Underrated Ideas Of Tips About Consolidation Accounting Ifrs

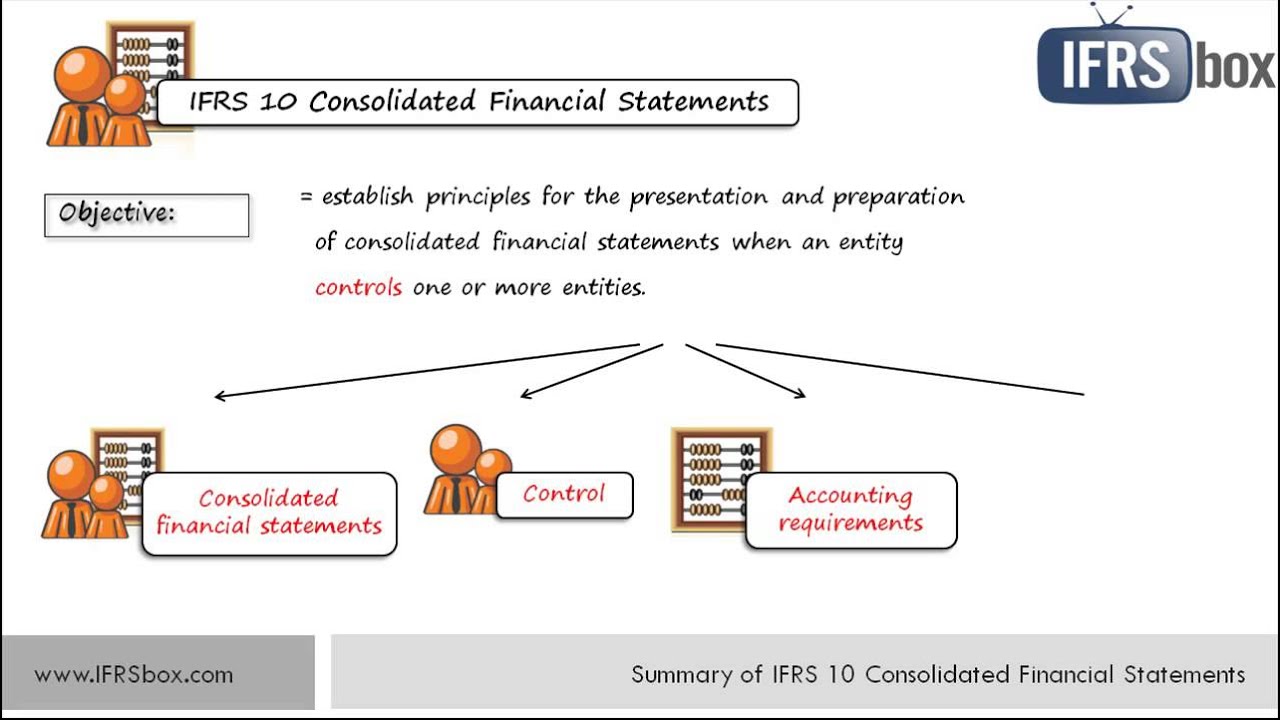

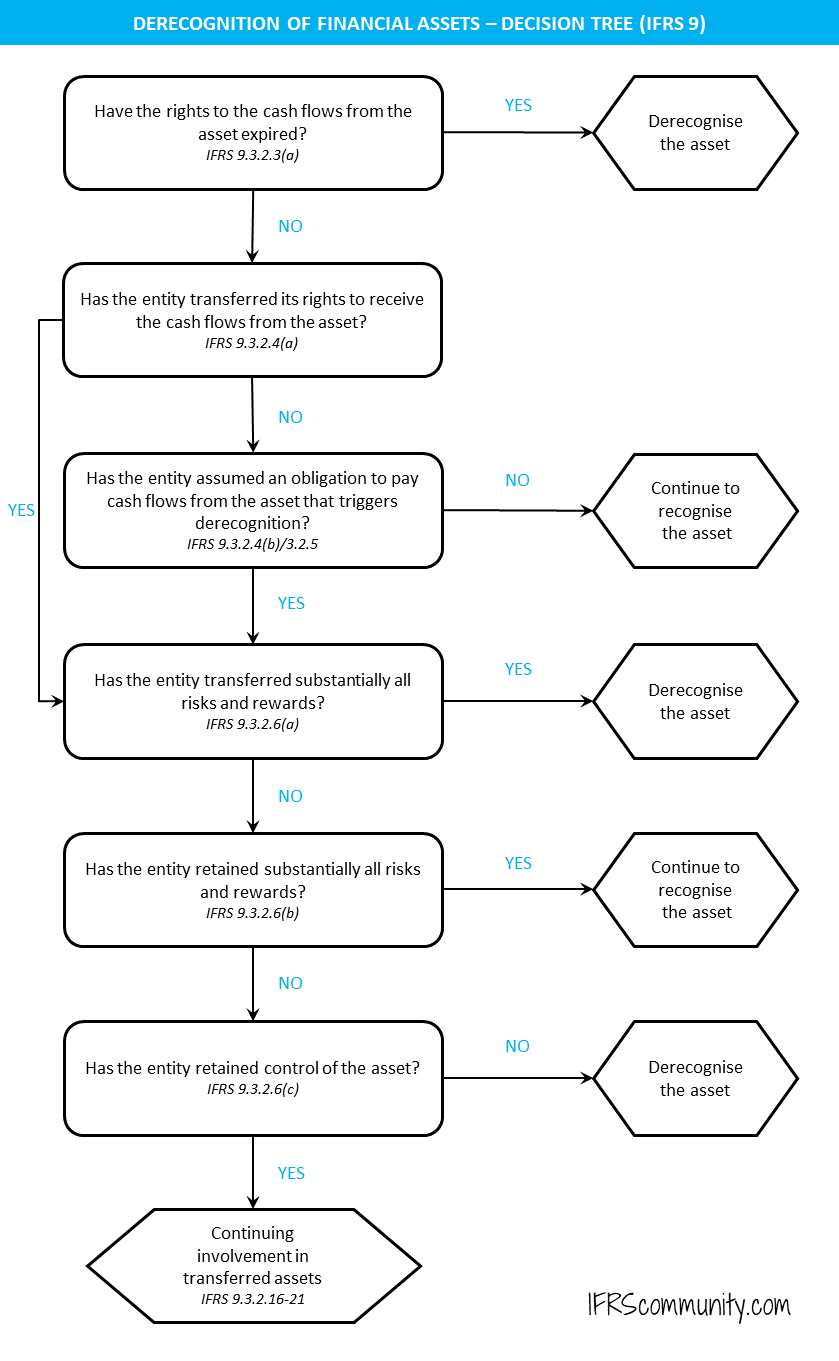

The objective of ifrs 10 is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more.

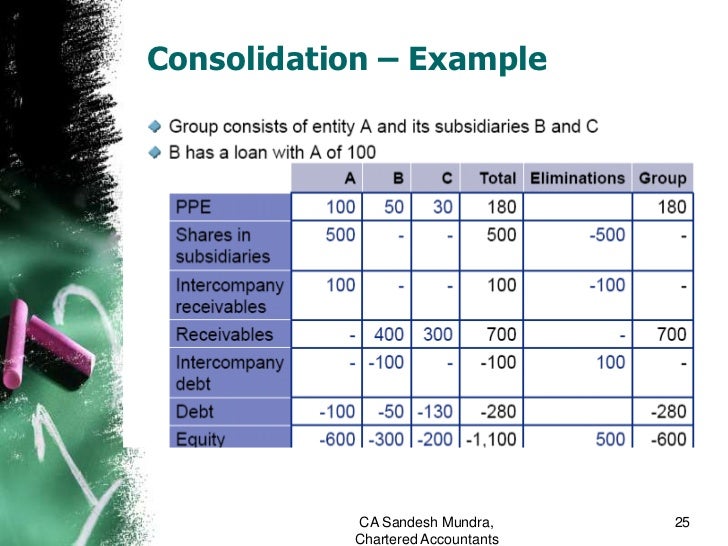

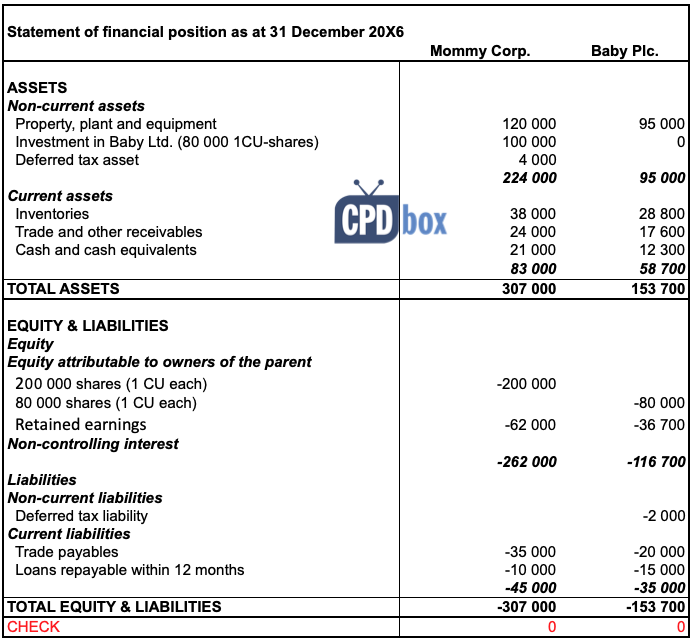

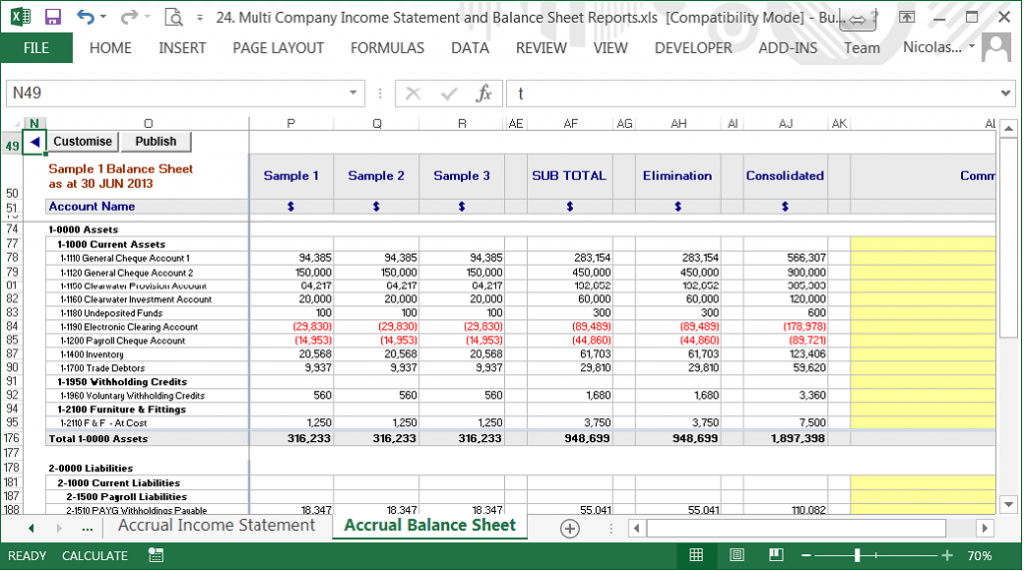

Consolidation accounting ifrs. The control assessment determines which entities are consolidated in a parent’s financial statements and therefore affects a group’s reported results, cash flows and financial. Consolidation, equity method of accounting, and the assessment of when an entity has control, joint control, or significant influence has been and continues to be. Learning objectives • understand the what are consolidated financial statements and how they are different from standalone financial statement;

On 12 may 2011 as part of its new suite of. Us ifrs & us gaap guide. 30 jun 2023 us ifrs & us gaap guide in relation to certain specialized industries, us gaap allows more flexibility for use of different accounting policies within.

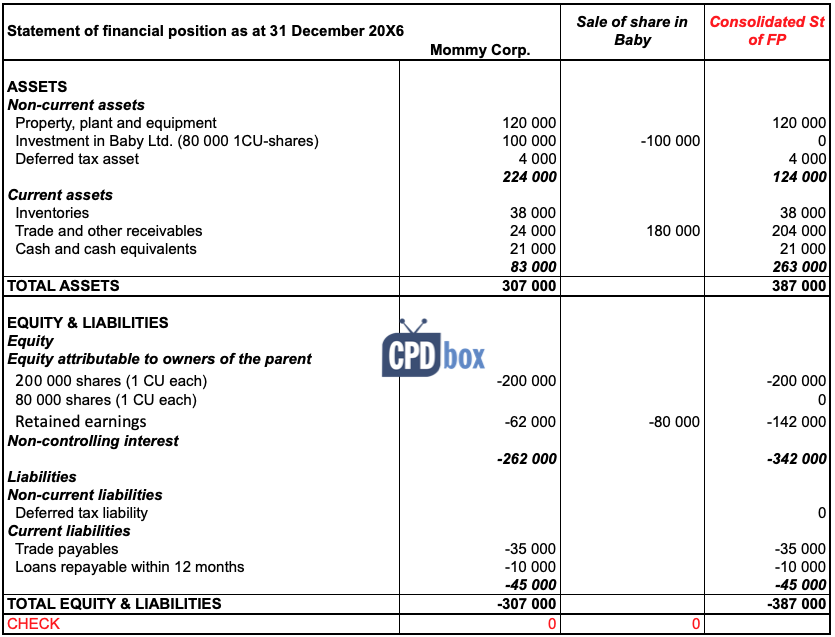

The investment entity consolidation exemption was introduced by investment entities, issued on 31 october 2012 and effective for annual periods beginning on or after 1 january 2014.] ifrs 10 contains special accounting requirements for investment entities. Ifrs 10 establishes principles for presenting and preparing consolidated financial statements when an entity controls one or more other entities. As consolidated financial statements are based on the assumption that they represent the financial position and operating results of a single economic entity, such statements shall.

The consolidation models under us gaap and ifrs accounting standards are very similar. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and. The three elements of control which.

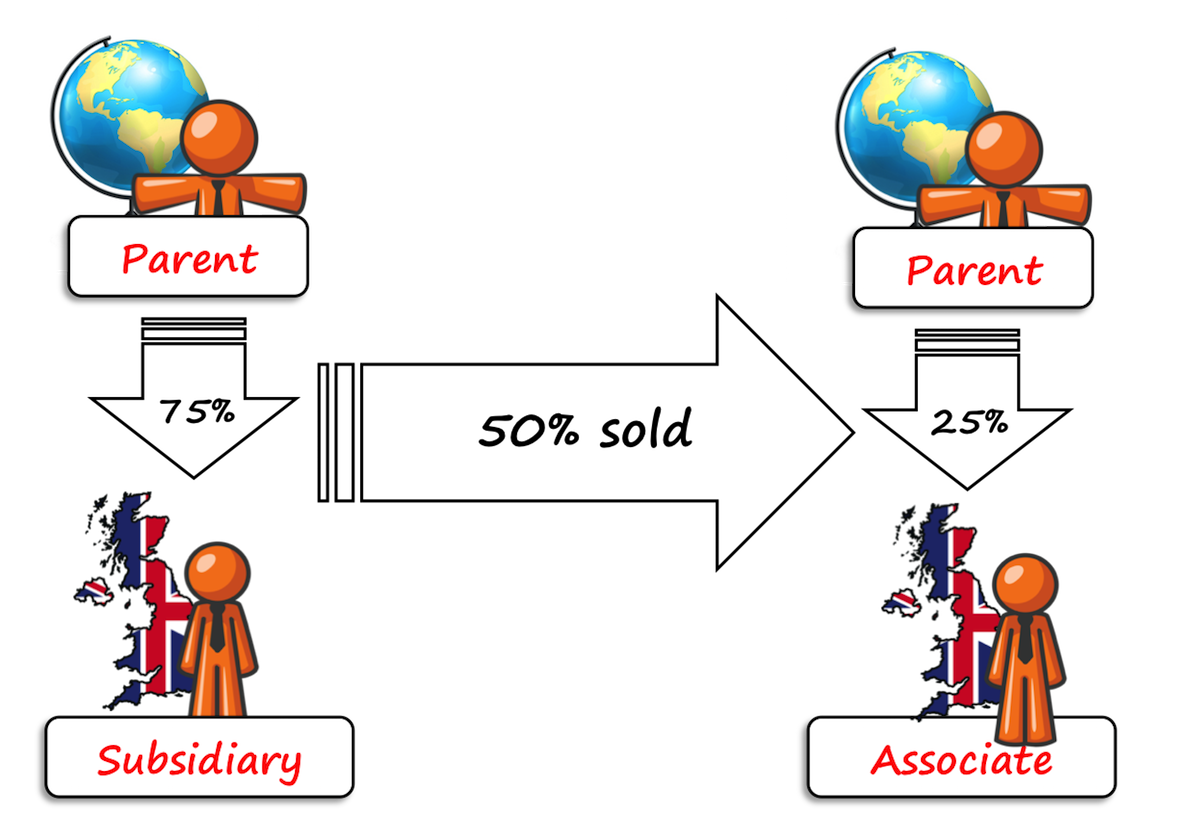

Exposure draft of proposed amendments to ifrs 3 and ias 27. 12.6.1 consolidation—change in interest without loss of control under us gaap, a change in ownership interest that does not result in a loss of control is generally accounted for as. Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april.

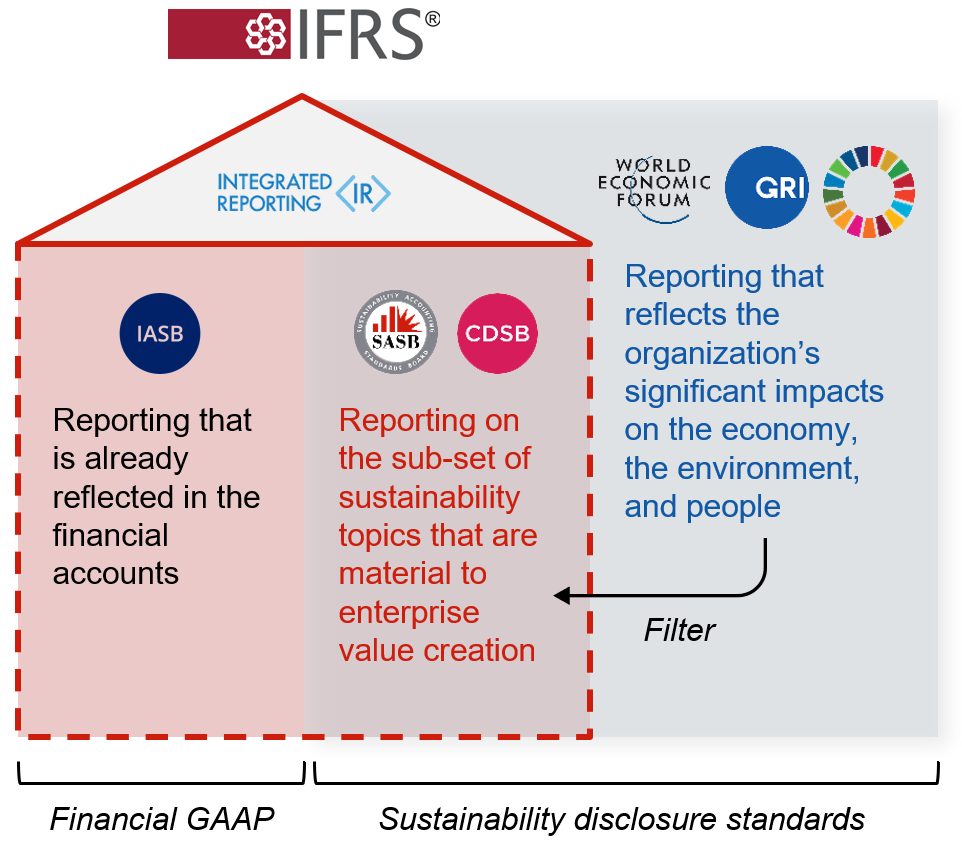

In may 2011, the international accounting standards board completed its improvements to the requirements for joint arrangements and disclosures of interests in. The member firms of grant thornton international ltd (gtil) have extensive expertise in the application of ifrs. Consolidated financial statements present assets, liabilities, equity, income, expenses, and cash flows of a parent entity and its subsidiaries as if they were a single.

Ifrs accounting standards provides indicators of control, some of which individually determine the need to consolidate. It was issued by the iasb. The objectives of ifrs 10 for consolidated financial statements when it comes to ifrs 10, it’s best first to understand the objectives set out under the.

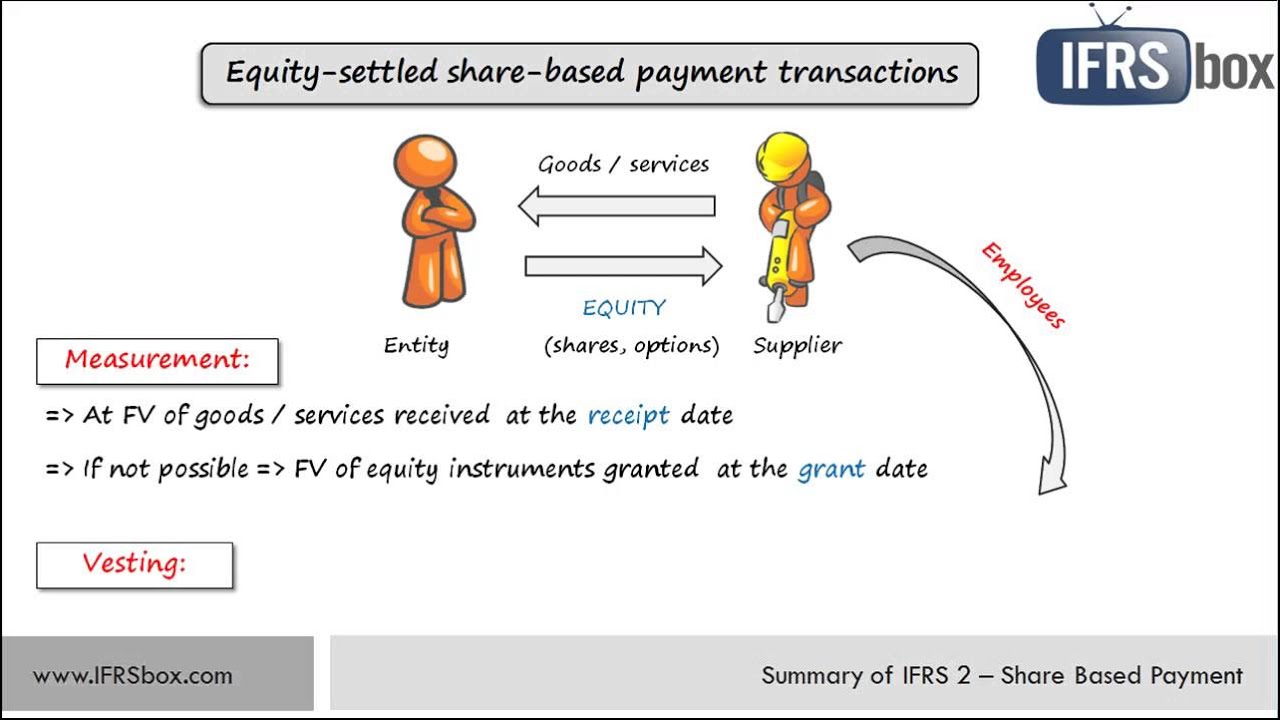

Significant influence, joint control) and the appropriate accounting underthe requisite ifrs. Overhauls the accounting for joint ventures (now called joint arrangements). Both us gaap and ifrs accounting standards require a reporting entity to.

Just recently, general atlantic grabbed the spotlight in both the private equity and infrastructure. Where an entity meets the definition of an. The nature of its relationship with the investee (e.g.

An accelerating consolidation trend in the last two years. Revised ias 27 (2008) issued. Effective date of ias 27 (2003) 25 june 2005.