Breathtaking Info About Income From Discontinued Operations

A reporting entity’s assessment of whether a component qualifies for discontinued operations reporting should occur when the component initially meets the.

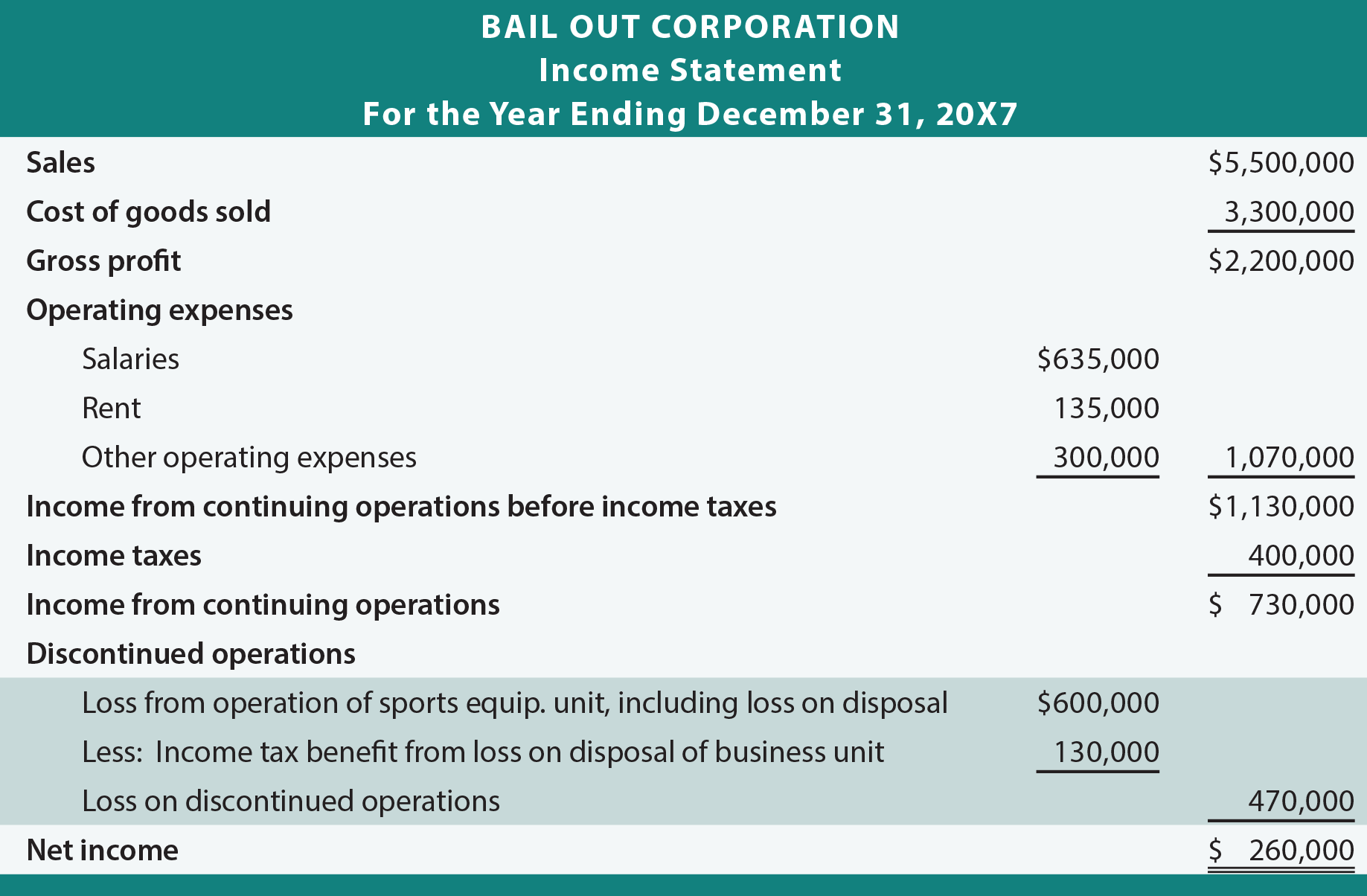

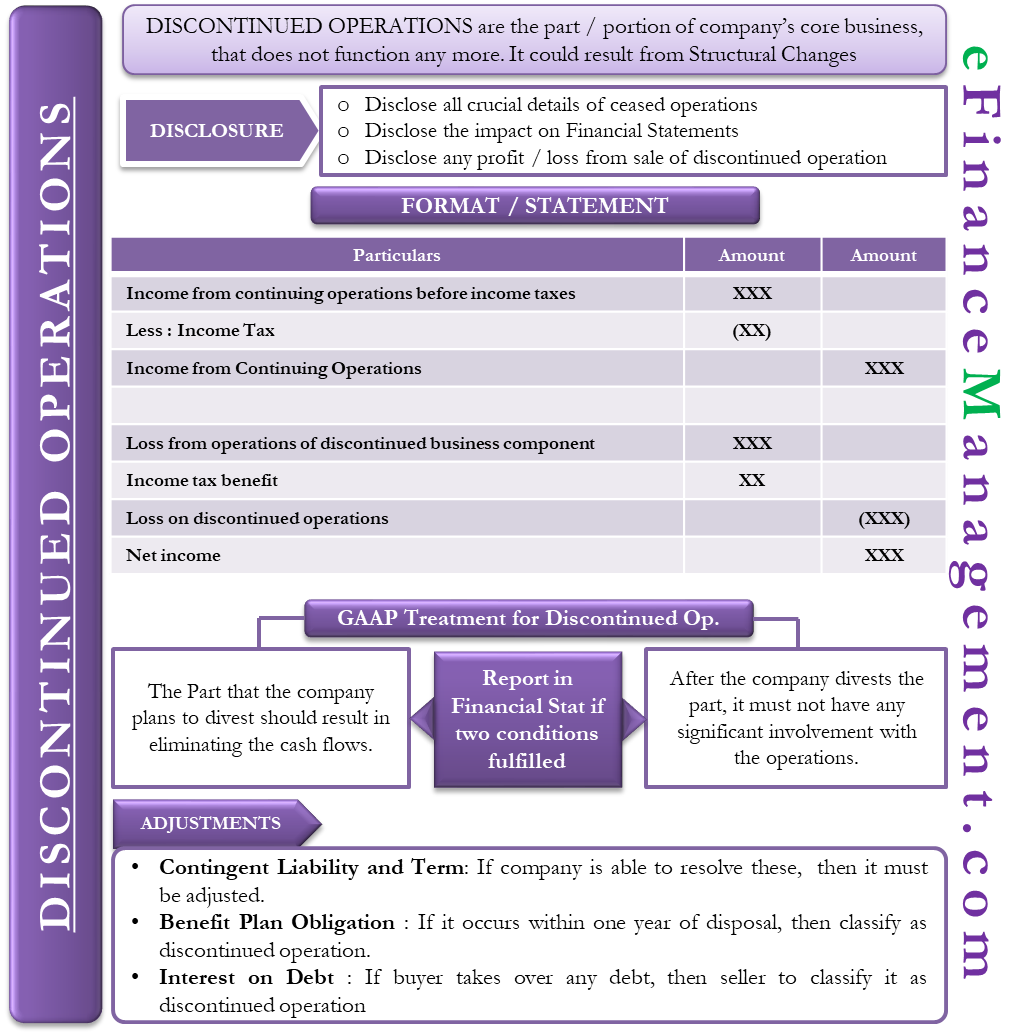

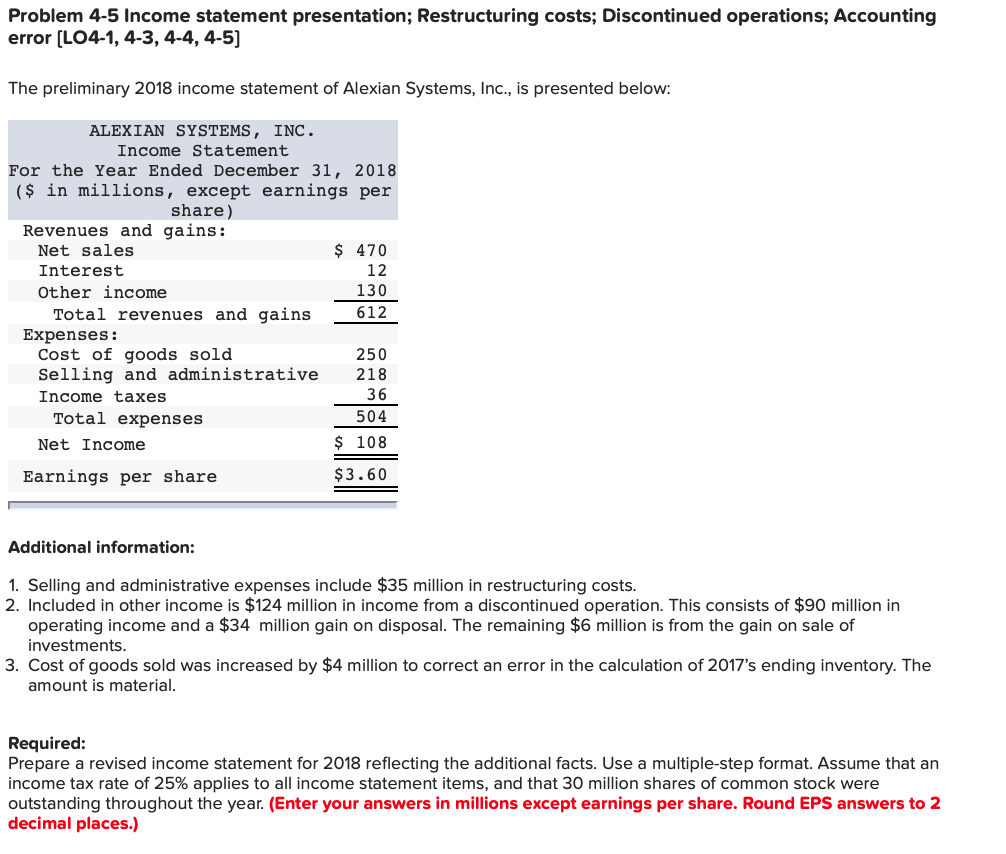

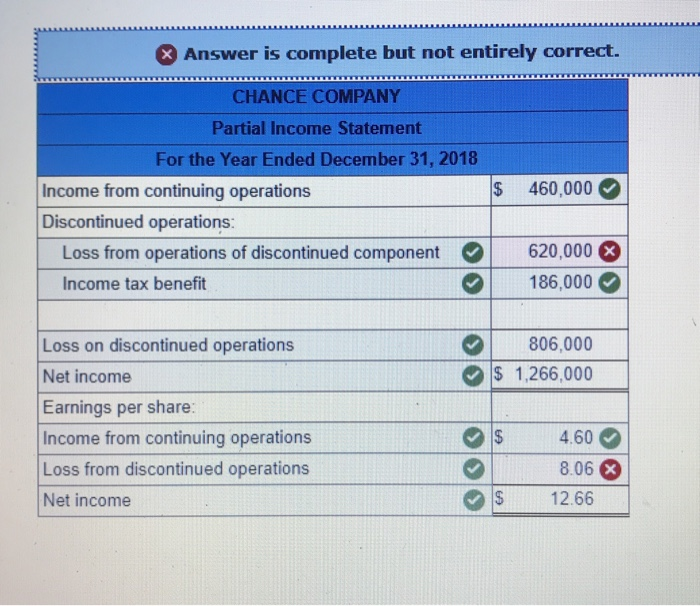

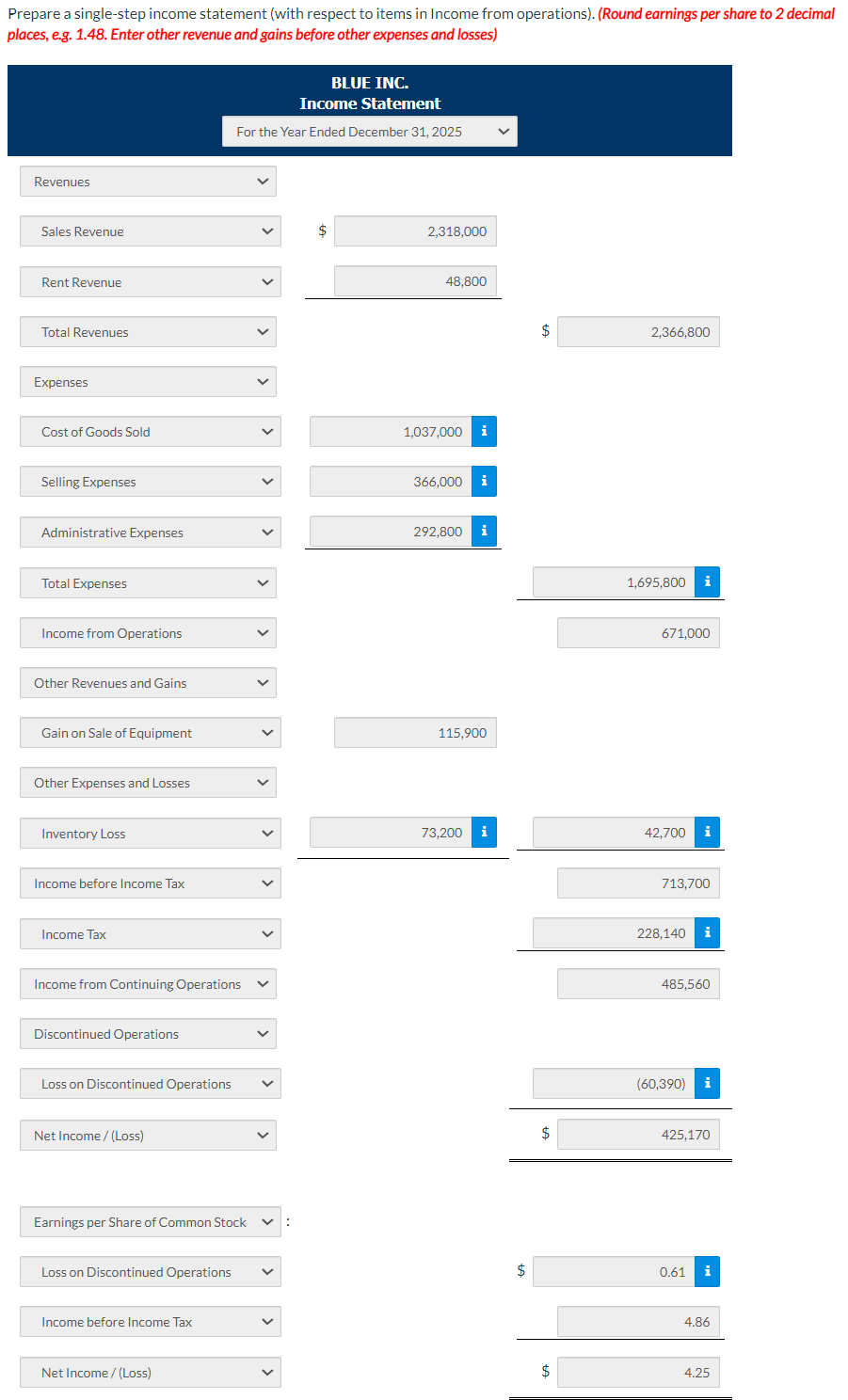

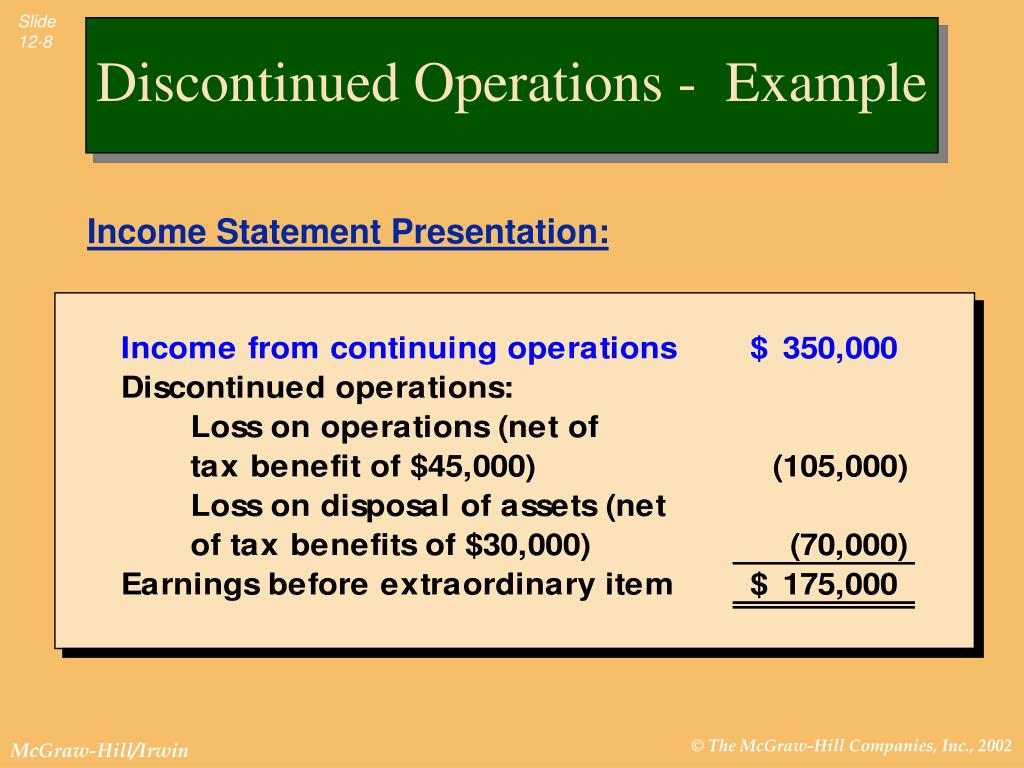

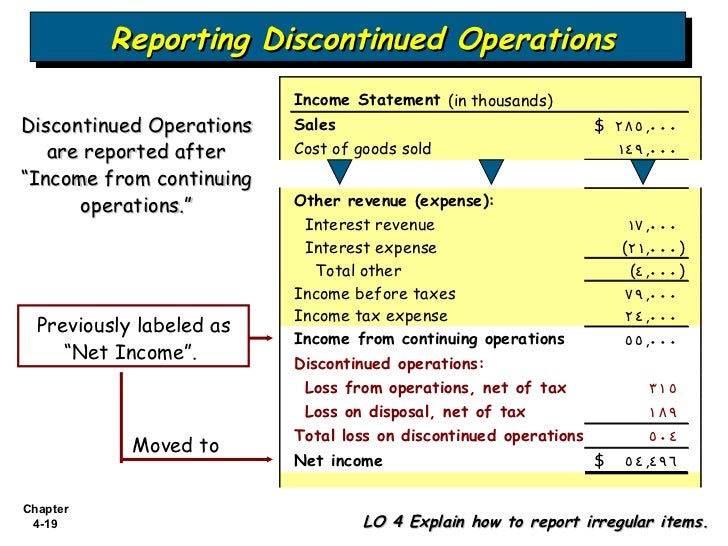

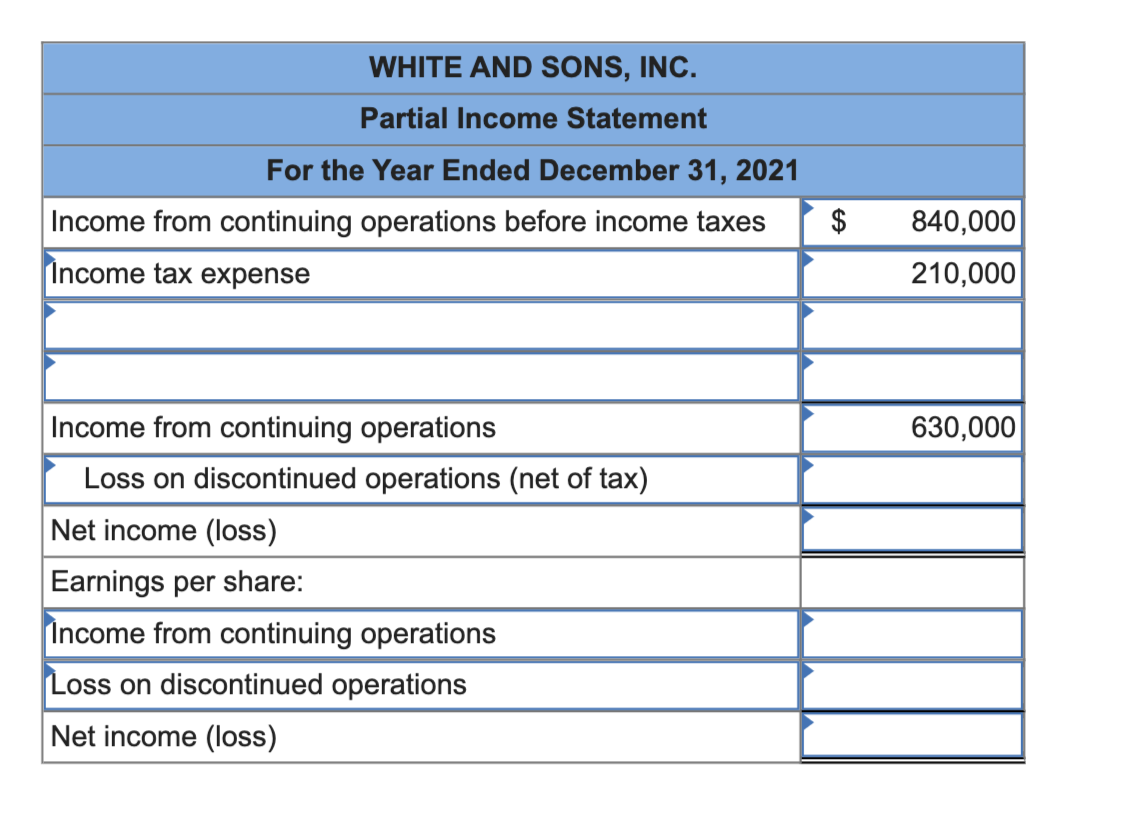

Income from discontinued operations. Although the business component is being shut down, it still could generate a gain or loss in the current accounting period. When operations are discontinued, a company has multiple line items to report on its financial statements. The income from continued operations is calculated by subtracting all the operating expenses and tax on the operating income.

Net income calculation includes income earned from the core business activities carried out daily along with irregular or unusual income and income earned from discontinued. Income from continuing operations is a net income category found on the income statement that accounts for a company’s regular business activities. For accounting purposes, all the gains and losses for that division must be.

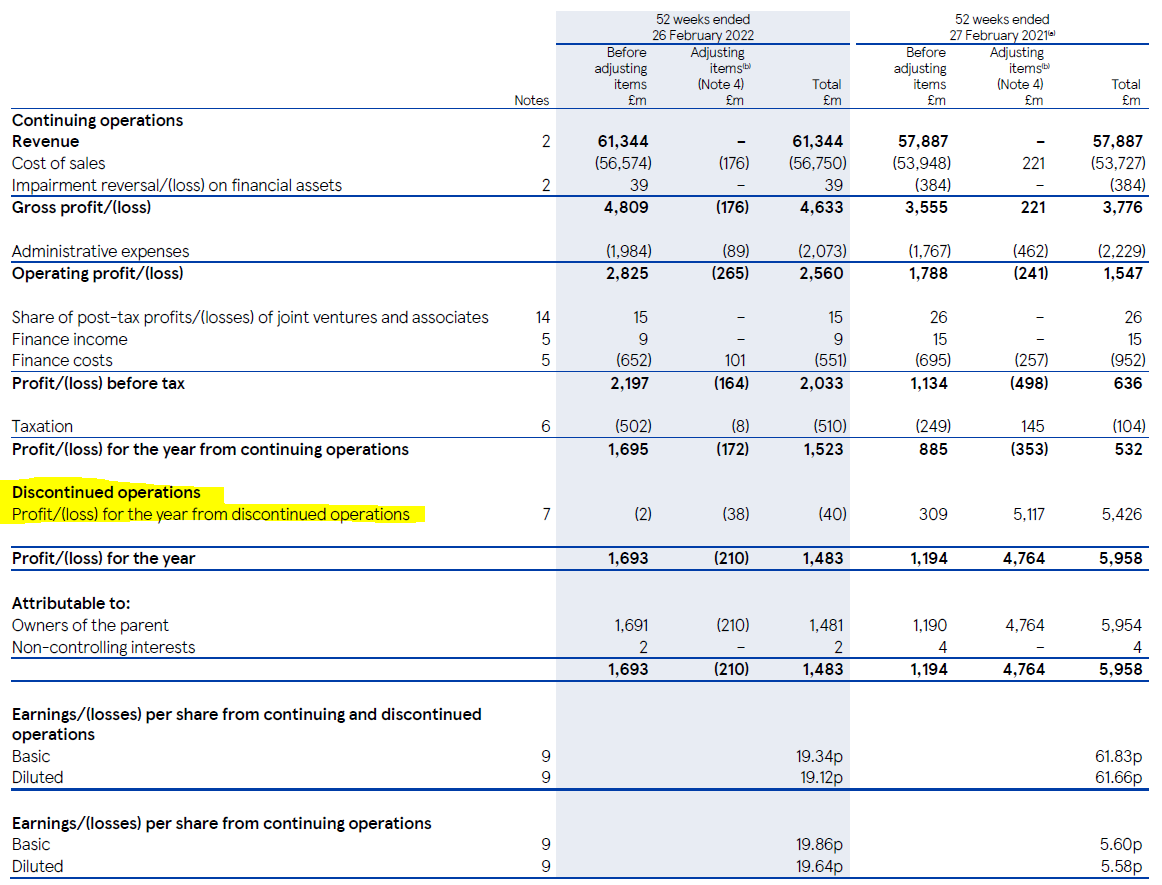

Income from continuing operations : Income statements from previous periods must be restated so that any operations classified as discontinued by the end of the current reporting period align with ifrs. The income statement discontinued operations information is listed on a separate line from continuing operations.

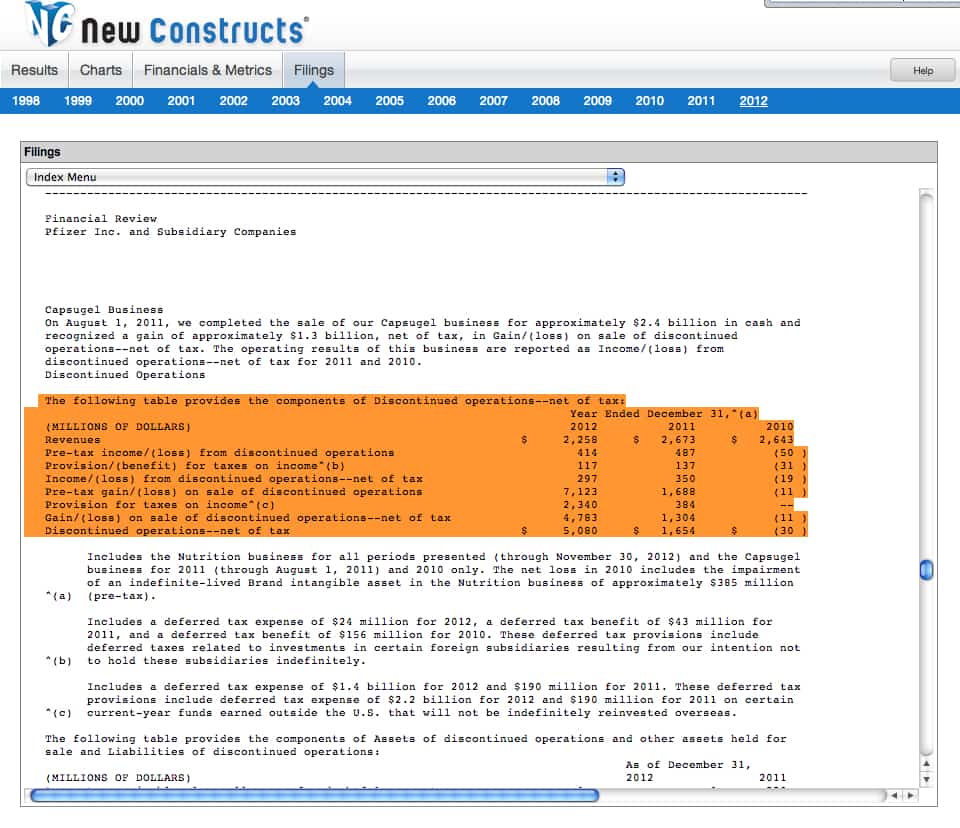

To report income or loss from discontinued. Net income from continue operations (1400 x 0.70) 980: Discontinued operations, net of tax — 6 (k) — — (218) (m) net income (loss) $ 49 $ 94 $ 58 $ 253 $ 118.

Discontinued operations is a term used in accounting to refer to parts of a company’s business that have been terminated and are no longer operational. Group net profit after ei and loss from discontinued operation was s$942 million, 11% higher than s$848 million in fy2022. Net income from discontinued operations when a company conducts a partial or complete sale of a business segment, it is classified as discontinued.

Discontinued operations are parts of a company’s business that have been sold or closed down. The total gain or loss from the discontinued operations is thus reported, followed by. Discontinued operations are the results of operations of a component of an entity that is either being held for sale or which has already been disposed of.

April 3, 2023 discontinued operations refers to the shutdown of a division within a company. Income from discontinued operations can be defined as income or loss from the complete discontinuation of a segment or business, net of associated taxes and fees.