Breathtaking Info About P&l Debit And Credit

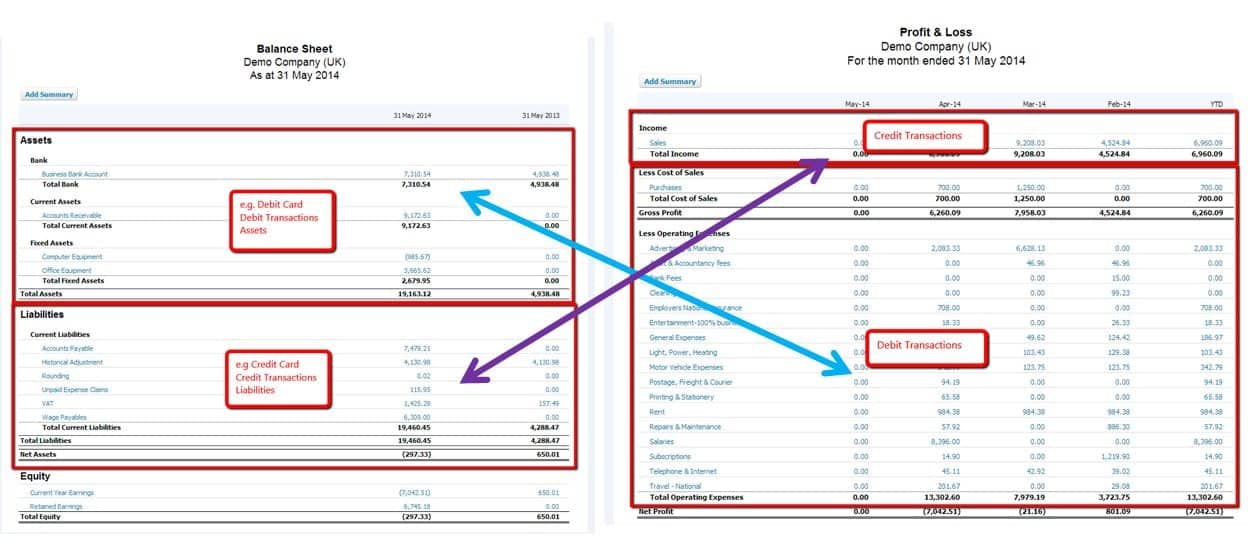

In a p&l account, when the expenses (debit) are greater than the incomes (credit), the business is said to be in a net loss.

P&l debit and credit. This loss is what we call the debit balance of a profit. But then people start throwing around terms like “asset. The other two are the balance sheet and the cash.

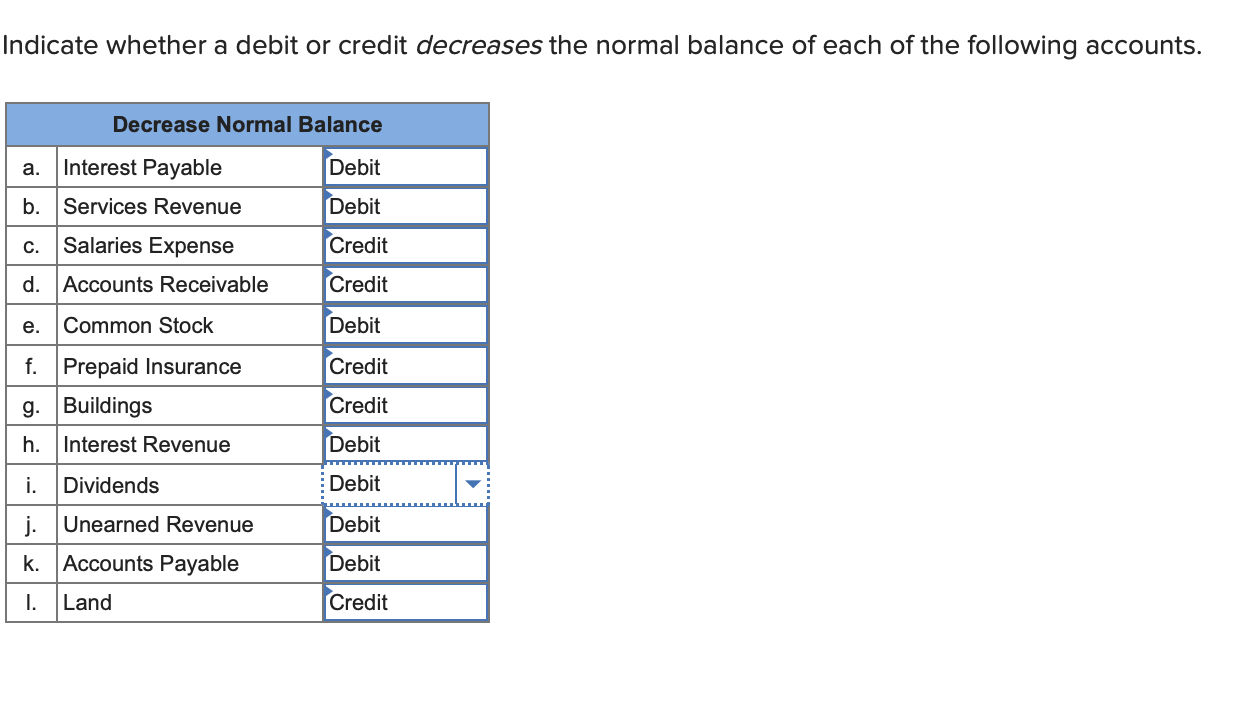

Your business p&l may look like this: A profit and loss statement (p&l) is an effective tool for managing your business. A debit is an accounting entry that either increases an asset or expense account, or decreases a liability or equity account.

Debit and credit are the two accounting tools. It gives you a financial snapshot of how much money you’re making (or losing) and can make. In the world of accounting, profit and loss accounts have a debit balance when the debit side (expenses & losses) exceeds the credit side (incomes and gains).

Debits and credits explained. A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. A p&l statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and.

Let’s look at some examples of typical business transactions and. Business transactions are to be recorded and hence, two accounts, which are debit and credit, get facilitated. Hub bookkeeping february 16, 2023 debits and credits seem like they should be 2 of the simplest terms in accounting.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Debits are the opposite of credits in an accounting system. Profit and loss (p&l) statement.

Every transaction you make will lead to (at least) two entries in your accounts, a debit and a credit. Debits represent money that is paid out of an account and credits represent money that is paid into an account. The terms debit (dr) and credit (cr) have latin roots:

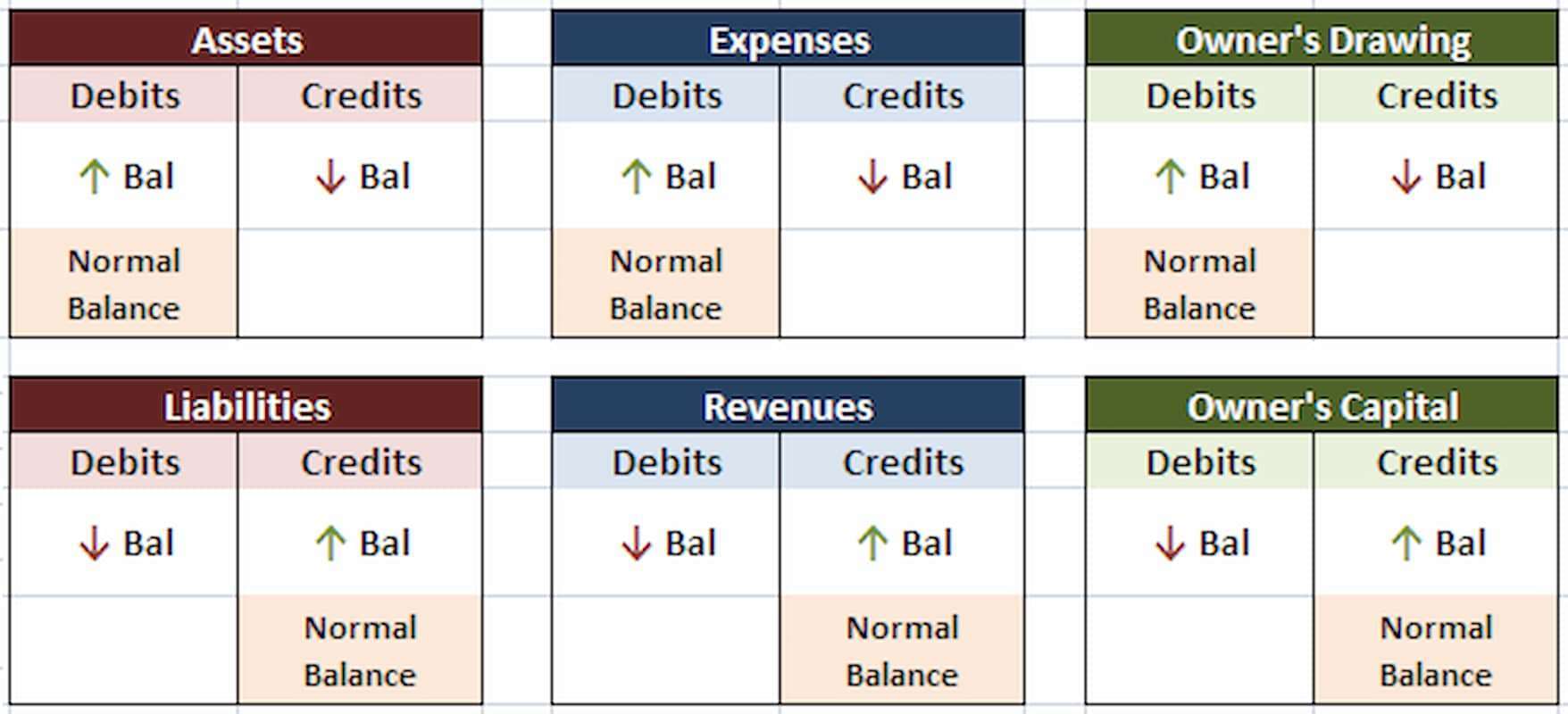

It is positioned to the left. Debits increase asset and expense accounts while decreasing liability,. The main differences between debit and credit accounting are their purpose and placement.

Profit's effect on the balance sheet. Assets and expenses have natural debit balances, while liabilities and revenues have natural credit. The profit or net income belongs to the owner of a sole proprietorship or to the stockholders of a corporation.

If a company prepares its. In the accounting equation, assets = liabilities + equity, so, if an asset.

.png)