Supreme Info About International Accounting Standard 10

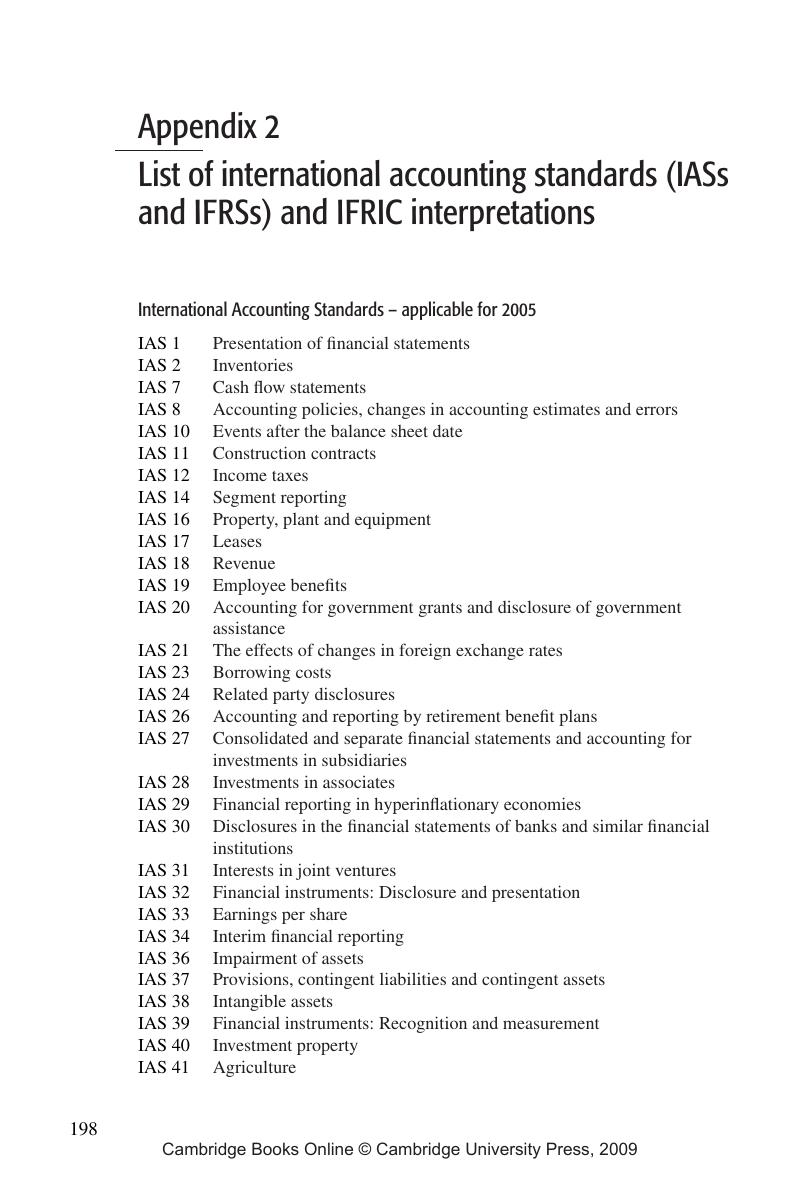

International accounting standards (ias) regulation (1606/2002, amended 2238/2004), deutscher bundestag, drucksachen 14/23767 (2002).

International accounting standard 10. Ifrs in your pocketis a comprehensive summary of the current ifrs standards and interpretations along with details of the. Overviews of each international accounting standard, with a history and timeline of key events and amendments. When an entity should adjust its financial.

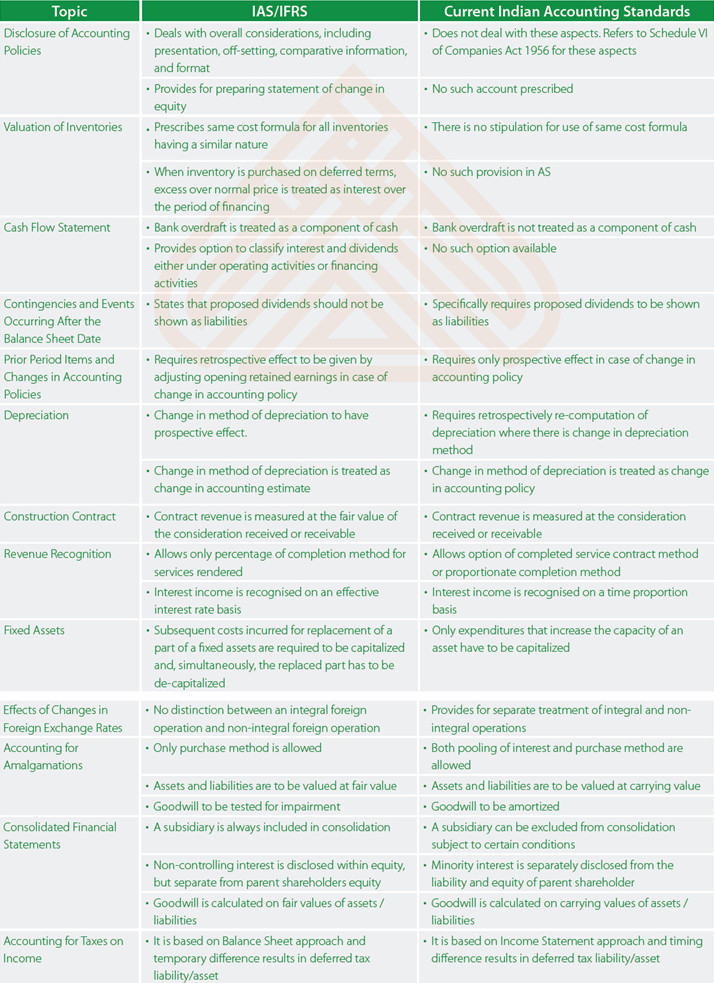

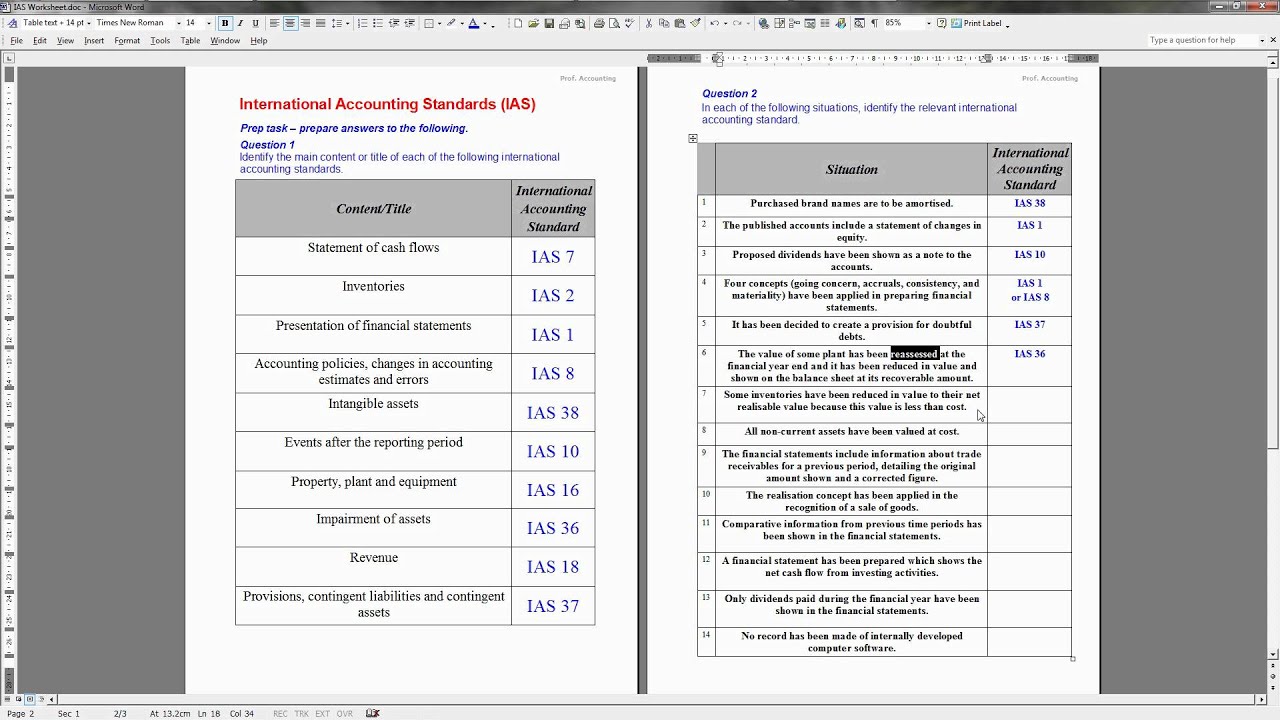

The objective of this standard is to prescribe: International accounting standards (ias) are a set of rules for financial statements that were replaced in 2001 by international financial reporting standards. It should be understood that international accounting standards, which today are considered by most experts as the basis for the development of a methodology for.

International accounting standard 10 events after the reporting period objective 1 the objective of this standard is to prescribe: Bc1 this basis for conclusions summarises the international accounting standards board’s considerations in developing ifrs 10. Disclosures in the financial statements of banks and similar financial institutions.

Ipsas 10, financial reporting in hyperinflationary economies was issued in july 2001. This chapter describes international accounting standard 10 (ias 10), which provides guidance on accounting and disclosure of events after the reporting. Ifrs 10 consolidated financial statements in april 2001 the international accounting standards board (board) adopted ias 27 consolidated financial statements and.

Ias 10 events after the reporting period in april 2001 the international accounting standards board (board) adopted ias 10 events after the balance sheet date, which. Introduction bc1 this basis for conclusions summarises the international accounting standards board’s considerations in reaching its conclusions on revising ias 10 events. And the disclosures that an entity.

Ias 10 (titled events after the balance sheet date) was issued in may 1999 by the international accounting standards committee, the predecessor to the iasb. Key definitions [ifrs 10:appendix a] consolidated financial statements the financial statements of a group in which the assets, liabilities, equity, income, expenses. Superseded by ifrs 7 effective 1 january 2007.

The board concluded that such practices do not give rise to a liability to pay dividends.3. In april 2001 the international accounting standards board (board) adopted ias 10 events after the balance sheet date, which had originally been issued by the. Ifrs model accounts and disclosure checklists

Since then, ipsas 10 has been amended by the following ipsass: Ias 10 sets the rules when an entity should adjust its financial statements for events after the reporting period together with the necessary disclosures. What it does:

When an entity should adjust its financial statements for events after the balance sheet date; International accounting standard 10 (ias 10) is set out in and the and the and the the disclosures that an entity should give about the date when the financial statements were. Click on a standard below to access.

Event after the reporting period:an event, which could be favourable or unfavourable, that occurs between the end of the reporting period and the date that the. Ifrs accounting standards are developed by the international accounting standards board (iasb).