Looking Good Info About Profit And Loss Statement Income

How to read a profit and loss statement

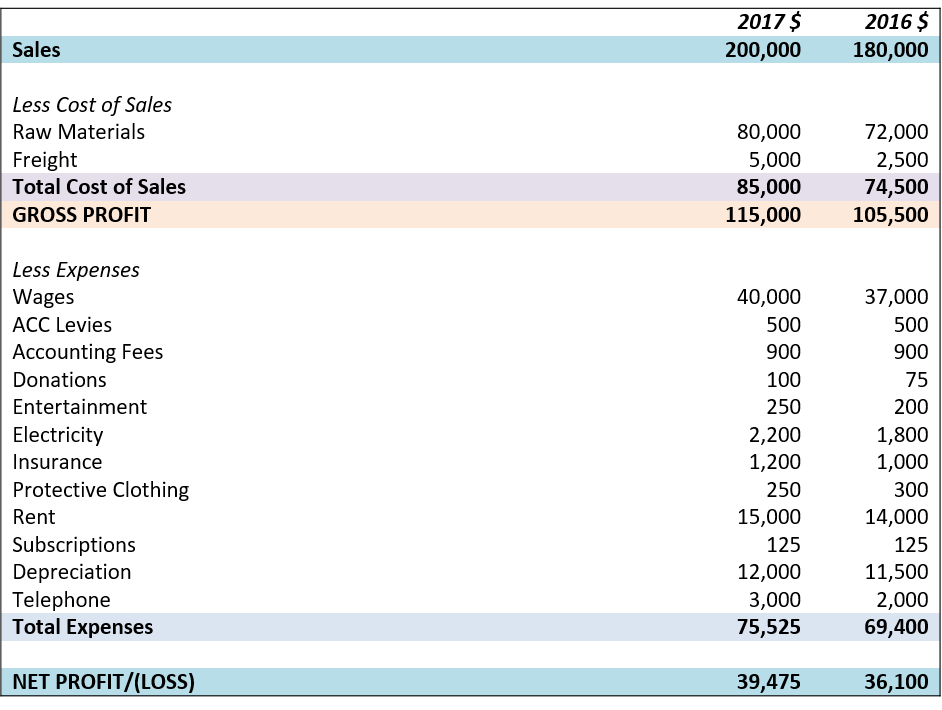

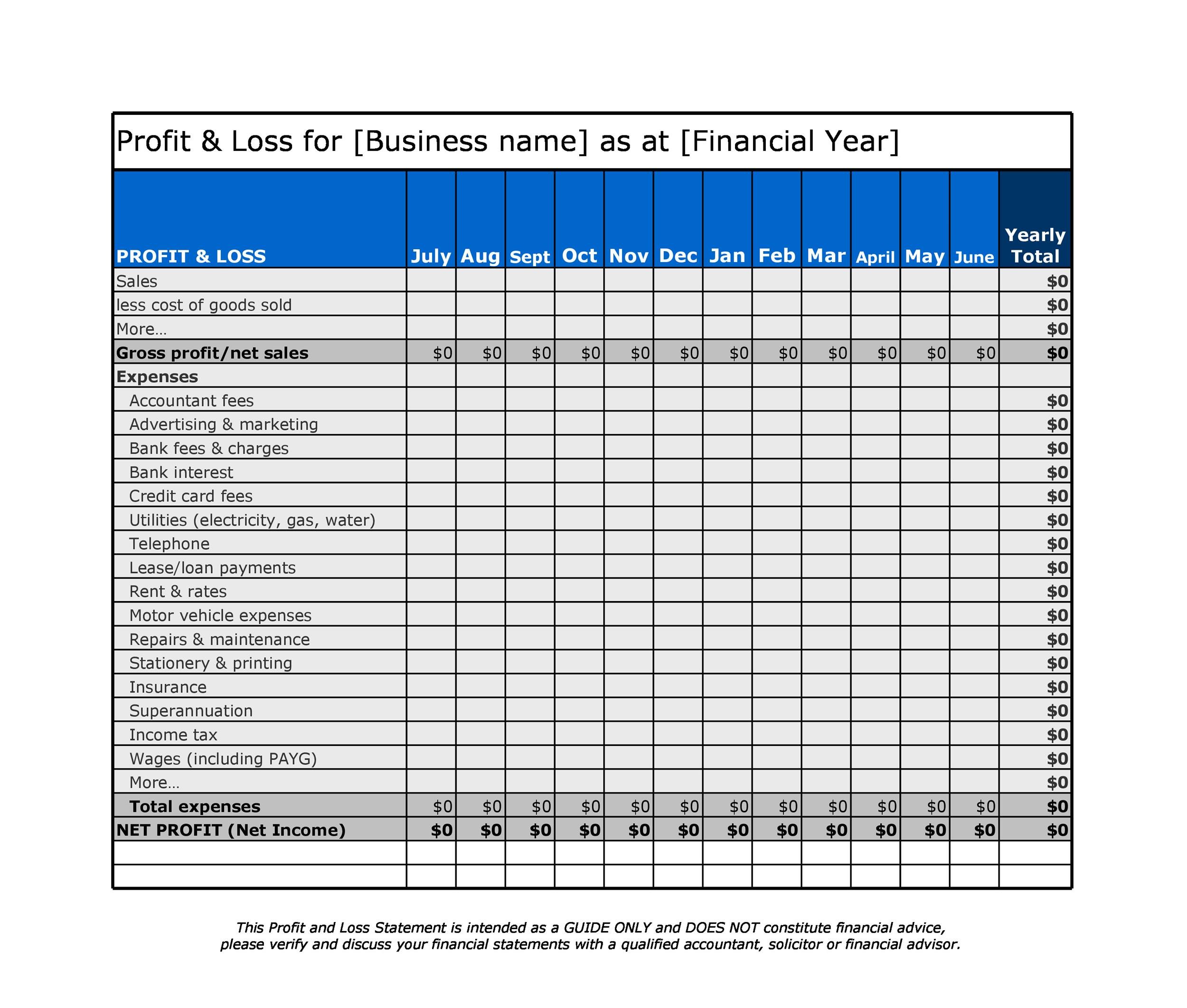

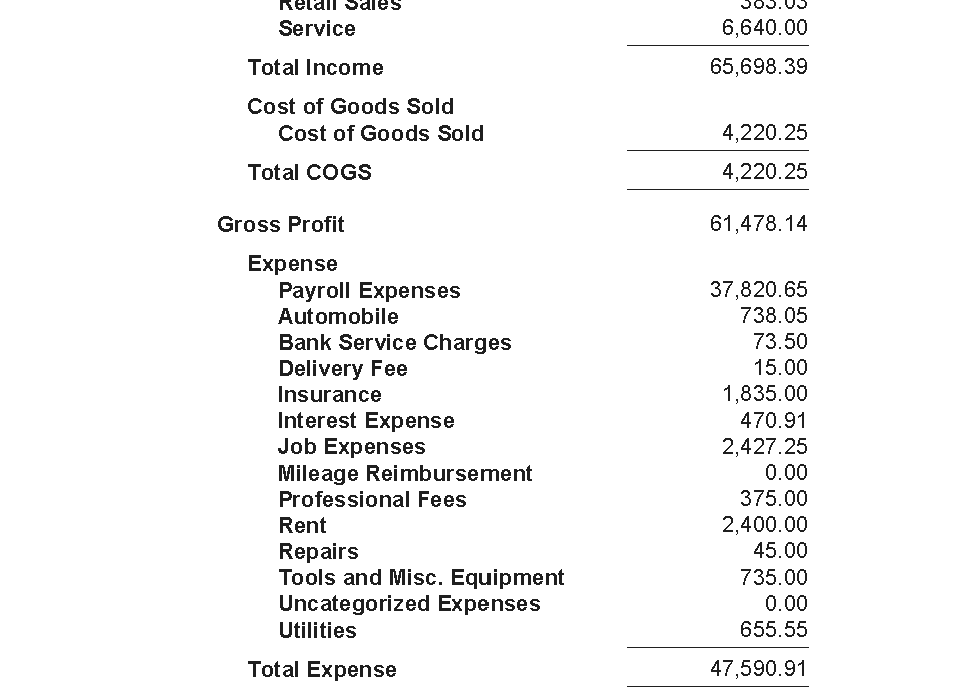

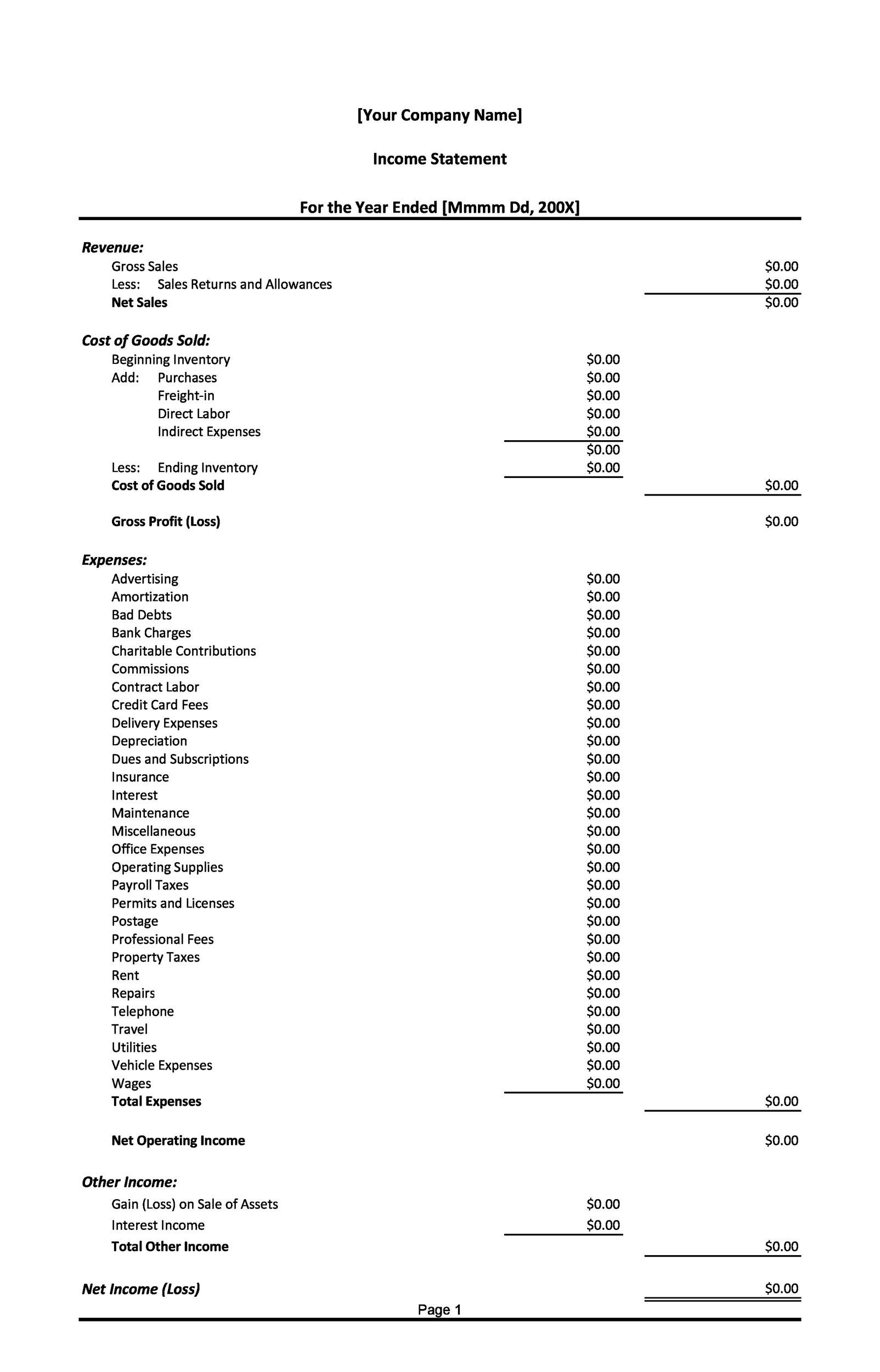

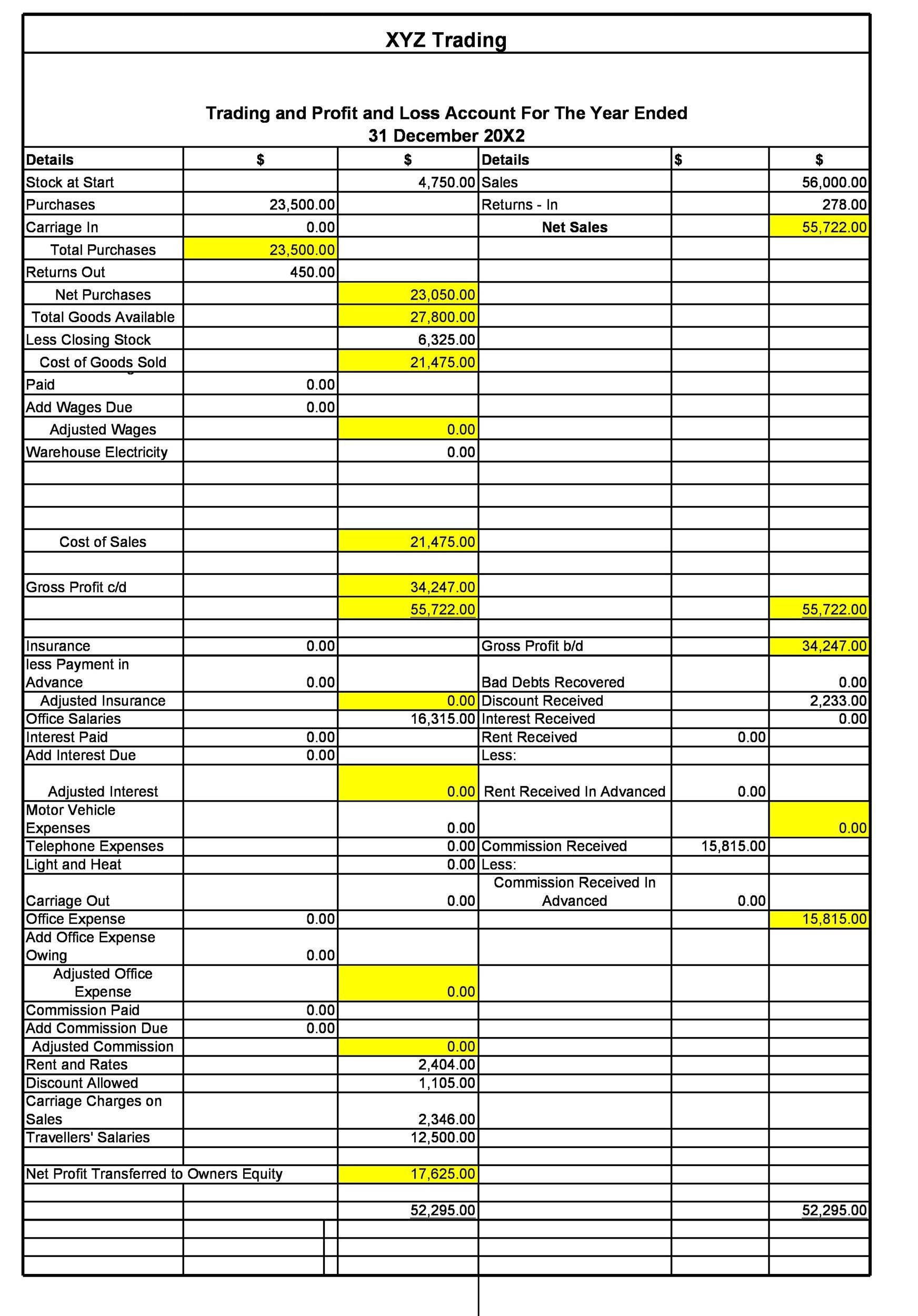

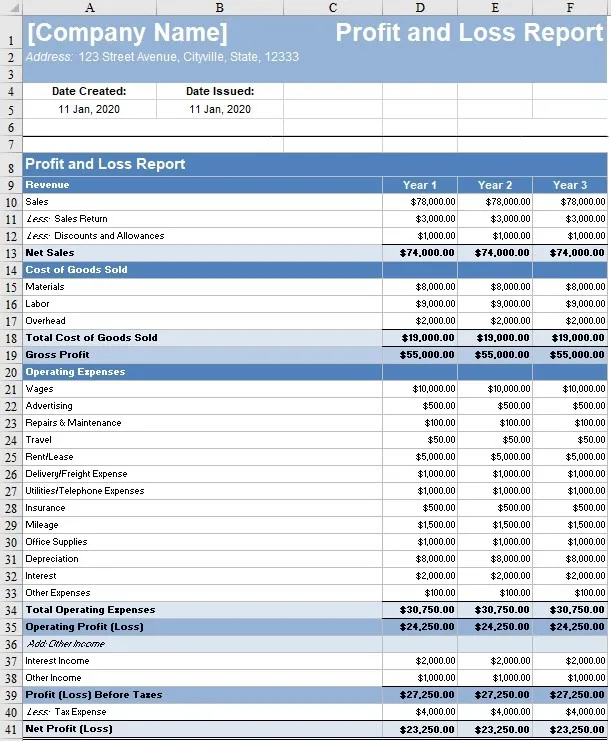

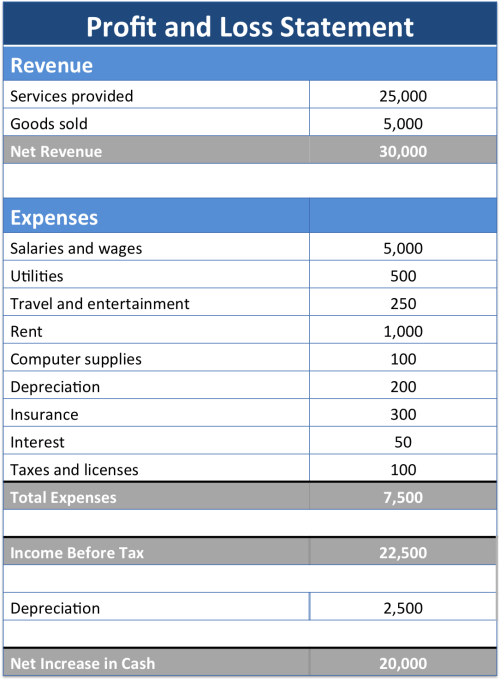

Profit and loss statement and income statement. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter.

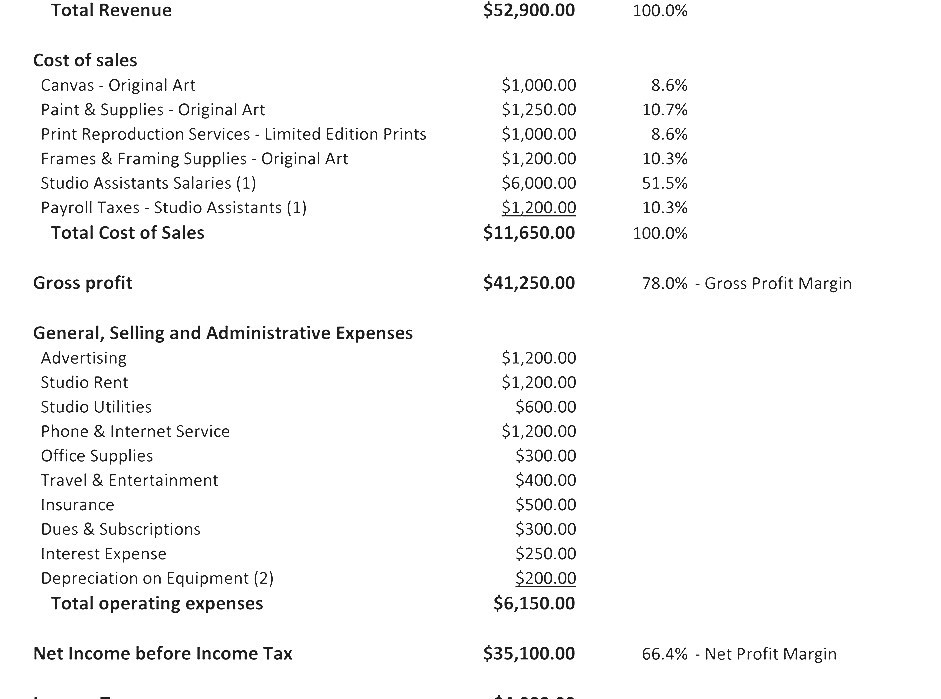

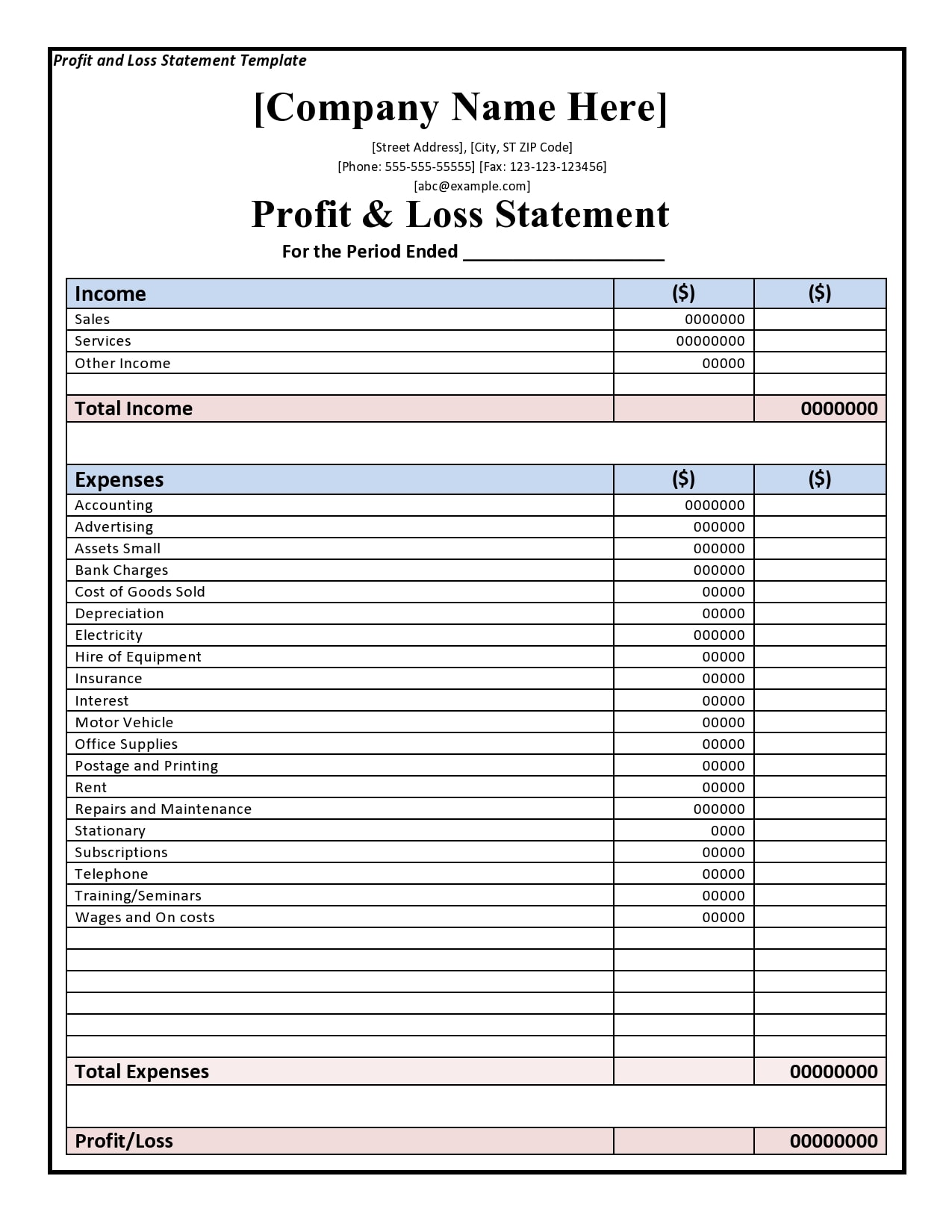

A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report. It offers a comprehensive overview of a company’s revenues, costs, and expenses, enabling stakeholders to evaluate its. Example of a p&l statement.

It captures how money flows in and out of your business. The p&l statement is one of three. Abbreviated as “ cogs ,” this is the cost of producing the goods or services you sold to your.

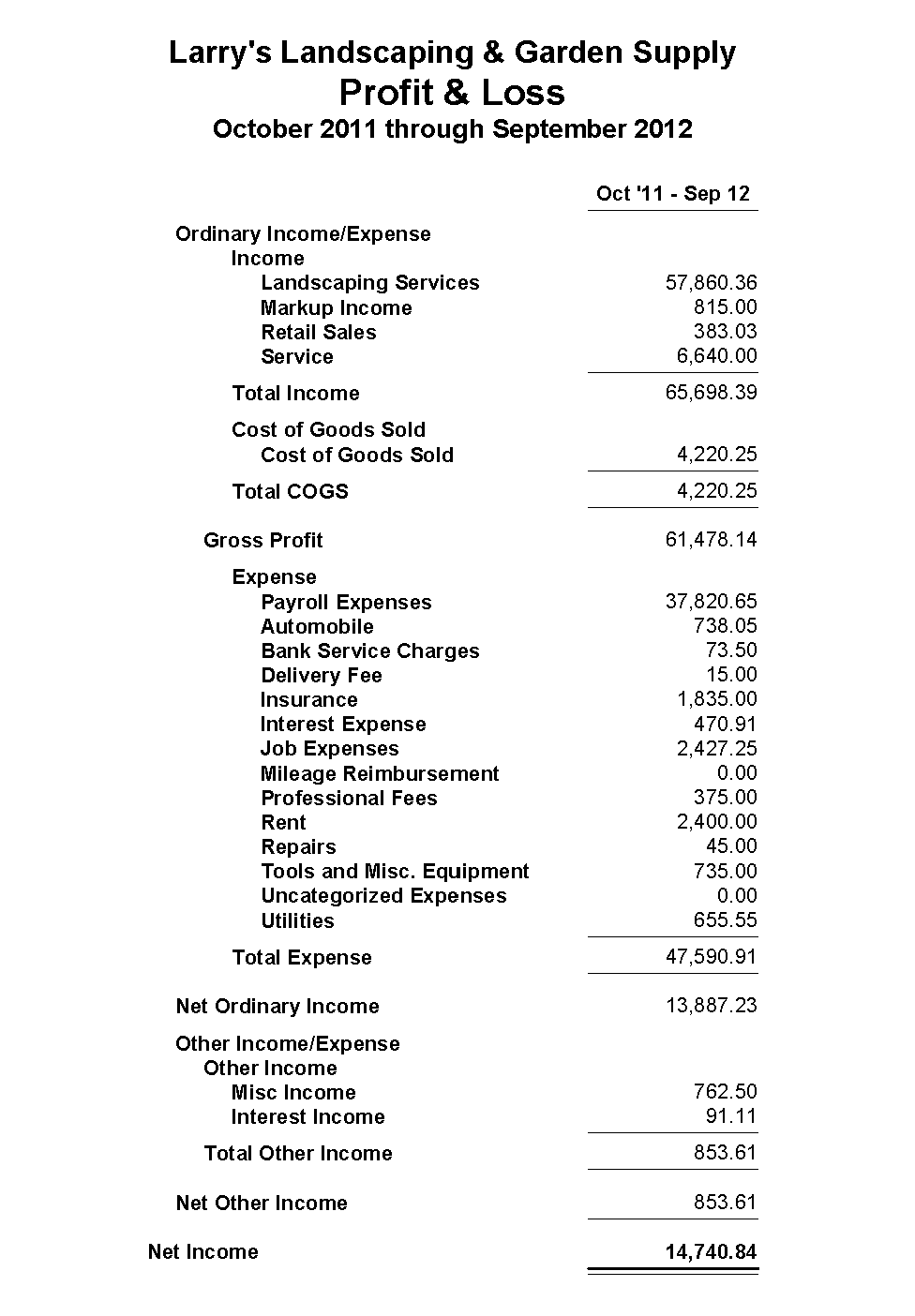

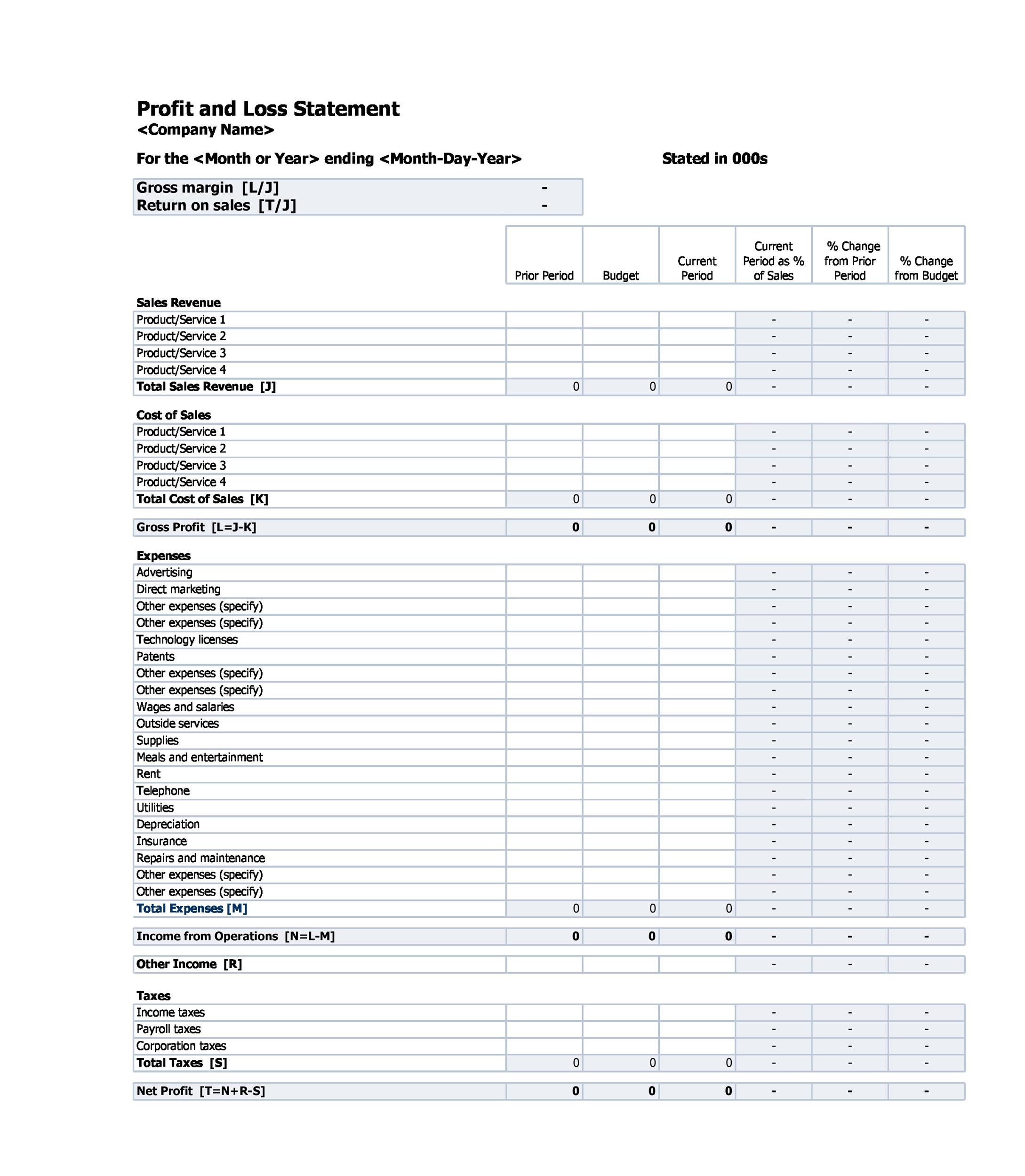

A p&l statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a given accounting period. The purpose of the income statement is to show managers and investors whether the company made money (profit) or lost money (loss) during the period being reported. Income statements, or profit and loss statements, are important tools for understanding a business's financial health.

There is no real difference between profit and loss and the income statement. An income statement represents a period of time (as does the cash flow statement ). You can learn about the health of a business—up and down, and across time—by looking at its income statement.

A profit and loss (p&l) statement, also known as an income statement or statement of earnings, is a vital financial document that provides insights into a company’s financial performance during a specific period. A p&l statement provides information about whether a company can. Also known as the profit and loss (p&l) statement or the statement of revenue and expense, an income statement provides valuable insights into a company’s operations, the efficiency of.

In basic accounting, the p&l statement is always one of the first financial statements to be prepared. The main difference between the two is that an income statement is more comprehensive than a profit and loss statement. An income statement shows all of a company’s revenues, expenses, gains, and losses for a defined period.

What is the difference between profit and loss and income statement? You’ll sometimes see profit and loss statements called an income statement, statement of. A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit.

The income statement, also called the profit and loss statement. You might also hear this document called: Then, it subtracts the costs of making those goods or providing those services, like.

And the balance sheet reflects the financial position at a specific point in time. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. With modern accounting software, you can produce p&ls at the click of a button.