Top Notch Info About Operating Profit In Balance Sheet

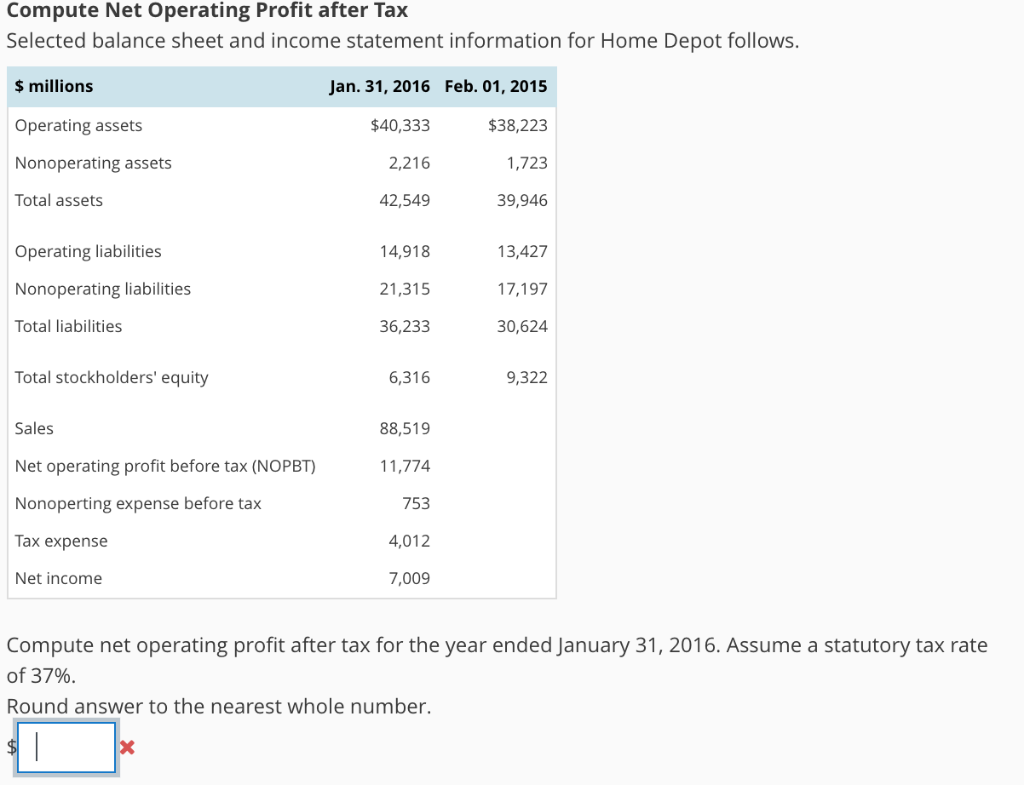

The following is the formula used to calculate the operating profit of a company:

Operating profit in balance sheet. Operating profit is the net income derived from a company's primary or core business operations. Operating income is calculated by subtracting operating expenses from a company's gross. Here are some of the changes:

The higher the operating profit, the more profitable a company’s core business is. The net assets (also called equity, capital, retained earnings, or fund balance) represent the sum of all the annual surpluses or deficits that an organization has accumulated over its entire history.

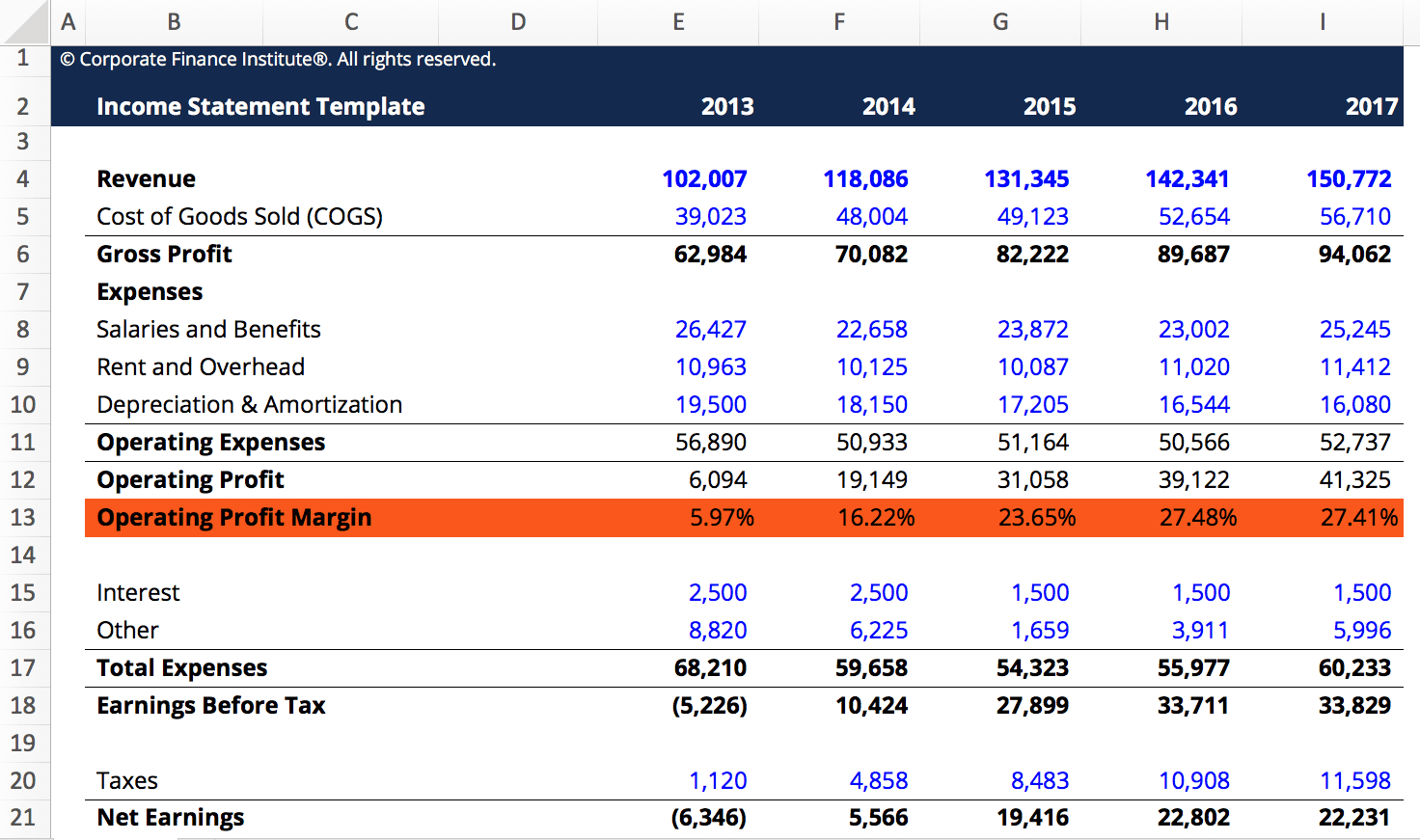

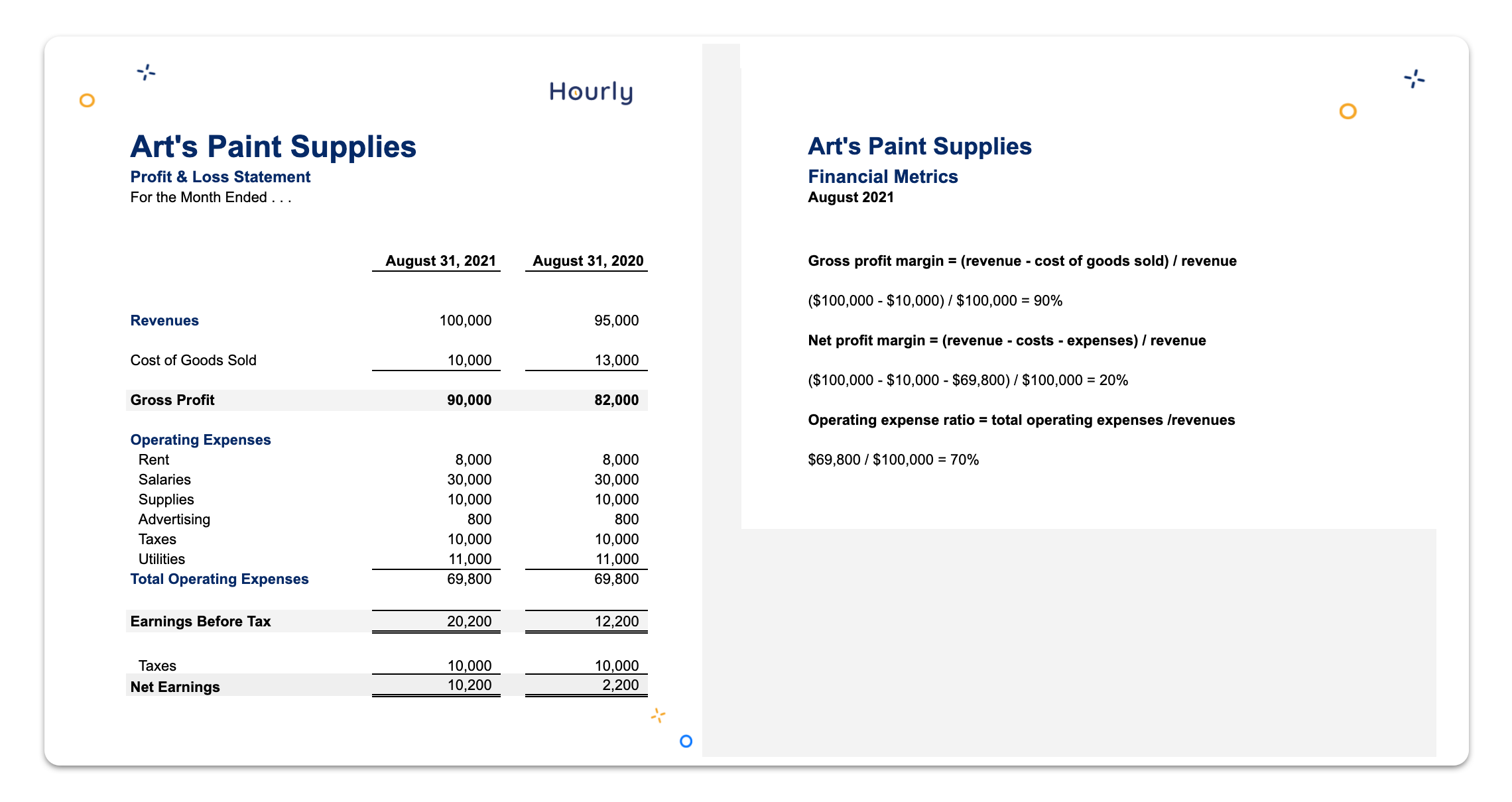

Operating income reports the amount of profit realized from a business's ongoing operations. Operating profit is reported in income statements rather than balance sheet. Business owners can calculate one of three measures of profitability:

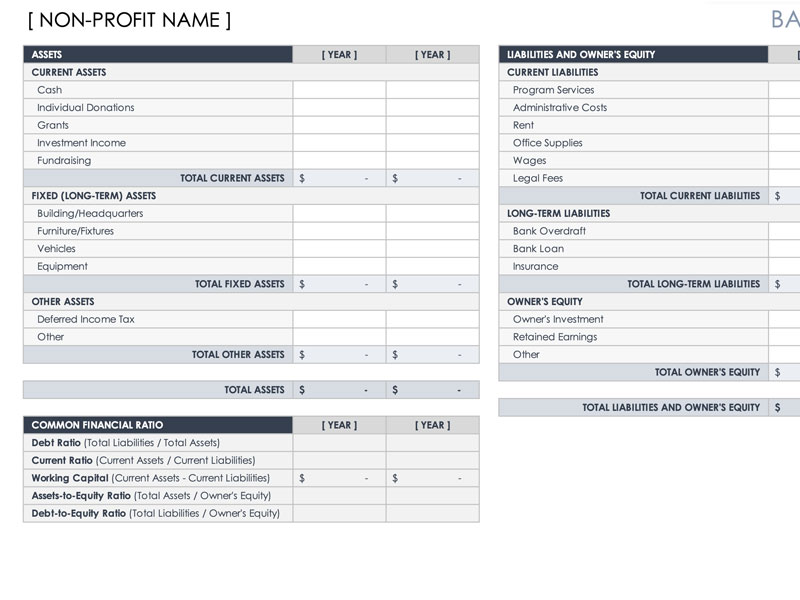

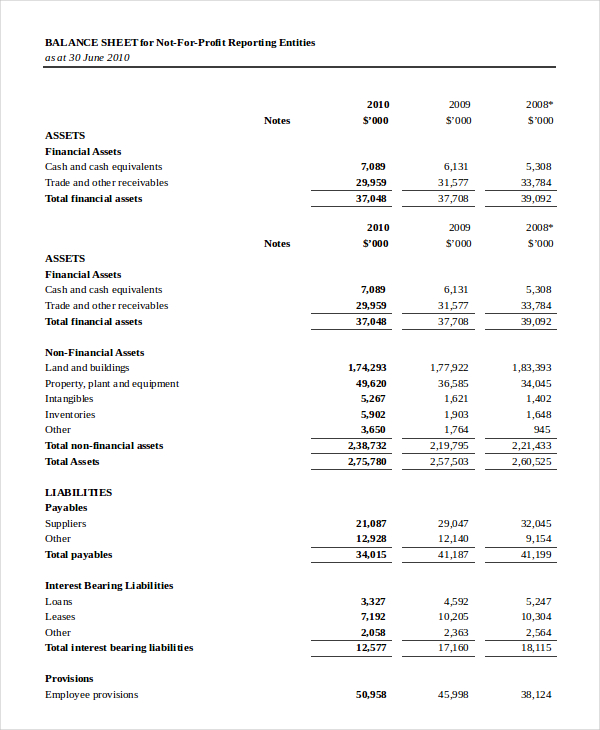

A balance sheet shows a company's assets, liabilities and capital structure. Why is operating profit figure important? It can also be referred to as a statement of net worth or a statement of financial position.

Assets = liabilities + equity. How profits change the balance sheet since all business transactions affect at least two accounts, there will likely be an enormous number of changes to the balance sheet. It is calculated by dividing the operating profit by total revenue and expressing it as a percentage.

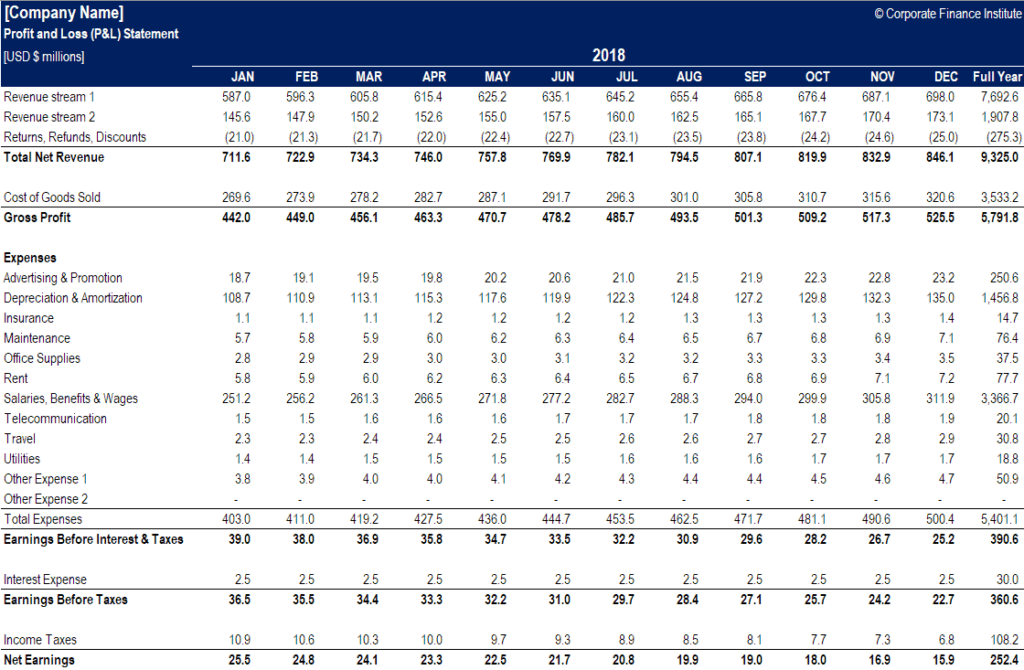

How to calculate operating profit in business. The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. Operating profit tells you how much your business makes from its core operations.

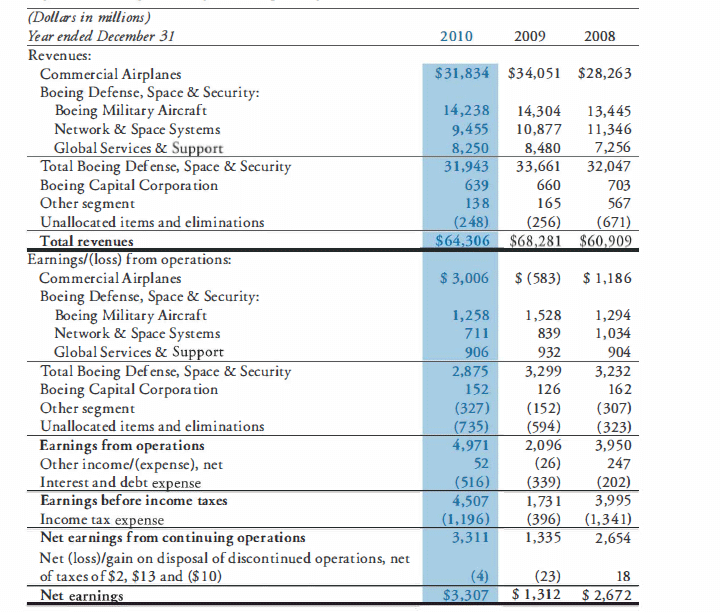

Such statements provide an ongoing record of a company's. However, the relationship between earnings, or profit, and balance sheet assets isn't entirely straightforward. Free cash flow before m&a and customer financing € 4.4 billion;

Operating profit tells you how much money you’re clearing from your core business and what your cash flow situation is. Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%. The balance sheet is based on the fundamental equation:

Operating profit margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and interest charges. Gross profit, net profit, and operating profit. The balance sheet reports an organization’s assets (what is owned) and liabilities (what is owed).

Miner anglo american aal said on thursday it will review its assets after a 94% plunge in annual profit and writedowns at its diamond and nickel operations. The commonwealth bank has recorded a cash profit of $5bn after closing 354 branches and removing 2,297 atms across the country in just five years. This profit is before charging interest expenses and tax expenses of the period.