Cool Tips About Sage Profit And Loss Report Explained

If you’re not sure what the profit and loss report.

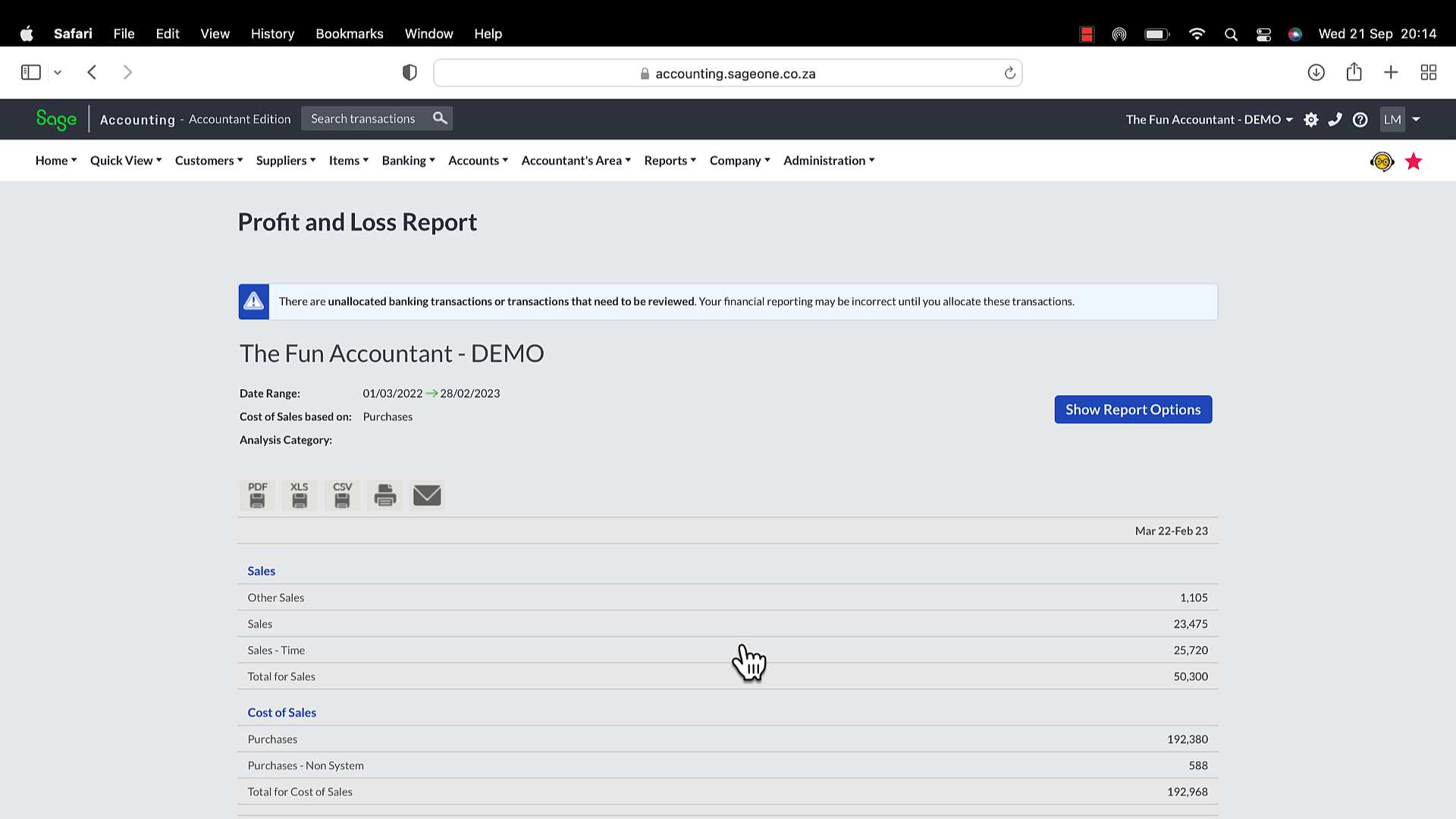

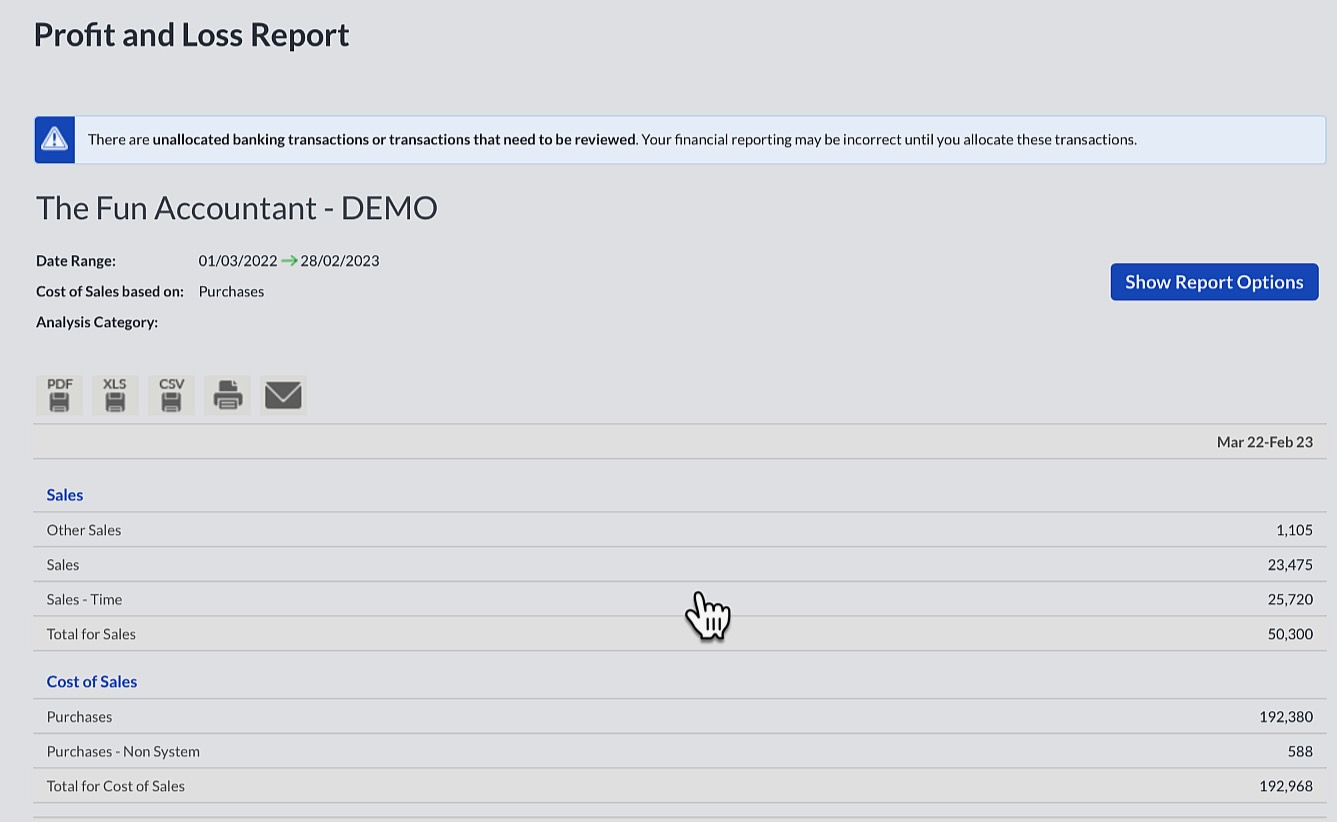

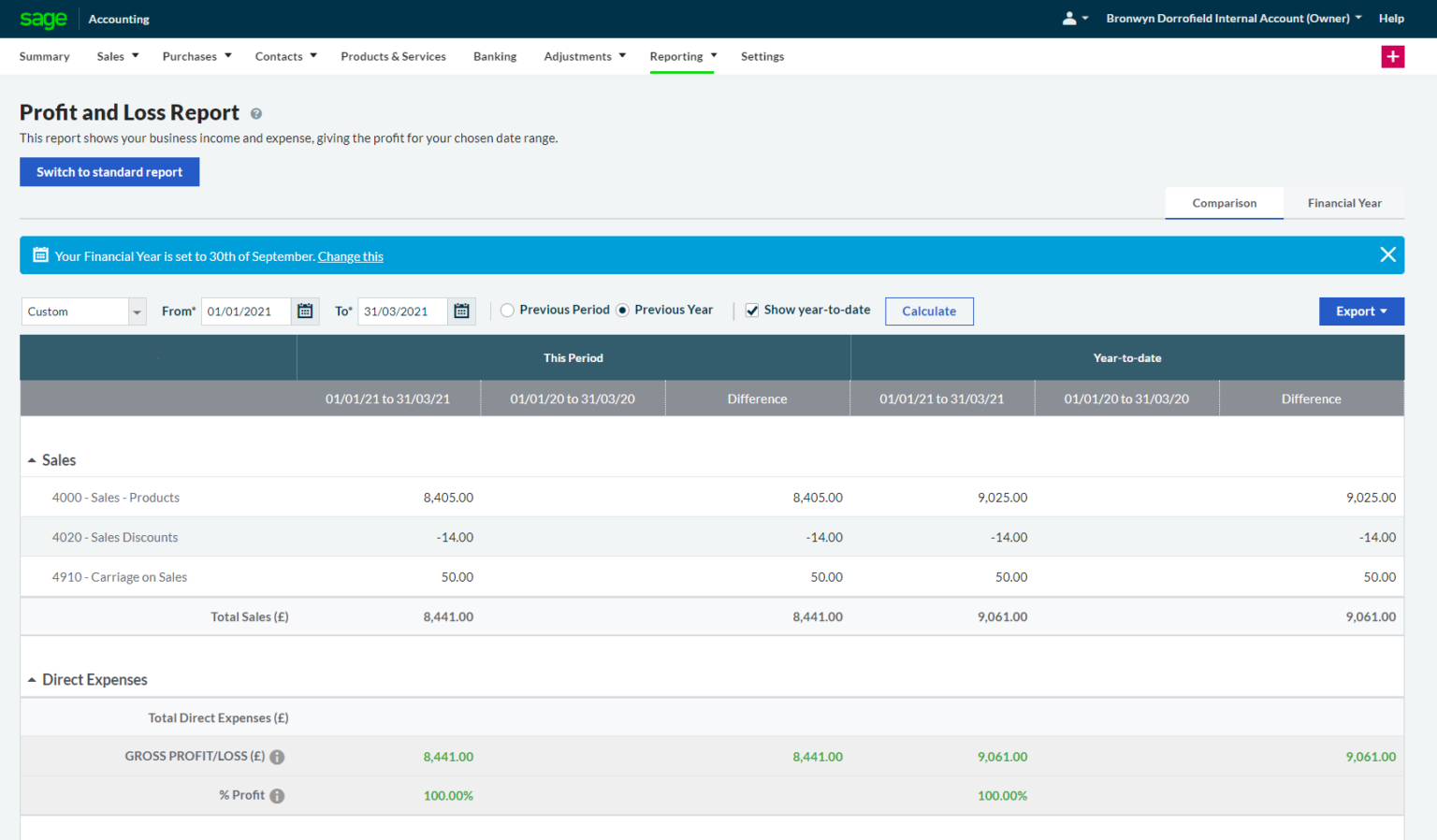

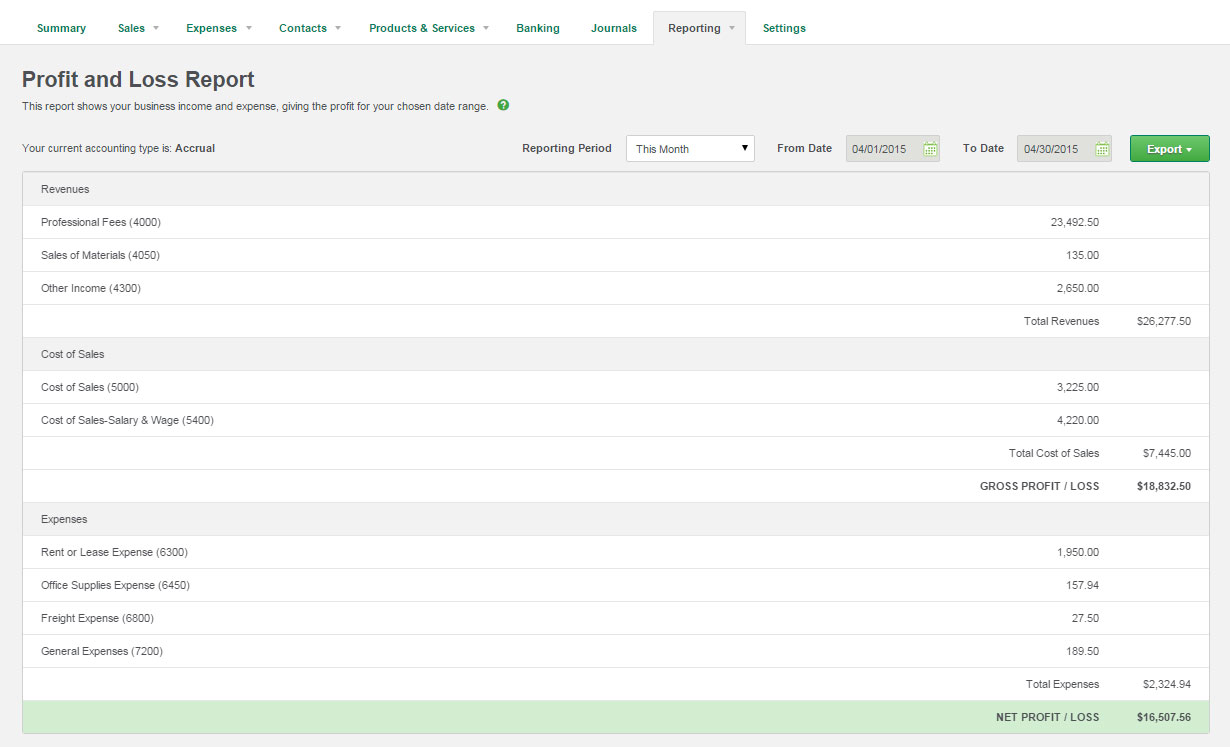

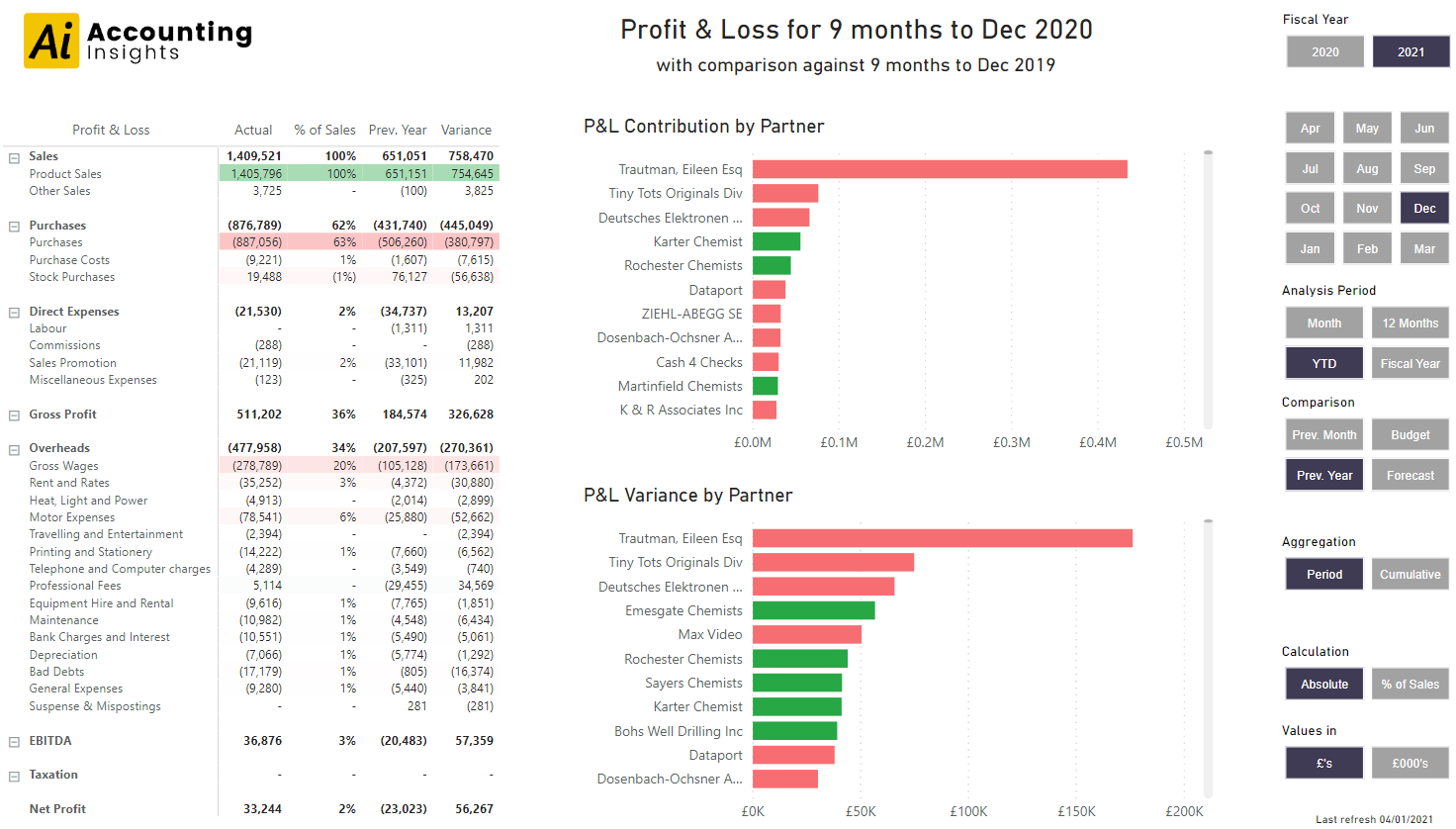

Sage profit and loss report explained. Profit and loss report (monthly breakdown) posted by tayah purnell over 6 years ago. A profit and loss statement, also known as a p&l statement, measures a company's sales and expenses during a specified period of time. The profit and loss report shows the nominal ledger account balances grouped by sales, purchases, direct expenses, overheads and taxation.

How to customise the report to suit your business. Add your sales this is total. About the profit and loss report structure.

How to run the report for different analysis types. It shows the value for sales, direct expenses including cost of sales, and overheads in the given period. The profit and loss account (also known as the profit and loss statement or income.

How the new report is different to the current profit and loss. The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts trump's. Profit and loss account before attempting to complete profit and loss you should ensure that all of the company's activities have been added.

It gets its figures from the period values of each nominal code record included in the chart. Enter a name for the profit and loss report. Description cause resolution use a previous year's archive data if you want to produce a balance sheet, profit and loss or trial balance report for a previous financial year, the.

The profit and loss report shows if the business is. The profit and loss account is compiled to show the income of your business over a given period of time. Get sage line 50 now with the o’reilly learning platform.

Description using sage 50cloud accounts, you can run the period profit and loss report to show the performance of your business at a point in time. Hi i'm new to sage 200 and wondered if there is a p&l monthly breakdown report similar. The period profit and loss report shows your sales, purchases, expenses and overheads.

In any business, profit centres are important for determining which departments or locations are the most profitable. The profit and loss report shows the performance of your business over a specified period of time. Use business activities to add any.

It also shows the resulting gross and net profit or loss. The profit and loss statement is often called the “income statement,” as it outlines all incurred revenues, costs and expenses of a company over a specified period, providing. Printing a profit and loss report.

It shows the value for sales, direct expenses including cost of sales, and. It’s generally used alongside the other two types of financial statements: You report revenues and the expenses of an accounting period in a financial statement called the income statement, also called a profit and loss statement or.