Lessons I Learned From Tips About Example Of Profit And Loss Statement For Small Business

Here is an example of an effective process to prepare a proper profit and loss statement.

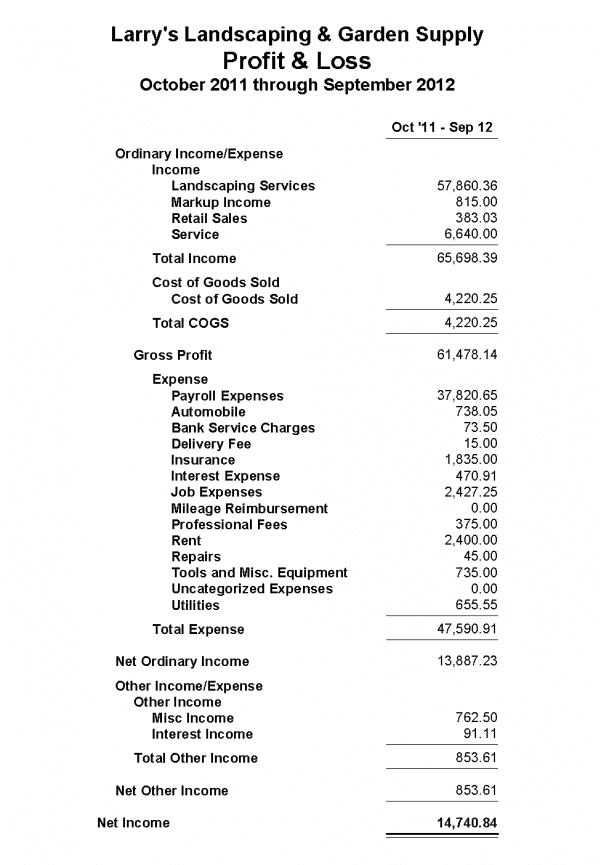

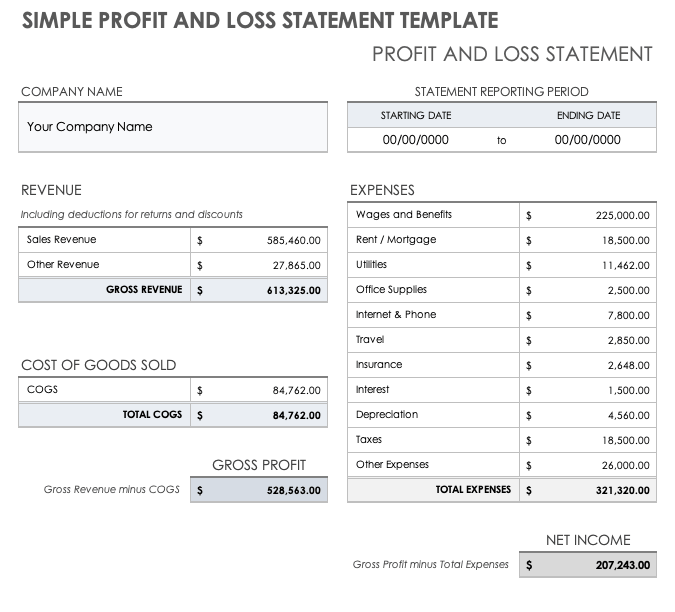

Example of profit and loss statement for small business. We’ve created a profit and loss statement for an imaginary small business—terracotta warriors, a supplies store for potted plant enthusiasts. A profit and loss (p&l) statement is a financial document that summarizes your business's revenue, costs, and gross and net income over time. The easiest method is to use the best accounting software.

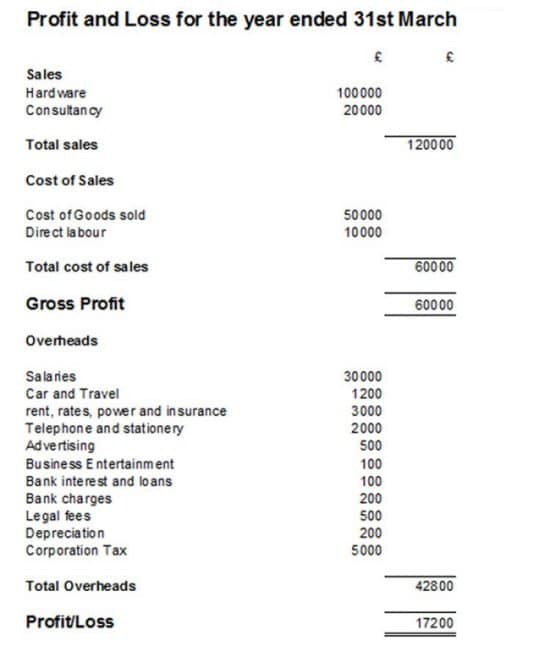

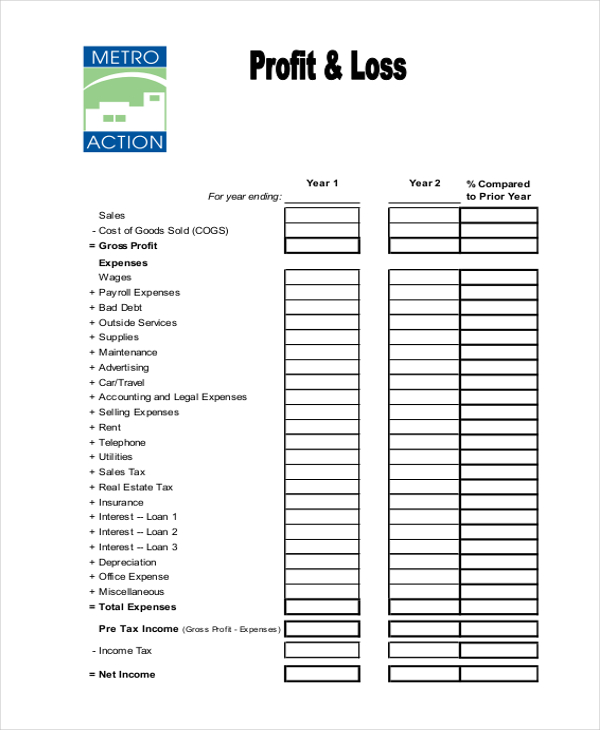

Company sports co. A profit and loss statement serves a simple purpose: You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings.

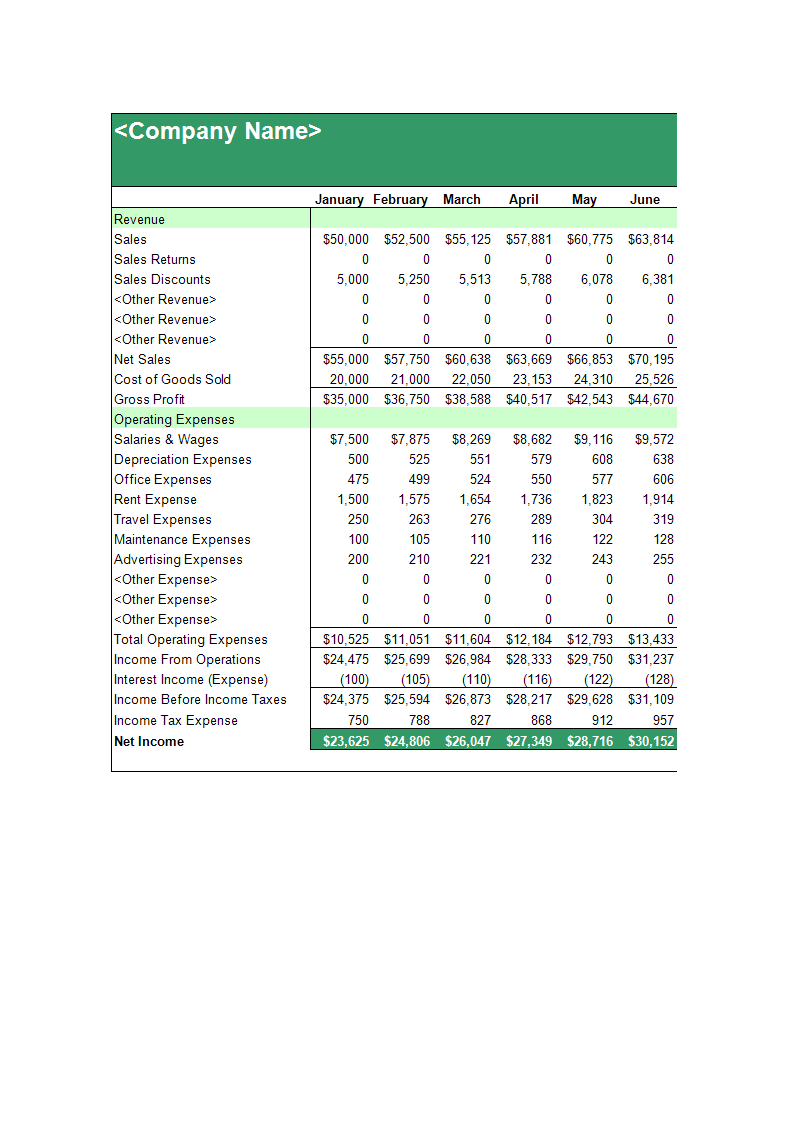

Along with your balance sheet, your profit and loss statement (p&l) is the most significant financial document your business will produce. For example, here’s a profit and loss statement from meta platforms, inc.: Annual profit and loss template sample;

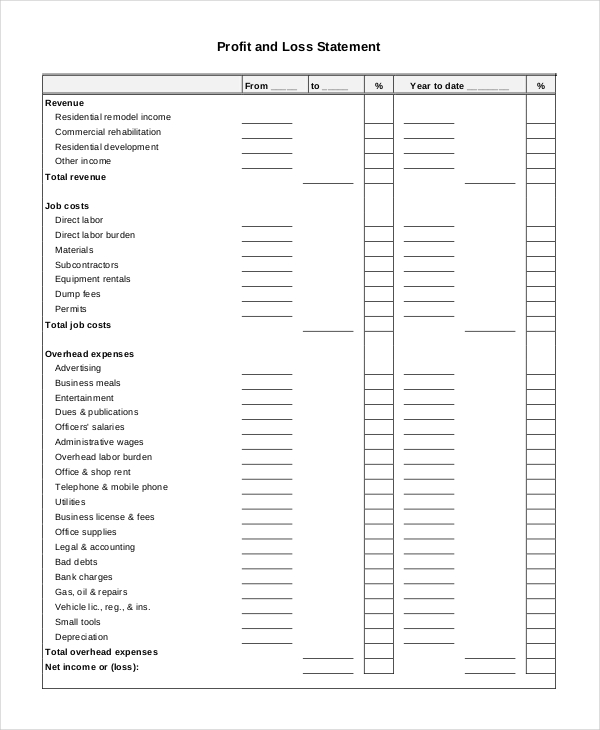

A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. Monthly profit and loss template; Infodocs profit and loss statement for the year ended december 31, 2023;

18 january 2024 a profit and loss statement tells you how much your business is making or losing. Small businesses produce an income statement either through bookkeeping software, in excel or manually. Table of contents toggle what is a profit and loss statement?

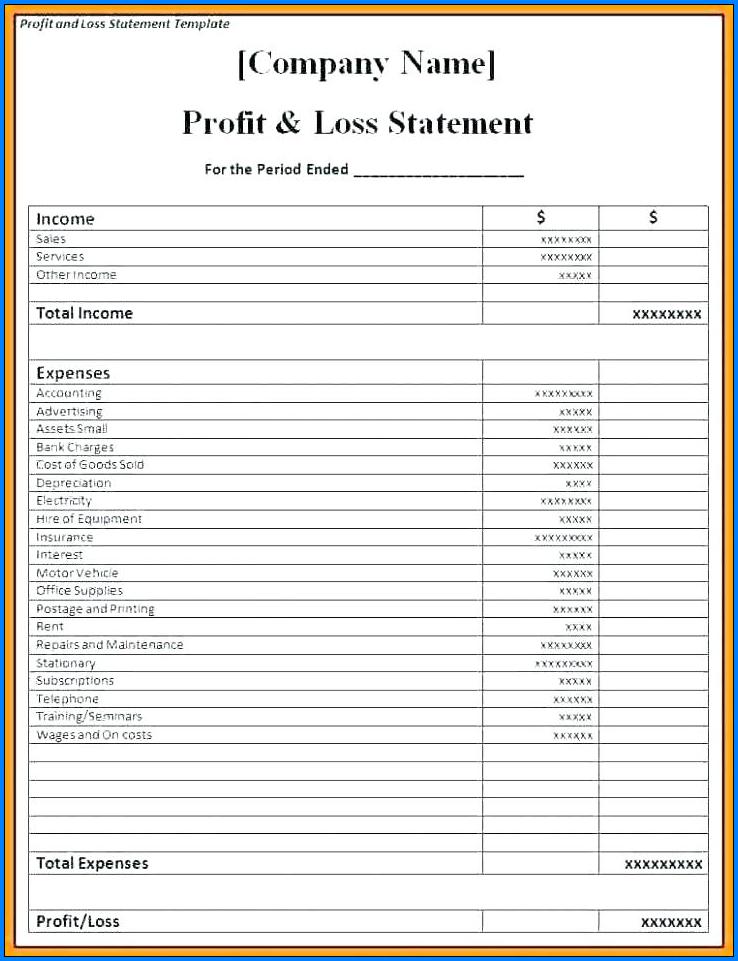

Overall, a profit and loss statement can be broken into five parts (highlighted in red in the image below): Income statement earnings statement revenue statement operating statement/statement of operations statement of financial performance Profit and loss statement (p&l):

Profit and loss statement example. With modern accounting software, you can produce p&ls at the click of a button. As you can see, from a tax perspective the tax payable would be $30 higher than the tax calculated on the business' net accounting profit.

P&l statements are made available to the public for a variety of reasons. It’s usually prepared for a fiscal quarter or a year, though some businesses. A p&l statement summarizes the revenues, costs, and expenses acquired during a specified period.

Other terms for a p&l statement include: Designed to provide business owners with revenue and expense details, the profit and loss statement, or p&l statement, is a must for business owners, whether you’re a small business. Finance financial tools and templates set up a profit and loss statement set up a profit and loss statement last updated:

Add up the income tax for the reporting period and the interest incurred for debt during that time. Declare income — this section may alternatively be titled “sales” and is often broken down into subsections by source or category. If your revenue is higher, then of course you’re operating at a profit.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Quarterly-Profit-Loss-Statement-Template-TemplateLab-790x1102.jpg)