Awesome Tips About Form 26as Purpose

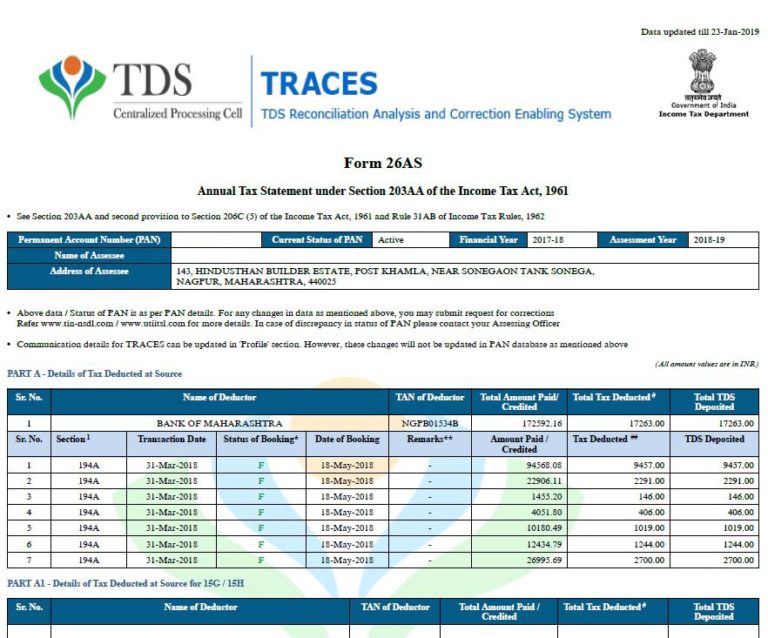

Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Form 26as purpose. Know how to view and download form 26as from traces website. It is an annual statement that is sent to individual. Form 26as helps taxpayers verify whether the taxes deducted from their income or paid by them have been accurately credited to their account.

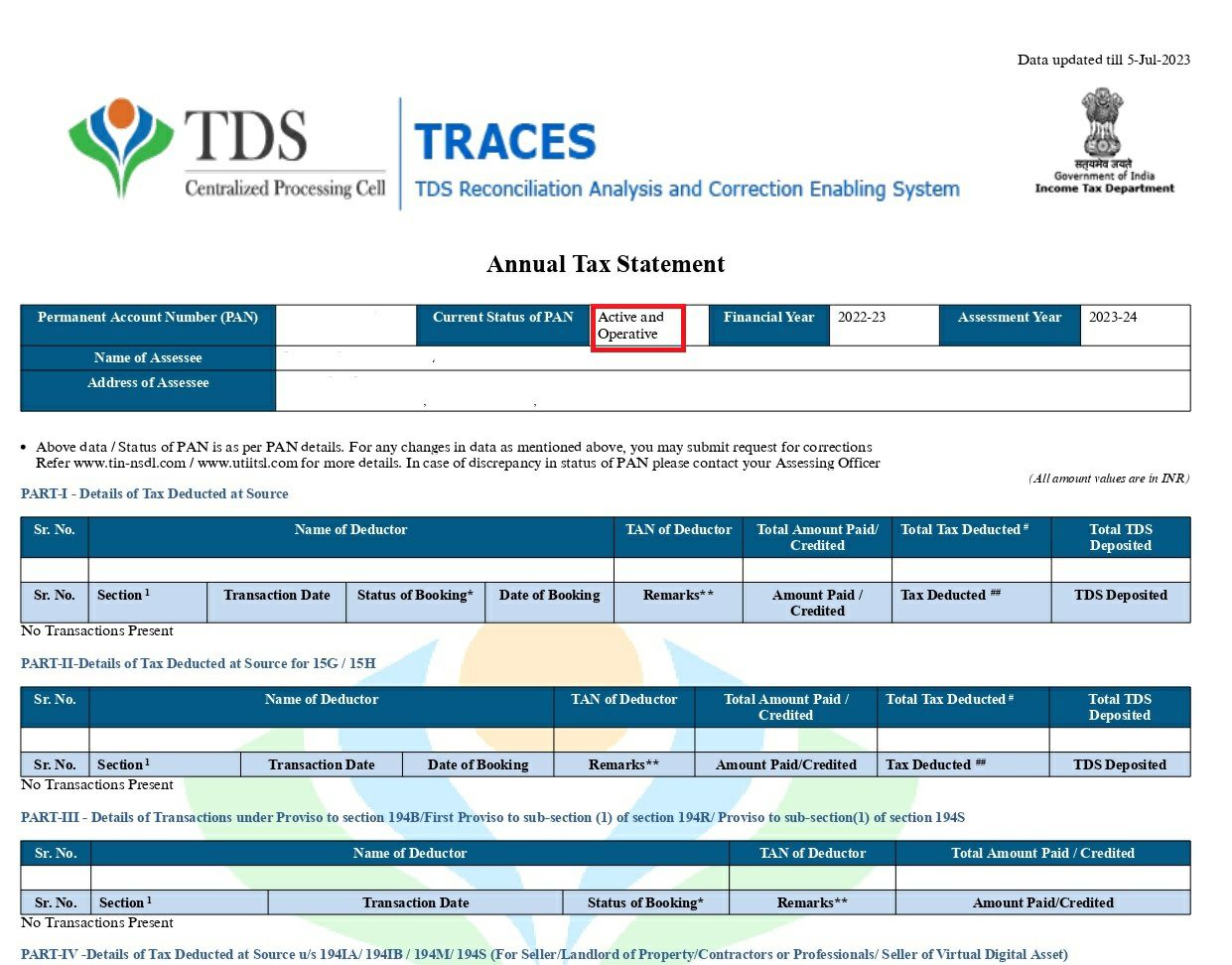

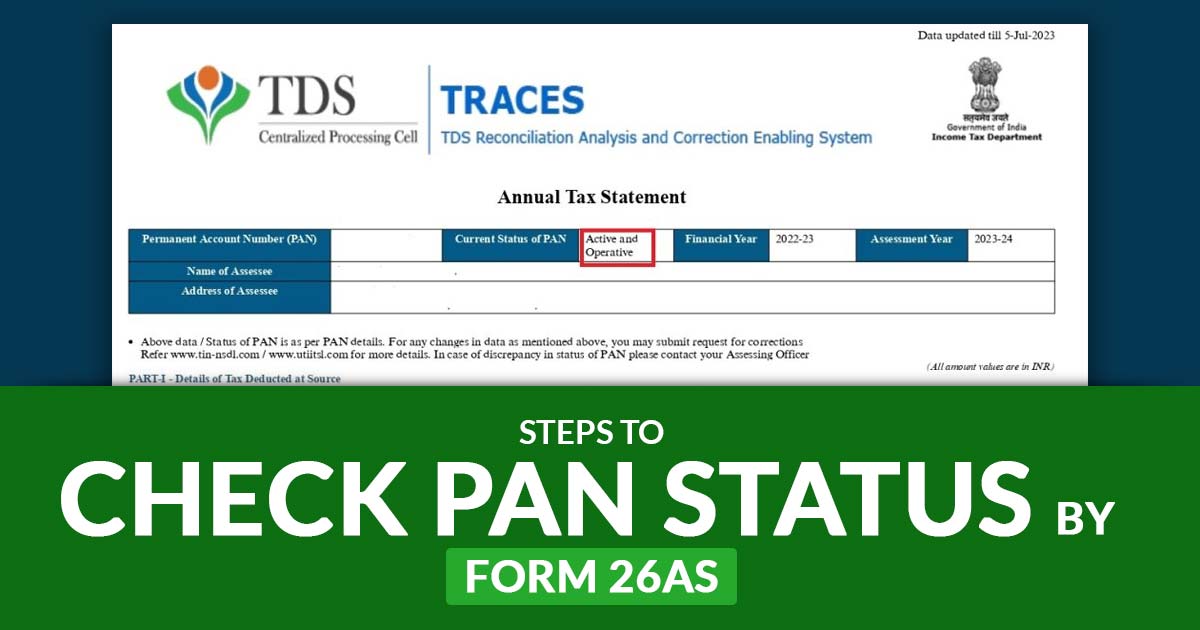

Certain transactions, like cash deposits above a specified threshold or buying. The tax credit statement (form 26as) is an annual statement that consolidates information about tds, advance tax paid by the assessees, and tcs. Upon being redirected, the individual needs to click on the “view tax credit (form 26as)” link.

On 9 th september 2021, cbdt has announced enhancing the timelines for some compliance. Form 26as is an important tax filing as it is tax credit statement. This form can be accessed from the income tax.

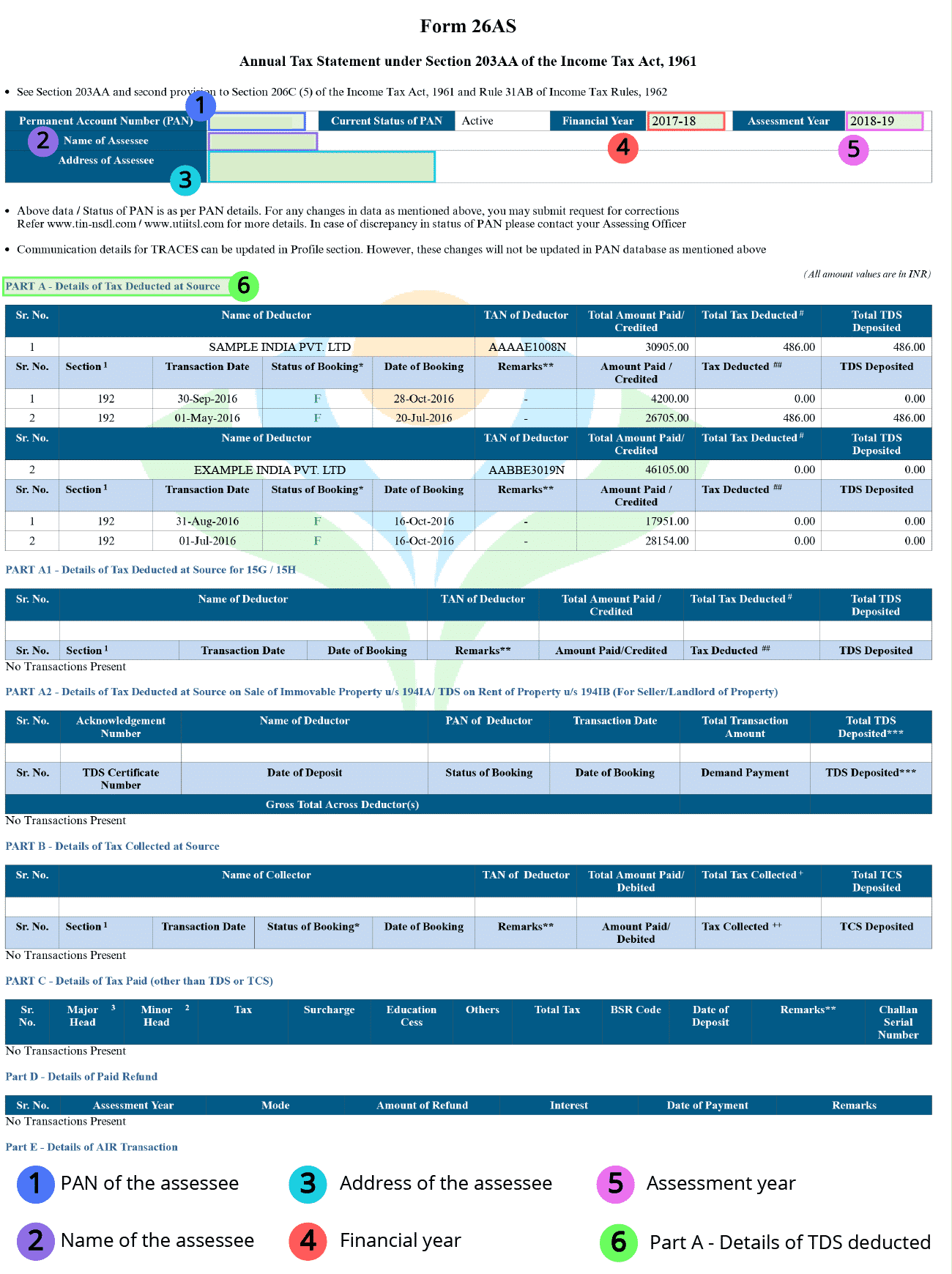

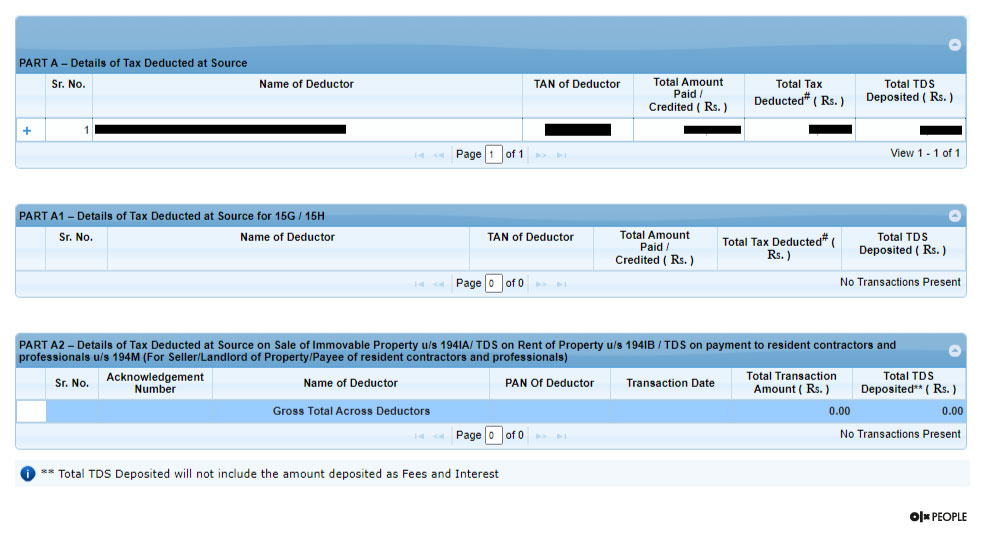

Details of tax collected source by all the tax collectors 3. Form 26as is a statement of tax credits. Here, the user is required to provide the assessment year.

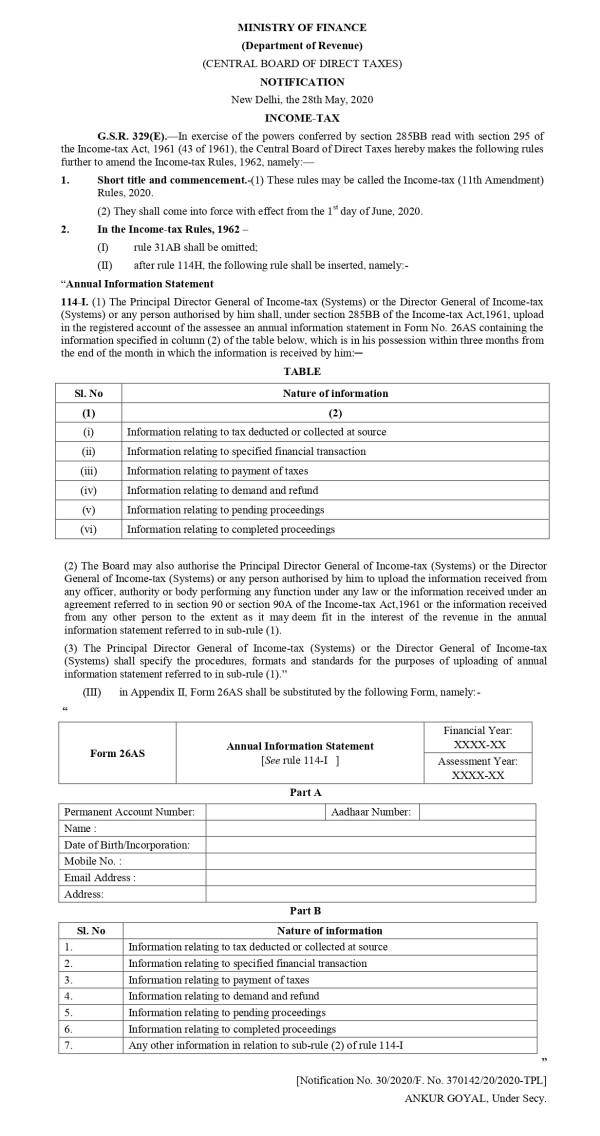

Form 26as provides a detailed overview of your financial activities for a specific year, going beyond just tds (tax deducted at source) and tcs (tax collected. Apart from reconciling your tax details, form 26as serves another essential purpose. When it is available, importance, usage & step by step process to download form 26as.

What is the difference between ais and form 26as? Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and self. A taxpayer’s form 26as is a declaration that lists all amounts withheld as tds or tcs from their different income sources.

Form 26as is an annual statement which has details of the tax credited against the pan of a taxpayer. Form 26as is a statement that shows the below information: It is a consolidated statement that contains information about the tax that has been deducted or collected from an.

It also shows information about high. Form 26as is a statement that provides details of any amount deducted as tds or tcs from various sources of income of a taxpayer. Each section of form 26as serves a specific purpose, providing taxpayers with detailed insights into their tds, tcs, tax payments, refunds, significant financial.