Top Notch Info About Cash Flow Statement Description

The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf.

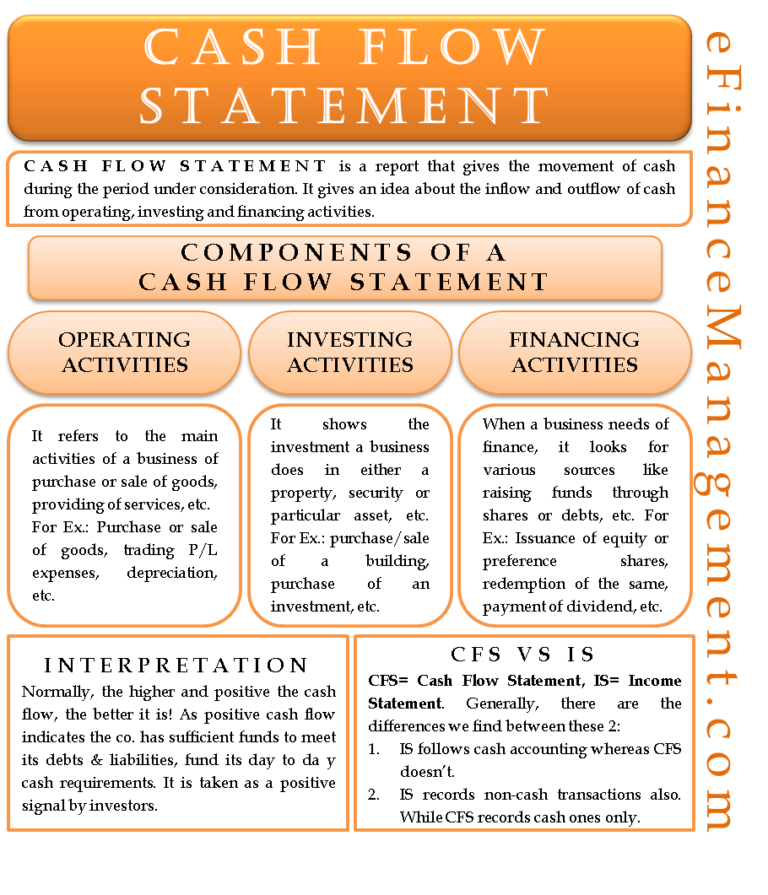

Cash flow statement description. Cash from operating activities, cash from investing activities and cash from financing activities. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. How to create a cash flow statement

The cash flow statement is required for a complete set of financial statements. A company's cash flow can be categorized as cash flows from operations,. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

This report shows how much cash a company receives and spends on operating, investing, and financing activities. Let’s look at what each section is showing. A cash flow statement (also referred to as the statement of cash flows) is a document that reports the inflows and outflows of cash within a business.

The cash flow statement differs from the profit and loss (p&l) statement. Treasury is a relatively small team with a wide range of responsibilities including cash flow forecasting, liquidity management, foreign currency risk management, interest rate risk management, management of salesforce’s. The direct method determines changes in cash receipts and payments.

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. It also includes all cash outflows that pay for business activities and investments during a given period. The cash flow statement includes cash.

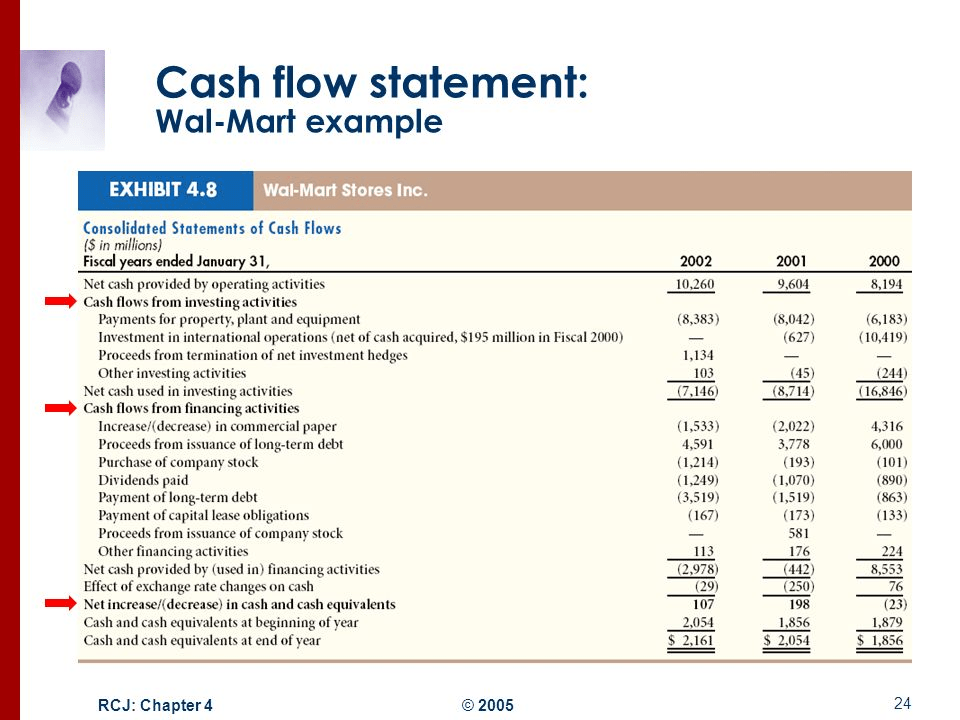

The cash flow statement is the third main financial statement, together with income statement and the balance sheet. Operating, investing, and financing activities. But profit is different from cash flow.

Cash coming in and out of a business is referred to as cash flows, and accountants use these statements to record, track, and report these transactions. Cash flow statement sections 1. Cash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company — both what comes in and what goes out — during a certain.

A cash flow statement consists of three sections: There are two methods for cash flow statement preparation: The main components of the cash flow statement are:

This includes all cash inflows a company receives from its ongoing operations and external investment sources. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. A cash flow statement is a financial statement that summarizes the amount of cash flowing into and out of a company.

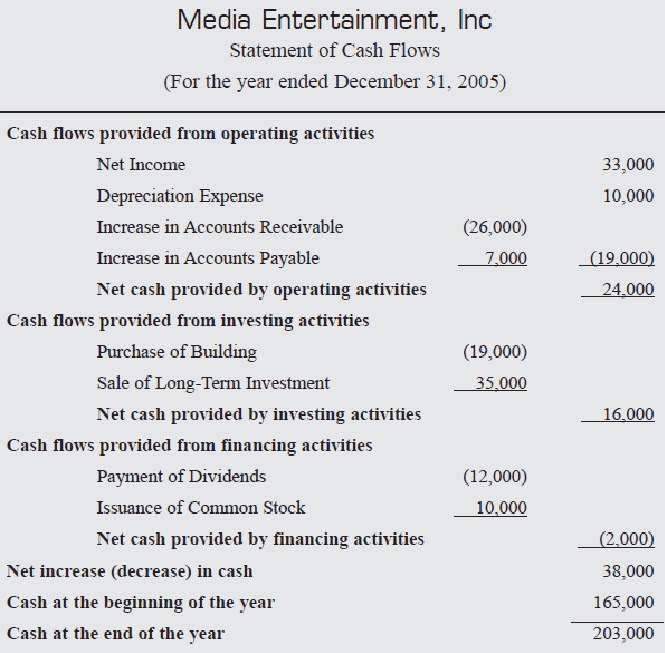

It is one of three main financial statements that businesses use alongside the. A company can be profitable—i.e., show a net profit on its p&l—but have cash flow problems. Cash flow statement example.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)