Painstaking Lessons Of Info About Reading Company Balance Sheet

Learning and mastering the skill of reading balance sheets is a crucial for investors.

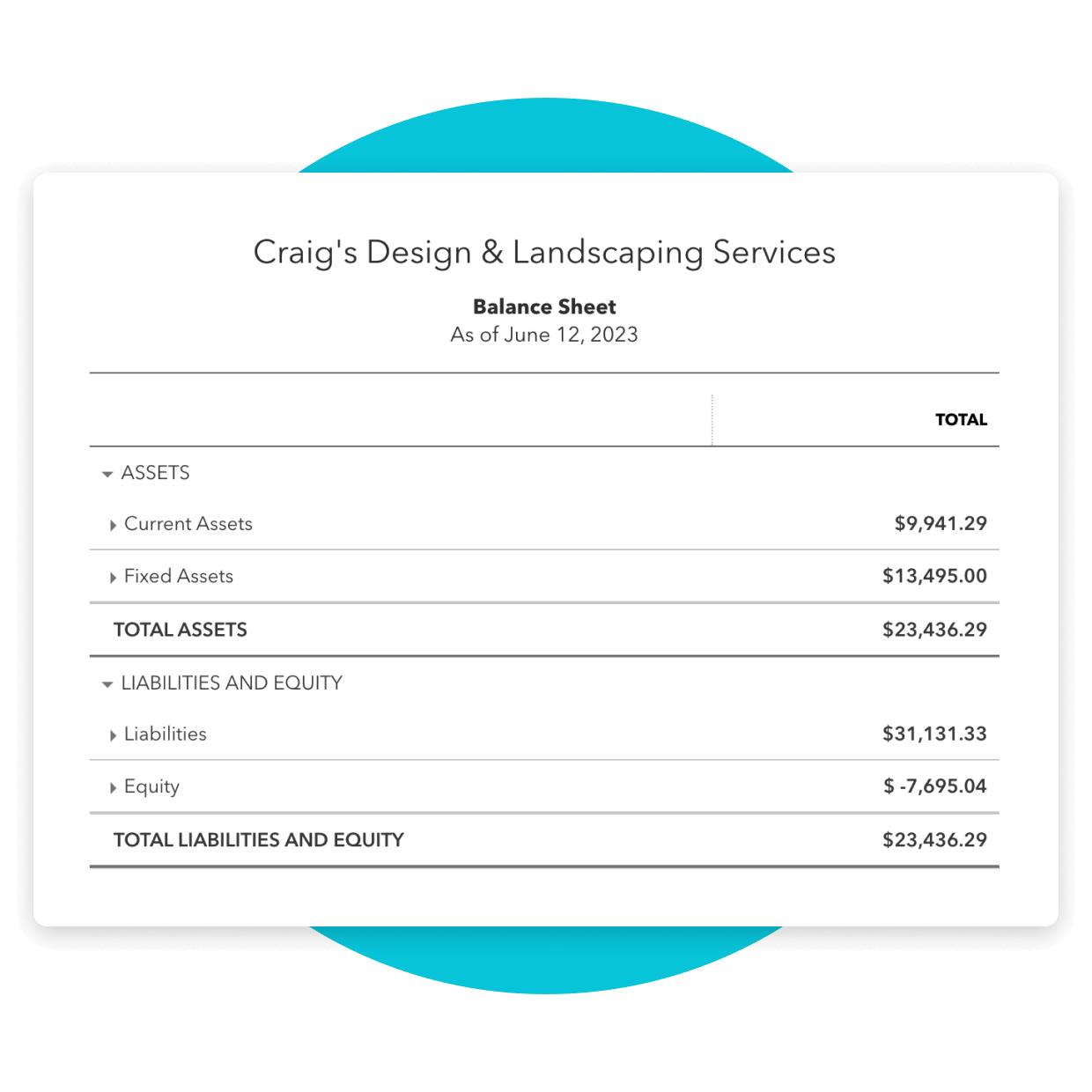

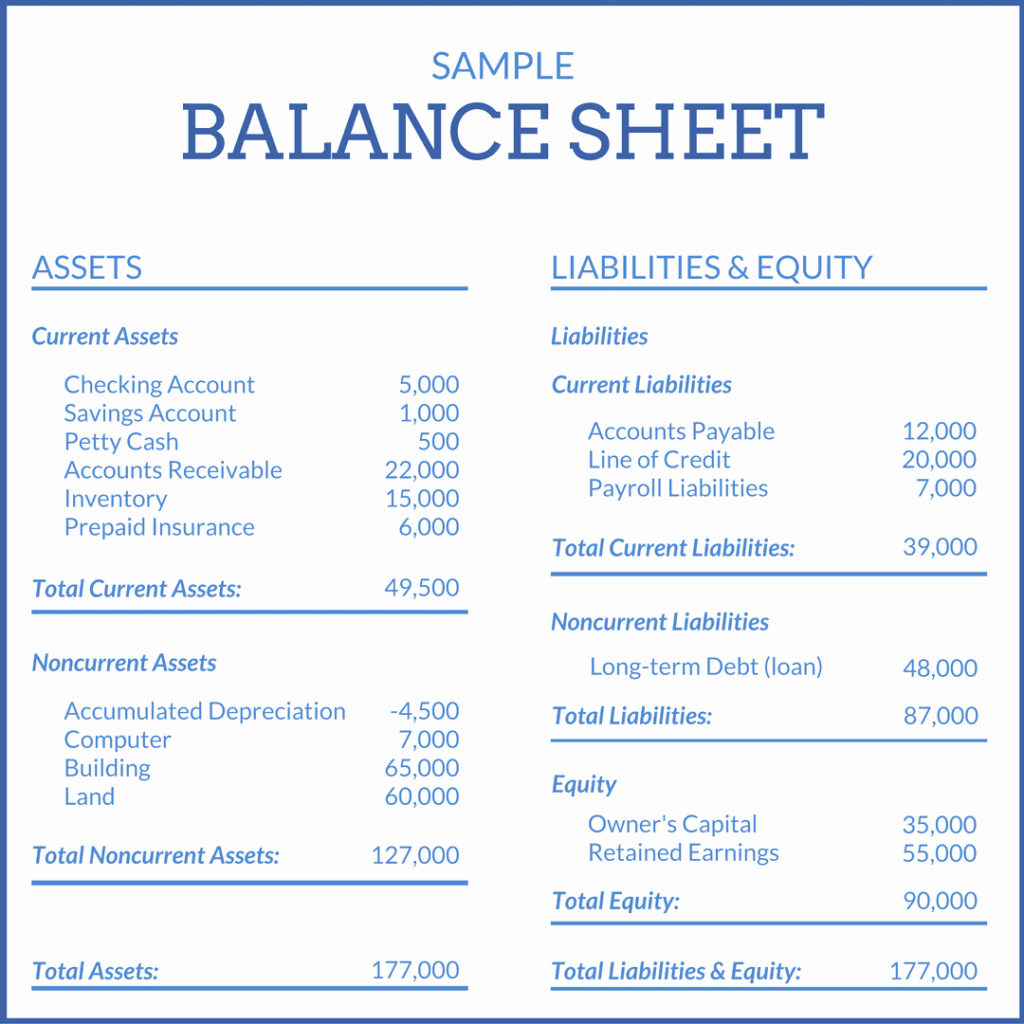

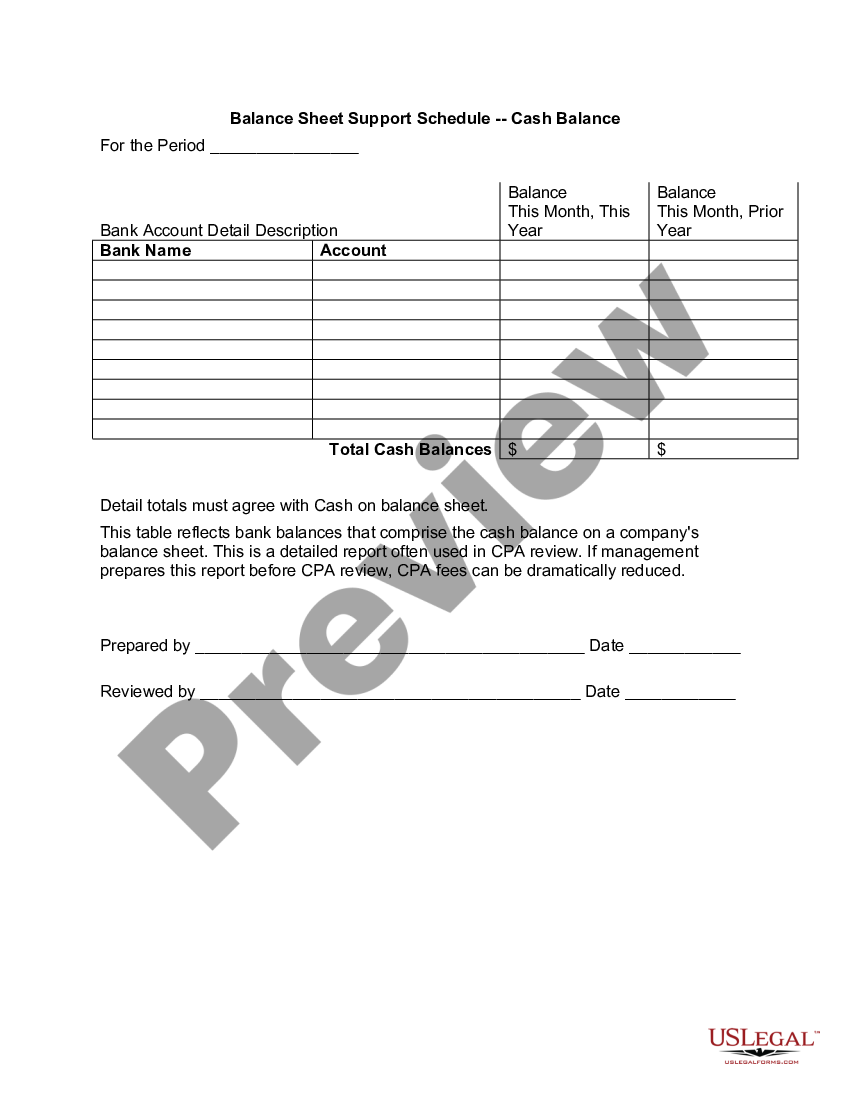

Reading company balance sheet. In any typical balance sheet, the company’s total assets should be equal to the company’s total liabilities. It is called a balance sheet because it adheres to the basic accounting equation: How to read a balance sheet?

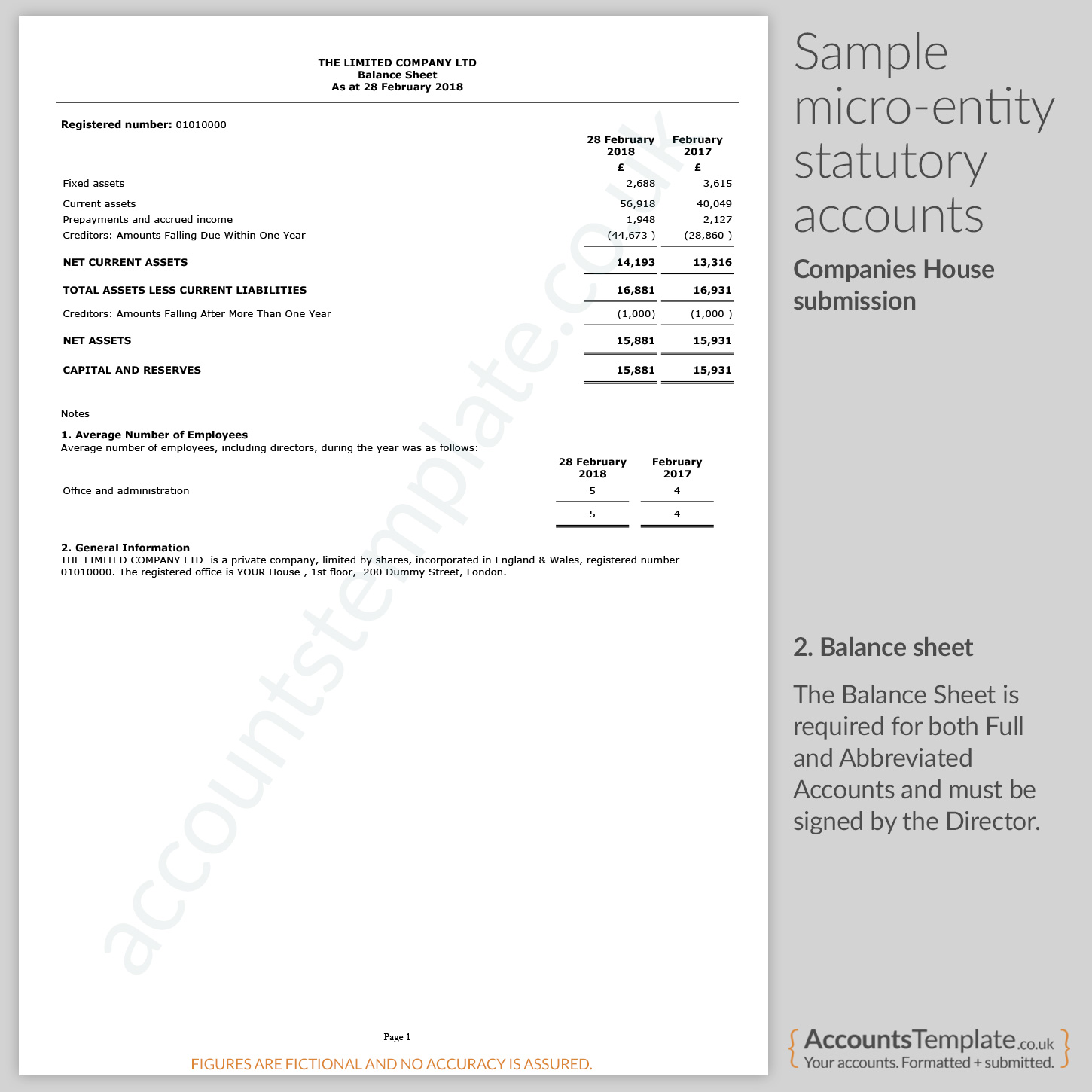

First quantum signs $500m copper deal with shareholder, says asset and stake sales progressing. You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios. Understanding the accounting equation (uk) introduction:

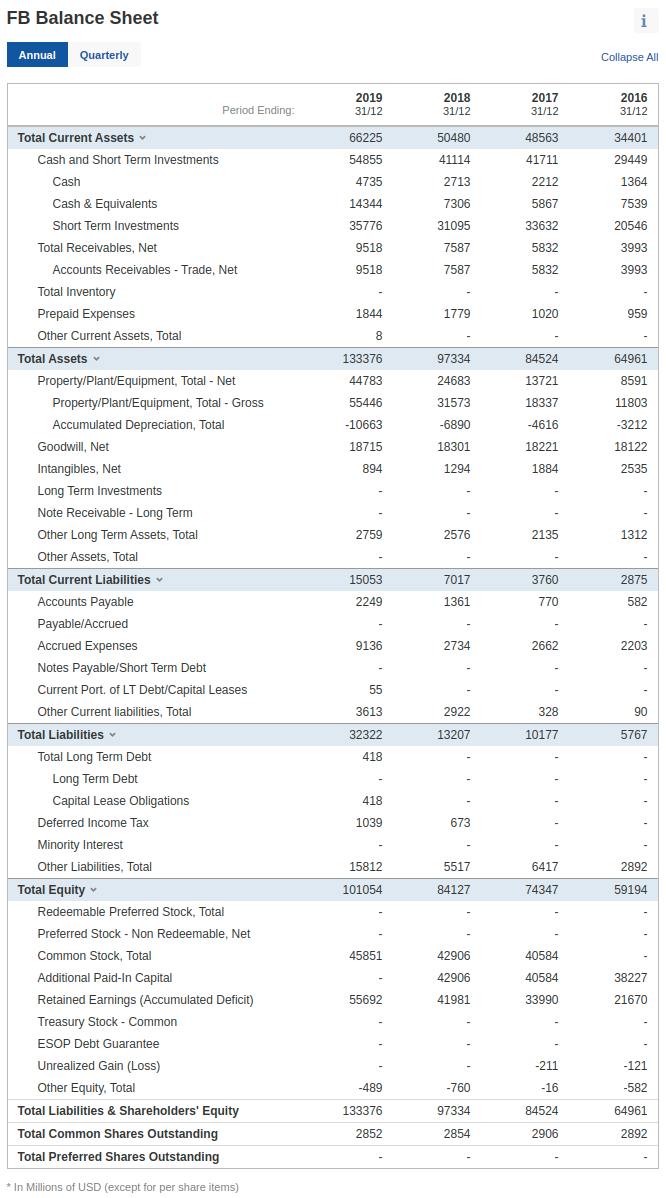

So if your total liabilities come out to $100,000, and your total equity comes to $200,000, you have $100,000 in assets. The equation above is called the balance sheet equation or the accounting equation. Comparing several years of a company’s balance sheet may highlight trends, for better or worse.

A balance sheet reflects the company’s position by showing what the company owes and what it owns. You can learn this by looking at the different accounts and their values under assets and liabilities. Reading and understanding the balance sheet of the company includes consideration of the accounting equation, which states that the sum of the total liabilities and the owner’s capital is equal to the company’s total assets, knowing different types of assets, shareholders’ equity, and liabilities of the company and analyzing the balance sheet us.

To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: How to read a company’s balance sheet by: If the equation doesn’t add up—if your assets are worth more or less than your.

For individuals interested in understanding a company’s accounts, decoding the balance sheet is. The report can be used by business owners, investors, creditors, and shareholders. How to read a company balance sheet 12 feb 2021 wondering how to read a company balance sheet?

How to read a company balance sheet: While all three contain important information, the balance sheet provides a balanced view of the company’s assets, liabilities, and equity. To read your balance sheet, you need to evaluate your company’s assets, liabilities, and equity to better view what your company holds and owns at any time.

A balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial health at a specific point in time. The information on a balance sheet is critical to understanding whether your business is performing well on revenue. A balance sheet contains 3 sections:

A balance sheet is one of the financial statements of a business that shows its financial position. Balance sheets, income statements, cash flow statements, and annual reports. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

Minres said it had $1.4 billion in cash at the end of the first half and net debt of $3.55 billion, up from $1.85. Investors looking for investment quality in this area of a company's balance sheet must track the ccc over an extended period of time (for example, 5 to 10 years) and compare its performance to. A business can prepare the balance sheet in several ways, but.