Fabulous Info About Provision For Doubtful Debts In Income Statement

At the end of each financial year,.

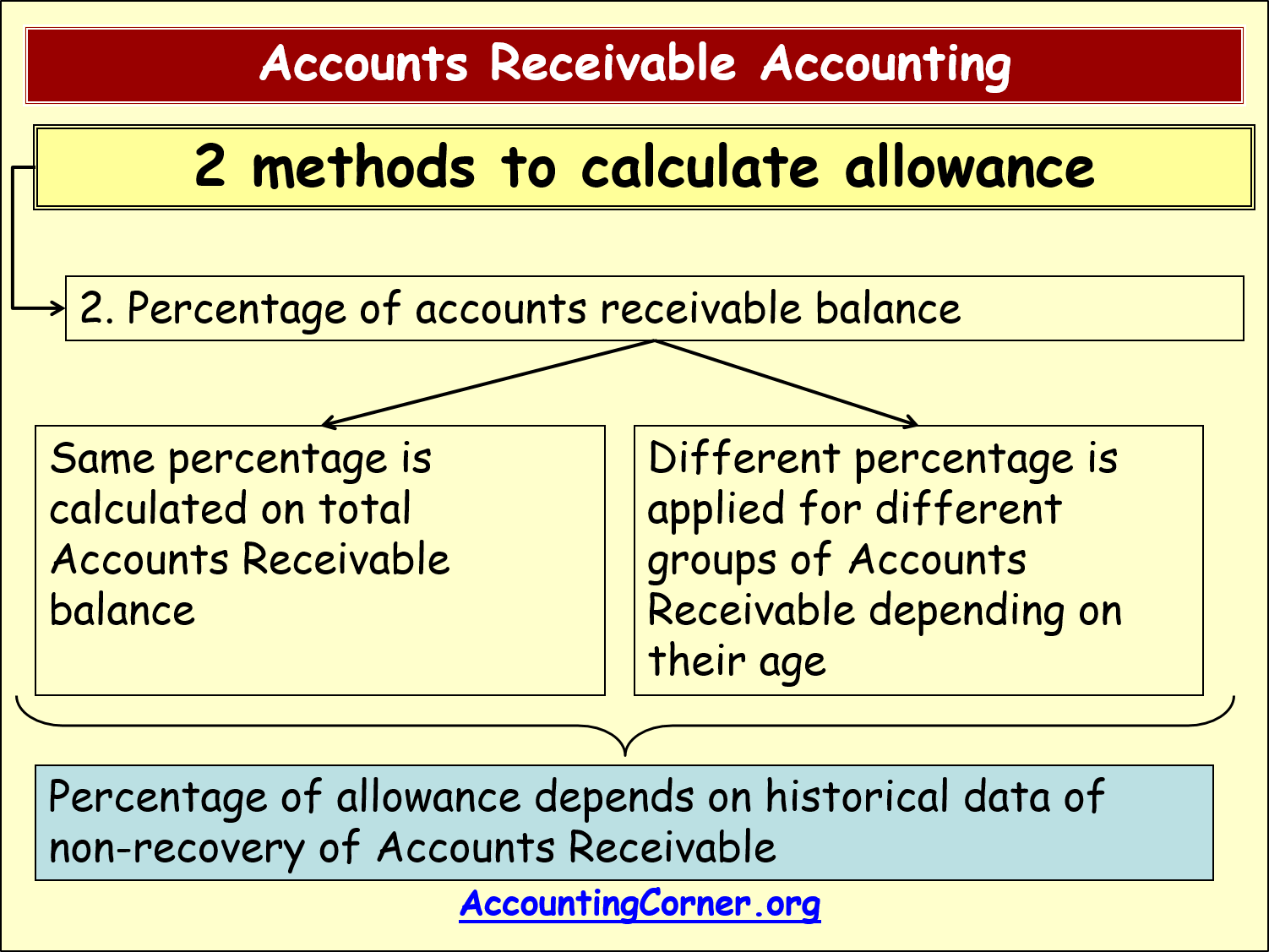

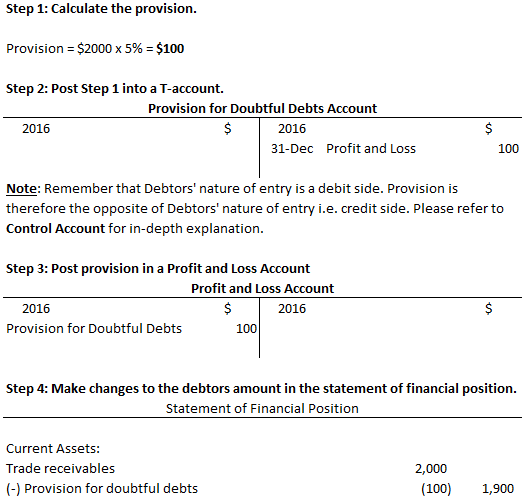

Provision for doubtful debts in income statement. Allowance for doubtful debt is created and increased on the credit side of allowance for doubtful debt account the account is decreased or. If you remember step 1 in the previous post, we will need to calculate the provision of doubtful debts. Company a decides to create a provision for doubtful debts that will be 2% of the total.

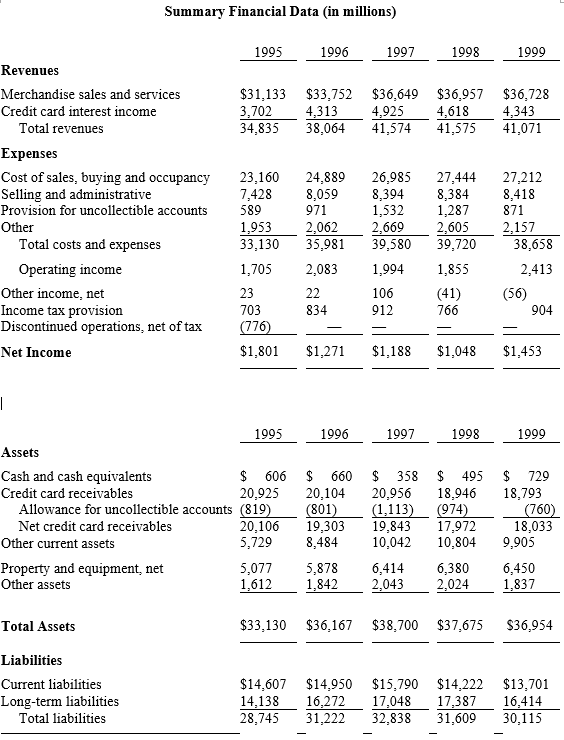

Similarly, it represents the liabilities that. New provision for bad debts is deducted from debtors in balance sheet. During the year, the debtors are $3,000.

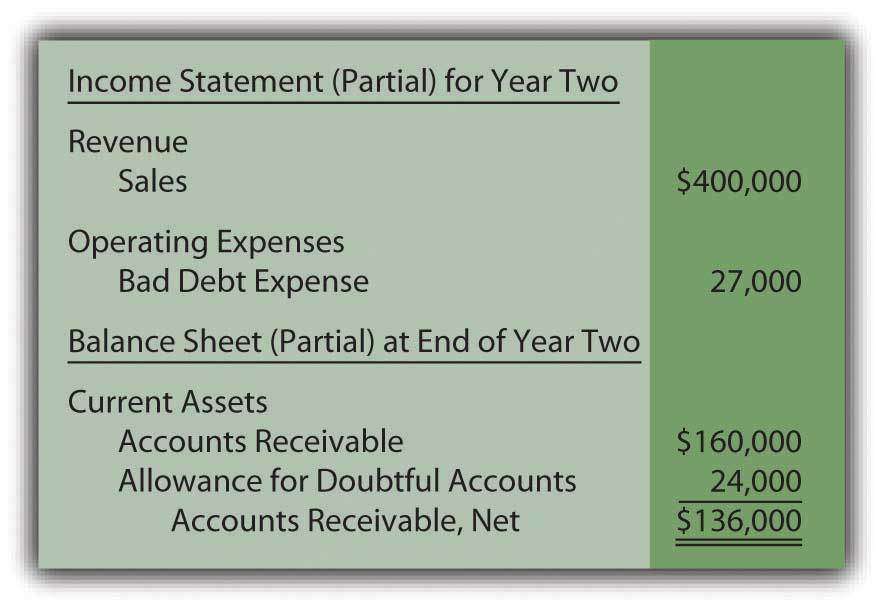

Company a decides to create a provision for doubtful debts that will be 2% of the total receivables balance. Imagine company a has a total of £100,000 account receivables at the end of the year. Income statement is debited with amount of bad debts and in the balance sheet, the accounts receivable balance to be decreased by the same amount in the.

A business typically estimates the amount of bad debt based on historical experience, and charges this amount to expense with a debit to the bad debt expense account (which appears in the income statement) and a credit to the provision for. The general rule is: This video shows how to calculate the figure for the provision for bad debts that goes in the income statement in three scenarios:

Provision / allowance for doubtful debts accounts payable allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables. Provision for bad and doubtful debt is a contra asset i.e it reduces the balance of an asset specifically the receivables. When certain bad debts are to be written off and a provision for doubtful debts is to be made, the amount should be first debited against the existing balance of provision and.

So, you can calculate the provision for bad debts as follows:. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for.

This expense becomes a part of the income statement. Provision for doubtful debts, on the one hand, is shown on the debit side of the profit. Overall, a provision is an amount recognized for future expenses or losses.

The following journal entry is made to record a reduction in provisions for bad or doubtful debts: Specific allowance general allowance specific allowance this is allowance created in respect of specific receivables which are. Provisions for bad debts faqs what is bad debt?

Provision for bad debts account cr:

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)