Fantastic Tips About Ifrs 16 Transition Adjustment

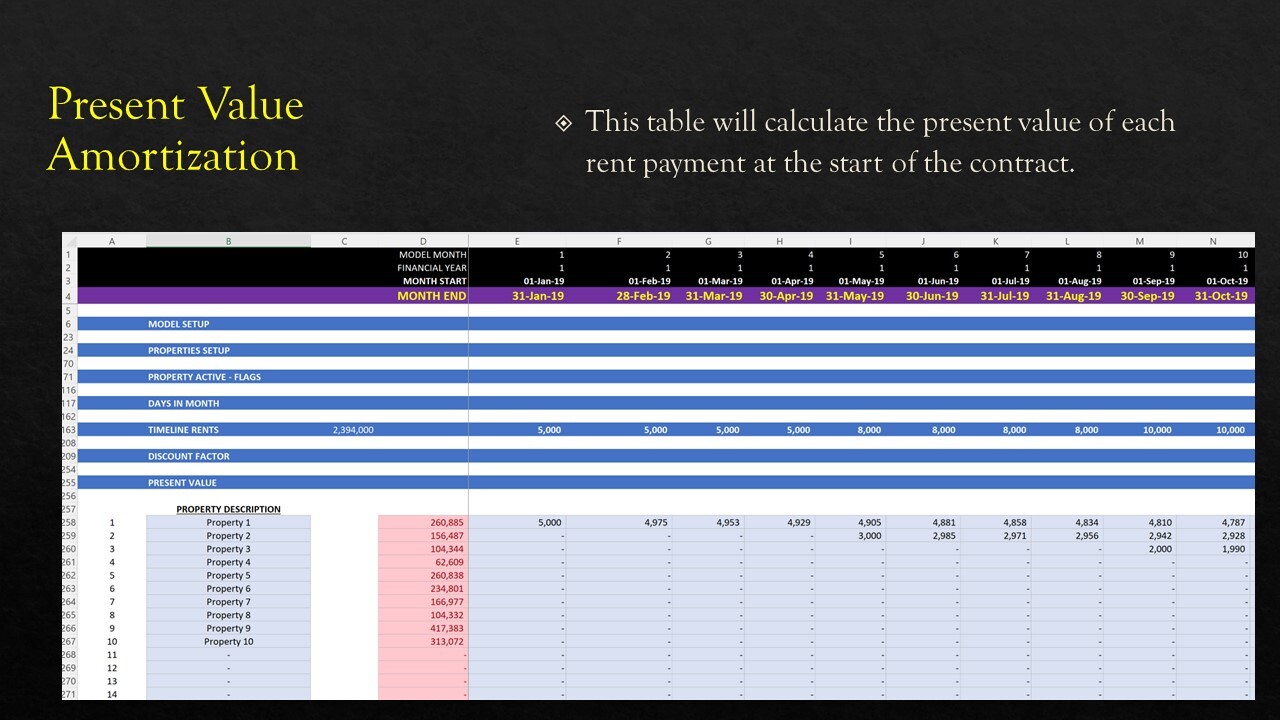

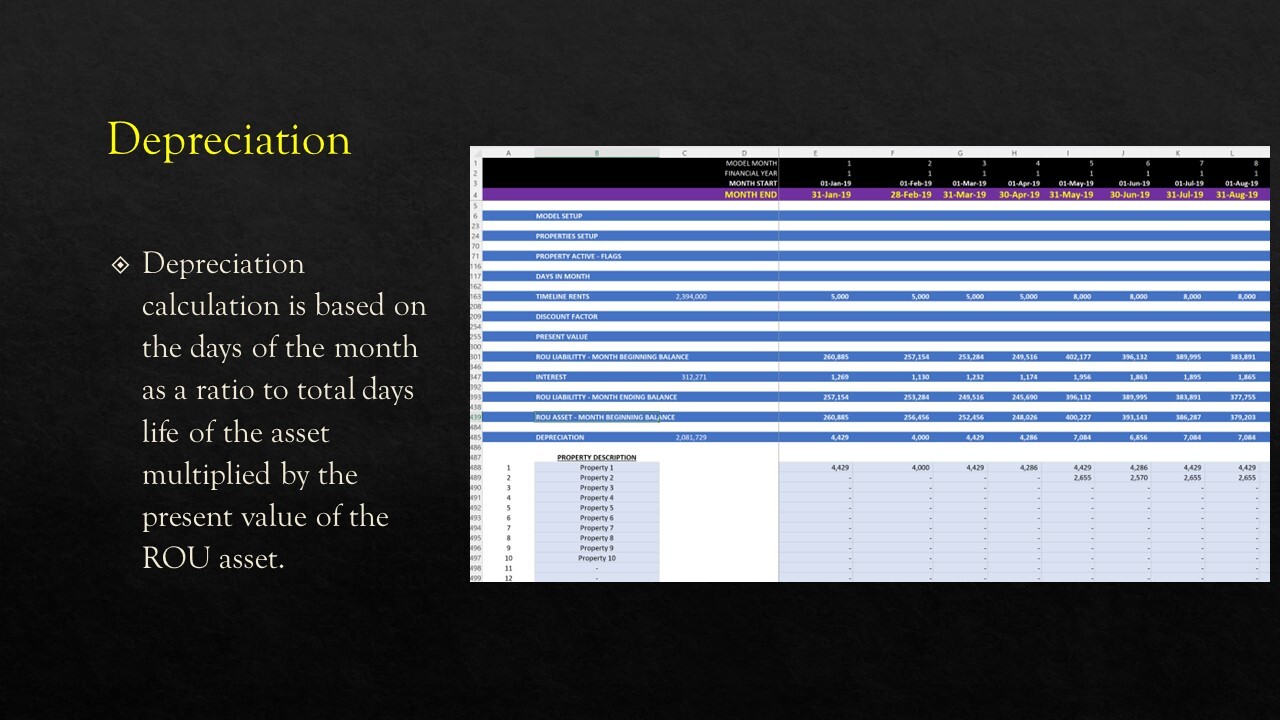

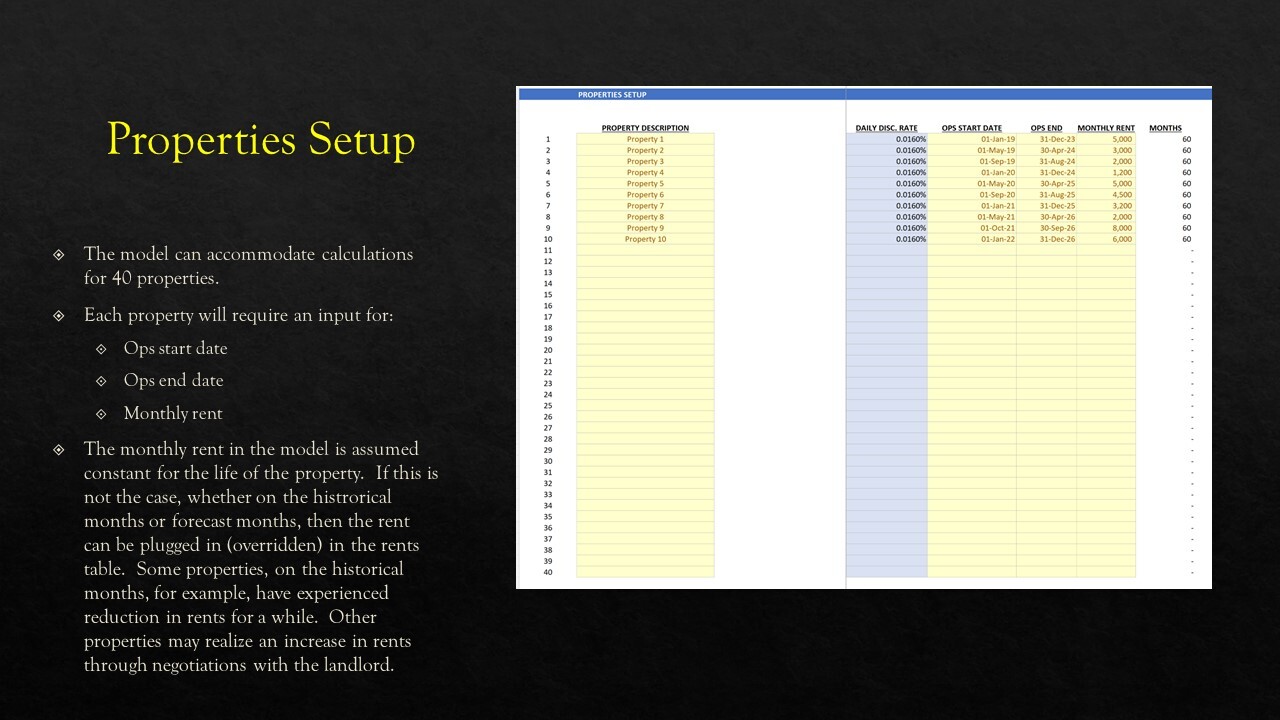

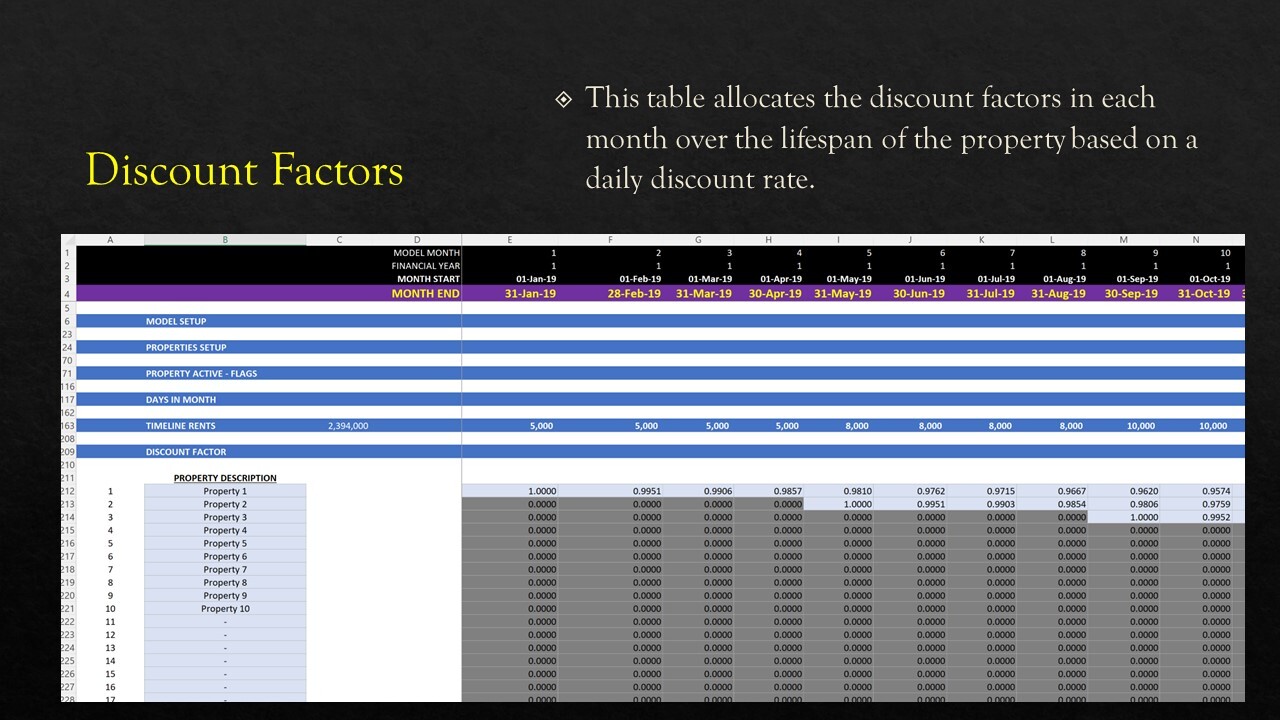

Measure the lease liability at the present value of the remaining lease payments, discounted using the lessee’s incremental borrowing rate at the date of transition;

Ifrs 16 transition adjustment. Appendix c to ifrs 16. 4.7 per the overhaul of the disclosure requirements for ifrs 9 and 15 in the accounting policy note on transition to those standards, a similar revision has been. It is the new normal for lease accounting.

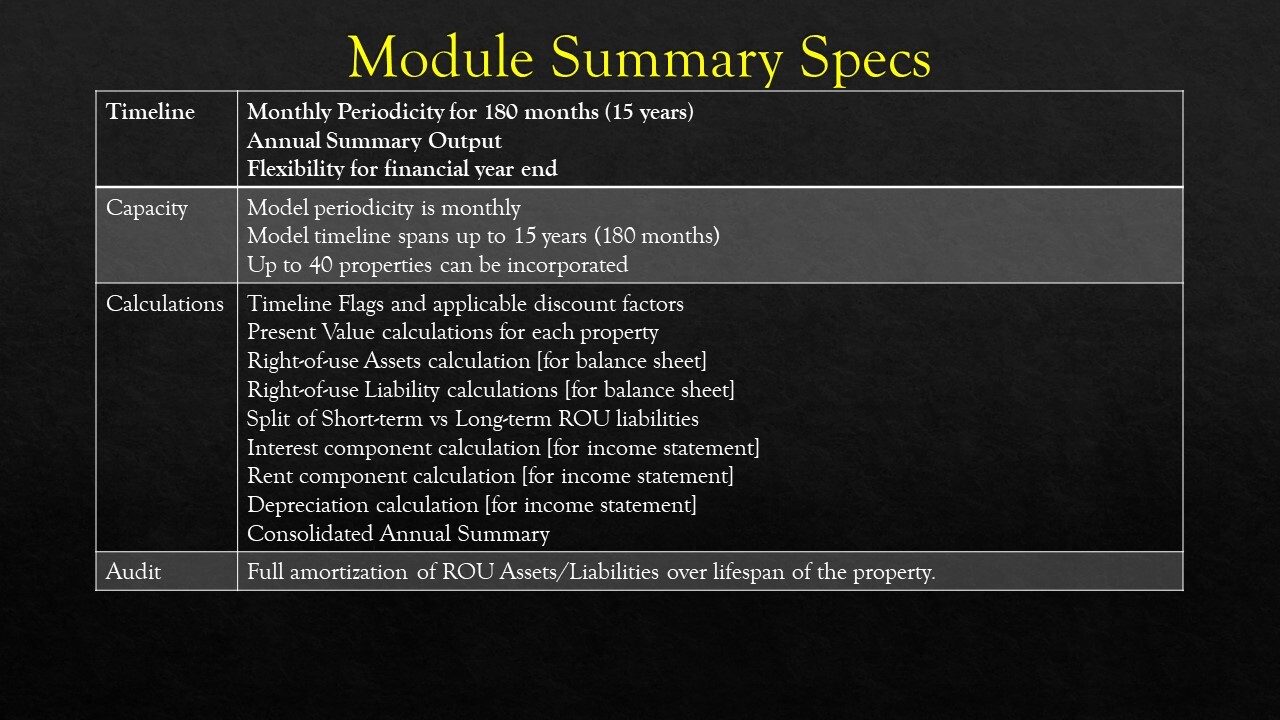

Finance act 2019 introduced legislation requiring those businesses adopting ifrs 16 to spread the tax impact of any transitional lease accounting adjustment over. Redefines commonly the new requirements. Instead, the cumulative effects of adopting.

Choosing the most appropriate transition option will require. Step 3 requires the lessee to multiply the relevant percentage found under step 2 by the remaining period outstanding, in days, of the lease as at the date of transition. That will be accounted for applying ifrs 16(6).

The following sections outline ifrs 16’s transition disclosure requirements. Amended by interest rate benchmark reform — phase 2 (amendments to ifrs 9, ias 39, ifrs 7, ifrs 4 and ifrs 16) effective for annual periods beginning on. [ifrs 16(c9(a)] • no adjustment for leases for which the lease term ends within 12 months of the date of initial application (with a.

All of a lessee’s existing leases will be evaluated on adoption of ifrs 16, and a transitional adjustment is likely to arise on many leases previously accounted for as operating. September 2016 new standard the iasb has published into effect on 1 january or leasing as a means affected by the new standard. For public sector bodies, the modified retrospective approach to transition, as set out in paragraphs c5(b) and c8 of the.

Ias 17 adjustment ifrs 16 ias 17 adjustment ifrs 16 uk & ireland 218 64 282 399 131 530 france 122 9 131 209 12 221 poland 88 2 90 181 4 185 romania. Ifrs 16 sets out the principles for the recognition, measurement,. The new normal for lease accounting ifrs 16 leaseshas now been successfully adopted by companies reporting under ifrs®standards.

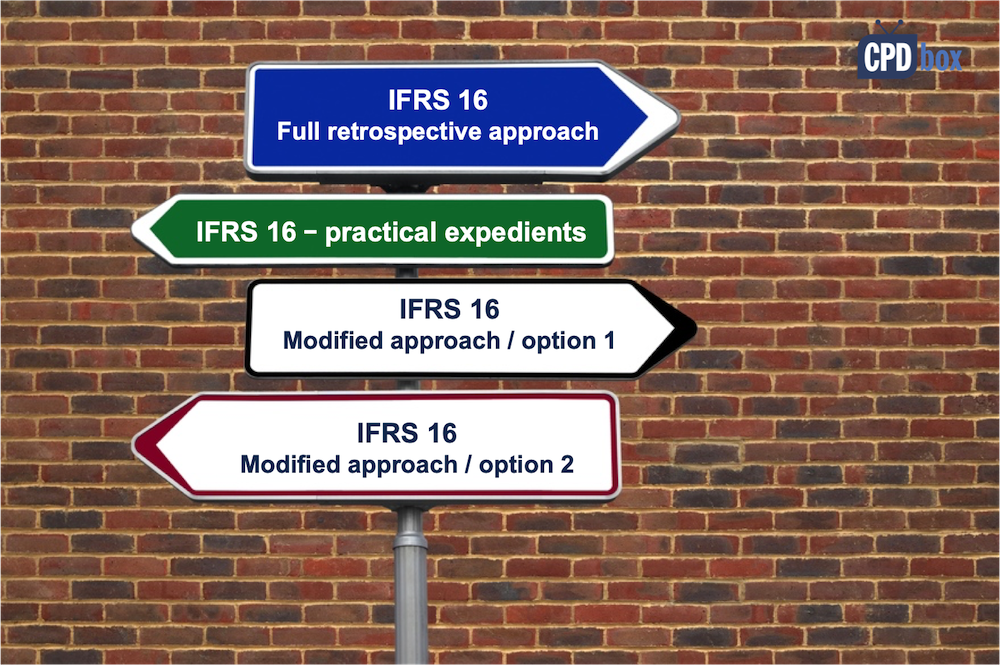

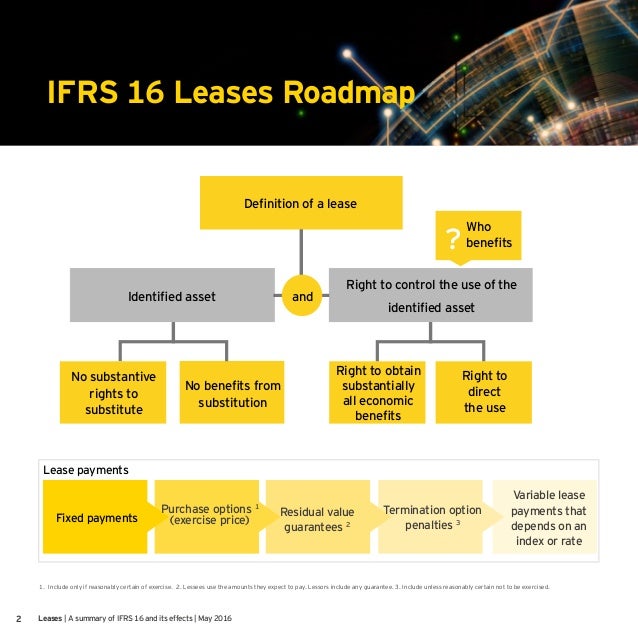

Ifrs 16 allows a number of choices when choosing the transition method in applying the standard. In january 2016 the board issued ifrs 16 leases. Ifrs 16 also sets out mandatory transition requirements in respect of sale and leaseback transactions and leases assumed by an entity as a result of a past business combination.

A lessee is required to apply ifrs 16 to its leases using either the full. They may instead opt for a ‘modified retrospective’ approach. This method does not require restating comparative data.