Unbelievable Tips About Two Types Of Income Statement

Definition of income statement accounts income statement accounts are one of two types of general ledger accounts.

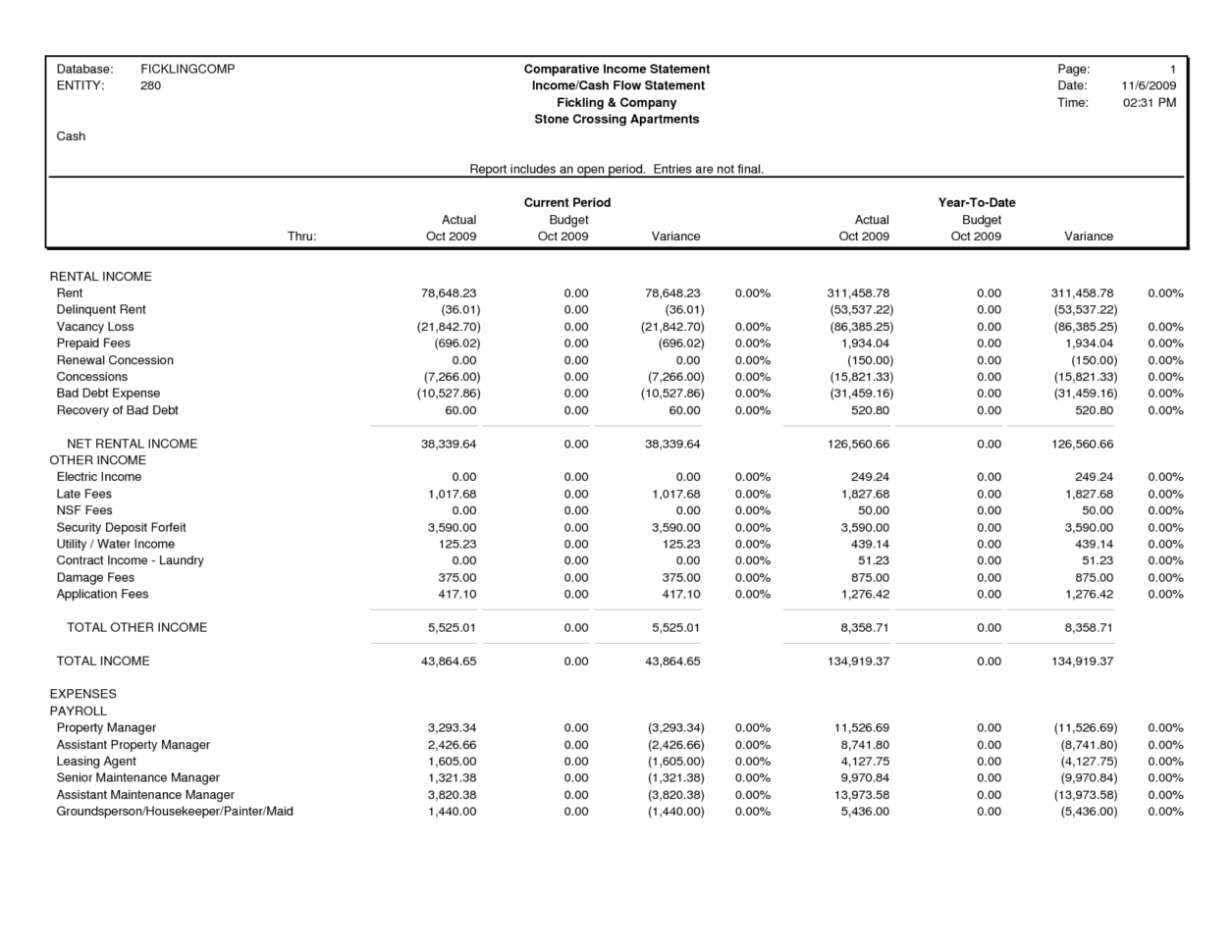

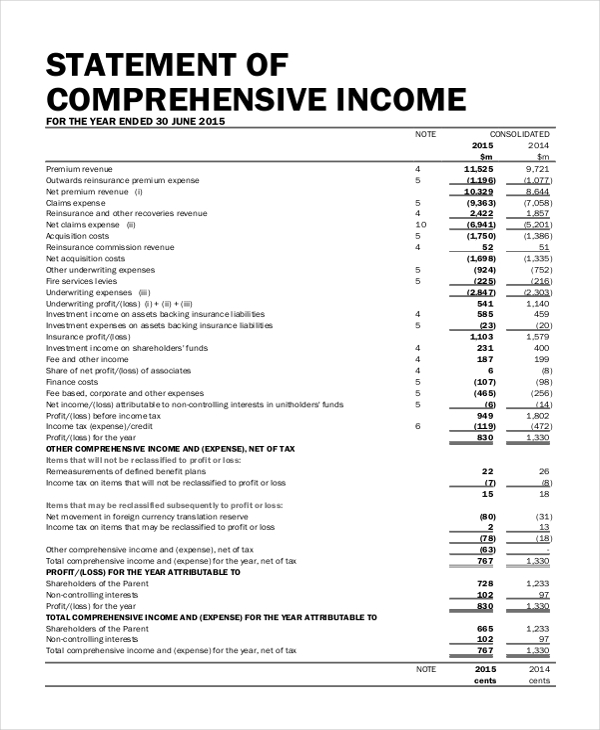

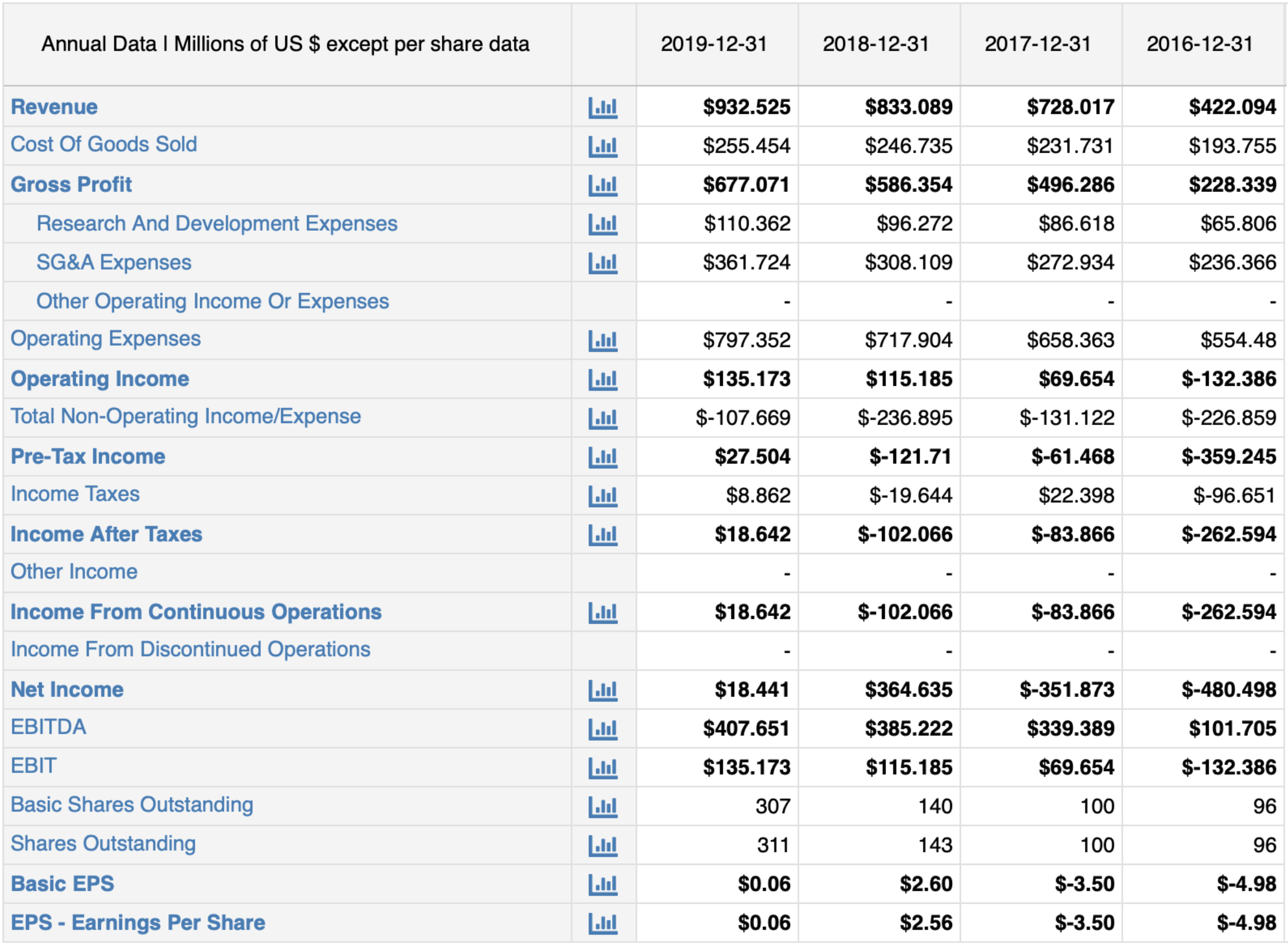

Two types of income statement. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. Revenue, expenses, gains, and losses.

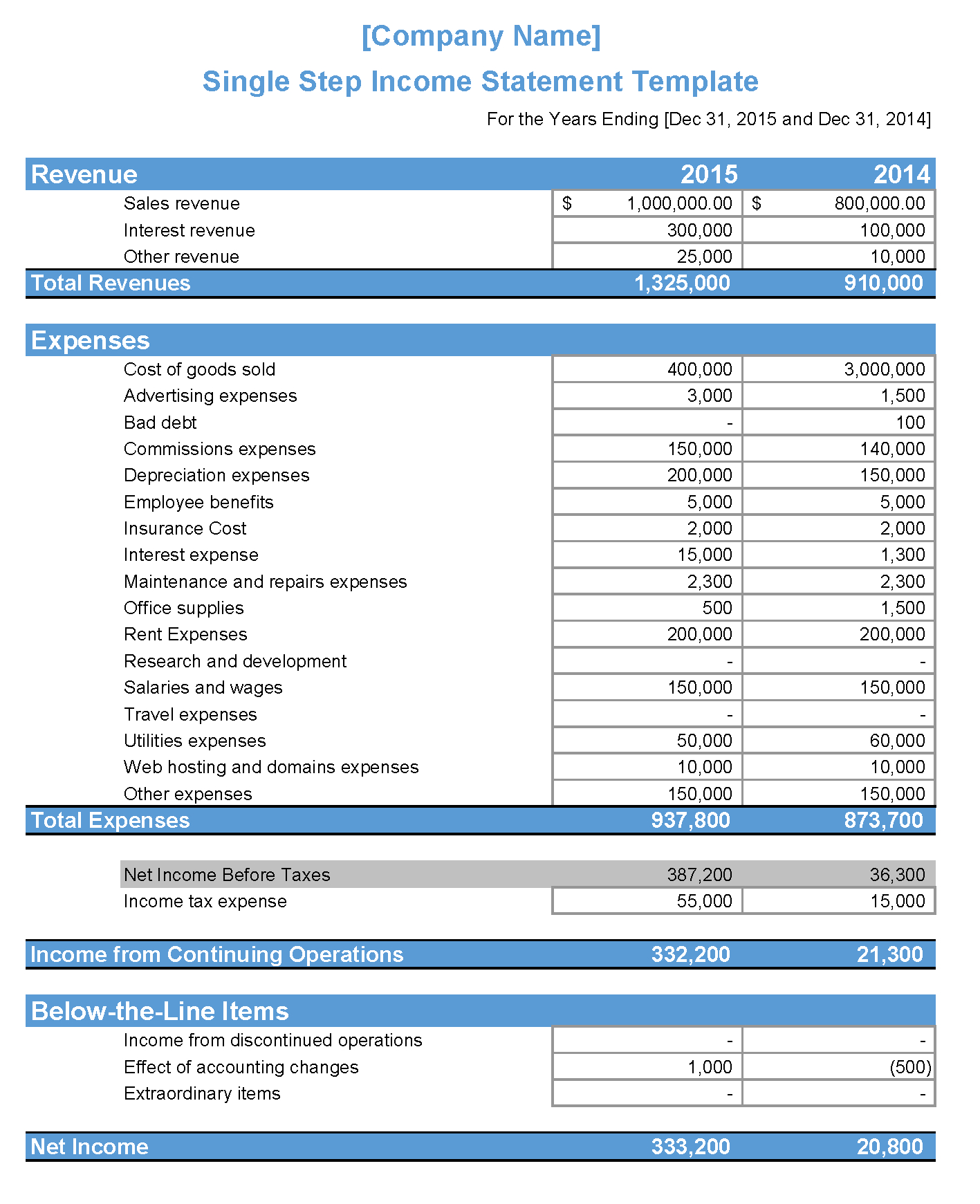

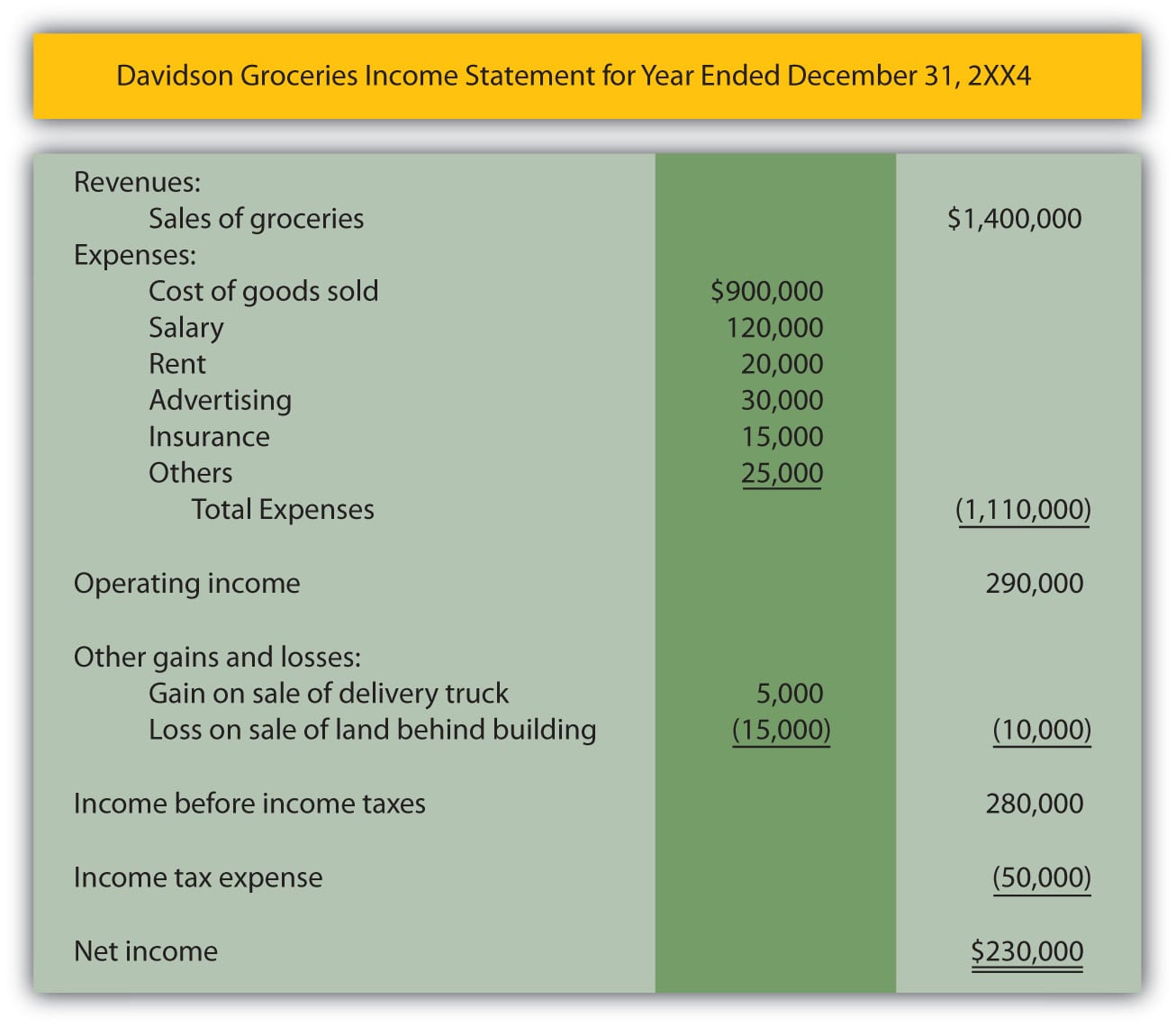

There are two types of income statement: The classified income statement uses subtotals for the gross margin, operating expenses,. The income statement is also known as a profit and loss statement, statement of operation, statement of financial result or income, or earnings statement.

An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period. There are several different types of income statements, each with its own purpose and information. The three main elements of income statement include revenues, expenses, and net income.

There are two methods commonly used to read and analyze an organization’s financial documents: The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. The difference between the two is in the way a statement is read and the comparisons you can make from each type of analysis.

The income statement is of two types: There are two types of income statements: By abigail tracy january 19, 2024 income statement reports show financial performance based on revenues, expenses, and net income.

Sales on credit) or cash vs. There are two income statement formats that are generally prepared. This format is less useful of external users because they can’t calculate many efficiency and profitability ratios with this limited data.

Vertical analysis and horizontal analysis. It is also known as the profit and loss (p&l) statement, where profit or loss is determined by subtracting all expenses from the. Depending on the business type and preferences, income statements may refer to revenue as:

The income statement is also sometimes referred to as. Objectives experience has shown that not all users and preparers accept the complex rules for measuring the amount of income. Revenues revenues are the incomes that the company generates from the sale of goods or services or other activities related to the.

The lettered boxes on the top and left side of the form contain identifying information for both you and your. 1) a single statement of profit or loss and other comprehensive income: Revenue and sales.

By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance. Revenue, or the top line, represents all operating income a company earns within the accounting period, excluding income from selling investments or capital assets. It shows whether a company has made a profit or loss during that period.