Spectacular Tips About Forecast Statement Of Financial Position

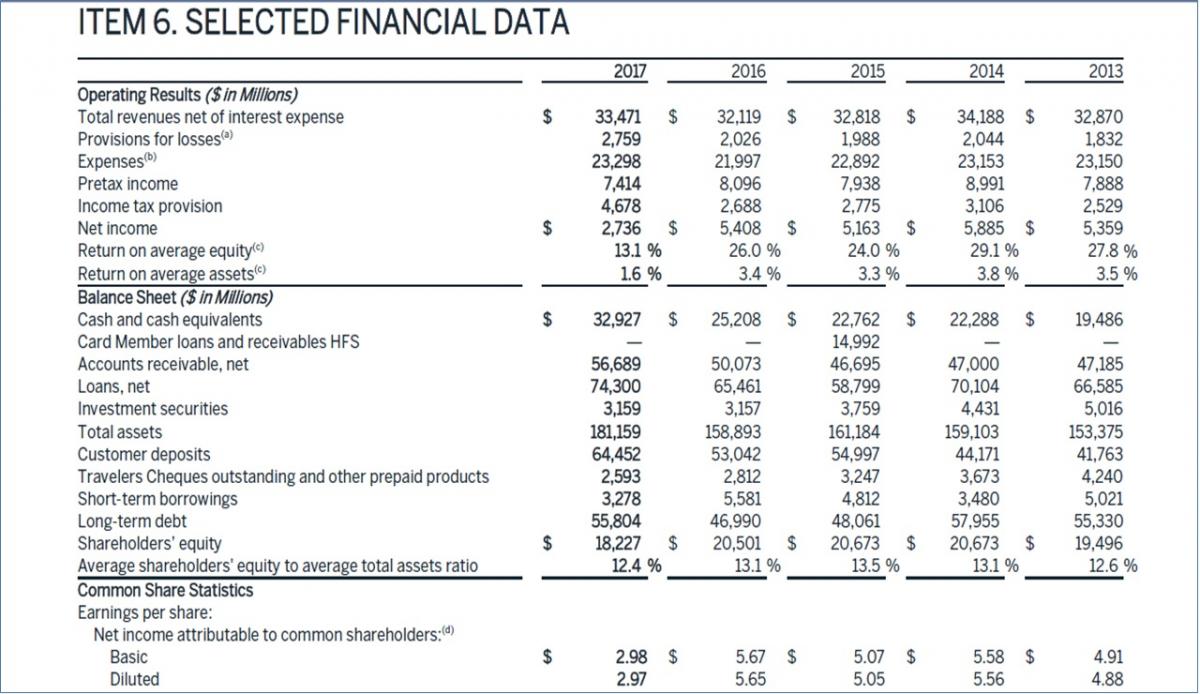

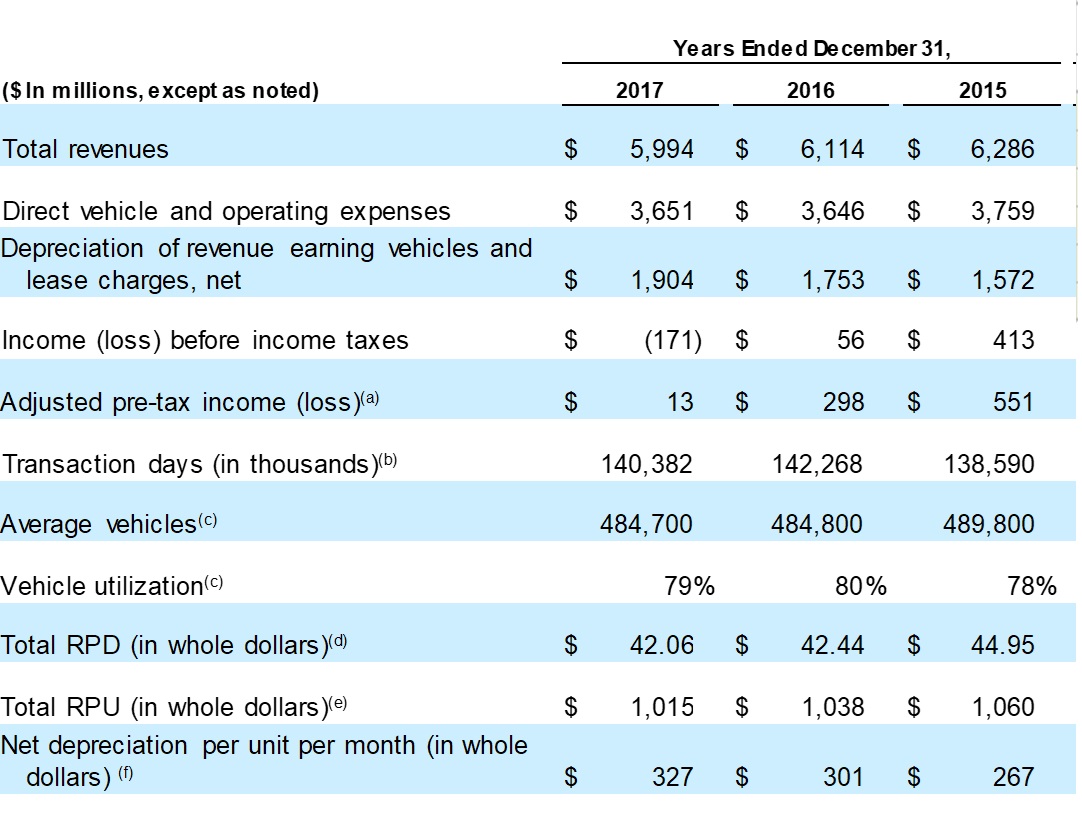

You’ll need to look at your past finances in order to project your income, cash flow, and balance.

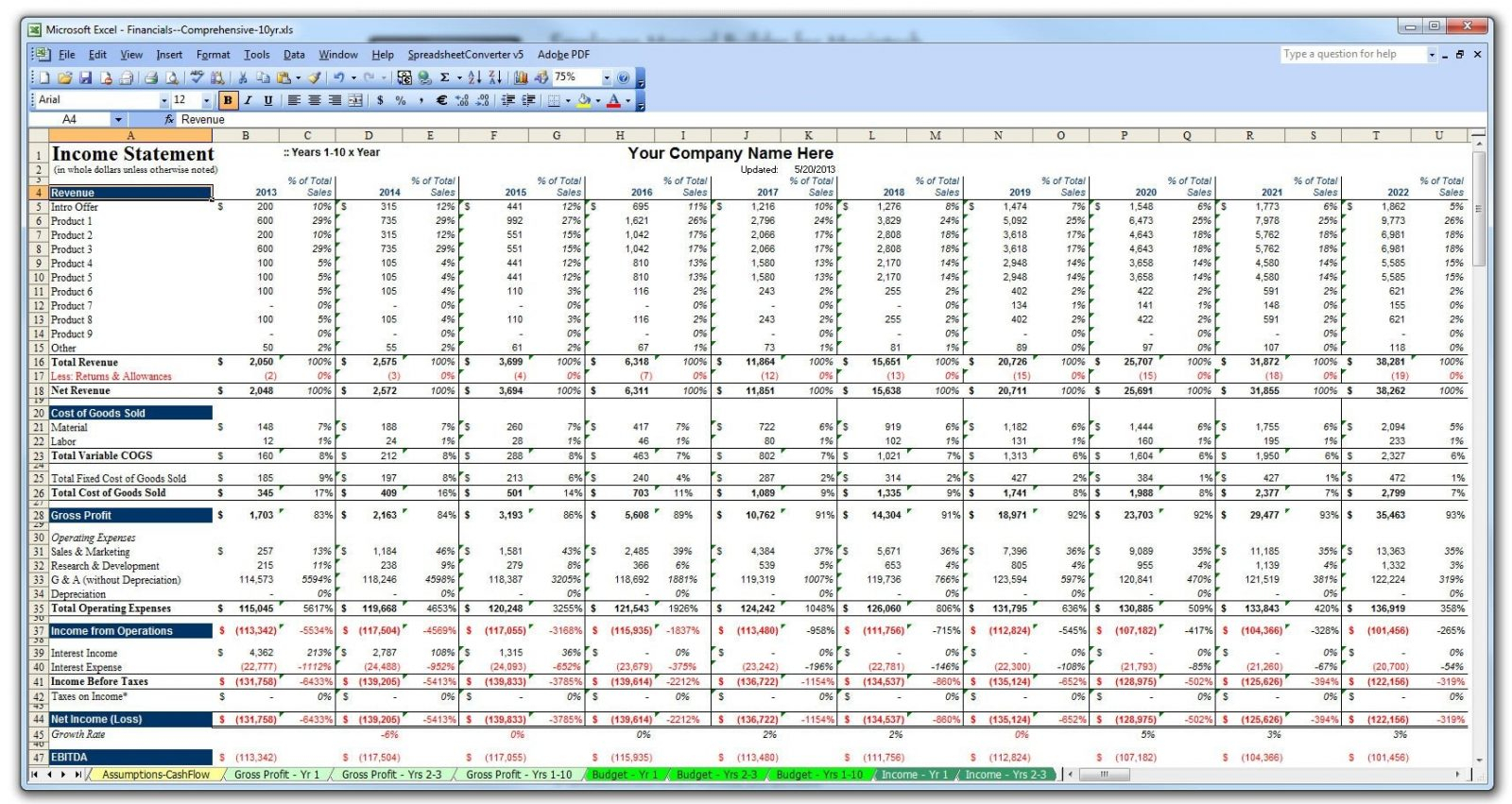

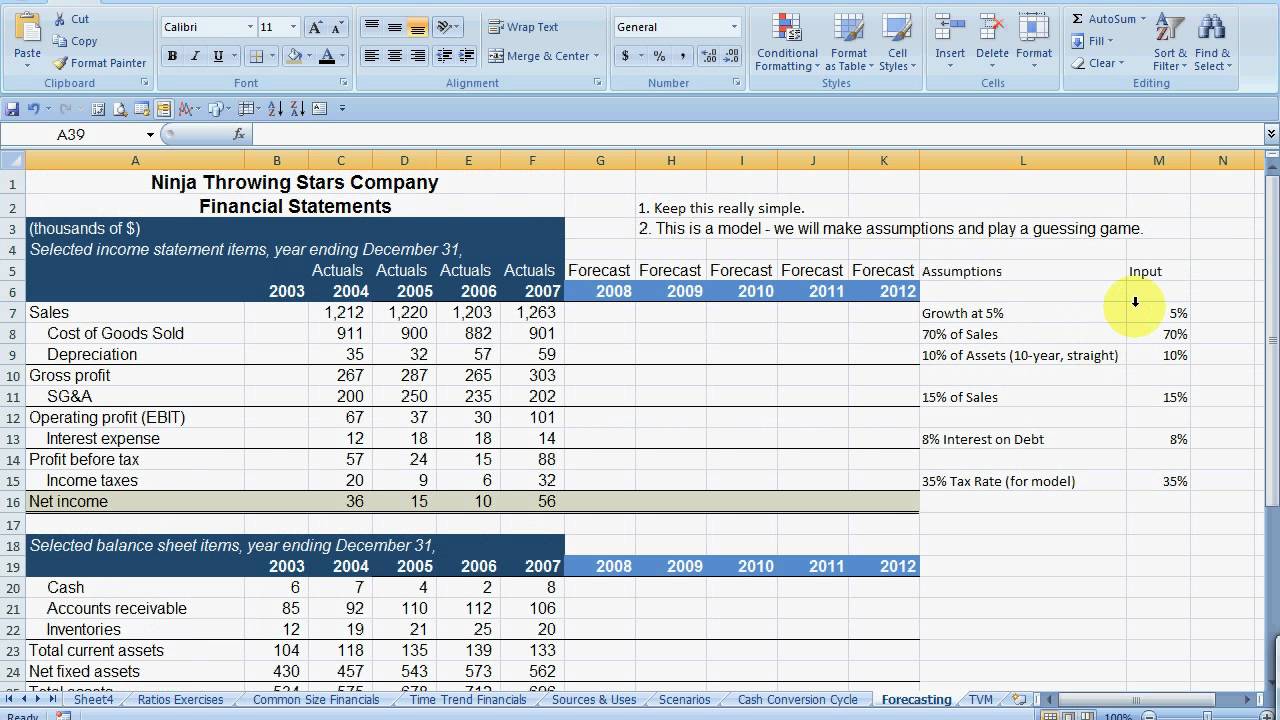

Forecast statement of financial position. Look back to look forward. Decide how you’ll make projections. Financial forecasting is often helped by processes of financial modeling.

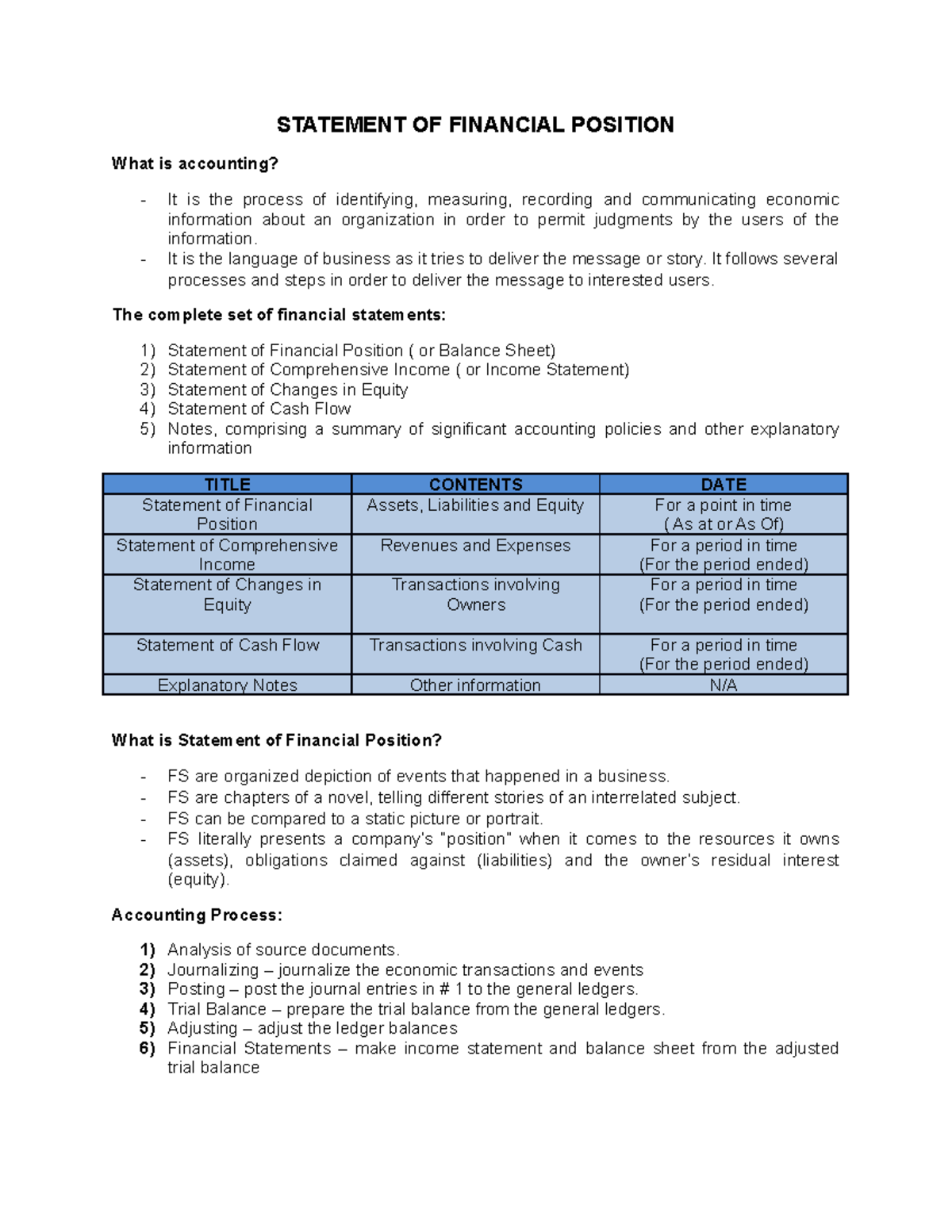

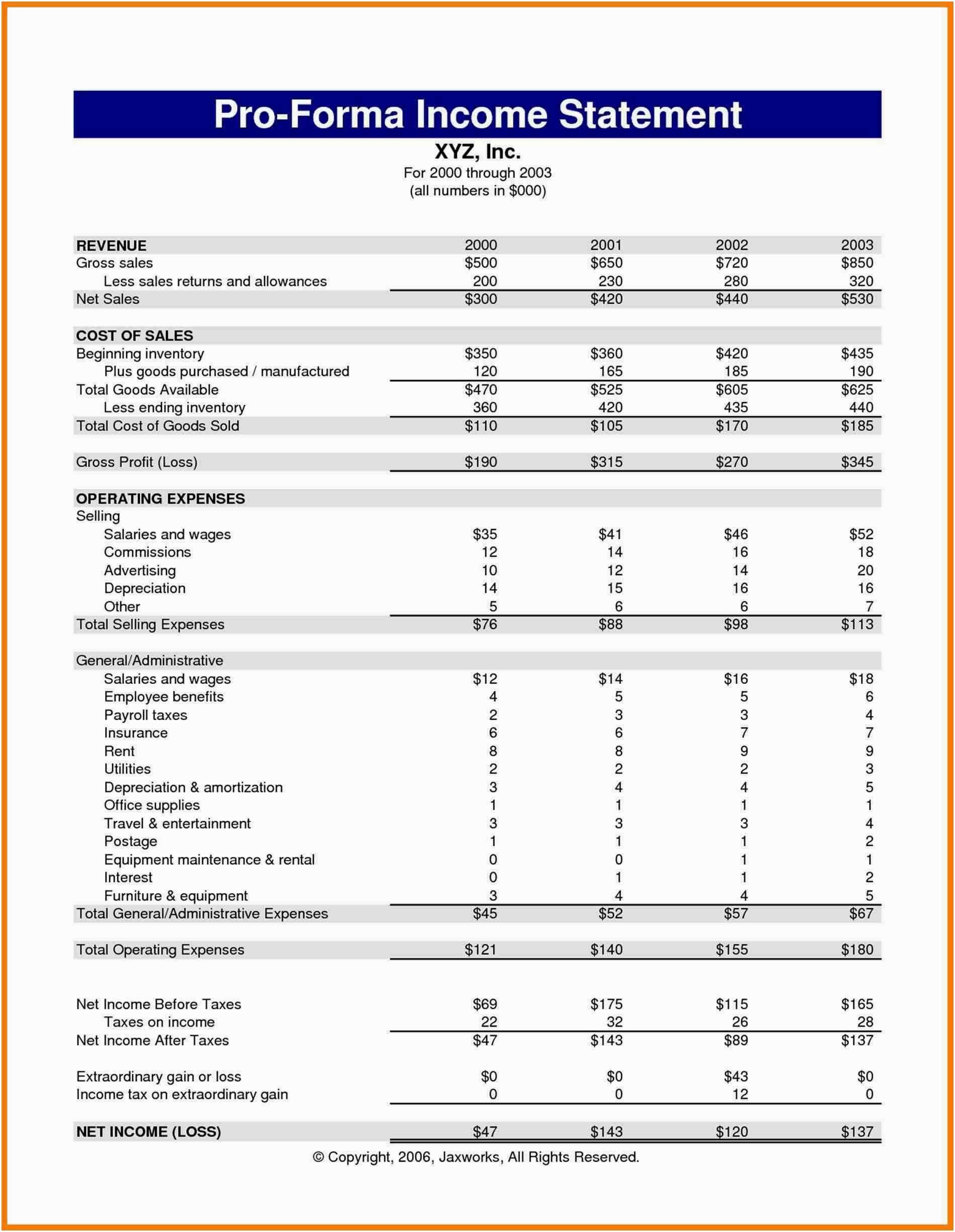

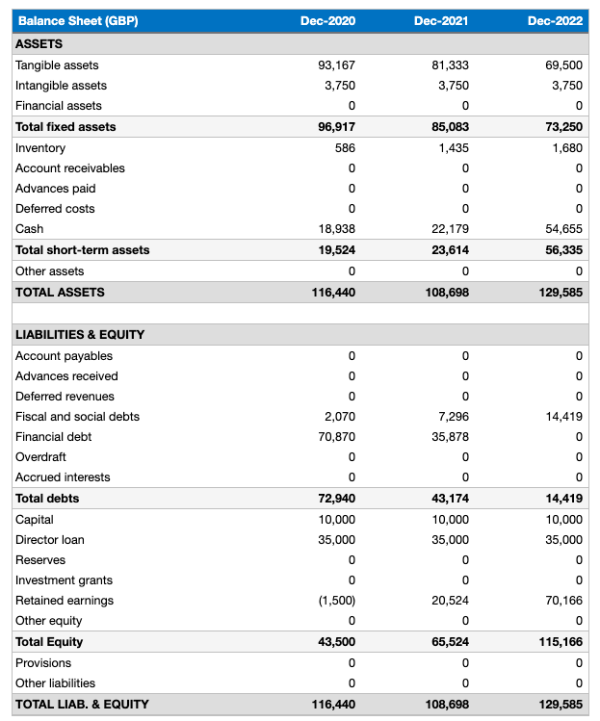

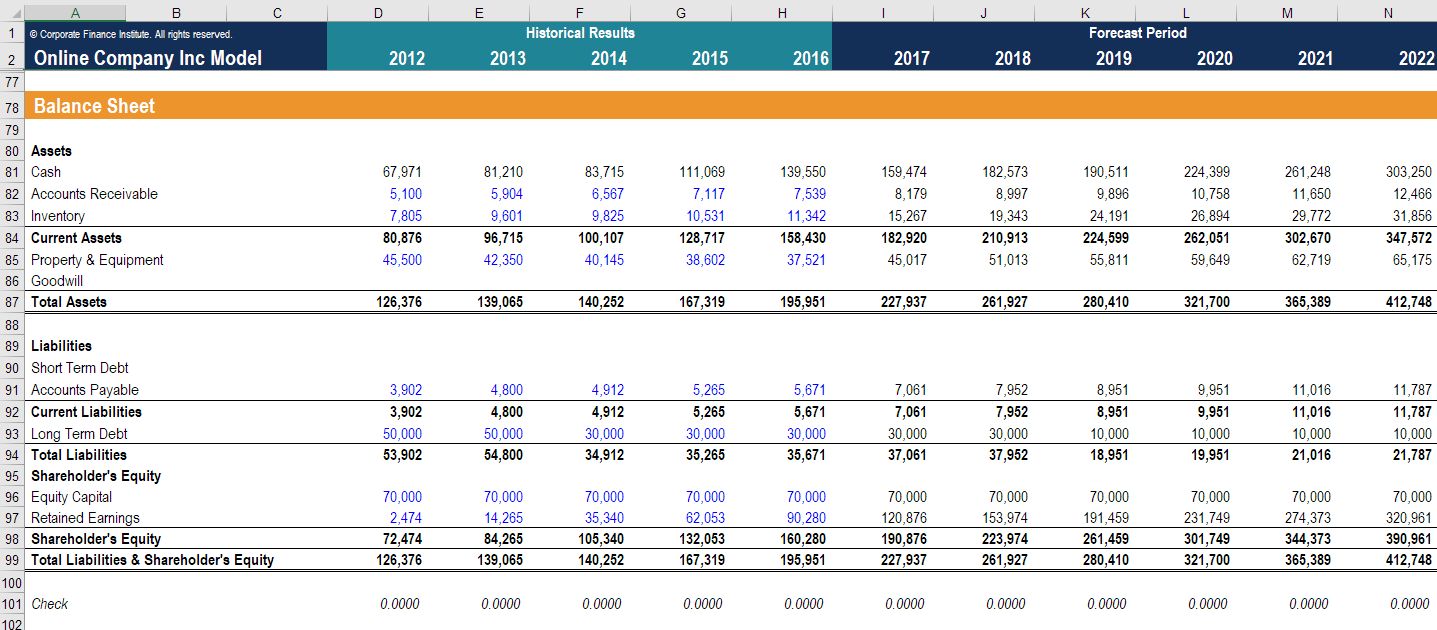

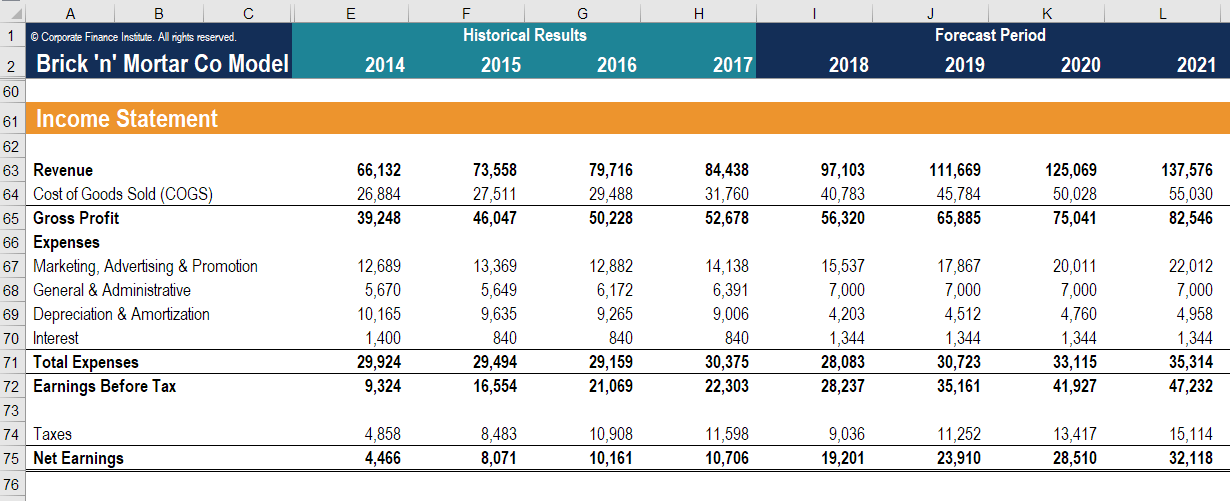

A balance sheet, also called the statement of financial position, is one of the major financial statements for small business accounting. However, in a complete financial model, all three financial statements are forecasted. Analyze historical data to accurately forecast your company’s profits or losses, you’ll first need to understand its past performance and use that data to predict future financial outcomes.

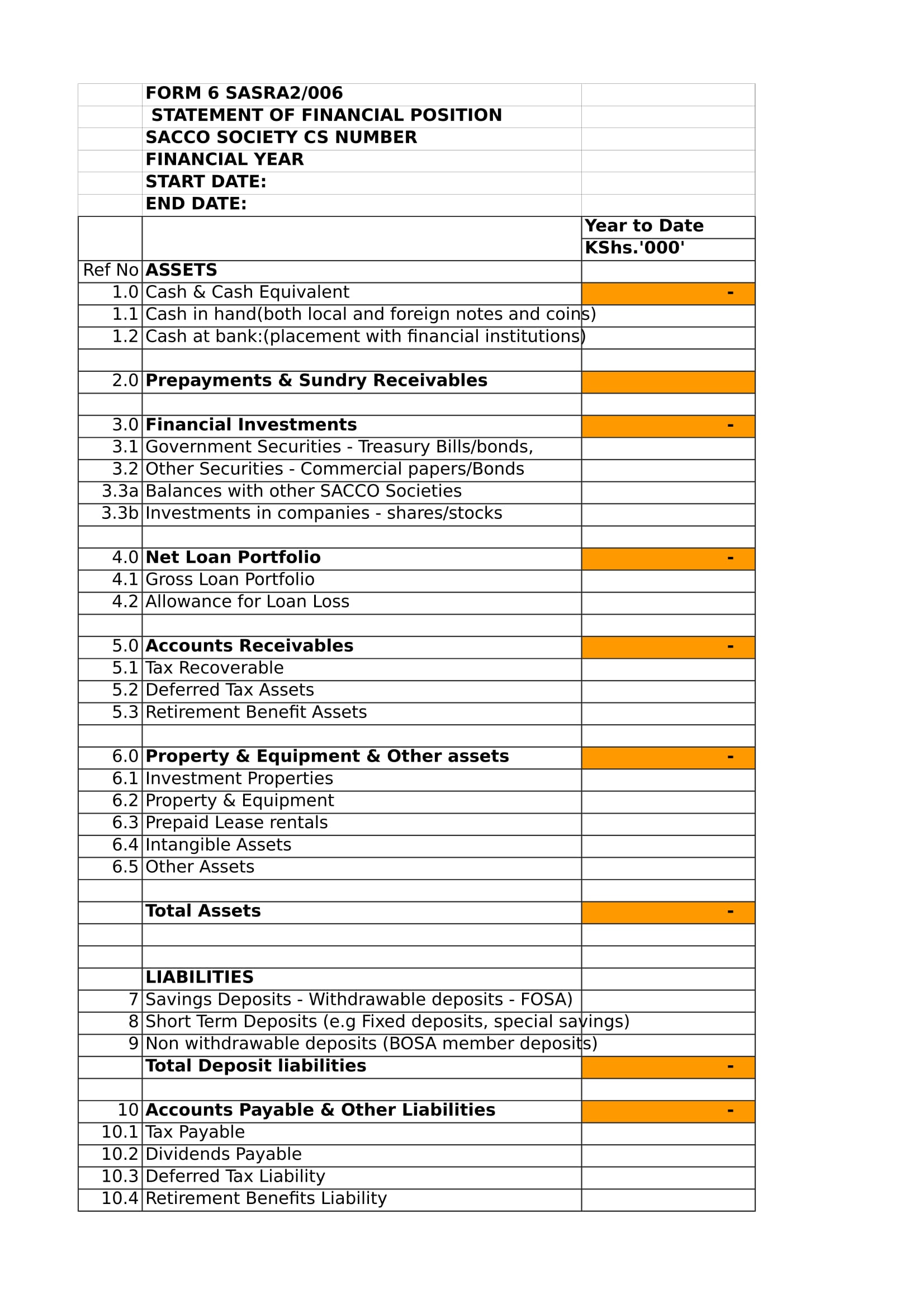

Ai revolutionizes financial forecasting and budgeting across sectors, enhancing accuracy and efficiency. Broadly speaking, working capital items are driven by the company’s revenue and operating forecasts. This module focuses on the presentation of the statement of financial position applying section 4 statement of financial position of the ifrs for smes standard.

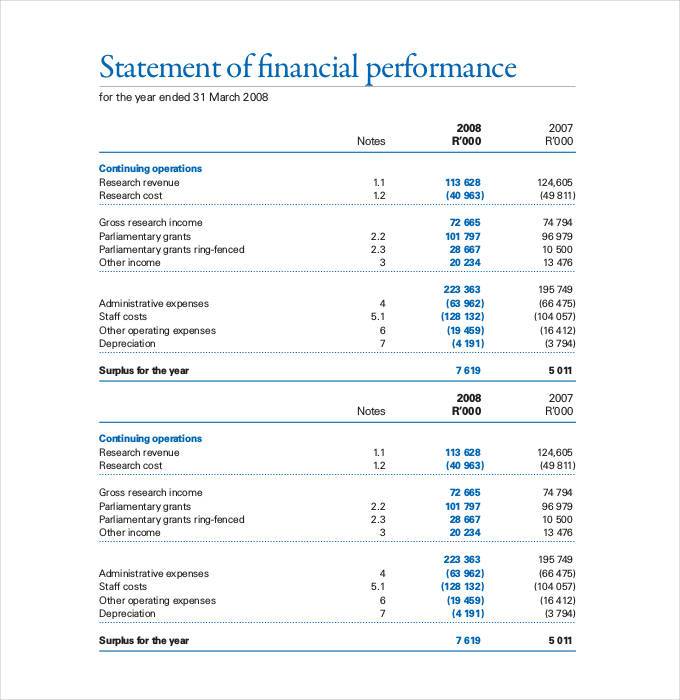

Analysts can directly forecast individual financial statement lines. The forecast is used to estimate what assets and liabilities a company will have in the future and thus represents the future financial position of the company. Financial forecasting is a process used by small businesses to project their future financial performance by evaluating historical data.

Here are the steps for forecasting your income statement: Outlook nvidia’s outlook for the first quarter of fiscal 2025 is as follows: Outside analysts can use a financial forecast to estimate a company's success in the coming year (figure 4.1).

Statement of financial position, also known as the balance sheet, gives the understanding to its users about the business’s financial status at a particular point in time by showing the details of the company’s assets along with its liabilities and owner’s capital. Make sure you’re using comparable data. Conceptually, working capital is a measure of a company’s short.

The balance sheet forecast is one of three forecasts that companies make to get an idea of their future financial situation. A company's worth is based on its market value. Financial modeling is the task of building an.

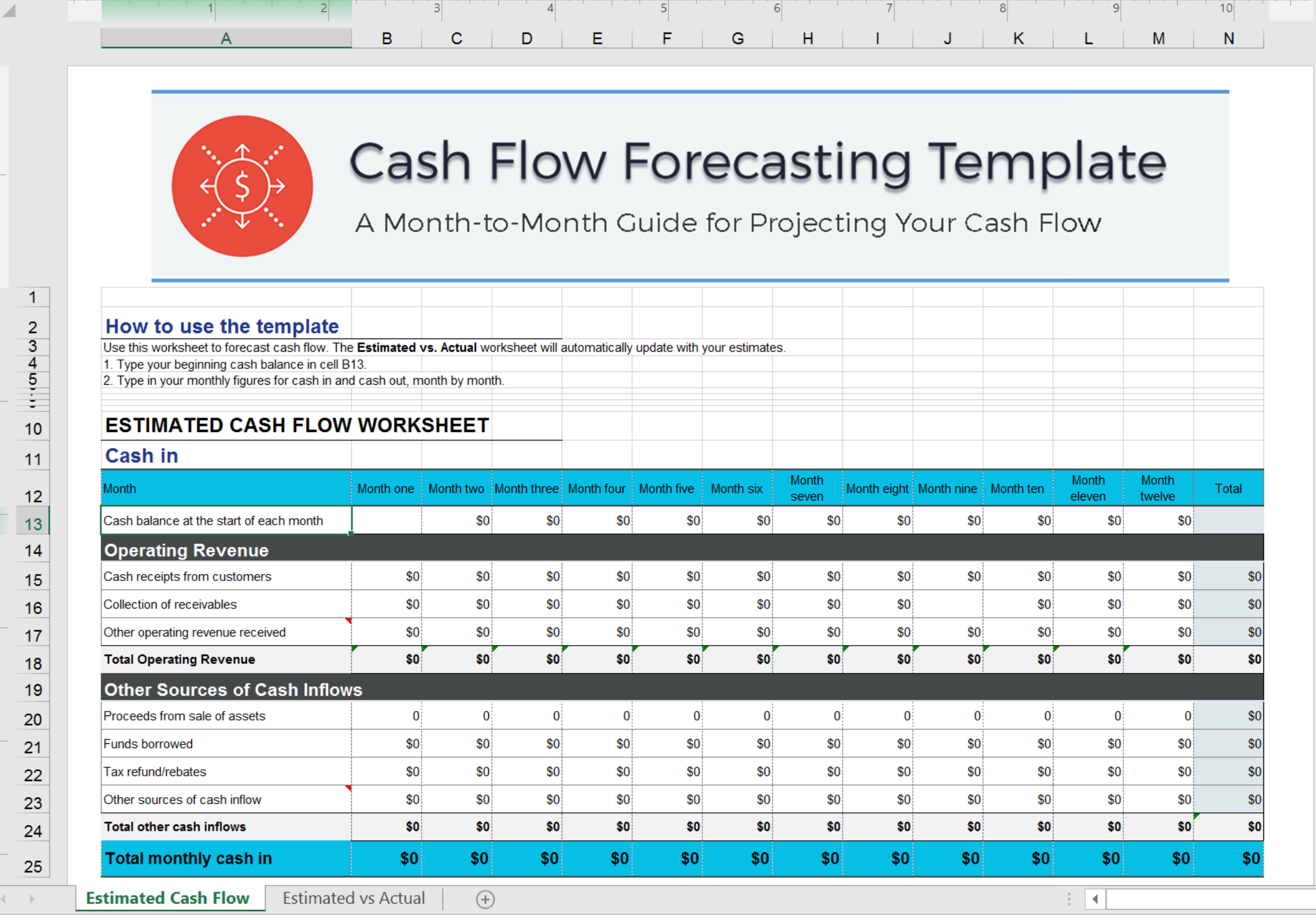

This is a free excel template displaying a typical statement of financial position. We begin by forecasting cash flows from operating activities before moving on to forecasting cash flows from investing and financing activities. It introduces the subject and reproduces the official text along with explanatory notes and examples designed to enhance understanding of the requirements.

Gather your past financial statements. The balance sheet forecast is an important accounting tool that can be used to estimate the impact of income statement line items and cash flow expectations on the future financial position of the business. If the total projected assets exceed the total projected liabilities and equity, the forecasting statement of position would express a shortage in future financing.

The ability to look forward and predict an organization’s financial statement requires first looking at the past. One of the components of financial forecasting involves analyzing past financial data, as explained. Discretionary projections would be needed to correct the imbalance in the forecasting statement of position, either as a shortage or a surplus.