Brilliant Strategies Of Tips About Forecasting Retained Earnings

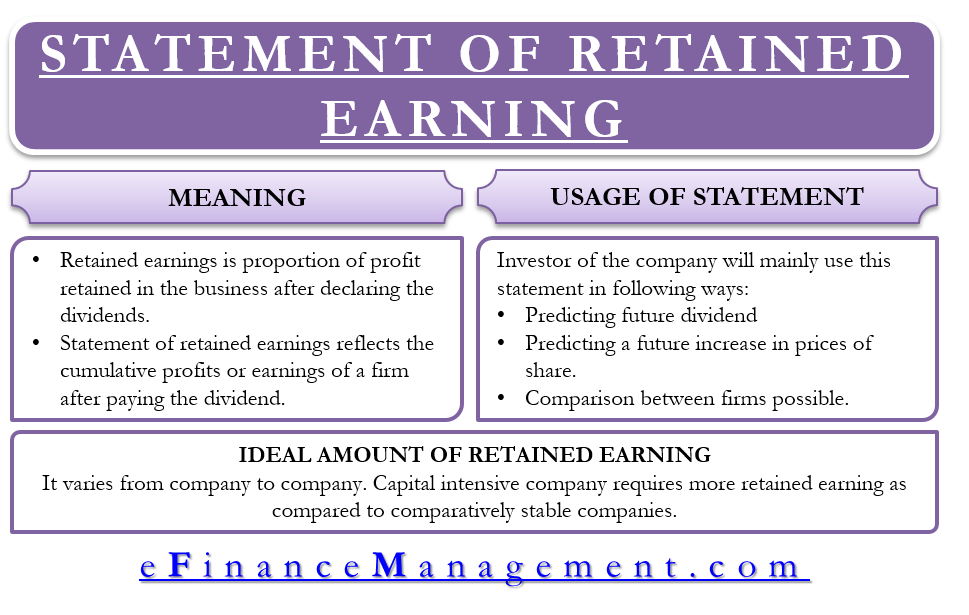

How is the retained earnings amount.

Forecasting retained earnings. How to calculate retained earnings your current or beginning retained earnings, which is just whatever your retained earnings balance ended up being the. Beginning retained earnings → the ending retained earnings. The correct figure, the company.

Here are the steps you can take to calculate it: We selectively review recent advancements in research on predictive models of earnings and returns. Financials for the most recent quarter look like this:

The decision to retain the. We finish up forecasting the balance sheet by calculating paid up capital levels and retained earnings. It is directly connected to the earnings growth rate, which is a key input in all valuation.

Air new zealand said it may raise ticket prices to cover rising costs after reporting a 38% slump in interim earnings and forecasting an even worse second. A forecasted financial statement using assumptions about the future. Actually, optimistic forecast may imply exponential growth of income.

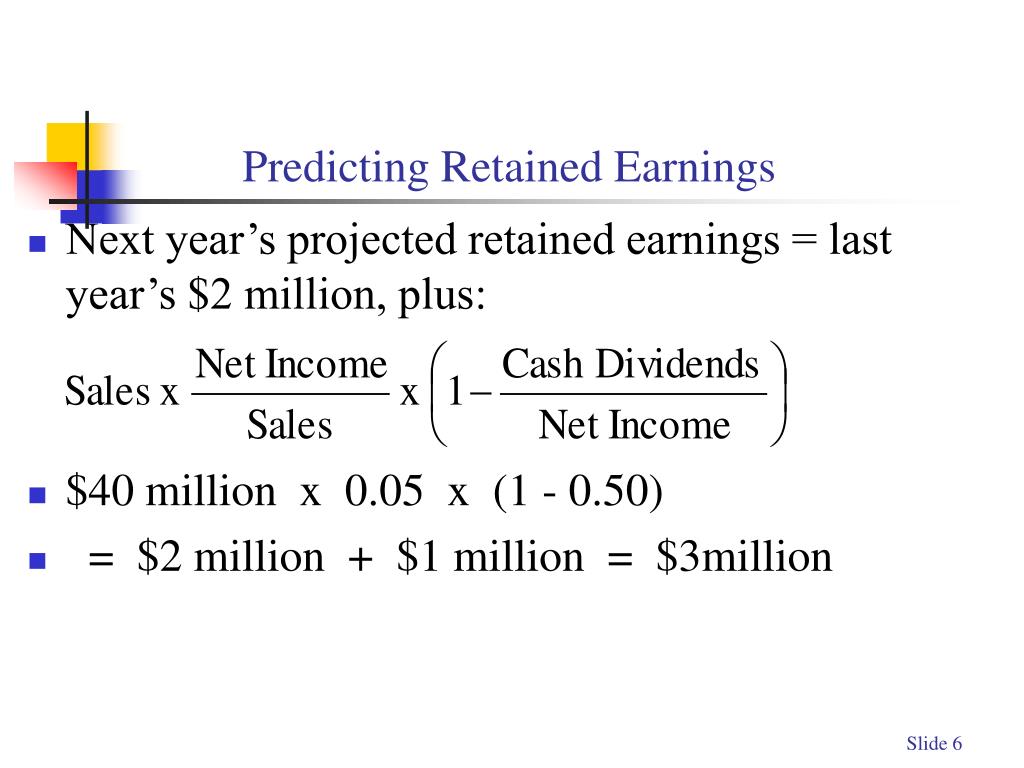

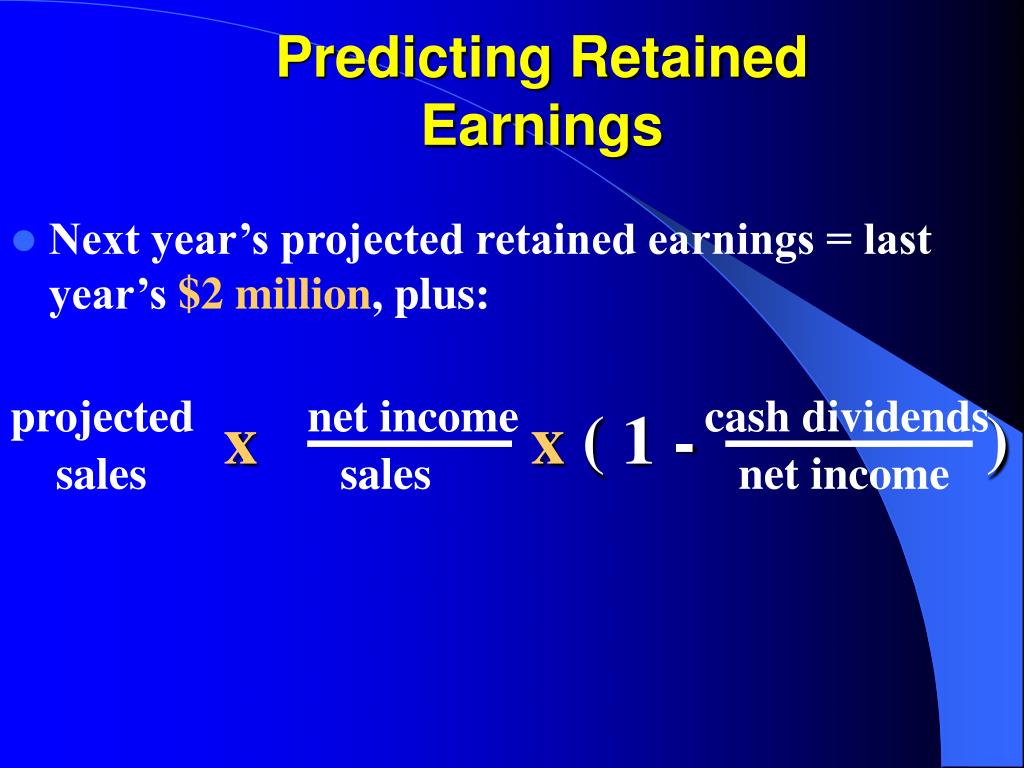

Projecting retained earnings essentially relies on the net income projection in a projected income statement for the same future period. We start year two with $60 in retained earnings that have been generated through prior years clear back to the beginning of the company. Changes in retained earnings will be strongly driven by forecasted net income and dividends.

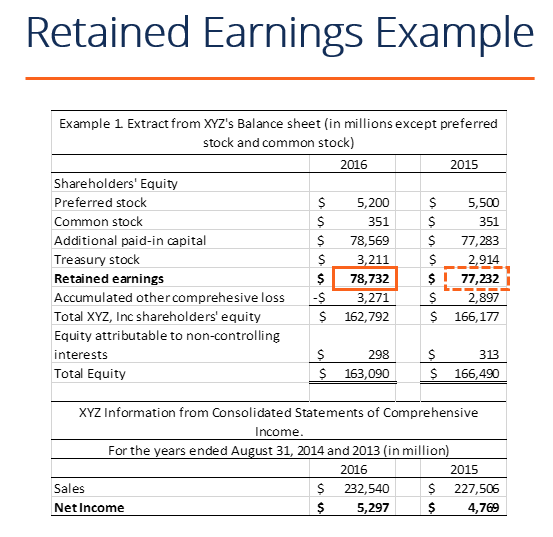

A release initially said the company was forecasting a 500 basis point, or 5%, expansion of its adjusted earnings margin for 2024. When the earnings of companies are credited to retained earnings, instead of dividends, the preserved amount flows into the “retained earnings” line item on the. The investor wants to know what retained earnings look like to date.

Project balance sheet all the way through to retained earnings 3. Assets and liabilities that need to increase as sales increase. Retained earnings (re) are the amount of net income left over for the business after it has paid out dividends to its shareholders.

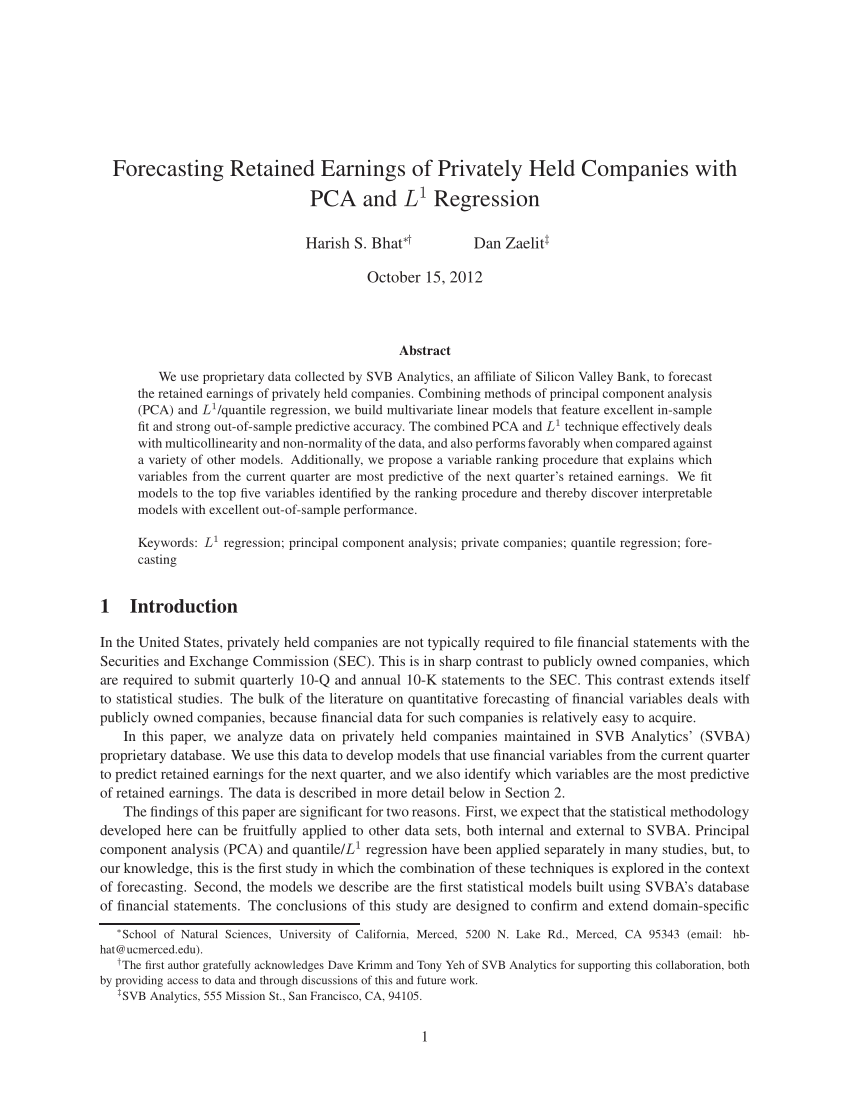

We discuss why applying statistical, econometric, and machine. We examine six forecasting models where the predicted variables include earnings per share, net income, and three profitability measures. It is directly connected to the earnings growth rate, which is a key input in all valuation.

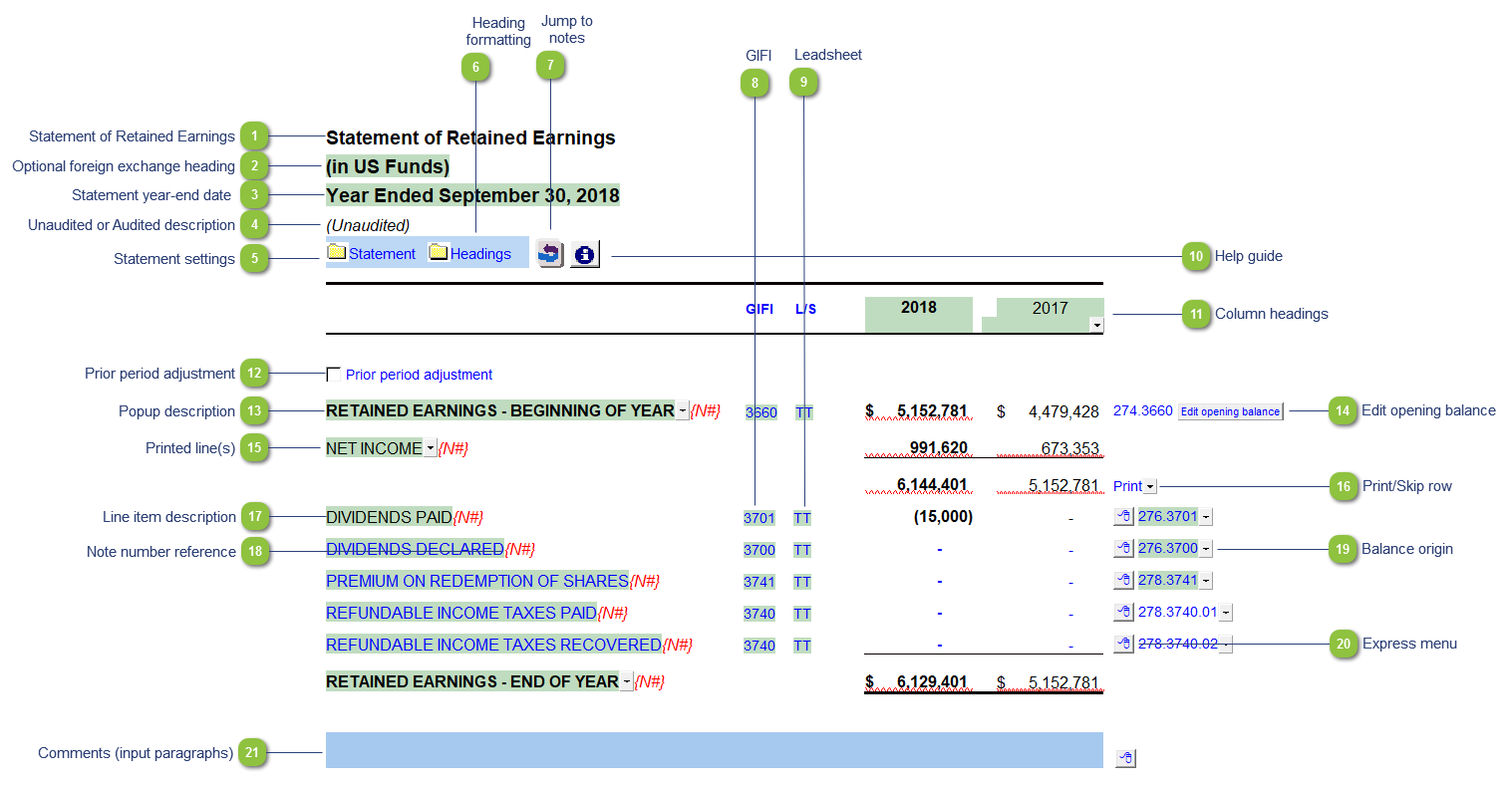

When forecasted retained earnings changes in a model, users should. Project income statement leading up to depreciation expense and interest expense 2. How do you prepare a forecasting balance sheet?