Formidable Info About Common Base Year Balance Sheet

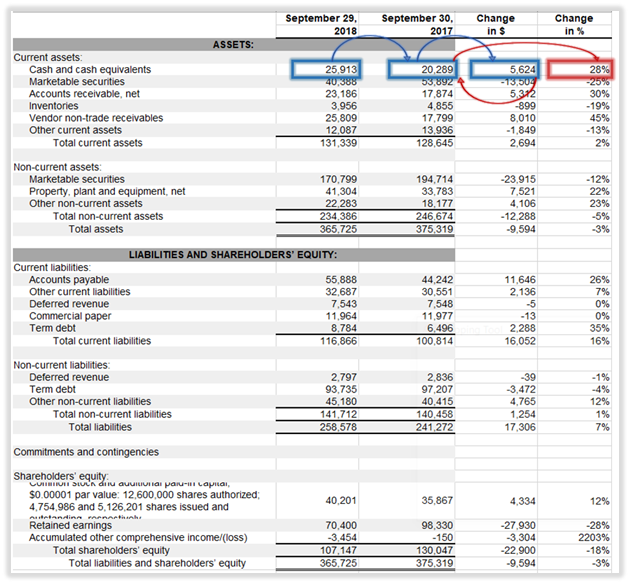

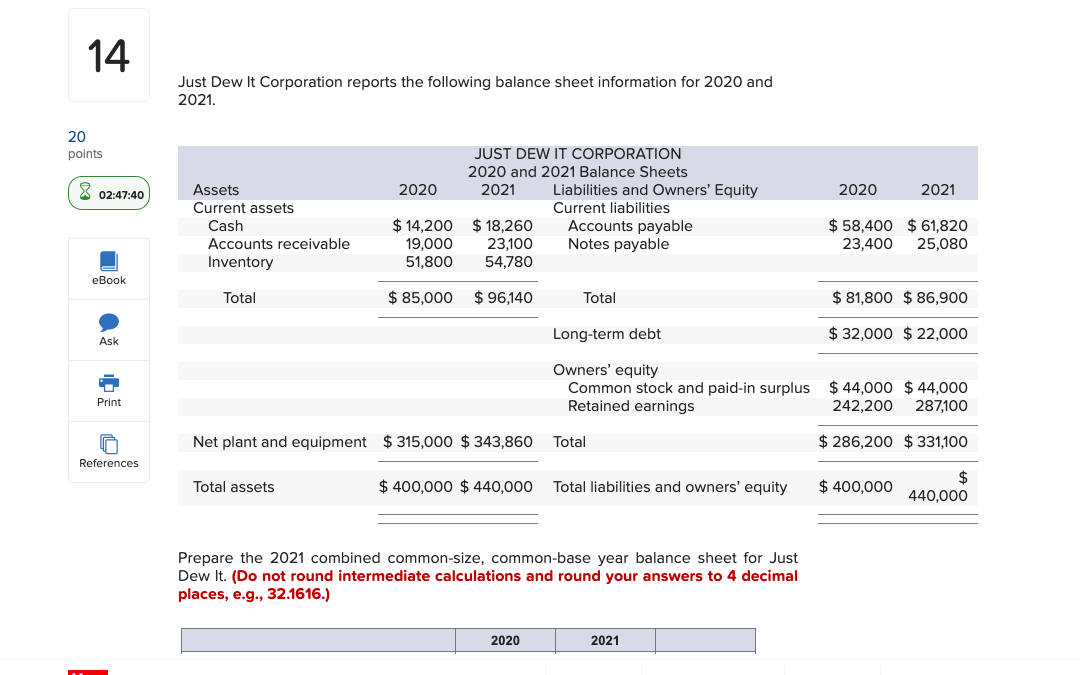

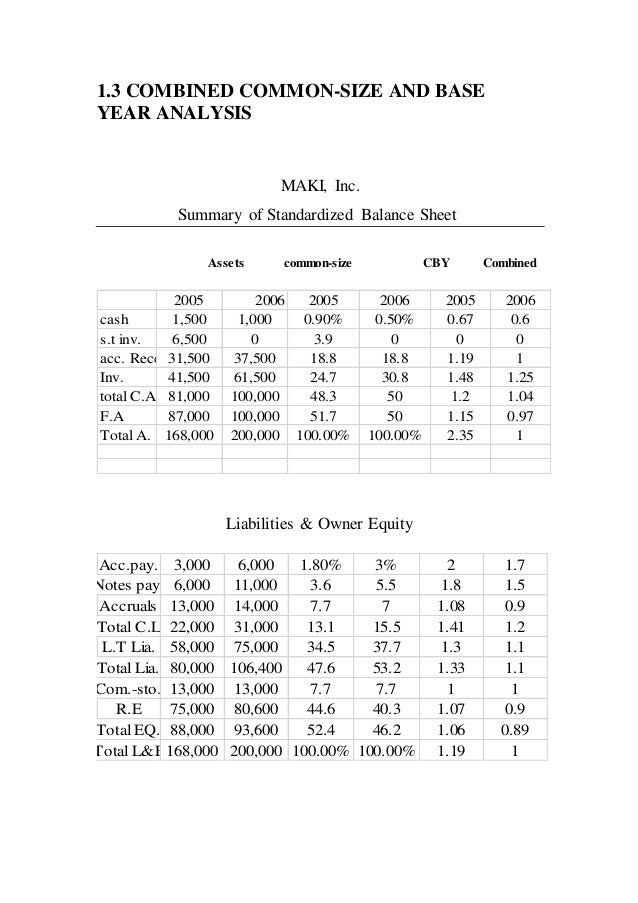

In accounting and statistics, the expression of financial information in a given year as a percentage of an amount in an initial year.

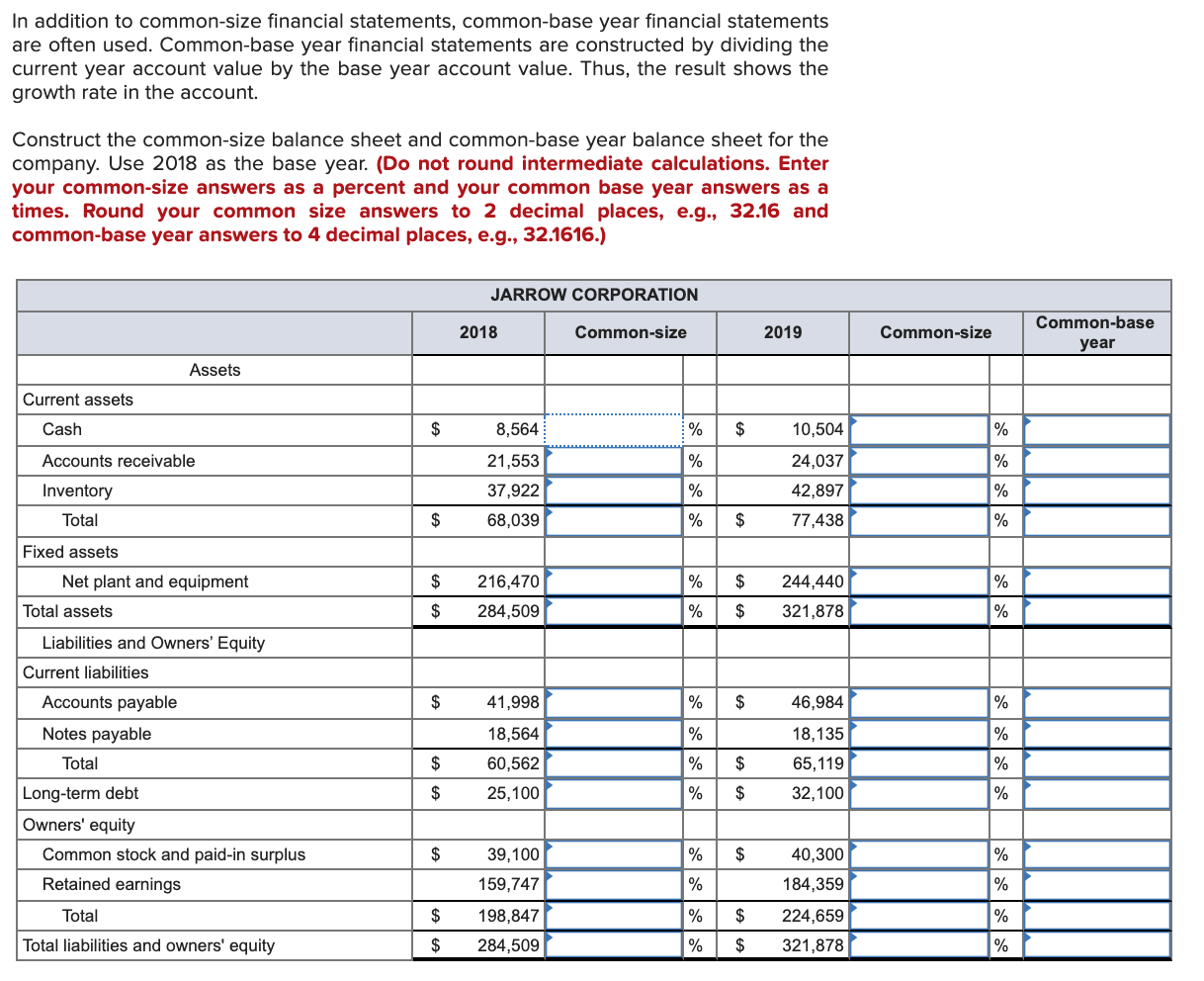

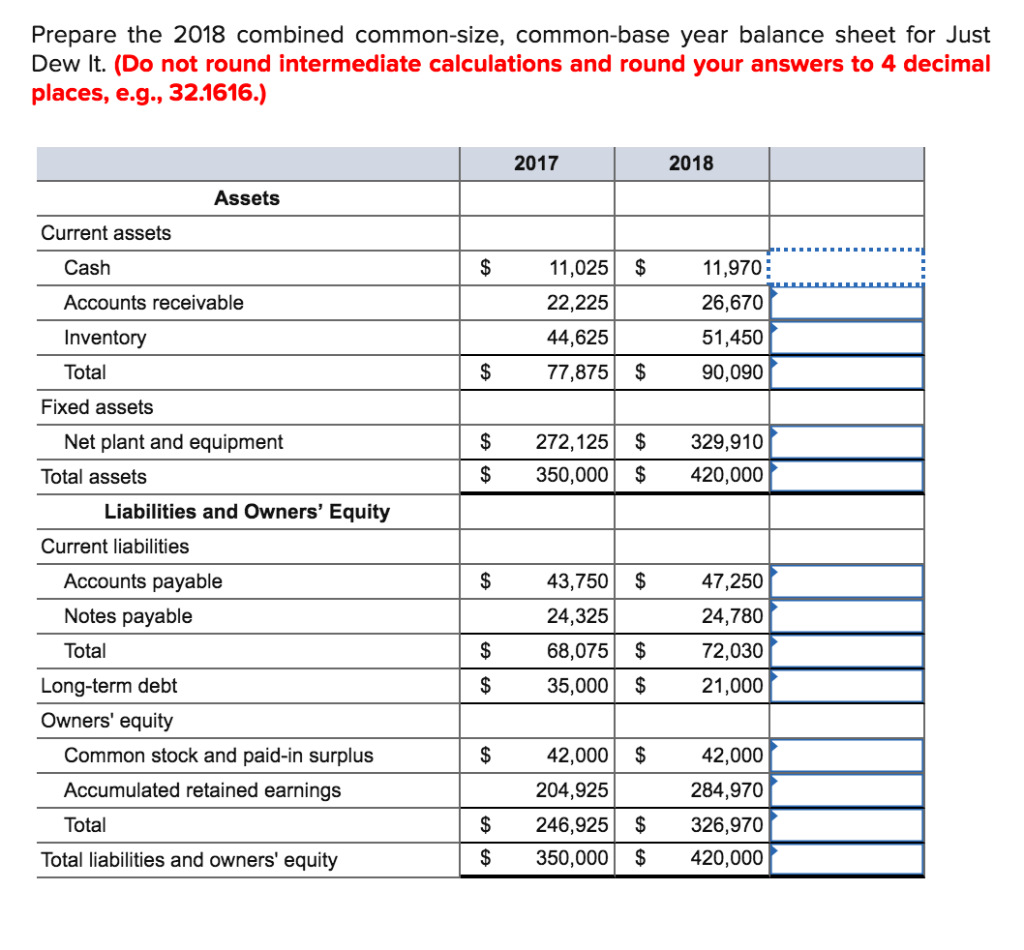

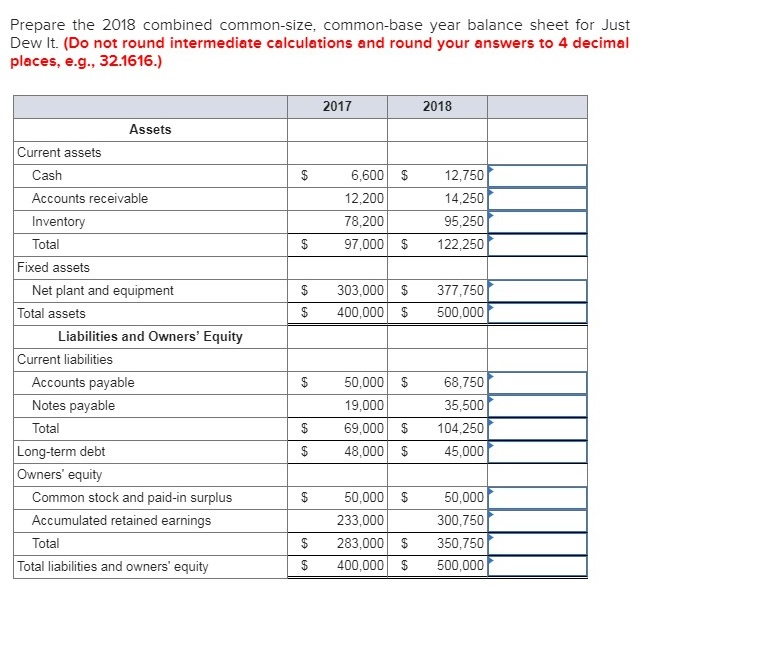

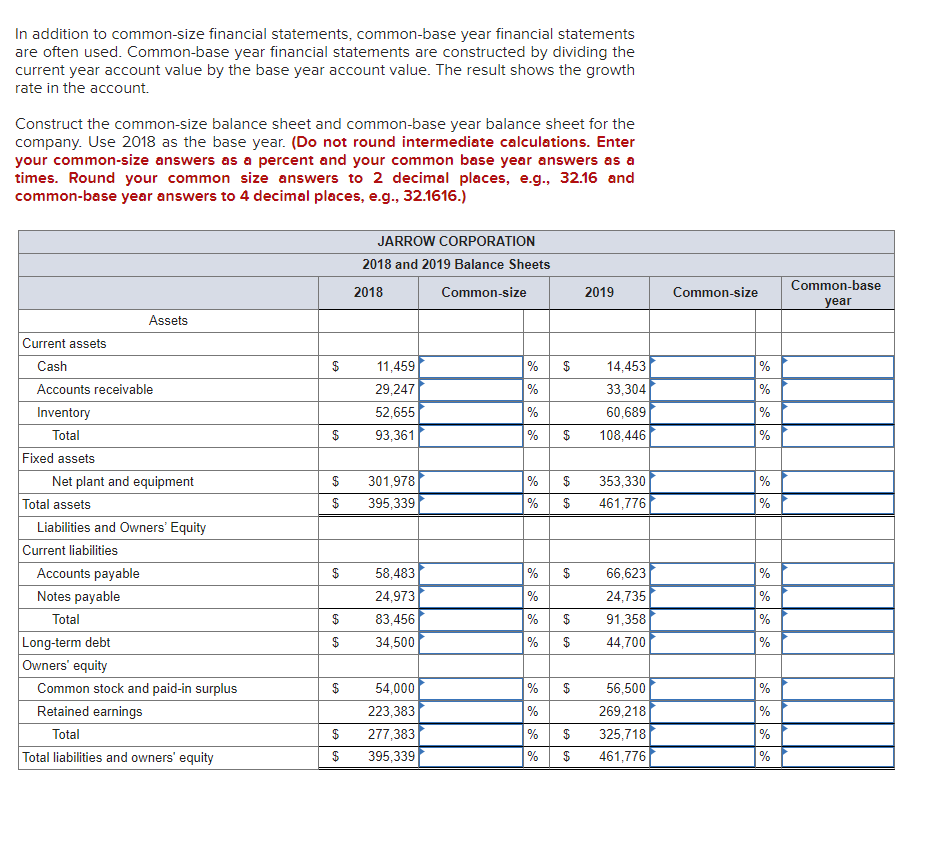

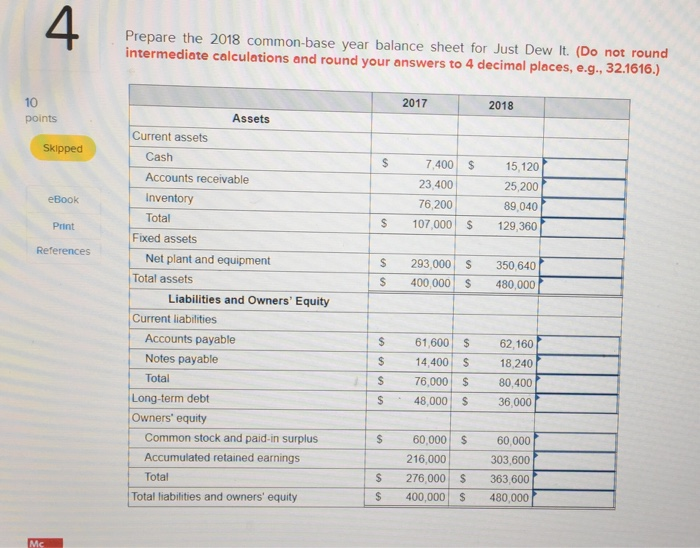

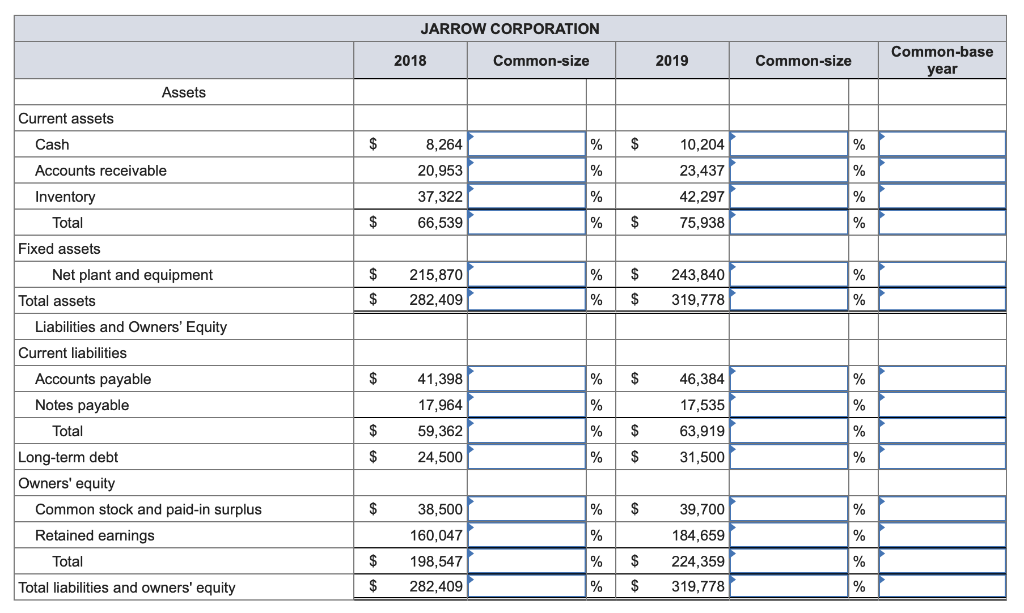

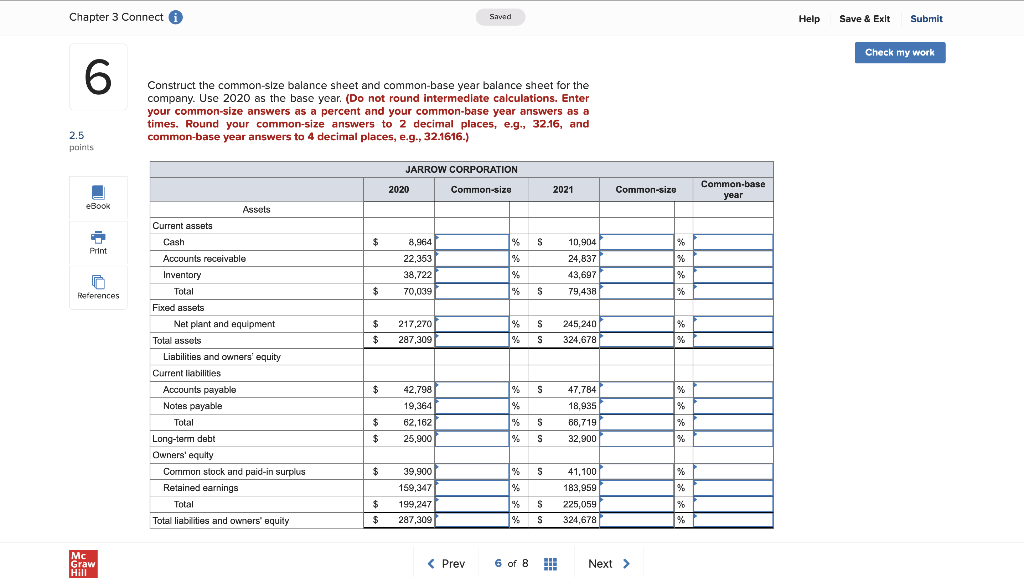

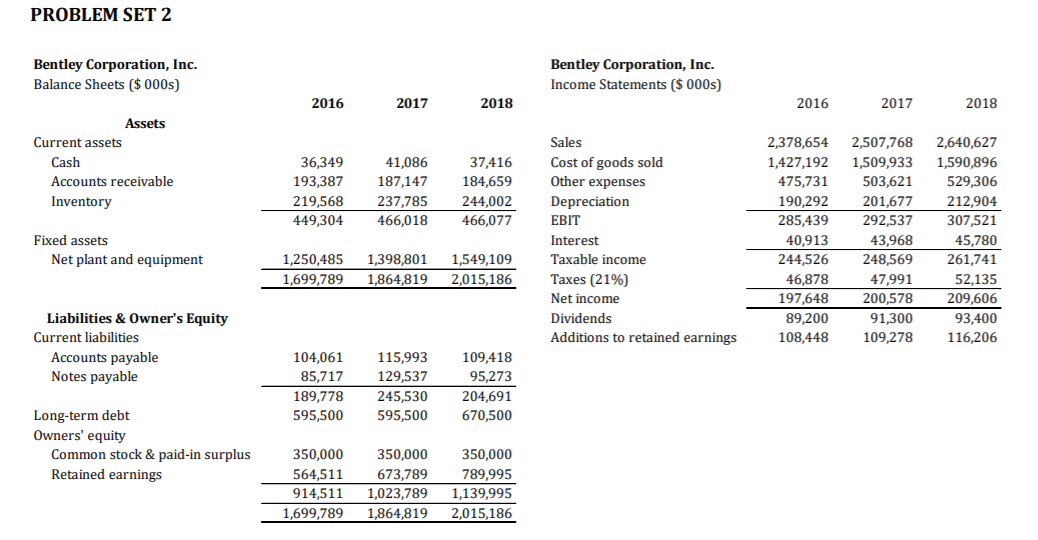

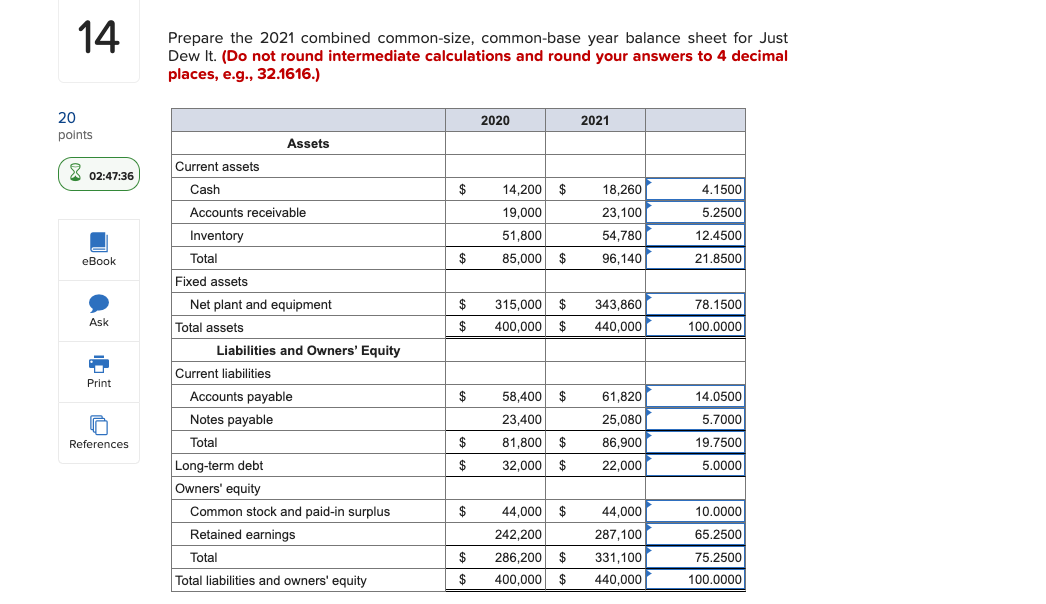

Common base year balance sheet. 5.0 annual fee $0 read review learn more common size analysis formula accounting software will typically run a common size financial analysis for you, but it's. Top 10 essential excel formulas for analysts in 2024. The purpose of a common base year balance sheet is to provide a standardized point of reference for comparing financial data over time.

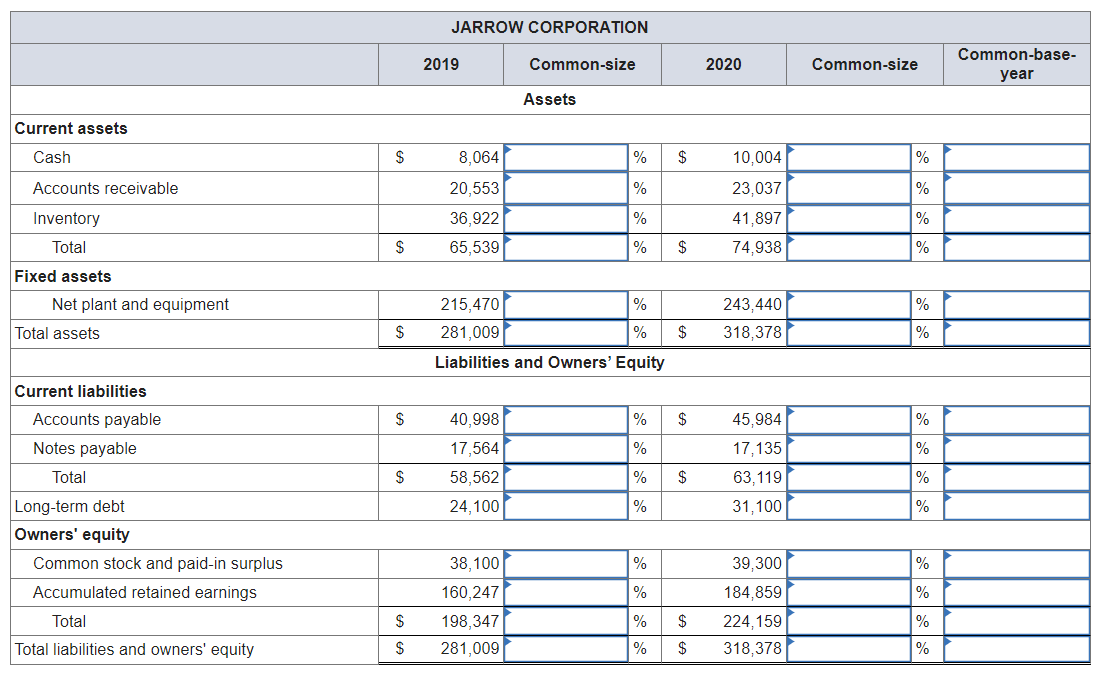

After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000 accumulated depreciation, for a net book value. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. 20,553 % 23,037 % inventory:

Common size income statement is an income statement in which each account is expressed as a percentage of the value of sales. A common base year balance sheet is a financial statement that presents the financial position of a company at a specific point in time, using a fixed year as a reference. $8,064 % $10,004 % accounts receivable:

By establishing a common base year,. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets,. Thus, the result shows the.

36,922 % 41,897 % total: Fundamental analysts use balance sheets to. Common size balance sheet chapters00:00 introduction01:00 what is.