Who Else Wants Tips About Types Of Cash Inflows

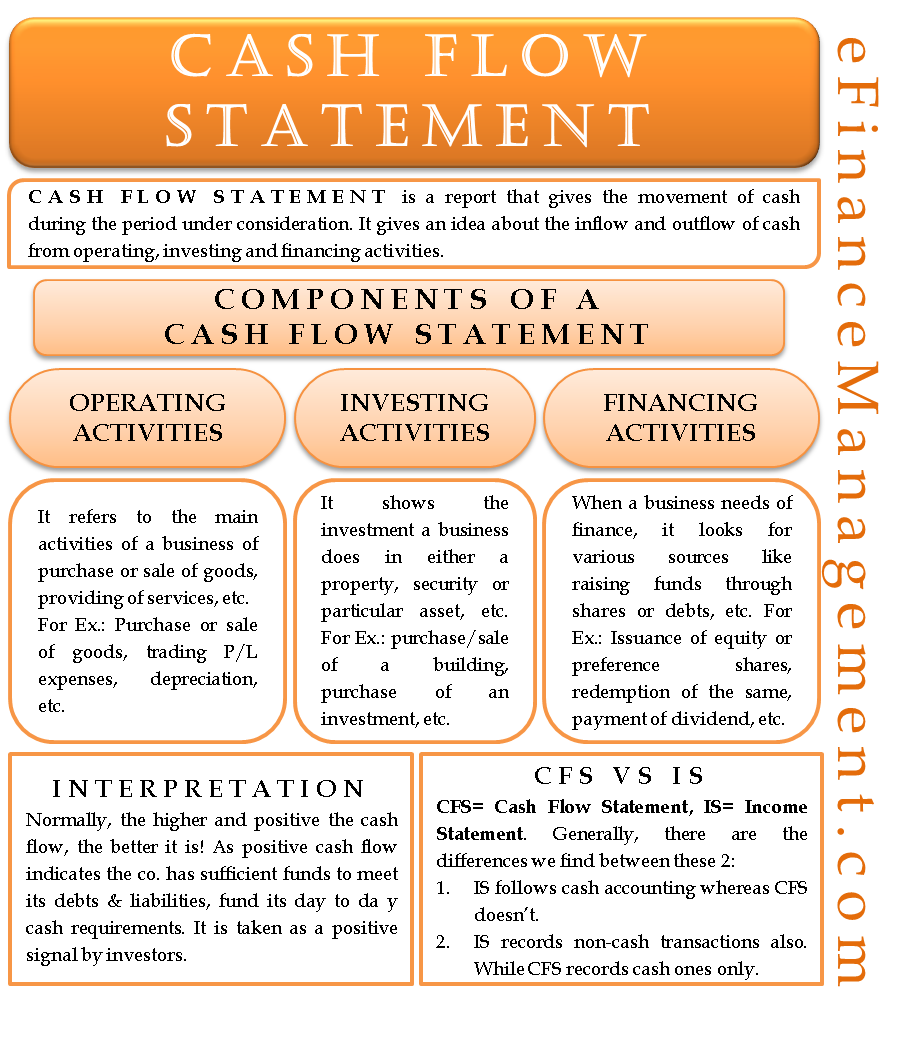

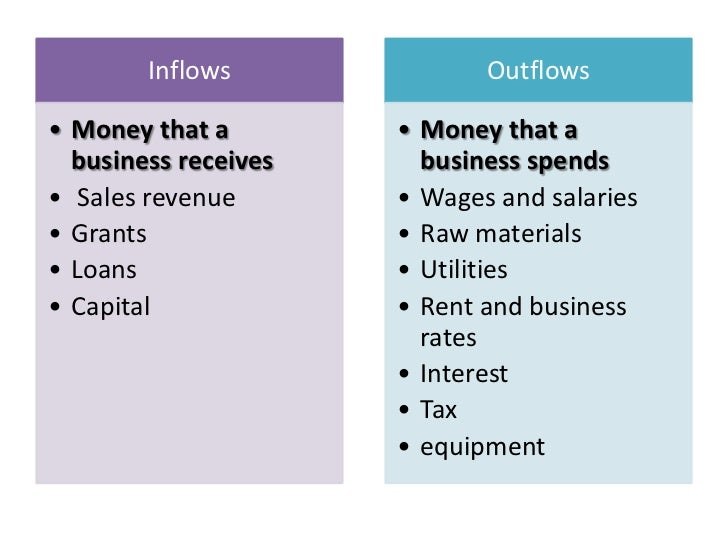

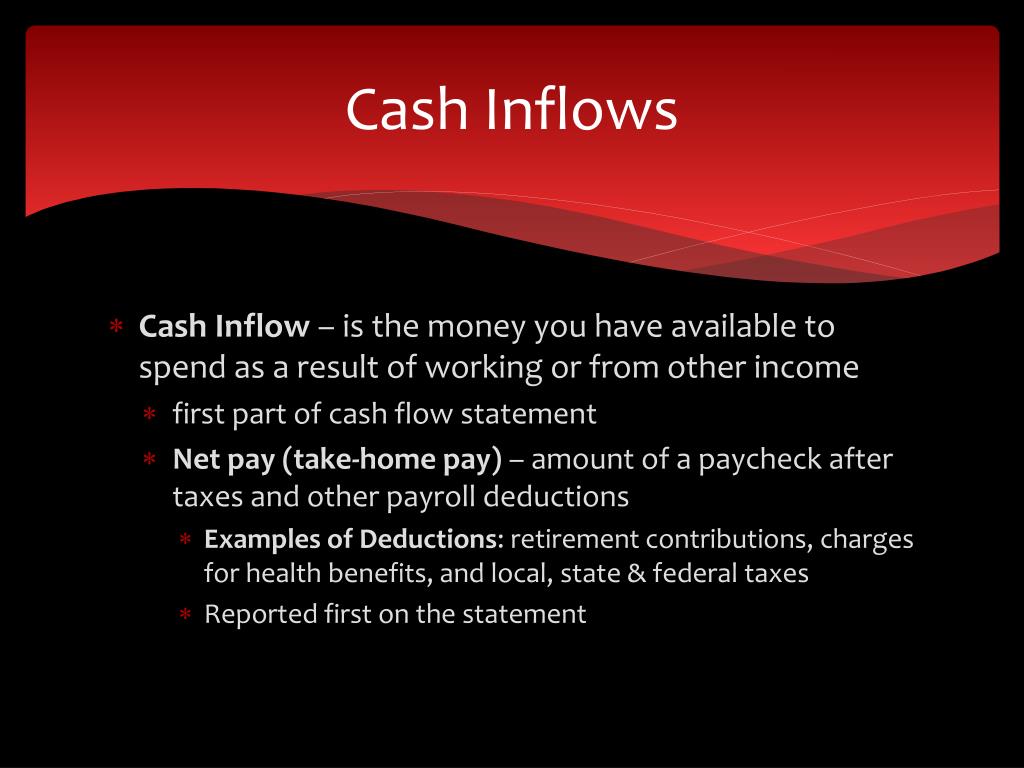

A cash flow (cf) shows inflows (receipts) and outflows (payments) of cash during a particular period.

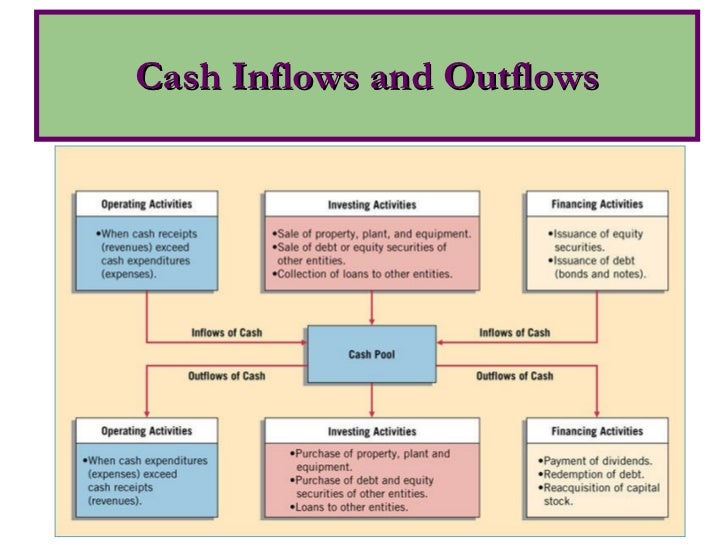

Types of cash inflows. Cash received from the debtors for providing. There are four types of cash inflows and outflows: Your company’s cash flow results from three types of activities, each of which can break out into both inflows and outflows:

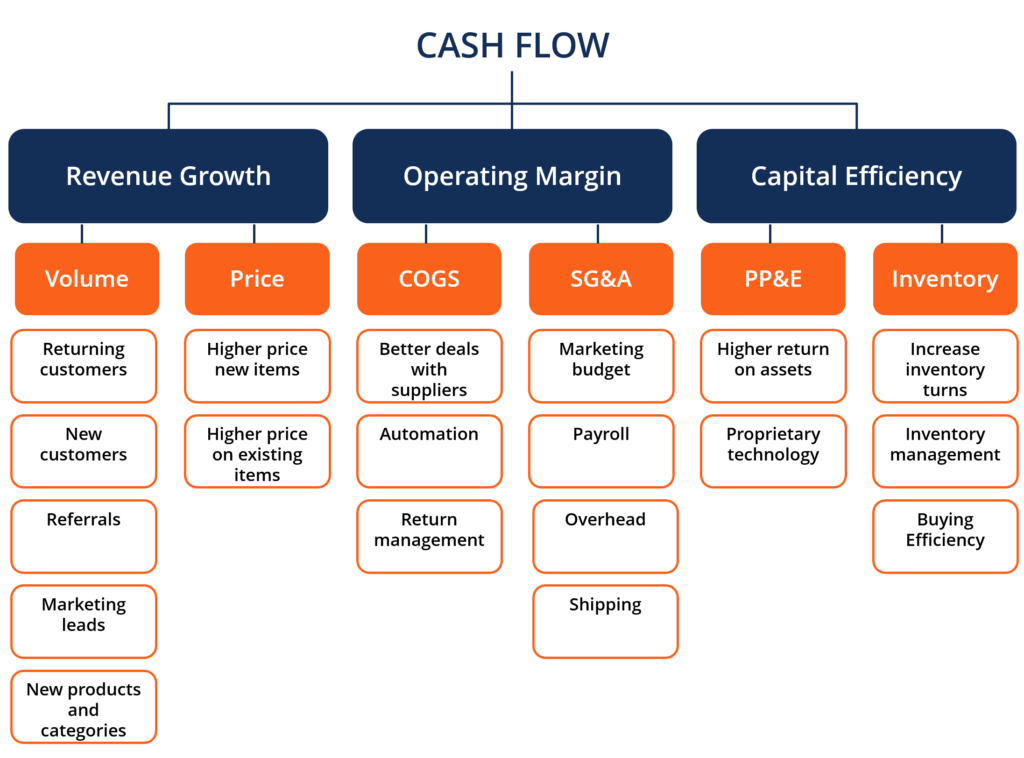

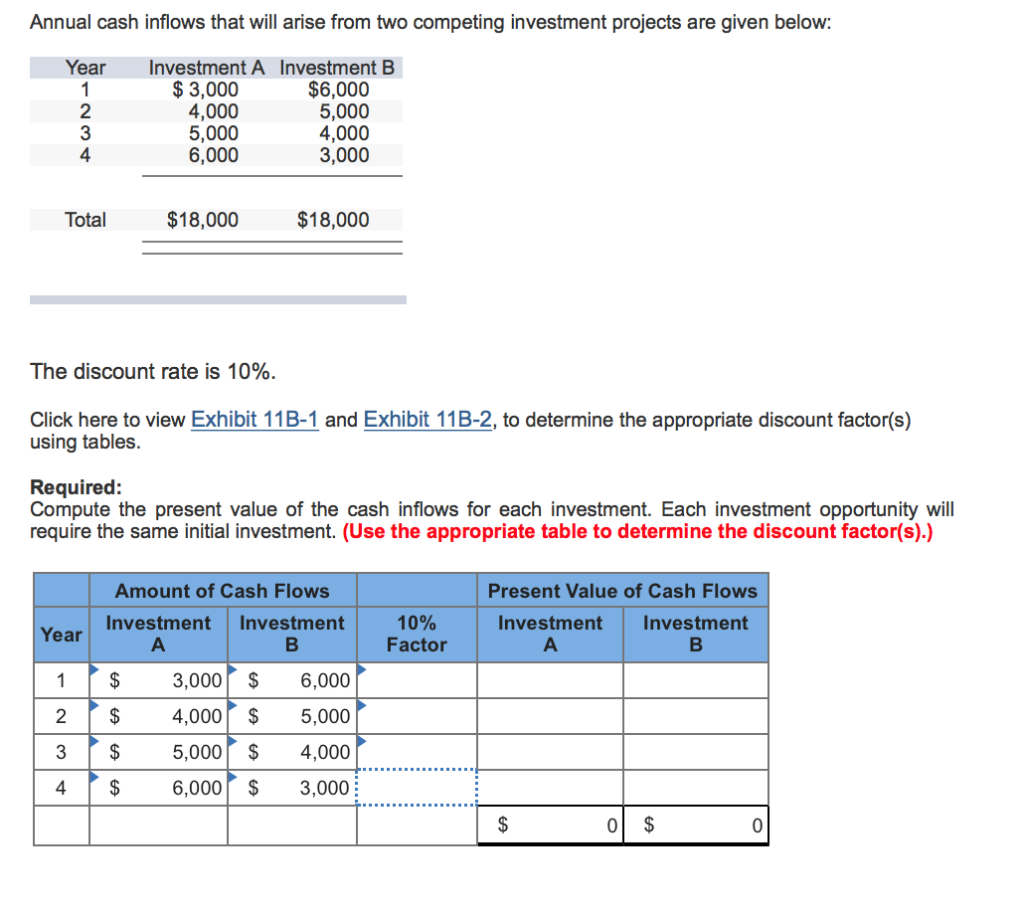

Forecasting cash inflows and outflows is important, especially for three types of business: A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. The 3 main types of cash flow below, we break down each type of cash flow and give the formula for each source.

Types of cash flows. The cfs highlights a company's cash. Now that we understand the importance of cash flows, let’s see the types of cash flows that are in use:

Let us look at some of the cash inflow examples that arise from the operating activities. Types of cash inflows. 1.cash inflow from operating activities:

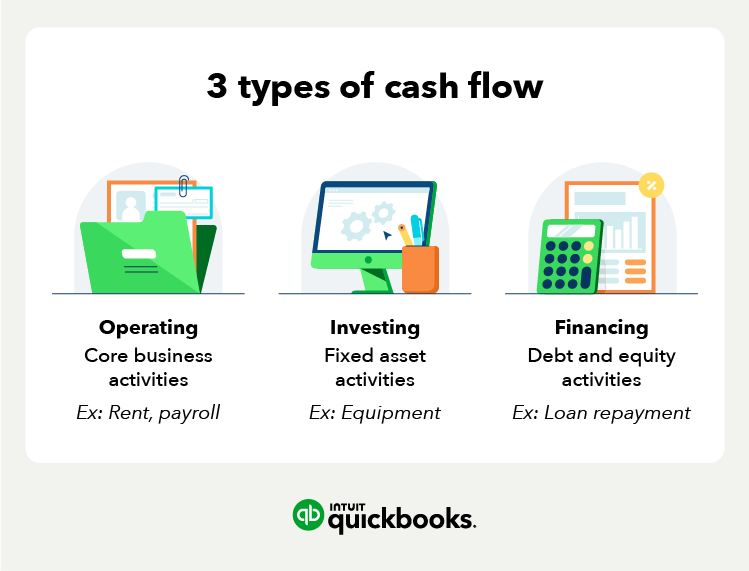

Understanding cash flow types of cash flow. There are three main types of cash flow that businesses should consider when managing their finances: Types of cash flow include:

Cash flow is the inflows. Cash received and spent or invested and debt repayment are categorized as business operating, investing, and. We also share some common items that fall under.

Cash flow is a measure of a business’s total cash inflows less cash outflows. In other words, it summarizes the sources and applications of. Together with the cash outflow, it results in the cash flow and thus plays an.

Cash flow is cash and cash equivalents inflows less outflows. Here we give you an overview of the most important formulas and methods.