Best Of The Best Info About Income Statement Under Absorption Costing

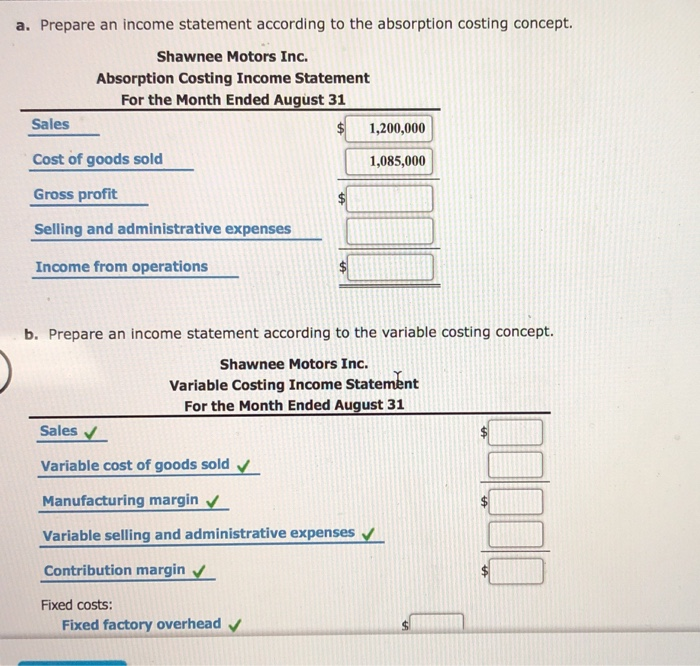

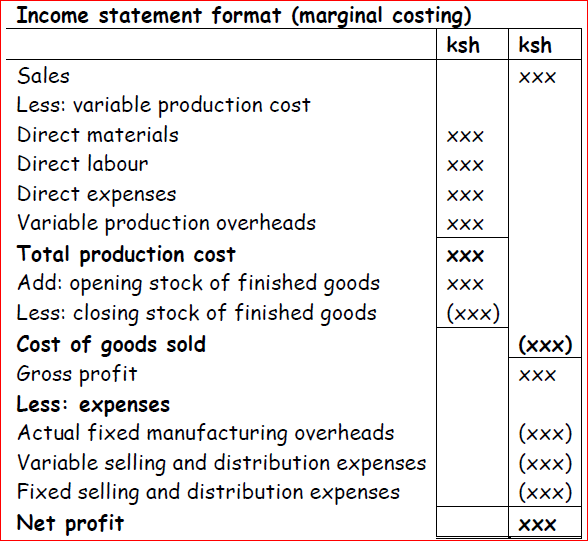

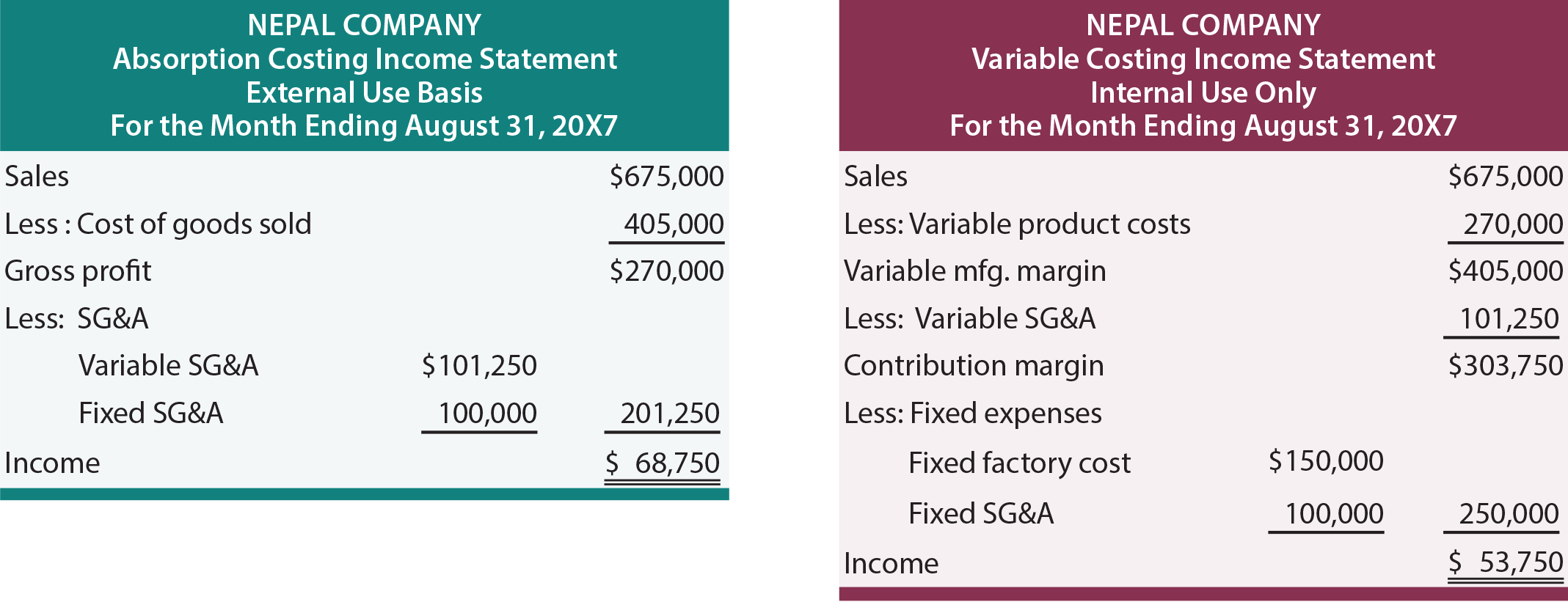

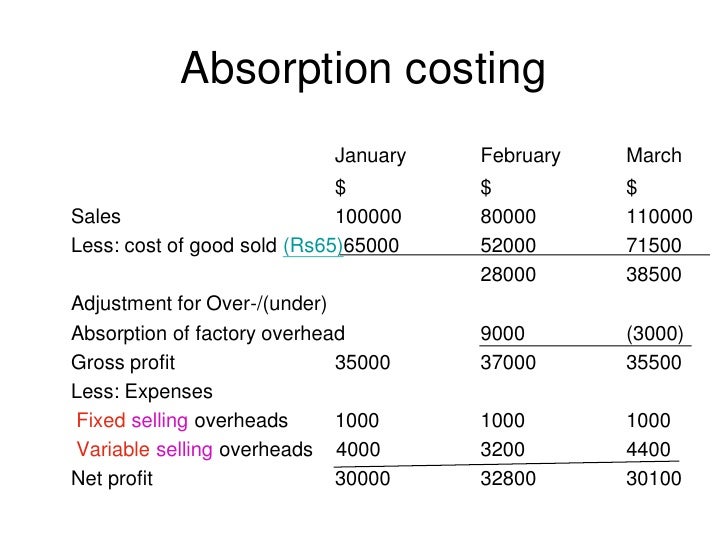

Category 1:in order to calculate gross margin/gross profit on sales in the income statement, all production expenses, both fixed and variable, are deducted from the sales revenue.

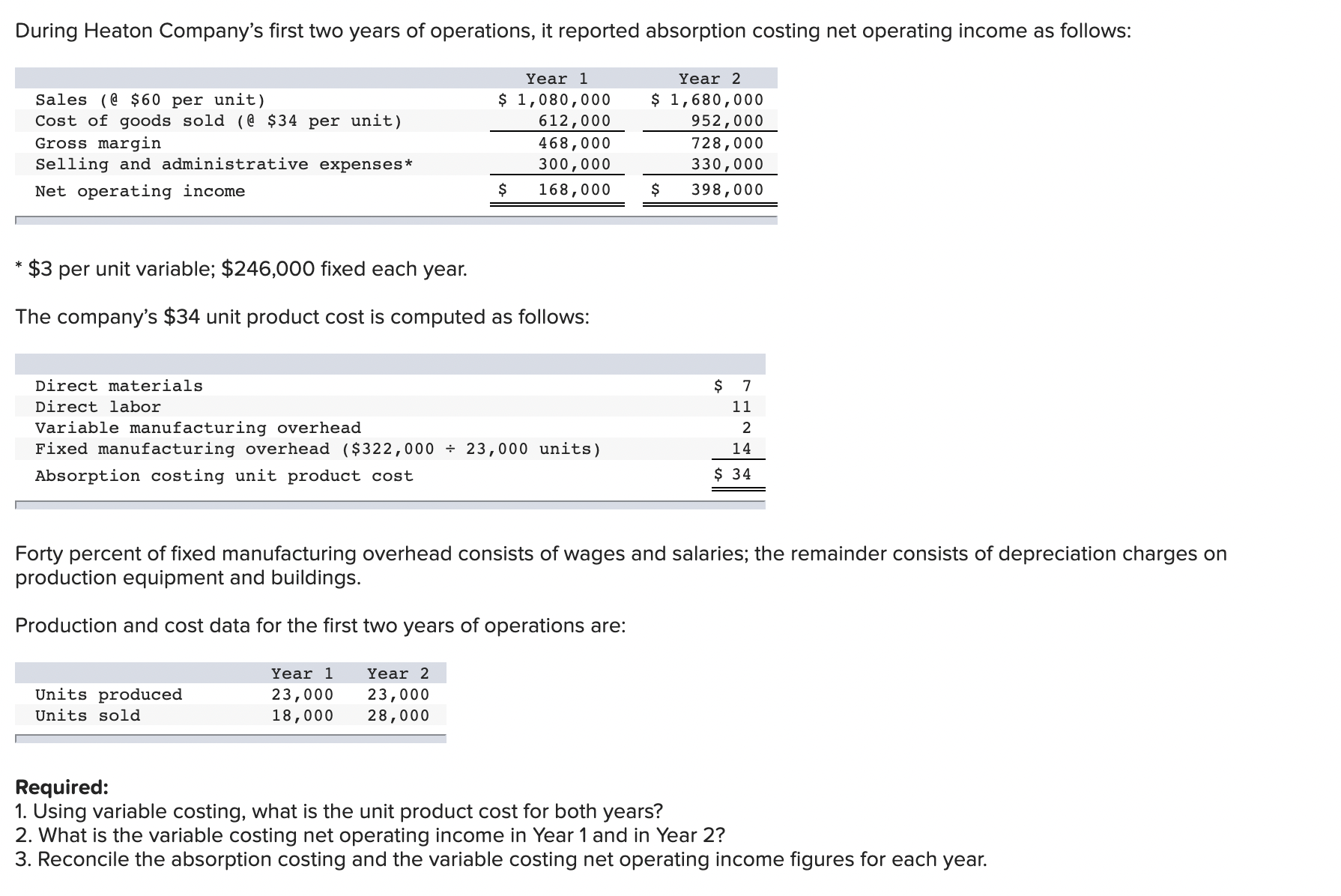

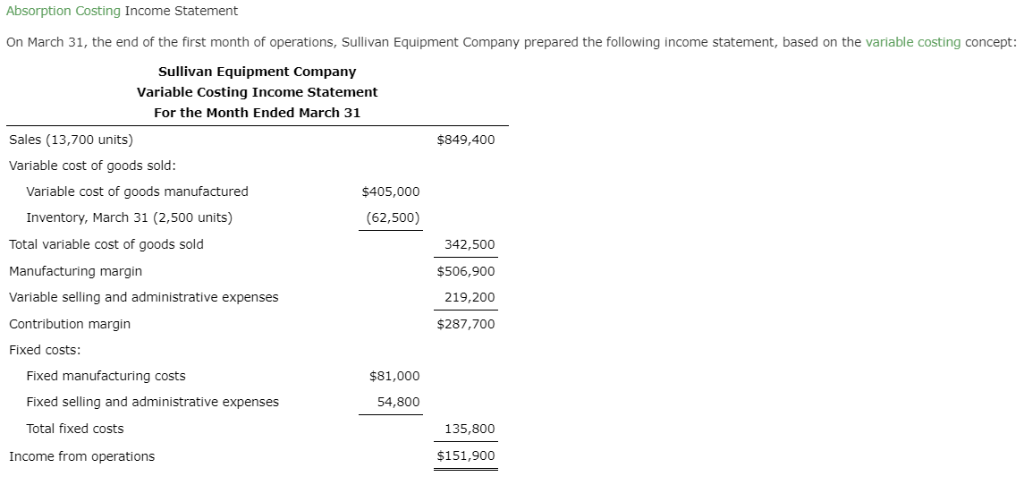

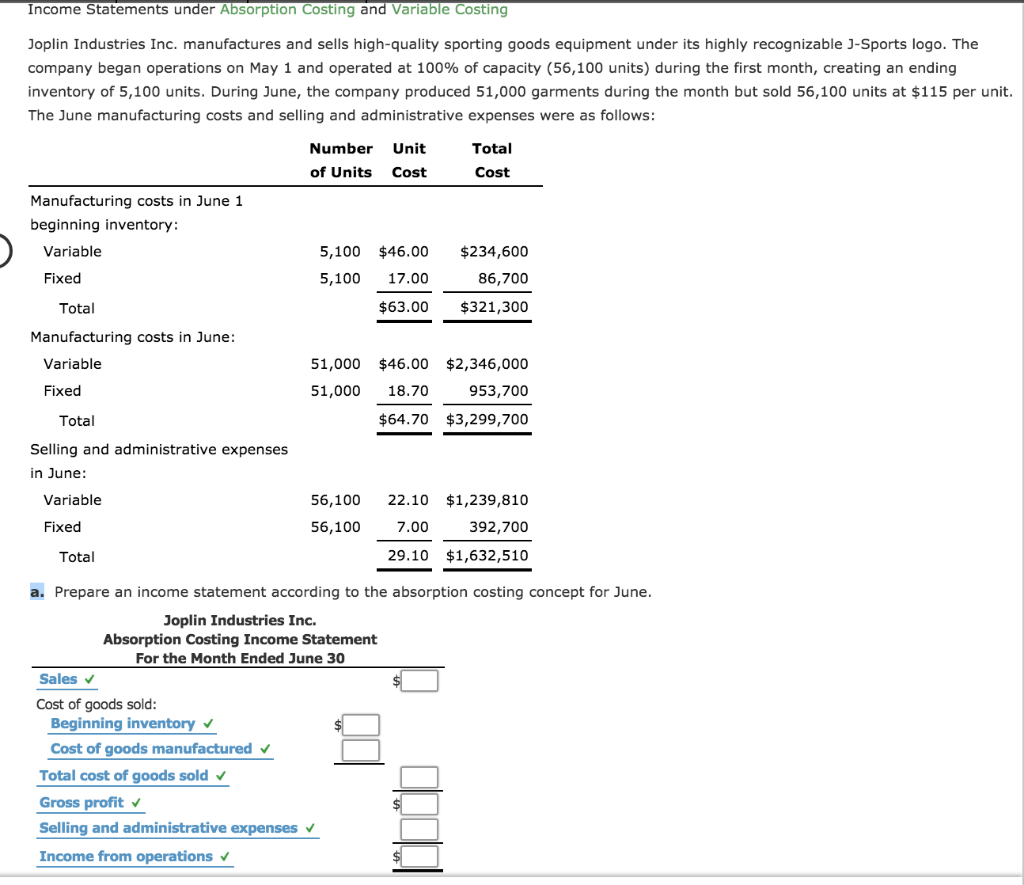

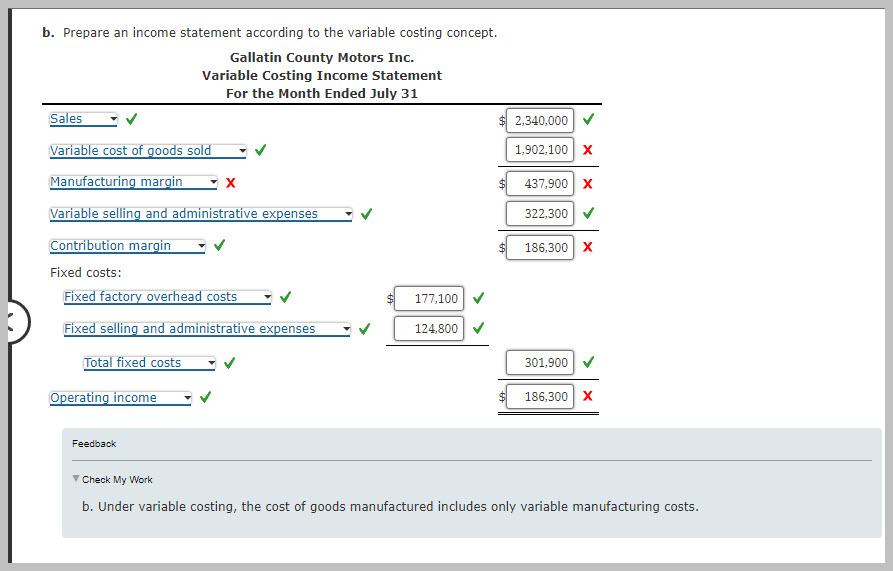

Income statement under absorption costing. That cost will be expensed when the inventory is sold and. Variable costing is also called direct. Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income.

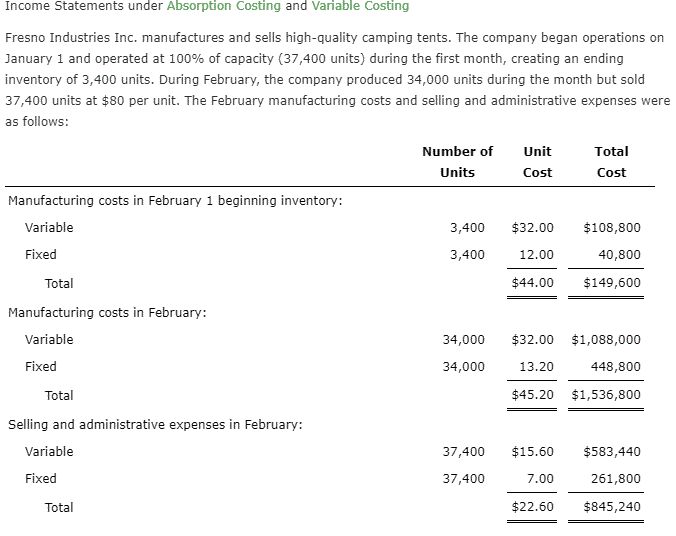

Variable costing will only be a factor for companies that expense costs of goods sold (cogs) on their income statement. Absorption costing is an accounting method used to allocate all manufacturing costs, including both variable costs and fixed costs, to the units. The absorption costing income statement is also known as the traditional income statement.

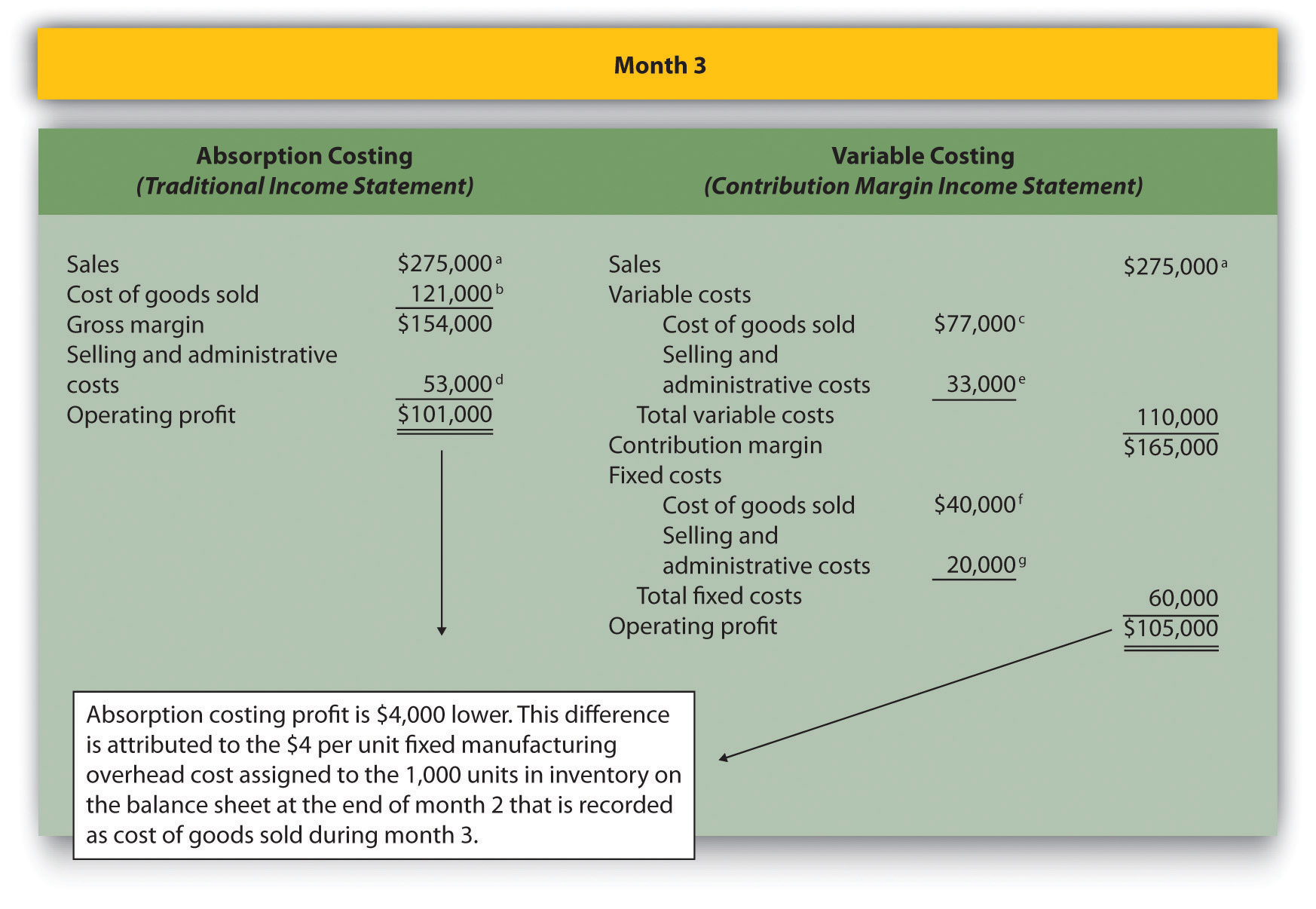

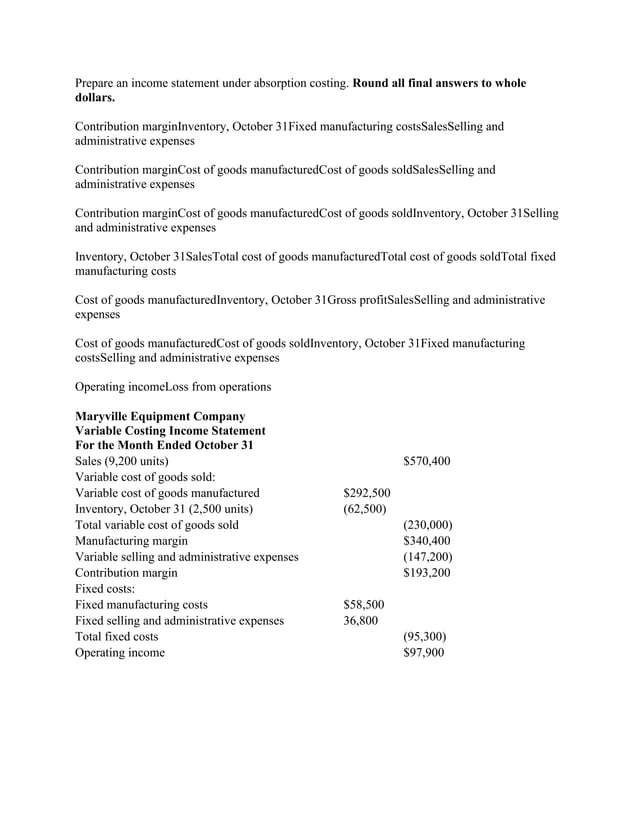

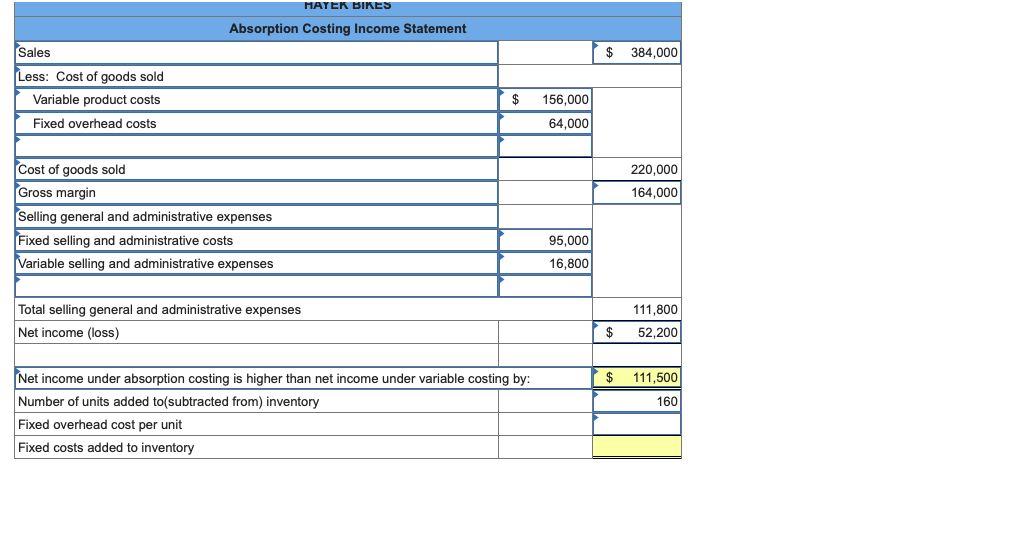

The company also reports the following per unit. When more units are manufactured (20,000) than sold (15,000), operating income is higher under absorption costing ($137,500). Points to remember the variable costs are directly.

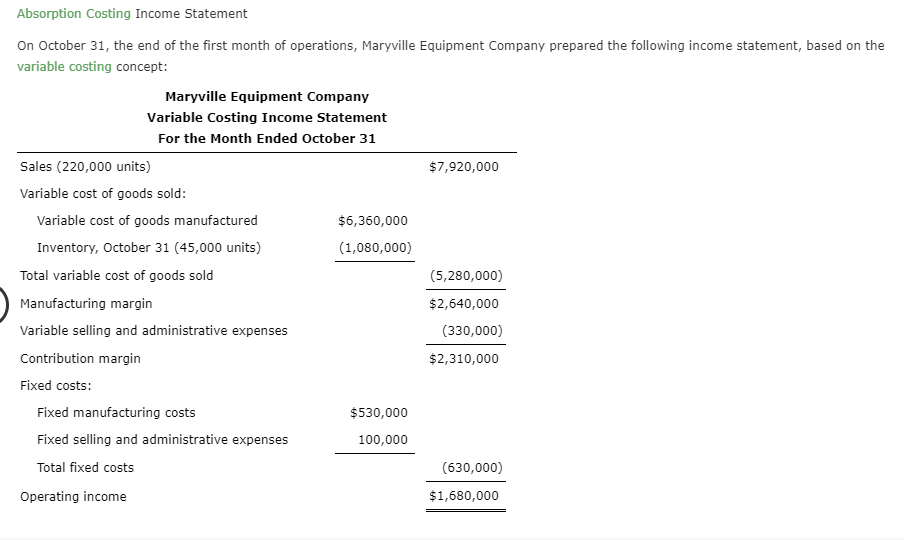

=income before tax variable cost: (2) when production is equal to sales: Calculate profit or loss under absorption and marginal costing reconcile the profits or losses calculated under absorption and marginal costing describe the advantages and.

These traditional income statements use absorption costing to form an. We will use the units sold on the income statement (and not units produced) to determine sales, cost of goods sold and any other variable period costs. Under absorption costing, the 2,000 units in ending inventory include the $1.20 per unit share, or $2,400 of fixed cost.

This episode lets our bbs 2nd year students explore the concept of income statement under variable costing and absorption costing. Due to the treatment of fixed manufacturing overhead, a higher net income is reported on the income statement, which summarizes revenue and expenses for a particular period. Increases in inventory cause income to be higher under absorption costing than under variable costing, and vice versa.

Administrative, selling and manufacturing costs are all separated into three categories by absorption costing. You are required to prepare income statement under (a) absorption costing and (b) marginal costing. Each racket was sold at a price of $84.

Assembles and sells snowmobile engines. 8 rows income statement under absorption costing usd: Fixed overhead costs are $66,960, and fixed selling and administrative costs are $64,600.

As with the absorption costing income statement, you begin a marginal costing income statement by calculating gross sales for the period.