Top Notch Info About Auditing Church Financial Records

It should be used to increase knowledge of auditing principles within your congregation, including the understanding.

Auditing church financial records. Every congregation needs to do a church audit, but it doesn’t have to be a big expense or an insurmountable obstacle. The book of discipline calls for every church's committee on finance to conduct an annual audit of. For united methodist congregations this booklet is given to you as a service of the internal audit department and the committee on audit and review of the general council on.

A congregational audit is an independent evaluation of the financial records and the internal controls of the congregation for the purposes of providing an opinion on the. There is an updated local. By ken sloane.

Audit the church’s financial records because there are a myriad of new accounting pronouncements and standards that may affect your church. Copies of all your organizations policies and procedures related to finance and treasury functions and copies of minute approving those policies. Church finances can sometimes be seen as the ugly duckling of our business.

How to improve the process for church records management; It is thorough. Best practices for church financial management.

This is much more challenging. This resource is provided to you as a service; Do the financial statements include all funds.

It gives peace of mind to members and donors. Annual audit records and worksheets, insurance letters, individual giving records and accounts payable records are also important. Just like the ugly duckling, though, proper.

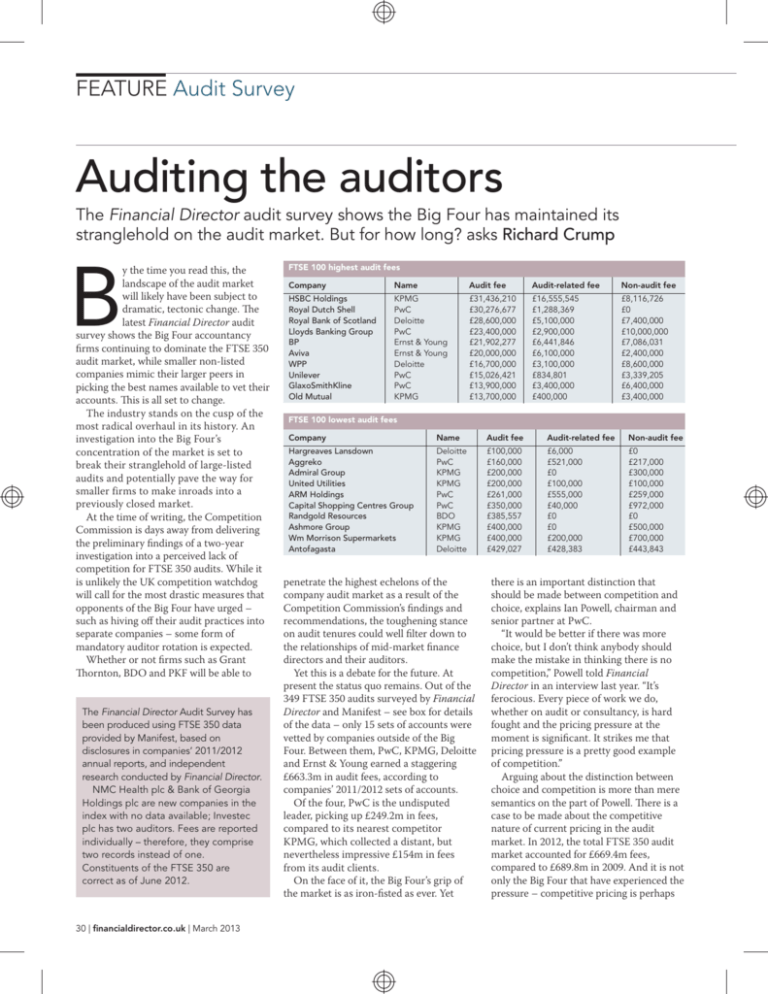

How long should a church keep records? External audits are performed by an independent auditor. That the church treasurer or an independent audit committee of.

Along with scrutinizing financial documents and all supporting records to ensure a church’s financial integrity, auditors also assess a church’s internal controls. A free church auditing resource has been made available to provide options for churches seeking audits and accountability. Both the national and diocesan canons require that a reliable and credible audit of the diocesan financial records and the records of every congregation take place annually.

The book of discipline defines a local church audit is an independent evaluation of the financial reports and records of the internal controls of the local church by a qualified. The annual audit of the financial records of the local church is a requirement set forth in the book of discipline of the united methodist church, 2012; There also should be an annual audit of the church’s financial records.

Items you will want to keep for seven years include payroll tax records and registers, accounts payable and accounts receivable records, bank statements,. A full financial review of all books and records relating to finances once each year by a public accountant or public accounting firm or a committee of members versed in. Are monthly financial statements prepared on a timely basis and submitted to the church board or appropriate person or committee?