Best Tips About Examples Of Operating Expenses On Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

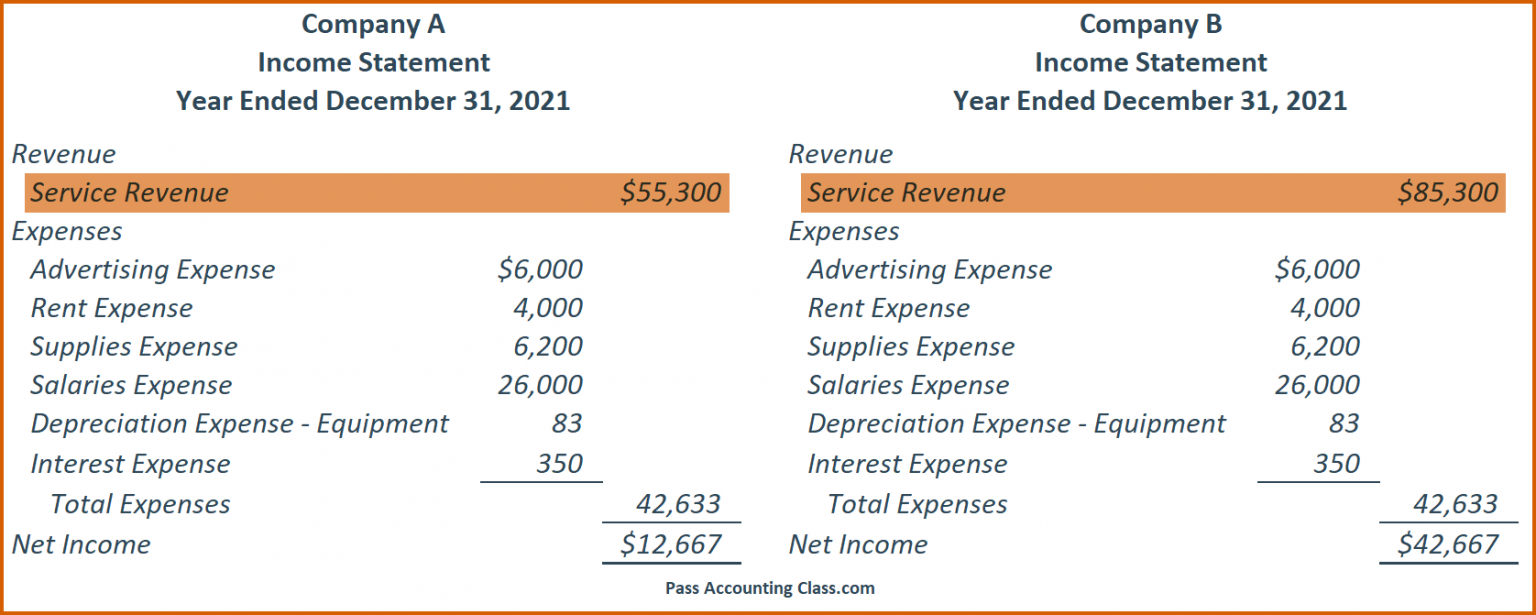

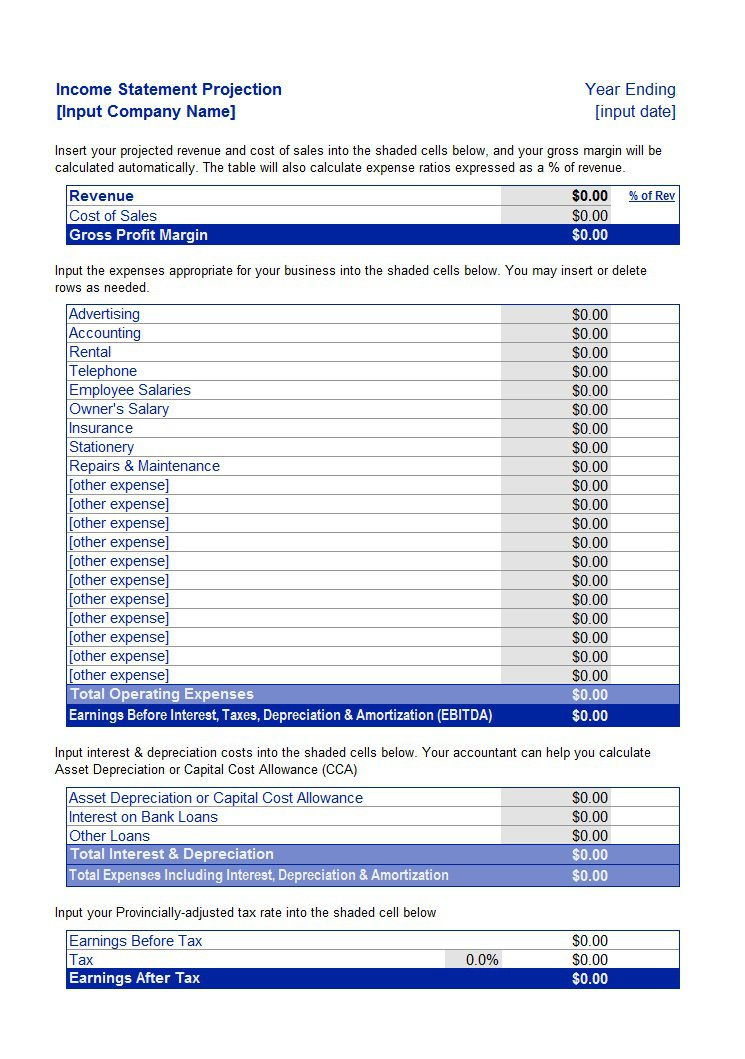

Operating statements summarize a company's revenues and expenses for a given accounting period.

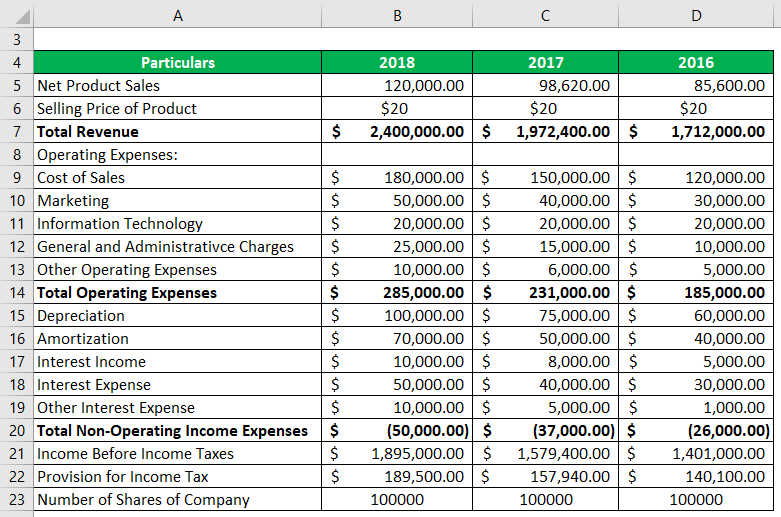

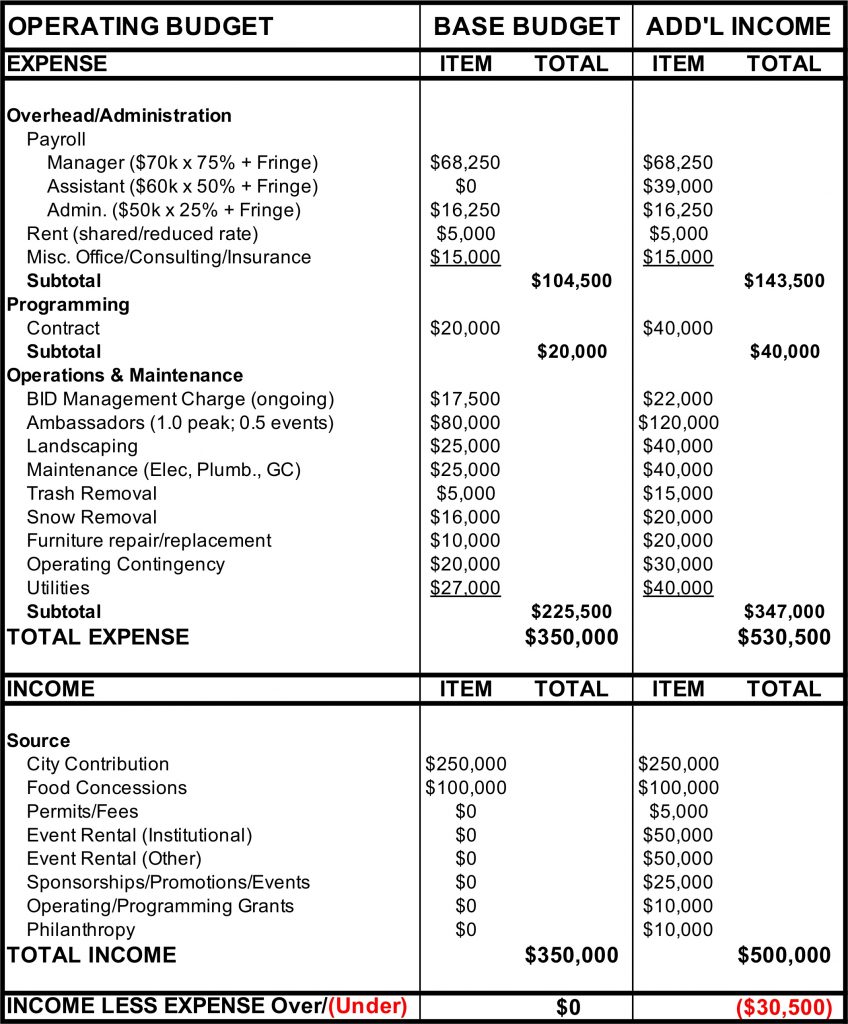

Examples of operating expenses on income statement. The concept of operating profit is easier to understand with an example of how it works. Revenue minus expenses equals profit or loss. Deduct the operational expenses from your gross profit.

The statement of operations is also known as an income. Definition of revenue expenditure. Revenue expenditures are also known as operating expenses or operational.

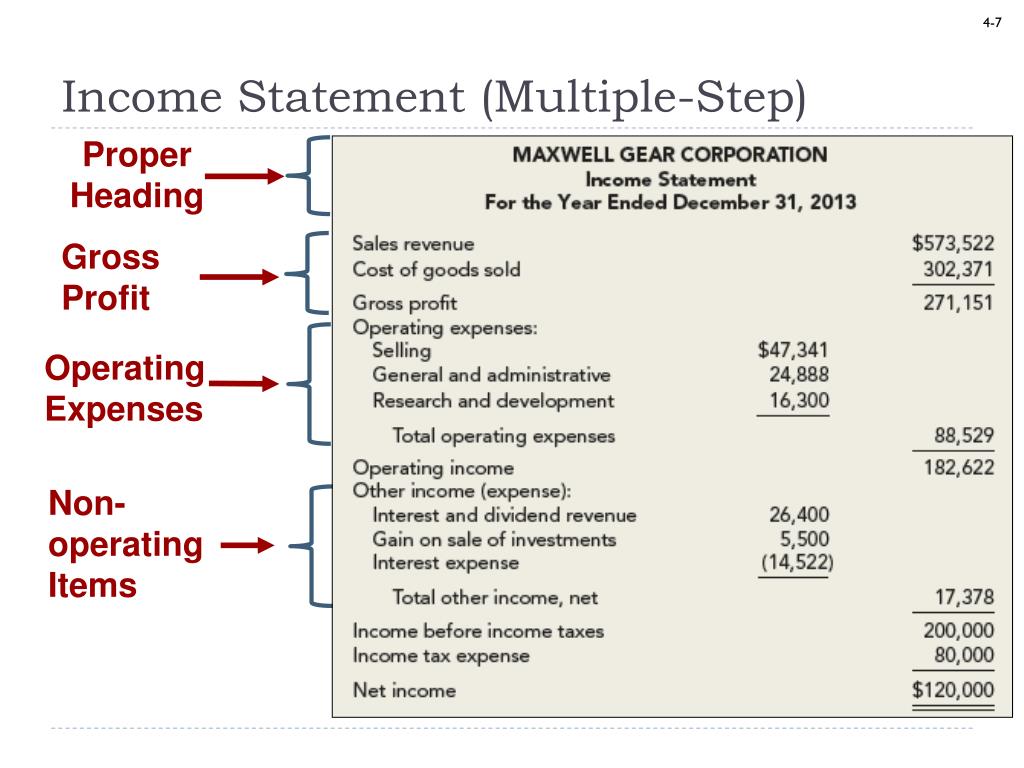

Operating expenses include the selling, administrative, and general expenses prior to taxes and interest expenses. Both the cost of goods sold and operating expenses impact a company's income and overall profitability, but they do so in different ways and are categorized separately in financial statements for clarity and accuracy. 3.6 operating expenses.

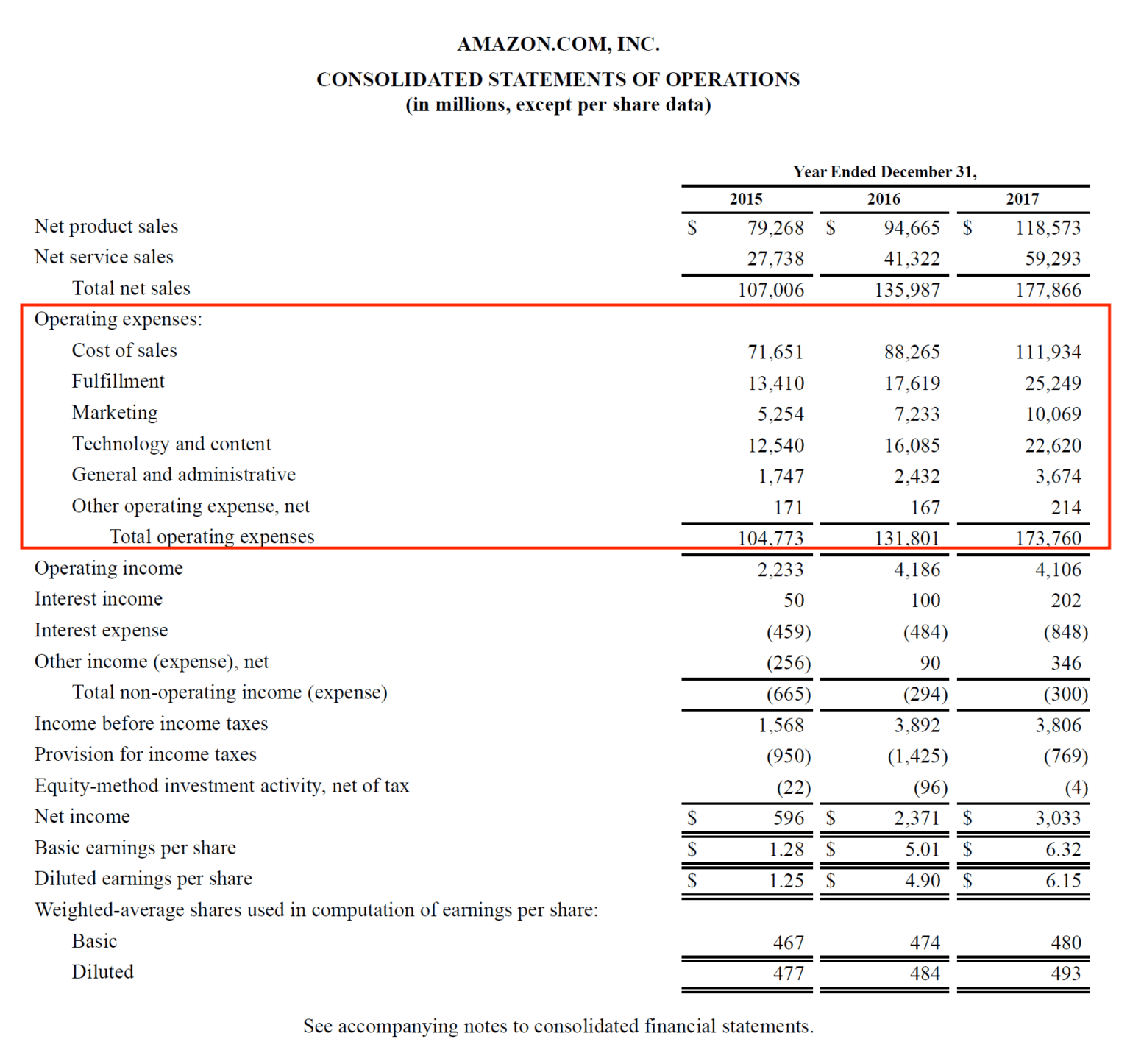

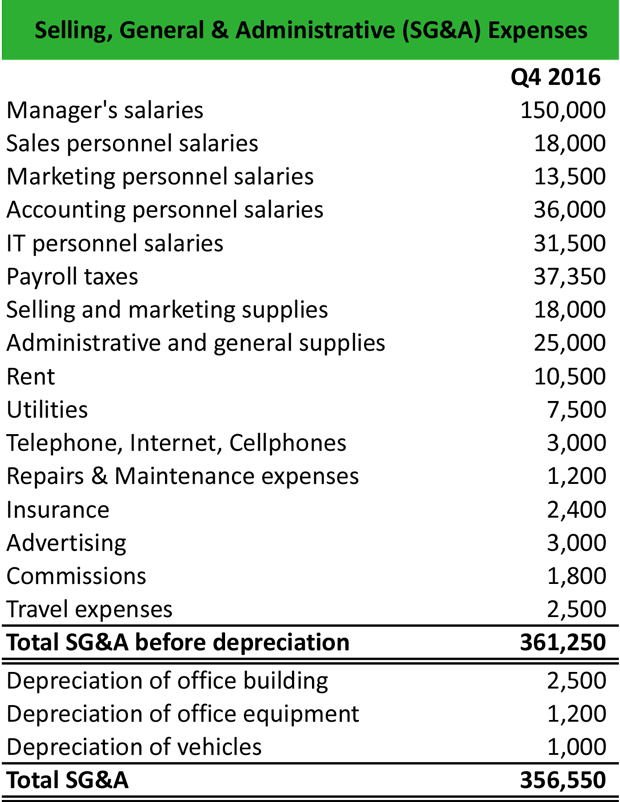

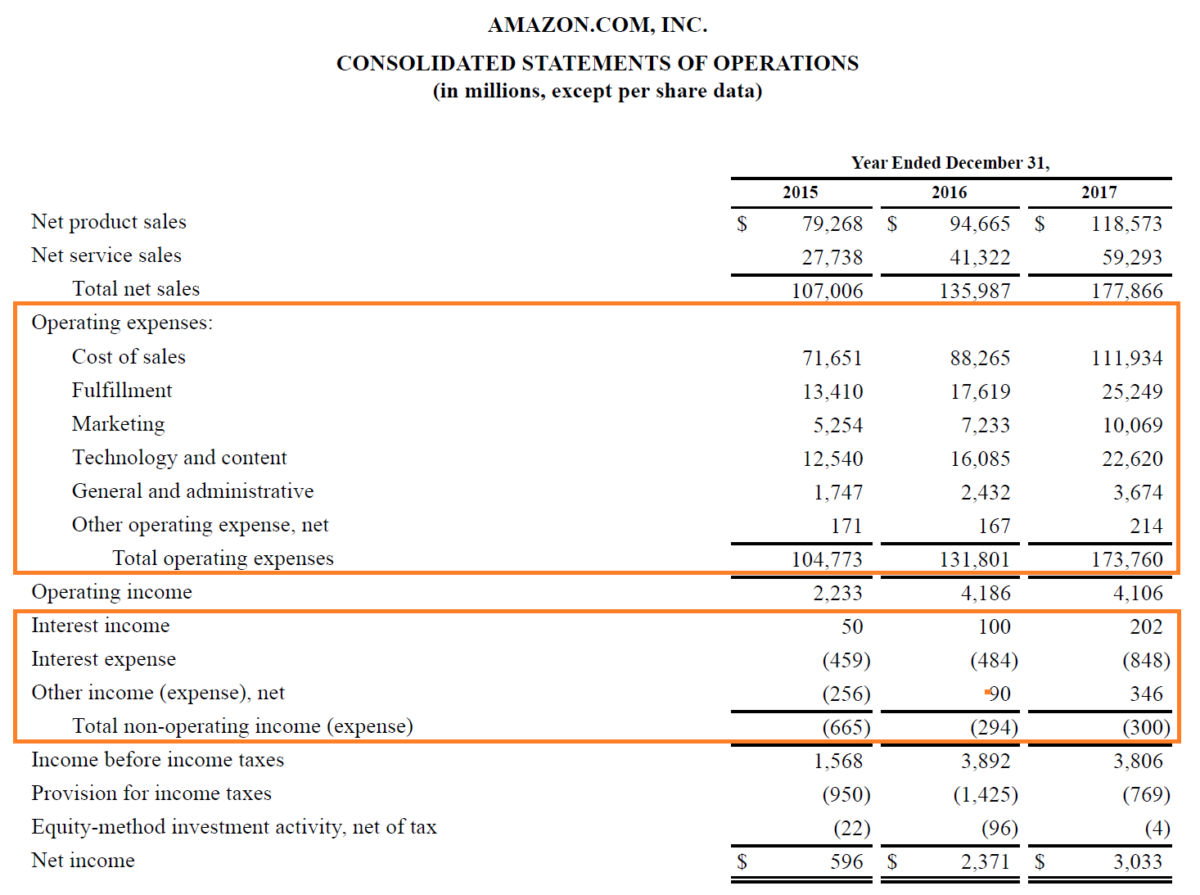

Encompassed by a red border, amazon’s operating expenses include the cost of sales, fulfillment, marketing, general and administrative, technology and content, and other operating expenses. Let’s look at an example of upgrading or purchasing a new ibm power system, and how the process differs when procuring it as either a capital expenditure or as an operating expense. Common operating expenses for a company include rent, payroll, travel, utilities, insurance, maintenance and repairs, property taxes, office supplies, depreciation and advertising.

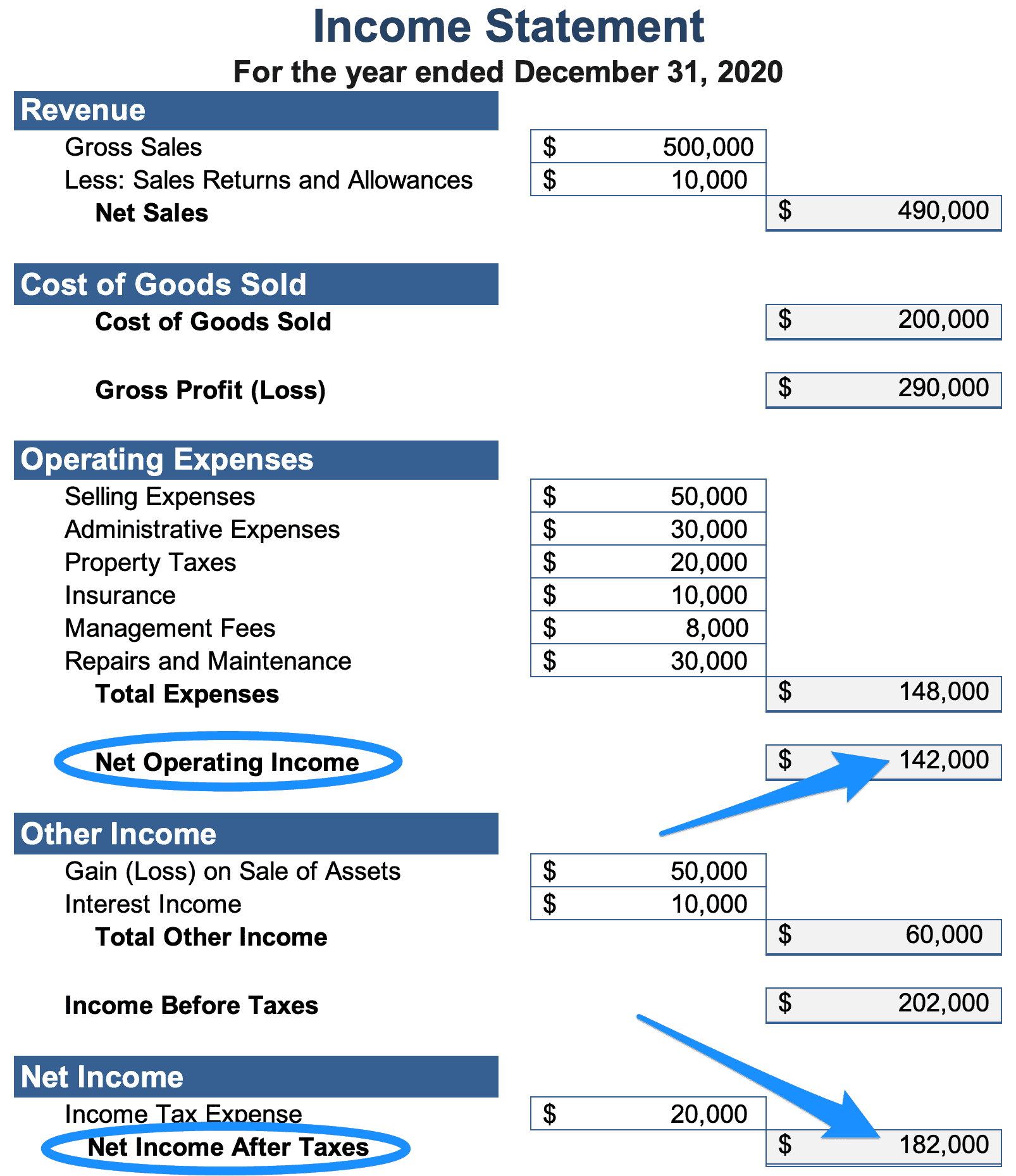

An income statement is another name for a profit and loss statement (p&l). The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. As seen before with best buy, macy's gross profit of $2.14 billion dramatically differs from its net income of $43 million, due to sg&a costs, interest expenses, impairment and restructuring costs.

Often abbreviated as opex, operating. An operating expense is an expense that a business incurs through its normal business operations. An income statement might use the cash basis or the accrual basis.

You can look at an income. If you’ve ever looked at an income statement,. While a balance sheet provides the snapshot of a company’s financials as of a particular date, the income statement reports income through a specific period, usually a quarter or a year, and.

An example of amazon.com ‘s income statement is shown below. Given the assumptions above, the year 0 gross profit is equal to $65 million, and the operating income is $35 million. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

Moving from the basics, revenue expenditure is all about the funds that a company uses to handle everyday business activities.these expenses cover everything from paying employees to buying office supplies. The list of such costs includes production expenses like direct material and labor costs, rent expenses, salary and wages paid to administrative staff, depreciation expenses, telephone expenses, traveling expenses. List of operating expenses.

Operating costs include direct costs of goods sold (cogs) and other operating expenses—often called selling, general, and administrative (sg&a)—which include rent, payroll, and other. The income statement is a useful way to see how a company makes money and how it spends it. Examples of indirect operating expenses include office supplies, advertising and marketing costs, insurance premiums, legal fees, and travel expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)