Best Of The Best Info About Is Drawings An Expense In Income Statement

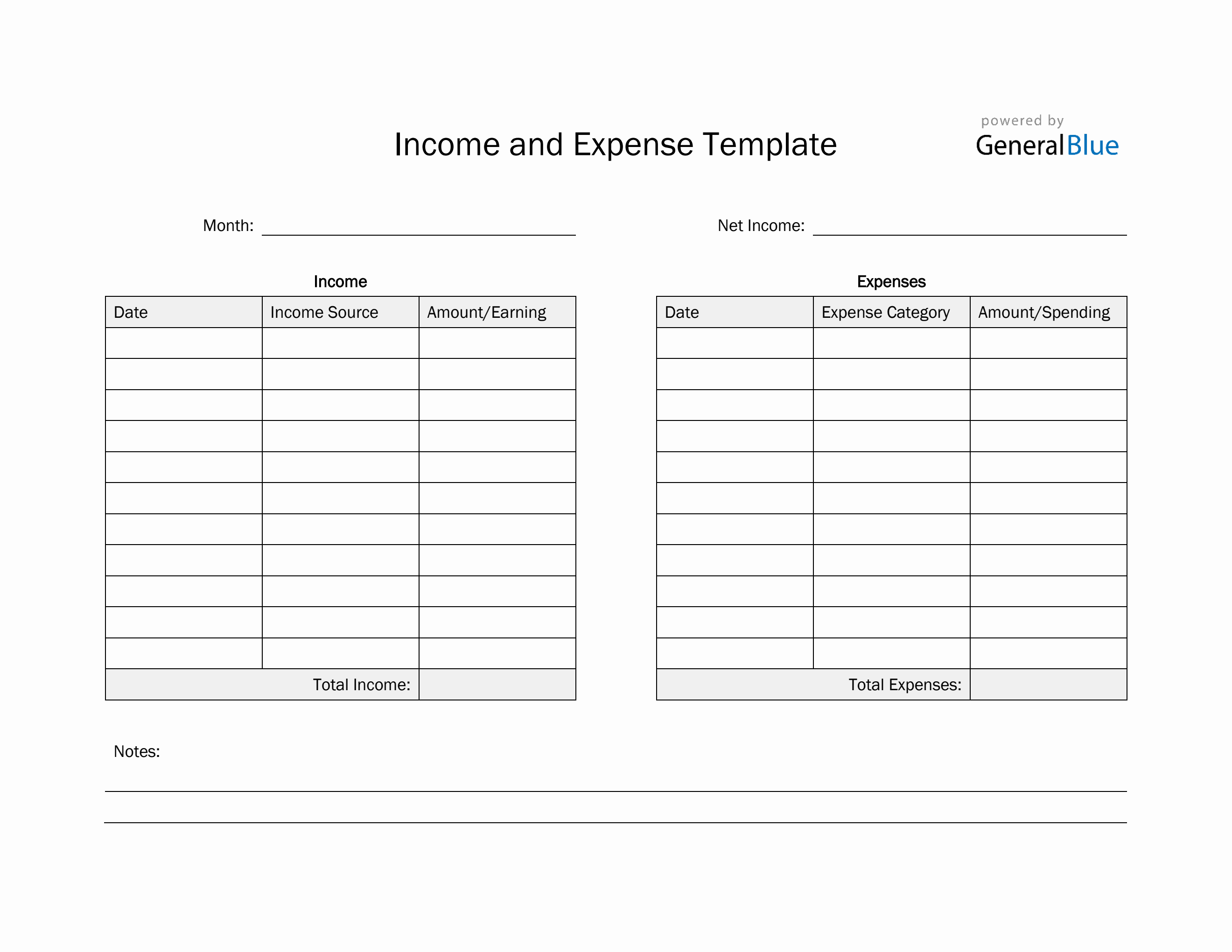

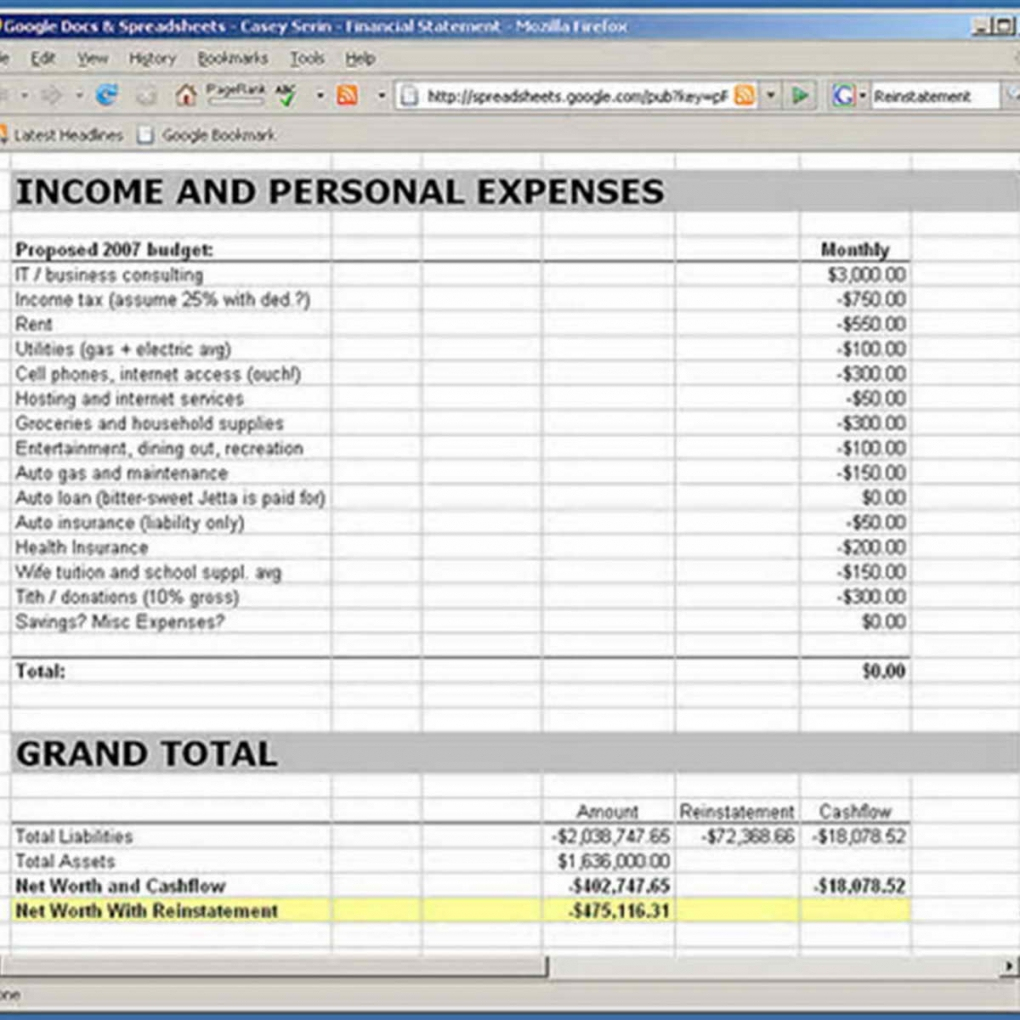

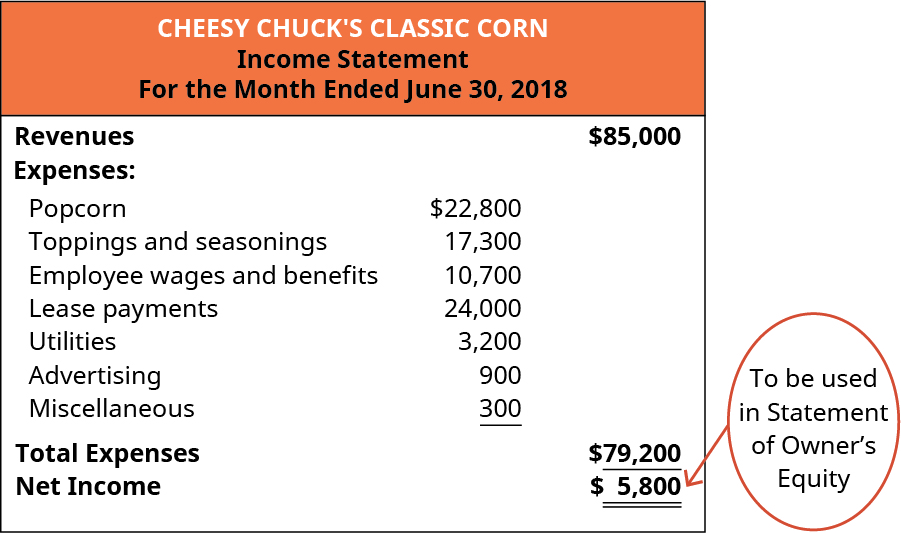

Revenue minus expenses equals profit or loss.

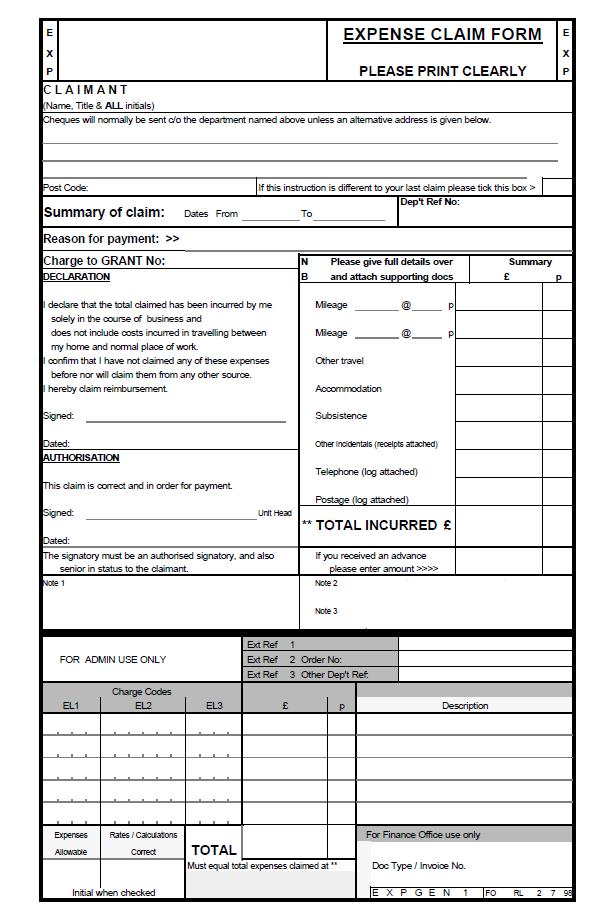

Is drawings an expense in income statement. Since the drawing account is not an expense, it does not show up on the income statement of the business. What are drawings and its journal entry (cash, goods)? So, drawing cannot be termed as assets or expenses.

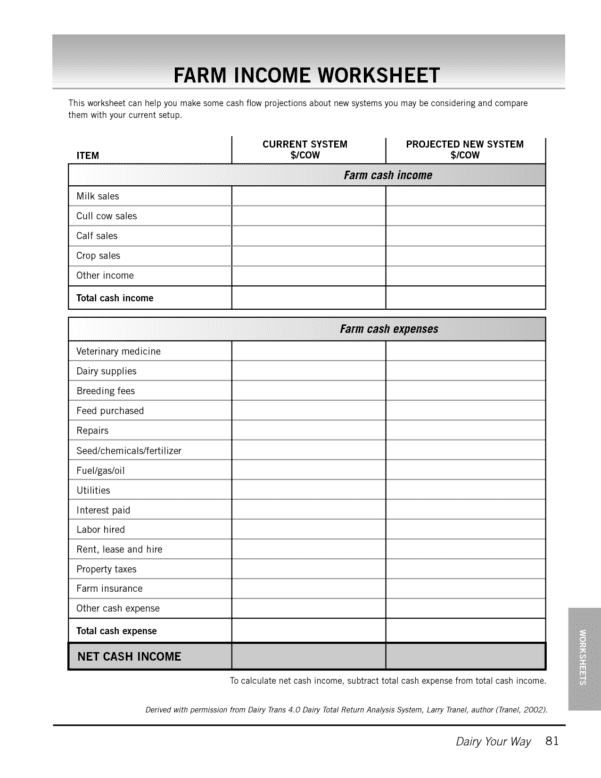

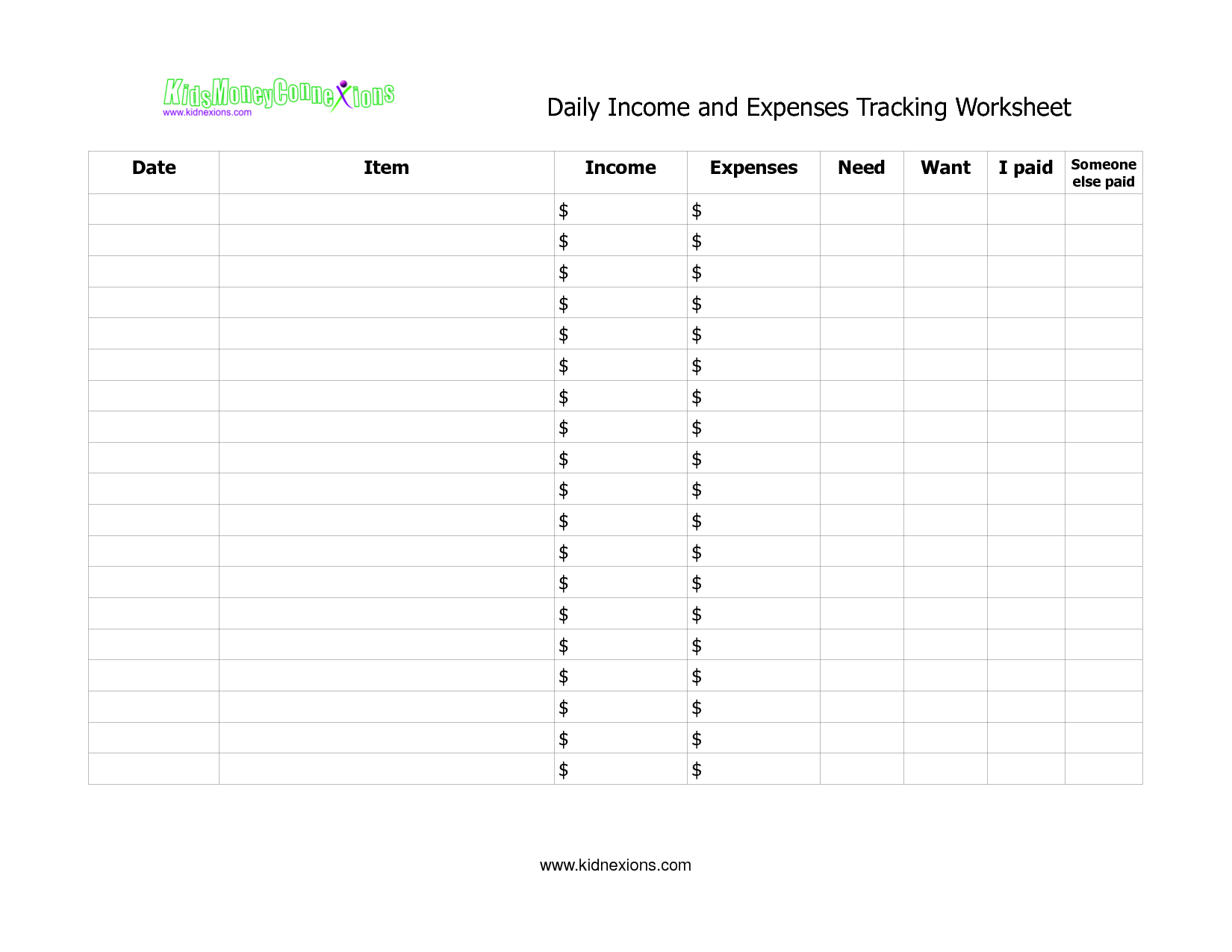

An income statement compares revenue to expenses to determine profit or loss. Drawing balances are not considered part of the company’s regular income and expenses, so it is not included in the income statement. As a result, the placement of drawings within the balance sheet depends on how it is categorised.

Drawings in accounting, assets such as cash or goods which are withdrawn from a business by the owner (s) for their. What is the income statement? Are drawings assets or expenses?

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s equity and appear on. Are reported directly on the current income statement as expenses. Instead, drawing balances are reported.

So, drawings are personal expenses and not business expenses. If the enterprise is a sole proprietorship, the owner's compensation should be debited to. Drawings are not an asset/liability/expense/income to the business.

Should an owner's compensation be recorded as an expense or in the drawing account? Trading account or profit and loss account rather it is closed in the capital account of the owner which is reported. That’s why drawings are not shown in the statement of profit or loss because it is.

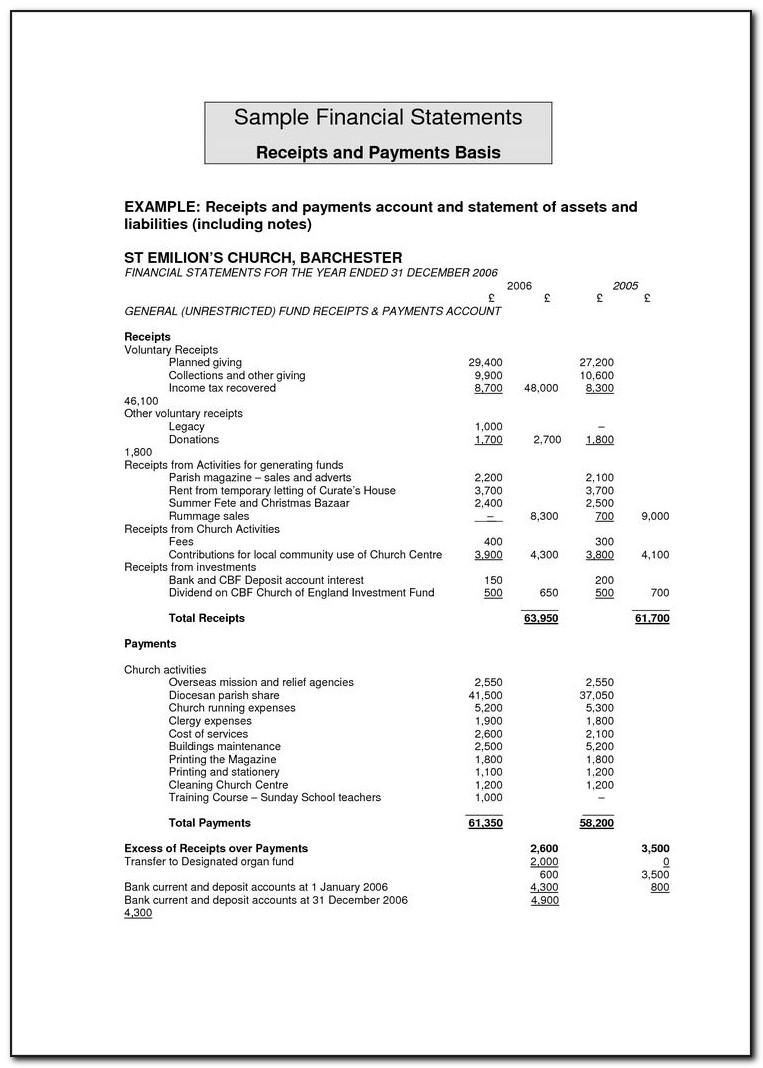

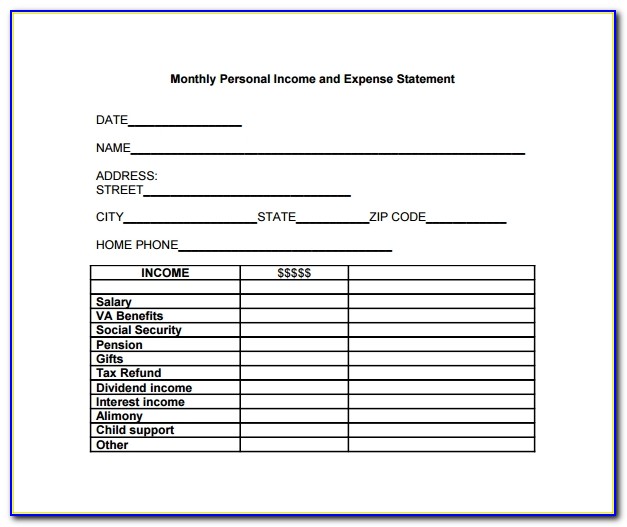

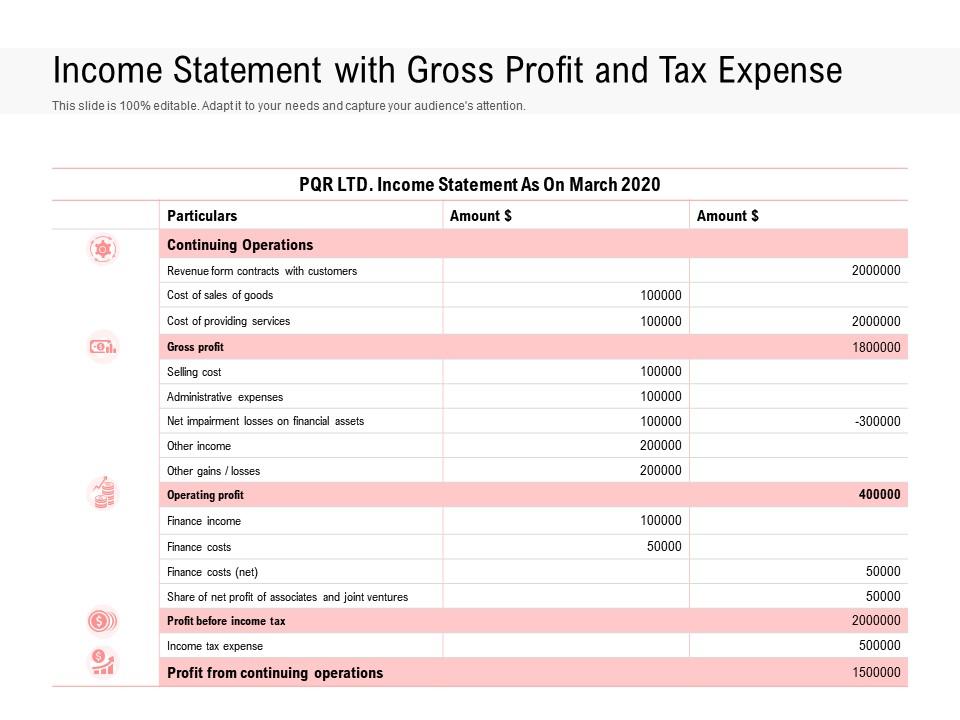

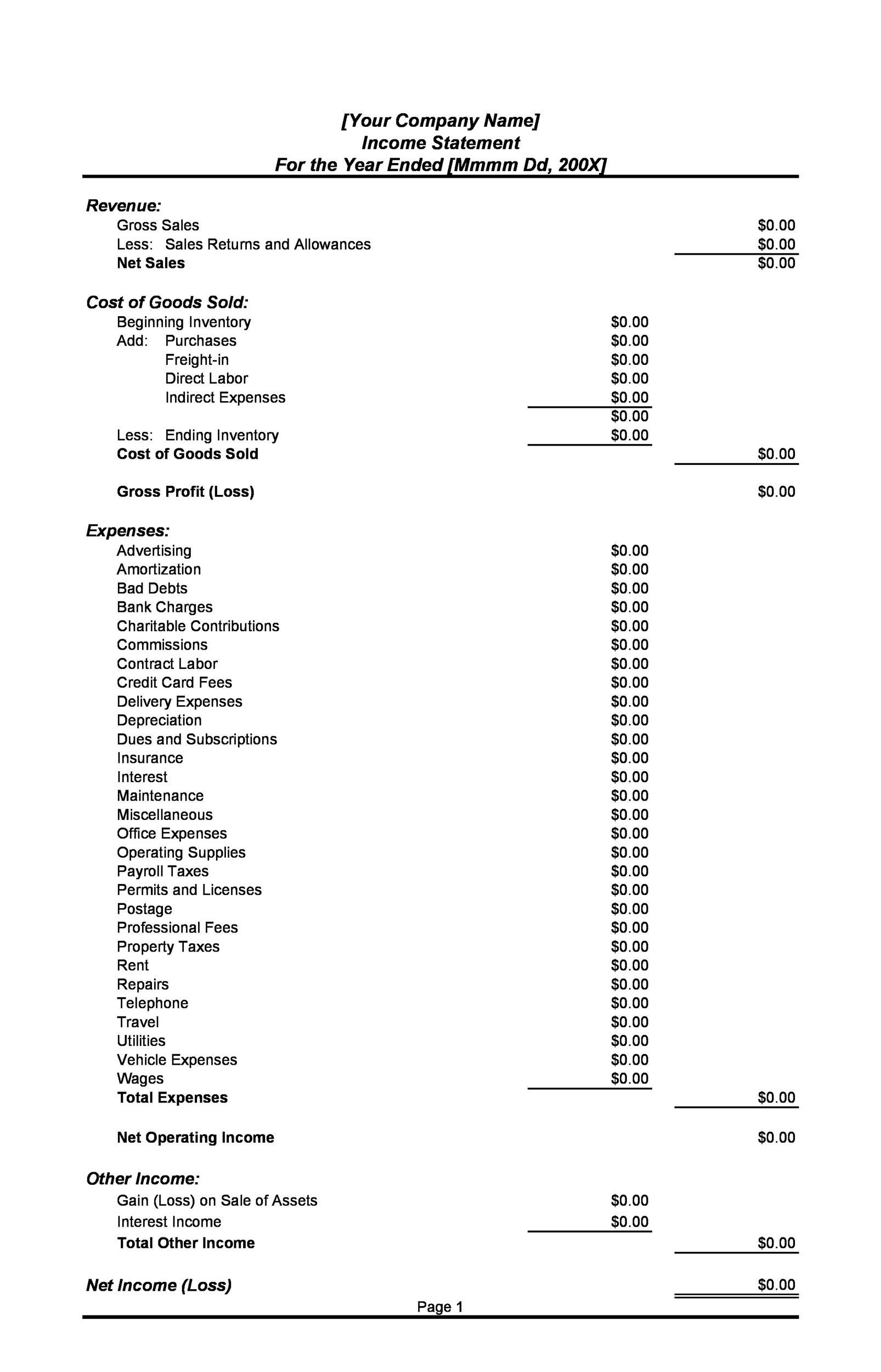

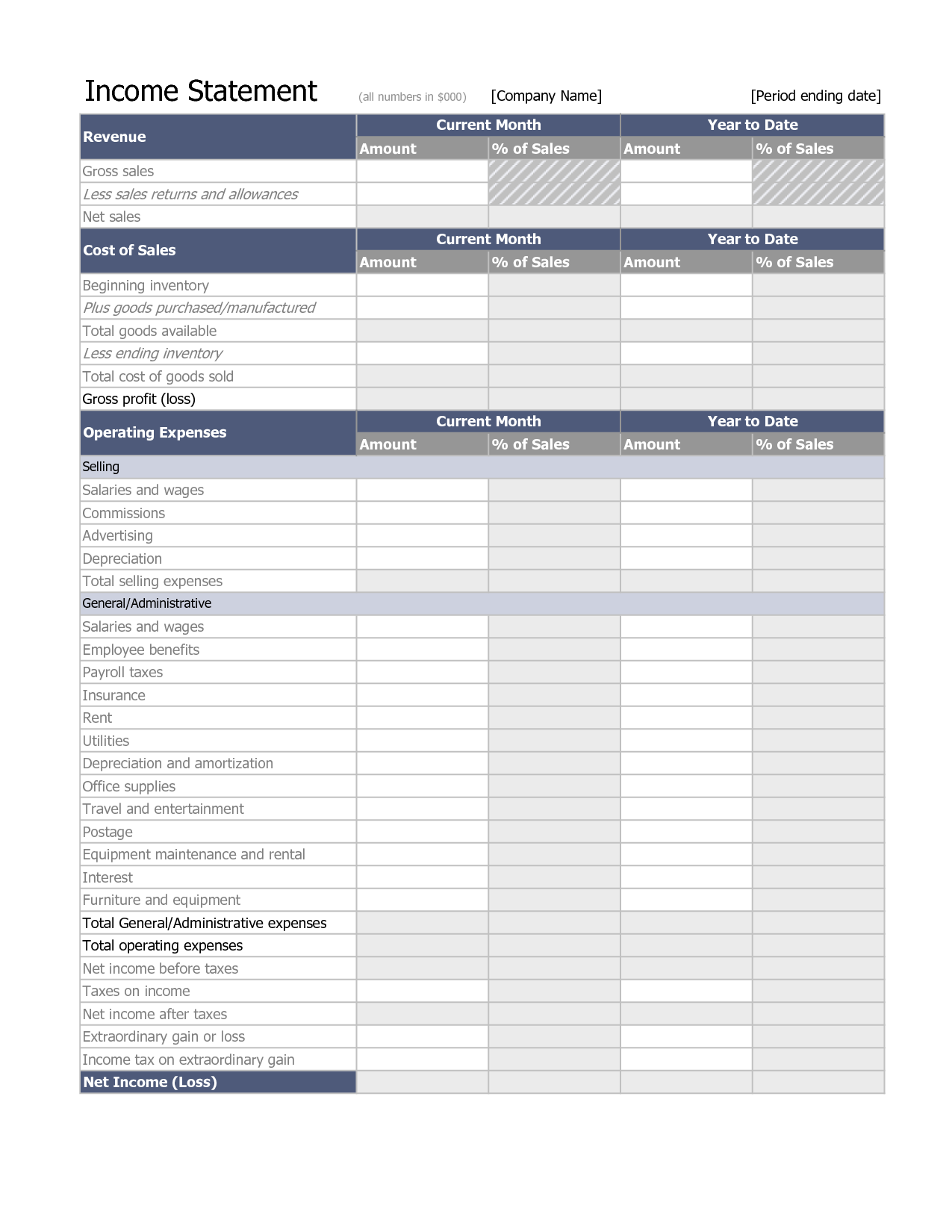

An income statement is another name for a profit and loss statement (p&l). Revenue, expenses, gains, and losses. The income statement focuses on four key items:

What is included in a statement of financial. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Are drawings an allowable expense?

An owner's drawing is not a business expense, so it doesn't appear on the company's income statement, and thus it doesn't affect the company's net income. The salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. Hence, they are simple reductions in equity.

Profit and loss account reports only the nominal accounts i.e. Drawings account is one of the temporary accounts and is closed at the end of accounting period. Do you put drawings in income statement?since the drawing account is not an expense, it does not show up on the income statement of the business.how is.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)