Spectacular Tips About Payroll Tax Expense On Income Statement

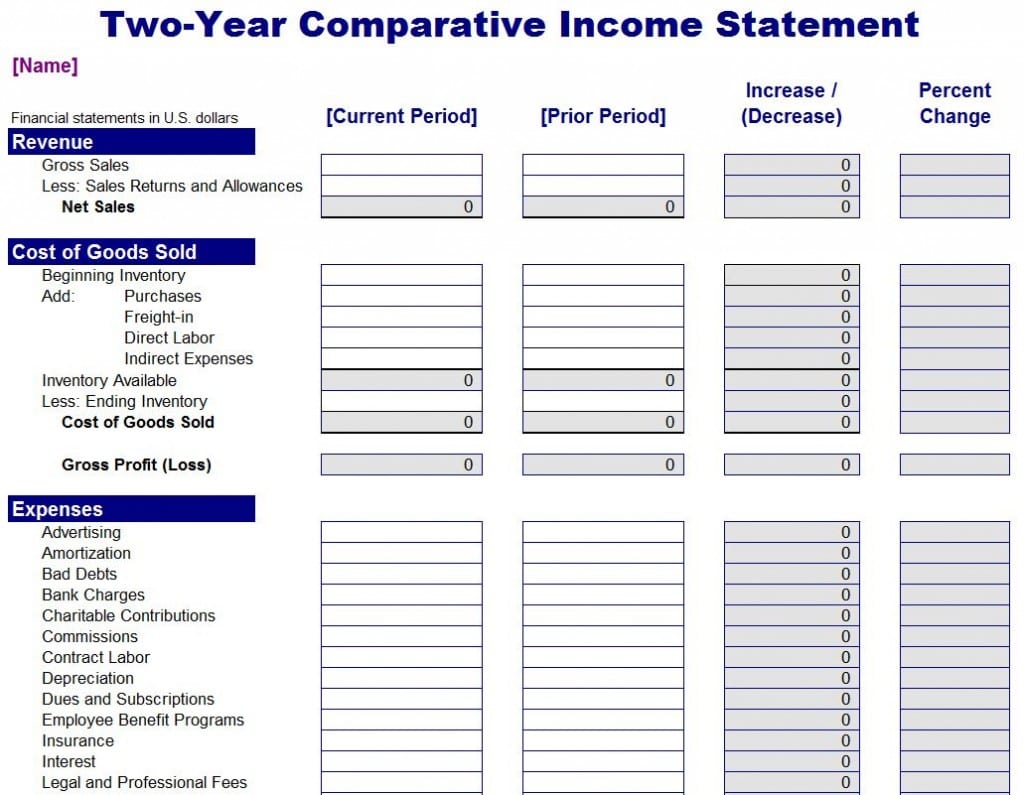

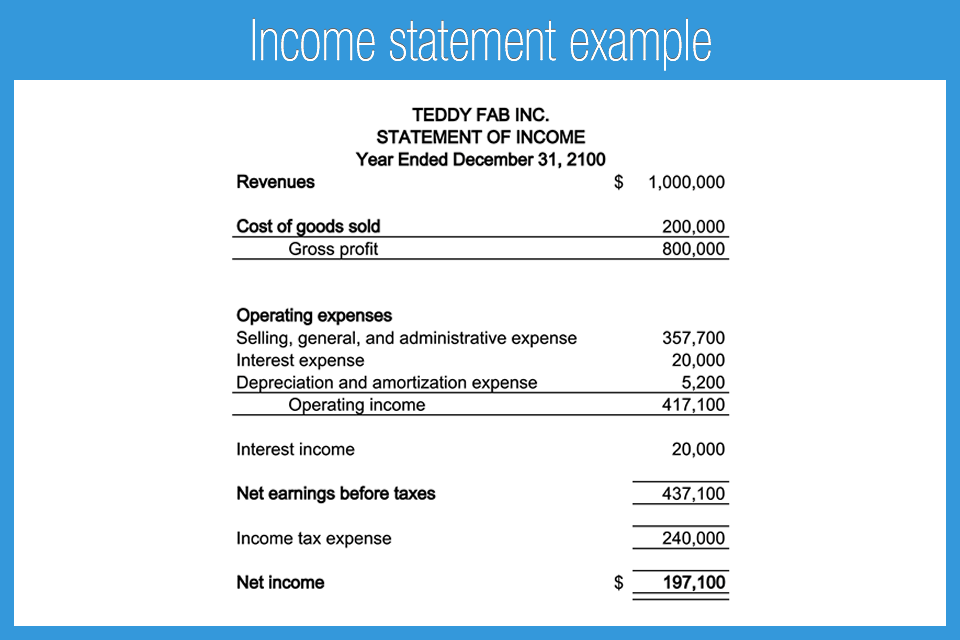

Income statements can help track a business’s.

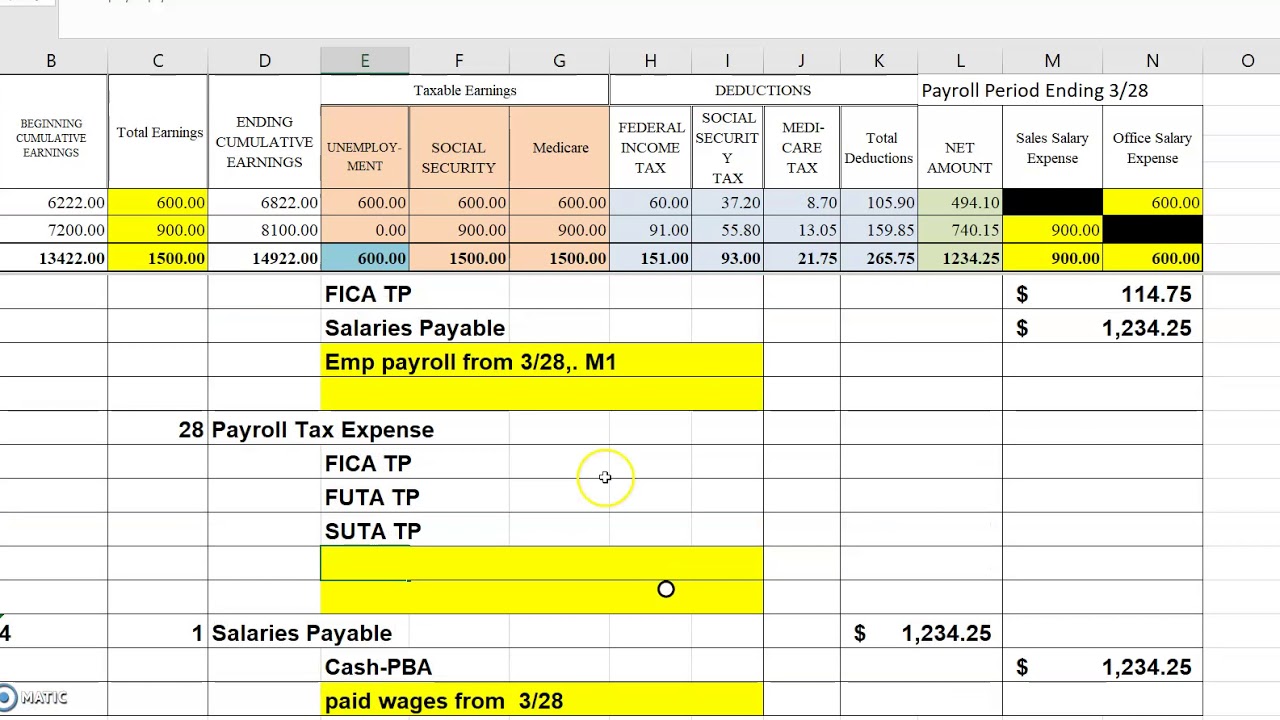

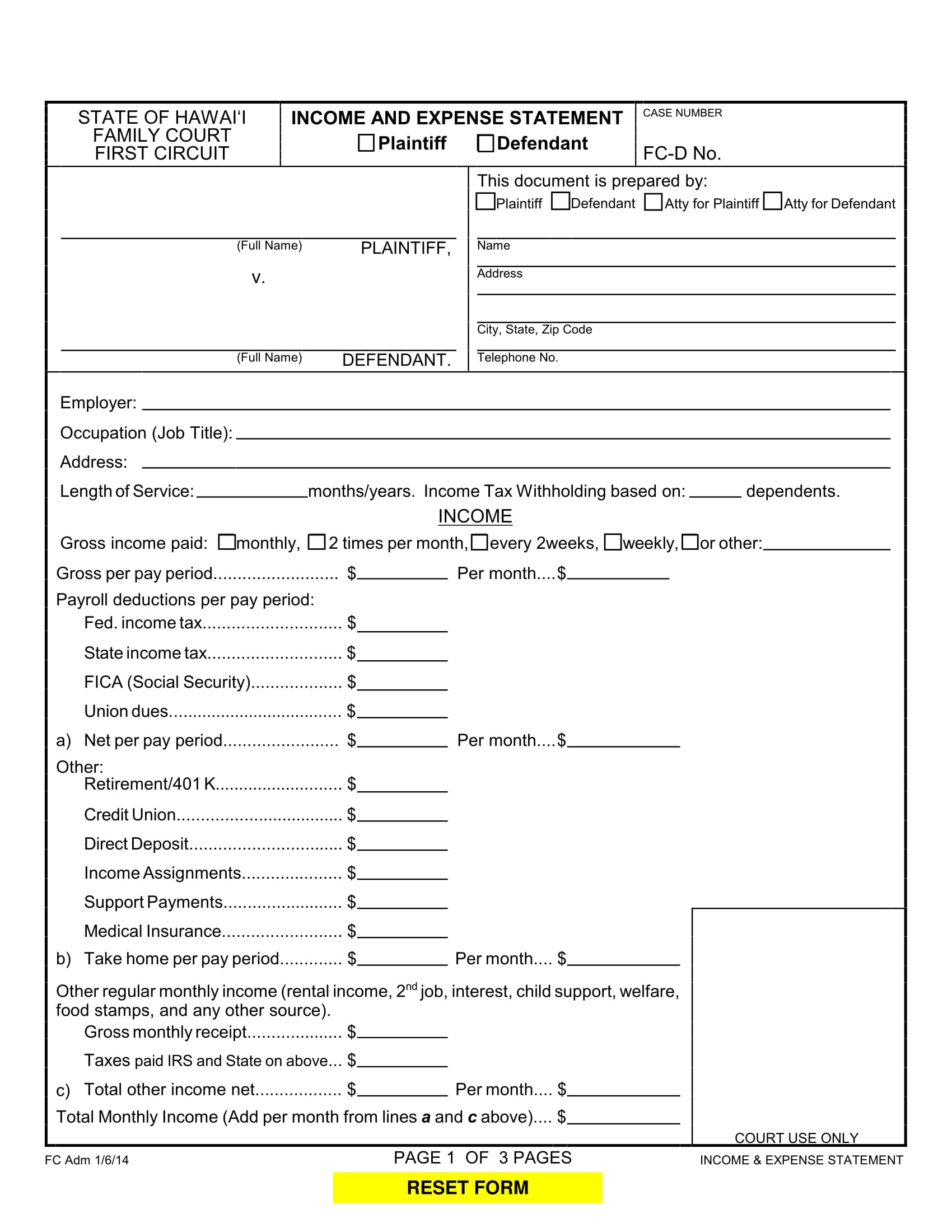

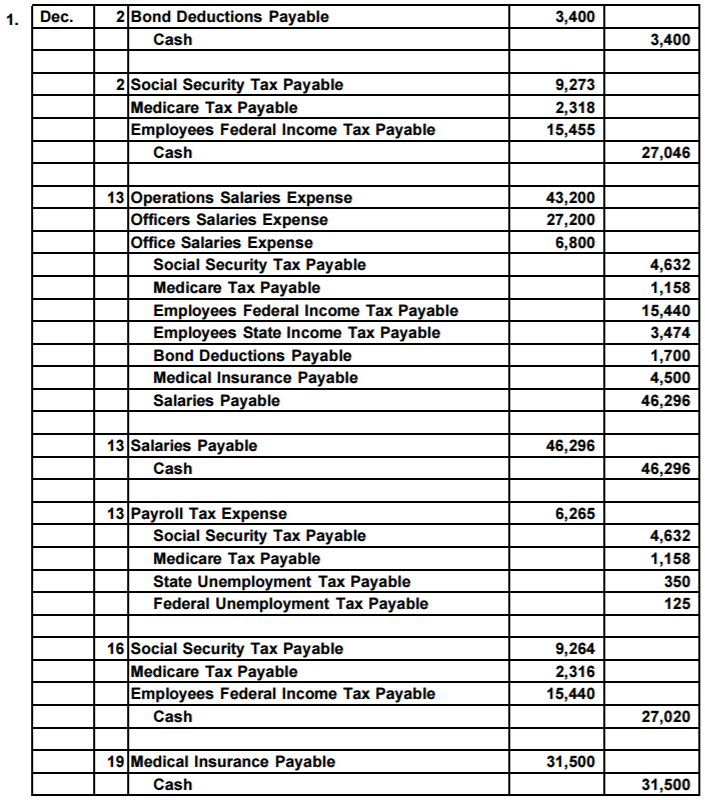

Payroll tax expense on income statement. Payroll taxes recognized in expenses. Employee wages are one of the highest expenses on a business’s income. Payroll taxes that are paid solely by the employer company:

Here are some of the taxes that employers are normally responsible for: An income statement is another name for a profit and loss statement (p&l). 1a) this is the same as gross wages:

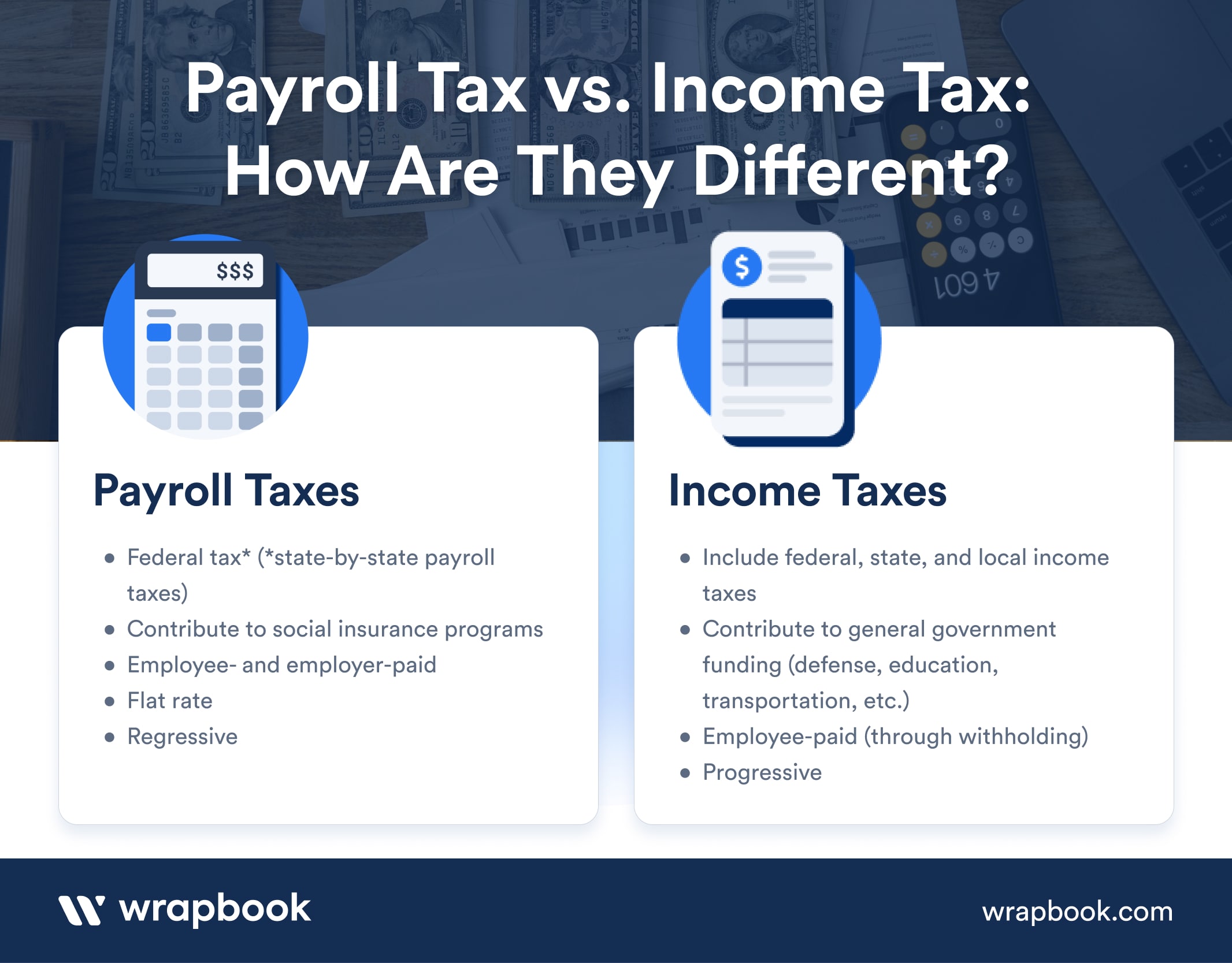

That means that combined fica tax rates for 2024 and. Compliance is key. In the us, employers have certain tax responsibilities related to remote work.

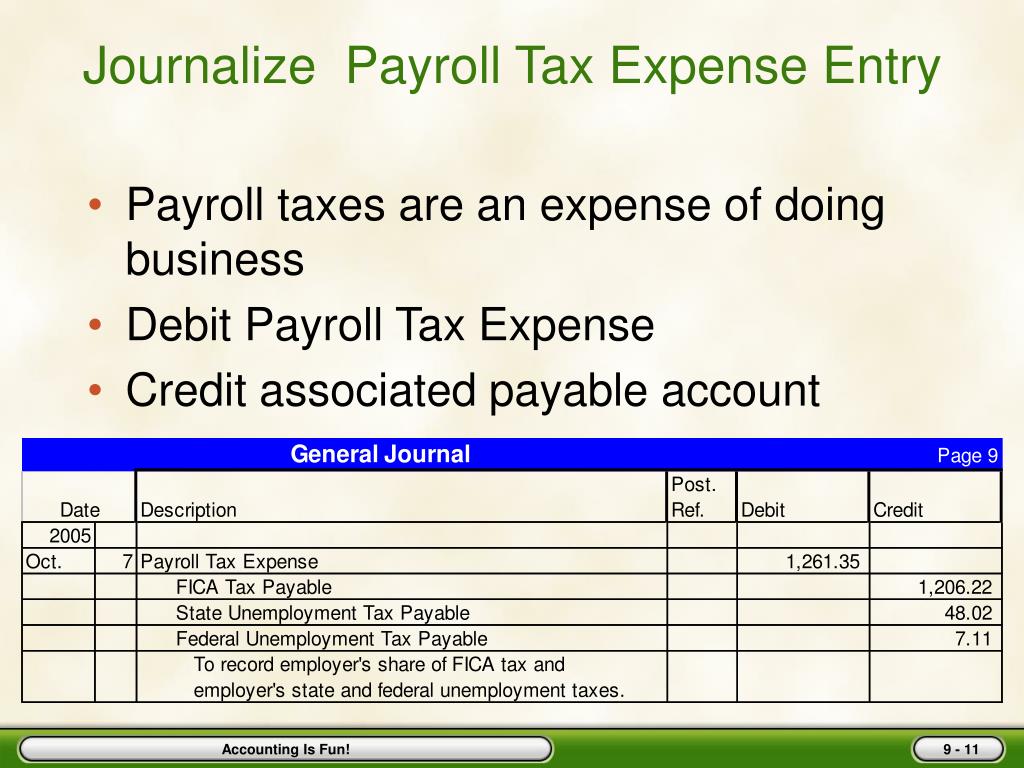

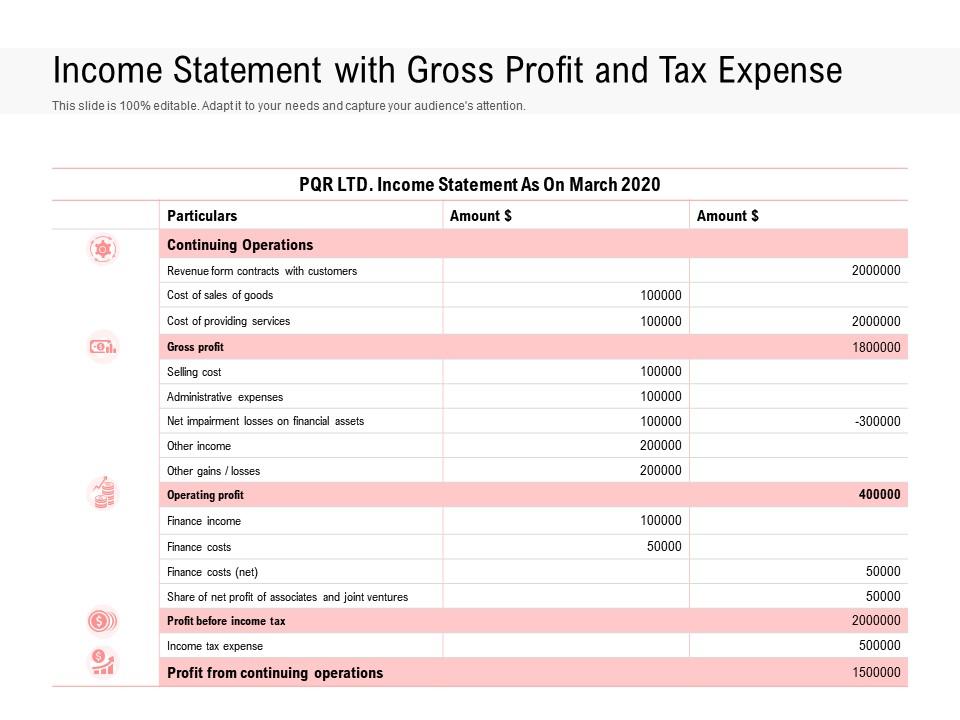

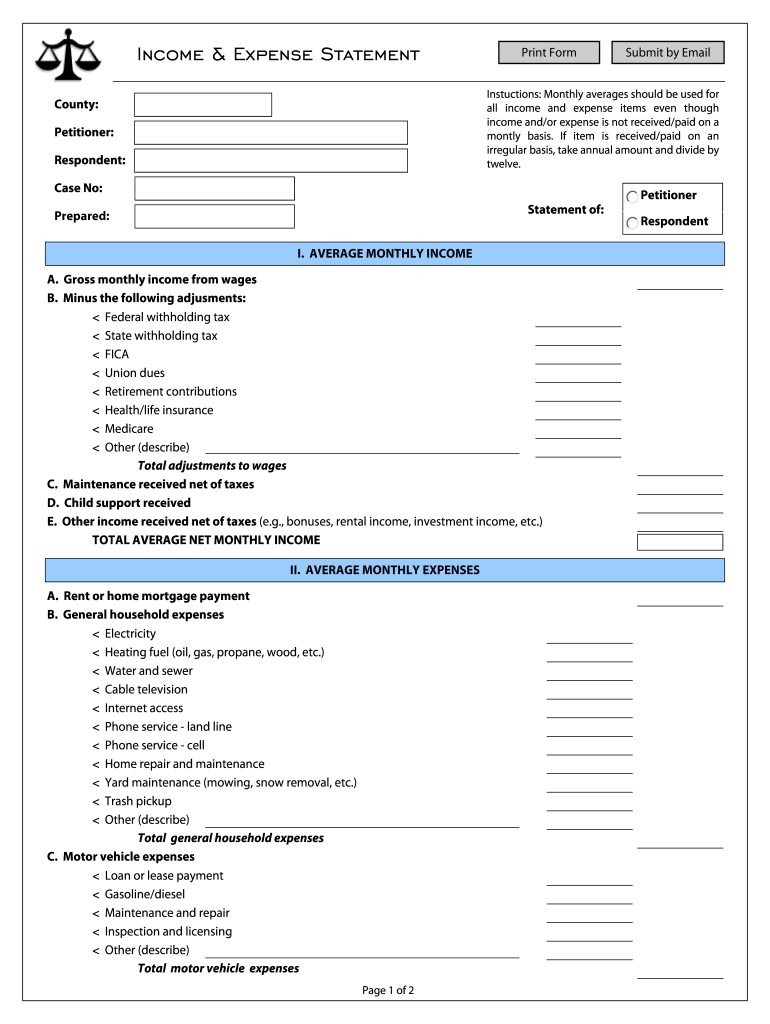

Income taxes are tax liabilities based on income, and these taxes are assessed at the federal, state, and local level. The payroll tax expense account is the holding account used to track the balance of the employer contributions to payroll taxes, including social security, medicare and. But calculating tax expense can be complex given that businesses and individuals are.

Payroll taxes are often considered an operating expense and are usually included in the “salaries and wages” or a separate “payroll tax expense”. In some locations, there may be additional taxes owed by the company, such as a head tax for every person employed. A tax expense is a specific amount that you owe to certain governments within a specific timeframe.

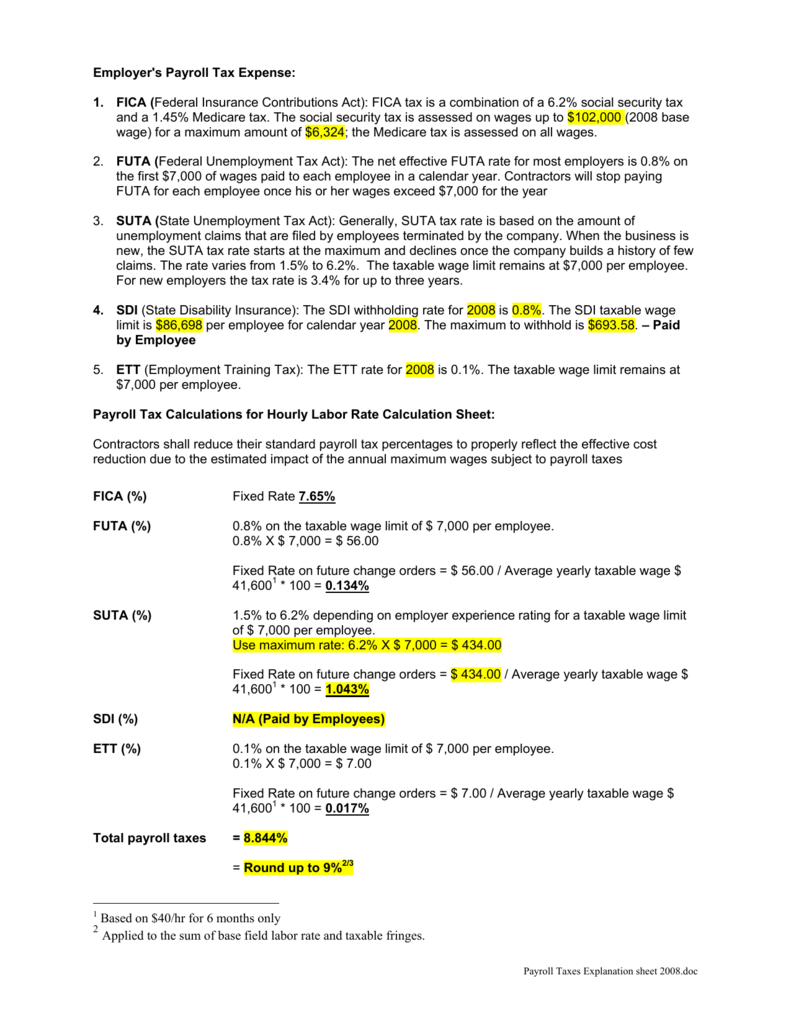

Examples of the payroll taxes paid by the employer/company and therefore reported as expenses on the company's income statement include the following: However, this rate is effectively reduced to 0.6% because employers receive. This could be federal, state, municipal, or a combination of.

The current rate for medicare is 1.45% for the employer and 1.45% for the employee, for a total of 2.9%. Income tax is a type of expense that is to be paid by every person or organization on the income earned by them in each financial year as per the norms prescribed in the. A tax expense is the effective tax rate multiplied by taxable income.

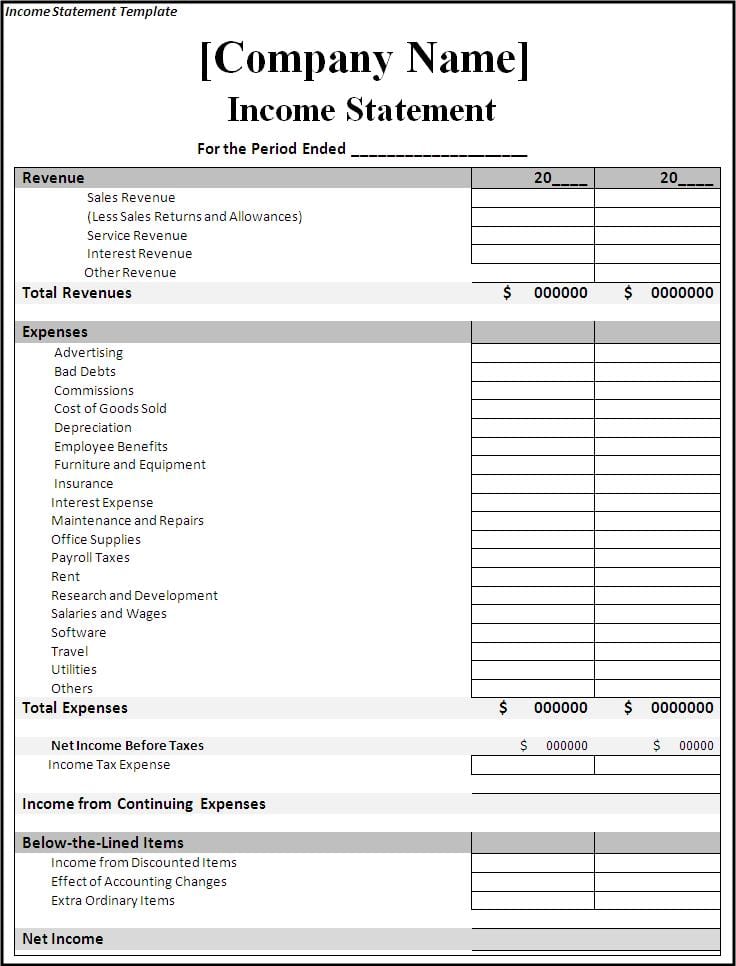

Federal unemployment taxes (futa) and state. Payroll taxes that have been. Expenses are recorded on the income statement.

In this guide, we’ll show you how to calculate employer payroll taxes (the taxes you, as the employer,. Payroll taxes refer to an expense of the company that appears on the income. Revenue minus expenses equals profit or loss.

Your reporting period is the specific timeframe the income statement covers. We explain the most common payroll taxes that employers and employees pay. Payroll taxes include income tax.