Brilliant Strategies Of Info About Total Liabilities And Equity Meaning

Assets = liabilities + owners’ equity.

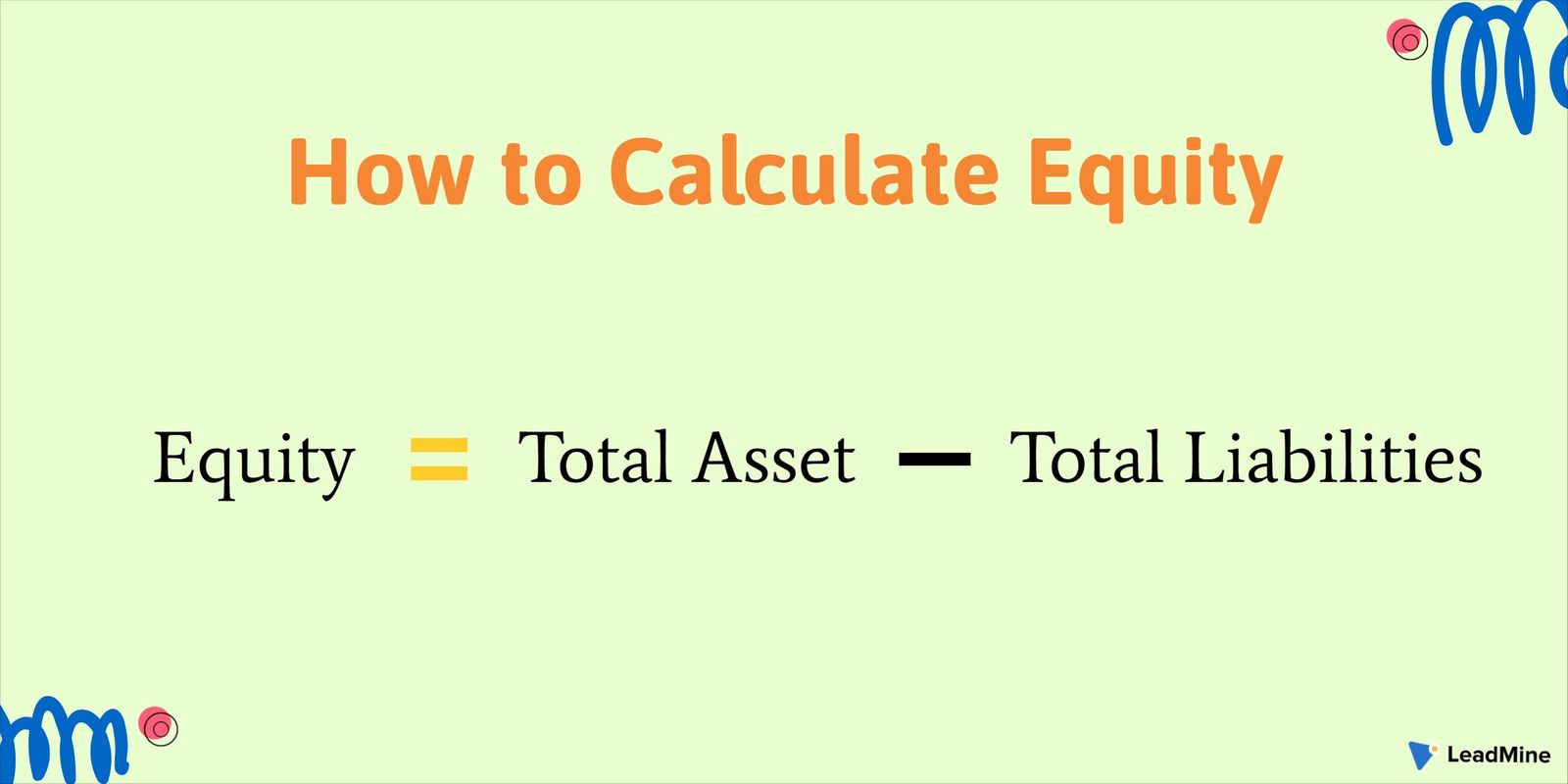

Total liabilities and equity meaning. Return on equity 11.05 percent; Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of money that would be returned to a company's shareholders if. Let’s take the equation we used above to calculate a company’s equity:

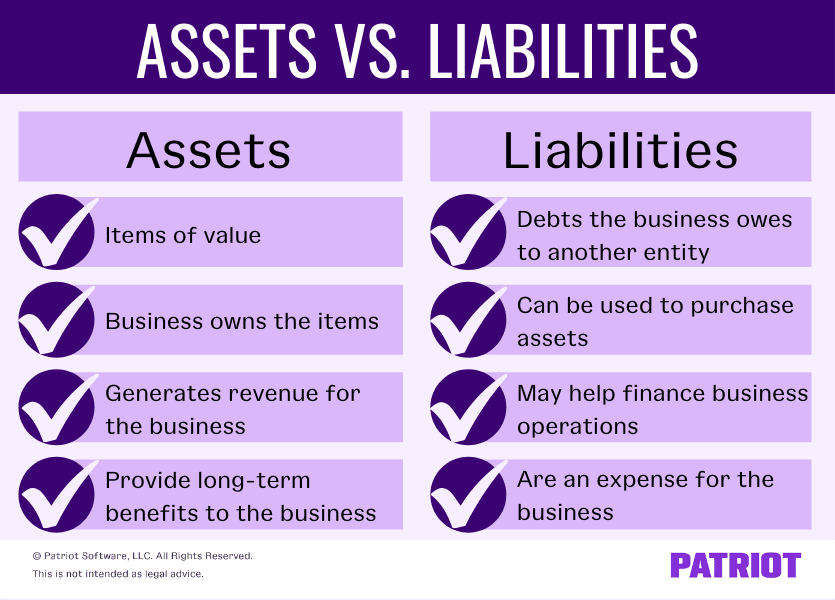

Long term liabilities expected cash outflows after >12 months, typically bank loans/hire purchase agreements. 8,792 9,170 equity share capital and share premium: Total liabilities refers to the sum of all debts and financial obligations a company owes to outside parties, including lenders, suppliers, and employees.

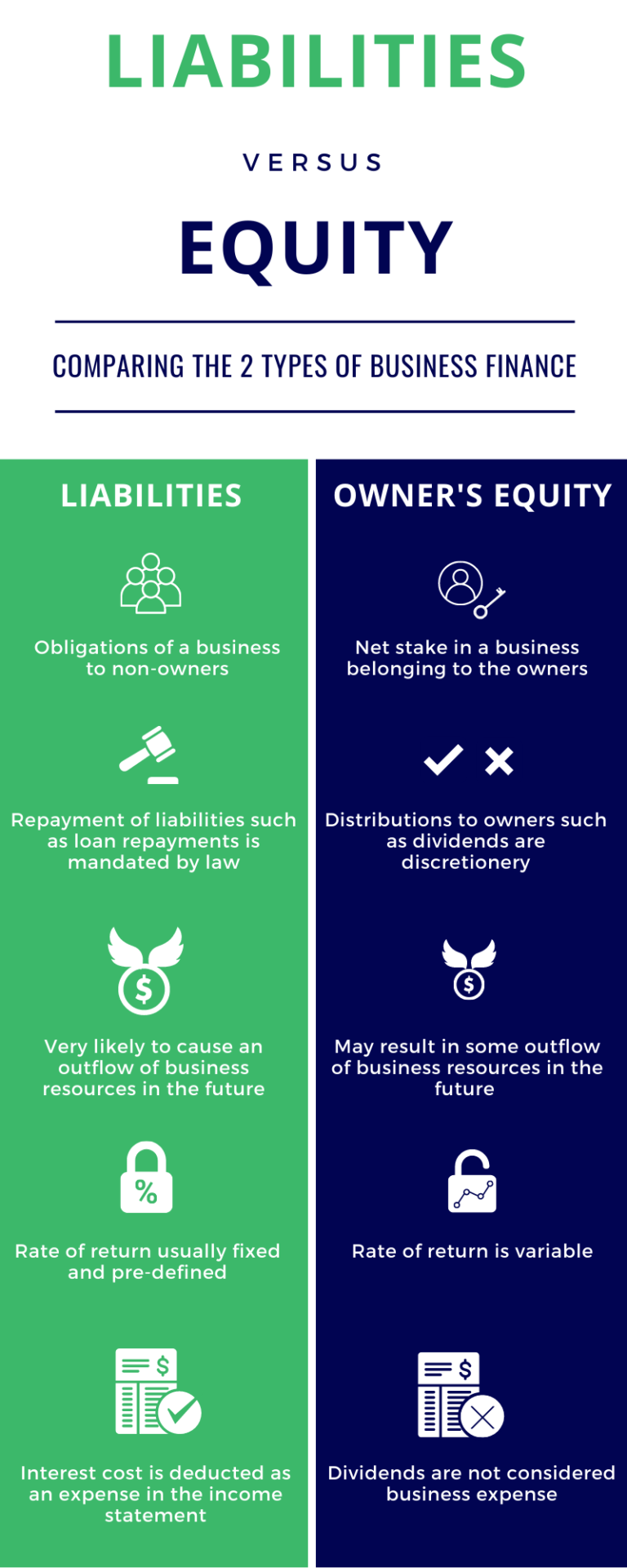

Accountants call this the accounting equation (also the “accounting formula,” or the “balance sheet equation”). Understanding the balance sheet examining the components and ratios of a balance sheet to show business health assets = shareholders’ equity + liabilities the equation above represents the primary components of the balance sheet, an integral part of a company’s financial statements. Therefore, this equation should always be true.

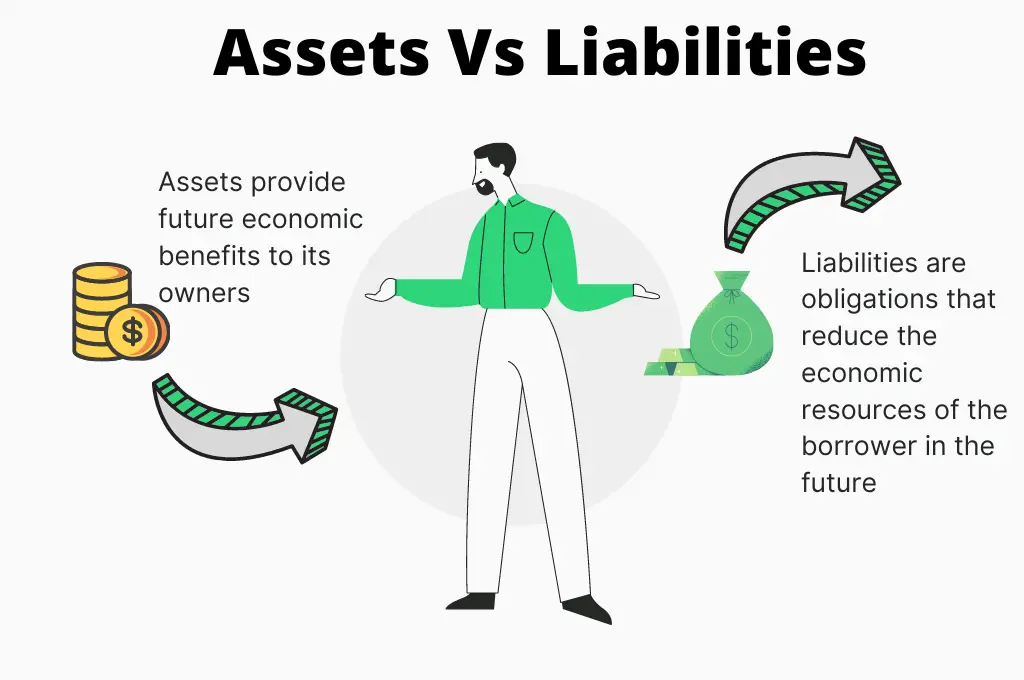

Total liabilities can be an important financial metric for company operations and economic performance. A company's equity, which is also referred to as shareholders' equity, is used. A balance sheet always adheres to the rule that assets equals liabilities plus equity.

This is a list of what the company owes. Common or preferred stock are types of. Total liabilities and total equity:

In this case, the return on equity increased from 6.5 percent to 11.05 percent as a result of using more debt. A balance sheet must always balance; The accounting equation states that a company's total assets are equal to the sum of its liabilities and its shareholders' equity.

To calculate your total liabilities, add all of your liabilities, both short and long term. Put another way, if you subtract liabilities from assets, equity is what is left over. Shareholder equity (se) is a company's net worth and it is equal to the total dollar amount that would be returned to the shareholders if the company must be liquidated and all its debts are.

The equity of a company is the net difference between a company's total assets and its total liabilities. D/e ratios vary by industry and. To calculate your total liabilities:

Equity, also known as owner’s equity, is the difference between the total assets and total liabilities of a business. What is a balance sheet? Assets = liabilities + equity.

Find out what your company’s liabilities are. And turn it into the following: Net assets total assets less total liabilities.

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)