Neat Tips About Provision For Bad Debts In Profit And Loss Account

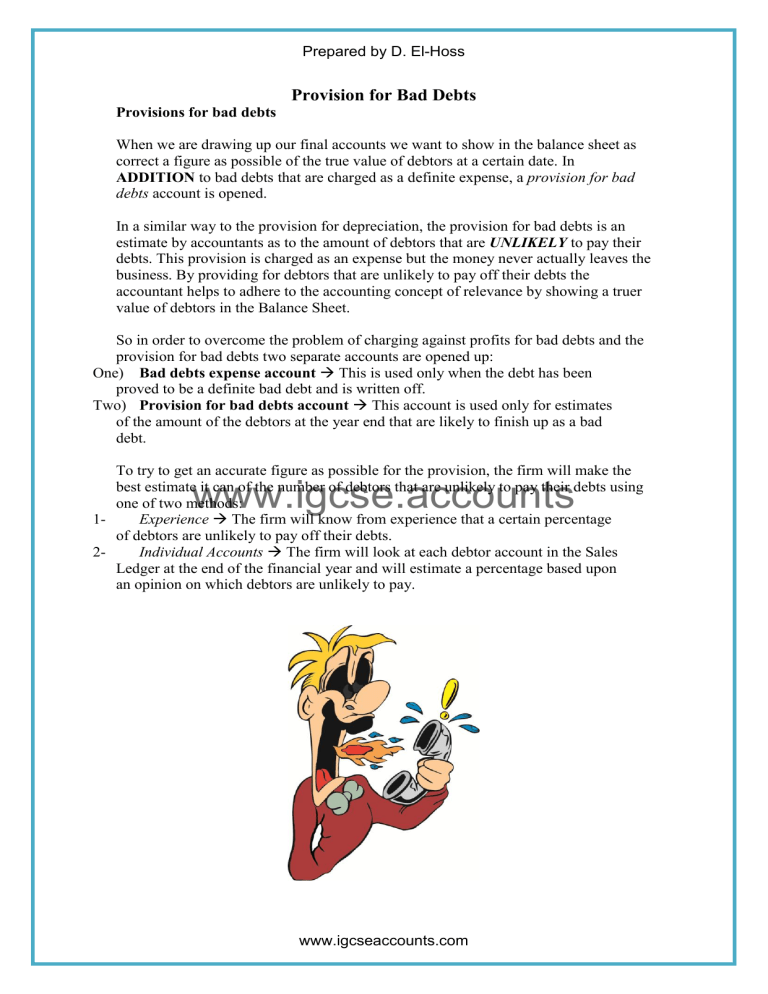

The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for.

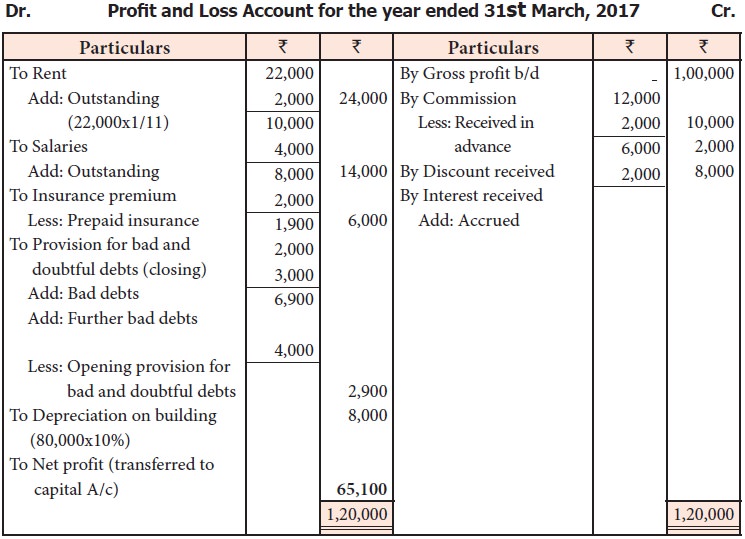

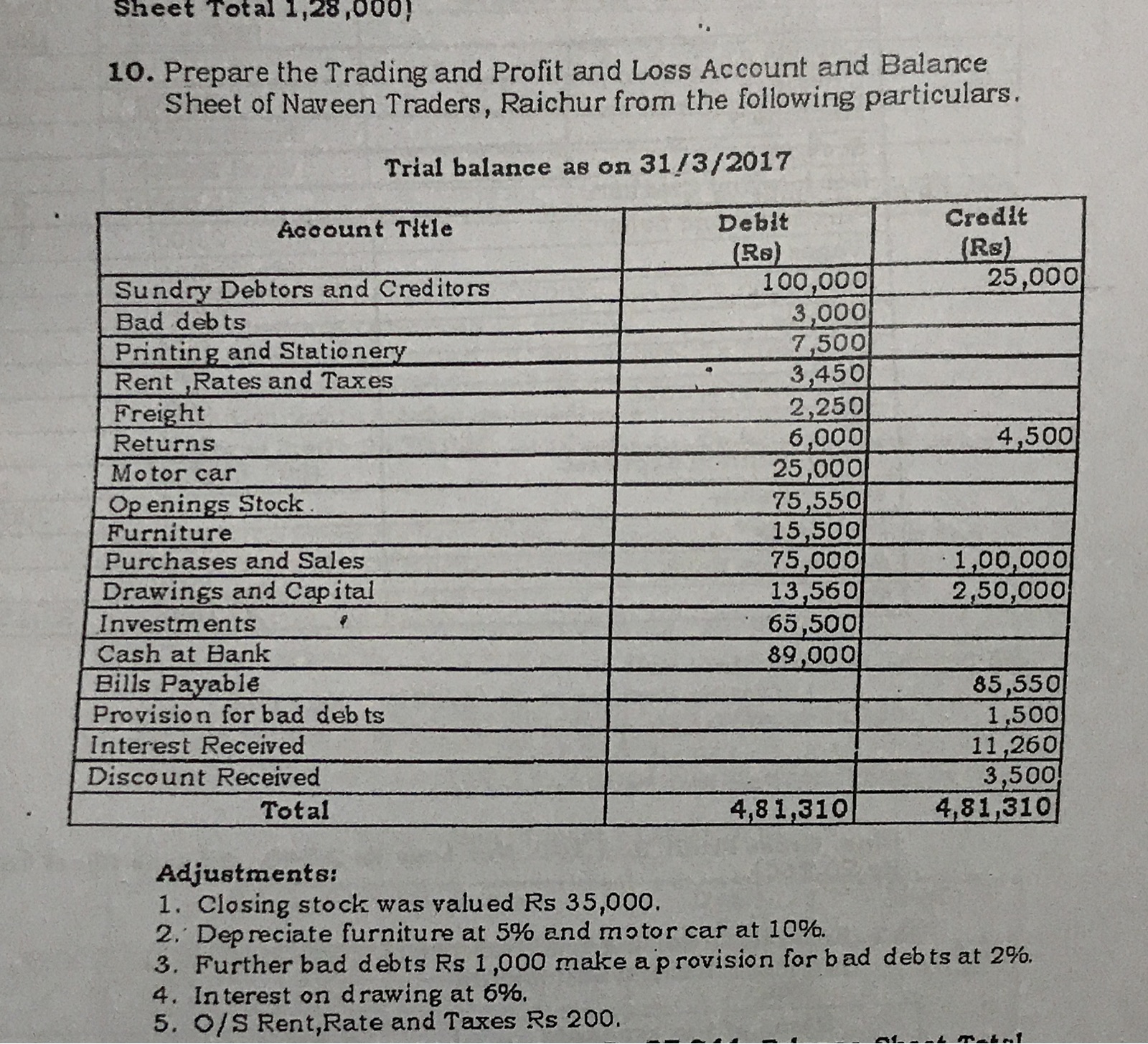

Provision for bad debts in profit and loss account. Provision for bad debts account cr. Provision for bad debts are created by ____________ profit and loss account. Bad debt expense represents the amount of uncollectible accounts receivable that occurs in a given period.

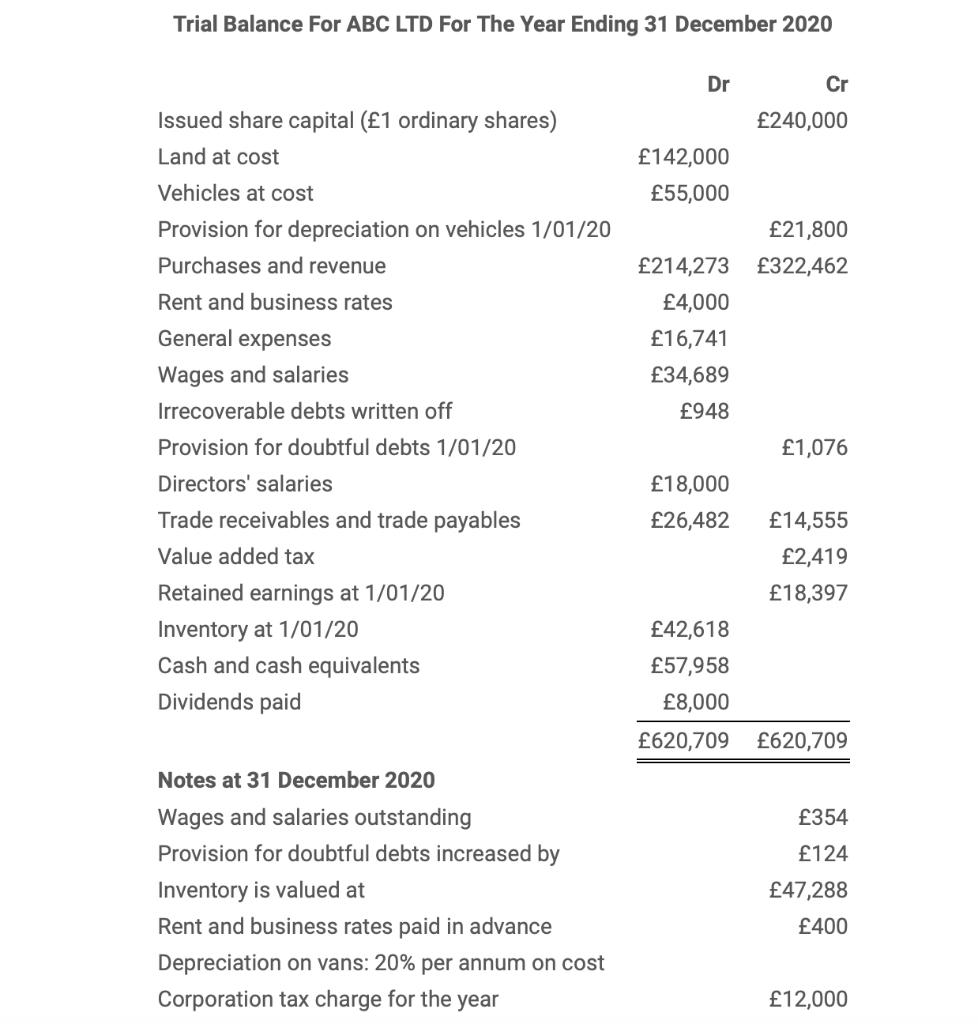

To loss on sale of machinery: In the balance sheet, include the provision for doubtful debts for the year,. At the end of each subsequent financial year, the.

Trial balance provides you the following information: Some of the typical items which find a place in the profit and loss account of a firm are depreciation, bad debts and provisions. Provision for bad debts account cr:

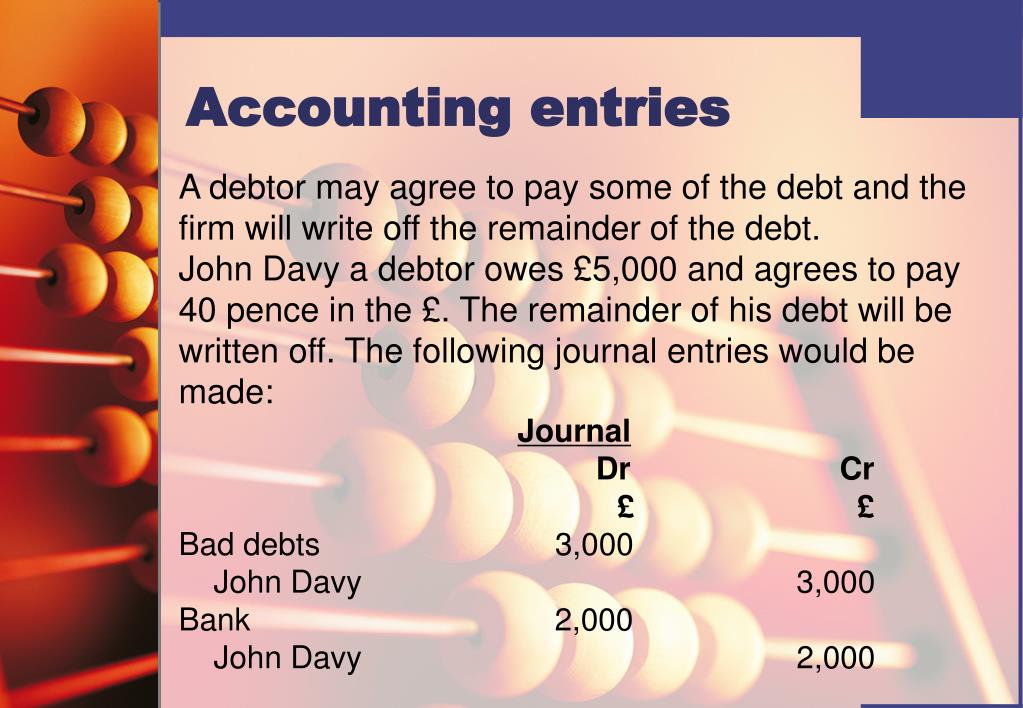

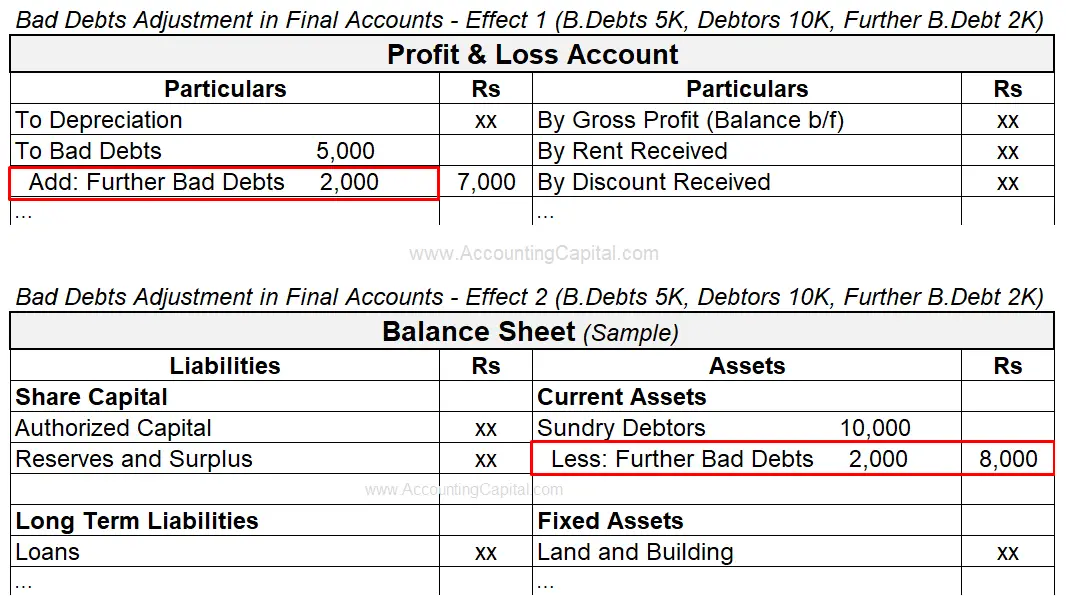

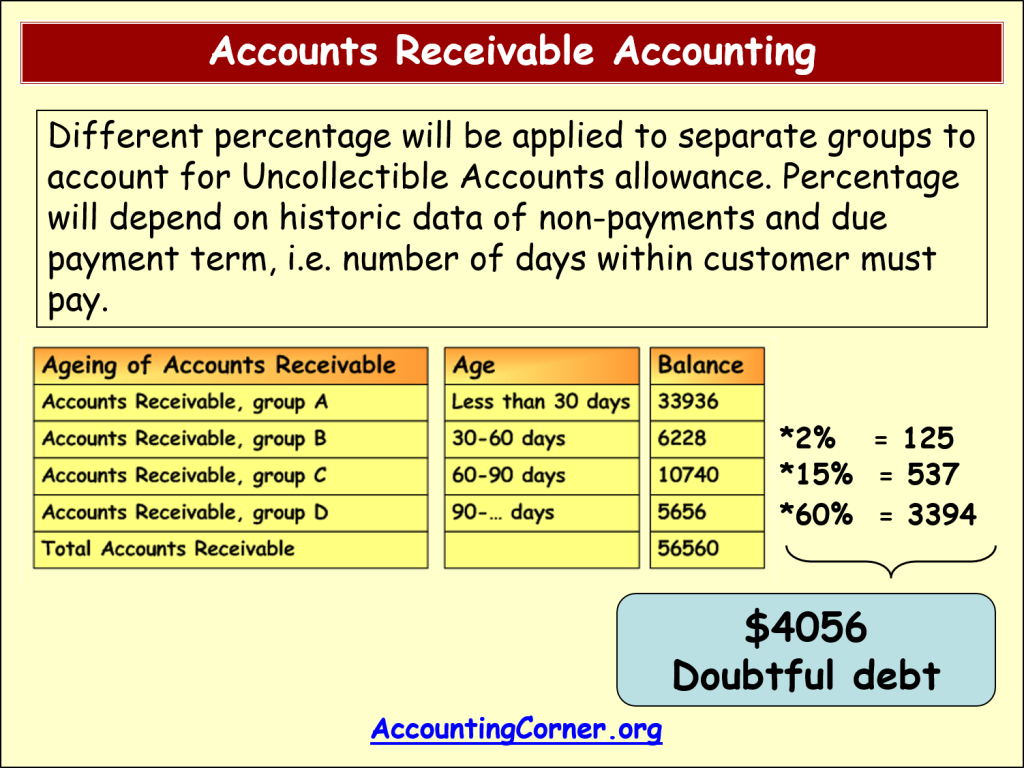

The credit balance on the account is then transferred to the statement of profit or loss (added to gross profit or included as a negative in the list of expenses). The amount to be transferred to profit & loss account is the shortfall in provision for bad debts account after leaving the desired balance of rs. The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision.

A provision for bad debts is the amount of receivable where the accounts manager feels that certain receivable amount could not be recovered. Bad debt provision is used for doubtful debts. (rs.) 2011 2011 bad debts a/c 2,500 balance b/d (old provision) 5,000.

The other side would be a credit, which would go to the bad debt provision expense account. If these items are not accounted for in the. The provision for doubtful debts is the.

There are several ways to make the estimates, called provisions, some of which are legally required while others are strategically preferred. Bad debt expense occurs as a result of a. Credit provision for doubtful debts account.

Debit profit and loss account. To provision for bad debts: Provisions for bad debts account, with the amount of anticipated bad debts;

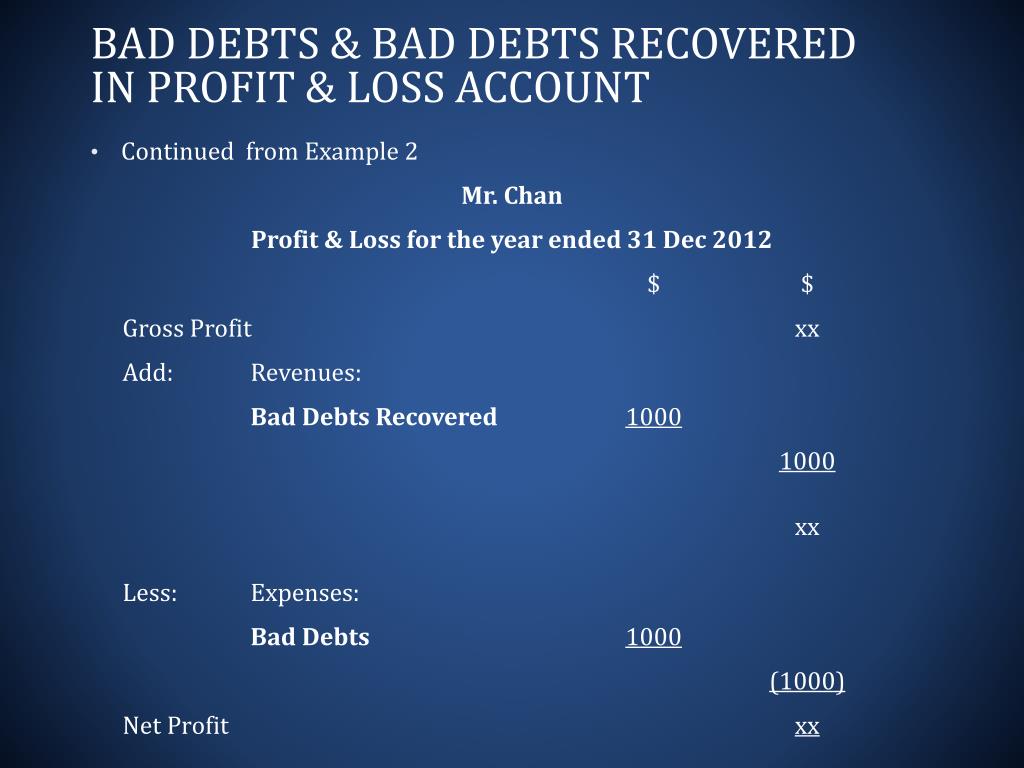

Profit & loss account example on 31 december 2017, david's trade debtors stood at $432,000 only. A provision for bad and doubtful debts is created so that the debtors who are not able to make the payment of their liability on the due date has no major effect on. We know that bad debt is a loss and is adjusted with the current year’s profit & loss a/c.

Make sure to research the provisioning standards that. Now, if the amount of bad debt is received in any succeeding year,.