Fabulous Info About Income Statement Indirect Method

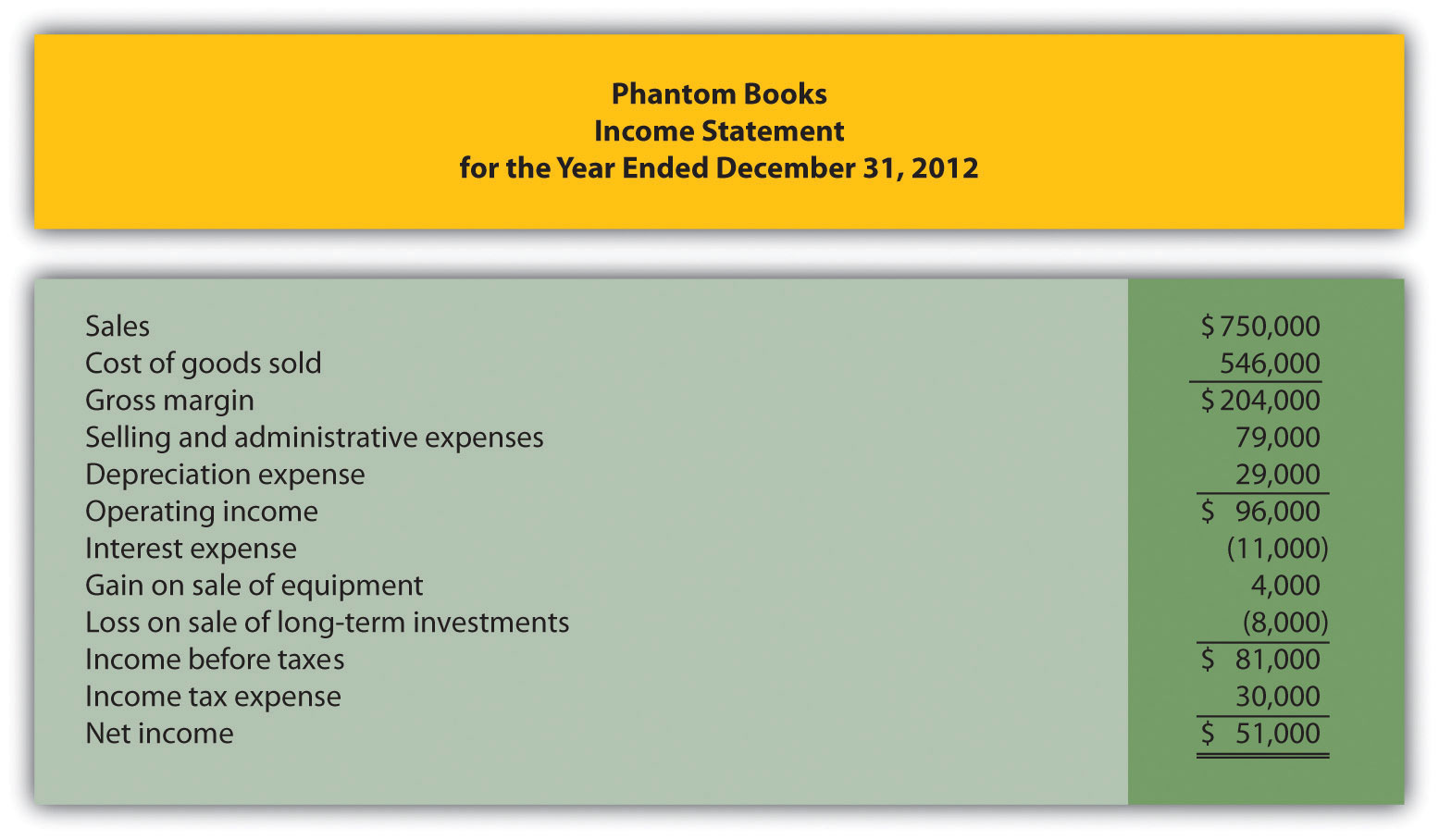

![[Solved] Prepare statement of cash flows using indirect method](http://2012books.lardbucket.org/books/accounting-for-managers/section_16/cb4f80e35640bf7be5a6bb78798febac.jpg)

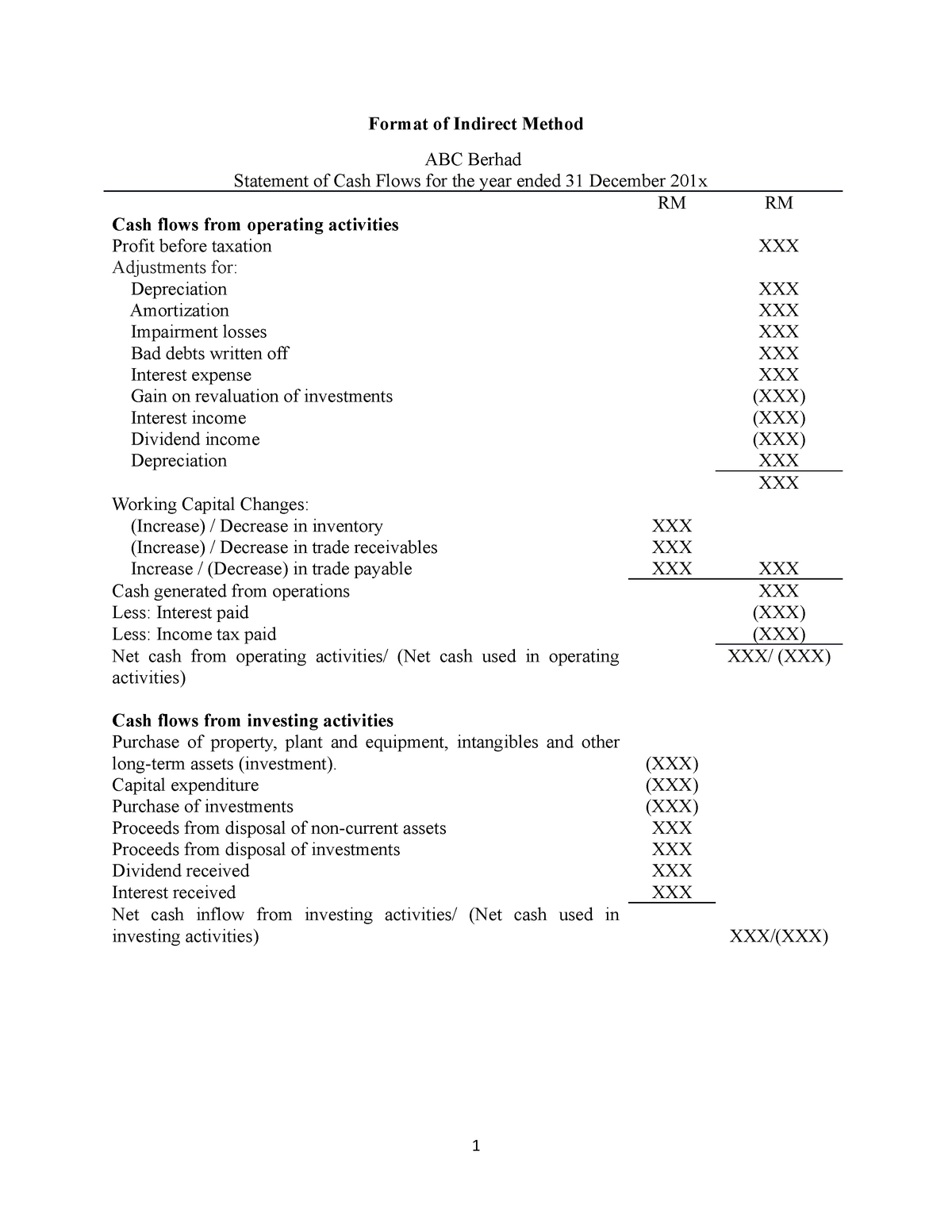

Using the indirect method, operating net cash flow is calculated as follows:

Income statement indirect method. Add back noncash expenses, such as depreciation, amortization, and depletion. This means that it uses increases and decreases in balance sheet accounts. The first of these is the income statement, also known as the profit & loss statement (p&l).

The indirect method would find these cash flows as follows: Determine net cash flows from operating activities. Add back noncash expenses, such as depreciation, amortization, and depletion.

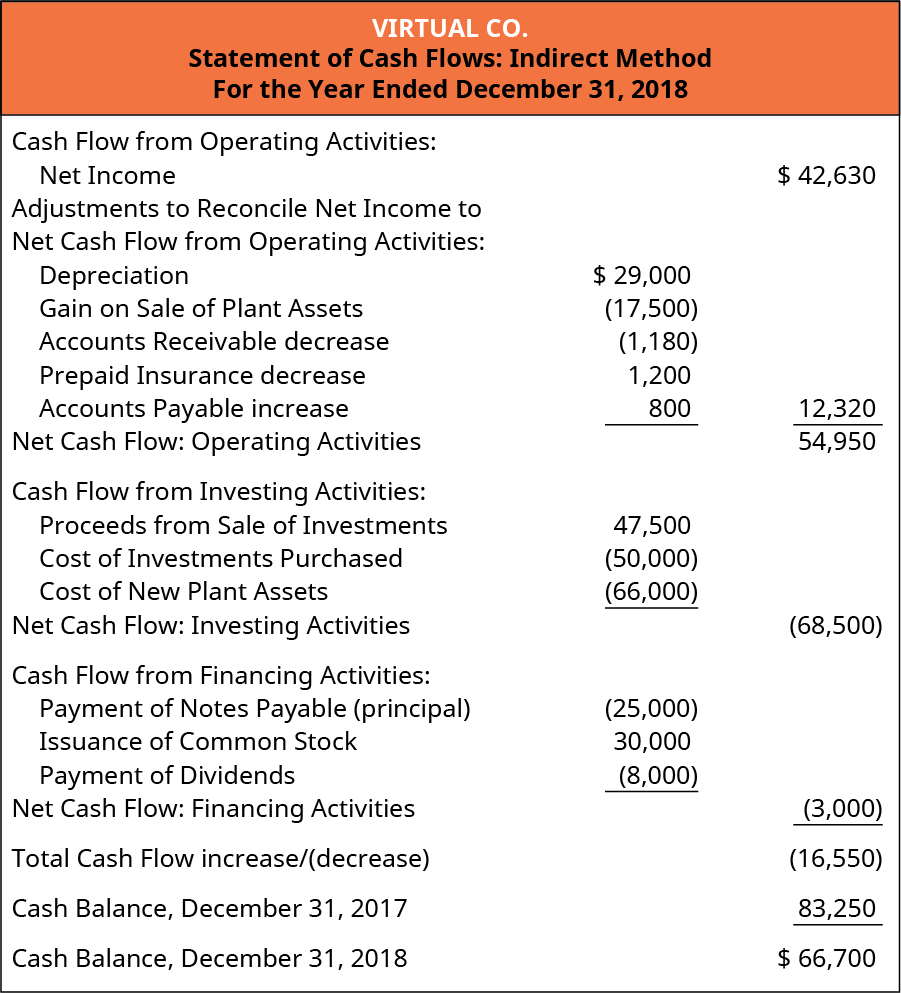

What is the indirect method of a cash flow statement? In this section, we use the example of virtual co. The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities.

The indirect method adjusts net income (rather than adjusting individual items in the income statement) for (1) changes in current assets (other than cash) and current liabilities, and (2) items that were included in net income but did not affect cash. A company can choose the indirect method or the direct method. In this section, we use the example of virtual co.

This video demonstrates how to prepare a statement of cash flows using the indirect method. Explained a cash flow statement contains three sections; Virtual’s comparative balance sheet and income statement are provided as a base for the preparation of the statement of cash flows.

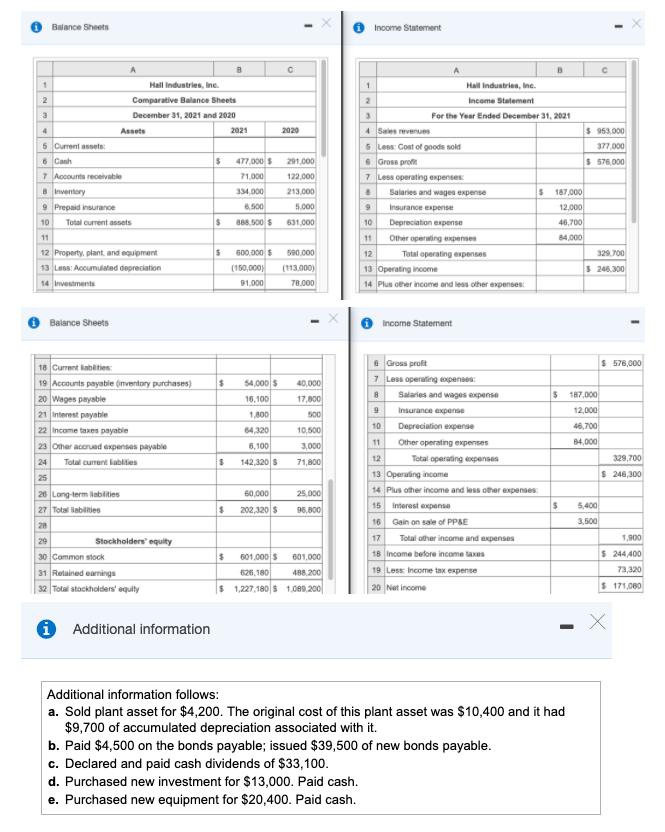

To construct the cash flow statement using the indirect method, we combine information from the two fundamental financial statements. The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. To work through the entire process of preparing the company’s statement of cash flows using the indirect method.

What is the statement of cash flows indirect method? The indirect method adjusts net income (rather than adjusting individual items in the income statement) for (1) changes in current assets (other than cash) and current liabilities, and (2) items that were included in net income but did not affect cash. If not, that will need to be done first before you can finish the cash flow statement using.

The indirect method is one of two accounting treatments used to generate a cash flow statement. Virtual’s comparative balance sheet and income statement are provided as a base for the preparation. Add back noncash expenses, such as depreciation, amortization, and depletion.

The indirect method uses increases and decreases in balance sheet line items to modify the. You’ve probably heard about this on multiple occasions. Begin with net income from the income statement.

The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of. A comprehensive example is provided to illustrate how an income. What is the cash flow statement indirect method?