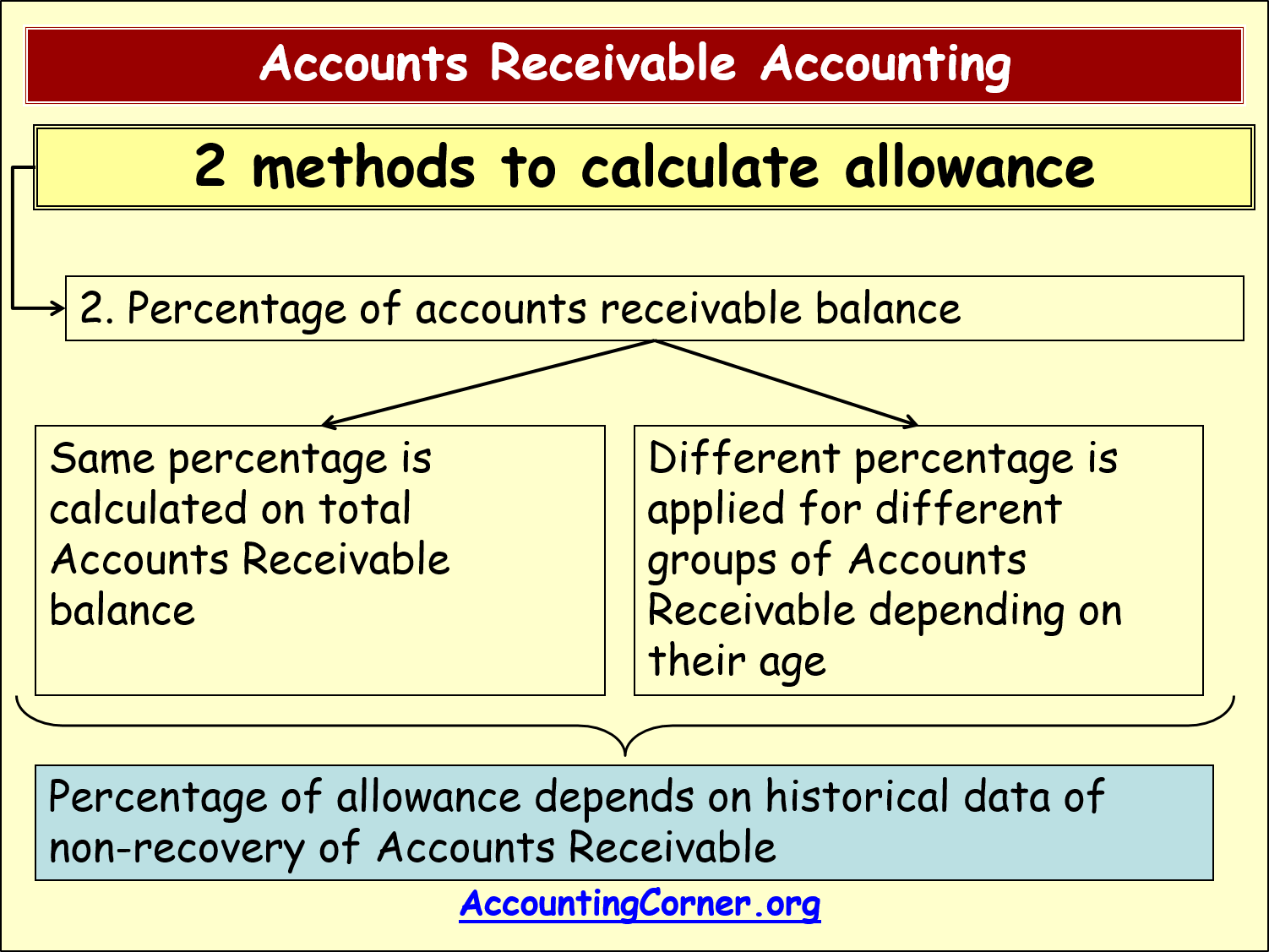

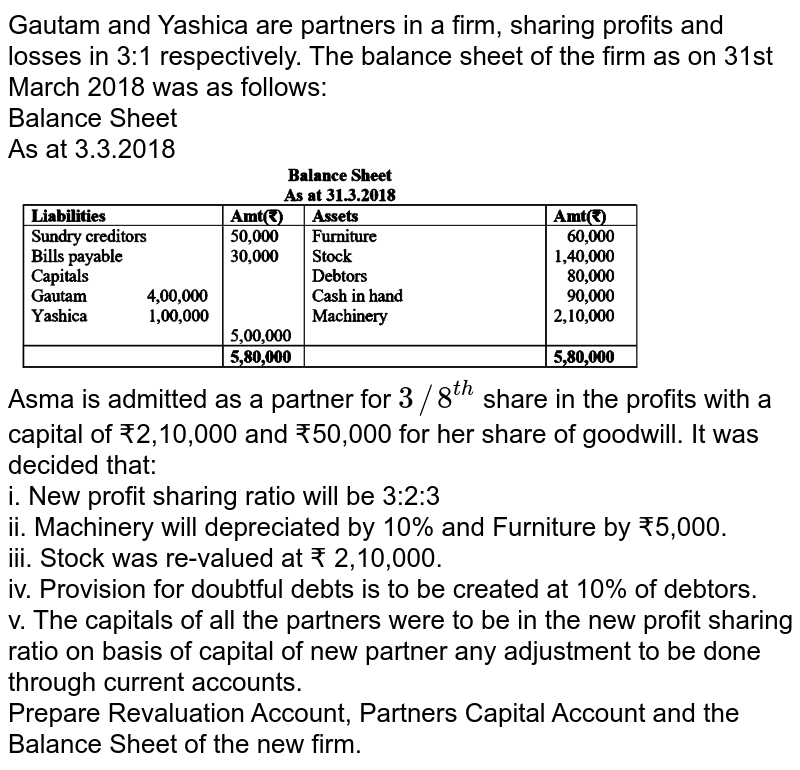

A provision for doubtful debts is created. To this end, a new account is opened in the books called provisions for bad debts account, or provisions for doubtful debts account. 2) no change in provision of doubtful debts. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for.

When this account is first. 3) decrease in provision of doubtful debts. The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of.

Company a decides to create a provision for doubtful debts that will be 2% of the total. Provision for doubtful debts, on the one hand, is shown on the debit side of the profit and loss account, and on the other hand, is also shown as a deduction from debtors on the. Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet.

A provision for bad and doubtful. Provision for doubtful debts. Provision is created out of profits of the current accounting period to reduce the amount of loss that may take place in the future.

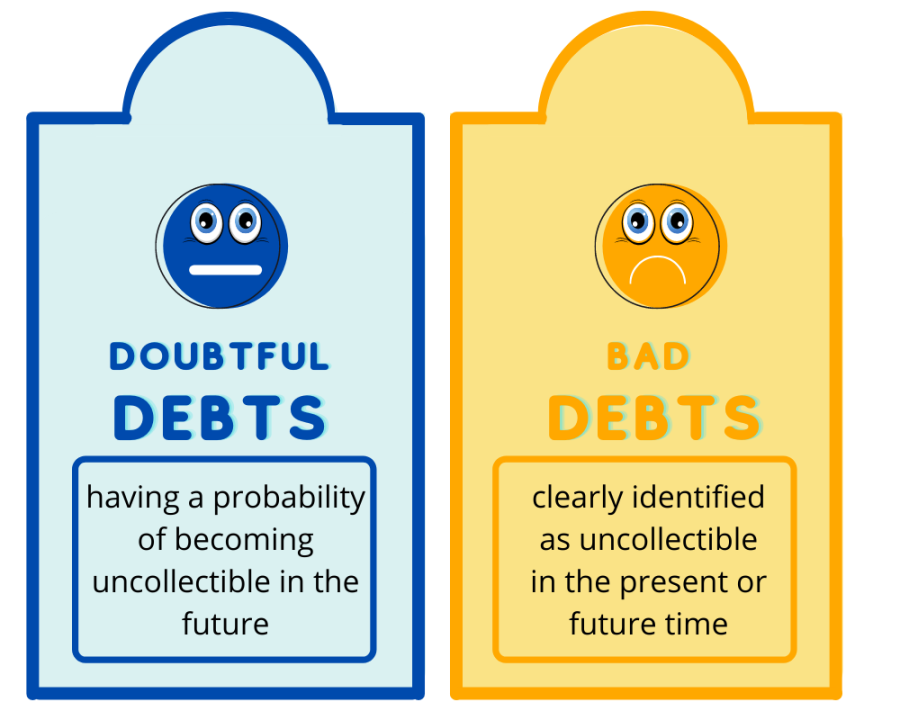

1) increase in provision of doubtful debts. When an entity remains doubtful regarding the recovery of its revenue i.e it has a reason to believe that such an amount due to be received may not be realised. Every year the amount gets changed due to the provision.

Imagine company a has a total of £100,000 account receivables at the end of the year. The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been.

Businesses providing any sale on credit, and therefore having trade debtors on. Provision for doubtful debt is created which is a charge against profit that may cover the loss if the doubtful debt turns out as bad debt. This estimate is called the bad debt provision or bad debt allowance and is recorded in a contra asset account to the balance sheet called the allowance for credit.

The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the. Definition of provision for doubtful debts.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)