First Class Tips About 3 Errors That Affect The Trial Balance

One way to find the error is to take the.

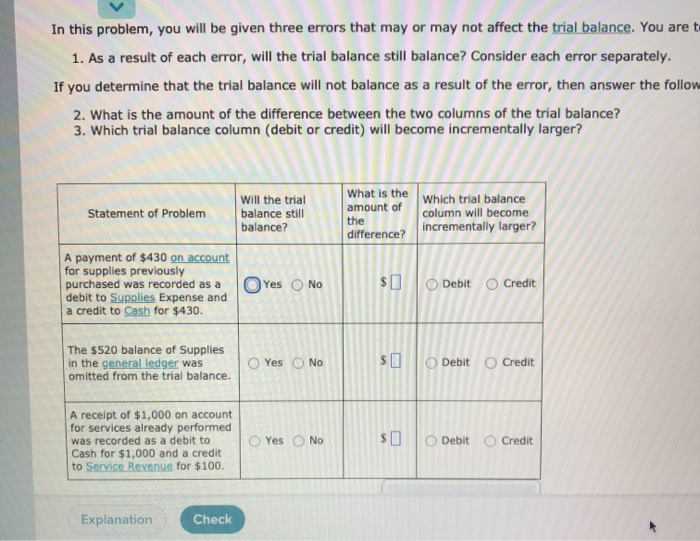

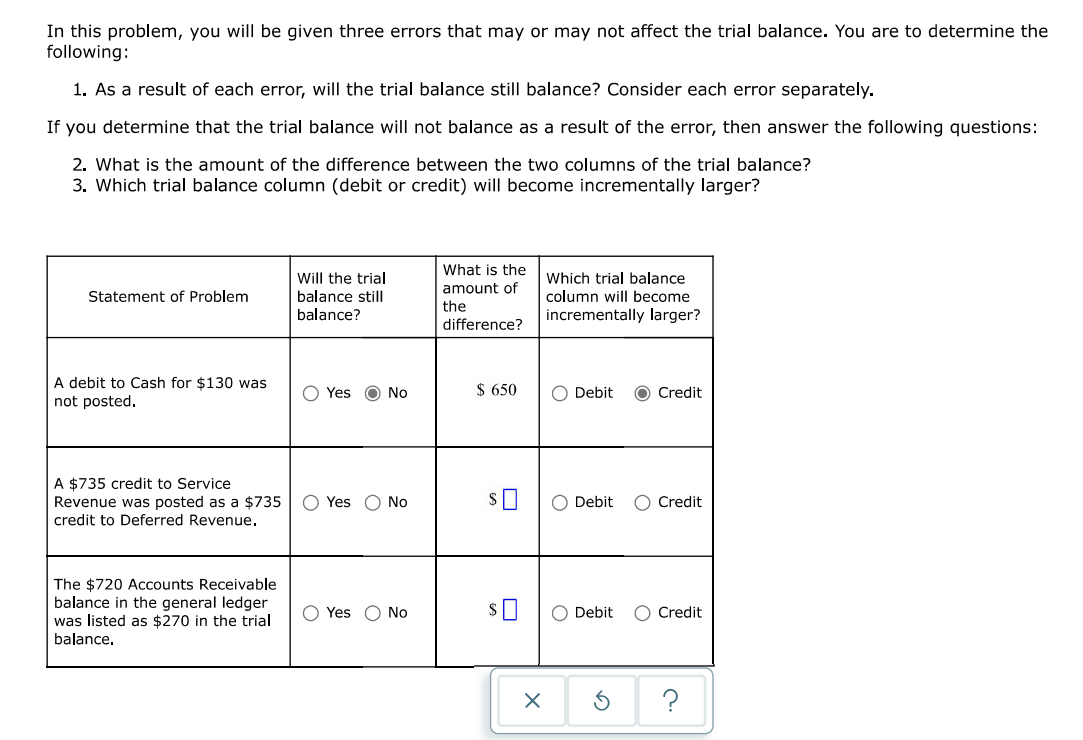

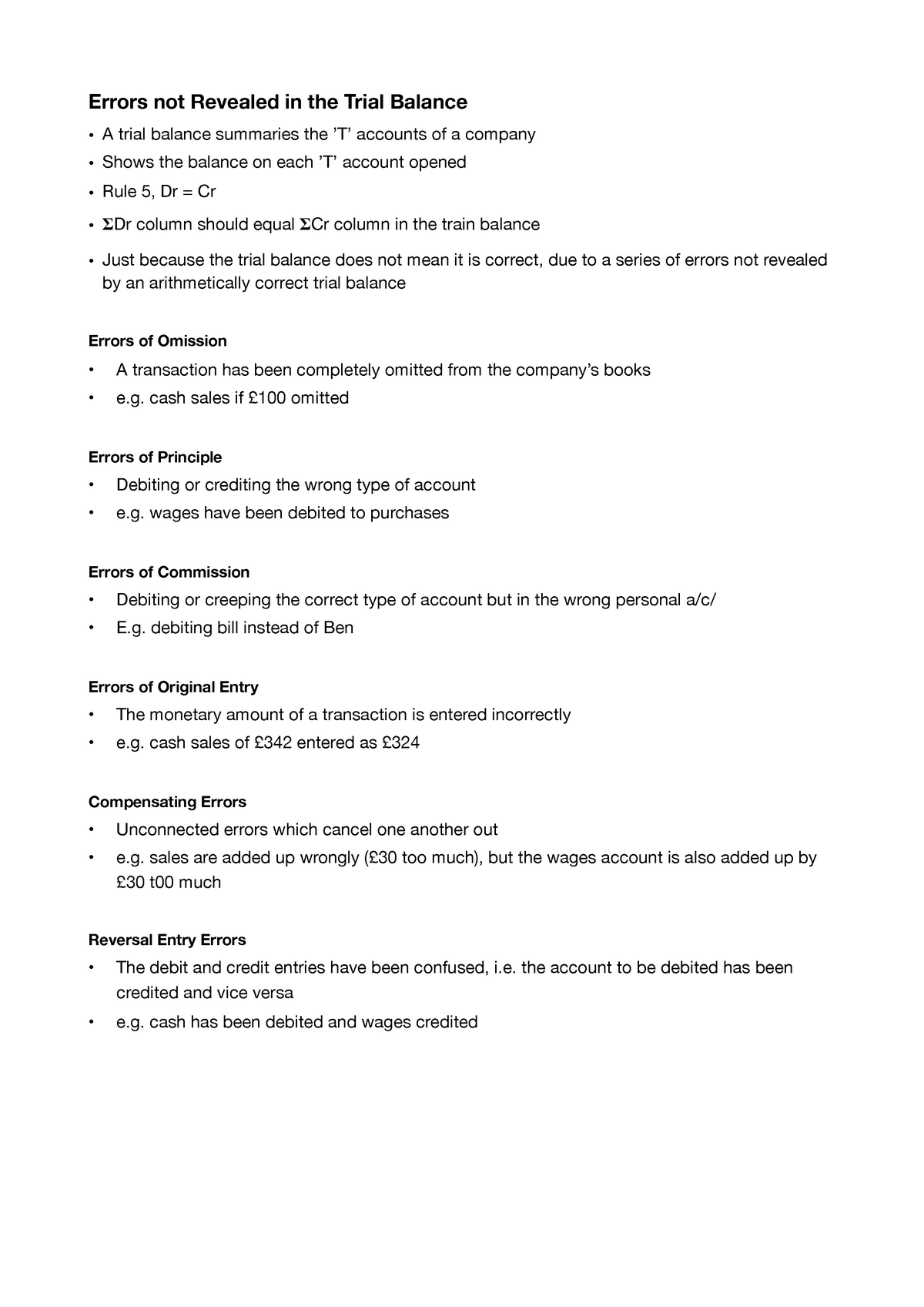

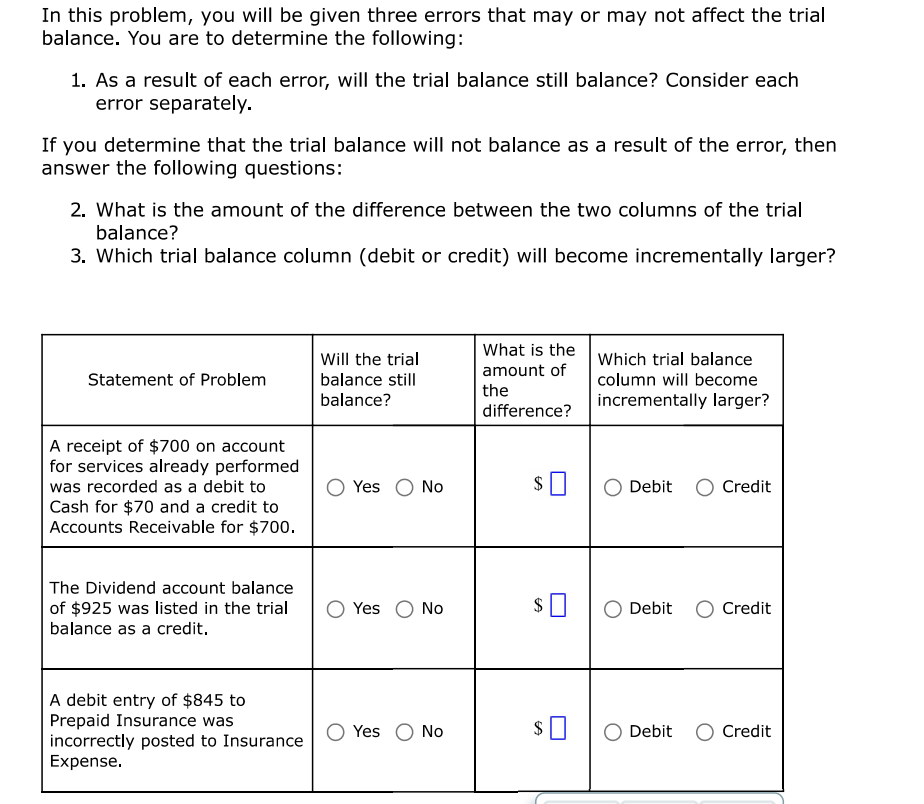

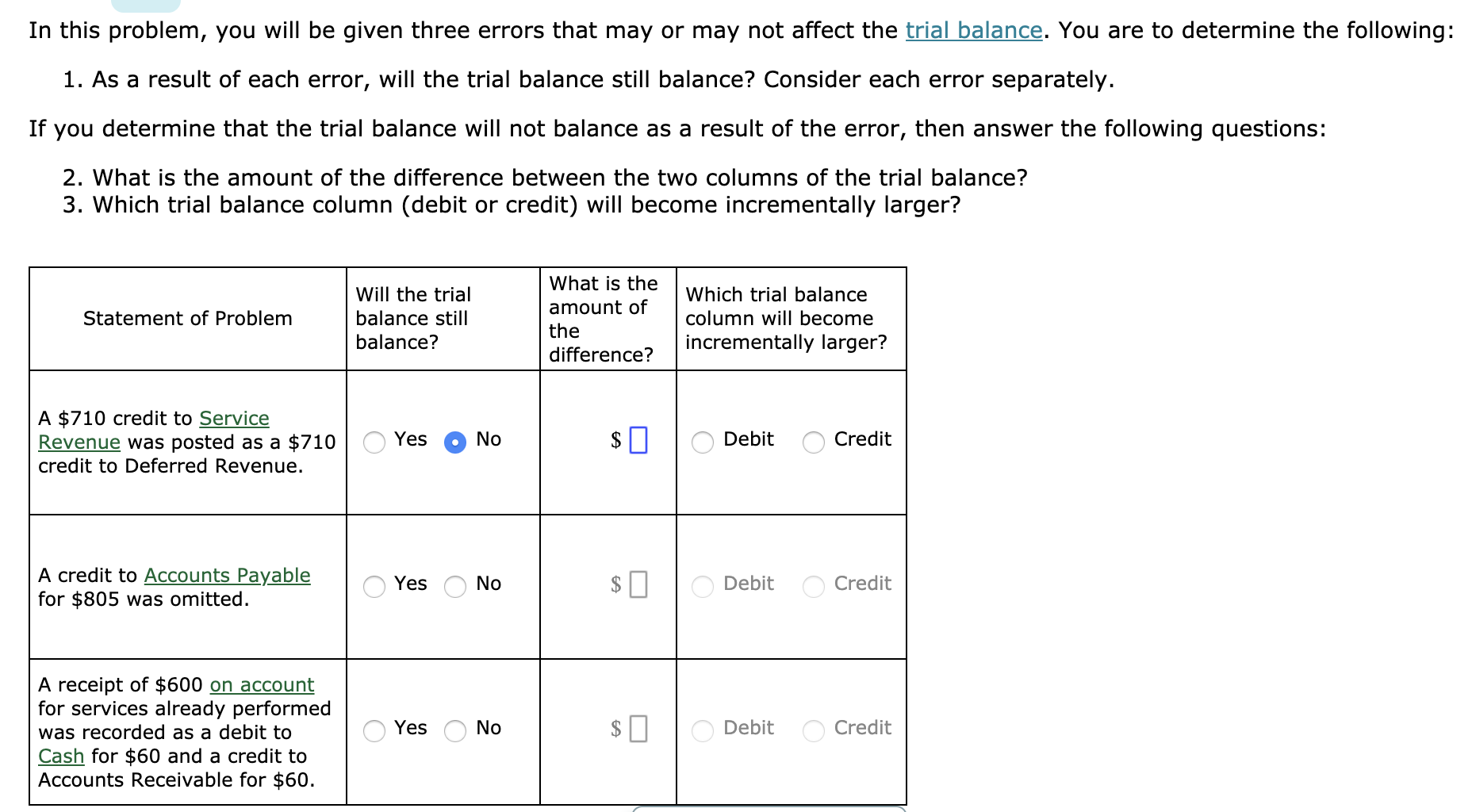

3 errors that affect the trial balance. In part one of this article we looked at the context of account categories linking it to the picture. (a) errors that not affecting trial balance (1)error of omission this is an error where a transaction is completely omitted from the books. The errors that affect the trial balance are following:

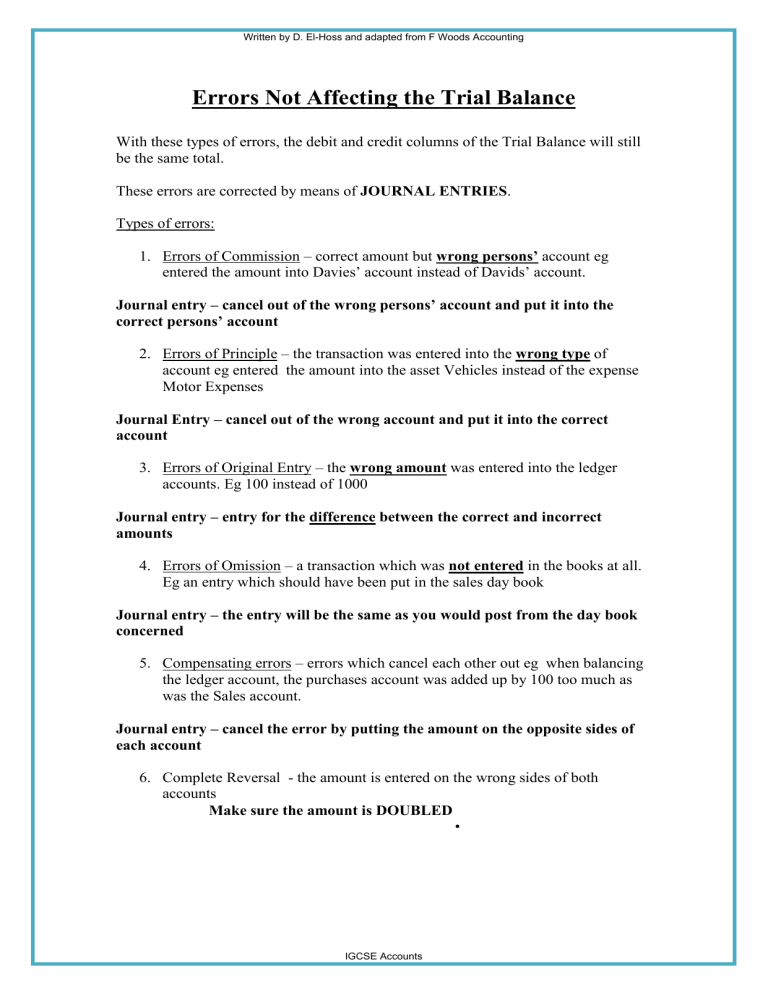

It is similar to the principle error described above, but commission error is. When we say ‘errors that are not disclosed on the. This is easy to find, since the underlying entry is unbalanced, and so should not have been accepted by the accounting software.

The judge in the fraud trial basically said as much. Errors in the accounts fall into two categories, those that are disclosed by the trial balance and those that are not. (b) error of carrying forward.

There are certain types of errors that will not affect tallying of the trial balance. Arithmetical errors in accounting for stock, spoilage and wastage are divided into two classes: Debits and credits of a trial balance must tally to ensure that there are no mathematical errors, but there could still be mistakes or errors in the accounting.

Sometimes errors may occur in the accounting process, and the trial balance can make those errors apparent when it does not balance. Errors of omission occur when a transaction is fully skipped. For example, a transaction may be entered in the subsidiary book at the wrong amount (i.e., error in.

The transaction amount is correct, but the account debited or credited is wrong. Trial balance and correcting errors series. No entries were made at all for the transaction.

Those that affect the trial balance and those that do not. If a manual system is being used, journal entry. Trial balance and rectification of errors 185 6.3 preparation of trial balance theoritically spreading, a trial balance can be prepared in the following three ways :

The trial balance subject has been introduced and discussed in the first two levels in this accounting tutorial series whereby it was clarified. Errors of omissions if any transaction is omitted from being recorded in a journal and ledger, it is called the error or omission. Errors not affecting trial balance can take several forms.

They are described below; Trial balance errors are defined as errors that happen while recording balances and transactions in ledgers while presenting them during a trial balance. There are two types of errors that can affect the trial balance:

It will tally but still there will be errors. Correction of trial balance errors. It is as if the transaction has not existed.

:max_bytes(150000):strip_icc()/debit-4198113-recirc-blue-1b26a301716d424387f86c5d3f3f9ea0.jpg)