One Of The Best Info About Explain The Cash Flow Statement

Key takeaways cash flow is the movement of money in and out of a company.

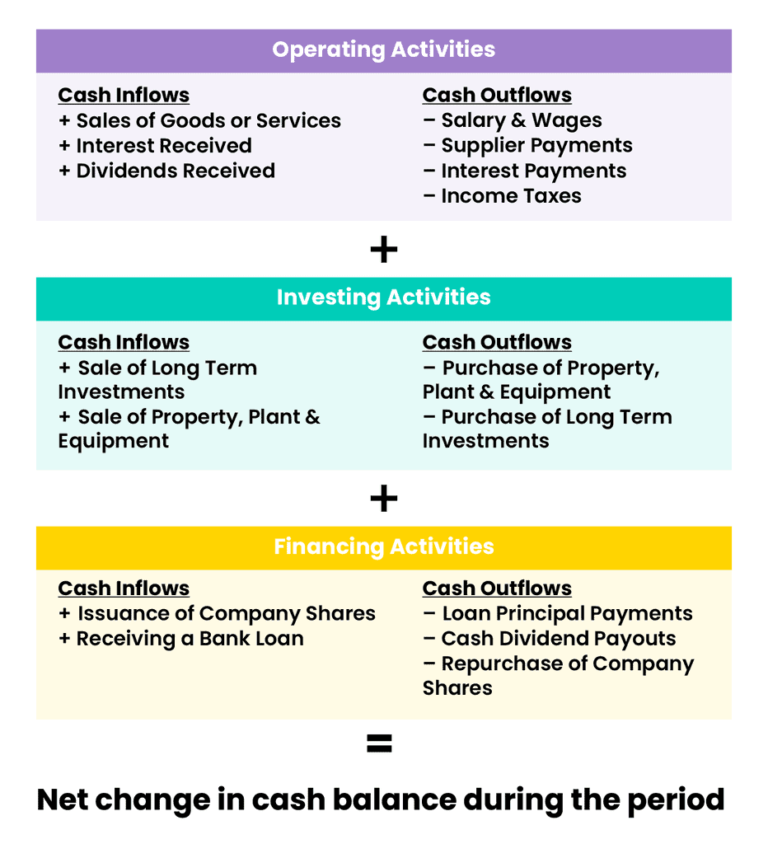

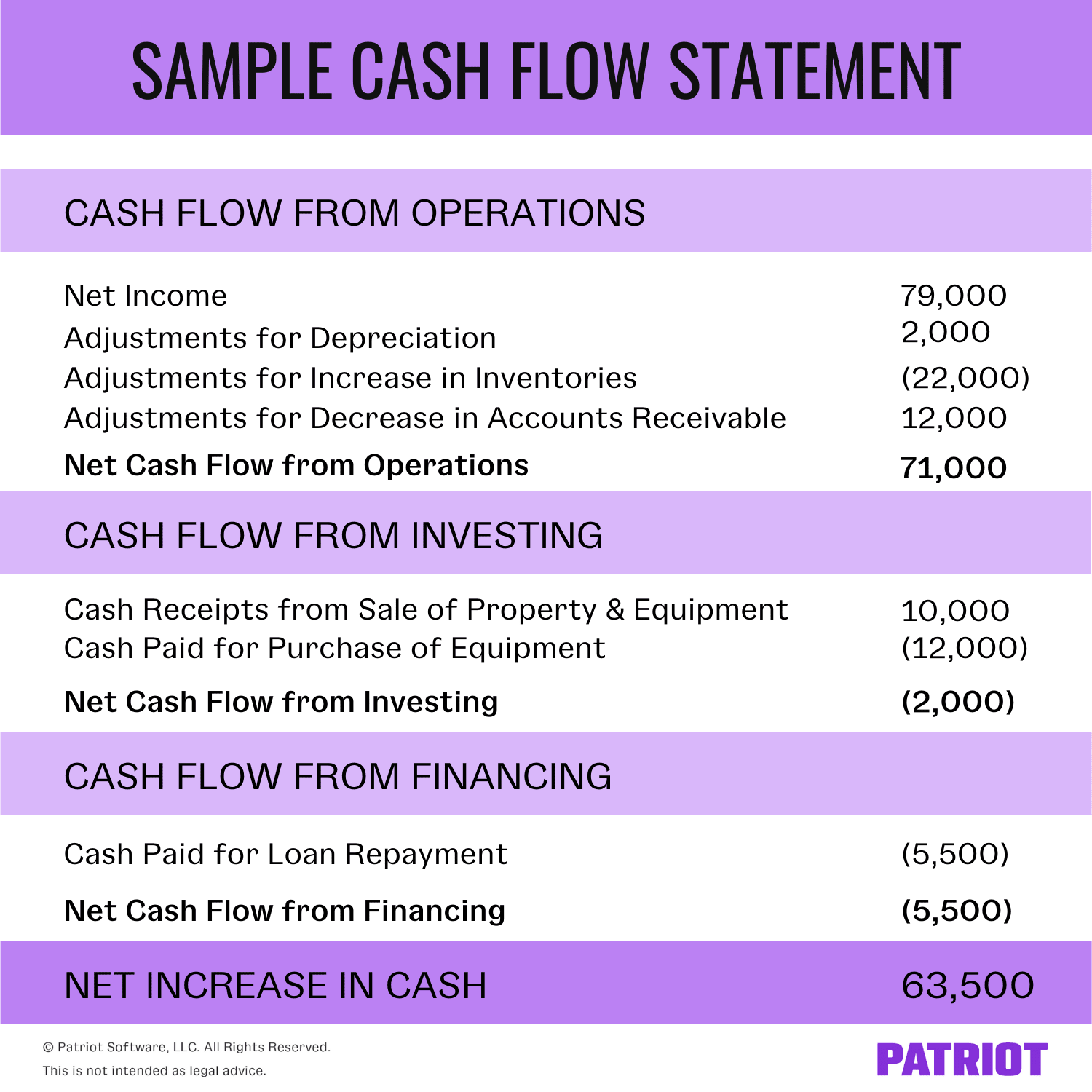

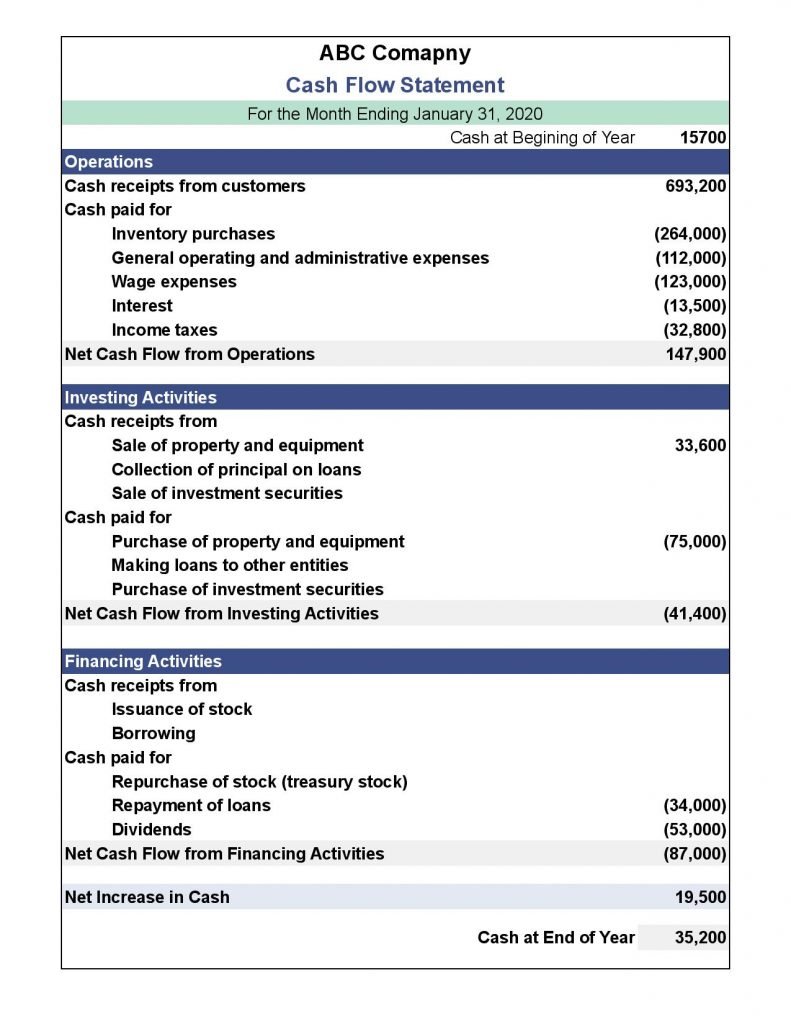

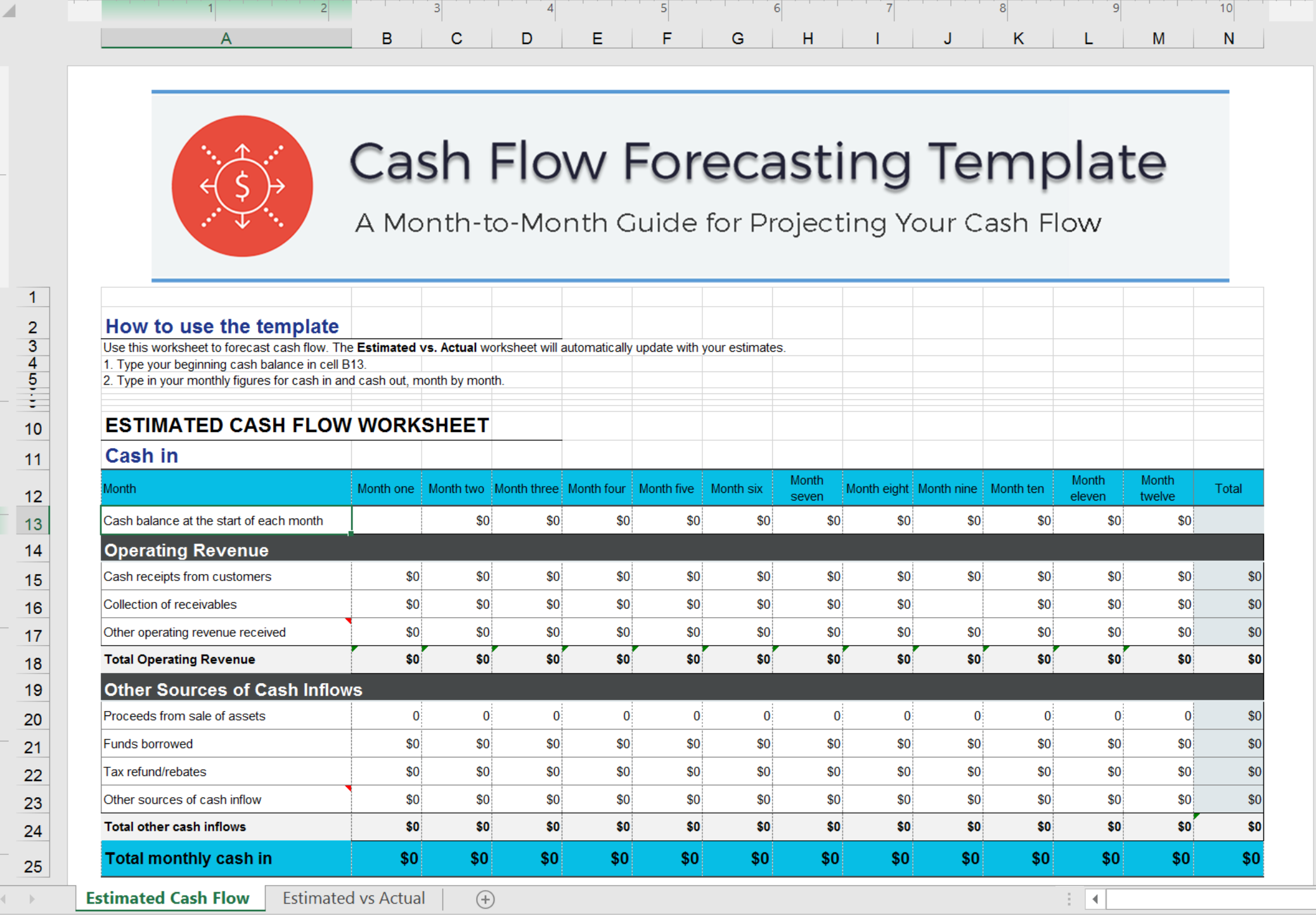

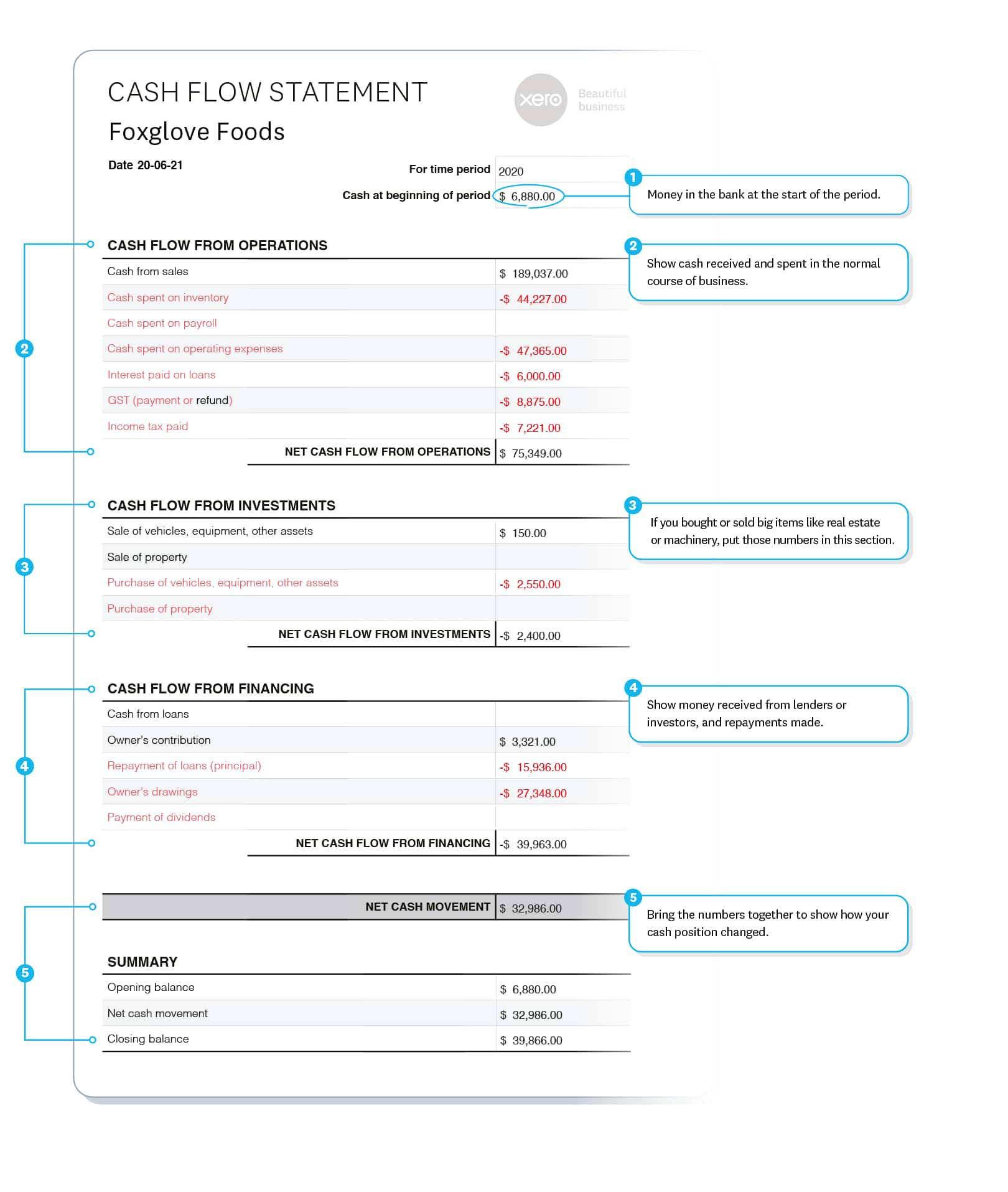

Explain the cash flow statement. How to create a cash flow statement Operating, investing, and financing activities. It tells you how cash moves in and out of a company's accounts via three main channels:

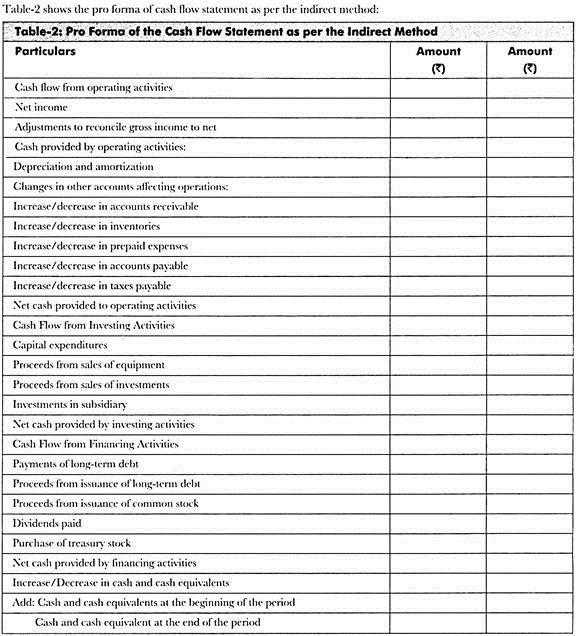

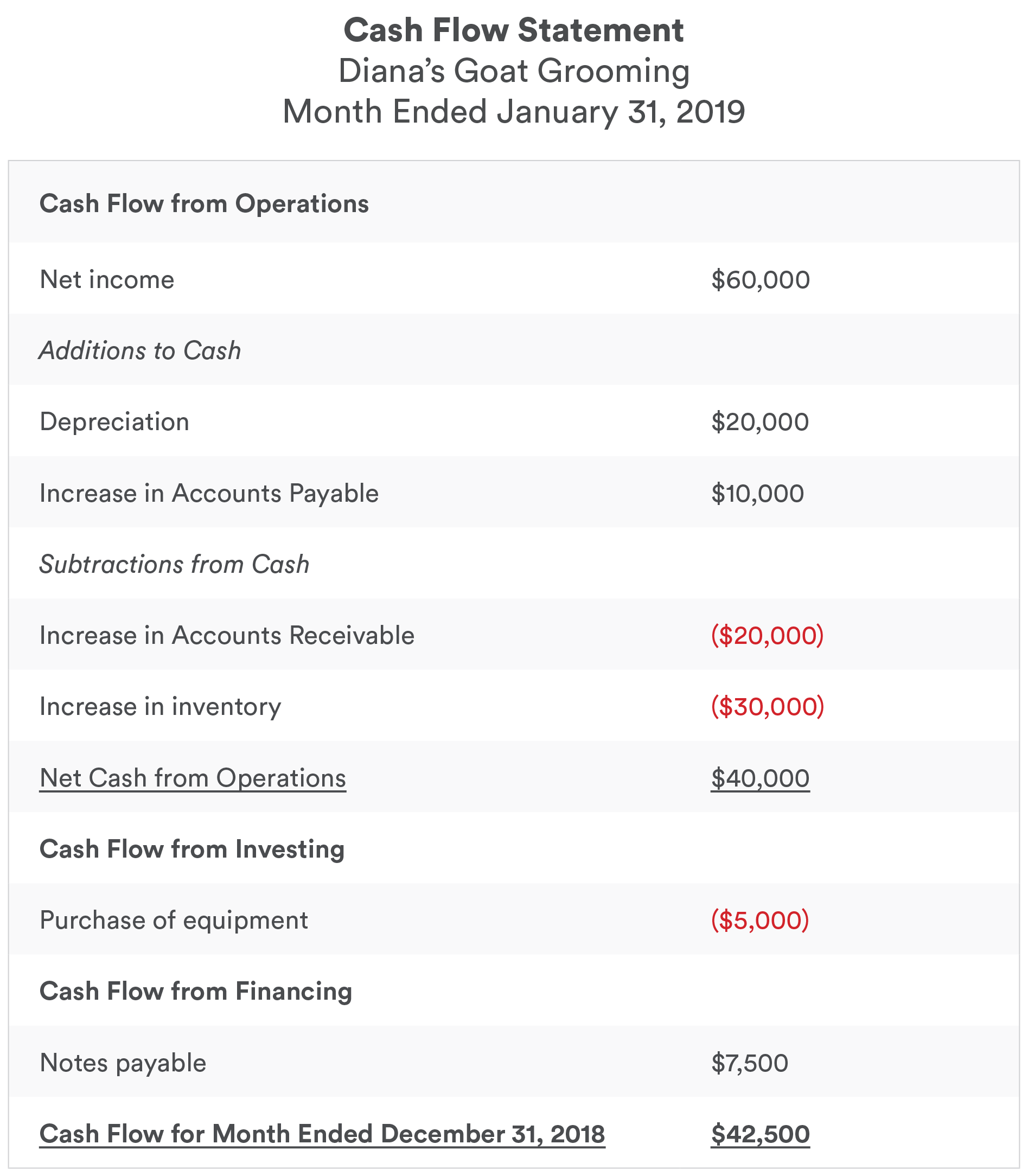

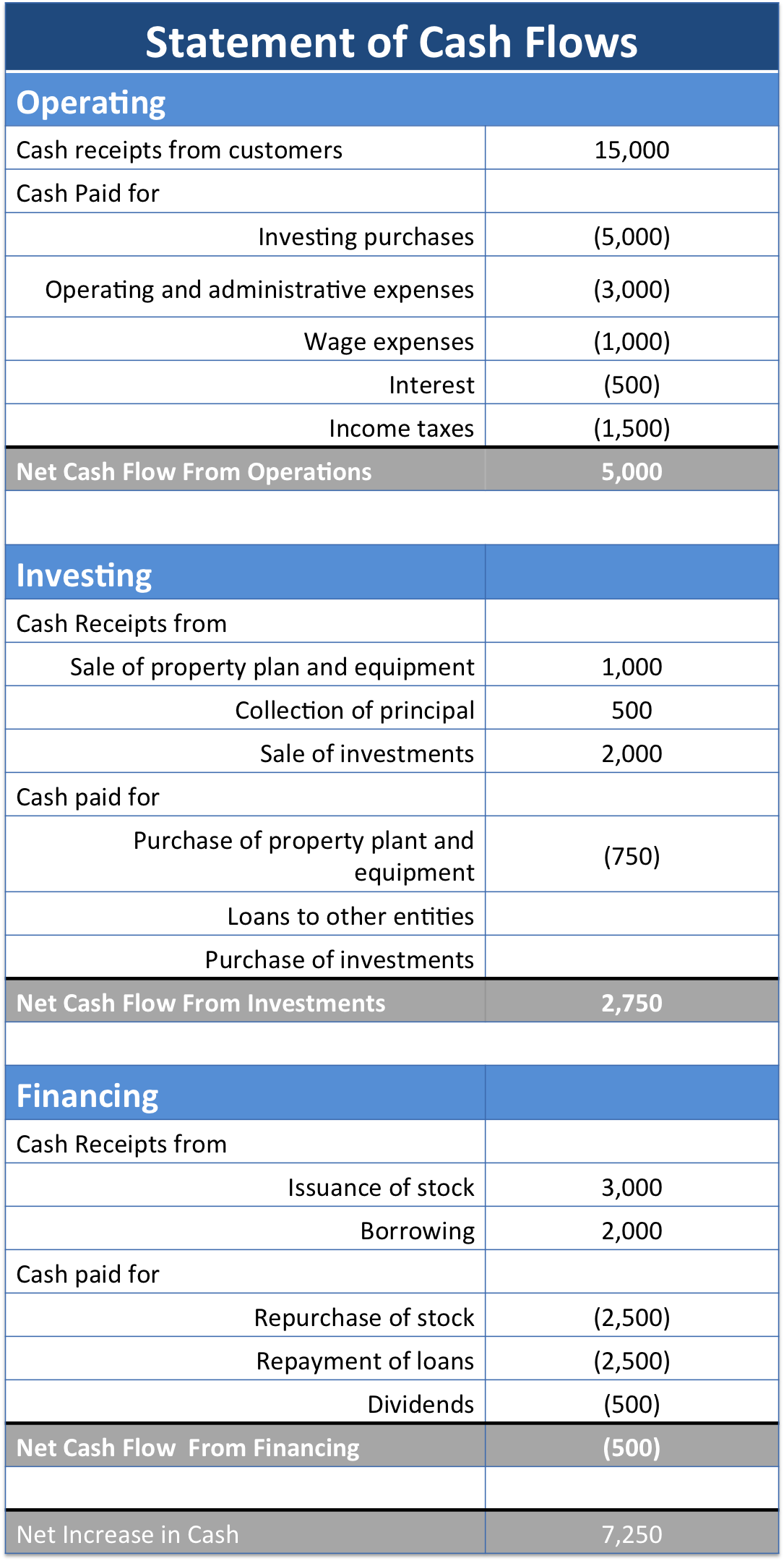

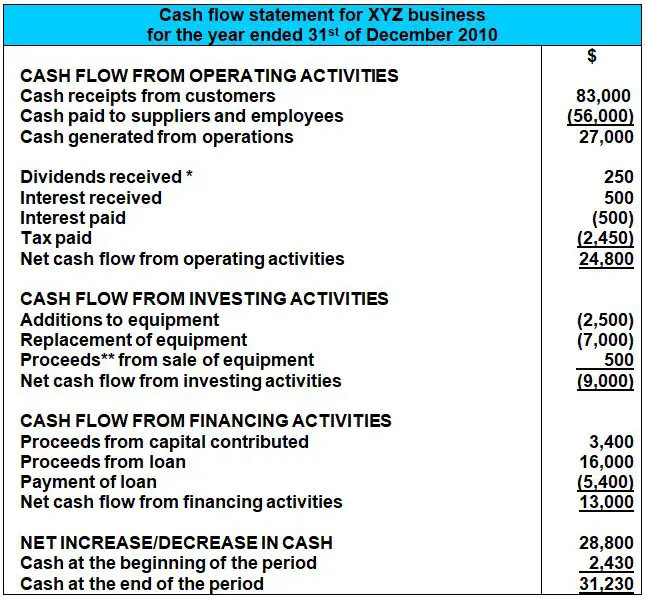

Cash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company — both what comes in and what goes out — during a certain. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. In this guide, we’ll go over:

What is a cash flow statement? A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization. June 7, 2022 cash flow is the amount of cash and cash equivalents, such as securities, that a business generates or spends over a set time period.

A cash flow statement is a financial statement that shows how cash entered and exited a company during an accounting period. A cash flow statement is a financial statement that presents total data. Learn the key components of the cash flow statement, how to analyze and interpret changes in cash, and what improved free cash flow means to shareholders.

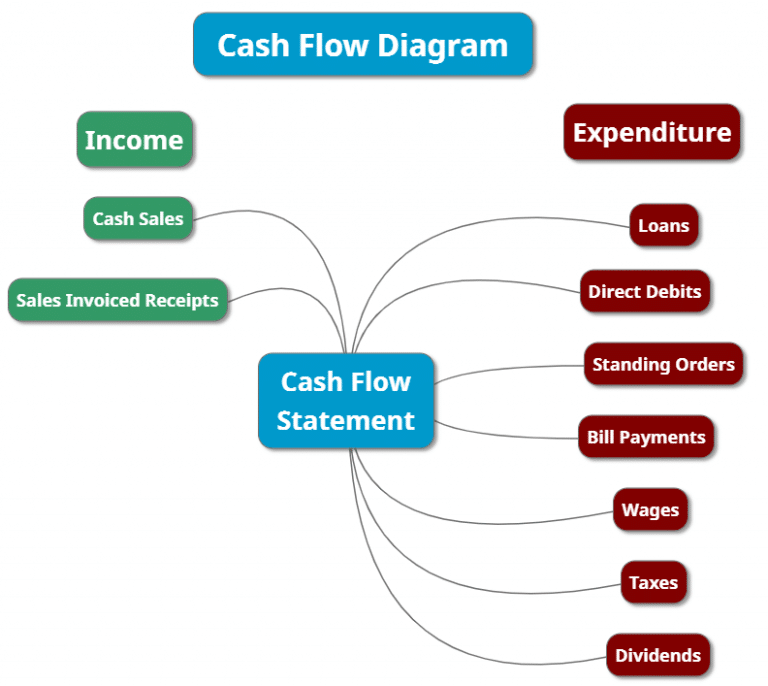

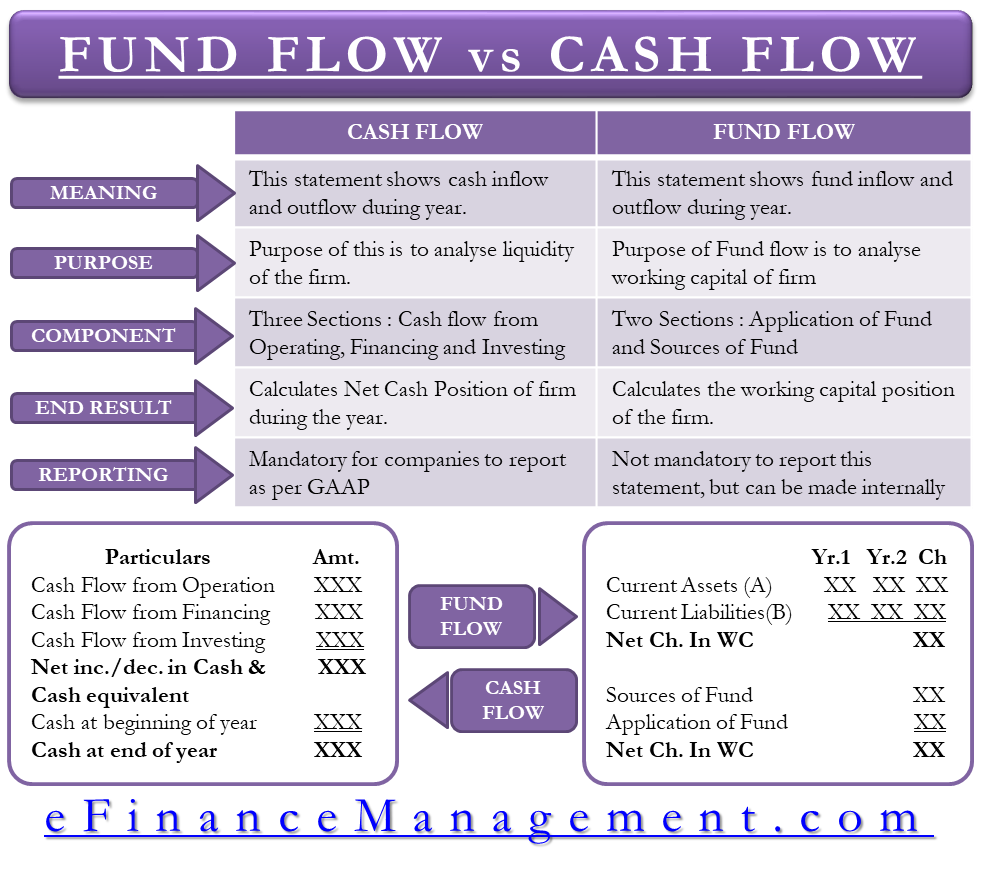

Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. The statement of cash flows is a financial statement listing the cash inflows and cash outflows for the business for a period of time. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period.

Cash flow from investing activities is cash earned or spent from investments your company makes, such as purchasing. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Cash flow represents the cash receipts and cash disbursements as a result of business activity.

The three sections of a cash flow statement cash flow from operating activities is cash earned or spent in the course of regular business activity—the main way your. In other words, the balance sheet shows the assets and liabilities that result, in part, from the. Cash received signifies inflows, and cash spent is outflows.

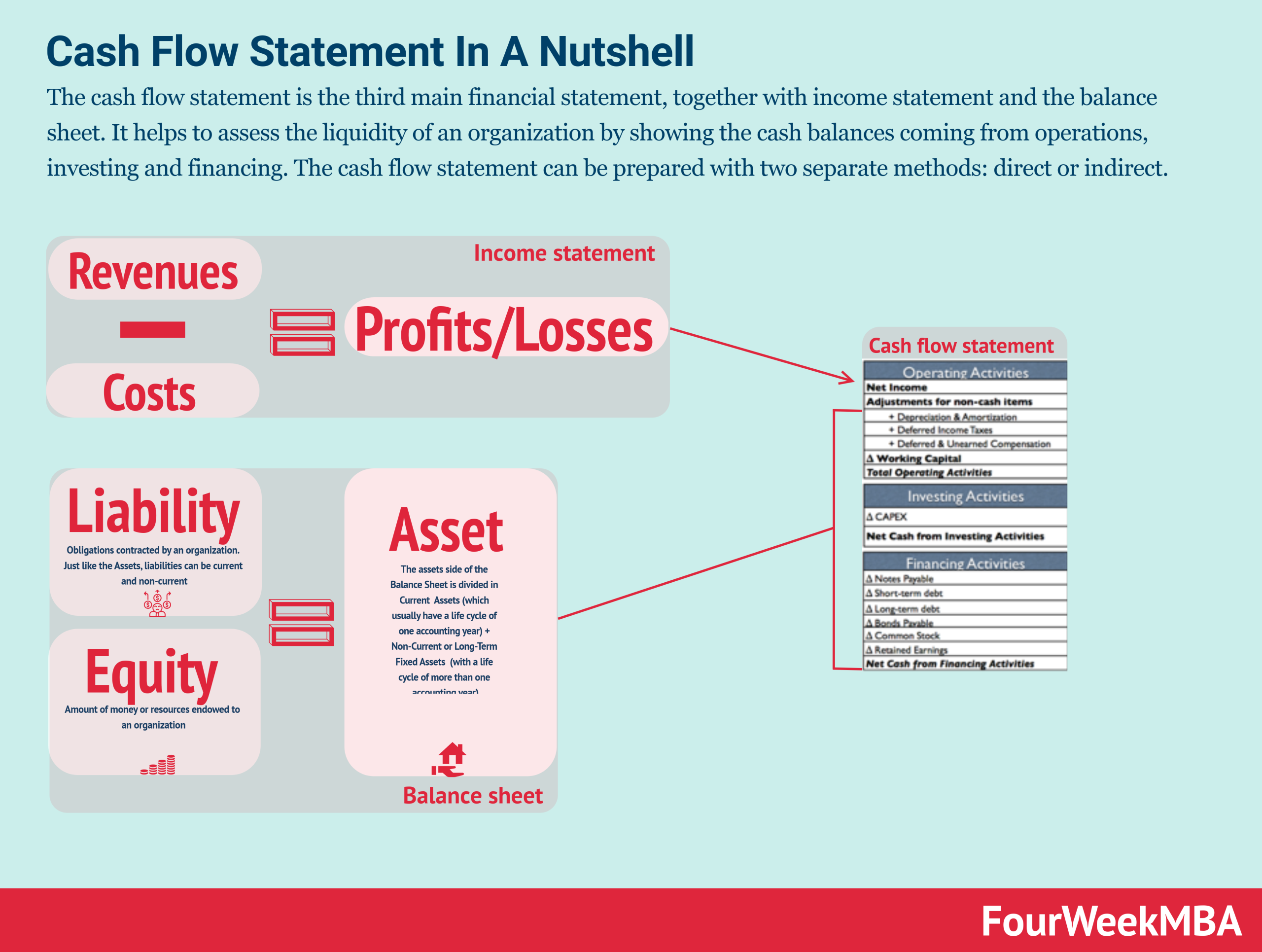

The cash flow statement is required for a complete set of financial statements. Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Statement of cash flows is one of the four financial statements which shows the cash movement, cash inflow and cash outflow of the business, and the overall change of cash balance of the company during the accounting period which could be monthly, quarterly, or. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. The income statement illustrates the profitability of a company under accrual accounting rules. The cash flow statement is a financial statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)