Best Tips About Profit And Loss Statement Nz

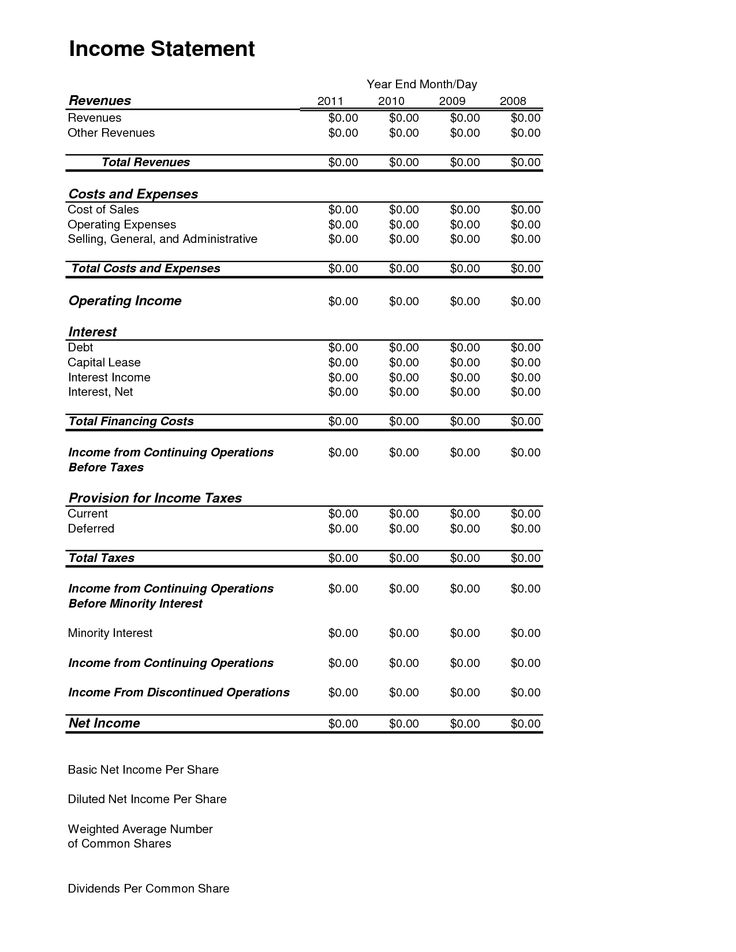

Learn about the two main financial statements for your business:

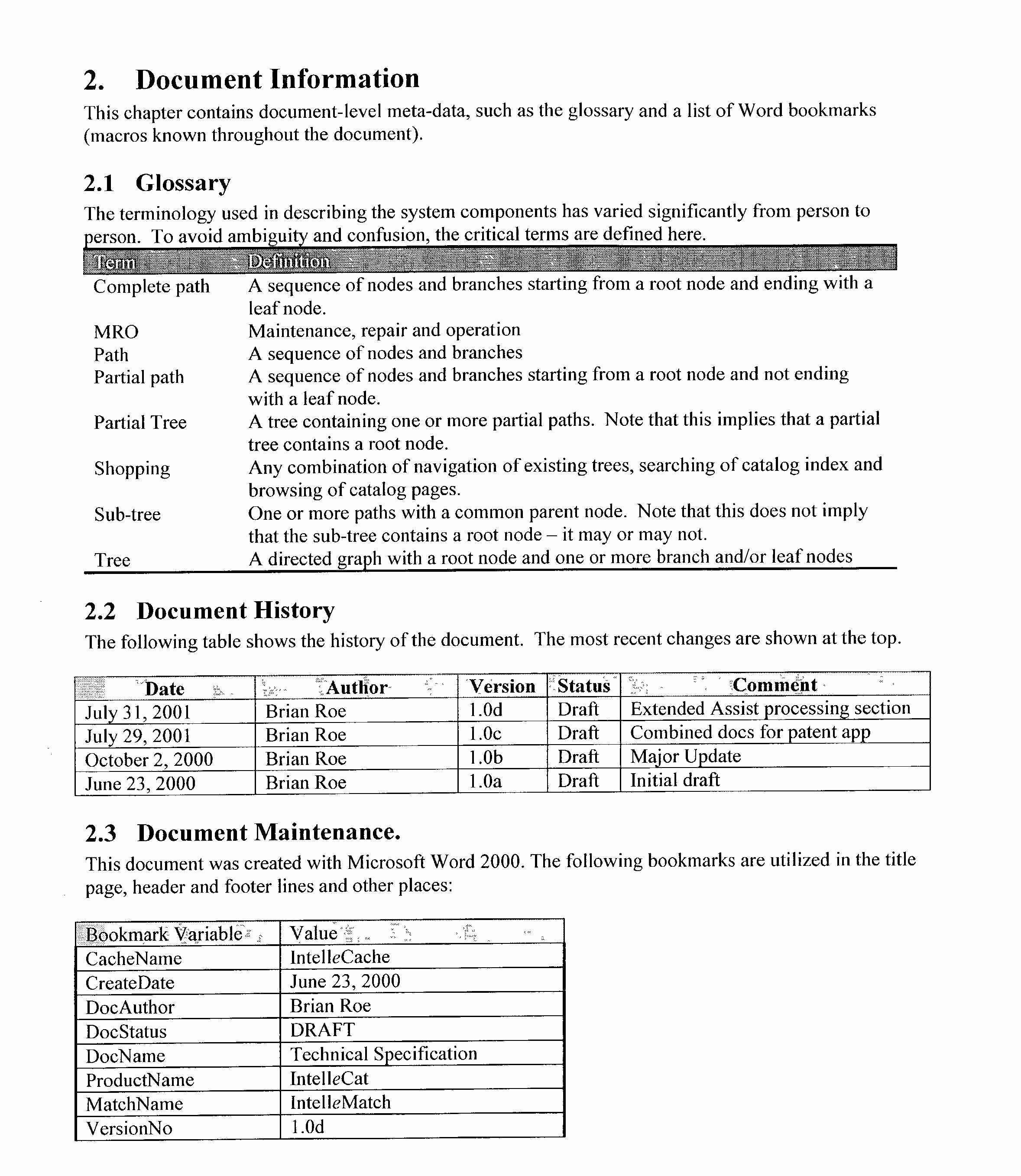

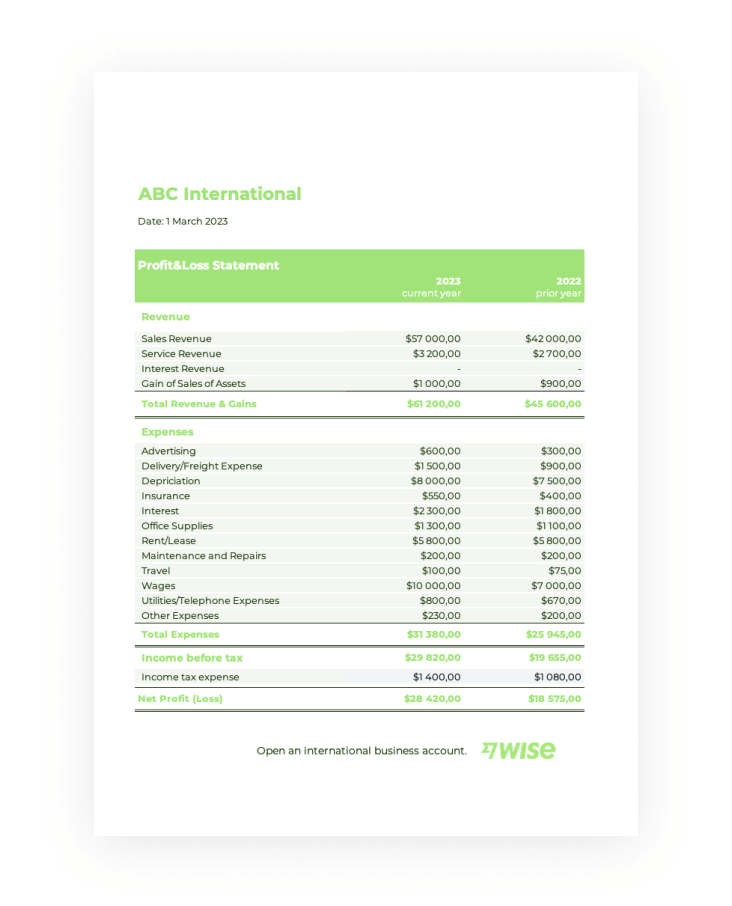

Profit and loss statement nz. Access all xero features for 30 days, then decide which plan best suits your business. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. It basically shows the money that comes in and the money that goes out.

A$36.6 billion, up by 4.4%. It’s in three parts, each with line items within it: Start using xero for free.

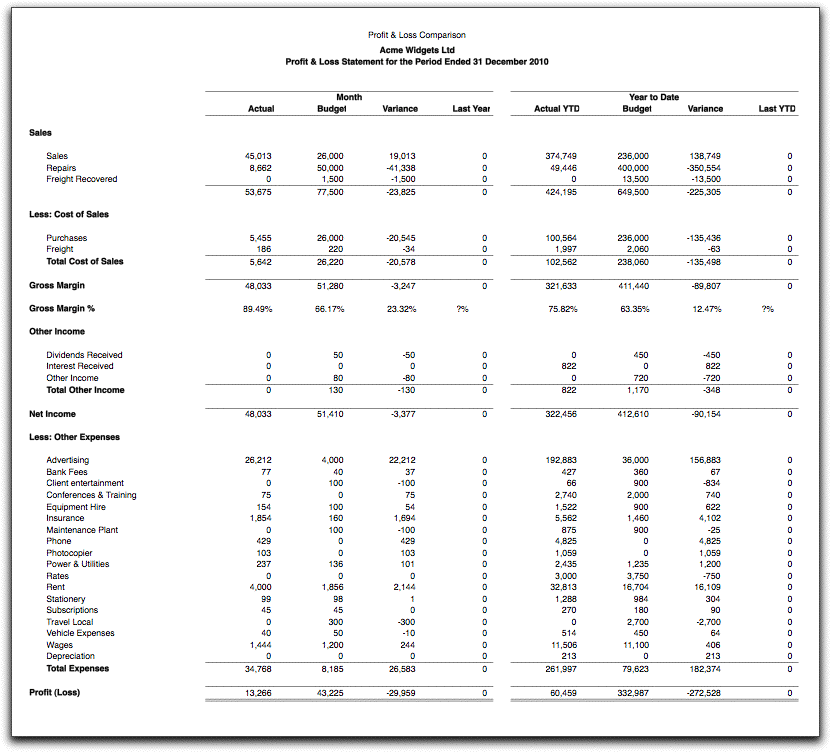

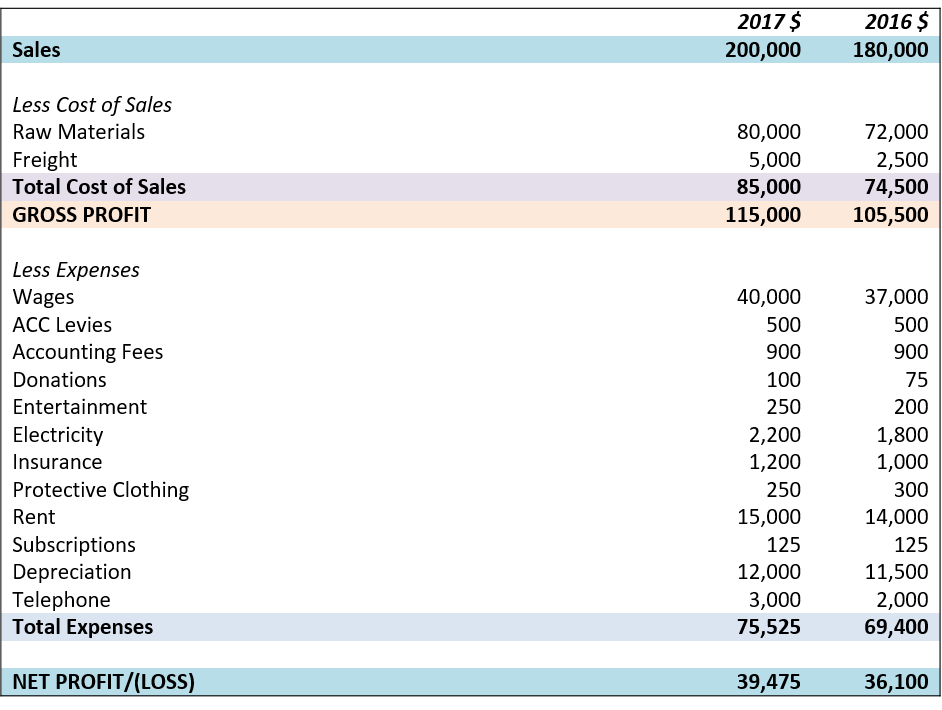

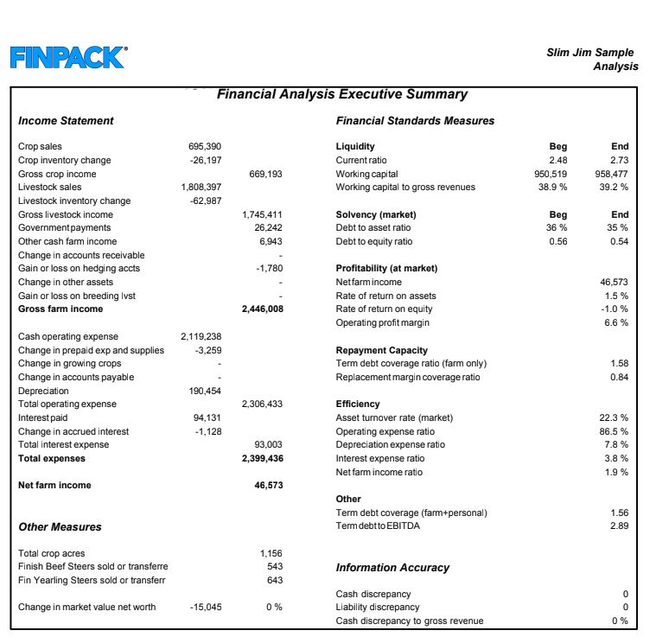

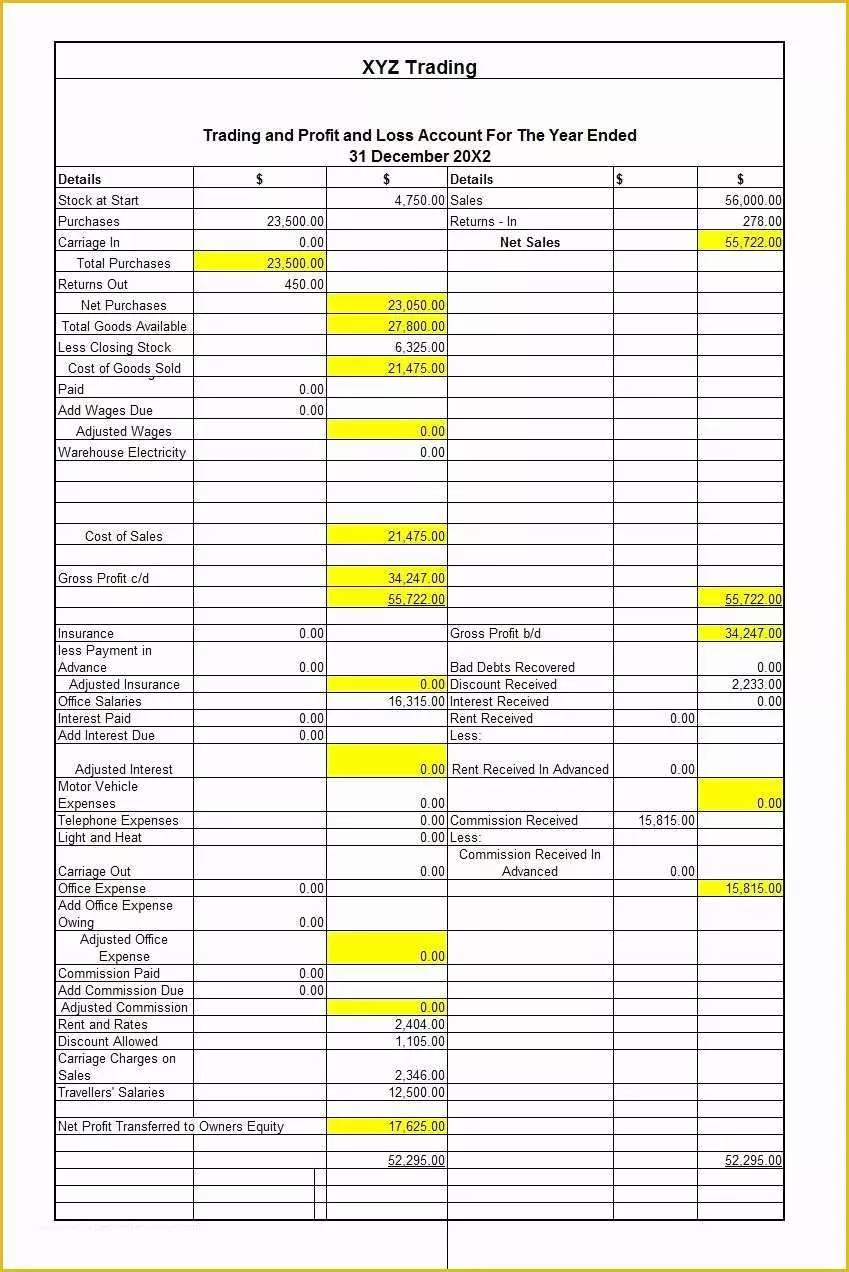

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it captures how money flows in and out of your business. Showing the profit and loss figures over a set period of time; The balance sheet and the profit and loss statement, and how to calculate some key finance ratios like profitability, business efficiency, or business liquidity ratios.

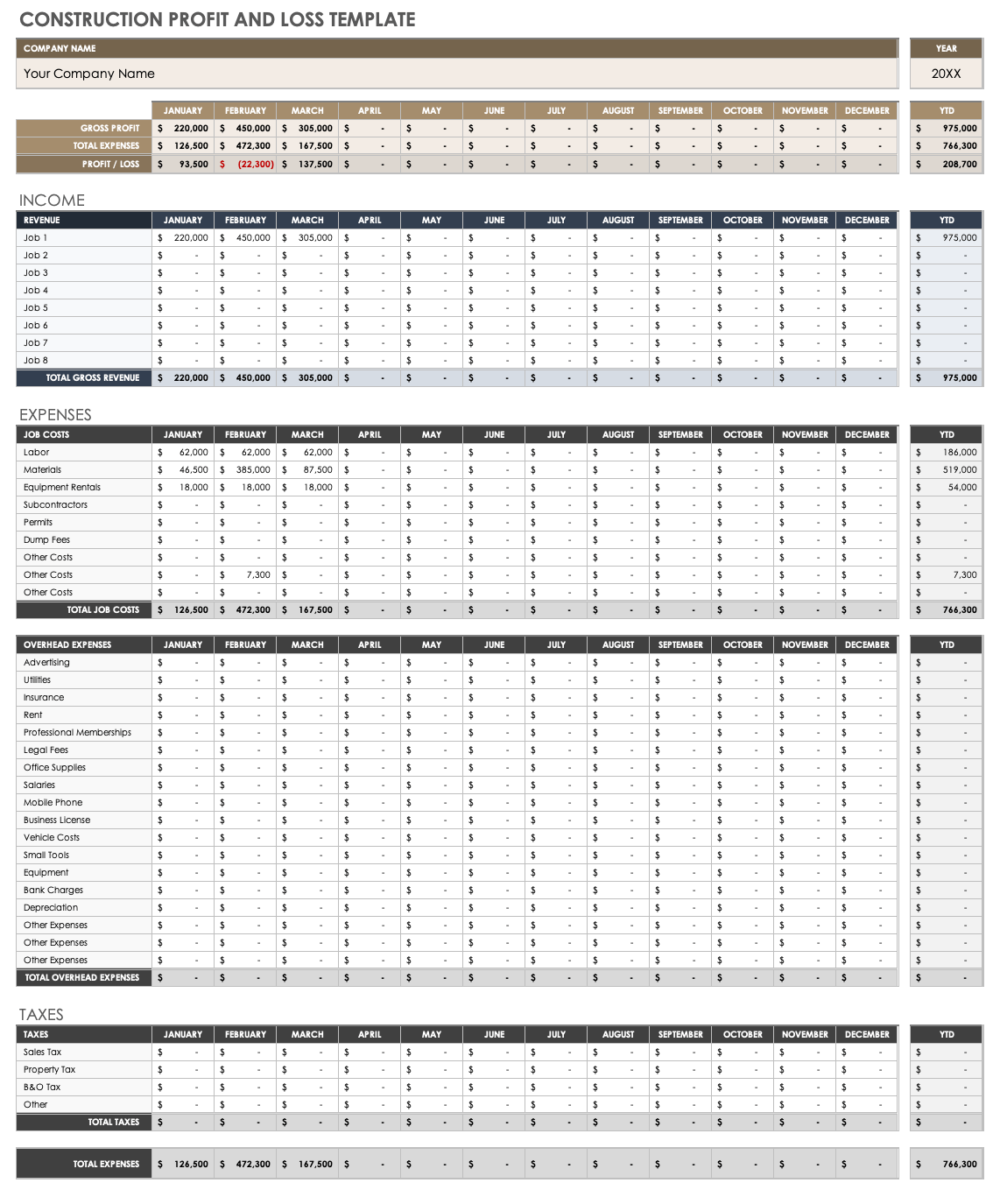

Create a profit and loss (p&l) statement with this simple template. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Enter the total amount of gross profit as shown in the profit and loss statement.

A profit and loss (p&l) statement (also known as an income statement) summarises the costs and expenses of your business, incurred during a particular period. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. Profit and loss statement.

It tracks how your business is doing and can help explain changes, eg why profit is down even though revenue is. The cost of goods sold is calculated by adding opening stock and purchases (including other direct costs) and then deducting closing stock. Chief executive brad banducci is leaving the company after 13 years with the supermarket group.

Profit and loss statements show a company’s net income over a period of time. A profit and loss statement might also be called a p&l or an income statement. Profit and loss statements are also called p&l or income statements.

The profit and loss statement has two main sections: The profit and loss statement, also known as the income statement, tracks the financial performance of a business over a given period of time. A profit and loss statement is a straightforward way to summarise expenses and income during a period of time.

Analysing profit and loss statements across various periods can offer detailed insight into a business' costs. It should be prepared at regular intervals (usually monthly and at financial year end) to show the results of operations for a given period. Your profit and loss statement (p&l) helps you understand your business performance and profitability over time.

The profit and loss statement has two main sections: It’s a full breakdown of your company’s revenue (money coming into the company as sales and other business income) and your expenditure (direct costs, overheads, expenses and other costs). They show all earnings and all costs over a time period, eg a quarter or a year.