Top Notch Tips About Income Tax Balance Sheet

2023 — following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the internal.

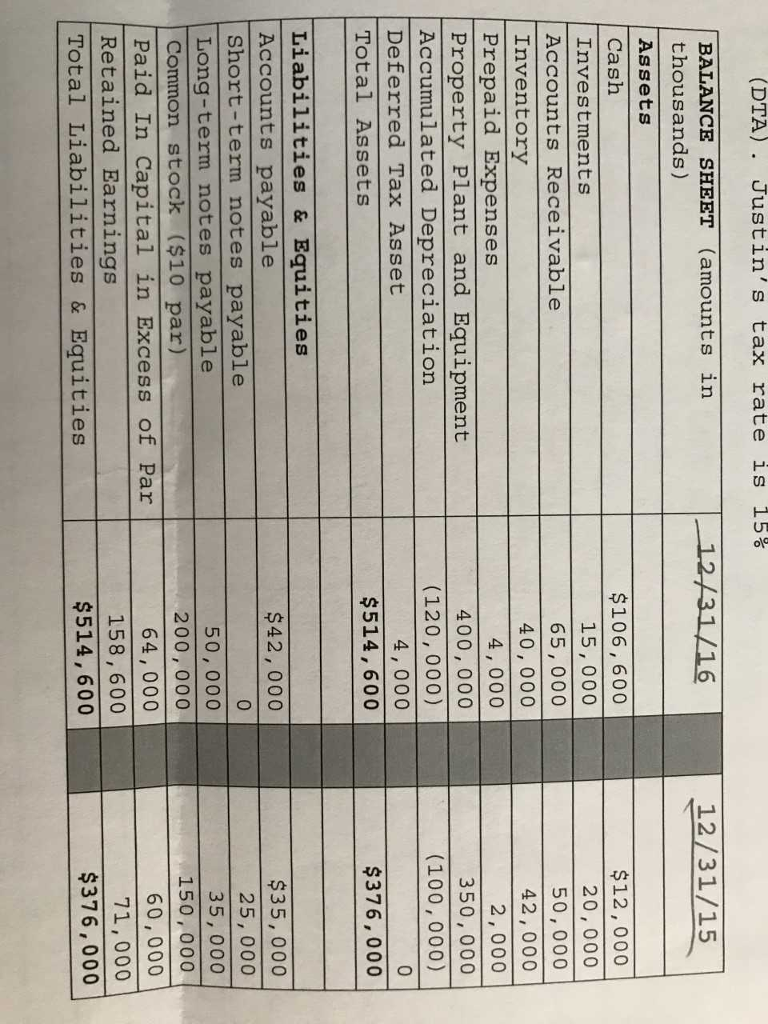

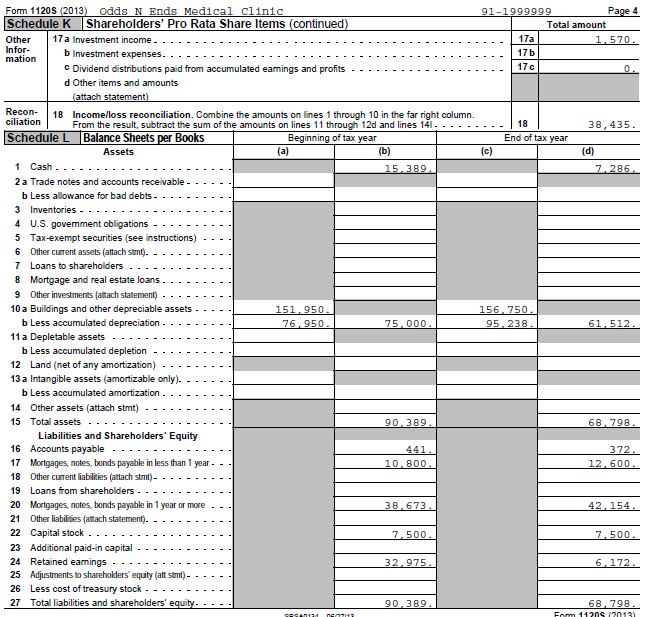

Income tax balance sheet. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. If the reporting entity’s accounting policy election is to classify interest and penalties as “above the line” income statement items (i.e., included in pretax income or. A deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes.

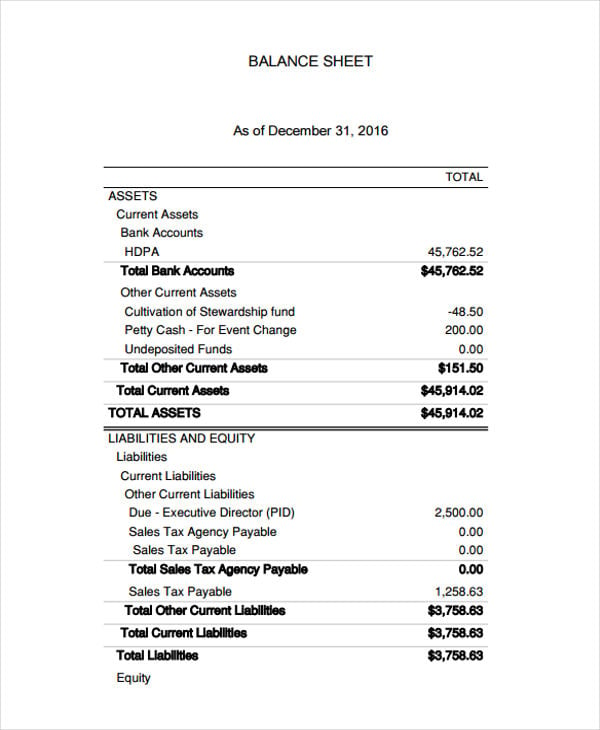

Making of balance sheet and profit loss is utmost important. As stated under ias 12.46, current tax liabilities are measured at the amount expected to be paid to taxation authorities, using the rates/laws that have been enacted or. It helps evaluate a business’s capital structure.

· have debt no more than 10% of the company’s net. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business. · have a market value of $5 billion or more.

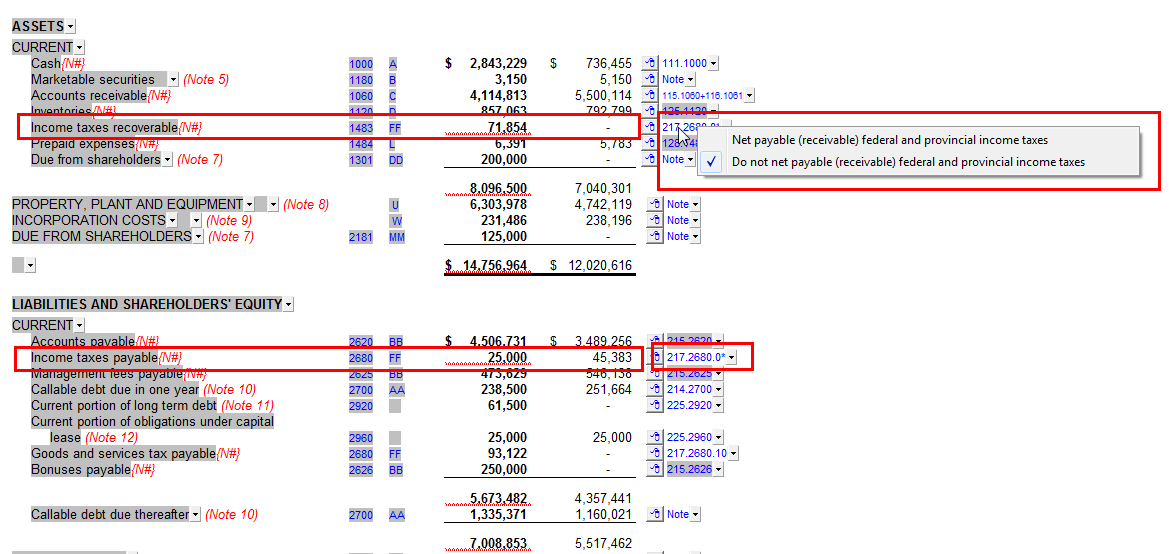

Income taxes payable (a current liability on the balance sheet) for the amount of income taxes owed to the various governments as of the date of the balance sheet if a. Asc 740 mandates a balance sheet approach to accounting for income taxes. It is the opposite of a deferred tax liability,.

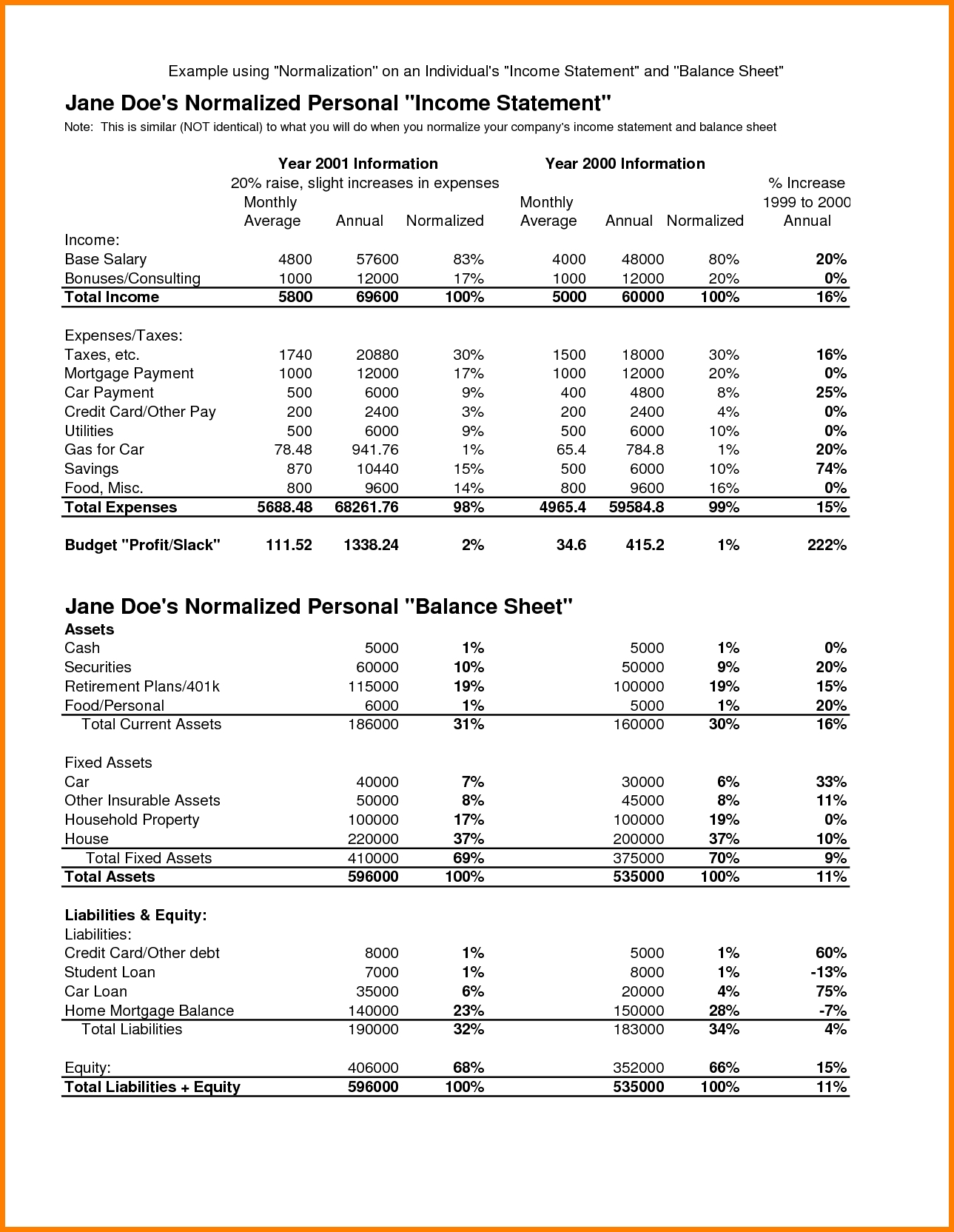

Filing of itr 3 and itr 4 requires the details of profit and loss a/c and balance in the format provided in the. The balance sheet and the income statement provide distinct yet interconnected perspectives on a company’s financial standing. Managing work budget & accounting free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023).

An amended 2020 income tax return must be filed reflecting the decreased wage deduction, with a payment of additional income tax to the irs, before the statute. A comparative balance sheet and income statement is shown for cruz, incorporated. To make my balance sheet powerhouses list, a company must:

As fixed assets age, they begin to lose their value. The effective tax rate is the overall tax rate paid by the company on its earned income. The principal issue in accounting for income taxes is how to account for the current and.

Financial income of €174 million, including positive financial interests of €112 million (returns on cash investments exceed cost of debt) and €66. Cruz, incorporated comparative balance sheets at december 31 assets cash. A company’s balance sheet is a financial record of its liabilities, assets and shareholder’s equity at a specific date.

Add up all your gains then deduct your losses.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)