Underrated Ideas Of Tips About Depreciation Profit And Loss

Depreciation expense is the amount that a company's assets are.

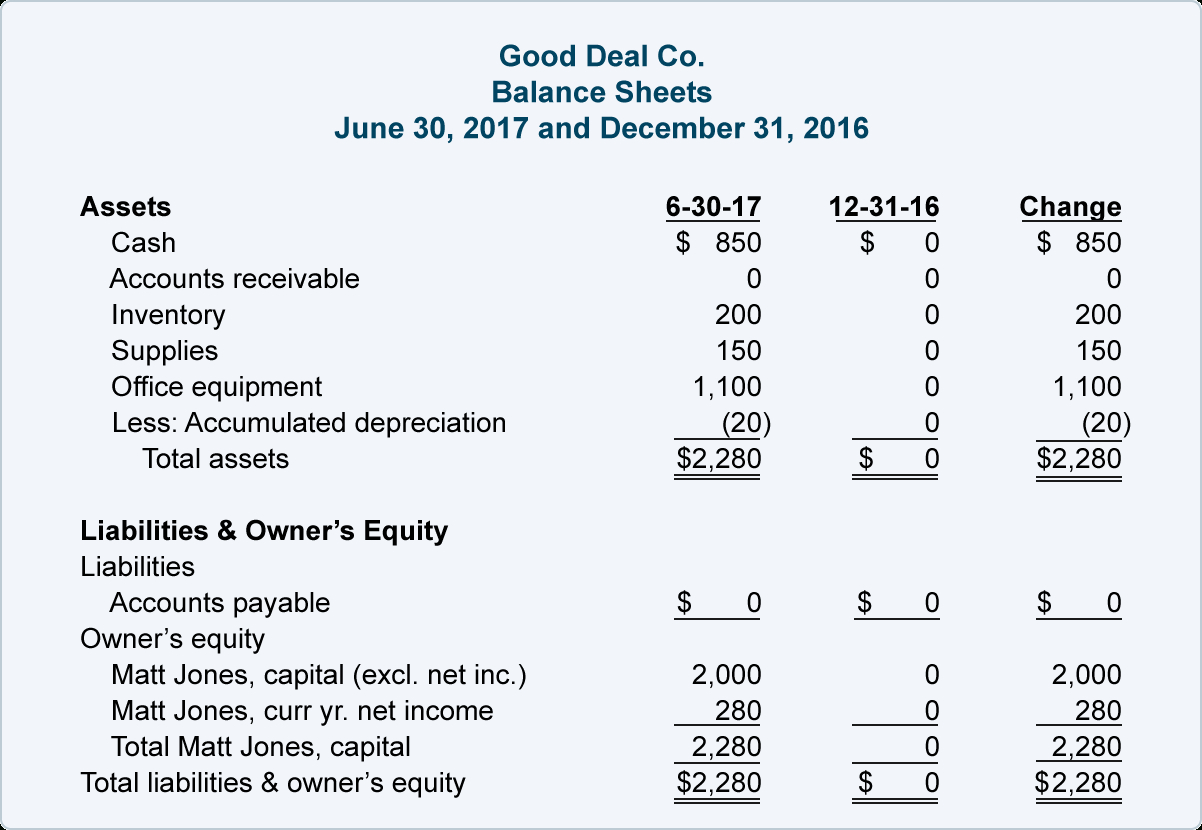

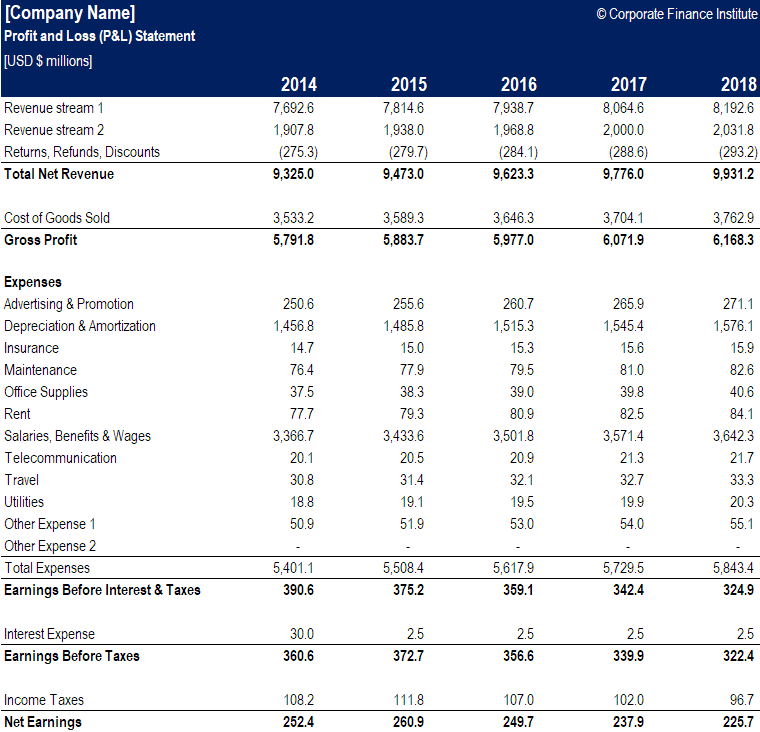

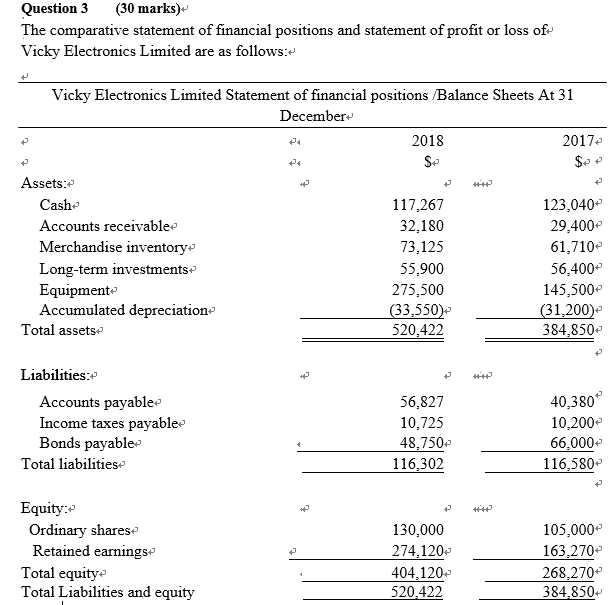

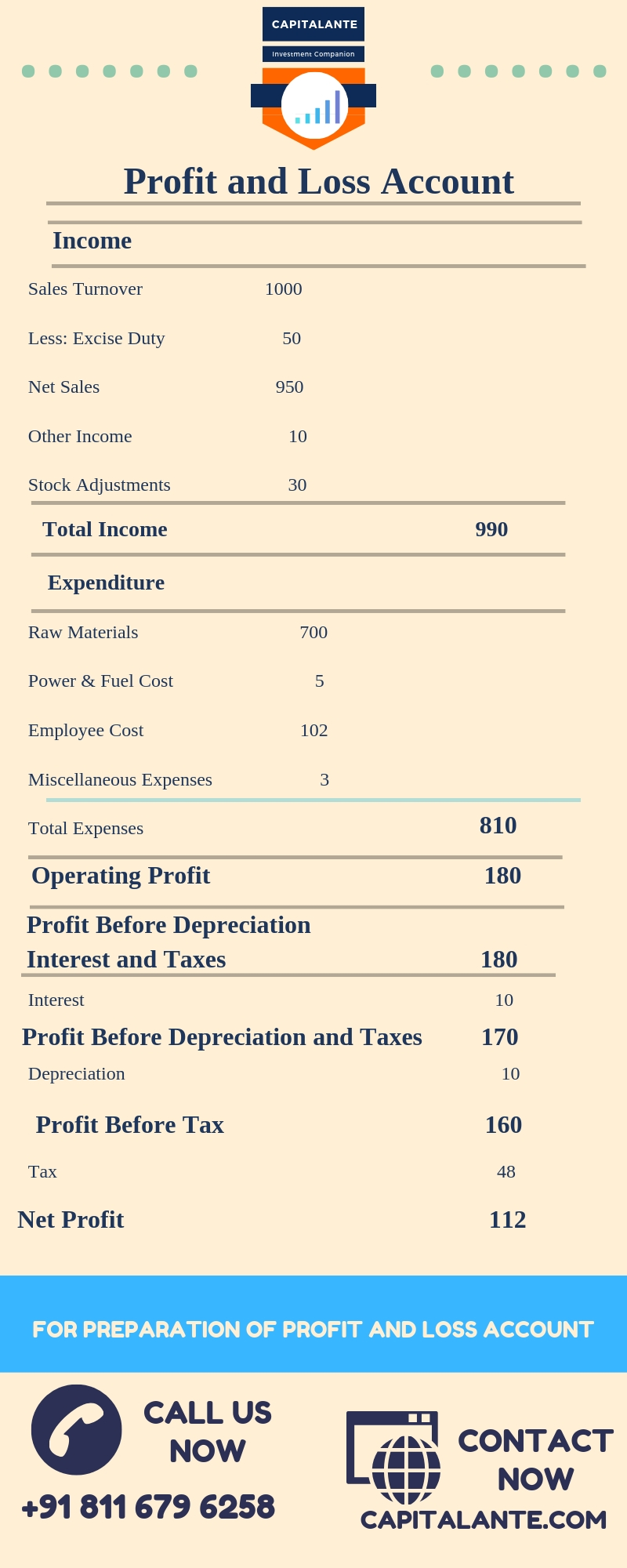

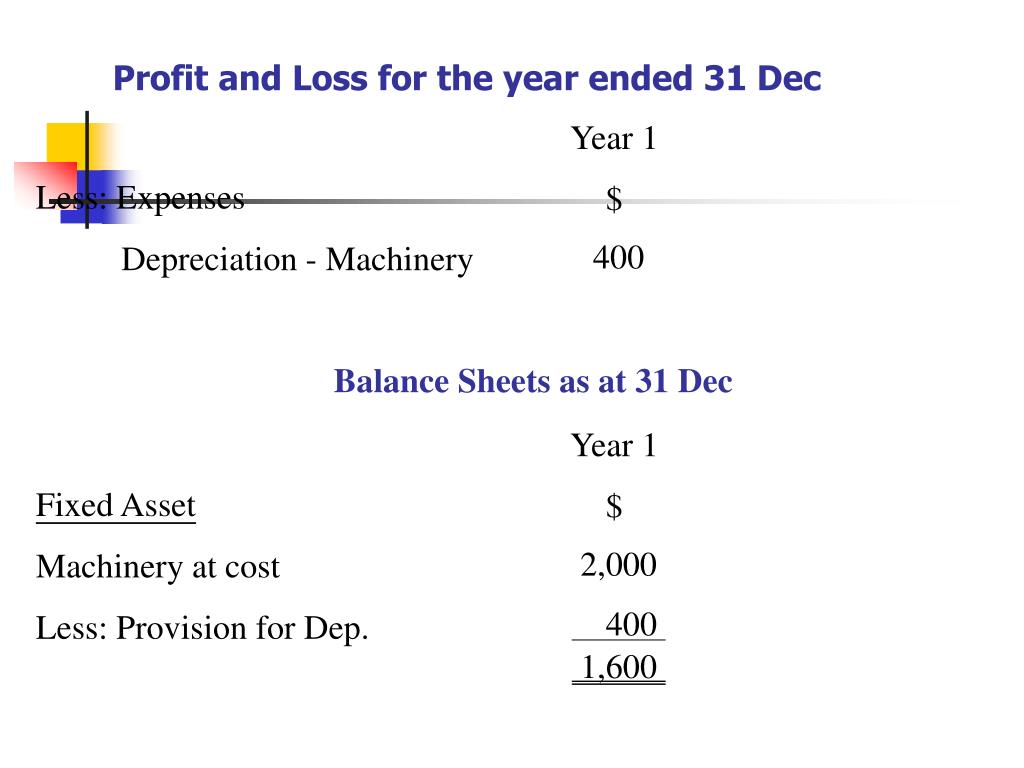

Depreciation profit and loss. Depreciation is what happens when a business asset loses value over time. Depreciation is considered a cost of doing business — as such, it should. The p&l statement shows a company’s ability to generate sales, manage expenses, and create.

The profit and loss account reports sales, expenditure and profit during. A profit and loss statement contains three basic elements: Profit is simply all of a company's sales revenue and any other gains.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The depreciation calculator uses three different methods to estimate how. Depreciation impacts positively the company's profits the theoretical.

The balance in depreciation expense account is transferred to the profit. The depreciation expense account, being a nominal account, is closed at. Depreciation expense is an income statement item.

/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)