Awe-Inspiring Examples Of Info About Loss Contingency Journal Entry

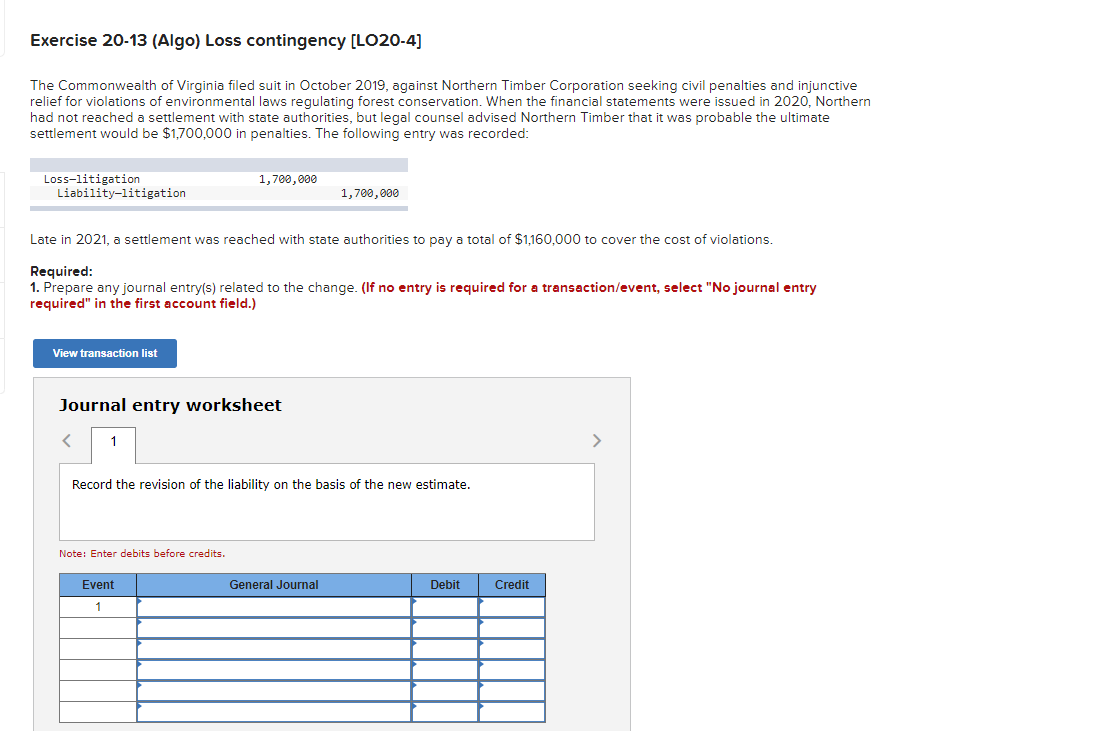

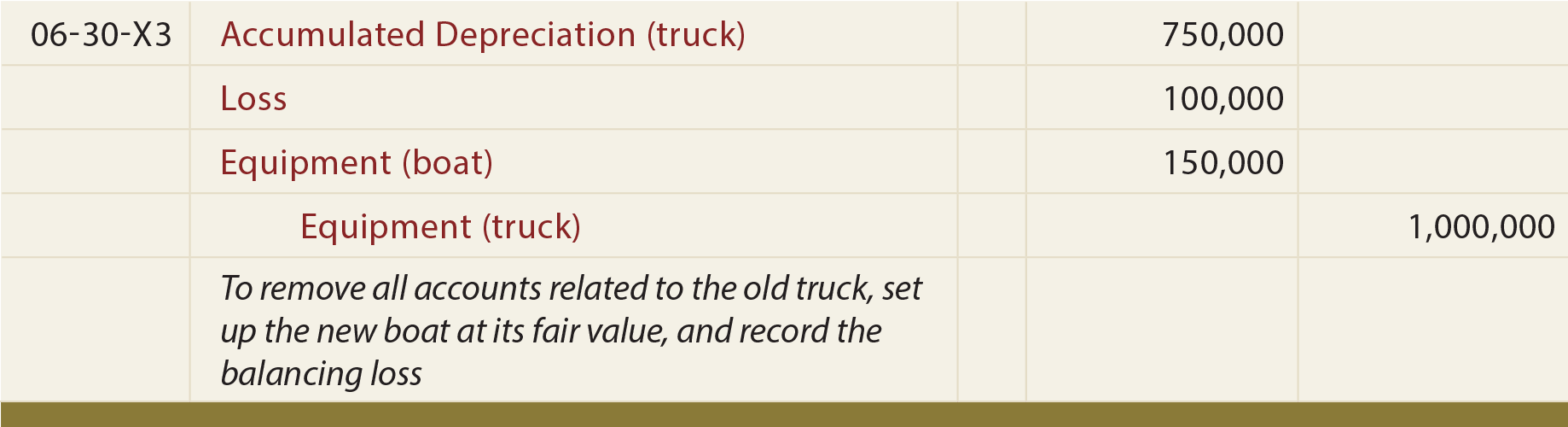

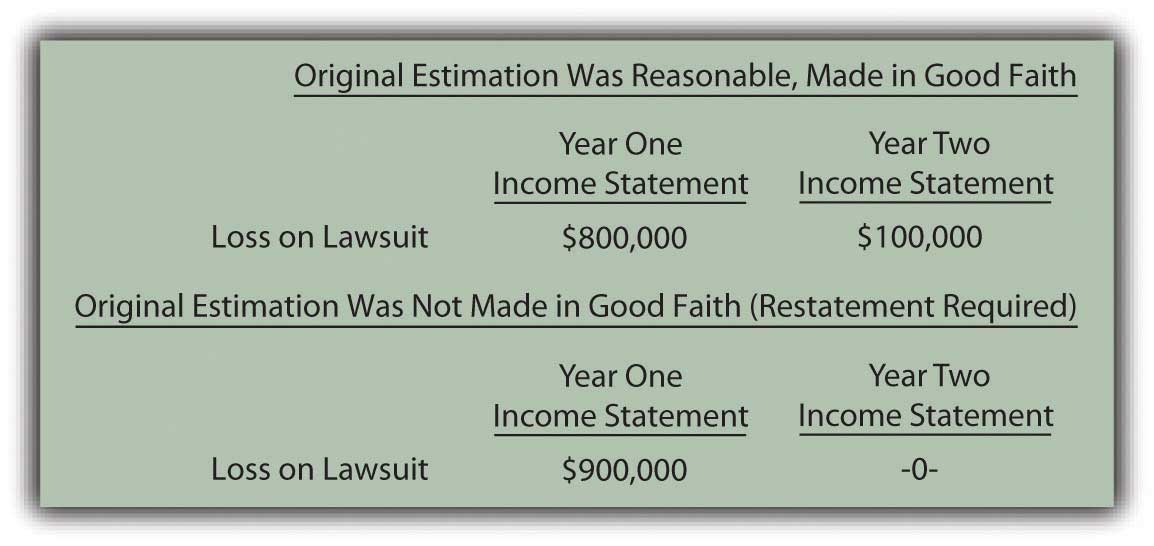

Explain the handling of a loss that ultimately proves to be different from the originally estimated and recorded balance.

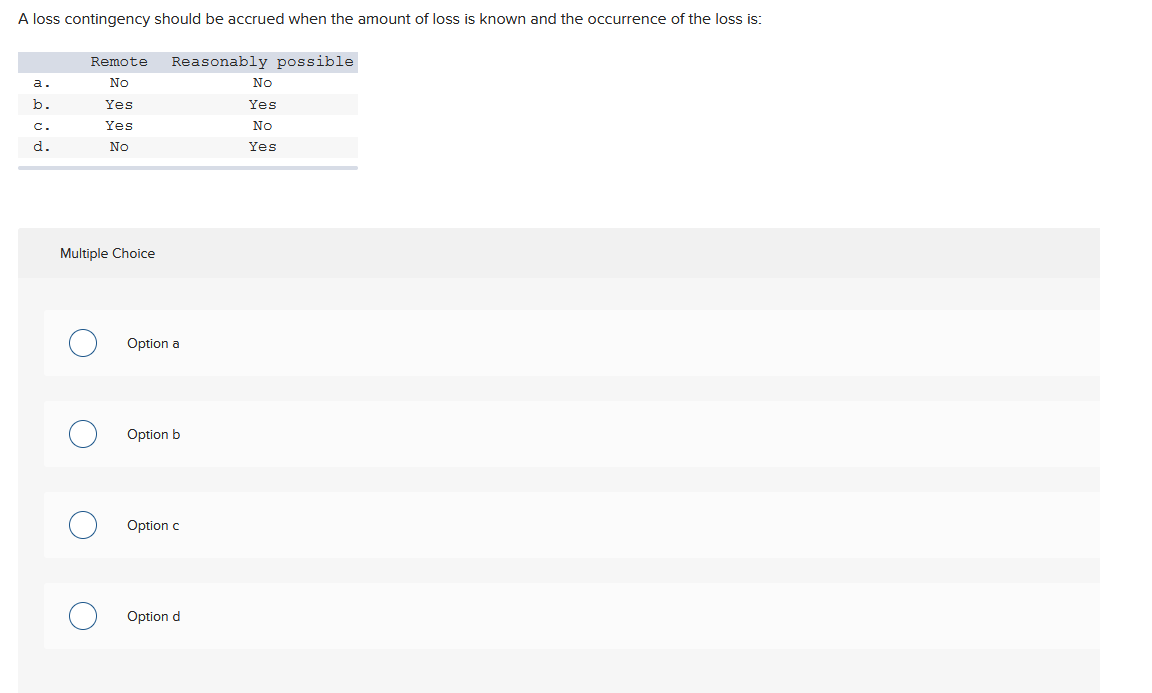

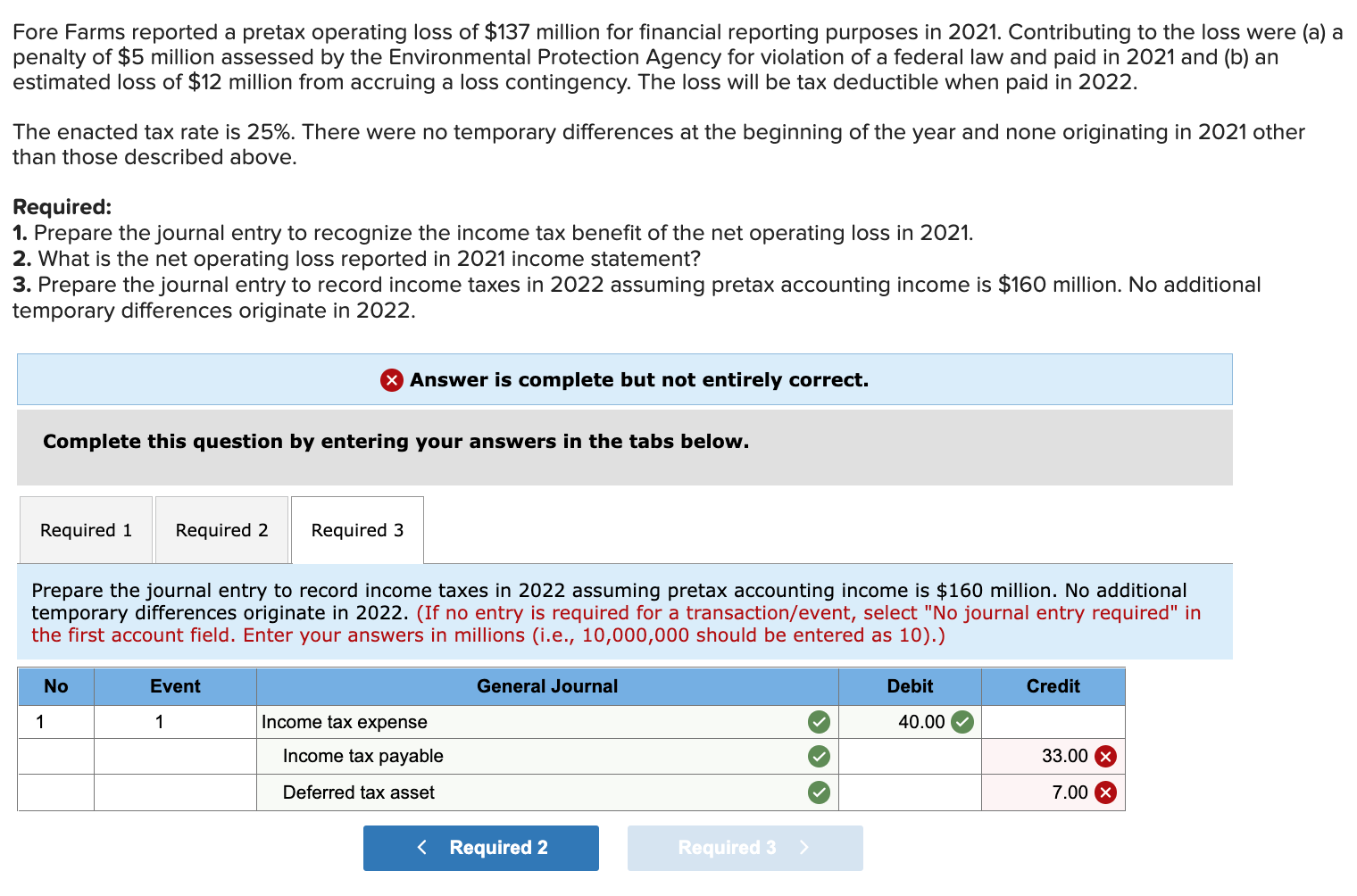

Loss contingency journal entry. Loss contingency — journal entry Gain contingency what are examples of contingent liabilities? Th e sec also charged the general counsel with failing to provide the issuer’s auditor with all material information about the doj investigation, which prevented the contingency from being properly audited.

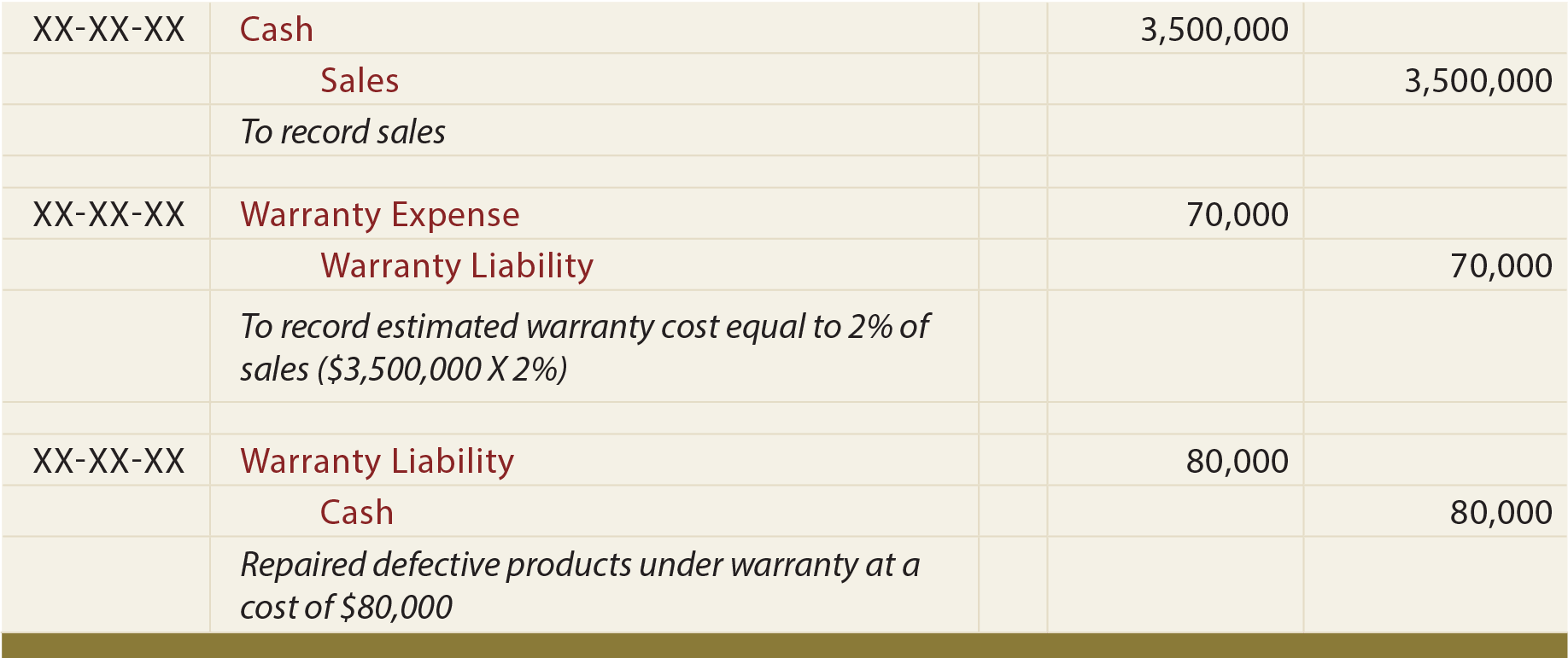

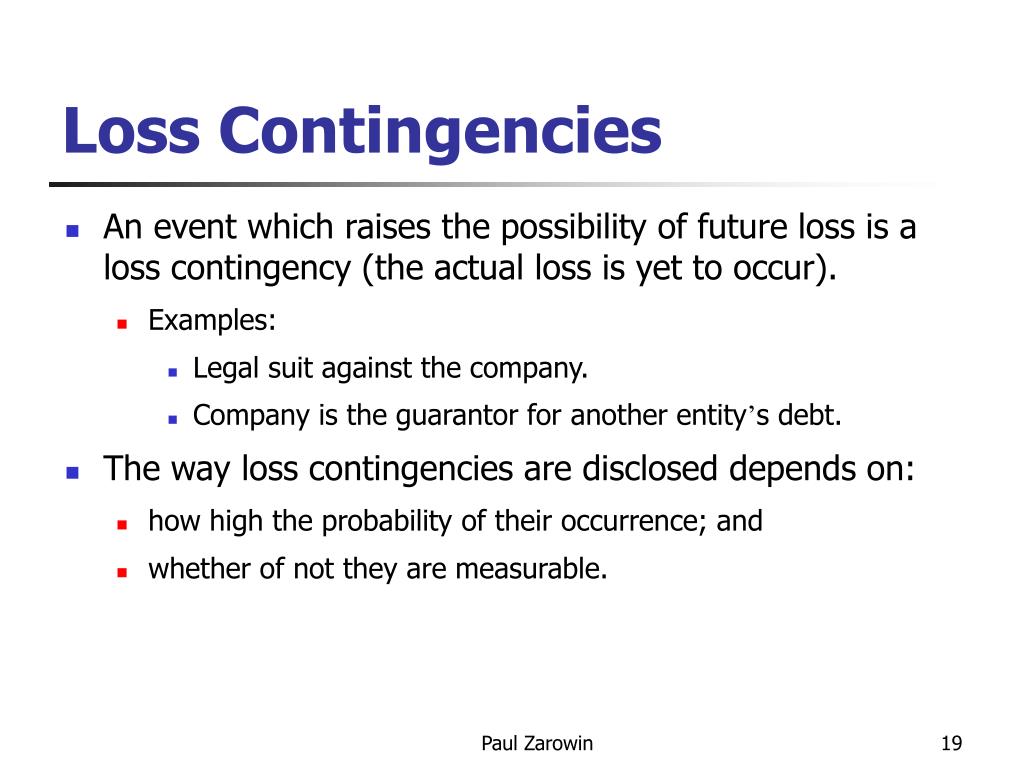

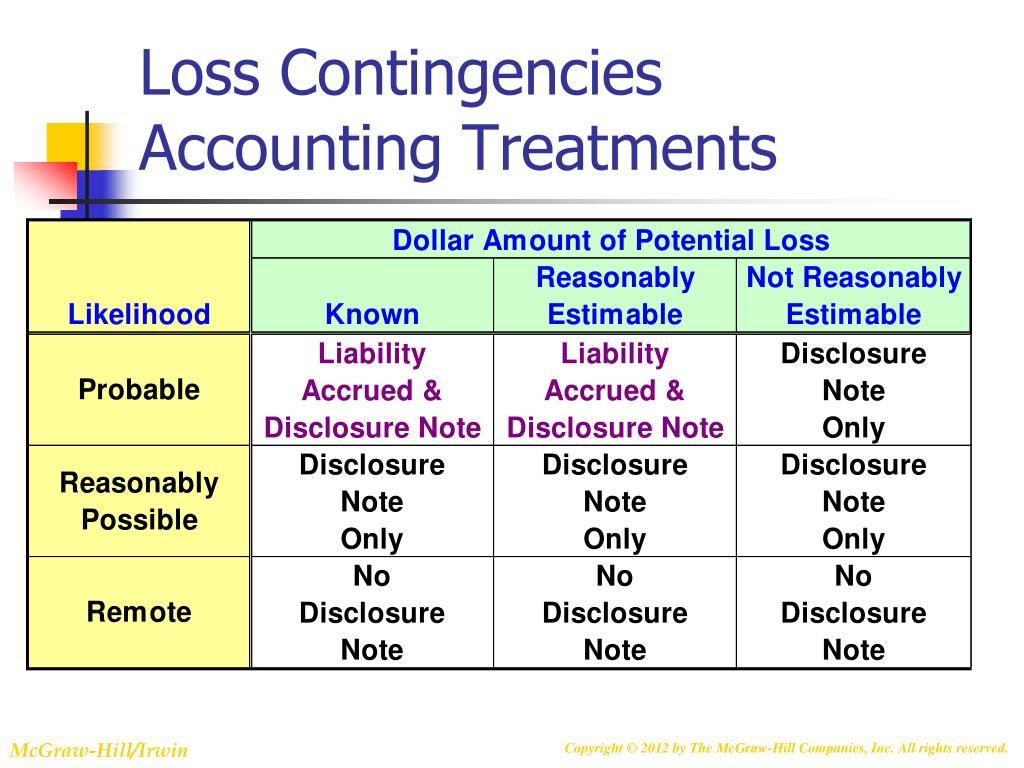

Ias 37 outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets (possible assets) and contingent liabilities (possible obligations and present obligations that are not probable or not reliably measurable). With a contingency, the uncertainty is about the outcome of. (1) the likelihood of the loss occurring and (2) the ability to estimate the amount of the loss.

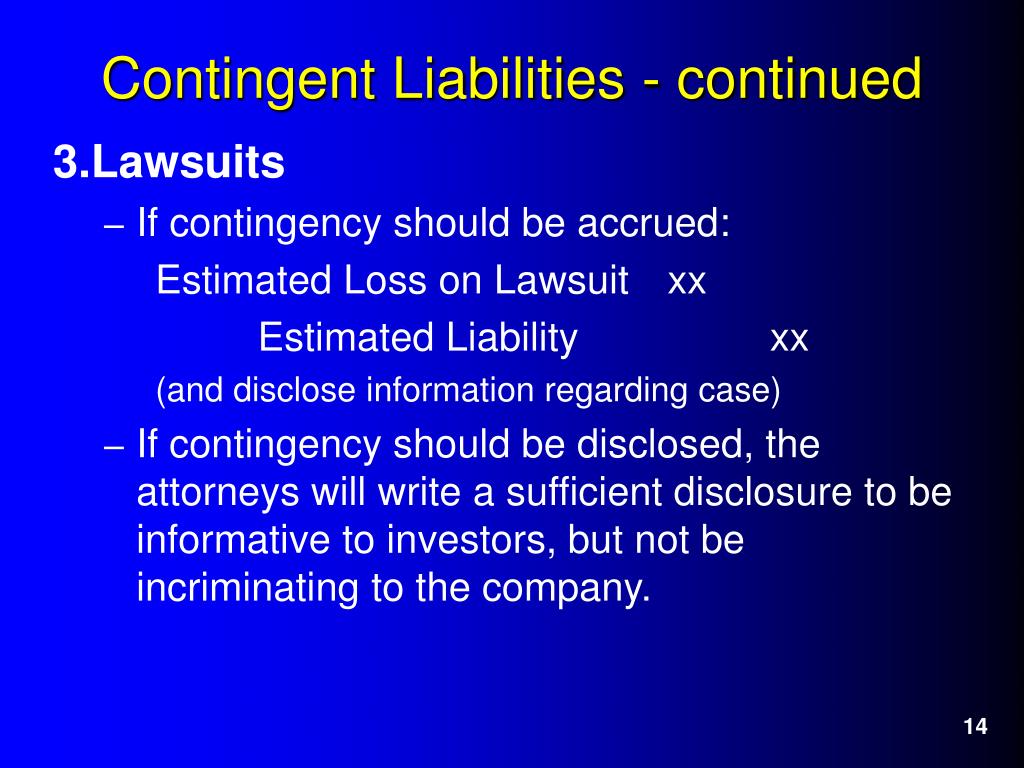

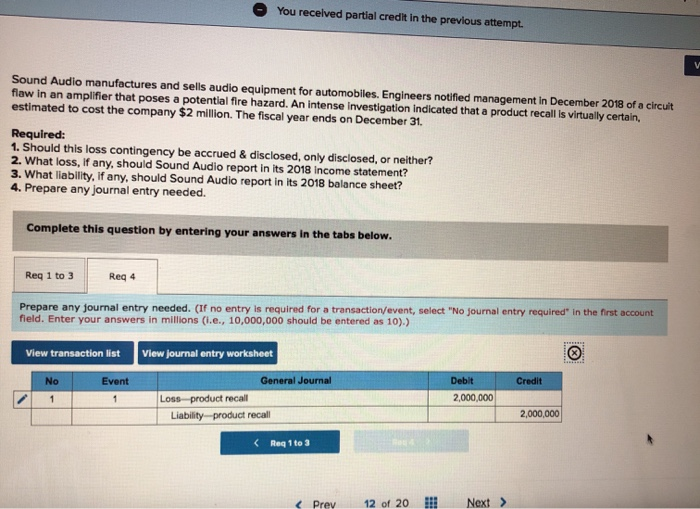

A loss contingency exists when the company thinks there is a chance they might have a cash outflow for an event in the future, but currently, there is no definite answer. Assuming that the loss contingency is “probable” and can be reasonably estimated, then a journal entry should be recorded to accrue the liability. A loss contingency is a charge to expense for what is considered to be a probable future event, such as an adverse outcome of a lawsuit.

When damages have been determined, or have been reasonably estimated, then journalizing would be appropriate. Liability in the balance sheet.

Instead, sierra sports will include a note describing any details available about the lawsuit. A potential loss that is dependent upon some future event occurring or not occurring. Describe the appropriate accounting for those contingent losses that do not qualify for recognition at the present time.

A loss contingency gives the readers of an organization’s financial statements early warning of an impending payment related to a likely obligation. Ias 37 outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets (possible assets) and contingent liabilities (possible obligations and present obligations that are not probable or not reliably measurable). When damages have been determined, or have been reasonably estimated, then journalizing would be appropriate.

Provisions are measured at the best estimate (including risks and uncertainties. Such loss contingencies never get recorded in. The proper accounting treatment for loss contingencies is based on two factors:

But if chances of a contingent liability are possible but are not likely to arise soon, estimating its value is not possible. If the loss is probable and the amount can be estimated, then the loss and a liability are recorded with a journal entry. A past event has occurred but the amount of the present obligation (if any) cannot yet be determined.

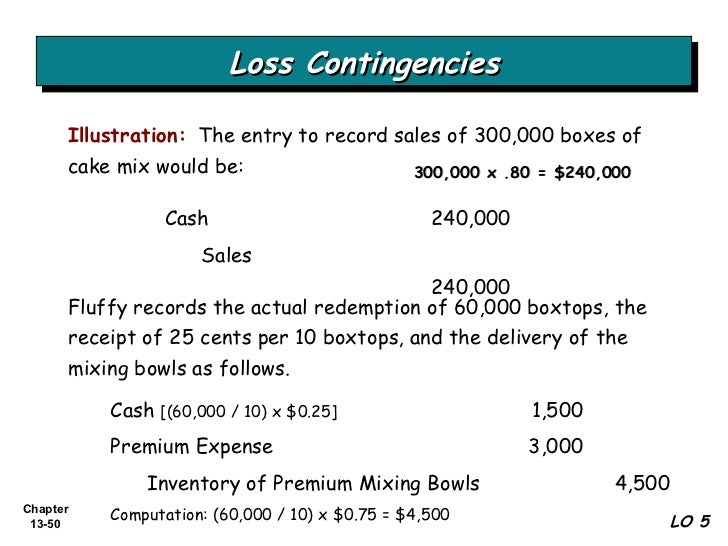

For loss contingencies, it depends on the assessment or likelihood of incurring the loss. A contingency occurs when a current situation has an outcome that is unknown or uncertain and will not be resolved until a future point in time. We'll define each term, give examples, and show how the journal entries should be performed.

In this journal entry, lawsuit payable account is a contingent liability, in which it is probable that a $25,000 loss will occur. The journal entry for a contingent liability—as illustrated below—is a credit entry to the contingent warranty liability account and a debit entry to the warranty expense account. A loss or expense in the statement of profit and loss;