The Secret Of Info About Adjusting Entries Are Made After The Preparation Of Financial Statements

Correct answer will be given on.

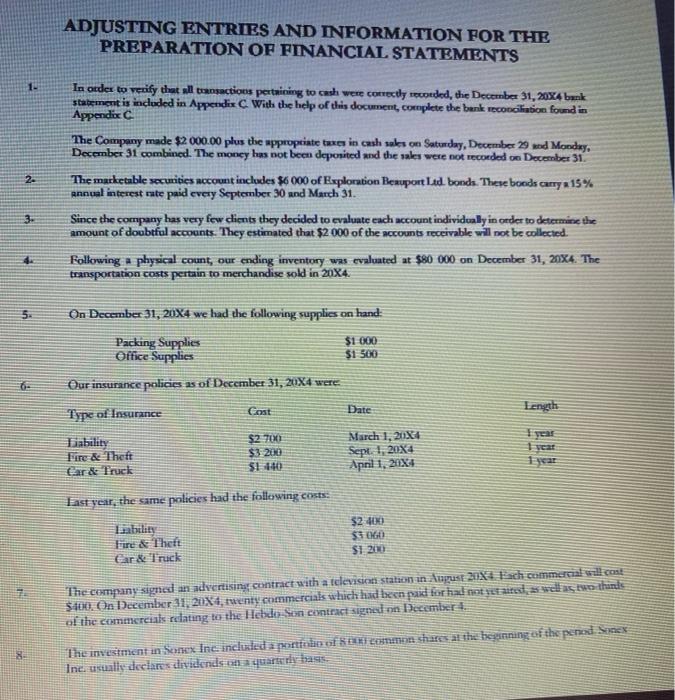

Adjusting entries are made after the preparation of financial statements. Adjusting entries are made after the preparation of financial statements. Adjusting entries are made after the preparation of financial statements. Making adjusting entries is a way to stick to the matching principle—a principle in accounting that says expenses should be recorded in the same accounting period as.

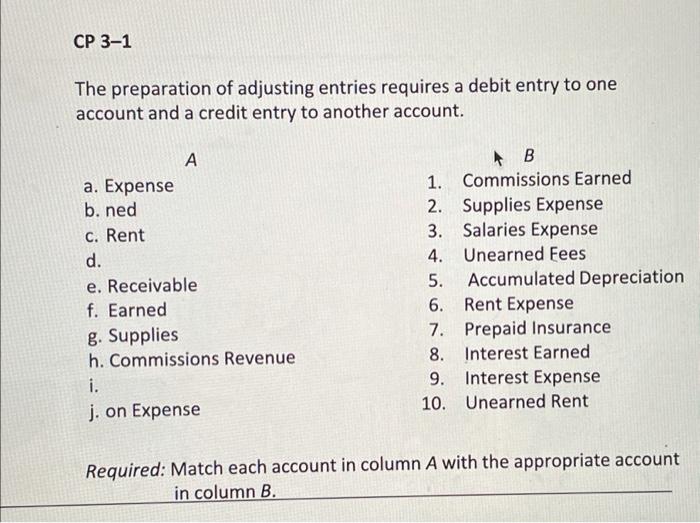

Adjusting entries are necessary to update all account balances before financial statements can be prepared. Contains at least one balance sheet account and one income statement. Before beginning adjusting entry examples for klo, let’s consider some rules governing adjusting entries:

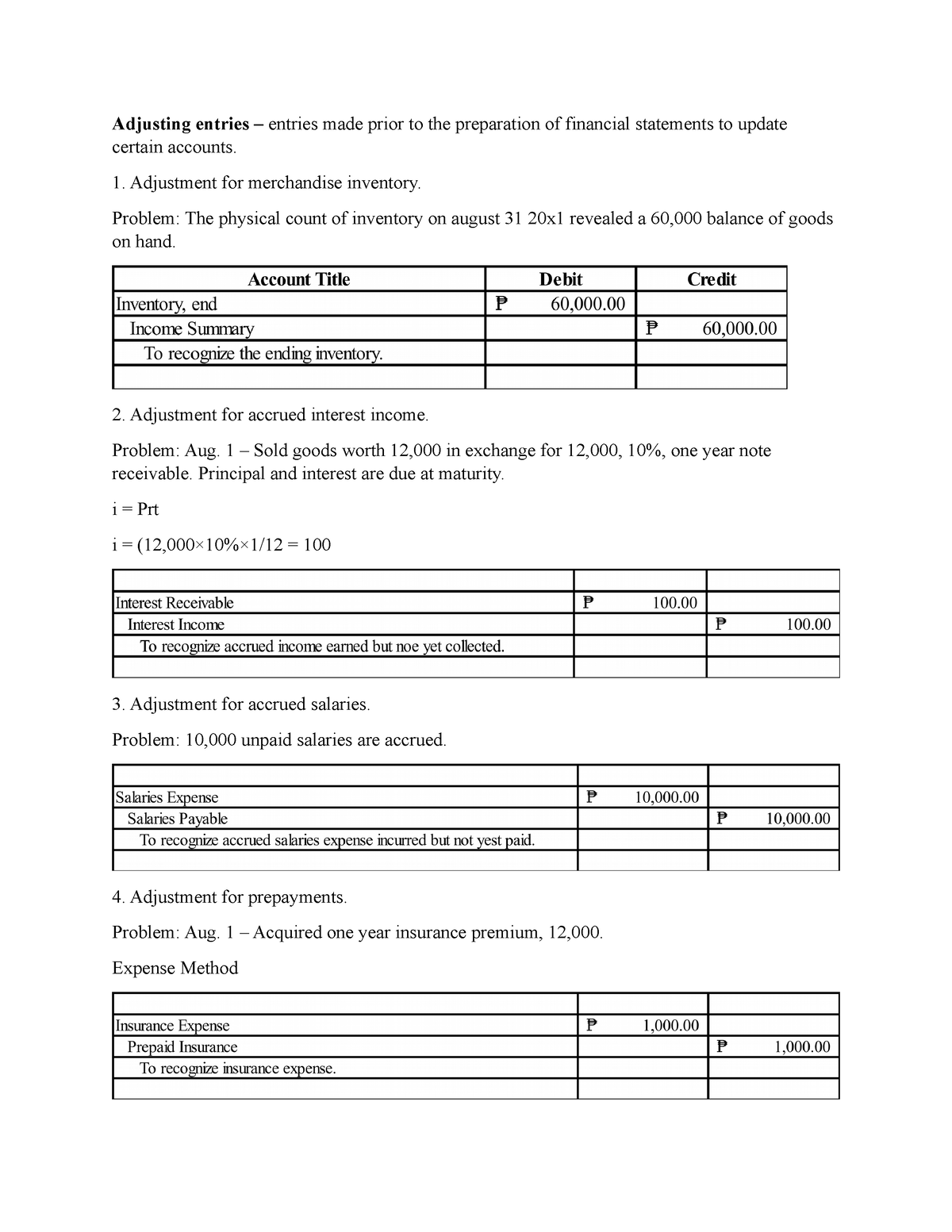

Every adjusting entry will have at least one income statement. The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. So if purchases had been $280,500 during the year, the.

Adjusting entries, also known as adjusting journal entries (aje), are the entries made in a business firm’s accounting journals to adapt or update the revenues and expenses. True [test choice) do not select this option. Adjusting entries affect only balance sheet accounts.

The eight steps of the accounting cycle are as follows: One important accounting principle to remember is that just as the accounting equation (assets = liabilities + owner’s equity/or common stock/or capital) must be equal, it must. Adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before the financial statements are prepared.

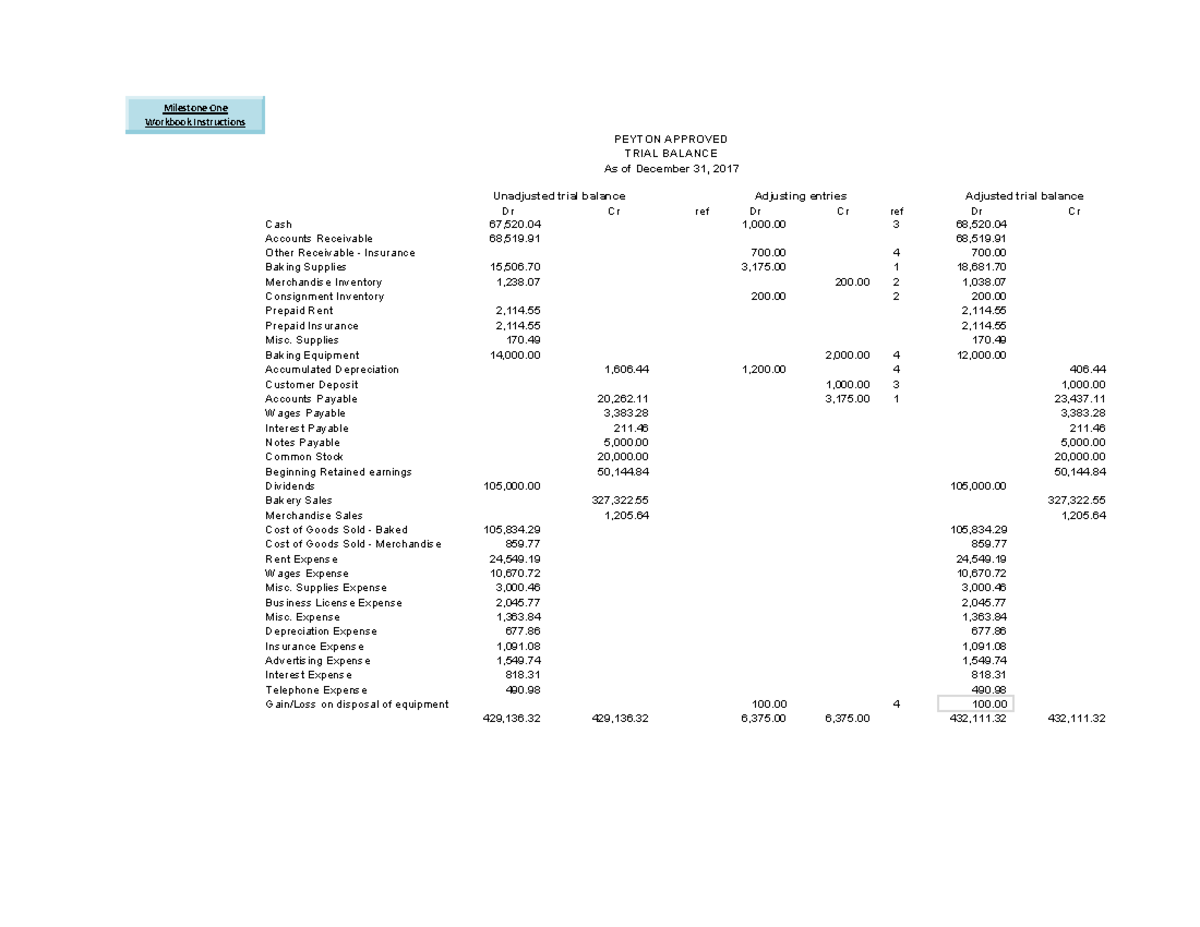

Identifying transactions, recording transactions in a journal, posting, the unadjusted trial balance,. Once you have prepared the adjusted trial balance, you are ready to prepare the financial statements. Types of adjusting journal entries

An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period. Key highlights an adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. The accounting principle that requires revenue to be recorded when earned is the:

The adjusting entries for prepaid items usually occurs when financial statements are prepared, not on a daily basis. It must be transferred out to this year’s statement of profit or loss, before the entry for the new closing inventory is made: Preparing financial statements is the seventh step in the accounting cycle.

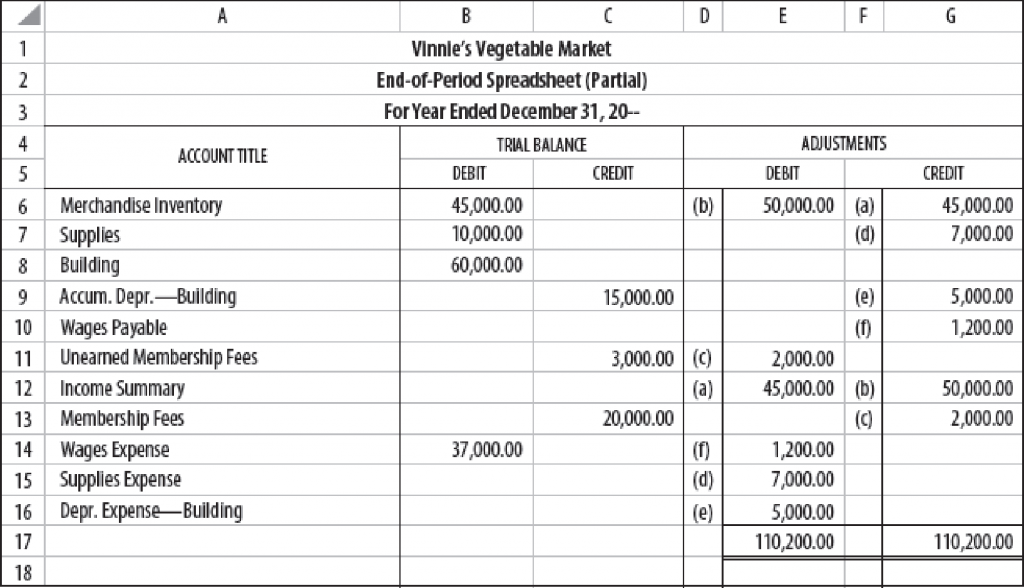

To align reported balances with the rules of accrual accounting, adjusting entries are created as a step in the preparation of financial statements. The preparation of adjusting entries is the fifth step of the accounting cycle that. Once you have prepared the adjusted trial balance, you are ready to prepare the financial statements.

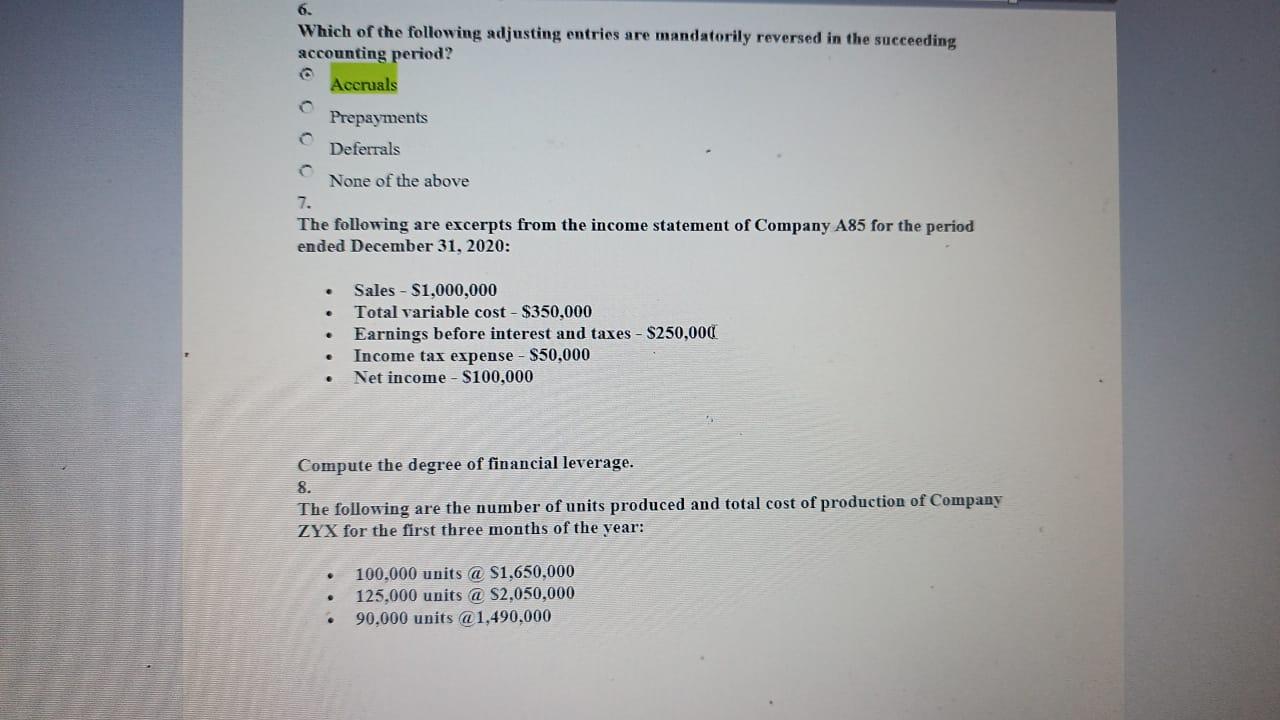

Adjusting entries also known as adjusting journal entries are made at the end of each financial year before preparing financial statements. At the end of the accounting period, after financial. At the end of the company’s accounting period, adjusting entries must be posted to accounts for accruals and deferrals.