Recommendation Info About Definition Of Statement Profit And Loss

It provides information on the company's ability to earn revenue, manage expenses and.

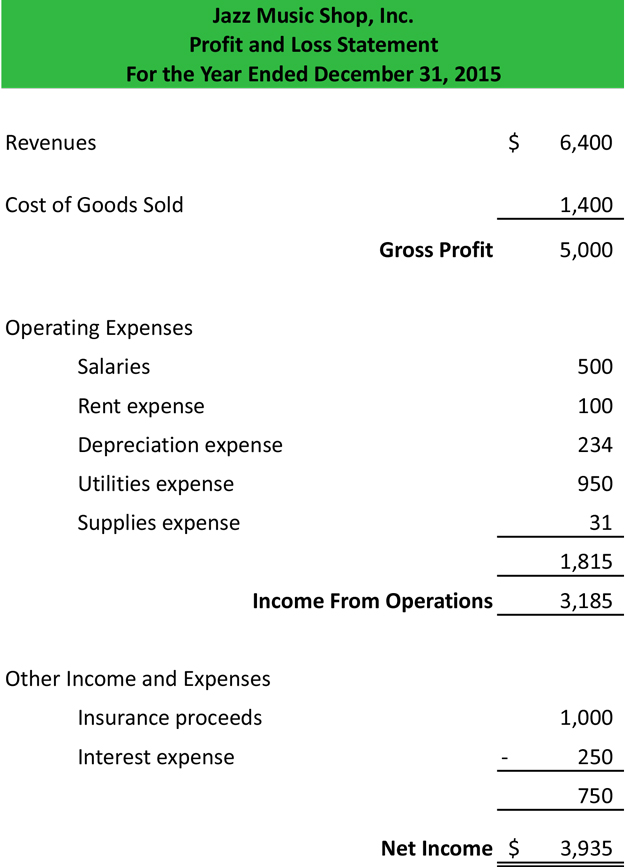

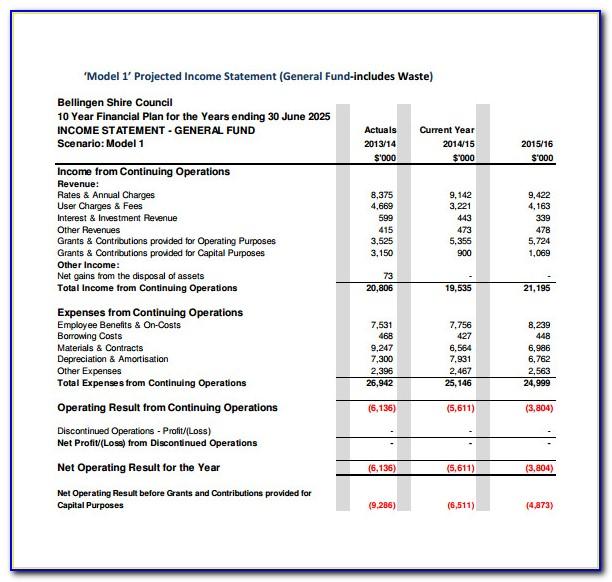

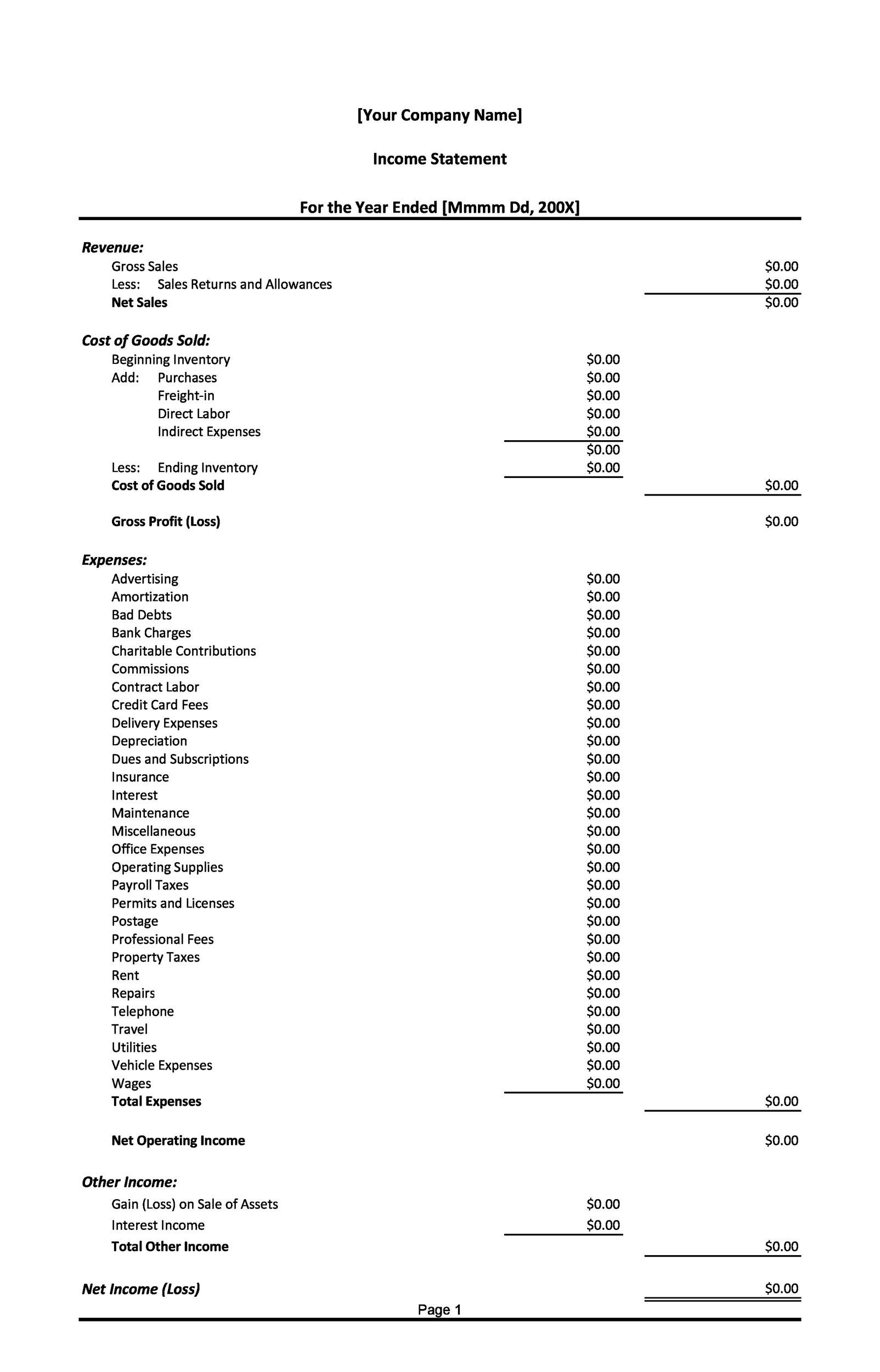

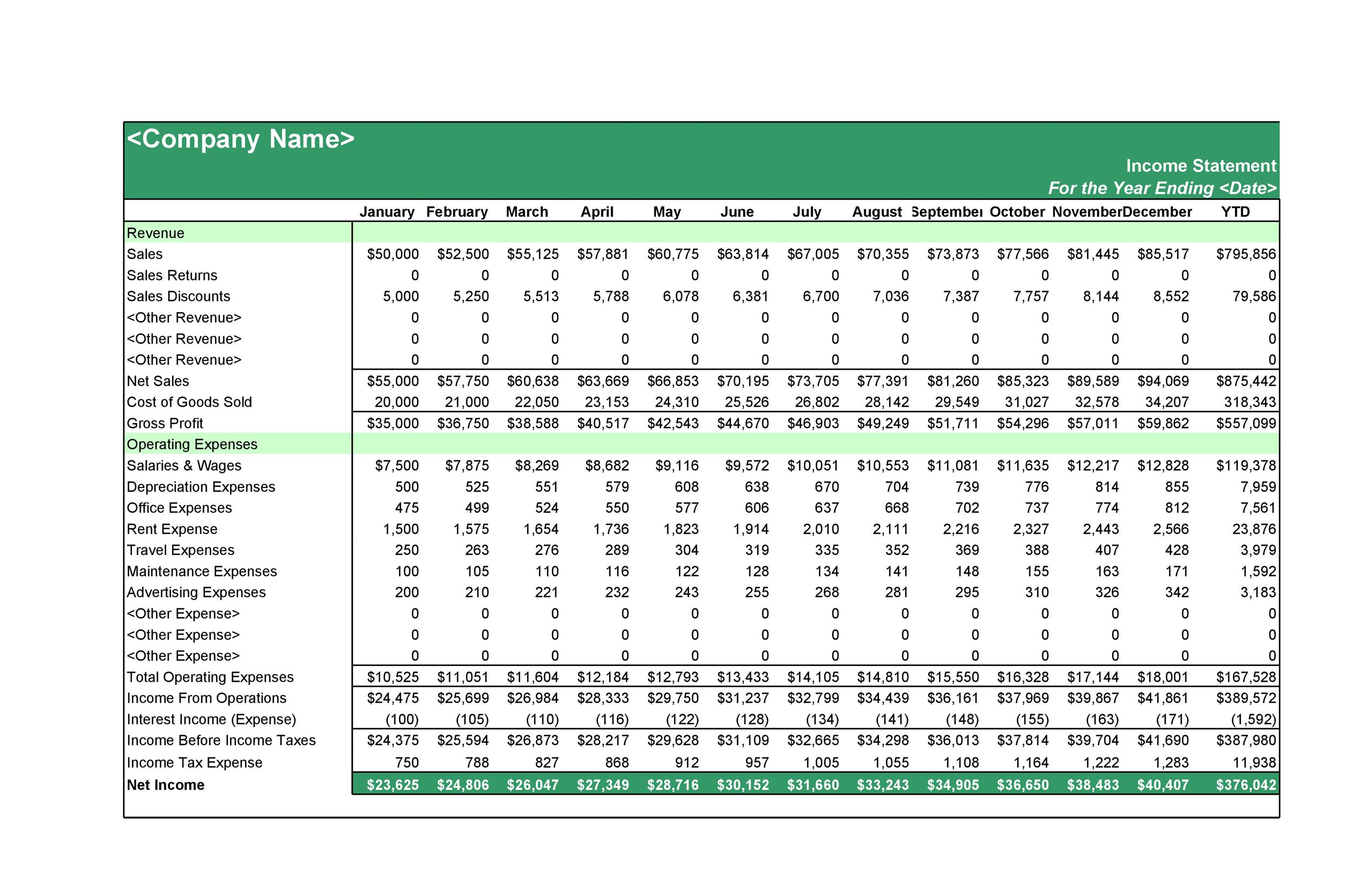

Definition of statement of profit and loss. Profit and loss accounting generates a profit and loss statement, also referred to as an income statement income statement the income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit. It summarizes revenues, costs, and expenses, allowing stakeholders to evaluate profitability. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

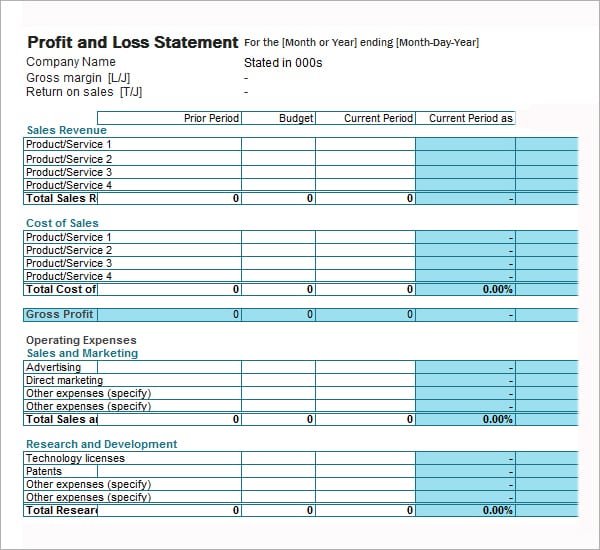

Key takeaways a p&l statement explains the income and expenses that lead to a company’s profits (or losses). Then, it subtracts the costs of making those goods or providing those services, like. (a few gains and losses are not reported on the profit and loss statement.

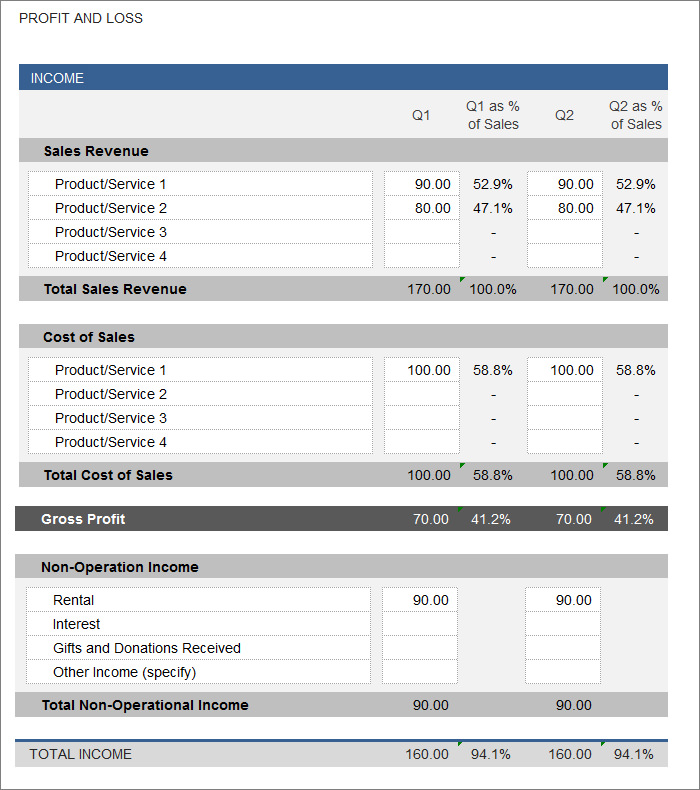

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. Statement of profit and loss statement of operations statement of financial results or income earnings statement expense statement income statement A p&l statement provides information about whether a company can.

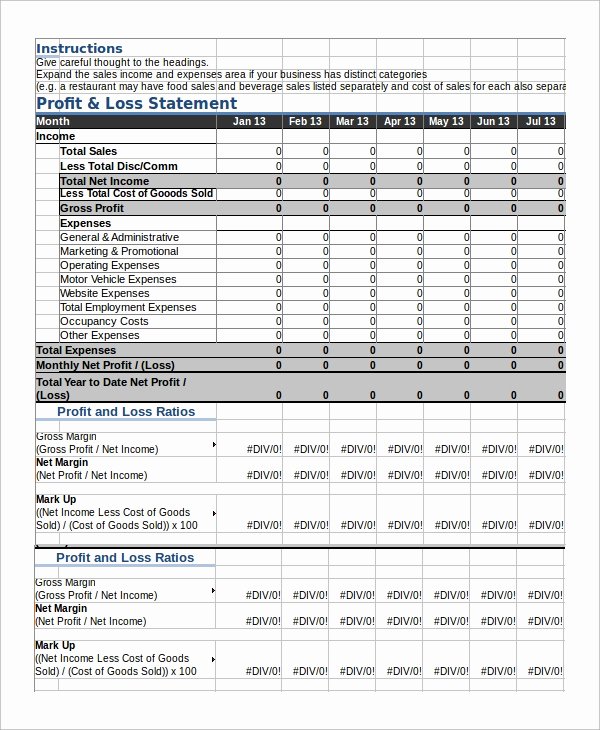

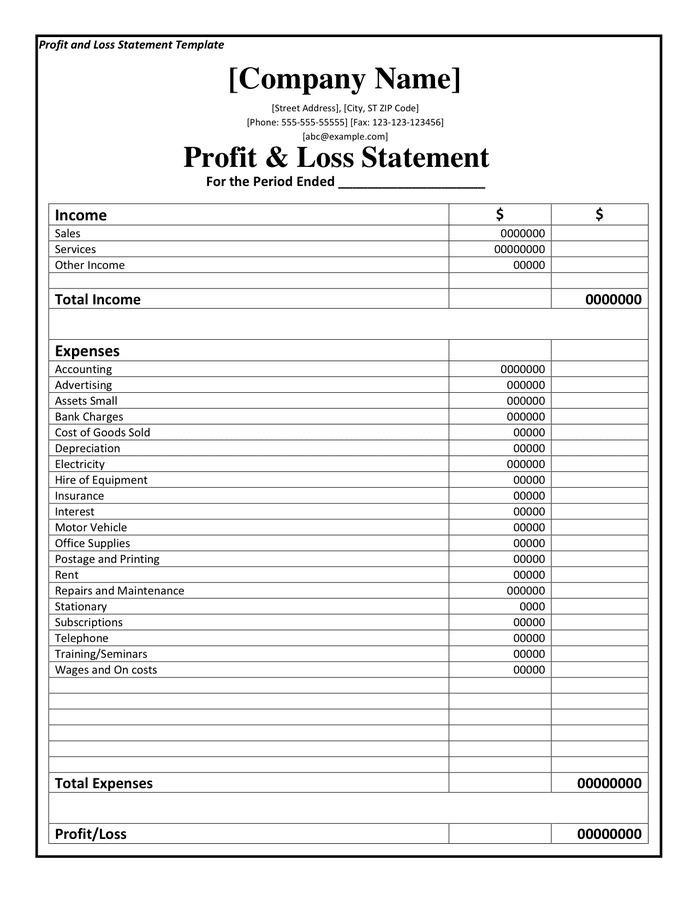

P&l statements are also referred to as a (n): What’s a profit and loss statement (p&l): A profit and loss statement is a financial report that shows how much your business has spent and earned over a specified time.

How to read a profit and loss statement In short, the profit and loss statement reports a company's revenues, expenses, and most of the gains and losses which occurred during the period of time shown in the statement's heading. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period.

The bottom line on a p&l will be net income, also known as profit or loss. The purpose of a p&l statement. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. In other words, the statement shows the profitable of a company for a time period. The profit and loss statement is a financial statement that summarizes the revenues, costs and expenses incurred during a specified period.

It shows your revenue, minus expenses and losses. Why is a p&l statement important to investors and traders? The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe.

It is identical to profit/loss for the period attributable to equity owners of the parent as defined by ifrs rules. Components of a profit and loss. It includes expenses, revenues, profits and losses over a specific period of time.

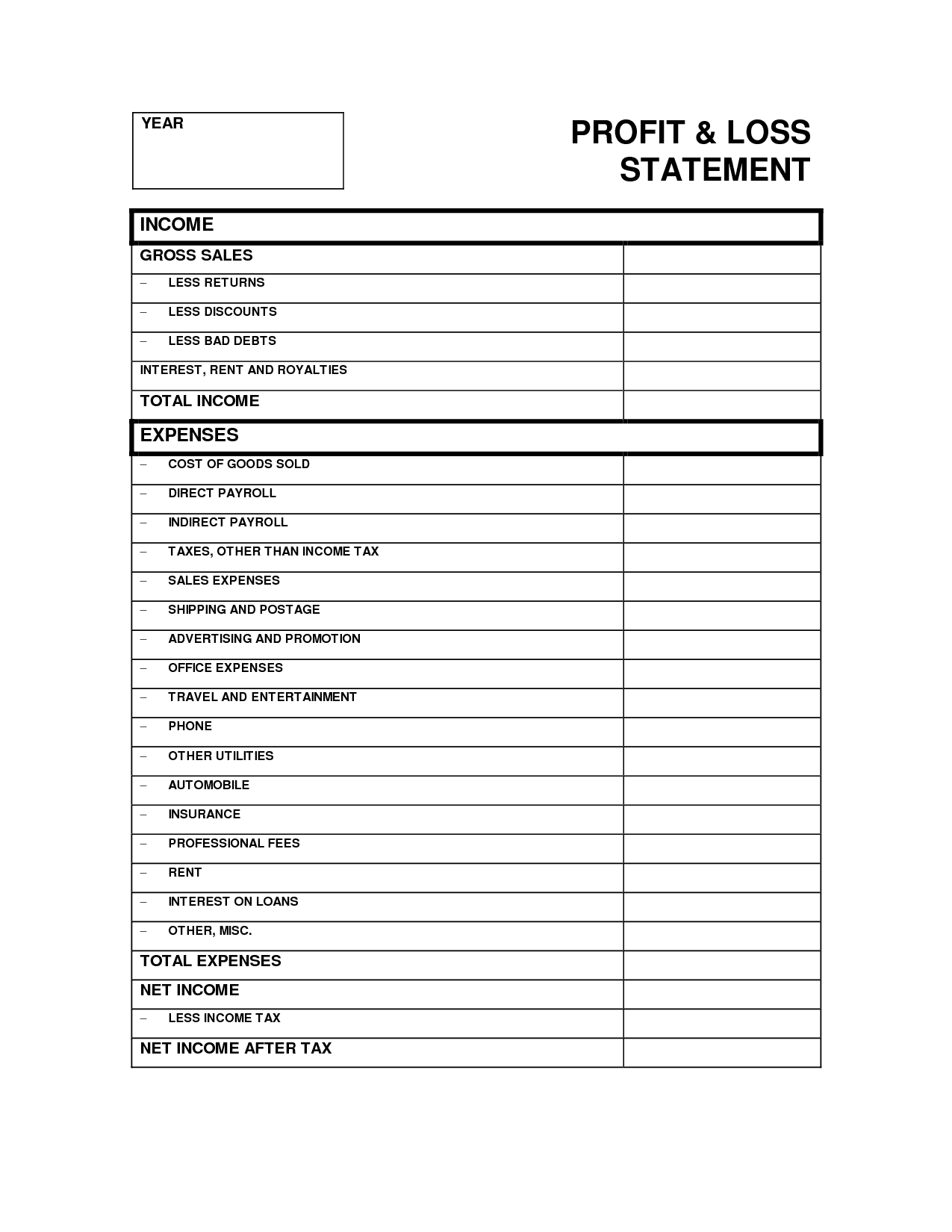

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A profit and loss (p&l) statement, together with the balance sheet and the cash flow statement, is one of three primary financial statements that assess a company's financial performance over time. The gross sales line item includes all sales recognized by the business during a reporting period.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-for-Small-Business-TemplateLab.com_-scaled.jpg)