Brilliant Info About Cra Form T2125 For 2019

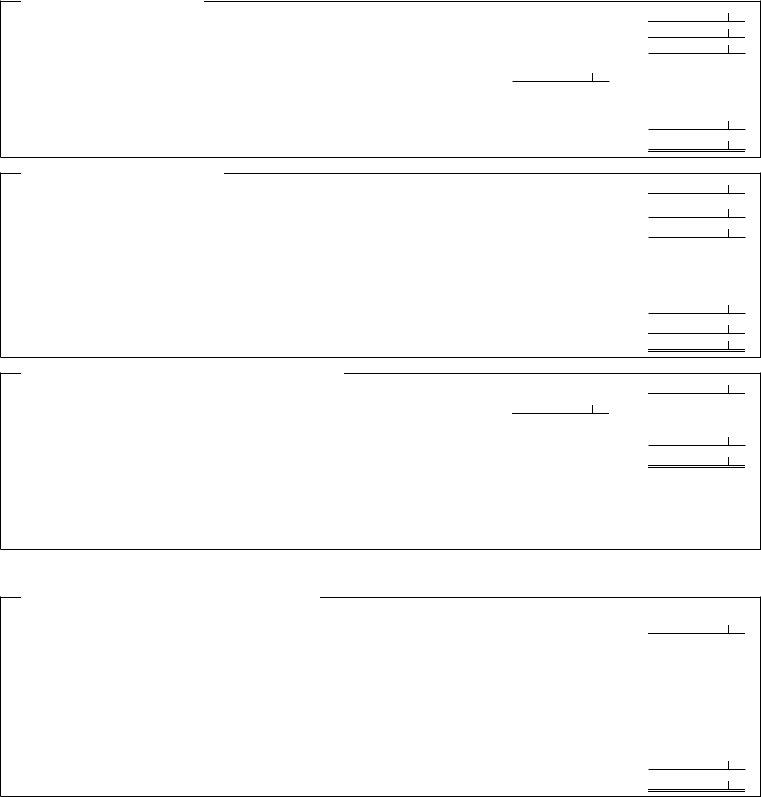

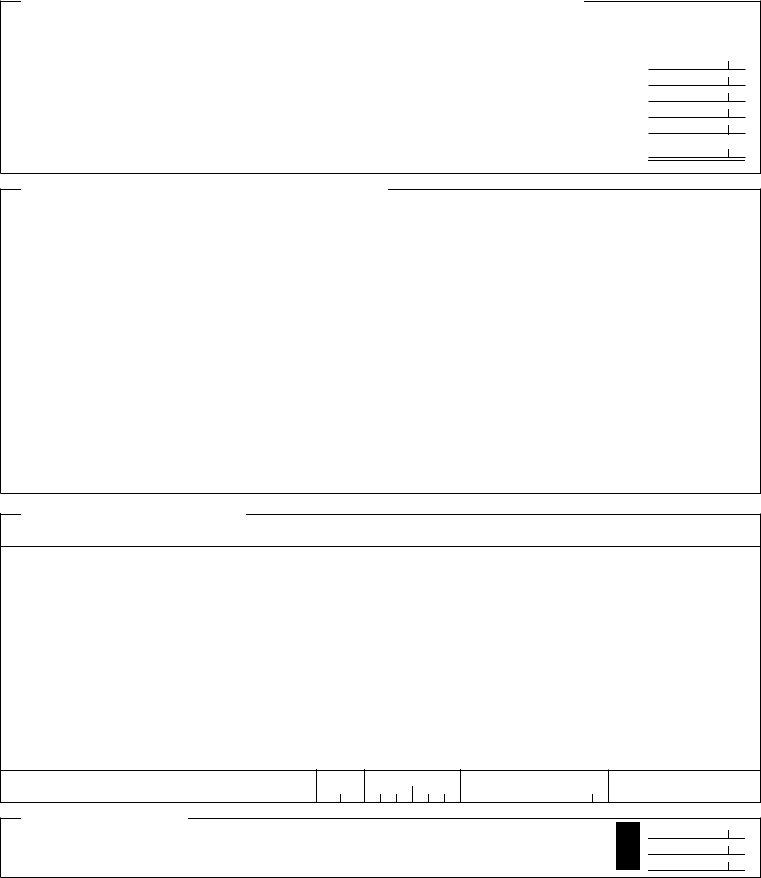

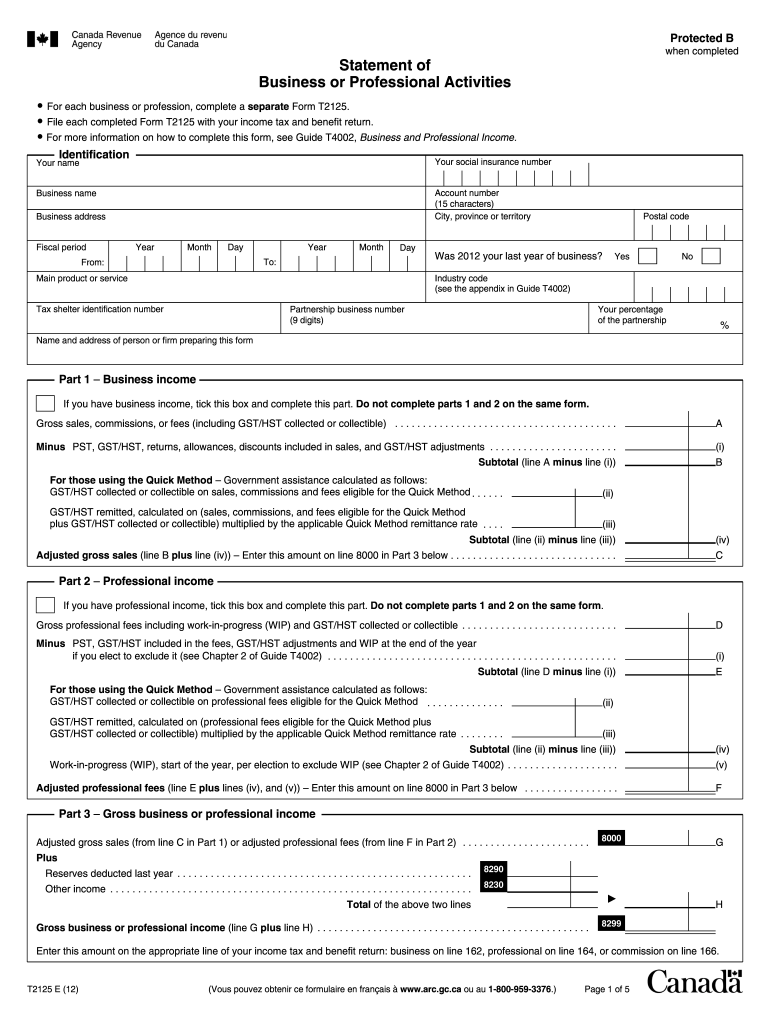

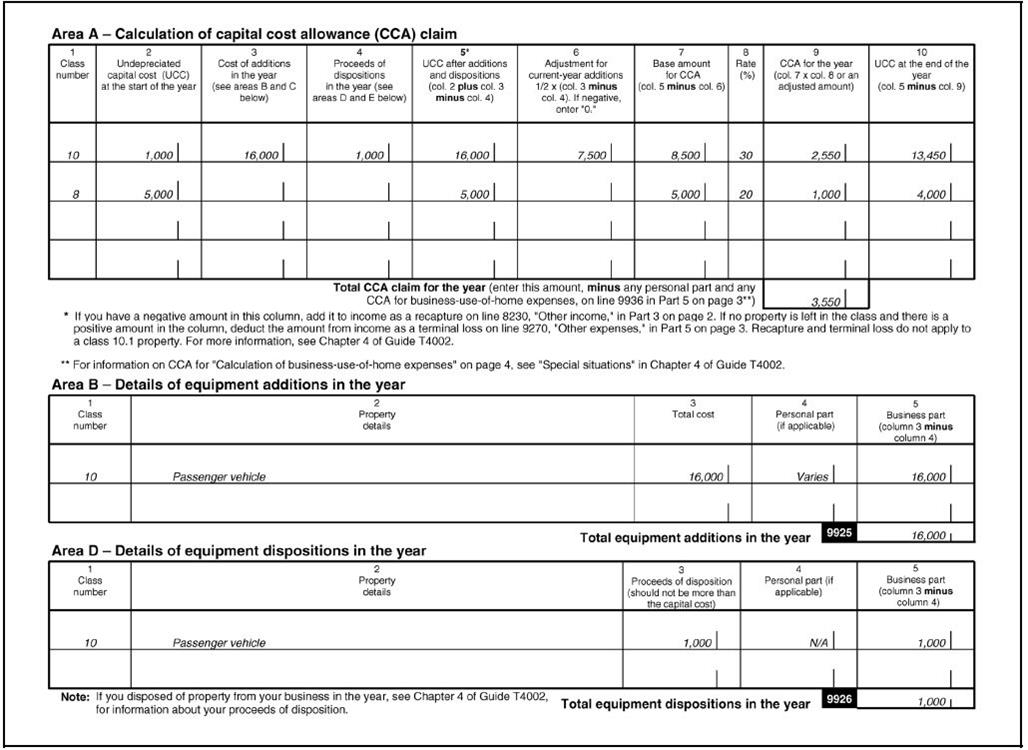

If you are completing form t2125 for a business activity, enter at line 8000 your adjusted gross sales from amount 3g in part 3a.

Cra form t2125 for 2019. For a professional activity, enter your adjusted. You can set up taxcycle to transfer the income automatically from the t4 slip to the related t2125. Statement of business or professional activities form to report your income and expenses for the year.

Enter the income in the appropriate box on the t4 slip: Canada revenue agency forms and publications access to canada revenue agency (cra) forms, tax packages, guides, publications, reports, and technical notices. Use the t2125 form to report either business or professional income and expenses.

Form t2125, statement of business or professional activities. This form can help you calculate your. 3 minute read.

You can find the cra form here: The t2125 form is a versatile reporting tool that allows taxpayers to disclose many facets of their enterprise to the cra including, but not limited to their business. 7 rows the t2125 form is available online via the canada revenue agency (cra) website.

It enables the canada revenue agency (cra) to accurately evaluate how much money you made. You can use form t2125, statement of business or professional activities, to report your business and professional income and expenses. The t2125 form is part of the canadian government’s t1 income tax package.

This form combines the two previous. Use this form to report either business or professional income and expenses. T2125 statement of business or professional activities.

Employees can cash in as. Using form t2125. Generally speaking, anyone who runs an unincorporated business in canada.

This form combines the two previous forms, t2124, statement of business activities,.