Ace Info About Profit And Loss Statement Tax Return

More return on equity (roe) calculation and what.

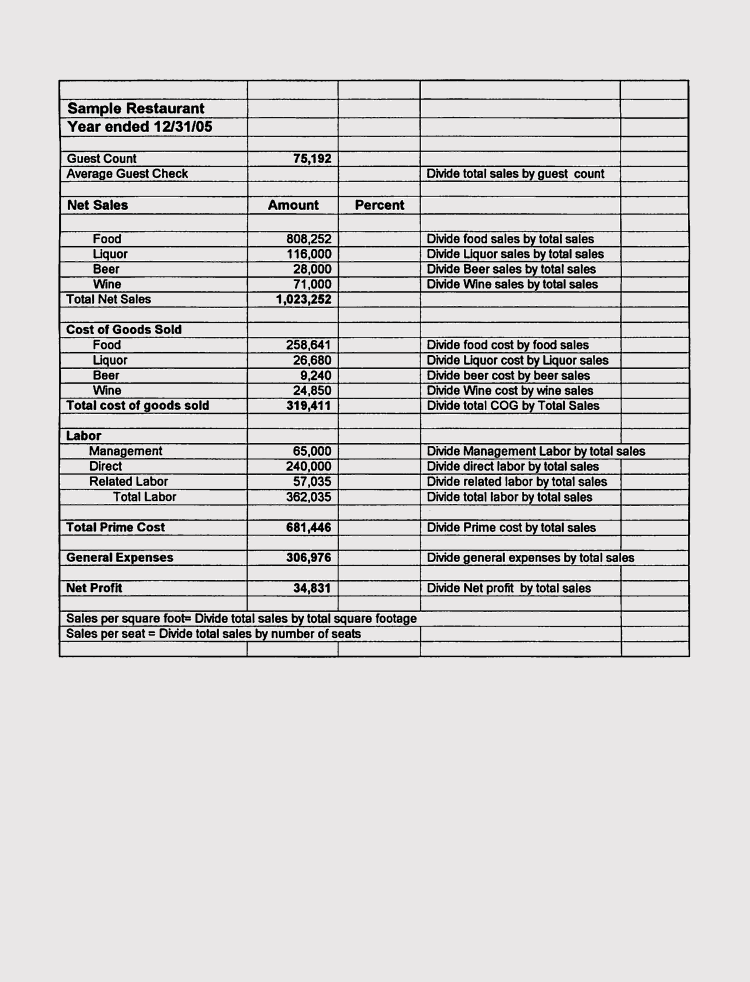

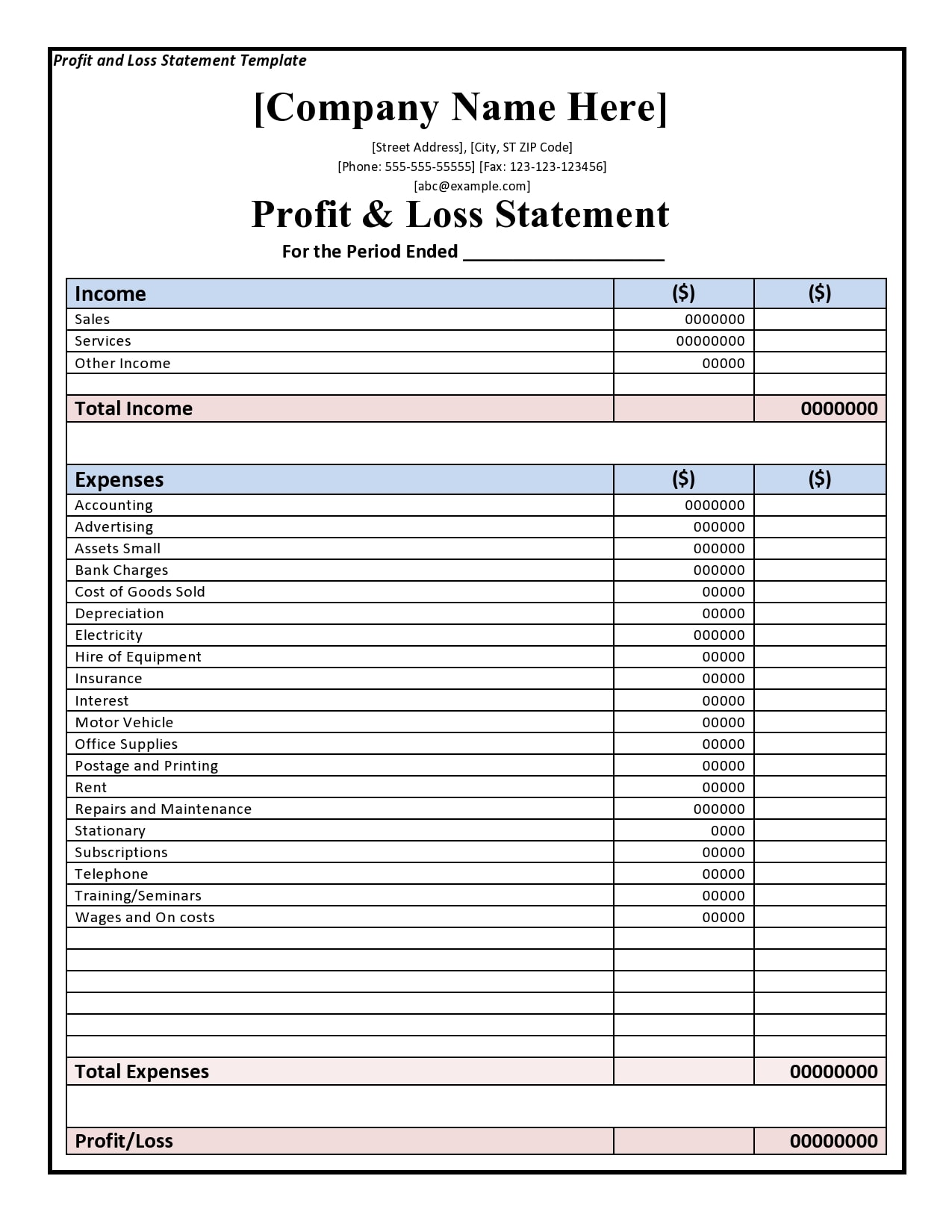

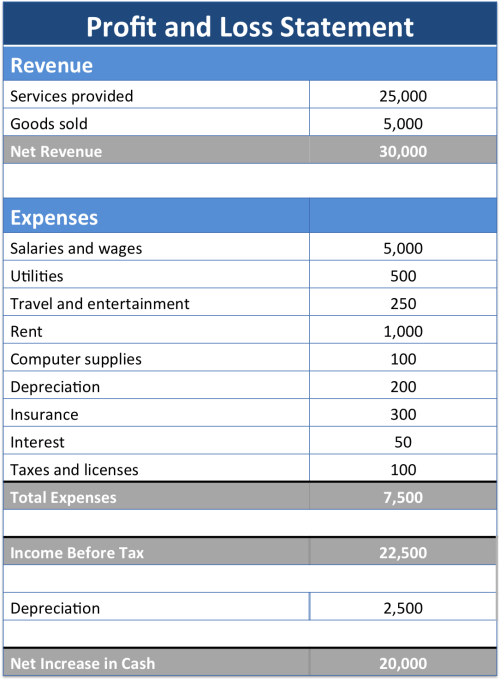

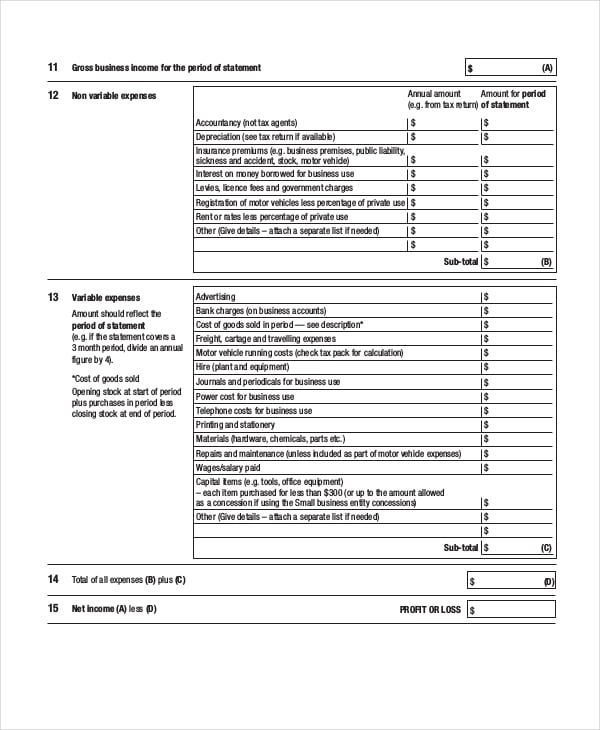

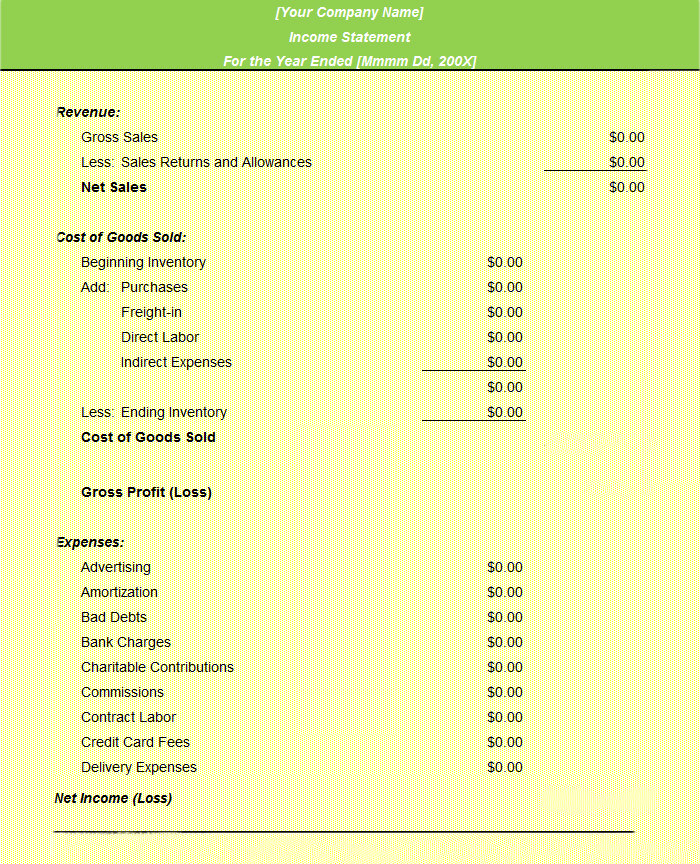

Profit and loss statement tax return. You can obtain current account balances from your. A document that identifies a business’s profit (revenue) and losses (expenses). It reveals the expenditure and revenue of a firm.

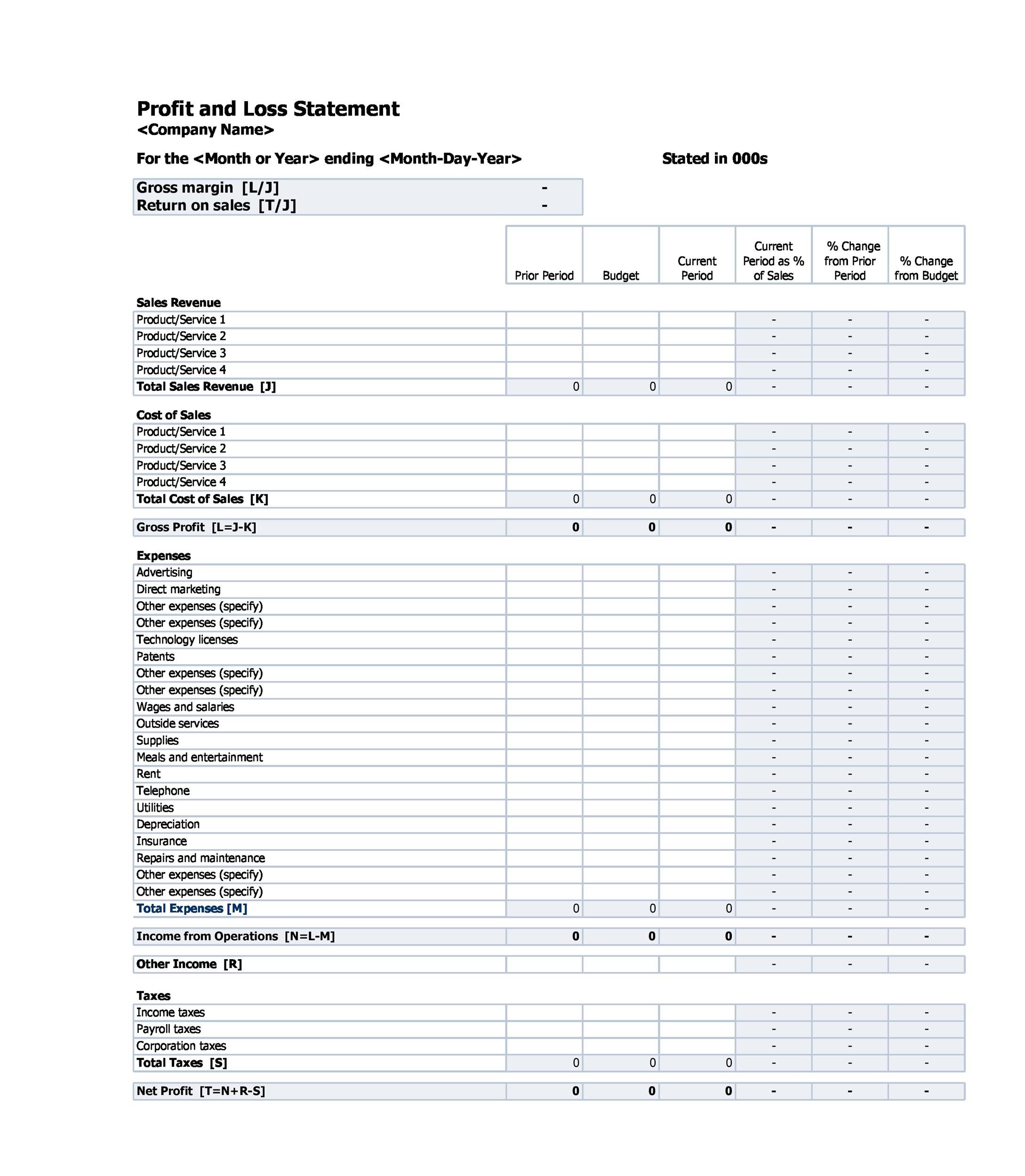

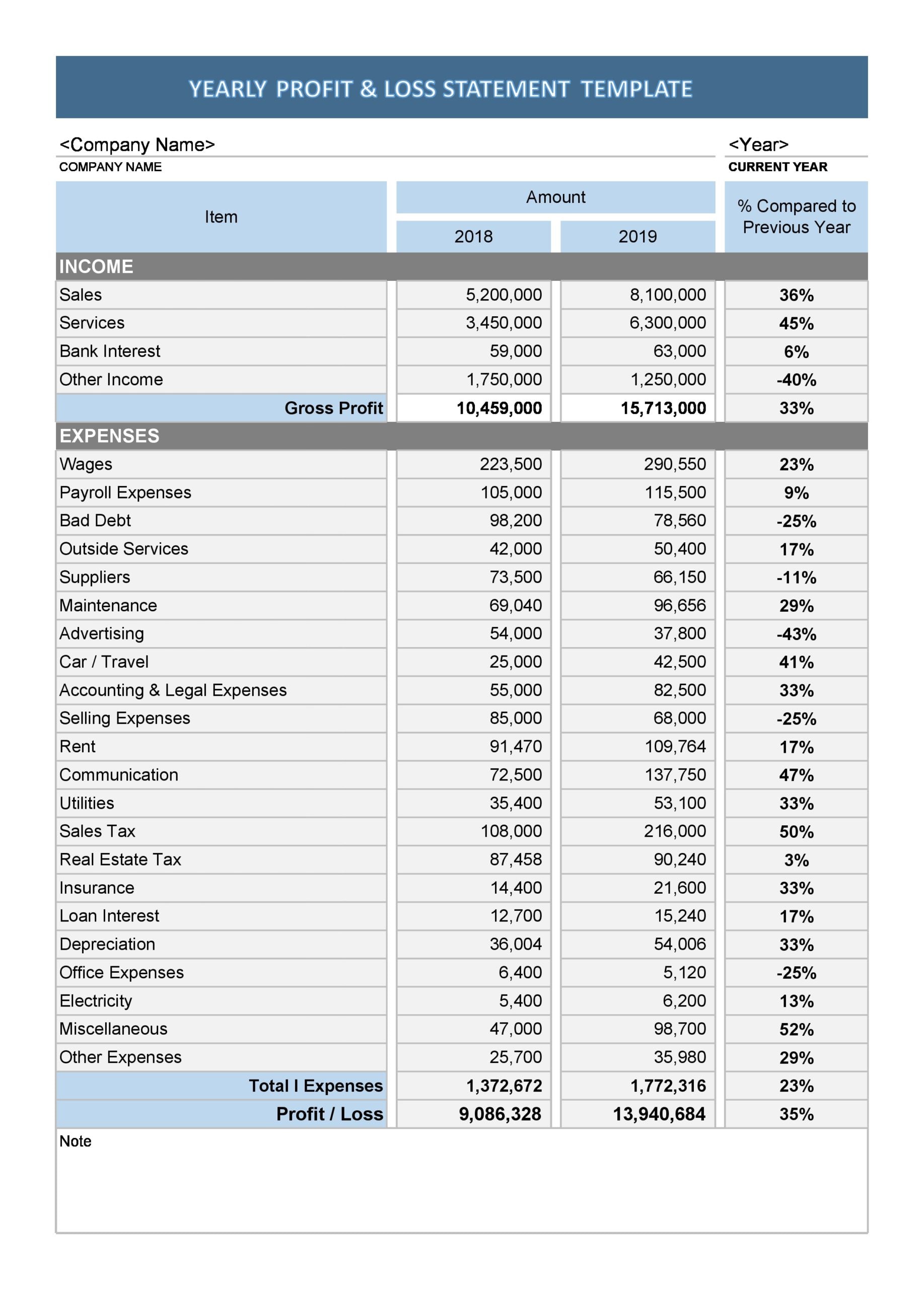

A profit and loss statement (p&l) is the bottom line of small business accounting. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). Includes recent updates, related forms, and instructions on how to file.

A profit and loss statement, or a p&l statement or income statement, is a financial document that summarizes a company's revenues, expenses, and profits/losses over a given period. The profit & loss statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a business during a specific period, usually a quarter or year. Purpose of a profit and loss statement.

The outcome is either your final profit or loss. Profit or loss from business. Department of the treasury internal revenue service.

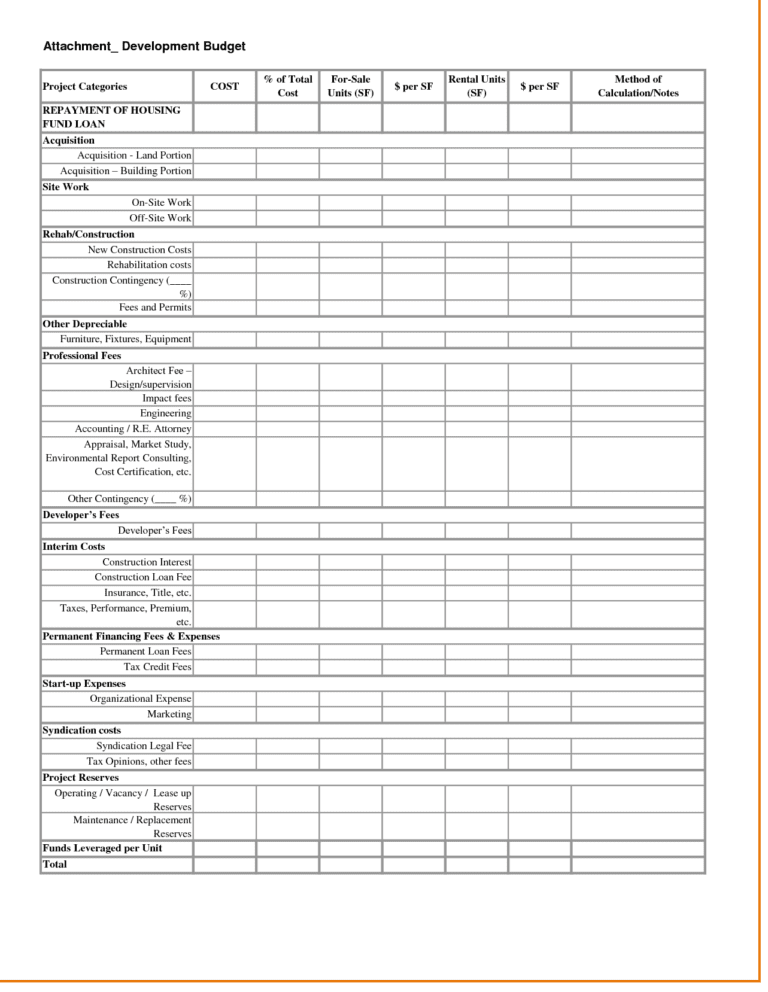

A profit and loss (p&l) statement offers insight into a property's finances. Basic income statements contain the following elements: Profit and loss statements vs.

A p&l statement is an account of a company's income and expenditures (and ultimately its profit) over a period of time. What is the profit and loss statement (p&l)? This guide will explain the details of real estate profit and loss statements and how investors use them to assess their business.

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. The result is either your final profit (if. A profit and loss statement contains three basic elements:

The report may also be required monthly or weekly to assist in financial business decisions. These statements help you evaluate your company’s financial health, typically quarter by quarter. If there's a profit, it'll be added to any other income you have.

Revenue, expenses, and net income. There are many reasons behind the preparation of profit and loss statements. Your lender will look at schedule c on your 1040.

A business can know if it earns or incur. The p&l statement is one of three. Partnerships must generally file form 1065.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)