Exemplary Tips About Journal Entry For Income Tax Payable

Income tax payable is a type of account in the current liabilities section of a company's balance sheet comprised of taxes that must be paid to the government within.

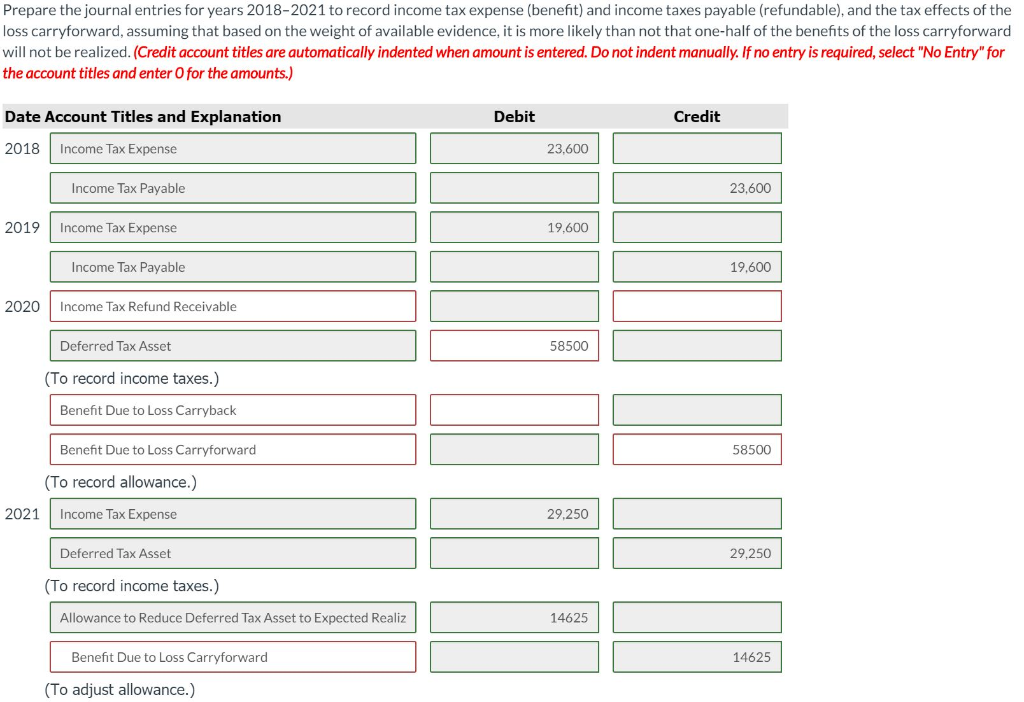

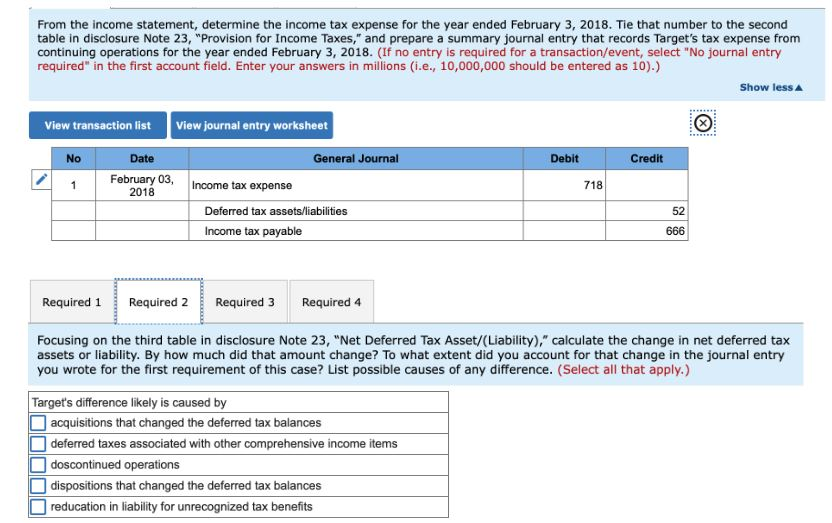

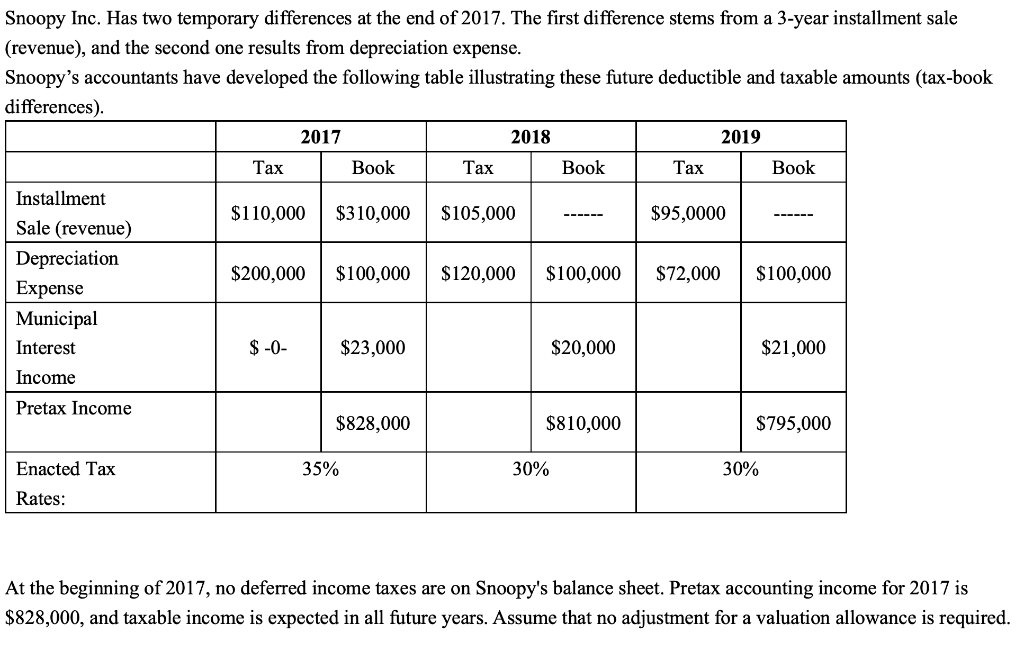

Journal entry for income tax payable. Income taxes payable. Accounting and journal entry for income. Journal entries for deferred tax liability.

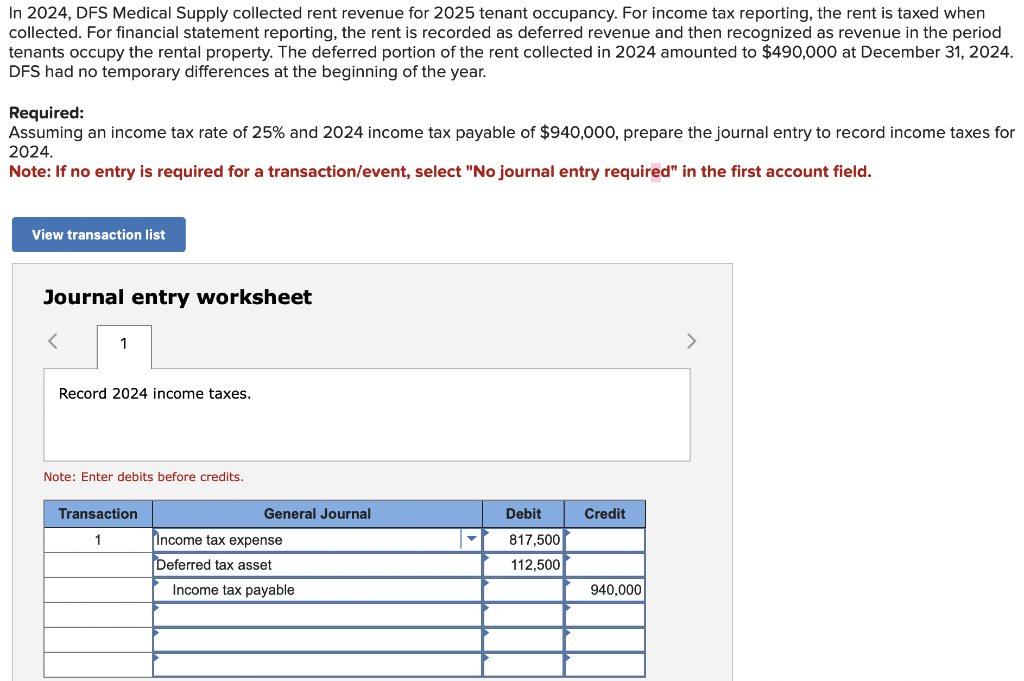

On december 31, 20×1, entity a estimated the income taxes expense for 20×1 as $260,000. Shannon stapleton/getty images. The reporting of financial obligations for taxes due at the end of the year necessitates a journal entry to accurately reflect the liabilities.

A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364. It increases the accounts payable liability, which is reported on. The income tax amount will be paid to the government within 2 months after the.

Solution this $6.25 million is the company’s expense. 1 post user australia november 2016 i am currently doing bank reconciliaton so inputing data's into myob. Recording gst payable in your books introduction:

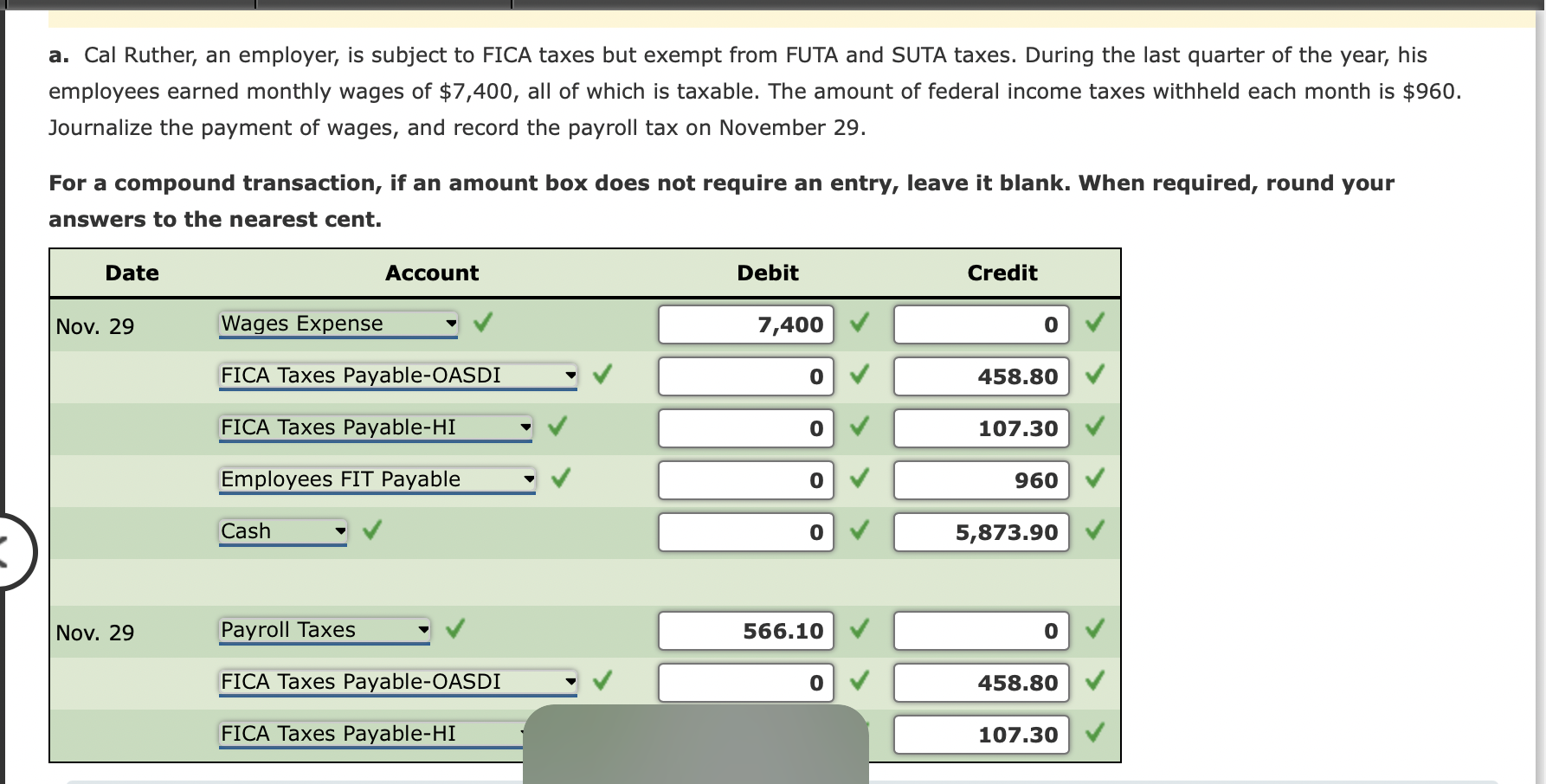

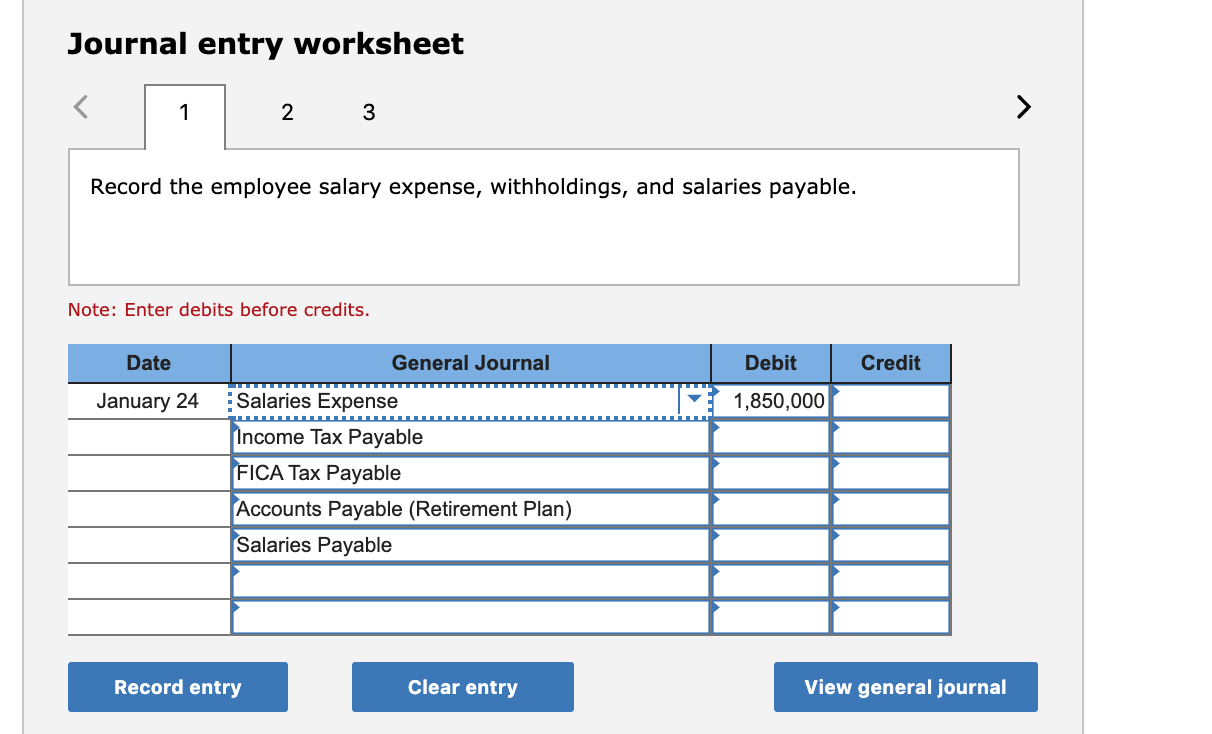

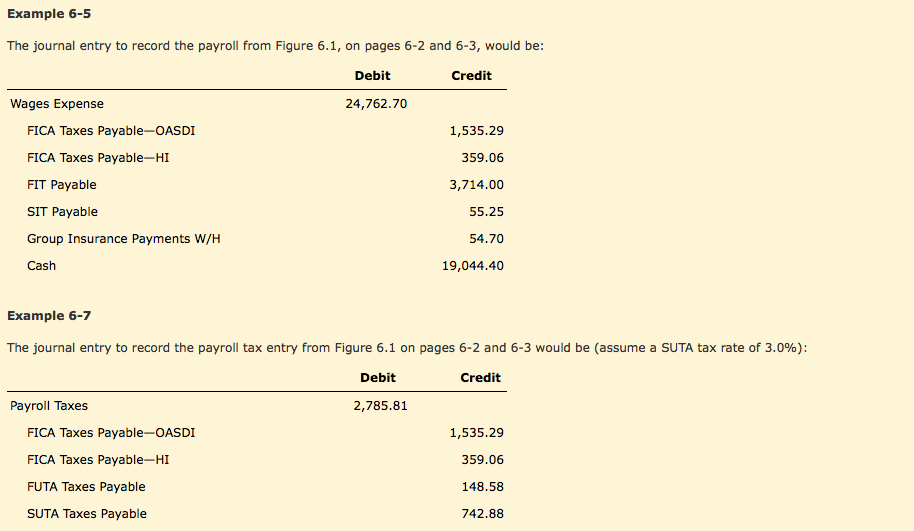

Employee fica tax (social security and medicare taxes) payable (7.65%): Federal income tax payable (12%): If you remember, one of the basic principles in bookkeeping is to match revenues with expenses.

Income tax is a form of tax levied by the government on the income generated by a business or person. A journal entry is often used for transactions that only happen occasionally and as such there isn’t necessarily a separate designated journal for them (such as. Income tax payable journal entry.

One of the transaction from the business account is payment to ato ,. Tds (tax deducted at source) journal entries using the example of postage and courier expens. Provision for income tax journal entry is an accounting item that is debited to the income tax expense account and credited to the income tax payable account.

An accounts payable journal entry impacts the financial statements as follows: The journal entry for income tax payable is a debit to the income tax. Provision for 2020 warranty expenses.

Accounting entry will be as under: (expected to be paid in 2021) 21,000. The accountant has calculated the annual income tax expense which is equal to $ 23,000.

Deferred tax assets and liabilities are crucial components of a company’s financial reporting, reflecting differences in the. Journal entry for income tax paid. At the end of the accounting period, accountants calculate the income tax expense based on the taxable profit and tax rate.