Awesome Tips About Balance Sheet Guide

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://www.addictionary.org/g/002-simple-basic-balance-sheet-template-sample-1920_1729.jpg)

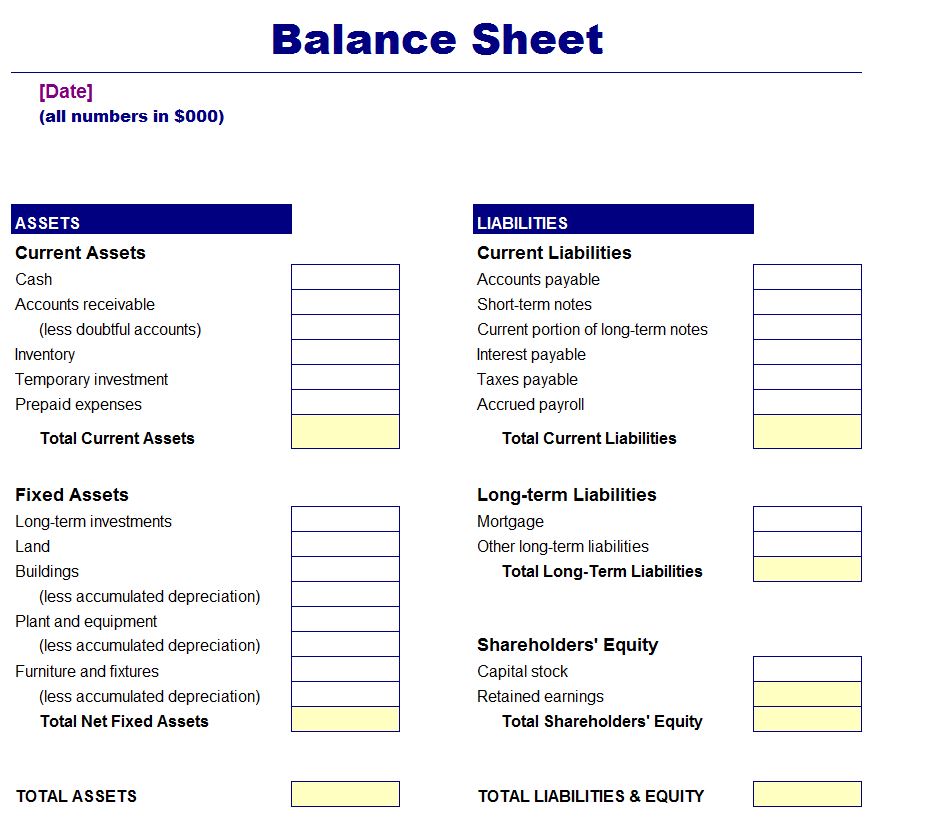

Set your balance sheet reporting date for the end of a fiscal quarter, month, or year.

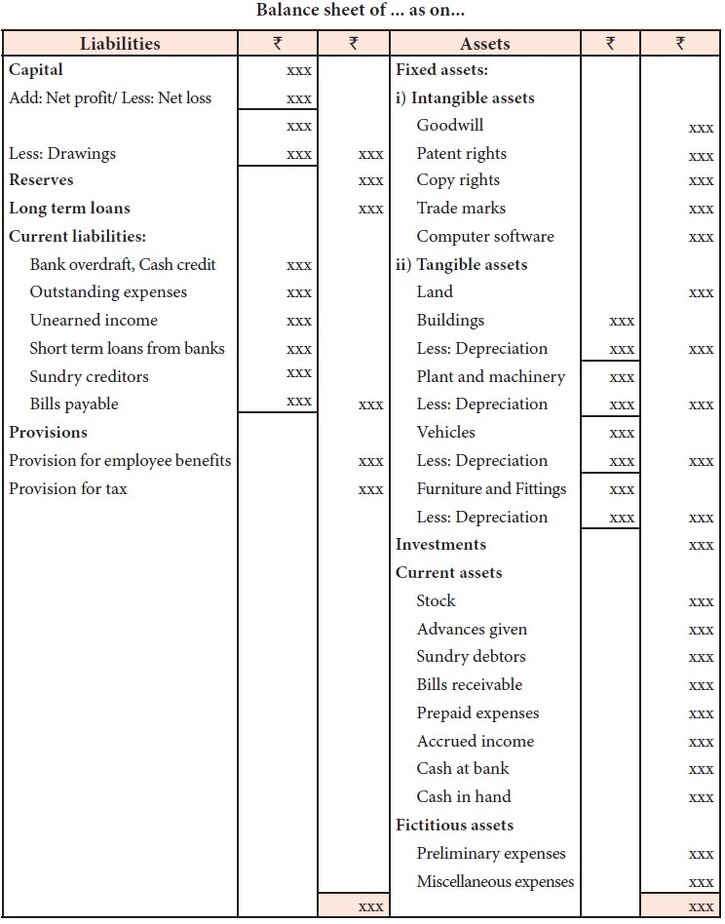

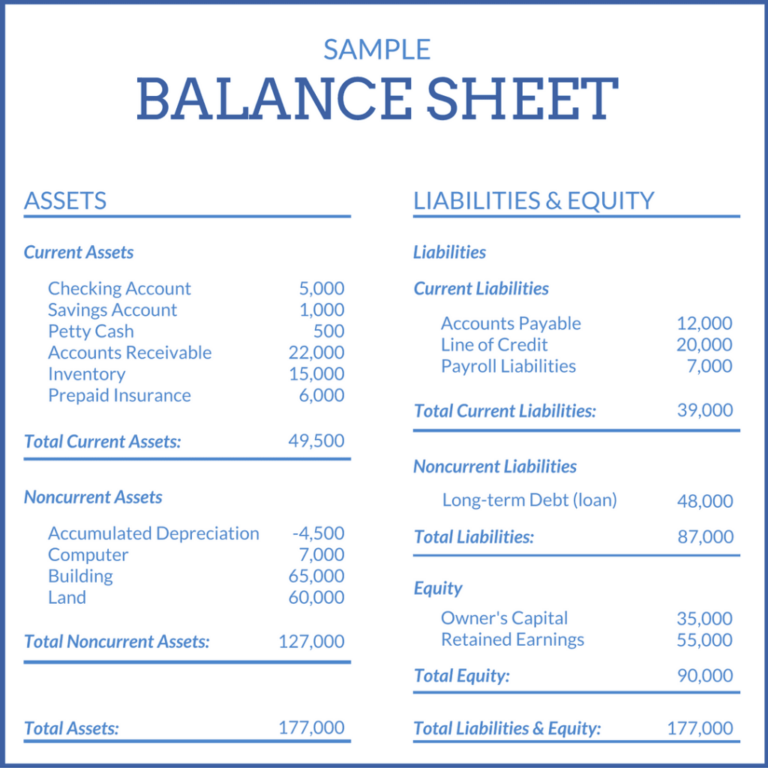

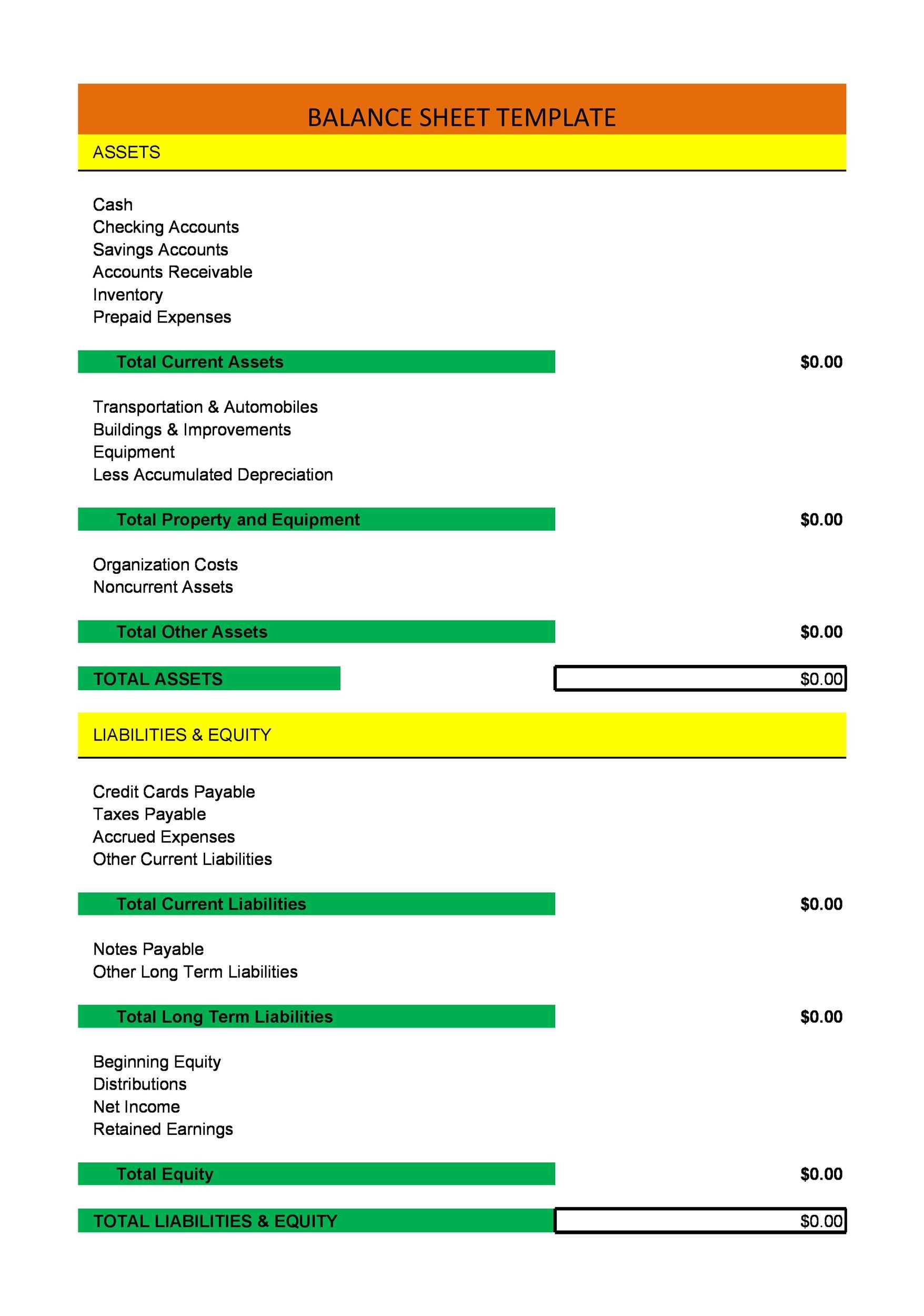

Balance sheet guide. A balance sheet is one of the key documents used in assessing the financial health of a business. It summarizes a company’s financial position at a point in time. Businesses typically prepare and distribute their balance sheet at the end of a reporting period, such as monthly, quarterly or annually.

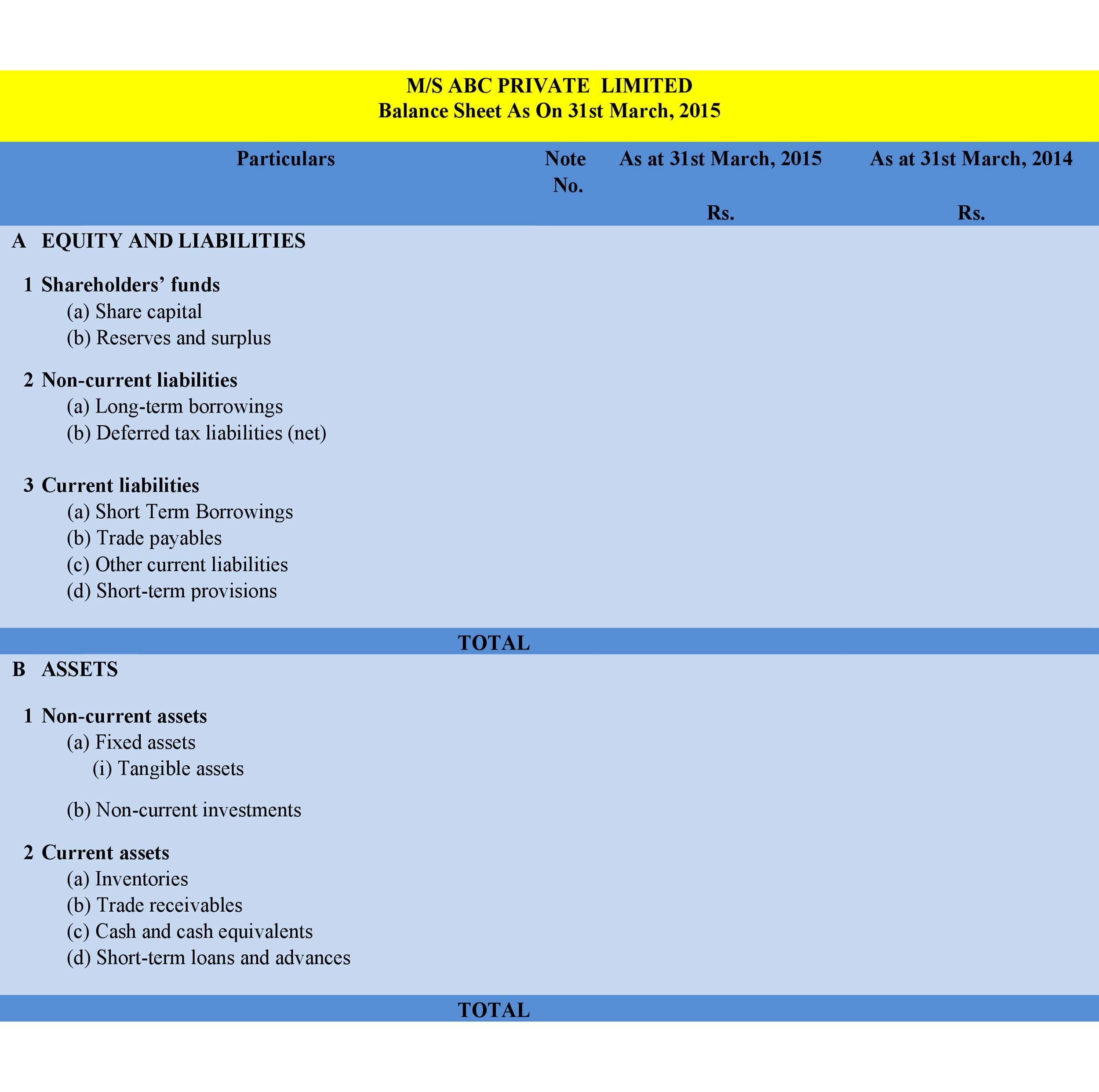

Balance sheets serve two very different purposes depending on the audience reviewing them. The balance sheet is one of the three financial statements businesses use to measure their financial performance. This guide outlines the components of a balance sheet and provides templates and examples, so you can generate one for your business.

Understanding the balance sheet is essential for investors, creditors, and company management as it helps assess liquidity, solvency, and overall financial stability. Alongside with income statement and cashflow statement, it helps to reveal a company's overall financial health. The balance sheet explained.

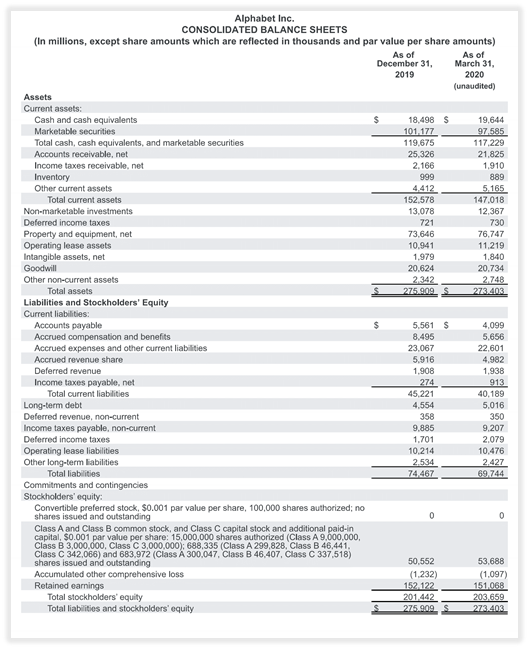

The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero. When evaluated along with the other financial statements, a balance sheet provides a view of the company at a specific point in time. 2024 digital marketing strategy guide.

Based on provisional unaudited data. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. Assets = liabilities + shareholders’ equity

The annual accounts of all the eurosystem national central banks will be finalised by the end of may 2024, and the final annual consolidated balance sheet of the eurosystem will be published thereafter. Conceptually, working capital is a measure of a company’s short. A balance sheet can make managing your budget a whole lot easier, regardless of whether you’re a small or large business.

Broadly speaking, working capital items are driven by the company’s revenue and operating forecasts. The other two are the profit and loss statement and cash flow statement. A balance sheet is a financial statement that lists a company’s assets, liabilities and owner's equity to provide an overview of the business’ financials at a specific point in time.

How a balance sheet works; Minres said it had $1.4 billion in cash at the end of the first half and net debt of $3.55 billion, up from $1.85. (for a complete guide to working capital, read our “working capital 101” article.).

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. Hence, the balance sheet is often used interchangeably with the term “statement of. If you are a startup looking for funding or established company business, you have to prepare a balance sheet.

Guides | 4 min read | 9 comments. A balance sheet basically tracks all the assets and liabilities of the company and also provides the current financial state of the company.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)