Cool Info About Investment Revenue On Income Statement

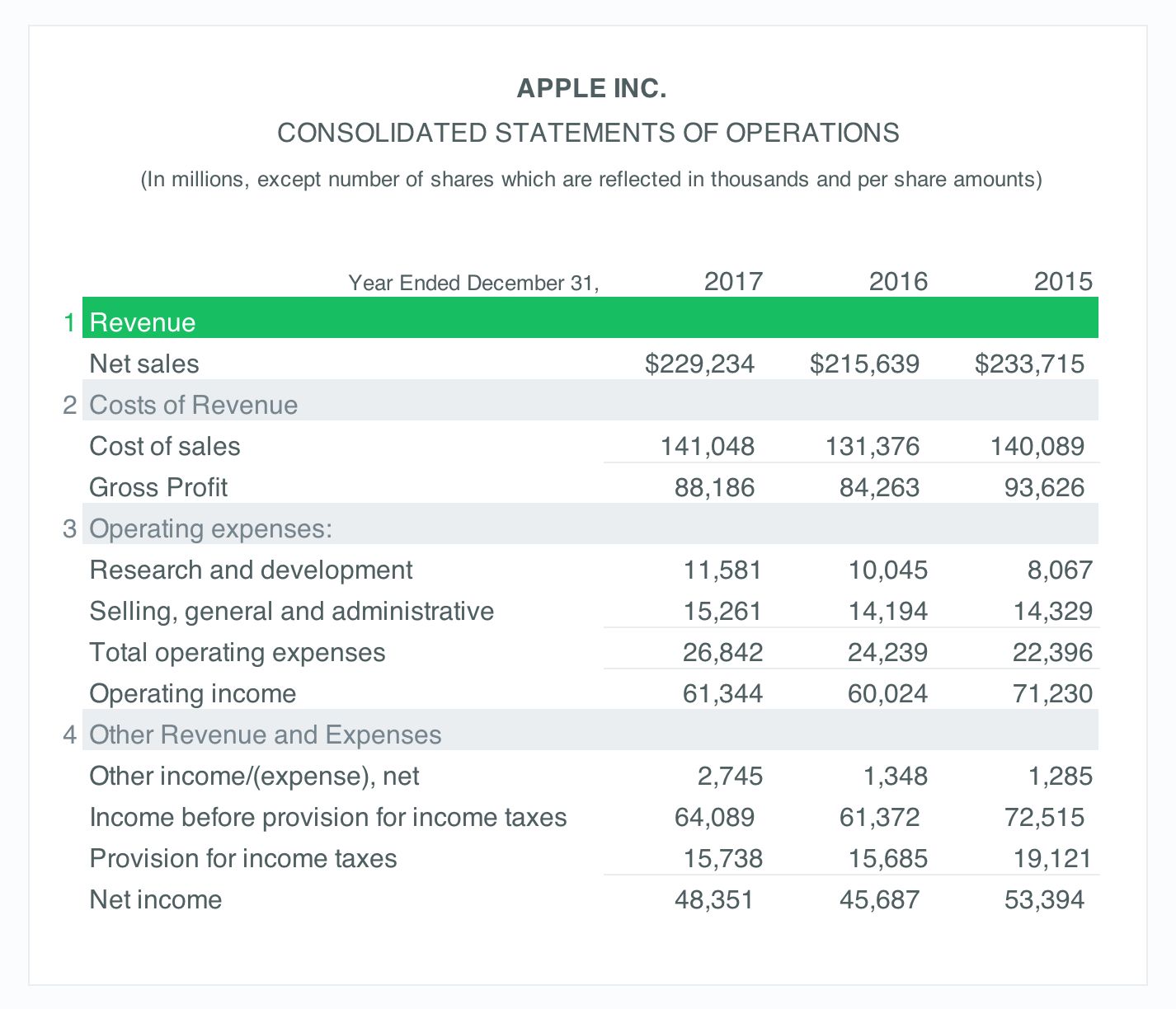

The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income.

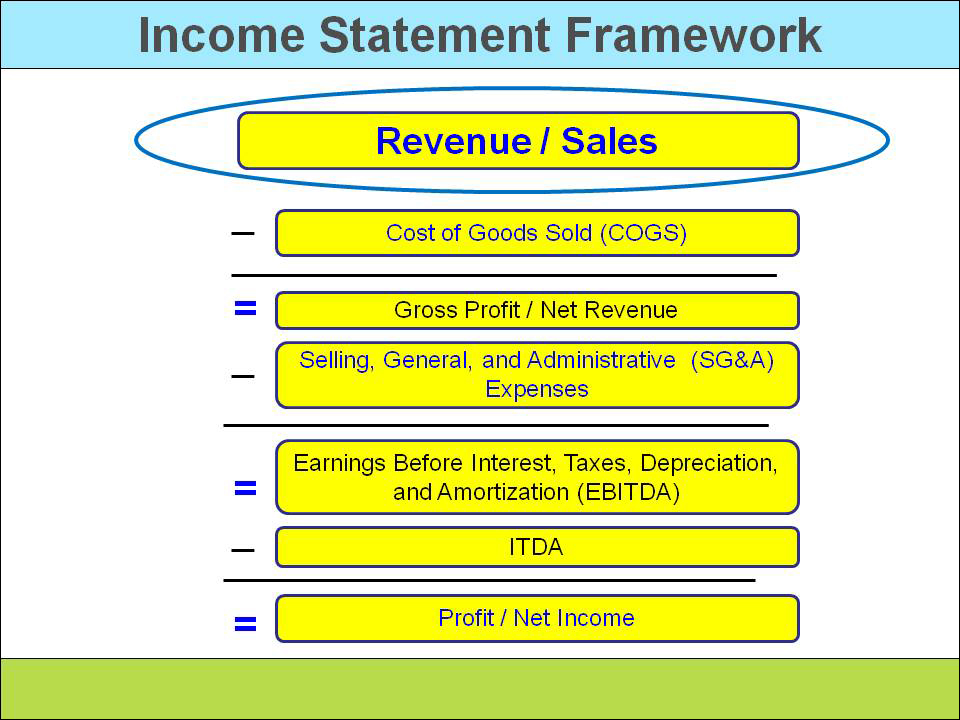

Investment revenue on income statement. Once expenses are subtracted from revenues, the statement produces a company's. What is an income statement? The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a.

At the bottom of the statement is net income and usually information about shares, such as eps. The first line on any income statement or profit and loss statement deals with revenue. The income statement focuses on four key items:

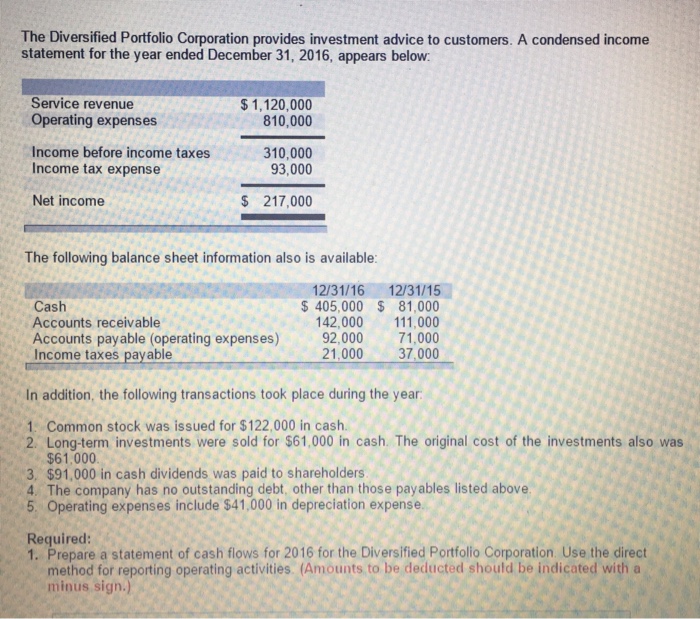

An investment income is recorded in the income statement. For a $10 million investment, we're getting $1 million a year. Dividends from bonds also are investment income.

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The income statement primarily focuses on a company's revenues and expenses during a particular period. The equation driving the income statement is:

The equity method does not involve consolidation of revenue or other income statement items. Revenue grew 15% yoy to $9.9 billion, or 13% on a constant currency basis. When looking at an income statement, you’ll see that there are three main sections.

The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. Companies have multiple reasons for. In most cases, investment income is recognized in income statement.

Revenue is the money generated from normal business operations, calculated as the average sales price times the number of units sold. Investment income is taxed at a. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

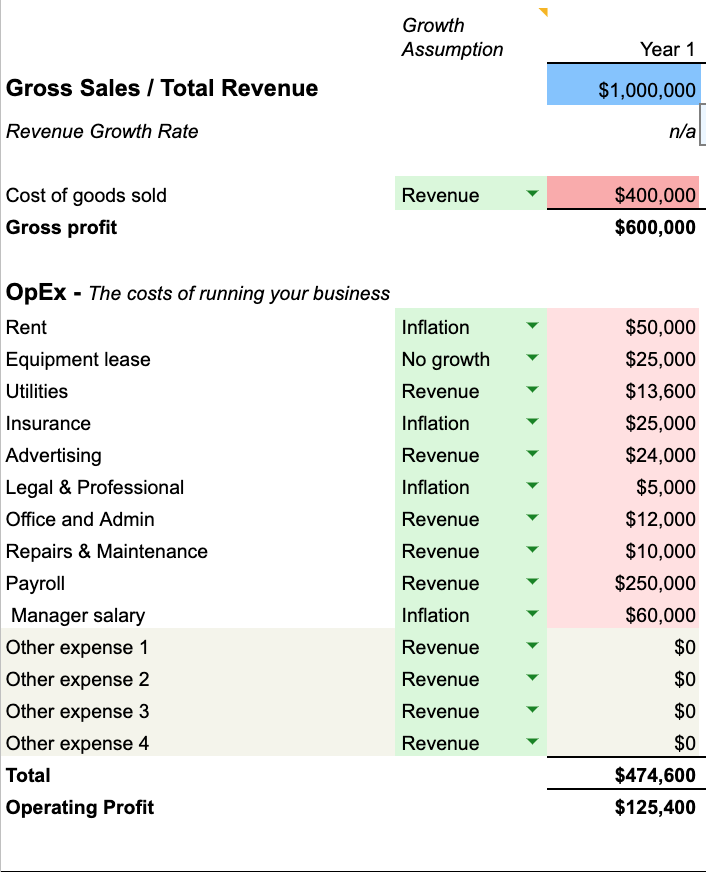

Grow revenues by inputting an aggregate growth rate. Net income from operations summarizes revenue and expenses from operational transactions. Find out the revenue, expenses and profit or loss over the last fiscal year.

Investors should know what to look for to understand the impact on a company's operating performance. We're getting 10% of our asset investment back every year. The income statement is also sometimes referred to as.

Then you’ll see a breakdown of the company’s expenses and losses. Accounting for investment income. It is the top line (or gross.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)